AMAG: Upgrading to Buy Based on an In-Depth Analysis of the Outlook for Makena Over the 2018 to 2020 Period (AMAG, Buy, $21.10))

Investment Thesis in Brief

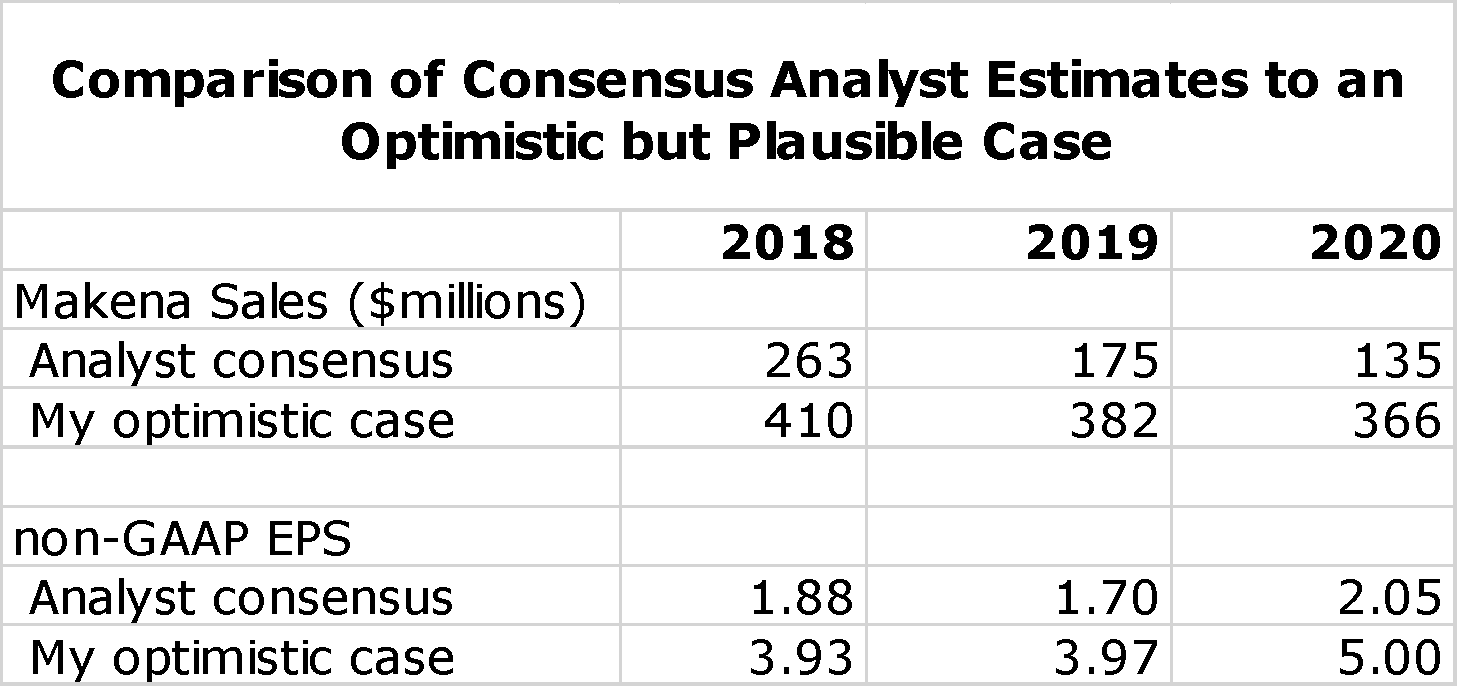

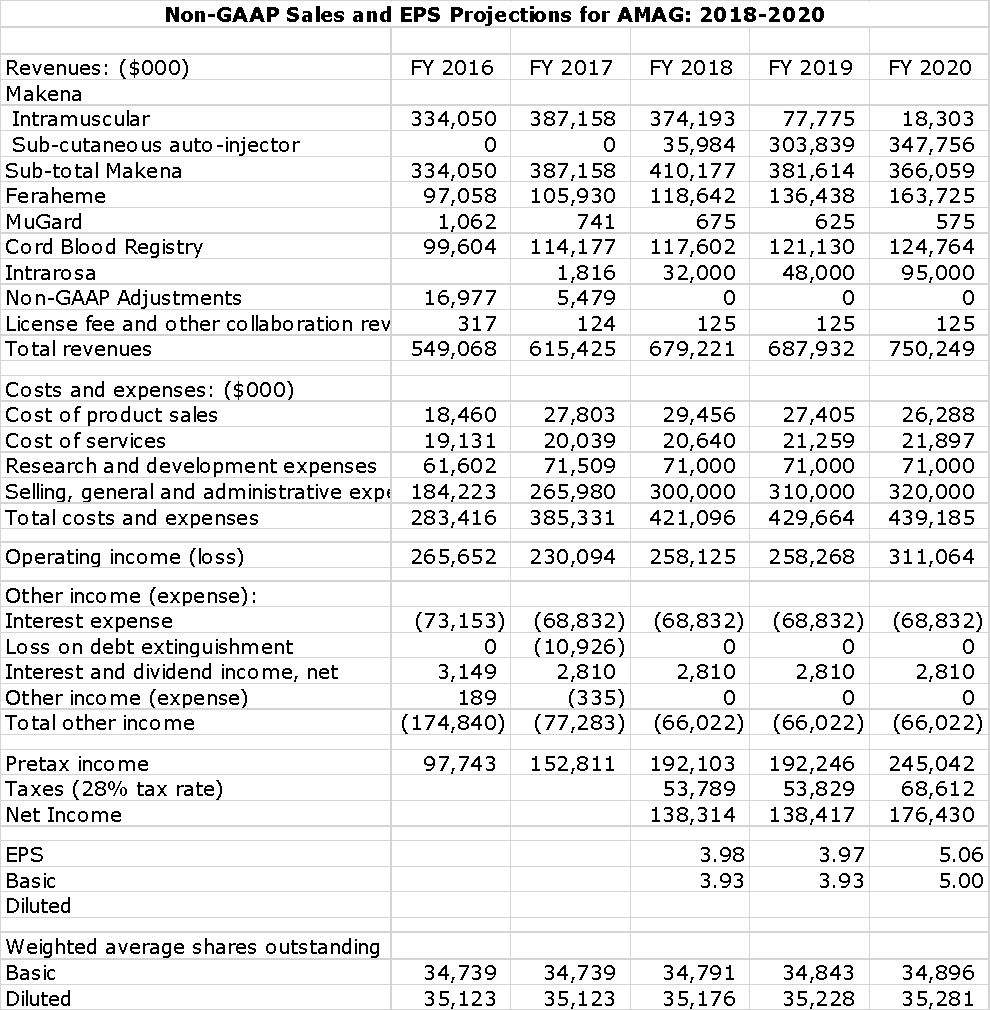

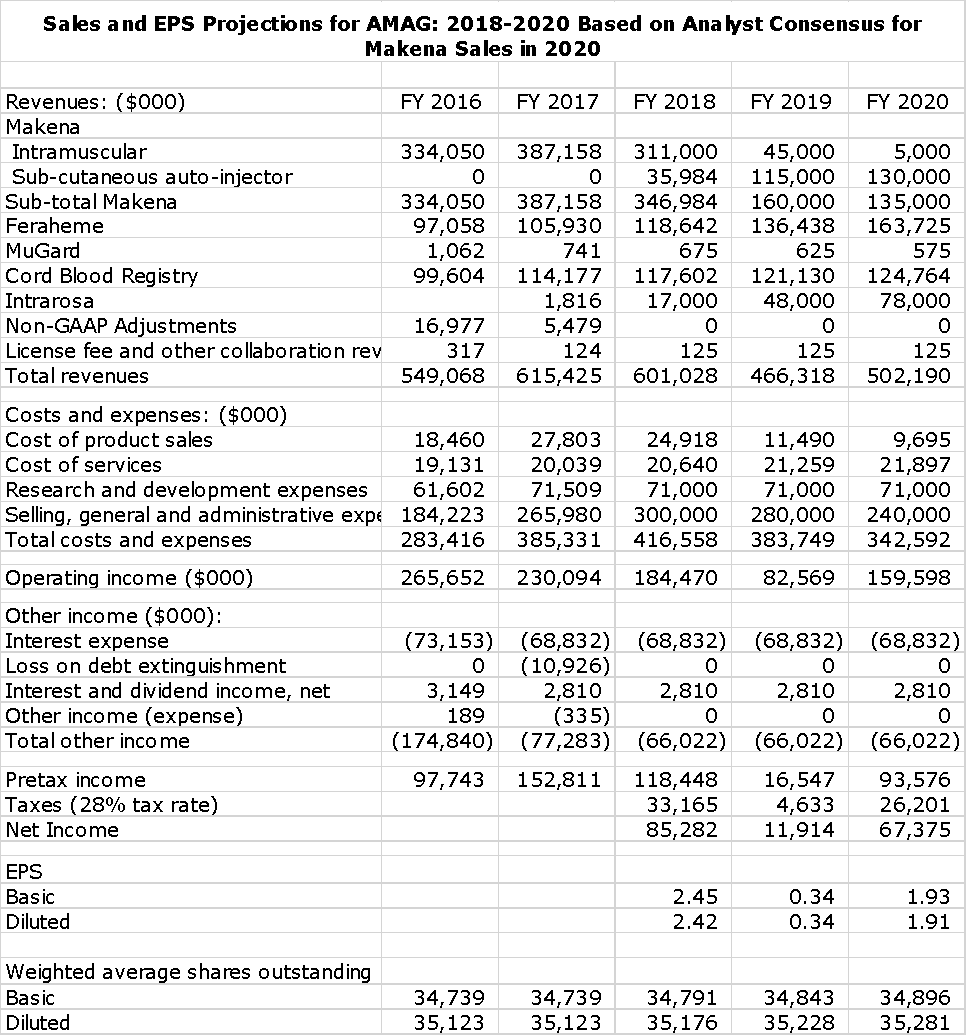

I want to emphasize at the very outset of this report that the key takeaway is that I believe that there is reasonable probability that analyst consensus estimates for Makena sales and projeciions for AMAG's non-GAAP EPS for the period 2018 to 2020 could be substantially low. Management has issued no direct guidance, but what has been released supports the dim analyst consensus view. The sales outlook for Makena is extremely difficult to project and numerous scenarios are possible. However, I have formulated an optimistic, but in my view achievable, outlook that is dramatically more positive. The following table compares analyst consensus estimates for Makena sales and non-GAAP EPS to this more optimistic scenario.

The analyst consensus view is really a mean rather than a consensus as the range of non-GAAP EPS estimates for 2020 ranges from a loss of $0.13 to a profit of $4.43. Based on analyst consensus projections, I estimate a price target range of $12 to $17 in 2020. In the optimistic case that I present I have a price target range of $50 to $60. To me, the risk reward is quite attractive.

There are two important potential catalysts in 2018. It is widely anticipated that there will be an approval of a generic to the intramuscular dosage form of Makena introduced in mid-year. Although widely expected, I would expect that this could cause a sharp, negative stock price reaction. On the other hand, there is also a possibility that no generic will be approved. Because of this uncertainty and the difficulty in having very strong conviction in my optimistic scenario. I will only buy a portion of a full position in the stock at this time. (I have a policy to only buy a stock 48 hours or later after publication of a new buy recommendation.)

The second catalyst is that there are reports that Cord Blood Registry may be divested. This business really doesn’t fit with the business model that now drives AMAG. This business was acquired for about $700 million in 2015 and even if it is divested for less, I think it would be a positive for the stock. AMAG is highly leveraged with $466 million of long term debt and $268 million of convertible debt that give rise to $68 million of annual interest expense. Although I deem it conservative, management guidance is for cash flow of $100 to $130 million in 2018 so that servicing interest expense on debt consumes much of cash flow. The proceeds from a CBR sale could be used tosubstantially de-lever the Company and I think that this could be a big boost for the stock.

Investment Thesis

This year will be crucial for AMAG’s key product Makena, which had sales of $387 million in 2017 (63% of 2017 sales of AMAG). It may face generic competitors to its older intramuscular (IM) dosage form as early as mid-year 2018 although this is not certain. Wall Street analysts following the stock have a consensus sales estimate for the Makena franchise of $135 million in 2020 and management guidance (quite conservative in my view) supports this pessimism. However, AMAG has just launched a line extension of Makena that administers the drug with a sub-cutaneous auto injector (SC) instead of a deep intramuscular injection. As I discuss in detail in this report, the advantages of the auto-injector are significant in my view and potentially could allow AMAG to maintain much more of its current Makena franchise than management is guiding toward and analysts are projecting. If so, there could be dramatic upside potential for the stock.

