AMAG Pharmaceuticals: Initiation of Research on a Complex but Potentially Very Interesting Investment Situation (AMAG, Neutral, $24)

Organization of Report

The first five pages of this report (section 1) provide a quick summary of my view of AMAG’s business outlook and how this leads to my investment thesis. It does not go into great depth as it is intended to give an impression so that you can decide whether you want to read more about AMAG. In the remaining 32 pages of the report there are two other sections.

Mark Twain once said “I am writing you a long letter because I don’t have time to write a short letter”. The third section of this report or the appendix is a long letter as it was my first attempt at writing the report. Recognizing that some or many readers want a short letter, the second section is my effort at such that tries to summarize key issues in the appendix. There is redundancy between section 2 and the appendix, but for those who want to understand my analysis to the maximum extent possible, I urge you to plow through the appendix.

Price Target Thinking

I have discussed four investment scenarios (from among many) for the Company in this report. In my most favorable scenario to which I subjectively assign a 40% probability, I have a price target of $56 to $71 in 2018 which explains my keen interest in the company. However, two other scenarios are much less favorable and one is quite dire as I discuss later. At this time, I am not recommending the stock, but events could change my view in late 2016 or 2017.

Investment Overview and Opinion

-Acquisitions Have Had a Dramatic Effect on AMAG

AMAG has dramatically changed the character of its business in the last two years through two large acquisitions. In 2013, the Company reported product sales of $72 million and a net loss of nearly $10 million based almost entirely on sales of Feraheme. Taking advantage of low interest rates and strong investor interest in biopharma companies, AMAG was able to arrange financing for two large, accretive acquisitions. In November 2014, it acquired Lumara Health (to gain control of Makena) for $600 million and potentially $350 million more based on sales milestones which will almost certainly be met. Then on August 17, 2015 AMAG acquired Cord Blood registry for $700 million in cash.

The non-GAAP guidance by AMAG for sales in 2016 is $520 to $570 million and for net income is $195 to $225 million. This clearly shows the dramatic accretion to sales and more importantly earnings from these two acquisitions. It is an understatement to say that this management has been extremely aggressive and opportunistic. So how did investors respond to all of this? The stock has been on a roller coaster ride for the last 2+ years as it ended 2013 with a price of $24, soared to a high of $76 on July 16, 2015 and currently trades at about $24.

-Looking at EPS Projections for 2016 and 2017

My model is projecting $195 million of non-GAAP net income in 2016 which is the low end of management guidance or $195 to $225 million. Based on 35 million shares outstanding, the non-GAAP EPS estimate for 2016 is $5.55. As explained later in this report, my non-GAAP net income estimate for 2017 is $183 million. Why the drop in net income? AMAG will not pay taxes in 2016 due to tax loss carry forwards, but in 2017 I am estimating a tax rate of 20%. The resultant non-GAAP EPS for 2017 is $5.21.

The stock is selling at about 4.3 times 2016 and 4.6 times 2017 non-GAAP EPS estimates, but this is misleading. In 2018, I project that the Company will be paying a full tax rate of 35%. Perhaps a fairer way of looking at the actual earnings power of AMAG in 2016 and 2017 is to hypothesize a 35% tax rate in each year. This would results in adjusted EPS of $3.61 in 2016 and $4.23 in 2017. The corresponding price earnings ratios are 6.6 times in 2016 and 5.7 times in 2017. The latter is the best way of looking at the Company in my opinion.

-Issues on AMAG’s Three Key Products

Makena SC has a medically important advantage over Makena IM that potentially could allow AMAG to shift almost all sales of Makena IM into Makena SC which has patent protection until 2026 (based on patents on the device). If it receives Orphan Drug status, this would confer seven years of exclusivity until perhaps 2025 or 2026.The issue for investors is the timing of approval of Makena SC and how quickly it can replace sales of Makena IM. The Company is guiding that the sNDA will be submitted in 2Q, 2017 and points to approval before yearend which assumes a six month FDA review. However, investors with good reason are anxious about the Company’s ability to meet these timelines and even if they are met are uncertain as to how quickly rapidly sales of the Makena IM can be converted into Makena SC. Remember, Orphan Drug exclusivity expires on February 3, 2018

The next most important product is Feraheme which is an intravenous (IV) iron treatment used to treat iron deficiency anemia (IDA) in adults with chronic kidney disease (CKD). Feraheme had a labeling change (a black box warning was added in 2Q, 2015) that slowed sales in 2015 (they were up 3.5%), but the product seems back on a 10+% per annum growth track in 2016 with good unit growth. A new phase 3 study, if successful, could expand the label and this would double the addressable market for the product; results for this study are anticipated in 2017.

There are six patents that cover Feraheme which expire between 2020 and 2023. Sandoz has challenged each of these patents and AMAG has sued for patent infringement and will vigorously defend its patents. Under provisions of the Hatch Waxman act, Sandoz is stayed from launching a generic until around 3Q, 2018. The usual course of challenges like this would be a settlement between AMAG and Sandoz that would allow Sandoz to launch a generic possibly in 2020 or so, but at this point in time this is all I can tell you.

Cord Blood Registry (CBR) is a service business with different operating characteristics than product based businesses like Makena and Feraheme. At the time of birth, the obstetrician collects blood and tissue from the umbilical cord that is sent to CBR for processing. Stem cells and tissue are recovered and then stored cryogenically so that they are available for that donor or for a patient closely matched to the donor’s cell type such as a sister or brother. The cells can be used for a future stem cell transplant or tissue regeneration application. Sales of CBR in 2015 were flat owing to a decision by prior management to cut prices in an effort to increase enrollment that backfired. AMAG management is guiding for a 1% sales increase in 2016 but believes that it can come up with strategies to accelerate growth in the future.

-Sales Contributions of Key Products

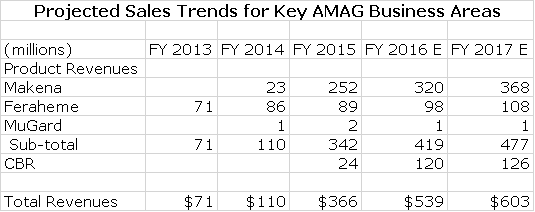

Actual product sales for Makena IM, Feraheme and CBR for 2014 and 2015 as well as projections for 2016 and 2017 are shown in the table below to provide perspective.

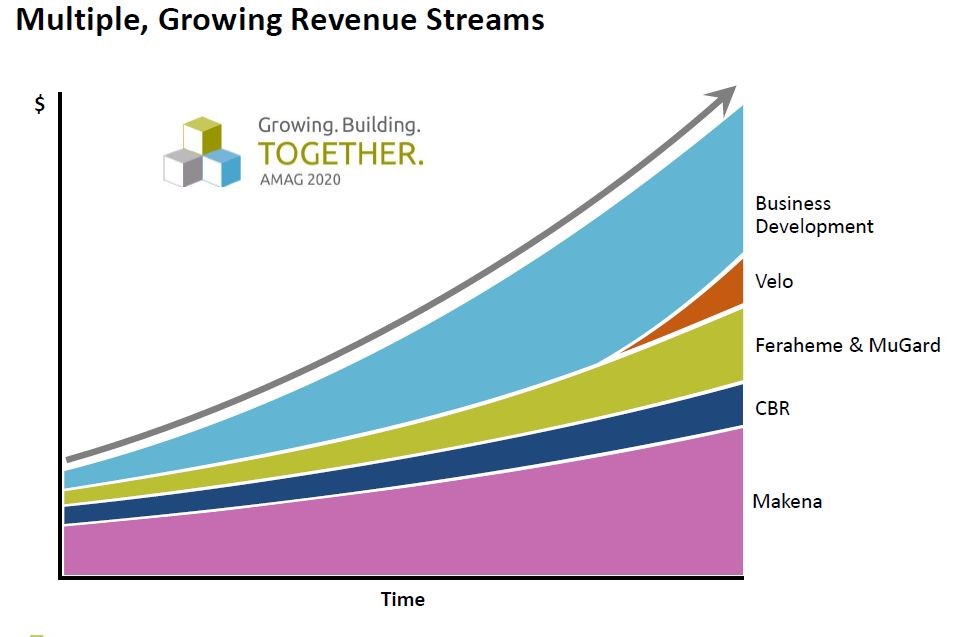

AMAG at its analyst day in June showed a graphical presentation as to how they viewed their businesses growing in the future. In addition to the product sales from its three key current revenue generators, they also show a very significant contribution to future sales from acquisitions and a new product Velo, which is under development for the treatment of severe pre-eclampsia. I am waiting for more clinical data on Velo and don’t discuss it in this report. I would note that there is a great medical need for treatment of severe pre-eclampsia so that the market opportunity is quite large. I also consider potential acquisitions in this report. Here is how AMAG sees future sales development.

