Antares: Recent Launch of Makena Subcu Auto Injector and Probable Launches of Xyosted and AB Rated Generic to EpiPen Could Make for an Outstanding Price Performance in 2018 (ATRS, Buy, $2.36)

Key Investment Issues

In this report I focus on three very important product related issues that will likely drive the stock price performance of Antares in 2018. Roughly in order of importance they are:

- The launch trajectory of the Makena subcutaneous auto injector,

- Probable approval of the Teva’s AB rated generic to EpiPen, and

- The probable launch of Xyosted in 4Q, 2018

Antares had $28.1 million of cash at the end of 1Q, 2018 and will receive $9.8 million of cash from Ferring in return for rights to the legacy product ZomaJet. Hence total cash available for funding operations in 2018 is $38.9 million. The burn rate in 1Q, 2018 was $6 million and this should meaningfully decrease or possibly turn positive in later quarters of 2018 owing to the Makena launch and the probable launch of the AB rated generic to EpiPen. There appears to be no need for an equity financing in 2018.

I continue to have a price target of $5.50 for ATRS later in 2018.

Makena Subcutaneous Auto Injector

AMAG’s Goal is to Transfer the Entire Makena Franchise to Subcu

The new subcu auto injector was introduced at the same price as the intramuscular dosage form of Makena. In 2017, the IM had sales of $387 million. I estimate that if the subcu were not introduced in 2018 and if there were no generic completion, that sales of the IM would have reached $415 million in 2018.

The goal of AMAG is to replace all of its IM sales with the subcu. The subcu is much superior to the IM in that it causes much less pain and discomfort to women who are already uncomfortable with their pregnancy. It is also easier and quicker to administer so that much less physicians’ office staff time is needed to give the injection. The reasons for preferring the subcu dosage of Makena over the IM are overwhelming. However, the fly in the ointment is the possibility of a generic to the IM (not the subcu) being introduced, perhaps as early as mid-2018 although it could be meaningfully later.

The Early Stages of the Makena Launch are Very Encouraging

The subcu auto injector was just launched on March 26 and I recently wrote an update on early results in a report entitled “It Is Early Days, but the Launch of the Subcutaneous Dosage Form of Makena Seems to be Going Very Well”. After only four weeks on the market, roughly 47 % of new patient starts are on the subcu. This is above management expectations and is pretty impressive in my view. If there is no generic competition this year, I think that over 90% of patients newly enrolled on Makena will be using the subcu by year end. I will discuss potential generic competition shortly, but first let’s touch on the economics for Antares for various sales levels of the subcu.

Antares Economics Stemming from Makena Subcu are Substantial

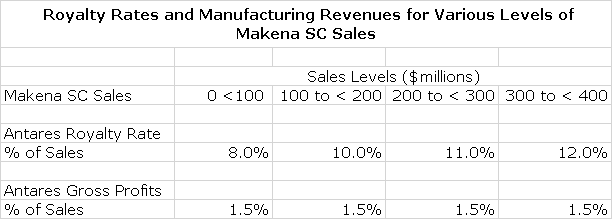

Antares has issued guidance that it will receive a high single digit to low single digit royalty on sales. I would estimate that the royalty would escalate from perhaps 8% of sales on the first $100 million of subcu sales to perhaps 12% on sales above $300 million. These are guesses on my part, based on what I have seen in other similar deals

In addition, Antares is making the device and will package it so that it provides a fully commercial product to AMAG. This will be done at cost plus a markup on injector sales. I estimate that that gross profits on device manufacturing and product packaging will be about 1.5% of Makena subcu sales. Because there are virtually no associated costs, the gross profit flows directly to pretax and is tantamount to a royalty of 1.5% of subcu sales. The following table is my guess at how the economics work out for Antares at various levels of sales for the Makena sub-cu injector.