The Makena situation will play out dramatically this year and next. I think that there is a strong case to be made that the auto-injector is meaningfully superior to the IM dosage form and that this will result in much of the Makena franchise being maintained. (The reasons for this view are discussed in detail in this report). At least until mid-year, AMAG will not have to deal with a generic competitor to the IM dosage form and there will be no generic to the new auto-injector for many years; Orange Book listed patents afford protection until the 2030s. Also, it is not a certainty that a generic will be introduced at mid-year as the generics division of the FDA has been notoriously slow in approving ANDAs. Even in the face of generic competition to the IM dosage form, there could still be rapid uptake of the auto-injector. I don’t have the resources to conduct a broad survey of OB/GYNS, but I did contact a few who are substantial prescribers of Makena and feel that the auto-injector could be a home run for AMAG and actually expand the Makena market. I emphasize that this is a very limited sample size. However, it bolsters my view that management guidance for Makena and analyst’s expectations are so low that there is room for a substantial upside surprise.

The stakes for the stock price are high. I think that if analysts’ expectations are accurate that non-GAAP EPS in 2020 reach $2.00 that AMAG’s stock in 2020 could trade in the $12 to $17 range. However, I present in this report a more optimistic scenario in which Makena sales remain stable (about $366 million in 2020) resulting in non-GAAP EPS of $5.00. Applying a low P/E for successful specialty pharmaceutical companies of 10 to 12 would result in a price target of $50 to $60. There are also all types of in-between scenarios. I think this strong upside case and acceptable downside risk warrants a Buy on the stock. I want to caution investors that the announcement of a generic approval (whenever) could cause a meaningful downside reaction in the stock price. For that reason, in my personal account I will initially only purchase a portion of the number of shares that I ultimately intend to purchase. I will be keenly watching the early launch of the auto-injector, the timing of generic entry (it could be delayed beyond mid-year) and the degree of Makena sales erosion caused by generics when they enter the market.

Wall Street Sales and Earnings Expectations and Management Guidance

In this report, I am primarily focusing on the issues that I believe will be most important in determining how successful AMAG may be in converting usage of Makena from the intramuscular injection to the subcutaneous auto-injector. As I have previously stated I think that management’s guidance and analysts’ expectations for 2018 through 2020 are too pessimistic. Let me start by going over the guidance that AMAG has issued for 2018.

Management Guidance for 2018 is Dismal, but Probably Too Pessimistic

Management has issued extremely discouraging guidance for 2018 based on the assumption that at least one generic competitor to Makena will be launched at mid-year. This would result in the introduction of an authorized generic by a partner of AMAG so that there would be the authorized generic and a competitor generic competing in the market alongside Makena. Management is vague on what they expect for Makena price erosion or the potential loss of unit market share, but for 2018, management has guided to:

- Corporate revenues of $500 to $560 million. Based on my sales model, this implies revenues for Makena of $180 to $240 million down from $387 million in 2017.