The above table indicates that management expects continued growth of Makena SC, Feraheme and CBR. It also indicates that acquisitions could be as important a contributor to sales as Makena SC and that Velo has the potential to be a significant contributor. In this report, I ignore any contribution from acquisitions or Velo so that they can only provide upside to my view of the Company and its stock.

-Current Valuation Seems Quite Reasonable, But…….

To repeat what I just said earlier the stock is selling at about 4.3 times 2016 and 4.6 times 2017 non-GAAP EPS estimates. In 2018, I project that the Company will be paying a full tax rate of 35%. Perhaps a fairer way of looking at the actual earnings power of AMAG in 2016 and 2017 is to hypothesize a 35% tax rate in each year. This would results in adjusted EPS of $3.61 in 2016 and $4.23 in 2017. The corresponding price earnings ratios would then be 6.6 times in 2016 and 5.7 times in 2017.

For a Company that has shown the explosive sales and earnings growth in 2014 and 2015 and the potential for very strong growth in 2016 and 2017, the valuation is very low; the market is obviously quite worried about the fundamentals. The overwhelming factor for this low valuation is uncertainty over the outlook for the Makena franchise. Patent issues for Feraheme are a lesser factor as are questions as to whether CBR can achieve reasonable growth. Also to be considered is the capital structure as the acquisition strategy has resulted in over $1 billion of debt and annual interest expense of $60 million per year. In a situation in which some scenario leads to a sharp decline in sales, this could be a problem. However, I note that the Company has $500 million of cash on its balance sheet and is projecting cash flow from operations of $200 million before a $100 million sales milestone payment due Lumara.

The stock price seems to me to suggest that investors believe there will be a decline (possibly steep) in sales and earnings beyond 2017. If investors become highly confident that most or all of Makena IM sales can be replaced, I could see a substantial increase in the price earnings multiple. In my most favorable scenario that I will shortly describe, I see 2018 EPS of $4.73 in 2018 and think that AMAG could sell at 12 to 15 times EPS which would result in a 2018 price target of $56 to $71 as compared to the current $24 and this explains why I am so interested in the stock.

-The Outlook for the Stock is Mainly Based on Makena SC

You will notice that I only showed sales projections in the previous table through 2017. I thought long and hard about doing a longer term projection, but I can come up with so many scenarios that when I started to put these on paper (actually in an Excel spreadsheet) I confused myself so I am taking a different approach. Of the 10 or 20 or more scenarios that I could model, I have limited myself to just four and then treated them as if they are the only possible scenarios and assigned a probability of occurrence to each.

Scenario 1: I give a 40% probability (highly subjective) that AMAG will be able to gain approval of Makena SC sufficiently prior to the loss of Orphan Drug Exclusivity on February 3, 2018 so that most Makena IM sales can be converted quickly to Makena SC and there will be minimal impact from generics. Makena IM only has about 33% of the addressable market and I think that Makena SC, if approved on time, could capture 70% or more. If so, sales on Makena SC could double the current sales of Makena IM. This scenario also assumes that Makena SC will receive Orphan Drug exclusivity which would prevent competition from another auto-injector based product until 2025 or so. I assume that an agreement with Sandoz will prevent generic drug competition to Feraheme until 2020+ and in the interim Feraheme grows at 10% per year. I next assume that CBR grows at about 5% per year In this and all other scenarios I have no contribution from acquisitions or the new product in development- Velo.

This would be extremely bullish as Makena SC would be viewed as having limited or no competition until 2025. At that point in time in which investors view this as the likely outcome, I think that they would award a P/E of 10 to 15 or more as opposed to the current multiple of 5.7 on fully taxed non-GAAP EPS of $4.23. I could see fully taxed (35% rate) non-GAAP EPS increasing 12% (or more) to $4.73. Investors would also consider that with seven years of Orphan Drug exclusivity that Makena SC would not face generic or branded competition and could enjoy strong growth through 2025. I think that investors would pay 12 to 15 times EPS in this scenario resulting in a price target of $57 to $71 in 2018.

Scenario 2: I give a 30% probability to the auto-injector being delayed for a year until 2019, but that generic competition in 2018 is minimal. For reasons I discuss later generics may not gain approval for some time after February 3, 2018. Also, injectable generics generally show less of an erosion pattern that orals due to manufacturing issues. It is not unusual to see sales of an oral branded generic fall 90% in the first year or so following generic entry. For injectables, the decline is usually a more moderate 30%. This scenario also assumes that Makena SC will receive Orphan Drug exclusivity. As in scenario 1, I assume that an agreement with Sandoz will prevent generic drug completion to Feraheme until 2020+ and in the interim grows at 10% per year. I next assume that CBR grows at about 5% per year.

A delay in approval of the auto-injector would cause enormous investor angst that could put some pressure on the stock. Investors would be in a wait and see mode and probably the stock wouldn’t do well until investors became confident of Makena SC. However, this scenario essentially only delays the outcome in scenario 1 by a year so that the price target could be of the same magnitude as scenario 1, but delayed by a year.

Scenario 3: I give a 20% probability that the auto-injector is delayed for a year until 2019 and that generic competition builds much more quickly than the case I described in scenario 2 and grabs and retains a large share of the market. A delay in approval of the auto-injector with strong inroads from generic competition could cause significant price weakness. Subsequently, approval for Makena SC in 2019 would lead to some recovery in price, but this is not a good scenario for investors in 2017 and 2018. Again the assumptions for Feraheme and CBR are the same.

Scenario 4: I assign a 10% probability that the auto-injector fails to gain approval and that Makena IM is subject to intense generic completion. This would be very negative for investors. Remember the balance sheet is highly levered and this would become a major worry.

I am quite confident that none of the above scenarios will be correct. Also, I am totally ignoring any contribution from Velo or acquisitions. I wish I could give you an iron clad sales and earnings forecast, but unfortunately projections are based on probabilities and at this point there are a broad number of variables each with a broad range of probabilities. Presenting just one outcome for the Company would be intellectually dishonest.

The one point I want to leave you with is that there are reasonable scenarios in which AMAG could be a big stock. So what does one do about the stock? For those who follow my work, you will know that I seldom write about companies that I am not positively inclined toward. I am attracted to AMAG because I think that the odds favor approval of Makena SC and protecting most of the Makena franchise.

For the time being I am remaining on the sidelines until I can make a more confident call on the timing for the possible approval of Makena SC. This mostly involves having confidence that they will meet their goal of filing the sNDA in 2Q, 2017. However, even at that point there is considerable uncertainty on whether the FDA will act on and approve the sNDA by year end 2017 and there is always a chance that the FDA could issue a Complete Response Letter (CRL) that could delay approval into 2019 or beyond. We probably can’t have a high level of confidence until the approval is actually obtained which in the best case is late 2017. If this occurs, the stock would be off to the races.

-AMAG Sales and Earnings Projections for 2016 and 2017

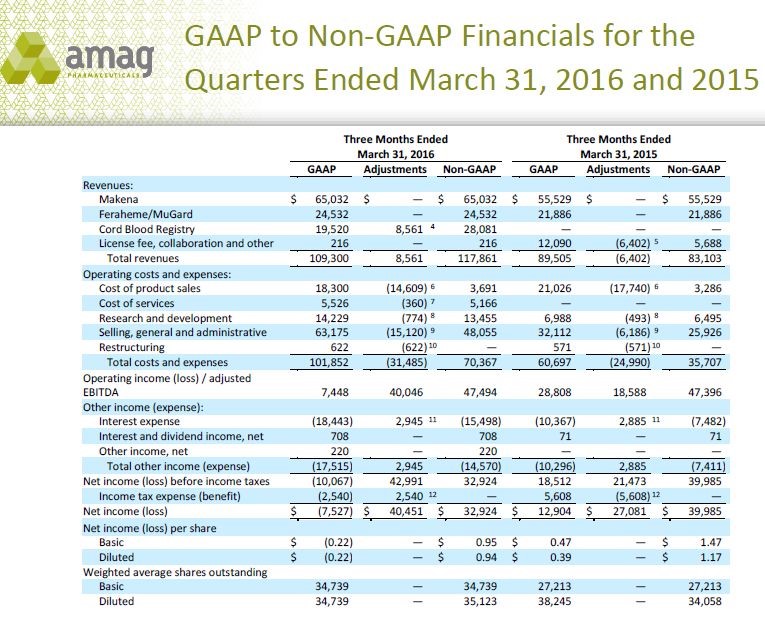

Those who have followed my work know that when I deal with commercial stage companies, I tend to do very detailed spreadsheets that forecast sales and costs. However, purchase accounting practices required under Generally Accepted Accounting Practices (GAAP) so distort reported costs (and to a much less extent revenues) that GAAP results can be very misleading in trying to assess the actual operating performance of a company. Consequently, AMAG has eliminated non-operating and non-recurring costs to provide investors a truer picture of the operating results; these are referred to as non-GAAP results.