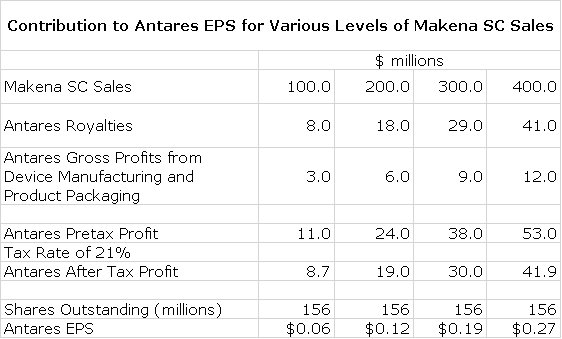

I next put this into the context of what this might contribute to Antares EPS. I assume that there are no costs to offset against the royalties and gross profit contribution so that they flow directly to pretax income. I then assume a tax rate of 21% on these pretax profits. In the early years, net operating loss carry-forwards may reduce or even eliminate this tax rate. However, I have no estimate for that so I am just going to assume a full corporate tax rate of 21%. Doing the math shows that at $100 million of subcu sales, the contribution to EPS is estimated to be $0.06 and at $400 million, it is $0.27. If all other parts of Antares were to just break even, this would be what ATRS would report for total corporate EPS. Of course, I am expecting significant contributions from other business segments in coming years.

Possible Launch of Generic to IM Dosage Form of Makena is a Major Concern for Wall Street

The fly in the ointment is that AMAG management has indicated that there could be a generic competitor to the IM dosage of Makena as early as mid-year. I am not going to go into great detail on this situation. I would urge you to read my June 25, 2016 report “Initiation of Research on a Complex but Potentially Very Interesting Investment Situation (AMAG, Neutral, and $24)” for a detailed discussion. Importantly, it is highly unlikely that there will be a generic to the subcu dosage form for perhaps a decade or more owing to Antares patents on the design of the injector.

There are three major questions to address on the generic. The first is when it will be introduced. There is no such thing as a PDUFA date for generics so that there is no signal on potential approval from the FDA. Approvals for generics has been notoriously slow, especially for injectables. May I remind you of the EpiPen saga? Without any facts to go on. I would have to say that there might be meaningful delay in approval that could result in a much longer period of time beyond the guidance of AMAG management.

The second question is whether there will be more than one generic approved in a relatively short time frame. While this can often be the case with generic competition to oral dosage forms, history shows that it is much more difficult to develop and gain approval for generics to injectables. Based on my experience, the second generic to the market could be years behind the first, but again there is no way of knowing.

The third question to answer is whether a lower price on an IM generic would enable it to gain a large share of the current unit market for the Makena franchise even though the subcu has major advantages over the IM in terms of ease of administration for physicians and nurses and causing much less pain and discomfort to pregnant women already in great discomfort. Would payors put themselves in a position of forcing pregnant women to suffer in order to make more profits for themselves? Also, Makena is not a large product so there isn’t that much profit for the payors if they were to force usage of the generic. I think that payors are likely to not put major barriers in place to force the use of a generic IM over the subcu.

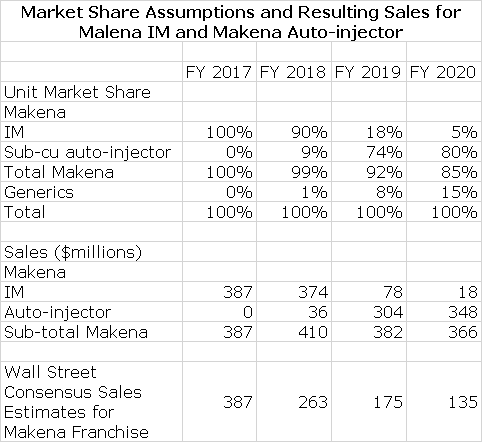

I Have Much Higher Expectations for the Subcu Launch than Wall Street Analysts

Management has been cautious and conservative in their public guidance for the Makena franchise. (Non-company sources suggest that in private they are actually much more positive.) They have pointed to a generic entry at mid-year and suggest that this will have a sharp impact on sales for the Makena franchise. Wall Street analysts have followed management guidance and reduced sales forecasts for the Makena franchise accordingly. In my most recent report in which I upgraded AMAG to a buy, I presented a more optimistic outlook for Makena sales than either management or analysts are projecting. I would refer you to my April 13, 2018 report “Upgrading to Buy Based on an In-Depth Analysis of the Outlook for Makena Over the 2018 to 2020 Period” for a more detailed discussion.

AB Rated Generic to EpiPen (Epineprine)

Still Awaiting FDA Approval

Teva received a complete response letter from FDA in February of 2016 and Antares worked with them to formulate responses. Teva submitted their responses and is working with the FDA toward a potential approval. Teva's original guidance was that they would be able to launch an AB rated version of EpiPen in late 2017 or early 2018. With no approval to date, the guidance now is for approval and a launch sometime in 2018. The part of the FDA that deals with generics is notoriously slow. As noted earlier, this could be a factor on timing of the approval of a generic to IM Makena, but I digress.