- GAAP operating loss of $117 to $147 million that corresponds to non-GAAP operating income of $100 to $130 million. This would have to service $68 million of interest expense.

The sales guidance for 2018 seems way too conservative. If we were to assume no generic competition in 2018 and that Makena franchise sales were to grow at 5% (they increased 16% in 2017), Makena sales in 2018 would be $407 million. AMAG assumes no generic completion in 1H, 2018 so that sales could grow at 5% reaching $189 million in 1H, 2018 and in a scenario where there is no generic competition, 2H, 2018 sales of Makena might be expected to reach $217 million. Management’s guidance points to Makena revenues of $180 to $240 million for 2018. This implies $0 to $50 million of Makena sales in 2H, 2018. I consider the 2018 management guidance to be so conservative as to be ignored.

What Is Management Saying About 2019?

Management hasn’t issued any guidance for 2019 for Makena sales.

What are Wall Street Analysts saying about 2018 and further on to 2020?

The consensus sales estimates by analysts who follow the stock is that 2018 sales for Makena will be $263 million. This compares to management guidance that implies $180 to $240 million. The consensus 2018 non-GAAP EPS estimate is $1.88 within a range of $1.06 to $2.84.

Looking out to 2020, the consensus sales estimate for Makena is $135 million and the consensus non-GAAP EPS estimate is $2.05 within a range of a loss of $0.13 per share to a profit of $4.43. I have constructed a P&L for 2020 in which I use consensus sales estimates for Makena of $135 million that results in a 2020 non-GAAP EPS estimate of $1.91.

What Conclusions Do I Draw?

Management guidance for 2018 seems to be much too low. Wall Street analysts seem to be a little more optimistic on 2018 sales of Makena, but are pessimistic on 2020. It seems to me that AMAG has lowered the guidance hurdle so low that an inch worm could jump over it. The guidance suggests extremely rapid erosion of the Makena franchise after a generic introduction and that the launch of the auto-injector will not be that successful.

I believe that a case can be made that management and Wall Street analysts are way underestimating the potential of the subcutaneous auto-injector to replace much of the unit usage of Makena. If so, this would be a major, major upside surprise and result in a dramatic upward price movement. But, is this a possibility? Maybe. Let me tell you what one OB/GYN who is a heavy prescriber of Makena had to say about the potential for the subcutaneous auto-injector. He was aware of the characteristics of the auto-injector. In his words, he said that the auto-injector is a home run that will not only maintain most of current sales of the Makena franchise but actually expand it.

In this report, I go over a number of the key issues that will determine how much of the unit market share of the Makena market that the auto- injector will maintain. I can come up with many different scenarios. However, in an optimistic, but plausible scenario I can see sales levels of Makena being flat through 2020. There are so many possible scenarios that I am not going to bang my fist on the table that this is the scenario but it is possible. I will leave you to go through my discussion of the attributes of the auto-injector and judge whether management’s and analysts’ grim outlook is correct whether a more optimistic scenario is possible or perhaps you may choose to come up with your own scenario.

Overview of AMAG Investment Issues

I initiated coverage of AMAG Pharmaceuticals on June 26, 2016 in a report entitled AMAG Pharmaceuticals: Initiation of Research on a Complex but Potentially Very Interesting Investment Situation. At the time, I adopted a wait-and-see approach to recommending the stock principally because of issues related to its key product Makena, which accounted for over 60% of sales. There were significant issues facing Makena as follows:

- Until February, 2016, Makena was supplied in a five dose vial (it is given as one dose per week) which meant that it required a preservative. The preservative was a concern as it was believed to cause allergies in some women.

- AMAG introduced a single-dose vial without a preservative in April 2016 which avoided allergic reactions.

- The Orphan Drug exclusivity on Makena was due to end on February 3, 2018 which allowed generics to enter the market for the first time.

- AMAG’s principal strategy for extending the life cycle of Makena was to introduce a subcutaneous auto injector to replace the intramuscular administration.

We are now at the moment of truth for AMAG and Makena. The subcutaneous dosage form gained approval and was commercially introduced in late March 2018. There could be an introduction of a generic version of the intramuscular dosage; expectations are that this will be in mid-2018 at the earliest. The critical question for the stock price of AMAG is how well the Makena auto injector performs in extending the life cycle of the Makena franchise. In 2017, Makena had sales of $387 million (63% of corporate sales). Consensus analyst expectations are for 2018 sales of $263 million and 2020 sales of $135 million. The key to the stock is whether Makena franchise sales can meaningfully beat these expectations.

There are two other key products of AMAG. The intravenous iron product Feraheme had 2017 sales of $107 million (18% of corporate sales) and Cord Blood Registry had $114 million (19%). Feraheme has just received a product label expansion that should significantly accelerate the growth rate above the 9% rate in 2017. Sandoz challenged the patents covering Feraheme and on March 23, 2018 a settlement agreement was reached. If Sandoz can gain an ANDA approval a generic could be introduced on July 25, 2021. However, under the terms of the agreement, it is more likely that Sandoz will launch an authorized generic on July 15, 2022. I will discuss this in more detail later, but it gives clarity that Feraheme is unlikely to face a generic for three to four years. I will also go into detail later on issues that have thwarted efforts to develop generics to some other injectable iron products that have gone off patent.

Cord Blood Registry was acquired in 2015. While it has predictable low-to mid-single digit sales growth, it seems increasingly clear that this doesn’t really fit with the strategic direction of AMAG, and there are reports that CBR is up for sale. I think investors would view a divestiture as positive even if AMAG received less that the $700 million it paid for CBR.

The pipeline of AMAG receives little focus from investors as they are so locked in on Makena. The Company just introduced in 2017 a new product for dyspareunia (pain during sexual intercourse) called Intrarosa (prasterone). This product is meaningfully differentiated from the leading estrogen based products for which sales of in the US are about $1.4 billion. They are prescribed for post-menopausal symptoms of which dyspareunia is one.

AMAG is making a huge investment in this product as it is marketed through a newly created 140 person sales force. I estimate that it costs about $200,000 to keep a sales person in the field so this is an investment of $30 million and there is considerable more in launch costs. AMAG seems to feel that Street consensus sales estimates of $21 million in 2018 and $73 million in 2020 are conservative and I agree. However, Intrarosa is not likely to be an important determinant of the stock price until late 2019 or 2020.

The Company also filed an NDA on bremelanotide in March 2018; it is for female sexual dysfunction. Further back in development is Velo for severe pre-eclampsia. Both bremelanotide and Velo are totally off the radar screen of investors and Intrarosa is a small blip. There is the potential for substantial upside surprise from these products at some time in the future, but not likely in 2018.

AMAG is a specialty pharmaceutical company that is a different type of company from the research driven companies that I tend to focus on. It is a pharmaceutical marketing company that does not develop products based on a technology base. It acquires products that have been created by others and then focuses on marketing, which it does extremely well. It also contracts out its manufacturing. AMAG is all about marketing. This creates a different dynamic from research driven companies as it has to identify and acquire products to feed its marketing engine.

AMAG has been dependent on acquisitions that have resulted in considerable debt leverage. By the end of 2017, it had long term debt and convertibles of $816 million outstanding which are primarily responsible for $68 million of annual interest expense. The acquisitions give rise to significant non-cash expenses that make financial reports based on Generally Accepted Accounting Principles (GAAP) quite difficult to interpret. Hence management provides non-GAAP numbers that exclude certain non-cash expenses. AMAG’s Specialty Pharmaceutical model is quite different from a research driven model that I tend to gravitate toward. Still, if executed properly, it can be very rewarding for shareholders. I think that Forest Laboratories is one of the prime examples of success for this model.

As a final note, this report is not going to go over a lot of the basics on AMAG. If you don’t have a good feel for the products of AMAG, the markets they compete in and other fundamental issues, I would refer you to my June 26, 2016, 37 page report. While obviously some things have changed, it still gives a reasonably good description of the basics. This current report is almost totally focused on one key question “Can AMAG defend or possibly expand its sales of Makena with the new subcutaneous auto-injector or will generics significantly damage the franchise.