The Lumara and Cord Blood Registry acquisitions were both based on purchase accounting which creates all kinds of adjustments in trying to reconcile reported earnings based on GAAP and the actual underlying sales levels and earnings power of a company using non-GAAP. Hence, investors focus on non-GAAP in order to provide a better picture of the operating strength of the Company.

This obviously raises the issue as to whether management could fudge the numbers to make them look better since these are unaudited results. While this is a concern, it has become common practice for all the big pharma companies such as Pfizer, Merck, Eli Lilly and many others to report both GAAP and non-GAAP numbers so this practice is not unique to AMAG. It is an industry wide practice. In order to illustrate the confusion caused, the following table shows management’s reconciliation of GAAP and non-GAAP accounting for AMAG’s 1Q, 2016.

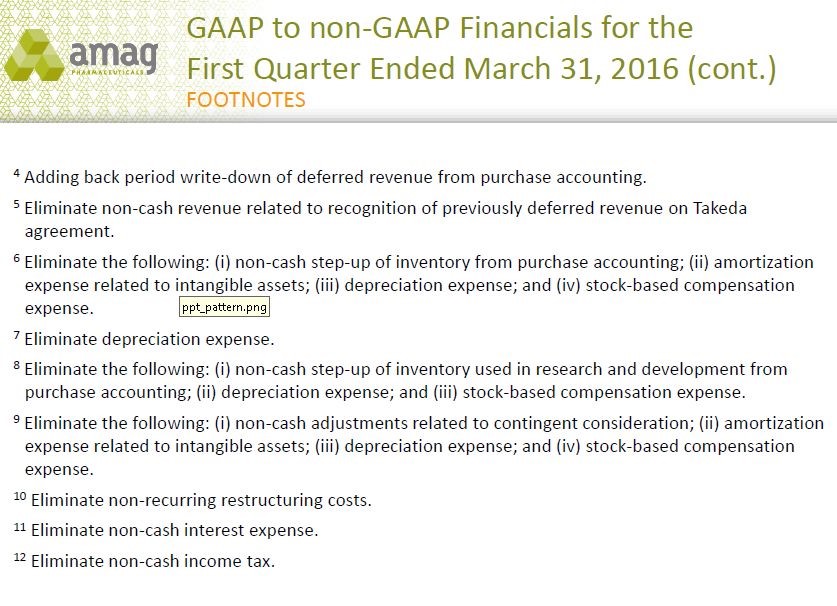

You can see all of the adjustments in the above table. An explanation of the footnotes is explained in the following chart.

This GAAP/ non GAAP issue forces me to take a different and a bit uncomfortable approach to forecasting earnings. In 2016, AMAG has forecast that Makena sales could increase to $310 to $340 million, Feraheme to $95 to $105 million and Cord Blood registry to $115 to $125 million. I believe these sales estimates seem achievable based on my analysis. However, I don’t think that I can reasonably forecast non-GAAP costs in order to gauge the accuracy of non-GAAP costs and then estimate profits. However, I think that management has a good insight as operating costs for a pharmaceutical company are highly predictable. This means that if I accept revenue guidance as achievable from AMAG, which I do, that I can have reasonable confidence in their guidance for non-GAAP net profits of $195 to $225 million in 2016. As a result, I am using the mid-point of management’s guidance for non-GAAP net income in 2016 to estimate non-GAAP EPS of $6.00.

In forecasting 2017 results, I first build my revenue forecast. I then assume that costs will grow at the same rate as sales (they will likely grow slower) so that non-GAAP EPS will grow as fast (probably faster) than sales. As previously shown I am estimating that revenues in 2017 will increase 12%. Based on the methodology just described this results in an estimate of net income of $235 million and EPS of $6.70 in 2017 on a non-GAAP basis.

More Detailed Discussion of Makena

-Makena Has Been an Amazing Success Story

Makena has been one of the most dramatic product success stories in the pharmaceutical industry over the last few years and it is poised for dramatic growth in 2016 and 2017. It is based on the active ingredient hydroxyprogesterone caproate that lacks any patent protection. However, the FDA approved Makena in 2011 and granted it Orphan Drug exclusivity which prevents generic competition for seven years until February 3, 2018.

Makena entered a market in which there were no branded products and the only competition was products produced by a number of compounding pharmacies. In September 2012, an outbreak of fungal meningitis was reported in the U.S. and was traced back to the New England Compounding Center in Framingham, MA. As a result of this outbreak, 64 people died and hundreds more were sickened. In response, the Federal Drug Quality and Security Act (DQSA) was enacted in November 2013, which detailed new regulations and the FDA’s authority governing compounded pharmacies. The FDA stated that “a pharmacist may not compound regularly or in inordinate amounts any drug products that are essentially copies of Makena.” (This was posted on the FDA’s website back in Nov 2013).

This key decision by the FDA along with effective marketing by AMAG has led to explosive sales growth. At this point in time (1Q, 2016), management estimates that Makena has 33% of the addressable market (determined by number of patients), that compounded formulations have 37% and that 30% of the market is either using a different (and unapproved) therapy or not being treated. I will address later why Makena has not yet replaced but could soon replace much of the formulated product.

The Orphan Drug exclusivity for Makena IM expires on February 3, 2018 and opens the door to generic drug competition. AMAG is engaged in strategies that if successful, will extend the life cycle meaningfully beyond that date. Let me address these in detail as it is the key issue in the AMAG investment scenario.

-Importance of the Just Introduced Single-Dose Makena IM Vial

Until 1Q, 2016, Makena was only supplied in a vial that holds sufficient drug for five weekly injections. This five dose vial required a preservative that some physicians feared might cause an allergic reaction and consequently they chose to prescribe a formulation made by a compounding pharmacy. Under FDA guidelines this was acceptable. Other physicians or payors could have used this concern as a pretext in order to use the much lower priced compounded products.

The first step in the product life cycle extension strategy was the recent introduction of a single-dose, preservative-free vial. This removes the one legitimate reason (concern about an allergic reaction to the preservative) for using a compounded product. If the physician or payor now uses a compounded product in opposition to FDA guidance, they open themselves up to ethical and legal issues. To illustrate, AMAG reports that this has resulted in the large nursing home healthcare service Optum, a subsidiary of United Health, switching from exclusively using compounded products to exclusively using Makena IM. This switch phenomenon should result in gaining an enormous amount of market share in 2016 and 2017 from compounded products.

Management reports that Makena IM’s market share grew from 30% to 33% during 1Q, 2016 and that their 2016 sales guidance is based on the assumption of an 8% to 10% increase in market share in 2016. Management reports that there was a 50% increase in enrollments in the month of April. Enrollment precedes the actual prescribing of Makena by a few weeks and is a leading indicator pointing to acceleration of growth. I would expect Makena to continue to make significant market share gains in 2017 and this leads to my estimate of a 15% increase in sales in 2017 to $368 million.

