AMAG: It Is Early Days, but the Launch of the Subcutaneous Dosage Form of Makena Seems to be Going Very Well (AMAG, Buy, $21.17)

Investment Thesis

The investment thesis for AMAG in 2018 and 2019is overwhelmingly dependent on how successful the Company will be in switching patients from the intra-muscular (IM) dosage of Makena to the new subcutaneous (subcu) formulation. The subcu was launched on March 26 and the first patient was injected on March 28. The subcu has markedly superior usage characteristics. It is much easier and quicker to administer, saving physician offices time and expense. It is also much less painful for pregnant women receiving weekly injections over a 16 to 21 week time frame and substantially reduces needle phobia.

Based on product characteristics, the subcu would be expected to almost totally replace the IM. However, there is likely to be a generic competitor to the IM in 2018 or perhaps 2019. The issue for investors is whether a lower price of the generic will result in meaningful conversion of some of the Makena franchise to generic IM even though the subcu is a markedly superior product.

Two of the most important issues that will determine the relative market shares of the subcu and generic IM product is the timing of generic entry and the number of generics that are introduced in coming years. Management has indicated that there could be a generic launch at mid-year although there is no concrete evidence that this will occur. They are indicating that the degree of price erosion will depend on how many generics are introduced. If there is only one, it is not likely that there would be as steep price discounts as would be the case with multiple generics.

Management has been cautious and conservative in their public guidance for the Makena franchise. (Internally, non-company sources suggest they are much more positive.) They have pointed to a generic entry at mid-year and that this will have a sharp impact on sales for the Makena franchise. Wall Street analysts have followed management guidance and reduced sales forecasts for the Makena franchise accordingly. In my most recent report in which I upgraded AMAG to a buy, I presented a more optimistic outlook for Makena sales than either management or analysts are projecting. I would refer you to my April 13, 2018 report AMAG: Upgrading to Buy Based on an In-Depth Analysis of the Outlook for Makena Over the 2018 to 2020 Period for a more detailed discussion.