Key Aspects of the Makena Franchise

Makena is Available in Three Injectable Dosage Forms

AMAG has three injectable dosage forms of Makena in which it is given once a week for about 14 weeks during pregnancy. The first dosage form that was introduced in 2014 is a vial that contains five doses of Makena’s active ingredient-hydroxyprogesterone caproate. Because the vial is used to deliver five doses over the course of five weeks, it has to contain a preservative which is believed to cause allergic reactions. In April 2016, AMAG introduced a single dose vial of hydroxyprogesterone caproate without a preservative that gained rapid acceptance and now accounts for about 90% of unit volume.

The administration procedure for both the five dose and single dose vial is essentially the same. An 18 gauge needle is used to first extract the drug from the vial. It is then transferred to a 21 gauge needle that is 1 and 1/2 inches long and is administered in a deep intramuscular injection that takes about 1 minute. This feels like a flu shot and can be painful. Also, the anticipation of pain can cause many women to dread injection and in some cases to reject the product. The length of the needle requires a deep injection so that it has to be injected in a large muscle which in this case is the gluteus maximus muscle in the buttocks; this means that the woman has to disrobe. The overall procedure can take several minutes.

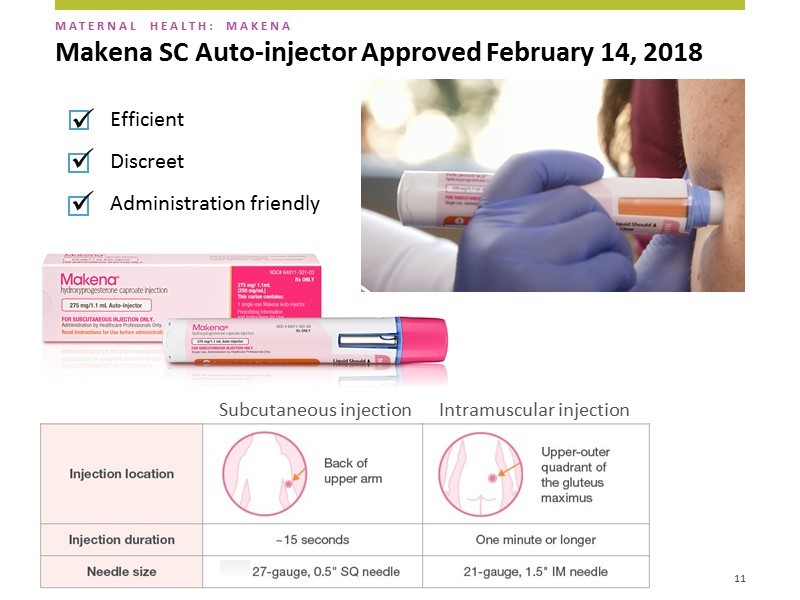

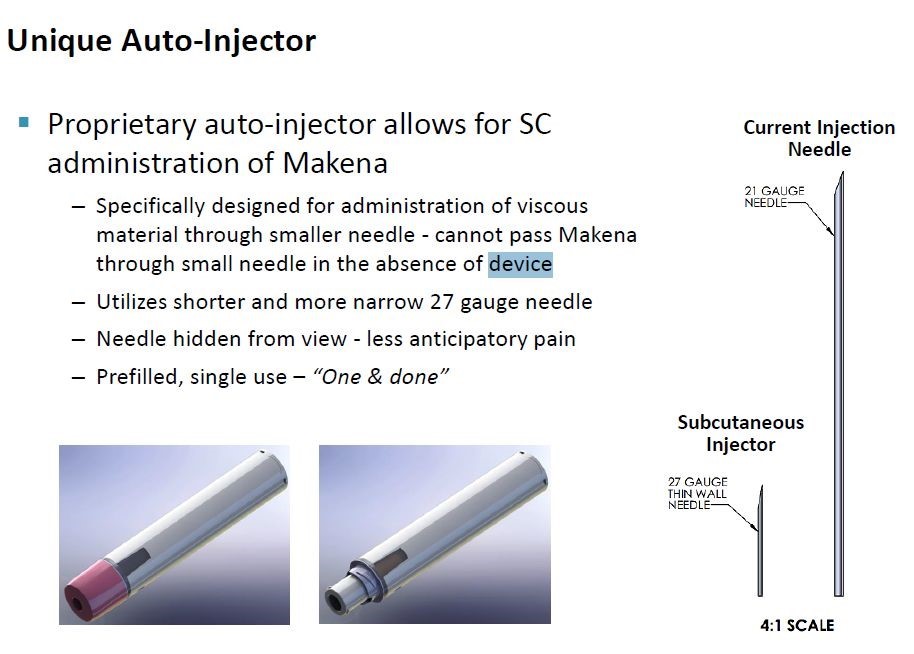

The subcutaneous dosage form contains one dose of hydroxyprogesterone caproate in a disposable auto-injector. The needle used is a small 27 gauge needle the same size as that used daily by diabetics to inject insulin. The needle is only 1/2 of an inch versus 1 and 1/2 inches for the intramuscular products. Hence, the injections can be given in the back of the upper arm without requiring the woman to disrobe. The needle is hidden at all times so the patient and healthcare provider never sees it. After administration the needle retracts into the device to avoid inadvertent needle sticks and the whole injector is discarded. The injection takes about 15 seconds and the overall procedure us about one minute. A picture of the auto-injector delivering a dose of Makena is shown below.

Comparing Pain of Intramuscular Versus Subcutaneous Injection

When I wrote my June 26, 2016 report it was my expectation that the subcutaneous injection would be virtually pain free. It uses the same auto- injector that Antares developed to administer Xyosted (a testosterone replacement product). Studies with the injector for that product indicated that on a scale from 0 (no pain) to 100 (severe pain) the subcutaneous auto-injector had an average pain score of 4. I personally have received an injection of saline with this injector and felt virtually nothing.

It was the expectation of both Antares and AMAG that Makena subcutaneous would be virtually pain free as compared to the significant pain of the intramuscular formulation. AMAG planned a study to show that the subcutaneous was less painful and if this trial was successful, AMAG could have potentially gained another seven years of Orphan Drug exclusivity. I thought this study would be a slam dunk success for the auto-injector. However, in the pharmacokinetics study that was the basis for approval (the study to show less pain was to be done later), to the great surprise of AMAG and Antares, the study showed that there was a meaningful incidence of injection site reactions.

In the package insert, the FDA required that this be described as follows:

“In a study where the Makena intramuscular injection was compared with placebo, the most common adverse reactions reported with Makena intramuscular injection (reported incidence in ≥ 2% of subjects and higher than in the control group) were: injection site reactions (pain [35%], swelling [17%], pruritus [6%], nodule [5%]), urticaria (12%), pruritus (8%), nausea (6%), and diarrhea (2%).

In studies where the Makena subcutaneous injection using auto injector was compared with Makena intramuscular injection, the most common adverse reaction reported with Makena auto-injector use (and higher than with Makena intramuscular injection) was injection site pain (10% in one study and 34% in another).”

This statement is perplexing as it seems to indicate that the injection site reaction with the subcutaneous and intramuscular injections is 10% in one study and 34% in another. The FDA chose to characterize this as greater injection site reaction with the auto-injector than with the IM dosage. Think about the 1 ½ inch long, 21 gauge needle used in the IM and the requirement for a one minute injection as opposed to the 15 second injection and a small 27 gauge ½ inch needle used in the auto injector. The 27 gauge is typically the needle size used to deliver insulin. It is baffling to think that the injection site pain would be the same or greater for the auto-injector. Still, this is what the language in the package insert seems to imply.