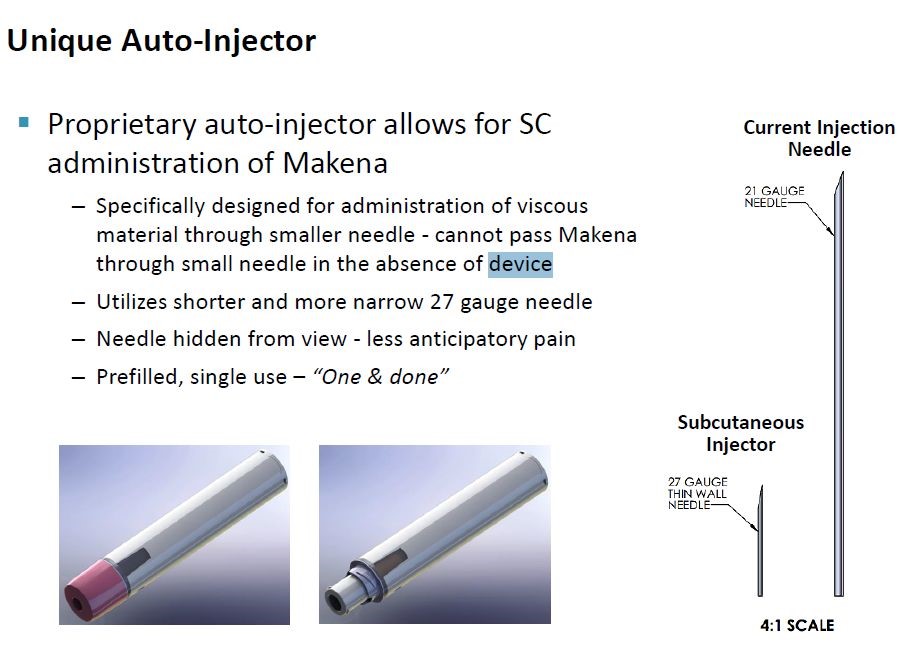

-The Auto-Injector is the Next and Most Critical Life Extension Strategy

Following on to the introduction of the single-dose vial, AMAG has another key life cycle strategy to deal with the loss of Orphan Drug status. It is working in conjunction with Antares to develop an injection delivered subcutaneously via an auto-injector device. This device developed by Antares allows the use of a small 27 gauge needle so that the care giver can inject just beneath the skin. The current weekly injections of Makena IM require a deep intramuscular injection with a larger 21 gauge needle that is quite painful.

The average pregnant woman now on average injects about 14 times. The auto-injector used with Makena SC is virtually pain free. In one user test that ranked pain on a scale from 0 (lowest) to 100, the auto injector came in at about 4. I have tried the injector and can assure you that injection is innocuous when compared to intramuscular injections. The next chart highlights what AMAG believes are the compelling product characteristics of Makena SC. Be aware that the representation of the needles for the auto-injector and syringe are four times actual size.

Based on physician surveys, AMAG believes that the auto-injector can potentially capture a very large share of the market if approved. A very important aspect of this thinking is that if the auto-injector is priced at parity on a per dose basis with the single use vial, it will immediately be reimbursed by most payors. It will not have to go through the slow process of gaining reimbursement that plagues almost all new product launches. This should allow for a rapid conversion of almost all of Makena IM sales into Makena SC.

-The Auto Injector May Provide for a New Orphan Drug Status

AMAG reports that conversations with the FDA has led them to believe that if the auto-injector can be shown to cause significantly less pain than the IM injection that this could be the basis of Orphan Drug exclusivity. This would give the product exclusivity from generic completion and potentially branded competition for seven years from the approval date so that this protection might extend until 2025 or 2026. This would be enormously positive for the long term sales potential of Makena SC. The plan of AMAG is to complete a separate study demonstrating less pain on injection of Makena SC versus Makena IM in time for the data to be included in the package label at time of approval.

-Potential Generic Competition to Makena IM

The strategy behind the single-dose, preservative-free vial and Makena SC is to improve the therapeutic profile of Makena IM and to also blunt potential generic challenges after orphan drug exclusivity ends on February 3, 2018. In this regard, the first question to address is when a generic drug to Makena IM might reach the market.

FDA may not approve a generic before the period of exclusivity for an orphan drug ends which in this case is February 3, 2018. However, it may accept and approve the same active moiety (hydroxyprogesterone caproate) for a different indication and indeed this has occurred. Aspen received an approval from the FDA for an abbreviated new drug application (ANDA) for a generic to Delalutin in August 2015 and plans to market it through ANI Pharmaceuticals in 2016. Delalutin has the same active ingredient as Makena IM, but it is approved for a different indication in non-pregnant women.

Because there is no market for Delalutin, it is obvious that the intent of Aspen is to use this ploy to develop a generic to Makena IM. With the ANDA approval for the generic to Delalutin, they have manufacturing approval in place for producing a generic to Makena IM. I would think that they may have already filed an ANDA for a generic to Makena IM, but it is difficult to predict how quickly after February 3, 2018 they might receive approval.

-AMAG’s View on Generic Competition

ANI Pharma probably will be launching at mid-year and will come to market as a multi-dose vial that includes a preservative. While the active ingredient of the Aspen generic and Makena IM are the same, the indications are entirely different as the generic is for treating non pregnant women for very different conditions. The only way to sell the generic is to promote it off-label, and the FDA can get pretty upset when this happens. AMAG has spoken to the FDA in advance about its concern for potential off-label promotion. AMAG says that they have various regulatory and legal avenues if that were to happen.

AMAG also says that there really isn’t any reason from the perspective of the patient and physician to move from Makena IM to a generic. Reimbursement procedures are established and this is not a hassle for physicians. Also, AMAG’s co-pay assistance programs aim to make out of pocket expense (if any) affordable for patients. AMAG feels they don’t have much to worry about in terms of generic completion through February 3, 2018. What about after that?

AMAG management notes that FDA approval for ANDAs based on recent experience is roughly 36 months from the time of submission. Aspen will need to prepare a separate ANDA for Makena IM from that for Delalutin. In order to have an early 2018 launch, the dossier would have had to have been submitted in early 2015 in order to gain approval in early 2018 if the historical experience of a 36 month FDA review holds. Even before this, they would have had to have conducted bioequivalence studies in 2014 or earlier. However, in 2014 Makena did not have high visibility for the commercial potential that has subsequently been seen. This raises the question of whether the generic approval could be meaningfully later than February 3, 2018.

AMAG will move aggressively to convert the market from the five dose vial to the single-dose. It may be hard to launch a generic product into a multi-dose market that may no longer exist. AMAG has the option to pull the 5 dose vial from the market from a commercial standpoint, i.e. they would no longer offer the product. However, they could not remove the regulatory approval because all of the bioequivalence work for Makena SC is really based on data from the initial approval of Makena IM.

-Gaining Approval and Converting the Market to the Auto-Injector

The key issue for investors is how quickly the Makena SC auto-injector can gain approval. The Company is now guiding that it will submit the sNDA in 2Q, 2017 and management has stated that the FDA has said that it will give the product a six month review. This suggests that it could be approved in October to December of 2017 and launched in the period of November 2017 to January 2018. This is very close to the February 3, 2018 date when Makena IM loses exclusivity. However, as I earlier stated conversion from the single-dose vial could be quite rapid, allowing for much of the Makena franchise to be shifted into Makena SC in less than a year.

So what are the chances of AMAG hitting this approval timeline? I think that they are reasonably good, but by no means assured. In clinical trial development, I have found that companies are invariably too optimistic and that issues arise that cause delays. Of note, AMAG initially guided that the NDA would be filed in 1Q, 2017 but recently moved guidance back to 2Q, 2017.

Feraheme

-Feraheme Has Been a Successful Product

Feraheme has about 10% of the market for intravenous iron supplement products used for treating iron deficiency anemia and is the fourth largest product in terms of sales. It has a narrower label than the market leading products that allows it to compete in only about half of the addressable market. It is currently approved only for chronic kidney disease (CKD) patients which account for about one-half the market with non-CKD patients accounting for the other half. Feraheme was approved by the FDA in 2009 and grew sales at an impressive pace for the next five years. In 2014, sales were $86 million, a 21% increase over 2013.

-Negative Label Change Slowed Growth in 2015

Following an FDA review of clinical data, the label of Feraheme was changed in March 2015. A warning to physicians that Feraheme could cause anaphylaxis (severe allergic reaction) and hypertension was moved from the warnings and precautions section of the label to being prominently featured in a black box. At the same time, the label was changed to recommend that Feraheme only be given intravenously and not through injection.

The change to intravenous injection took away one of the key product differentiating points of Feraheme and the black box warning was an issue. As expected, this caused some volatility. The black box was put in place in March 2015. Notably 2Q, 2015 was the only quarter in 2015 with down Feraheme sales. Sales returned to growth in Q3 and Q4. For the full year 2015, sales increased by 3% to $89 million with price increases accounting for much of this increase. Many investors thought that the impact on sales would be more dramatic. However, the impact of these label changes has now been felt and Feraheme appears back on track as sales increased 13% in 1Q, 2016 with volume growth accounting for over half of this. Management is guiding for a 10+% sales increase in 2016.