Sales of EpiPen

Mylan disclosed in its 2016 10-K that sales of EpiPen in the US were about $1.0 billion in both 2015 and 2016. However, it is common practice in the US industry to give significant rebates to managed care. Mylan hasn’t disclosed the extent of these rebates, but I have seen estimates that they could account for 40% so that actual manufacturers’ realized revenues were probably closer to $600 million. The brouhaha over Mylan aggressively raising prices caused a lot of public relations embarrassment for Mylan, but industry sources suggest that it didn’t have much of an effect on sales. Since 2016, Mylan has not disclosed its sales on EpiPen in regulatory filings.

In December 2016. Mylan announced that it was introducing an authorized generic to Epi-Pen at half the listed price of brand name EpiPen which is over $600 for two injectors packaged together. However, realized revenues per twin pack for Mylan after rebates and discounts to managed care are more like $275. I understand that the authorized generic is shipped direct to accounts and the realized price is around $300. If this information is correct, the market that Teva’s AB rated product is addressing is still $600 million inclusive of Mylan’s authorized generic.

Economics of EpiPen to Antares are Substantial

I am assuming that the AB rated generic to EpiPen will be launched in 2018 as per guidance of Teva, but I am not sure if it will be sooner or later. I also estimate that current EpiPen sales are running at a rate of $600 million. I assume that Teva will launch at a 35% price discount and will capture 40% of EpiPen units sold. This would amount to $156 million of peak sales for Teva. I assume royalties to Antares of 8% of sales and injector revenues of 4% of sales. The gross margin on injector sales is about 50% so that the gross margin Antares will receive is 2% of Teva’s sales; there are no offsetting costs so this gross profit margin contribution flows directly to pretax income.

I estimate that Antares will realize pretax profits that amount to 10% of Teva’s peak sales. These peak sales are likely to be reached quickly, probably within three or four quarters of launch. On peak sales of $156 million, Antares would realize pretax profits of $15.6 million. Assuming a 21% tax rate and 156 million outstanding shares the contribution to EPS would be $0.08 per share.

Xyosted Approval in 2018 Seems Highly Likely

Management Guidance on Timing of Approval

During the recent 1Q, 2018 conference call, management seemed highly confident that Xyosted would be approved on or before its September 29, 2018 PDUFA date and that the initial phase of the launch would begin in 4Q, 2018. This would be aimed primarily at getting on formularies and negotiating rebates and discounts with payors.

Xyosted Seems to be Best in Class

Testosterone replacement therapy is all about pharmacokinetics. The FDA has established a maximum blood level for testosterone and a minimum level. Excursions above the maximum level increases side effect risks and excursions below reduces efficacy. Xyosted has outstanding pharmacokinetic properties in maintain blood levels comfortably within this range for the one week period between injections. This could ultimately lead to its emerging as the best in class testosterone replacement product and dominate what is now a growing, $1 billion market in the US.

Managed Care Hurdles Could Constrain Launch Early-On

The best in class pharmacokinetic characteristics does not mean that the product will jump out of the blocks with a quick sales uptake. Antares has to negotiate with insurers and PBMs to gain formulary acceptance and negotiate contracts which is a slow process.

The PBMs will be a major hurdle. These organizations were first created with the noble purpose of giving insurers leverage to negotiate better drug prices and reduce insurance costs and patient co-pays. While this is an important function, unfortunately the PBMs have evolved to become more focused on getting rebates and discounts than on controlling costs. Why? Because they get a percentage of the rebates and discounts. It is actually in the self-interest of the PBMs for drug companies to raise prices because it increases the level of rebates and discounts and their take from them. They are not incented by what is the best product, only with the level of rebates and discounts. This means that it may be in their self-interest to continue to emphasize older testosterone replacement gels and injectables in the near term.

Let me give you an example of what PBMs can do based on an Eli Lilly discussion about how it has been affected by pharmacy negotiations. In 2017, the Company discounted the average list prices of its portfolio of drugs by 51%, up from 50% in 2016. Because of its huge presence in the extremely competitive insulin market, Ell Lilly is much more affected than most of big pharma, but still this is shocking. In 2017, LLY raised list prices by 9.7%, but after rebates and discounts, the realized price increases came to 6.0%.