Based on anecdotal comments and not on data from a trial, it is my understanding that about 25% of women given the subcutaneous auto-injector experienced an injection site reaction in the PK study. The remaining 75% appear to experience the lack of pain that I had expected. The degree and type of pain appears to be different from an IM injection. With the auto-injector there is a stinging, burning sensation that is transient and seems to result from some interaction of the drug and tissue, not the injection. The pain with the IM injection is more like that experienced with a flu shot and can last for a day or so.

If the anecdotal comments are correct, the important point to remember is that 75% or so of the women who receive the subcutaneous injection will experiences little pain and the 25% who do have an injection site reaction may not experience the lingering pain of a deep IM injection. If so, I believe that in the marketplace the subcutaneous auto-injector will live up to the expectation that it will cause less pain and will be much preferred over the IM by both patients and physicians. Still, AMAG feels that it is extremely important for reps to alert doctors and patients that there could be an injection site reaction so that it does not come as a surprise.

Needle Phobia

There is also the corollary issue of needle phobia. Some women look at the large 1½ inch long IM needle and refuse to take the shot. With the subcutaneous auto-injector, the design is such that the patient never sees the needle before or after injection. AMAG feels that needle phobia might be a greater deterrent to continued or initial use than an injection site reaction. The following picture illustrates this.

Formulary Issues

AMAG has been working with insurers on gaining reimbursement for the auto injector and has said that so far there have been no issues. They have built into many of their contracts the provision that if they introduce a line extension like the auto-injector at the same price as the intramuscular dosage that they will gain immediate formulary access and reimbursement. This provision allowed the single dose vial quickly to capture 90% of the unit market for Makena following its April 2016 introduction. I think that there certainly could be very quick conversion in the time in which there is no generic in the market.

AMAG does much of its business with managed care and Medicaid through contractual agreements. It may be the case that some of these contracts extend beyond the time when a generic(s) is introduced (mid-year or later). If this is the case, upon approval, the generic might not immediately compete for the Makena business. This would allow more time for the physicians to develop familiarity and comfort with the auto-injector and possibly conclude that it provides meaningful medical benefits over generic IM injections.

After the generic is approved, some formularies might position it as tier one which means that a generic IM should be the first dosage used unless there is a medical reason for prescribing the auto-injector. However, if physicians are convinced that the auto-injector causes less pain and that women will be more compliant with the auto-injector, this would be a legitimate medical reason that probably would allow the auto-injector to be used first. These women are already very uncomfortable from their pregnancy and the physician would like to avoid contributing further to this discomfort. Also, if a woman were to elect not to take the drug because of the fear of pain or needle phobia, it increases the risk of premature birth. The cost of caring for a premature birth can run into the hundreds of thousands of dollars. Weighed against saving a few hundred dollars by mandating the use of the generic IM may not be a good risk/ reward decision.

The Medicaid Market

Because of the price sensitivity of the Medicaid market, my first impression was that this would be the market most vulnerable to sales erosion from a generic, but I think this may not be the case. The WAC or list price for Makena is $803 but discounts and rebates sharply reduce the actual selling price. AMAG says that the average net selling price across all accounts is $420 to $450. It further says that Medicaid accounts for half of the unit usage of Makena. I would generally expect that the rebates and discounts to managed care would be about 30% implying a price of $562 (remember this is half the business). In order to achieve an average price of $435, the Medicaid business (the other half of the business) would have to be priced at $308.

Using these assumptions sales to managed care would be $250 million and sales to Medicaid would be $137 million. Later in this report, I discuss the generic situation in which the Delalutin generic (having the same active drug component but approved for a different indication) was priced at $345. This $345 is a good proxy for the price that a generic will initially be priced. It may be the case that the Medicaid price of Makena is already so low that it is not that vulnerable to generic competition.

Price Competition in the Sterile Injectable Markets

Most investors are accustomed to think that there will be a rapid meltdown of price when a generic enters the market. This is certainly the case for many oral generics. The first generic competitor comes in at a 40% or so price discount to the original price. The second comes in at 60% discount and as others enter the market the price can collapse 80% or more. In a year or two, it becomes a commodity market.

This type of price erosion is not typical of what occurs with generic competition to sterile injectable products. The manufacturing requirement demands rigid quality control as the product is being injected directly into the blood stream so that if it contains an impurity or pathogen, there could be devastating consequences. This makes the cost of manufacturing higher and can limit the supply of drug in the market. It also means that the FDA sets a much higher bar for gaining approval of an ANDA. Delalutin’s manufacturing facility is already approved so this should not be a problem for its developer Aspen/ANI and I expect that they will be first to market. However, subsequent generics may find it very difficult to gain approval.

Potential for Self-Injection

Investors have asked if there is any potential for patients to self-inject. AMAG’s discussions with the FDA suggest that this would be an involved process that would require a user study and would probably be cost prohibitive. Also, these are high risk pregnancies so that physicians like to see these women frequently so that a weekly visit is not a big problem.

The auto-injector does, however, offer the opportunity for market expansion. The injection could be done in a retail pharmacy which would be an important change because the intramuscular cannot be administered in this setting. Some states are pressing quite hard for Medicaid patients to receive injectable therapies at pharmacies rather than in the physician’s office or having a home health care nurse administer the shot at home. This is a natural partnership for AMAG to pursue with pharmacies and could afford meaningful cost benefits to Medicaid or managed care for that matter.

AMAG believes there are Three Key Selling Points for the Auto-Injector

AMAG emphasizes that there are three key selling points of the auto-injector, it is: (1) efficient, (2) discrete and (3) administration friendly.

It is a rapid injection that takes only 15 seconds. The IM takes over one minute. It may not seem like a lot but if you think about a 1 1/2 inch needle going into the buttock and staying there for over a minute, it can be really uncomfortable- this is a big factor.

Discrete is important. The needle is much smaller and is covered so that the patients cannot see it. AMAG did market research which showed that this along with the size of the needle was the number one reason why patients would prefer the subcutaneous over the IM.

It is administration friendly. It is much easier for offices to use this product. They don’t have to use an 18 gauge syringe to remove the drug from the vial and then inject that into a 21 gauge needle to administer the drug to the patient. Also the patient doesn’t have to disrobe. The auto-injection injection takes about 15 seconds while the whole process of unwrapping, injecting and disposing takes about one minute. The auto-injector is taken out of the box, unwrapped, injected and disposed of in 10 to 15 seconds

Initially AMAG thinks that the auto-injector will be broadly used in new patients. The question is whether patients already started on the intramuscular dose will be switched to the auto-injector. Once the office staff gets comfortable they may switch over mid-therapy. This is an important variable to monitor.

Potential Generic Competition to Makena IM

FDA could not approve a generic to Makena before its period of exclusivity due to its Orphan Drug status ended on February 3, 2018. However, it did approve the same active moiety (hydroxyprogesterone caproate) for a different product targeted at a different indication. Aspen Pharmaceutical received approval for an abbreviated new drug application (ANDA) for a generic to Delalutin in August 2015 and marketed it through ANI Pharmaceuticals (ANIP) in 2016. Delalutin has the same active ingredient as Makena, but it was approved for a different indication in non-pregnant women. Its manufacturer Squibb, ceased marketing in 1999 so there are minimal or perhaps no sales. It seems obvious that this was the first step of an Aspen/ ANI plan to launch a generic against Makena by gaining FDA approval to manufacture hydroxyprogesterone caproate. In any ANDA, obtaining manufacturing approval for the active ingredient is a major hurdle for a generic to overcome. This should make gaining approval for a generic to Makena quicker and easier than would otherwise be the case.

Delalutin is available as a five dose vial with a preservative required. As over 90% of the Makena market has converted to the single dose preservative free vial, the market opportunity for the five dose vial is small and disappearing. The focus of Aspen must be on the single dose vial; the length of time to gain approval can only be guessed at, but let me lay out some facts to consider.

- We do not know when Aspen submitted an ANDA for either the five dose or single dose vial. Will they seek approvals for both dosage forms and just the single dose, preservative free vial?