-Growth Prospects are Good

Aided by strong double digit growth in the overall market for intravenous iron products, Feraheme appears capable of maintaining 10+% growth in upcoming years. The Company is now enrolling a phase 3 trial that is intended to broaden the indication to include non-CKD patients and effectively double the US addressable market from $300 million to $600 million. This same study will be a head to head comparing Feraheme to another leading product, Injectafer. The objective is to show that Feraheme is as safe and potentially more effective. If successful, this study could greatly increase the usage of Feraheme in the period beyond 2018.

-Potential Generic Competition

The next important issue to address is patent protection. Feraheme has six issued patents listed in the Orange Book with the expiration of the latest patent in 2023. In February 2016, Sandoz challenged the validity of these six patents and filed for approval of a generic to Feraheme. Under the Hatch-Waxman act, if AMAG sues Sandoz for patent infringement as it has done, there is an automatic 30 month stay that blocks introduction of the generic. This means that the earliest a generic could come to market is 3Q, 2018.

The action by Sandoz is standard operating procedure for generic companies who generally challenge almost every drug patent. Oftentimes the aim of the generic company is to push for a settlement in which the generic company agrees not to launch before a certain date which is usually a year or two before patents expire. If this is the aim of Sandoz, it would suggest that generic competition could arise in 2019, 2020 or so. The litigation procedure and possible settlement talks move slowly so that investors may not be able to determine the outcome for one or two years.

Cord Blood Registry (CBR)

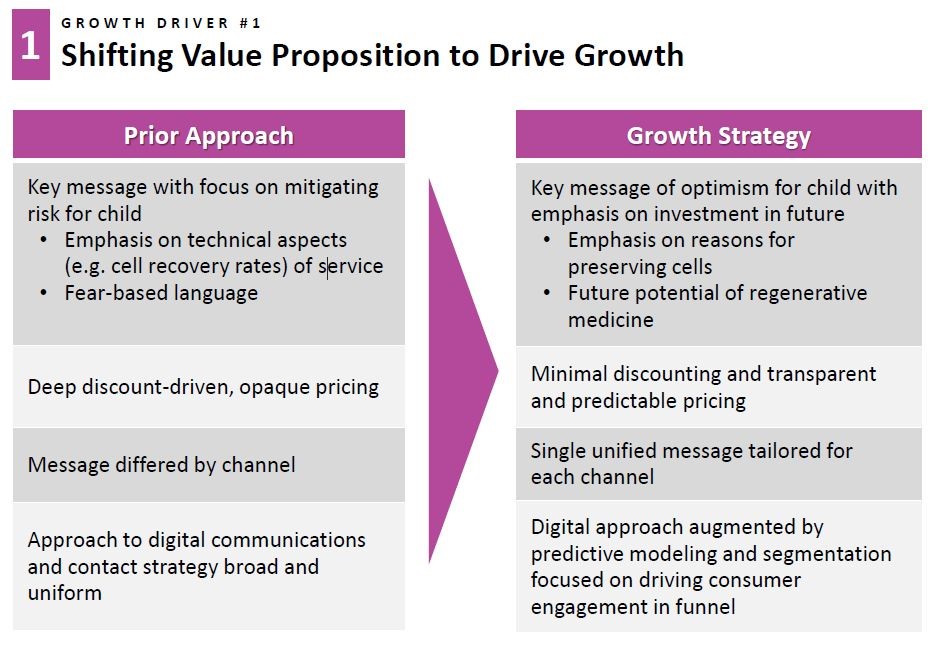

-Coming Up with a Strategy for Growth

CBR is a very different business for AMAG and management is just beginning to come up with a longer term strategy. In 2015, prior management of the then independent CBR initiated a price discounting strategy in an effort to increase enrollment. Unfortunately, the market proved price inelastic as the price reductions did not increase enrollments. The lingering effects of this strategy are expected to limit CBR sales growth to about 1% in 2016.

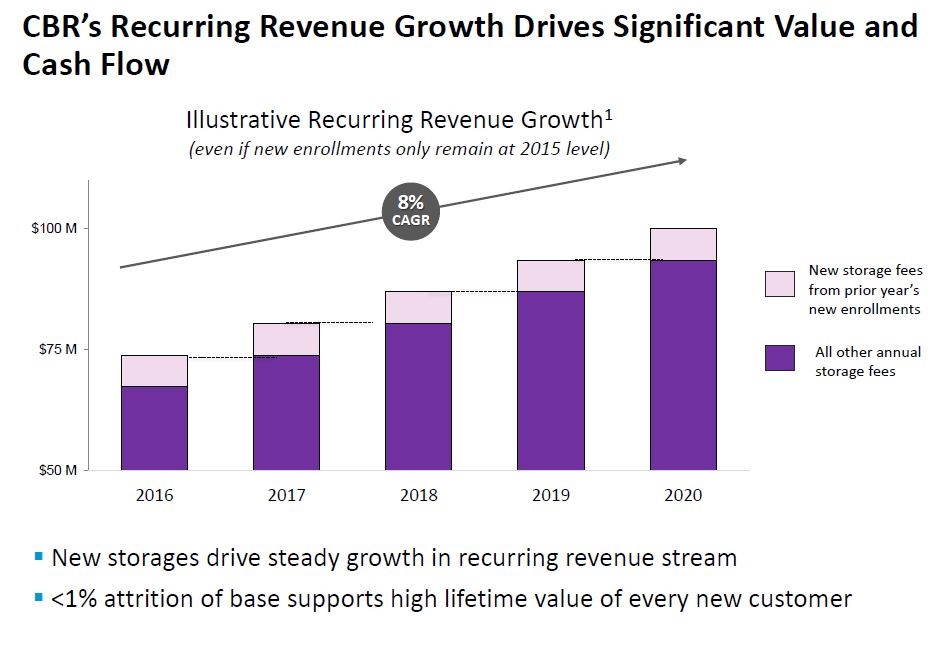

Management is studying a number of ways to segment the market as opposed to what is essentially “a one offering fits all” approach that it currently uses. It hopes this will stimulate the market. CBR’s sales are roughly divided into two equal parts stemming from (1) upfront fees charged at the time the service begins with the collection of cord blood and tissue and (2) the cryogenic storage for which families are charged a yearly fee. The storage business is remarkably stable with an annual attrition rate of less than 1%. It has been and should continue to be a source of stable revenues that promise at least modest growth. Management has done a calculation that shows that if enrollments were to remain flat in coming years that storage revenues would still increase at about 4% per year.

The goal of management is to devise strategies that will increase enrollment and investors are awaiting a description of their plans. Management is also hopeful that there will be ever growing amounts of clinical data that will demonstrate the value of cord blood stem cells and tissues in a broad number of diseases. These factors could lead to increased enrollment figures.

-Uncertainty Raised by Delayed Clamping of Umbilical Cord

Based on the issues so far discussed, CBR would appear to be a stable and profitable business with modest growth if enrollments remain stable and more impressive growth if enrollments are stimulated. However, there is one further issue, a negative one that concerns me. The long established practice of physicians has been to clamp the umbilical cord immediately at birth. The obstetrician then collects the cord and tissue and sends them to CBR for processing. More recently, some physicians have begun to delay clamping the umbilical cord for 30 seconds or more on the theory that the blood remaining in the cord can be pumped into the baby and produce benefits.

There is no clinical data demonstrating whether this delayed clamping procedure produces benefits, but it certainly has intuitive appeal. This creates an issue for CBR as to whether the reduced amount of blood in the cord following this procedure will allow CBR to collect a sufficient amount of blood to process. I can’t read this issue right now and I am not sure that management can either. The key question is how wide spread the procedure will become and if delayed clamping is used, can CBR still collect enough blood and tissue for its needs.

Appendix

Makena

-Medical Need for Makena SC

The principal and very important advantage offered by Makena SC is much less pain on each injection. Pregnant women on average now receive on average 14 intramuscular injections of Makena IM to help them carry full term. AMAG will be conducting a study that will have the goal of establishing superiority of Makena SC over Makena IM based on less pain on injection. If this is achieved, much of the Makena IM franchise will be switched to Makena SC and Makena SC probably will be granted orphan drug exclusivity which confers seven years of marketing exclusivity though 2025 or 2026.