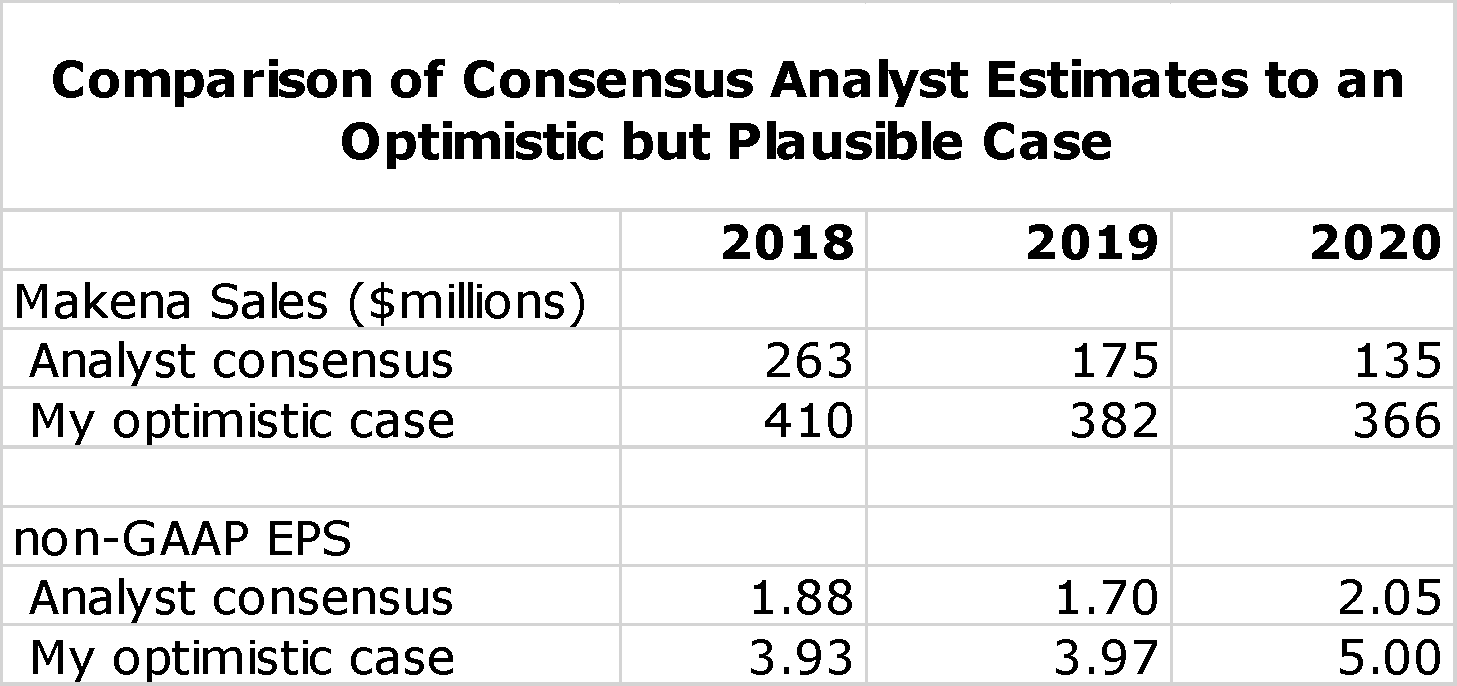

There are many moving parts that can lead to many different outcomes for the Makena franchise. I don’t pretend that I can accurately forecast each one. However, in the April 13 report I laid out an optimistic case which in my mind is as likely to occur as the much more negative expectations laid out by Wall Street analysts and which AMAG management at least in public seems to be endorsing. If my more optimistic case prevails, there is a lot of upside in the stock. The following table compares analyst consensus estimates for Makena sales and non-GAAP EPS to this more optimistic scenario.

The analyst consensus view is really a mean rather than a consensus as the range of non-GAAP EPS estimates for 2020 ranges from a loss of $0.13 to a profit of $4.43. Based on analyst consensus projections, I estimate a price target range of $12 to $17 in 2020. In the optimistic case that I present I have a price target range of $50 to $60. To me, the risk/ reward is quite attractive.

Purpose of Report

It is very early in the introduction of the subcu as it was launched on March 26 and the first patient was injected on March 28. During the 1Q, 2018 conference call, management presented some encouraging updates which I comment on in this report. There was no new information on the timing of a potential generic entry.