- The FDA generics division is so overwhelmed with ANDAs that recent approvals have taken roughly 36 months from the time of submission. However, because Aspen already has approval to manufacture hydroxyprogesterone caproate, this timeline might be shorter.

- The ANDA for the five dose vial could have been submitted at the same time as Delalutin back in 4Q, 2014 or 2015 which was over 36 months ago, but the FDA could not approve it until after February 3, 2018. Obviously, there has been no such approval, but the ANDA submission most likely would have surpassed 36 months.

- The approval for AMAG’s single dose vial of Makena was in February 2016. Did Aspen anticipate this line extension and begin preparing before then? In 2014, it was known that AMAG was pursuing this line extension so Aspen should have anticipated it.

- An ANDA requires a pharmacokinetics (PK) study that takes perhaps six months to complete. There was no single dose vial of Makena commercially available until April 2016 that would allow Aspen to do such a PK study. This suggests that the PK study started sometime after that, but could have been completed by 4Q, 2017 and allow for an ANDA filing about 12 months ago.

- Because of prior approval of manufacturing the 36 month average time for ANDA approval may not apply and approval of an ANDA could be faster.

- On the other hand, the FDA seems much more careful on injectable biological products. AMAG encountered delays in gaining approval for the single dose vial as Complete Response Letter was received in May 2015. However, a second contract manufacture, Hospira, filed a sNDA in July 2015 and this led to approval in February 2016.

- Are firm(s) other than Aspen/ANI pursuing Makena generics?

- Has Aspen/ ANI filed ANDAs yet? It seems probable that they would be first to file. Given that the potential opportunity to genericize Makena is a material event for these companies, it might have required a press release in which these companies stated that they have been notified or believe that they were first to file. This has not yet occurred.

There are a lot of moving parts to trying to assess when a generic to either the single or five dose vial could be approved. If we were to apply the 36 month average time for approval and if we assume that Aspen/API filed an ANDA for the five dose vial at the same time as it filed the ANDA for Delalutin, the ANDA was probably filed in early 2015 or over 36 months ago. If we assume that a PK study for the single dose vial was started a month after the approval for Makena in February 2016, an ANDA for the single dose might have been filed in 4Q, 2016 or 18 months ago and if the 36 month timeframe were to apply, it might not gain approval until 4Q, 2019. However, the fact that Aspen already has approval for manufacturing hydroxyprogesterone caproate could mean that the 36 month rule might not apply.

It is difficult for investors to guess when there will be an approval for the single dose generic to Makena. AMAG has issued guidance that they do not expect approval of a generic before mid-2018 but provided no guidance as to whether this would be the single dose vial or five dose vial. This guidance is based on two inputs. They have signed up with a generics company to do an authorized generic if and when a generic is approved. This firm has good insight into potential generics to Makena entering the market. They also have signed up a firm specializing in projecting when generics will come to market. Based on this combined input they are expecting a generic at mid-year or later. I think that a five dose vial with preservative would be rejected by the market; AMAG may only have to fear a generic to the preservative free single dose.

Potential Generic Competition to Subcutaneous Auto-Injector

It may be the case that there will be no generic competitor to the auto-injector for several years, if then. There are patents that may protect the auto-injector into the 2030s so that a potential competitor could not exactly copy the design. They would have to design around patents. This means that they would likely have to gain approval through the 505 (b) 2 regulatory pathway and not as an ANDA. The competitor would not be substitutable for the Makena auto injector and would have to be marketed as a branded product.

AMAG holds a U.S. patent directed to subcutaneous administration and dosing of the Makena auto-injector which will expire in 2036. In addition, AMAG developed the Makena auto-injector with its device partner Antares Pharma which holds issued patents on the auto-injector device and drug-device combination, the last of which expires in 2034. All patents are Orange Book listed

Of course, payor formularies could still position a single dose, preservative IM Makena generic as tier 1 and put the auto injector at 2. This would require the use of the generic ahead of the auto injector unless physicians could argue and payors agree that the auto-injector meets an unmet medical need. The argument would likely be that the lesser pain and sharply reducing needle phobia would be necessary for the patient to remain compliant. The cost of caring for a premature birth can run into the hundreds of thousands of dollars. Weighed against saving a few hundred dollars by mandating the use of the IM is not a good risk/ reward decision.

Other Products of AMAG

I do not intend to go into great detail on the other marketed products of AMAG and its pipeline. If you would like some background on Feraheme and Cord Blood Registry I would refer you to my initiation report of June 26, 2016. I will only touch lightly on them in this report. I go into modest detail on two new products that were acquired in 2017-Intrarosa and bremelanotide. This is because the investment outlook for 2018 is all about Makena. However, I would hasten to add that I believe that the pipeline prospects of AMAG are generally underestimated and I can see enthusiasm for Intrarosa and bremelanotide potentially driving the stock in 2019 and 2020.

Feraheme

Approval of Broader Label is a Major Positive

AMAG announced on February 5, 2018 that it had received a sNDA approval that broadens the existing label from treating only patients suffering from iron deficiency anemia (IDA) due to chronic kidney disease (CKD) to include all eligible adult IDA patients who have intolerance to oral iron or have had unsatisfactory response to oral iron. This sNDA approval immediately doubles the number of patients who could benefit from Feraheme (both CKD and non-CKD) to approximately one million patients per year.

Phase 3 Studies That Supported Label Expansion

The Feraheme label expansion approval was supported by two positive pivotal phase 3 trials evaluating Feraheme versus iron sucrose or placebo in a broad population of patients with IDA. It was also supported by positive results from a third phase 3 randomized, double-blind, clinical safety trial comparing Feraheme to the market leading product Injectafer (ferric carboxymaltose injection) in approximately 2,000 adults with IDA. The study demonstrated comparability to Injectafer based on the primary composite endpoint of the incidence of moderate-to-severe hypersensitivity reactions (including anaphylaxis) and moderate-to-severe hypotension.

The study also met important secondary safety and efficacy endpoints, including the demonstration of mean improvement in hemoglobin per gram of iron administered from baseline to week 5 (1.35 g/dL Feraheme versus 1.10 g/dL for Injectafer. Adverse event rates were similar across both treatment groups, however, the incidence of severe hypophosphatemia (defined by blood phosphorous of <0.6 mmol/L at week 2) was less in the patients receiving Feraheme (0.4% of patients) compared to those receiving Injectafer (38.7% of patients).

Broader Label Enables Differentiation from Injectafer and other Intravenous Irons

There are two key things in the label. The lower incidence of hypophosphatemia is an important differentiation over Injectafer which is the largest selling injectable iron product; in 2017 it accounted for 34% of the market. There is also important data in the label relating to reduction of fatigue. Feraheme is the only intravenous iron product that has this data in its label.

Management believes that this data will allow Feraheme to replace Injectafer as the market leader. It is also important for market expansion. They see the opportunity to address a new market that potentially could significantly increase the addressable market. One of the largest pools of patients diagnosed with anemia but not treated with IV iron are women with abnormal uterine bleeding. These patients are treated by the OB/GYNs that also prescribe Makena. AMAG knows this market well and has strong relations with OB/GYNs through its marketing of Makena, CBR and Intrarosa.

Management believes that in terms of contracting, there are some large group practices in which Feraheme could now become either the first choice or the sole source for the treatment of anemia for patients who have failed oral iron products. They state that discussions are going very well and as 2018 progresses, they anticipate that they will sign some very large contracts that will shift unit volume from Injectafer and other IV irons to Feraheme. By the end of 2018, they project a significant increase in the sales run rate and of course, the full benefit will be seen in 2019.

Patent Challenge

Sandoz has challenged the patents covering Feraheme and the litigation was scheduled to begin on March 19, 2018. On March 23, 2018, AMAG reached a settlement with Sandoz that ended the patent challenge. According to the terms of the settlement, if Sandoz receives FDA approval by a certain undisclosed date, it may launch its generic version of Feraheme on July 15, 2021. Sandoz will then pay a royalty to AMAG until the last patent listed in the Orange Book expires in 2023.