AMAG has announced plans to do a head to head study of Makena SC and Makena IM with the objective of establishing Makena SC as superior. The measure of superiority would be a meaningful reduction in pain on injection as opposed to an efficacy endpoint. AMAG believes that it can complete this superiority trial in time to get the results included in the label of the sNDA approval for Makena SC that has a timeline of late 2017 or early 2018.

-There is a Generic Issue for Makena IM

The goal of AMAG is to gain approval of Makena SC prior to the loss of orphan drug exclusivity for Makena IM on February 3, 2018.It is possible that a generic to Makena IM will enter the market around or sometime after February 3 which complicates the situation.

-Makena SC Sales Potential

AMAG is projecting that Makena IM sales in 2016 could reach $310 to $340 million which would represent a 23% to 35% year over year sales increase. AMAG also suggests that Makena IM has only 33% of its addressable market and suggests that there is substantial room for growth. I see a plausible scenario in which Makena SC sales could reach $500 million by 2020 if the FDA is convinced that trial data establishes superiority to Makena IM.

Before engraving this $500 million sales estimate into a 2020 sales and profit model, one must be aware that the pivotal pharmacokinetics (PK) study needed for approval of Makena SC has not been completed. There is no guarantee of success, but this is a relatively straightforward development project. Likewise the superiority trial has not yet been completed, but it seems reasonable to think that a subcutaneous injection will cause much less pain than intramuscular. As a further note of caution one should consider that based on its well established playbook, managed care would be expected to do everything possible to promote the use of a generic to Makena IM and to block conversion of Makena IM to Makena SC. However, they would then be in the position of forcing pregnant women trying to avoid a preterm birth to undergo a meaningfully more painful weekly injections over as long as 21 weeks. Very importantly, if Makena SC is judged to be superior to Makena IM, managed care would have to acquiesce and the conversion would be rapid.

-The Active Pharmaceutical Agent in Makena

The active agent of Makena is a synthetic progestin called hydroxyprogesterone caproate. Progestin refers to a group of drugs that mimic effects of the female hormone progesterone that has various functions, one being to help maintain a pregnancy. Makena IM draws on this biological property and is indicated to reduce the risk of preterm birth in women pregnant with one child (singleton) who have previously delivered pre-term infants. It is given as an intramuscular injection once a week that is started between 16 and 20 weeks of gestation and is continued through 37 weeks of gestation or delivery, whichever comes first.

Hydroxyprogesterone caproate was introduced in 1956 by Squibb under the trade name Delalutin and obviously is generic. Delalutin was approved for use in non-pregnant women for several indications including advanced uterine cancer, amenorrhea (absence or skipping of menstrual cycles), and uterine fibroids. Makena IM was approved by the FDA on February 4, 2011 under sub-part H accelerated approval for the very different indication of preventing preterm delivery in pregnant women with a history of preterm delivery. For this indication, Makena IM was given orphan drug status that expires on February 3, 2018. The FDA withdrew Delalutin from the market in 2000 at the request of Squibb, which decided to no longer market the product.

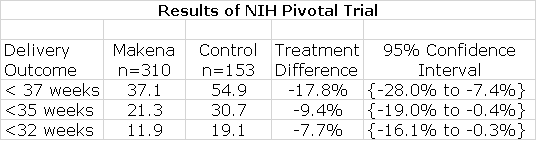

-Clinical Trial that Led to Approval

The approval of Makena IM was based on a randomized, double-blind study conducted by NIH and published in the New England Journal of Medicine in 2003. It enrolled 310 women on Makena and 153 on placebo who had previously delivered preterm and were considered to be at particularly high risk of another preterm delivery. The results were as follows: IMAGE 6

As shown by the confidence intervals, Makena showed statistically significant improvement over control in reducing premature delivery at these three stages of delivery and this was sufficient for FDA approval.

-Makena’s Commercial Success has been Stunning

The company that originally gained FDA approval of Makena IM in 2011 using the subpart H filing strategy was KV Pharmaceuticals, later renamed Lumara Health. The FDA awarded orphan drug status which gave Makena IM seven years of marketing exclusivity. Prior to Makena IM’s approval, formulations of hydroxyprogesterone caproate for injection could be obtained for a specific patient from a number of compounding pharmacies across the nation. KV announced that the price would be $1,500 per injection which compared to $10 to $20 for a dose prepared by a compounding pharmacy. This caused an enormous uproar at the time and in response KV cut the price $690 per injection. AMAG just recently implemented the first price increase which raised the WAC to about $730. However, after discounts and rebates, the net price per injection is $425 to $450. Based on an average of about 14 injections per pregnancy, this amounts to a total cost of about $6,000 to $6300 per patient.

Makena IM enormously benefitted from an FDA statement in June 2012 in which FDA essentially recommended using an FDA-approved drug product, such as Makena IM, instead of a compounded drug except when there is a specific medical need (e.g., an allergy) that cannot be met by the approved drug. This action was prompted by deaths resulting from the use of injectable steroids that were formulated by compounding pharmacies as previously explained. They did not adhere to good manufacturing practices allowing pathogens to grow in the (what were supposed to be) sterile vials for injection resulting in a number of deaths. This FDA action essentially created an open playing field for Makena.

Makena was introduced in late 2011 and at the time of acquisition of Makena IM by AMAG in November 2014, revenues for the 12 month period ending August 31, 2014 were $130 million up 75% from the comparable prior year sales of $75 million. Under AMAG’s control, Makena’s revenues in 2015 were $252 million up from a pro forma $166 million in 2014. The guidance for sales in 2016 is $310 to $340 million. It has been an enormous commercial success story in the biopharm industry. The guidance for 2016 is based on the prospect for 30% growth in Makena IM. There has been a 5.5% price increase which brought the WAC up to about $730 from a previous $690 per injection, but most of this growth is based on increased unit volume. Taking share from compounders based on life extension strategies figures prominently in management guidance.

-Makena Product Life Extension Strategies; Where Antares Comes In

Orphan drug exclusivity for Makena IM expires on February 3, 2018 and this could lead to generic competition then or sometime after that date. AMAG has formulated an impressive strategy to improve the medical value of the Makena franchise and to extend marketing exclusivity. The first product life extension strategy is based on the recent approval of Makena IM in a single-dose, preservative-free vial. Currently, it is supplied as a vial containing five doses. The single-dose has significant advantages that may transition much of the market away from the current five dose vial.

The second important strategy involves a partnership with Antares to develop Makena SC, the subcutaneous auto-injector. Makena IM is an oily and viscous solution (like testosterone solutions). Each dose is administered as a 1 milliliter injection containing 250 mg of hydroxyprogesterone caproate that uses a 21 gauge needle with a length of 1.5 inches. Gauge is a measure of needle diameter and somewhat paradoxically the smaller the gauge, the larger the needle diameter; the larger the gauge, the less the pain of injection. The product is supplied in a vial containing enough for five doses.

Makena IM must be injected intramuscularly by a health care professional, at a physician’s office or in the home health care setting because of difficulty in giving the intramuscular injection and the pain of that injection. In the NIH study, the most common side effect of Makena was 35% incidence of injection site pain which was about the same as 33% in the control group Obviously this was due to the diameter and length of the needle used for injection in both groups. The pain of injection is the greatest drawback to Makena IM therapy. This is made vividly clear when you read the experiences of women who have taken Makena IM as reported on a website.

There is a significant unmet medical need to reduce the pain and discomfort caused by the pain of Makena IM injections and this is where Antares comes in. Like older testosterone solutions which Antares QST is intended to obsolete, hydroxyprogesterone caproate solutions are oily and viscous and require intramuscular injections. The technology developed by Antares in developing QST can also be applied to Makena. This gives rise to the promise that Makena SC can be delivered like QST using a larger gauge needle (smaller diameter) that can be given with a much less painful subcutaneous injection. It may also be important that it has the potential to be administered by the patient at home. In my opinion, every patient and almost every physician would prefer Makena SC over Makena IM. The stumbling block to rapid acceptance would be managed care which I will address later.

-The Marketing Opportunity for Makena IM Afforded by the Single-Dose Vial

Makena IM has 33% of its addressable market and compounding pharmacies have 37%. This implies that at the price charged for Makena IM, the US addressable market in dollar terms is about $750 million. From a reimbursement standpoint, about 50% of U.S. births are covered by Medicaid and about 50% are covered by commercial payors. AMAG’s business had been more oriented toward the commercial side. However, they have had considerable success recently on the Medicaid side so that sales to that sector have been growing faster. AMAG is guiding to closer to 50-50 mix in 2016.