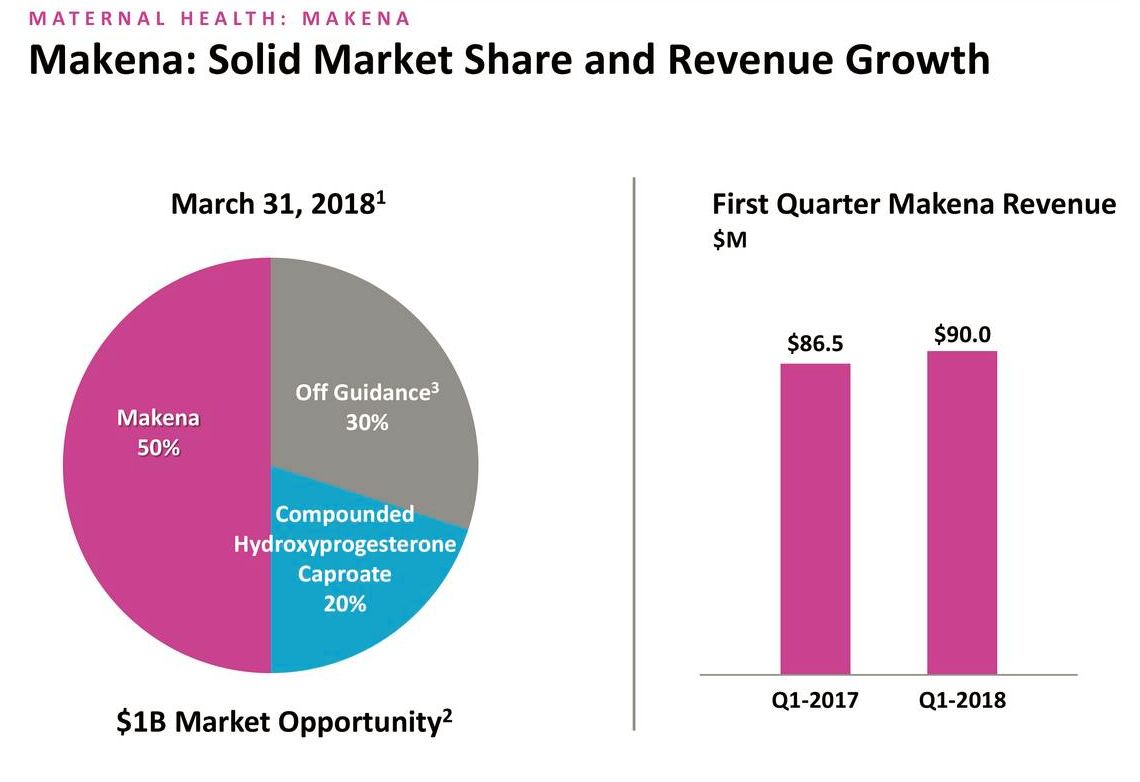

First Quarter Sales Trends for Makena

Makena sales grew by approximately 4% to $90 million in the first quarter, almost all of which came from sales of the IM dosage. Unit growth was a few percentage points higher as reported sales were reduced by a planned drawdown in inventory which resulted in five days of inventory reduction. Management intentionally reduced intramuscular product inventory in the channel in anticipation of conversion to subcu. As shown below, during the quarter, Makena market share of the hydroxyprogesterone caproate market remained steady at 50% relative to 4Q, 2017 and was up six percentage points versus 1Q, 2017.