It may be difficult for Sandoz to gain this approval. The complex nature of IV iron products has largely prevented generic competition to intravenous iron products. The U.S. IV iron market is made up of five branded products, three of which have been off patent for several years. Despite attempts by a number of manufacturers to develop generic versions, there is only one generic IV iron available, and that was approved seven years ago. AMAG believes that this is because of difficulties in manufacturing and demonstrating bioequivalence. Feraheme is a complex molecule. It is a supermagnetic particle that is covered by a PSE shell so that the manufacture and demonstration of biological equivalence is a very significant hurdle.

If Sandoz is unable to secure approval by a certain undisclosed date, it will be entitled to launch an authorized generic version of Feraheme on July 15, 2022 for up to 12 months. Sandoz’s right to distribute, and AMAG’s obligation to supply the authorized generic product are in accordance with standard commercial terms and profit splits. In this event there would be two identical products in the market, Feraheme marketed by AMAG and the authorized generic marketed by Sandoz. There would likely be no generic. If Sandoz is unable to secure approval by June 2023 (the conclusion of the AG period), Sandoz would no longer be able to sell its generic version of Feraheme and AMAG would be the sole distributor of ferumoxytol. There is a good reason to believe that Feraheme will not experience a sales meltdown in the period beyond 2022.

Cord Blood Registry

Reasonably Attractive Business

Cord Blood Registry was acquired in August 2015. In AMAG’s hands its sales have been slow but steady and growing annually in low double digits. CBR now has over 700,000 stored units. They maintain a close relationship with customers, keeping them up to date on research advances and health issues. Management feels that this is a solid business with opportunities for growth beyond the current tissues they are storing for customers. For example, they cite studies in stem cell research. Duke University scientists have produced some exciting results in autism and cerebral palsy and other studies have suggested that stem cells could be of value in treating hearing loss.

CBR Is Probably Not a Good Strategic Fit for AMAG

In the short period of time since CBR was acquired, the business model of AMAG has rapidly evolved into marketing drugs for women’s health. This is meaningfully distinct from the service business of CBR. There have been rumors in recent months that AMAG is exploring a sale of CBR and management seems to suggest that it would be agreeable to selling CBR. There may well be buyers as I think that this could be a very interesting asset for a private equity firm.

The money received in a sales might provide greater value to stockholders by retiring debt and/or making more acquisitions. They have a high yield note that is $475 million. If AMAG were to sell CBR they would likely retire debt and the portfolio would more appropriately reflect what the company is becoming. AMAG paid $700 million for CBR, but I believe that even if they sold it for less than that, the market would take it positively.

Intrarosa (prasterone)

Product Description

On April 4, 2017, AMAG completed a licensing agreement with Endoceutics, Inc. for the U.S. commercial rights to Intrarosa (prasterone), which was approved in November 2016; it was then launched by AMAG in the US in July 2017. Intrarosa is the only FDA-approved, locally administered, non-estrogen steroid hormone for the treatment of moderate-to-severe dyspareunia (pain during intercourse); this is a common symptom of vulvar and vaginal atrophy (VVA) that occurs after menopause. Importantly, Intrarosa does not carry a boxed safety warning in its label like its estrogen competitors

Addressable Market

The addressable market is huge as there are an estimated 64 million post-menopausal women in the U.S. As many as 32 million women suffer from VVA symptoms and studies indicate that 44% to 78% of women with VVA suffer from dyspareunia. This is an undertreated disease as it is estimated that more than half of women who report symptoms of dyspareunia are not currently being treated with a prescription therapy or seeking treatment. The addressable market for Intrarosa is approximately 20 million post-menopausal women; this includes those who are currently on estrogen-based therapy.

Mechanism of Action is Different from Estrogens

Prasterone, the active pharmaceutical ingredient of Intrarosa, is an inactive steroid hormone that is converted locally inside the vaginal cells into androgens and estrogens. This intracellular production does not result in clinically meaningful increases in blood concentrations which is a major differentiation from the estrogen products. Unlike the estrogen based products, the Intrarosa label does not carry the boxed warnings about the increased risk of certain types of cancers, such as endometrial cancer, as well as cardiovascular disorders and dementia.

Phase 3 Trials That Supported Approval

Approval of Intrarosa was based on two 12-week placebo-controlled efficacy trials which demonstrated that women taking Intrarosa experienced a significant reduction in symptoms of dyspareunia. The most common adverse reactions were vaginal discharge and abnormal Pap smears, predominantly composed of atypical cells of undetermined significance. Intrarosa has not been studied in women with a history of breast cancer.

Sales Outlook

Intrarosa only recorded sales of $1.8 million in 2017, but this is not indicative of its potential. In the early phase of a launch revenues don’t follow prescriptions due to sampling, extensive couponing and other marketing measures intended to get women and physicians to give Intrarosa a try. Prescriptions are headed in the right direction as every week. NRxs and TRxs are growing as are the number of new prescribers. Each of these indicators are moving in the right direction. Since the launch in July, the emphasis has been on educating physicians about the product with the message being that Intrarosa should be the first product they prescribe for dyspareunia.

The next step will be to increase patient awareness. They will be launching a digital social media campaign in 2Q, 2018 to raise awareness that dyspareunia is a treatable disease. Management notes that every month there are about 74,000 internet searches about painful intercourse. This will be followed by a digital social media campaign to raise patient awareness of Intrarosa. The sales launch curve based on sales rep efforts to increase physician awareness is growing nicely. The patient directed social media campaign could cause a meaningful sales inflection later in 2018 and more pronounced in 2019.

In 2017 there was a significant promotional spend to ramp up the physician awareness and education program, CME programs, speaker programs, promotional material, samples. So there was a pretty significant cost directed at health care professionals. In 2018 they are shifting part of that initial investment over to consumers.

Bremelanotide

Product Description

On February 3, 2018 AMAG closed a licensing agreement with Palatin Technologies for exclusive North American commercial rights to bremelanotide. AMAG filed an NDA on March 26, 2018 so that approval and launch is possible in 2019. This product is an on-demand treatment of hypoactive sexual desire disorder (HSDD) in pre-menopausal women. HSDD is the most common type of female sexual dysfunction (FSD).

Addressable Market

HSDD affects approximately 12 million women in the U.S. and is characterized by low sexual desire that can cause marked distress or interpersonal difficulties. Approximately 6 million pre-menopausal women have a primary diagnosis of HSDD. Recent market research indicates that 95 percent of pre-menopausal women suffering from HSDD are unaware that it is a treatable medical condition. Furthermore, the majority of these women indicated a willingness to try a product like bremelanotide, if recommended by their doctor. This product fits very well into the product portfolio of AMAG.

Phase 3 Trials Supporting NDA Filing

Bremelanotide has a novel mechanism of action as it activates endogenous melanocortin pathways involved in sexual desire and response. Palatin has successfully completed two Phase 3 clinical studies in pre-menopausal women. These were double-blind placebo-controlled, randomized parallel group studies comparing a subcutaneous dose of 1.75 mg of bremelanotide delivered via an auto-injector pen to placebo. Each trial consisted of more than 600 patients randomized in a 1:1 ratio to either the treatment arm or placebo with a 24 week evaluation period. In both clinical trials, bremelanotide met the pre-specified co-primary efficacy endpoints of improvement in desire and decrease in distress associated with low sexual desire as measured using validated patient-reported outcome instruments.

Women in the trials had the option, after completion of the trial, to continue in an ongoing open-label safety extension study for an additional 6 months. Nearly 80% of patients elected to remain in the open-label portion of the study. In both Phase 2 and Phase 3 clinical trials, the most frequent adverse events were nausea, flushing, and headache, which were generally mild-to-moderate in severity. Importantly, bremelanotide has no known alcohol interactions.