-How Single-Dose can Take Market Share from Compounding Pharmacies

AMAG received approval for a single-dose, preservative-free vial on February 23rd, 2016 and launched in April 2016. The single-dose provides meaningful opportunities to take significant market share from compounders. Remember that Makena IM today has about a 33% market share and compounding pharmacies have about 37%.

Currently, Makena IM is supplied in a vial that has enough drug for five injections (remember there is one ejection per week). Each week, one fifth of the drug is withdrawn and given as an injection. Over the course of five weeks, the vial must be stored for the patient for whom Makena IM was prescribed. Storage is at room temperature but the product must be stored upright and out of sunlight. The package insert requires that Makena IM must be given by a health care professional so that the majority of injections are given in OB/GYN offices or by home health care professionals. These providers must deal with the logistics of the five dose vial and while this is not a foreboding issue, it is time consuming. Also, the five dose vial costs around $2,000 so if the vial is misplaced or contaminated, it can be costly for the provider to replace. The one dose vial greatly simplifies the logistical issues of storage and safe keeping of the vial.

I emphasized earlier that the great success of Makena IM was a result of an FDA statement that recommended the use of FDA approved products over products made by compounding pharmacies. The FDA stated that the only reason to use a compounded product is if there is a valid medical reason. In the case of Makena IM this reason can be a concern that the patient might be allergic to the preservative used in the five dose vial. Right now, physicians can point to the need for a preservative free product as a reason to use compounding pharmacies. This would now be obviated and the physicians prescribing a compounded formulation would be at more legal risk for violating FDA guidance to use FDA approved products. Remember that compounding pharmacies can’t offer the quality control inherent in FDA approved manufacturing facilities for FDA approved products and this makes the risk of contamination of the product much higher. As was seen in the case of compounded steroids, this can lead to severe infections and sometimes death.

-Increasing the Number of Doses per Pregnancy

AMAG believes that the single-dose vial could increase compliance. Currently compliance stands at 13.7 paid injections per patient. AMAG’s target is in the range of 16-18 paid injections per patient. As a woman nears the end of her pregnancy but has not yet reached week 37, the physician might have to order another five dose vial for which all doses may not be needed. This leads to wastage of the product and to avoid this the treatment may end a few weeks early.

There are some commercial plans that still have a prior authorization for Makena IM so that when first trying to fill a prescription there may be a delay while waiting for reimbursement authorization. In these cases, AMAG may offer a free five vial supply until reimbursement is obtained. If reimbursement is obtained at say three weeks, AMAG has now paid for two or three doses. The single-dose vial does not have this issue and this can then result in more paid for doses per patient.

-Launch of the Single Dose Vial

AMAG launched the single dose vial in April, 2016. The AMAG reimbursement team has been talking to insurers to make sure that this product is on formulary and that the proper NDC reimbursement code is loaded into their systems, so that as those first prescriptions come through there are no issues.

In regard to physicians, the near term opportunity is to target those physicians who are prescribing compounded product. AMAG says that many have indicated that they might change to Makena IM if it were available in a single-dose, preservative-free vial. Importantly, some physicians are reluctant to prescribe new products because of hassles with reimbursement. These reimbursement hurdles have been removed over the three plus years that Makena IM has been on the market so that the final hurdle for a physician using compounding pharmacies is the dose size and the preservative. Hence, conversion could be rapid for this physician group.

Payors don't like the multi-dose vial in its current configuration because they really prefer reimbursing for a month of treatment and with five doses there is more than a month. By going to a product that is packaged in individual vials in a tray that is holding four single-dose, preservative-free vials, it is easier for payors to process claims. I would think that the price will be the same for the single-dose vial as for the multi-dose vial on a milligram of drug basis so I see no issue with payors that would hinder conversion.

-Makena SC is The Next and Most Important Product Life Extension Strategy

AMAG says that it chose Antares as its partner because of that company’s experience and expertise with auto-injector devices. AMAG cited the example of sumatriptan SC, which was approved with an AB rating. They also emphasized that Antares has moved QST through clinical trials preparatory to filing a sNDA. Importantly, the testosterone solution in QST has viscosity similar to Makena IM and presents the same development challenges. The Antares device stands out for its ability to administer viscous products subcutaneously using an auto-injector. AMAG said that Antares is absolutely the right partner.

-Strategy for Filing a sNDA

The two companies are working on parallel paths to finalize the design of the device and at the same time to do the initial bioequivalence work. This sets the stage for starting a pivotal PK study later in 2016 that will be the basis of the regulatory filing. The activities of each company are geared to achieve this. Pilot PK studies are being done in small groups of healthy volunteers. Of course, AMAG knows the PK profile of Makena IM and is making small adjustments in the pilot PK studies to ensure that Makena SC mirrors the PK profile of Makena IM to the greatest extent possible.

The work necessary for the chemistry, manufacturing and control (CMC) section of the sNDA is also ongoing in parallel. For example they are doing stability studies in which the cartridges that will be used within the auto-injector are filled and then put on a shelf in order to test stability. I think that there is little scientific risk to the development of Makena SC, the risk is execution. AMAG is looking to file a sNDA filing in 2Q, 2017.

-Advantages of Makena SC over Makena IM

There is an important difference between the size of the needle used with Makena IM which is a 21 gauge needle and Makena SC which uses a much smaller 27 gauge needle. This means that Makena SC needs only to penetrate just under the skin to inject the product while Makena IM requires a deep intramuscular injection. This should result in significantly less pain upon injection and this is a critical differentiation.

-Clinical Trial Plans and Potential Orphan Drug Status

AMAG has had a dialogue with the FDA on the design of a trial that could establish superiority of Makena SC over Makena IM based on pain scores. AMAG believes that the FDA will accept a reduced pain score as a satisfactory endpoint for a superiority trial. They further believe that the success in such a trial would make Makena SC eligible to apply for an additional seven years of orphan drug exclusivity. The FDA hasn’t officially signed off on this as the agency always retains the right to make a decision based on the data submitted. However, AMAG believes there will be a meaningful difference in pain scores for a deep intramuscular injection versus a sub-cutaneous auto injection that should be persuasive to the FDA.

The current plan is to first submit a sNDA based on a single-dose PK study in healthy volunteers. The pain study aimed at showing superiority of Makena SC will be on a separate, but slightly later track. It is not required that the pain study be submitted at the same time as the sNDA. However, the goal is to submit the superiority study during the FDA review so that the results would be included in the label at the time of approval. AMAG also hopes to be granted orphan drug exclusivity, which would provide seven years of marketing exclusivity starting from the approval date of the sNDA.

-Reimbursement

One of the most troubling aspects of investing in biopharma companies is obtaining reimbursement. Time after time, new launches have disappointed investors as managed care implements measures such as co-pays, prior authorization, tiered formularies and other measures to slow or block reimbursement. The positive aspect about the Makena franchise is that AMAG has already worked through these issues with managed care. It has also done this with Medicaid programs which often opt for low cost alternatives such as compound product over Makena. AMAG has been successful in gaining reimbursement in both arenas.

It should be very easy to extend reimbursement to the single-dose vial so that this does not seem to be a hurdle to product uptake. In the event that generic Makena IM is available at the same time as Makena SC, managed care may be restrained in trying to force pregnant women to use the cheaper but more painful generic to Makena IM instead of Makena SC. However, if the superiority study for Makena SC is successful and the FDA includes that data in the label, it seems probable that Makena SC would replace almost all of Makena IM usage and there would be little opportunity for a generic to Makena IM.

-Market Exclusivity Issues

The seven years afforded to Makena SC by orphan drug status would be in addition to existing issued patent protection that covers Antares devices. AMAG also has filed provisional patent applications which pertain to the specific drug device combination and some of the novel discoveries are related. There is substantial patent protection for Makena SC

-Potential for Generic Competition to Makena IM

The strategy behind the single-dose, preservative-free vial and Makena SC is to improve the therapeutic profile of Makena IM and to also blunt potential generic challenges after orphan drug exclusivity ends on February 3, 2018. In this regard, the first question to address is when a generic drug to Makena IM might reach the market.