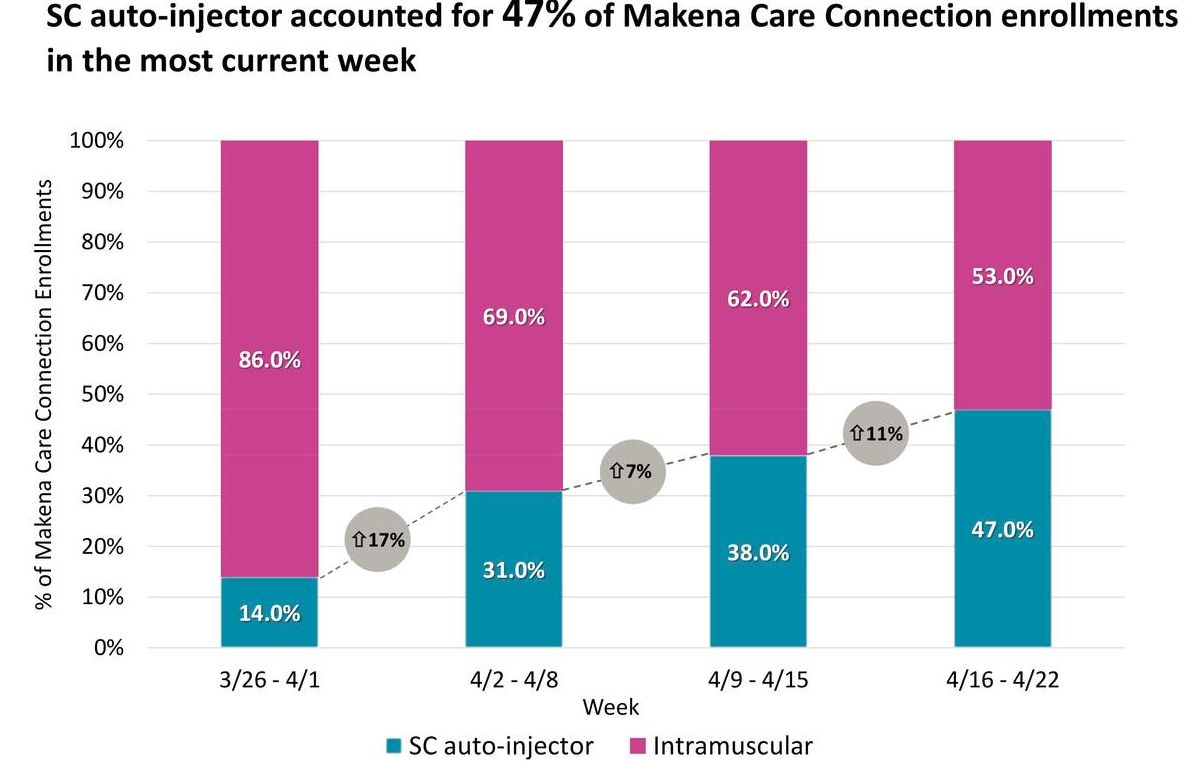

AMAG offers a support service for patients and physicians called Makena Care Connection that makes filling prescriptions easier, addresses patients’ financial concerns, and encourages adherence to therapy. More than 50% of new Makena patients and enrollments come through the Makena Care Connection. This provides a good read on the percentage of new patients starting therapy with the subcu auto-injector.

After four weeks, the auto-injector is already nearing 50% of the Makena Care Connection enrollments, and management expects that to grow in the second quarter. Enrollments are a leading indicator of future sales, as they precede treatment by approximately two weeks. The anecdotal feedback is similar, whether it's Makena Care Connection or from partners in the specialty distribution or specialty pharmacy markets. The following table shows the extremely encouraging trends in enrollments in Makena Care.

Reports from sales reps indicate that physicians are commenting very favorably on ease of use of the subcu and also feel that it will meaningfully increase patient willingness to undergo therapy and to remain compliant after therapy is begun. Management said that they are off to a good start in converting the market from IM to subcu. Obviously, the more time they have to convert physicians and patients to an improved patient experience will solidify Makena’s position prior to the potential generic, entry and enable them to preserve a greater portion of this franchise. Slipping somewhat from their very cautious public guidance, at one point management commented that the Makena subcu new patient starts are terrific and they are really bullish about their ability to maintain the Makena franchise. Management reports that the field force is really excited about the uptake. My checks confirm this.

Guidance for corporate revenue in 2018 was increased to $540 to $580 million from previous guidance of $500 to $560 million and guidance for non-GAAP adjusted EBITDA was increased to $120 to $140 million from $100 to $130 million. No specific guidance for sales by product was given, but sales of other components of the Company are more predictable. Hence, subtracting sales of these other products from guidance for total sales suggests that management is indicating full year sales of Makena will be $220 to $260 million. Last year Makena sales were $387 million and in the absence of a generic competitor would be expected to increase to $407 to $426 million in 2018.

Comments on Generic Entry against IM Makena

There were no new comments on the timing of a generic entrant against IM Makena so that management is still indicating that this could come at mid-year 2018. As discussed in my April 13 report, there is a good possibility that this introduction could come later. I also want to point out that there is unlikely to be generic completion against the subcu for many years (ten or more).

Management has raised the expectation for price pressure on Makena subcu as IM generics enter the market. Price pressure on Makena depends on how many generics are approved. If there is only one there is likely to be substantially less pressure than if there are several. The pricing pressure would come from increased rebates required to maintain formulary status. There might also be a copay component as generics might end up in a lower or no-co-pay tier. This could cause AMAG to enhance its co-pay assistance and that would pressure the net selling price for Makena.