Bremelanotide is Very Different from Addyi

Investors will compare bremelanotide to the miserable recent failure of another drug for HSDD. Sprout received approval for Addyi (filbanaserin) after previously twice rejecting the NDA. Valeant acquired Sprout in December 2015 for $1 billion primarily to acquire Addyi. The launch was a miserable failure and Valeant returned Addyi to certain shareholders of Sprout in December 2017 that freed Valeant of commitments to spend on the launch and marketing of Addyi. Valeant loaned these shareholders $25 million to fund operating expenses and will also receive a 6% royalty on sales. Investors are obviously looking at this precedent launch to judge whether this miserable failure was due to drug attributes or that there is no real market to address.

The mechanism of action of Addyi (filbanserin) is comparable to anti-depressants such as Prozac and Zoloft. It has a direct effect on the neurotransmitter serotonin and an indirect effect on dopamine and norepinephrine. The most prominent side effects are dizziness (11%), sleepiness (11%) and nausea (10%). The dosing is chronic rather than on-demand as is the case with Viagra for males and because of the side effects it is recommended that the dose be taken at bedtime. There was also a warning in the label not to consume alcohol with the drug. You can see that these are very troublesome side effects and dosing that would be a major deterrent for women.

The mechanism of action of bremelanotide is distinct from Addyi; it is a melanocrtin-4 agonist. Bremelanotide is an on-demand therapy which is much more desirable than chronic dosing for women who are probably going to have sex three or four times per month it doesn’t make sense to take a drug every day.

Addressable Market is Huge

There are 12 million women suffering from HSDD and most are not seeking treatment because they don’t believe they have a medical condition. This product will require an extensive education program to reach and persuade women to talk to their physicians. There will be a lot of education, but this is what AMAG is good at. As with Intrarosa, they will first focus on sales reps educating physicians about bremelanotide and then will follow with direct to consumer programs to the patient.

Summary of Key Sales and Cost Assumptions for AMAG

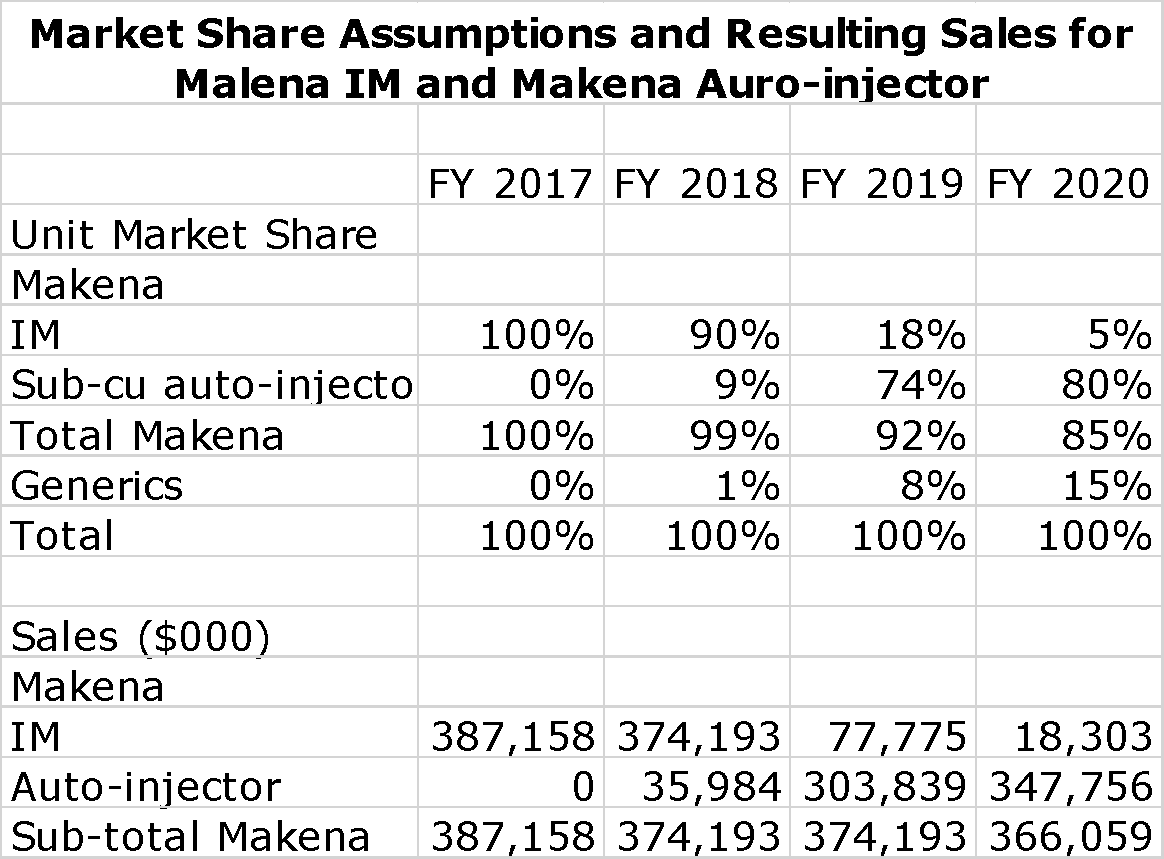

I have calculated the following table which shows sales and cost assumptions on a non-GAAP basis through 2020. This is based on AMAG maintaining stable sales levels of Makena through 2020. The numbers appear to be much more precise than they really are. By far, the most important thing in the sales and earnings forecast is total sales of Makena. I show my sales assumptions for Makena as an intramuscular injection and as an auto-injector. Here are my key assumptions:

- Overall unit volume growth for the market (Makena and generics) is 5% per annum though 2020.

- The first generic will be a single dose IM vial introduced into the US in 3Q, 2018. I would not be surprised if the introduction is considerably later.

- Remember that a woman on average takes 14 weekly injections of Makena. This means that women starting on Makena account for somewhat less than 30% of sale in each quarter. I assume that women started on IM won’t be switched to the auto-injector or a generic.

- By 2020, I have generics to IM Makena accounting for 15% of the unit market.

The Makena assumptions lead to the following sales projections for the Makena franchise.

Sales and Earnings Projections for AMAG Based on Maintaining Stable Sales of Makena Through 2020

In looking at other components of sales, I think that it is a fair assumption that Feraheme sales will accelerate from around 9% to 15% to 20% and I think that Intrarosa will contribute meaningfully to sales growth. I think that there is a high probability that Cord Blood Registry will be sold and the money used to retire debt and eliminate most of the interest expense. This could meaningfully offset the loss of operating income from CBR and boost EPS. However, my model does not project for this event and I show CBR continuing to grow sales at a low double digit rate. I do not include any sales projections for bremelanotide or Velo in this model

A meaningful portion of AMAG’s expenses are discretionary and could vary greatly depending on how well the switch goes of the Makena franchise switch to the auto injector. If sales decline sharply as is projected by most analysts, AMAG will cut back on sales efforts supporting Makena. The same goes for the launch of Intrarosa and the possible launch of bremelanotide. The more successful the launches, the more spending support. It is very difficult to project these expenses. Expenses in 2016 and 2017 are based on non-GAAP accounting and projections for 2018 to 2020 are also based on non-GAAP.

I am using a 28% tax rate to arrive at my EPS figure. This includes both federal and state taxes. There could be factors that change this, but using a normalized tax rate better reflects earnings power.

The detailed P&L for the case in which Makena sales are assumed to be stable through 2020 are as follows:

Sales and Earnings Forecast Based on Analysts’ Consensus Sales Estimate for Declining Makena Sales

I have also built comparable model for the case in which Makena sales decline to $135 million in 2020 which is the consensus analyst expectation. Sales estimates for Feraheme, Cord Blood Registry and Intrarosa are the same:

Tagged as AMAG, In-depth report on AMAG, Makena launch and market opportunity + Categorized as Company Reports, LinkedIn