Antares has already seen the hurdle posed by PBMs play out with Otrexup. I thought that this would be an extremely successful product. Its drug properties allowed for patients to remain on methotrexate, the gold standard treatment for rheumatoid arthritis, for much more time before they had to switch to much higher priced biologicals. I naively thought that these characteristics would lead to a quick uptake but instead the launch has been very slow. Here is why.

A biological might be priced at $20,000 per year while Otrexup is priced around $4,000. PBMs are probably getting 30% to 50% rebates and discounts on the biologicals so that for each patient treated with a biologic, the PBM gets a meaningful percentage of the $6,000 to $10,000 in rebates and discounts. Even if Otrexup matched the percentage level of rebating and discounting, the amount per patient would be only $1,200 to $2,000 per patient. The primary incentive of the PBMs is not to assure that the best medicine for the patient is received or that health care spending is reduced. For them, it is the amount of rebates and discounts per person treated.

Xyosted will face the same PBM hurdle as Otrexup although there are significant differences that may allow for faster acceptance. It will be priced at the same level as generic products (the category is heavily genericized) and the PK advantages will be very apparent to prescribing physicians who will want to prescribe the product over older gels and injectables because of the PK. This could make the Xyosted launch meaningfully less painful than was the case with Otrexup, but it will still be constrained as the PBMs figure how to get their pound of flesh.

FDA Will Require Data on Side Effects as Condition of Approval; This Could be a Positive

Let’s look on down the road. During the conference call management seemed to indicate that Antares has committed to creating data that assesses cardiovascular and depression risks, this could be an absolute and very positive game changer for Xyosted. If a post marketing study showed no issue with cardiovascular risks and depression, Xyosted would be the only product to have demonstrated this. It would be a hugely positive differentiation in the market. The PK profile suggests that this may be the case. If there are issues, it would confirm FDA fears that this is a class effect and Xyosted would not be disadvantaged against other products although the class as a whole might be negatively affected.

Could the Approval of Xyosted Lead to an Acquisition of Antares?

If numerous past launches are any indication and if Xyosted is launched in 4Q, 2018, it might take until 2020 to assess how well sales are progressing. This could lead to uncertainty by investors about its potential and restrain its effect on the stock price. This raises the possibility that Antares management might take an easier course of action by being receptive to a takeover. Antares would be a very good fit for AbbVie as it could use Xyosted to protect its position in the market as AndroGel sales fade. Abbvie has the market presence and insurance and PBM relationships to make Xyosted the dominant product in the market more quickly, especially if a post marketing study shows no meaningful risk for depression and cardiovascular issues. Aside from AbbVie, virtually every specialty pharmaceutical company would love to gain control of Xyosted.

On the other hand, Antares has a lot of other developments going for it on the new product side such as the launch of an AB rated generic to EpiPen (which is way overdue) and the Makena launch that is just starting. Both are big opportunities and in my mind, Antares would be unlikely to sell before the potential for both products is evidenced and reflected in the stock price. This could suggest that management probably would not commit to an acquisition until 2019.

Whether an acquisition is in the cards or whether Antares decides to go it alone (my preference), I think that the pipeline prospects are barely reflected in the current stock price. My price target thinking was explained in an August 17, 2017 report in which I indicated a 2018 price target of $5.50 to $7.60. At the time, I was anticipating the approval of Xyosted in October 2017 and the AB rated generic to EpiPen by the end of the year. The delay in approval for both probably means that we should look at the lower end of this target price range for 2018, i.e. $5.50.

Tagged as Antares Pharma Inc., ATRS, launch of AB rated generic to EpiPen, launch of subcu dosage form of Makena, pending launch of Xyosted + Categorized as Company Reports, LinkedIn

Larry,

Your last section and mention of Abbvie. I find it interesting that Abbvie is the only remaining testosterone gel player that still sells a branded product, Androgel. All of the other gel players have moved to generic gels. In other words, I believe Abbvie is the only one that still has a metabolic sales force on the street that pushed a branded gel. A new branded testosterone therapy (Xyo), with best in class PK and strong/durable IP, would be an ideal drug for Abbvie’s metabolic sales org to switch to and promote instead of Androgel. Xyo is a better drug, no transference issues, better efficacy with extended efficacy, and no competing sales force to sell against. At the least they sure sound like a good potential marketing partner.