Market Expansion

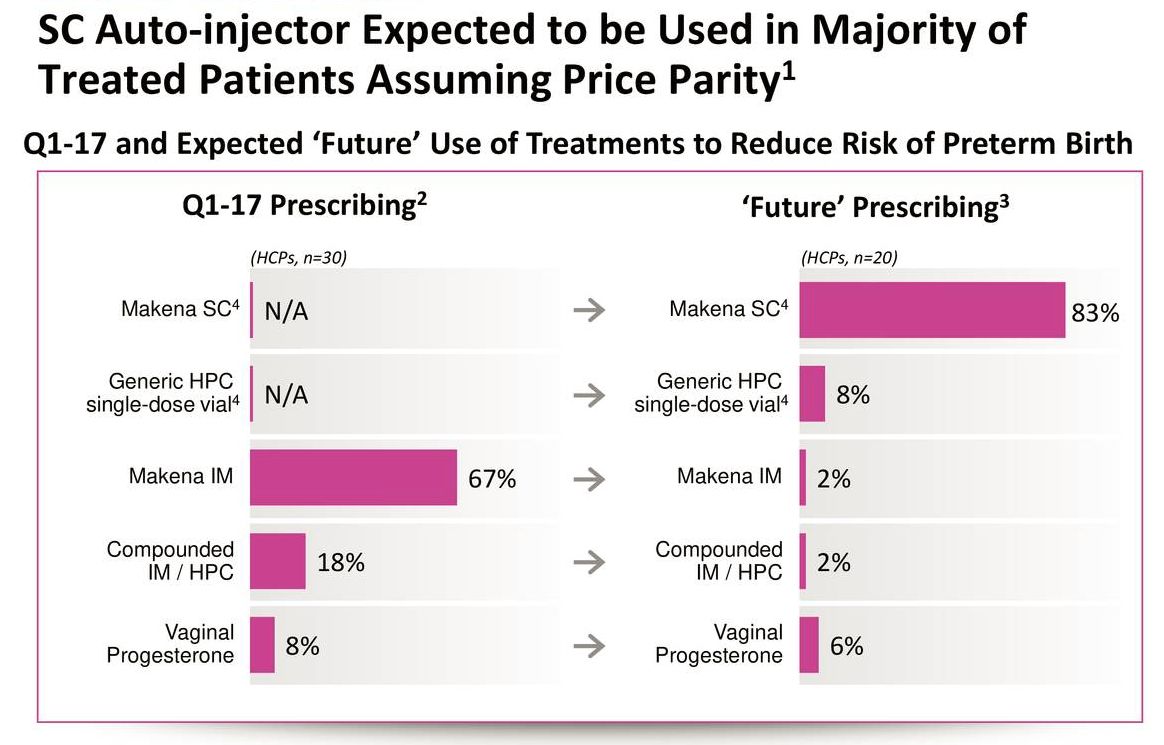

AMAG was asked if the subcu might expand the market as the Makena franchise has only 50% of the hydroxyprogesterone caproate market. Market research done in 2017 asked physicians before introduction about how the subcu and an IM generic might change their practice. This indicated that Makena might gain share from compounded product. There are some patients that may be not going in for injection, because they are afraid of the pain of IM injections and have needle phobia.

The sales force is initially focused on converting current physician users, particularly the high prescribers, to the sub-cu. In the future, there may well be opportunities to expand this market.

Medicaid Sales May Not Be So Vulnerable to Generic Competition

In my April 2018 report, I estimated that Medicaid sales account for $137 million of Makena sales in 2017 and that sales to managed care were $250 million. Generally sales to Medicaid populations are most vulnerable to generic competitions as Medicaid is extremely price sensitive. However, AMAG has already provided deep discounts and a very low price to Medicaid programs. Management has suggested on several occasions that Medicaid sales may be quite resilience to a generic launches into marketing on because of the pricing structure AMAG has in that particular channel,

Tagged as AMAG, AMAG Pharmaceuticals, Launcj of Makena subcutaneous auto-injector + Categorized as Company Reports, LinkedIn

Thanks Larry. I would expect the subcu transition trend trajectory to remain strong through at least Q2. We’ll know soon enough (by July?) if a generic will indeed be approved first cycle.