FDA may not approve a generic before the period of exclusivity for an orphan drug ends, which in this case is February 3, 2018. However, it may accept and approve the same active moiety (hydroxyprogesterone caproate) for a different indication and indeed this has occurred. Aspen received an approval from the FDA for an abbreviated new drug application (ANDA) for a generic to Delalutin in August 2015 and plans to distribute it through ANI Pharmaceuticals in 2016. Remember that Delalutin has the same active ingredient as Makena IM, but it is approved for a very different indication.

Because there is no market for Delalutin, it is obvious that the intent of Aspen is to use this ploy to develop a generic to Makena IM. With the ANDA approval for the generic to Delalutin, they have manufacturing approval in place for producing a generic to Makena IM. I would think that they have already filed an ANDA for a generic to Makena IM, but it is difficult to predict how quickly after February 3, 2018, they may might receive approval. Their product is supplied in the same way as Makena IM, i.e. a vial containing enough hydroxyprogesterone caproate for five doses.

-AMAG’s View on Generic Competition

ANI will likely be launching midyear 2016 with a multi-dose vial that contains preservative. While the active ingredient of the Aspen generic and Makena IM are the same, the indications are entirely different as the generic is for treating non pregnant women for very different conditions. The only way to sell the generic is to promote it off-label, and the FDA can be pretty aggressive when this happens. AMAG has spoken to the FDA in advance about its concern for potential off-label promotion. AMAG says that they have various regulatory and legal avenues if that were to happen.

AMAG also says that there really isn’t any reason from the perspective of the patient and physician to move from Makena IM to a generic. Reimbursement procedures are established and is not a hassle for physicians. Also, AMAG’s co-pay assistance programs aim to make out of pocket expense (if any) affordable for patients. AMAG feels they don’t have much to worry about in terms of generic completion through February 3, 2018. What about after that?

AMAG management notes that FDA approval for ANDAs based on recent experience is roughly 36 months from the time of submission. Aspen will need to prepare a separate ANDA for Makena IM from that for Delalutin. In order to have a 2018 launch, the dossier would have had to have been submitted in 2015 if the historical experience of a 36 month review holds. Even before this, they would have had to have conducted bioequivalence studies, perhaps in 2014. However, in 2014 Makena did not have high visibility for the commercial potential that has subsequently been seen. This raises the question of whether the generic approval could be meaningfully later than February 3, 2018.

Following the approval of the single-dose vial, AMAG aggressively moved to convert the market from the five-dose vial to the single-dose. It may be hard to launch a generic product into a multi-dose market that may no longer exist. AMAG has the option to pull the 5 mL vial from the market from a commercial standpoint, i.e. they would no longer offer the product. However, they could not remove the regulatory approval because all of the bioequivalence work for Makena SC is really based on data from the initial approval of Makena IM.

-How Would a Subcutaneous Formulation of Makena Do Commercially?

The goal of AMAG is to transition the Makena IM market to Makena SC as entirely and quickly as possible so that there is no reason to use compounded or generic products. There are many moving parts to this strategy that can lead to a broad number of possible scenarios. This section illustrates the difficulties in forecasting one specific outcome.

The first thing to consider is the market opportunity. It appears that at the current trajectory, sales of Makena IM in 2016 could be around $325 million and if sales increase say 15% in 2017, Makena IM sales would be $370 million. Makena IM has only 33% of the addressable market so that there is substantial opportunity for market share growth through 2020. In a best case, Makena SC sales could exceed $500 million in 2020. In order to assess the probability of this, I have asked myself a number of questions. For most of these questions, I can’t give a definitive answer but I do have some thoughts.

Question: Will the first trial of Makena SC show bioequivalence to Makena IM?

Comment: I think that based on the experience with QST that it will likely show superior pharmacokinetics.

Question: Will AMAG be able to file a sNDA for Makena SC in 2Q, 2017?

Comment: Companies are usually too optimistic on timing for completion of clinical trials, but this is a simple bioequivalence trial and AMAG does have a sense of urgency. Also, this is not a complex trial to run. This is likely.

Question. Will AMAG be able to complete the superiority trial and submit the data to FDA in time for inclusion in the package insert for the sNDA.

Comment: This is AMAG’s goal.

Question: Will FDA approve the NDA within 6 months of the submission in 1Q, 2017?

Comment: This is not a complex filing, but the FDA is notorious for not meeting timelines and then issuing Complete Response Letters to buy themselves more time. The approval of the sNDA before the expiration of the orphan drug exclusion of Makena IM on February 3, 2018 is possible, but I would not be shocked to see it approved later than this.

Question: How will patients and physicians respond to Makena SC?

Comment: I think that both groups would be very excited about the potential for experiencing less pain on injection. If it were there were their decision, there would be a rapid conversion from Makena IM and generic competitors, if any?

Question: How will managed care respond to Makena SC?

Comment: With most new products, managed care does everything possible to prevent patients from quickly gaining access to a new product using tools such as formulary tiering, high co-pays and prior authorizations. However, this situation may be different in that the patients are pregnant mothers who are experiencing significant pain from the injections. Managed care might be less inclined to be as ruthless because of fear of adverse publicity. If Makena SC is considered by the FDA as superior to Makena IM, managed care would have to stand aside and allow rapid conversion of the market to Makena SC.

Question: Will Makena SC be judged as superior to Makena IM and receive orphan drug exclusivity based on less pain on injection?

Comment: It is very likely that this will be the case. Subcutaneous injections are made just under the skin and are substantially less painful than deep intramuscular injections.

Question: When might the trial comparing Makena SC to Makena IM lead inclusion of results in the label if results show superiority?

Comment: AMAG is aiming to supply the information to the FDA while the sNDA for the bioequivalence study of Makena SC versus Makena IM is under review. If so, the information would be included in the package insert for Makena SC. If AMAG meets its goals and the FDA also meets its timelines, this approval could occur up to seven months prior to February 3, 2018. However, when the FDA is involved, there is always uncertainty.

Question: Will there be generic competition at or slightly after February 3, 2018.

Comment: It seems possible that Aspen has filed an ANDA and might launch a generic in February 2018. They already have their manufacturing in place via the Delalutin ANDA. However, the FDA is even slower on ANDA approvals than NDAs and this approval could be meaningfully later as I discussed earlier.

Feraheme

-Product Description

Feraheme is an intravenous (IV) iron treatment used to treat iron deficiency anemia (IDA) in adults with chronic kidney disease. Feraheme can deliver a 1 gram dose of iron in two 15 minute infusions given three days apart. This is a more convenient dosing schedule that older IV iron products and is a major competitive differentiation. These older iron products often require five to 10 infusions over several weeks or even months. Feraheme is more convenient for patients and health care professional delivering the product.

-Market Addressed

The iron deficiency anemia market for patients with chronic kidney disease (CKD) is a market of about 300,000 patients in the US that represents a $300 million market opportunity. AMAG currently has about 30% of this market segment. IDA patients who do not have CKD is the same size or $300 million. Feraheme is not approved for the non-CKD, IDA population, but a phase 3 trial is now underway that could broaden the label to include this population. If the trial is successful, approval could be gained in 2018.

There are another 4.5 million other patients diagnosed with IDA. They are mainly treated with oral iron supplements, but there is some opportunity for IV treatment if the phase 3 trial is successful. Of these, one-third are under the care of an OB/GYN and AMAG has over 100 sales reps calling on that market segment who are currently promoting Makena and Cord Blood registry.

With the current label, AMAG is focused on growing Feraheme in the two customer segments of hematology/oncology and hospital. Management believes there is a great opportunity to grow share in hospital market, where they now have about 10% of the market. They will also look to maximize business in the hematology/ oncology segment where many patients with CKD are referred for IV iron infusions. Patients are most often treated in the same type of care for IV iron whether they are CKD patients or non-CKD patient.

-Recent Sales Performance

In early 2014, the FDA requested that AMAG supply additional information specifically in regard to safety. The Company worked closely with FDA and this led to label changes in March 2015. This included a boxed warning and a change in the method of administration from injection to infusion.

Feraheme posted a 23% increase in year-over-year sales in 1Q, 2015 with 15% coming from price increase and 8% from volume growth. However, beginning in the second quarter, the sales force was educating and communicating the Feraheme label changes and this led to under performance in the second quarter. The focus was on defending and holding existing business in the face of competitive pressure, especially in the hematology/oncology segment. Prescription volume as measured by IMS dropped 8% in 2Q, 2015. With the label change behind them, Feraheme began to stabilize in 3Q, 2015 as sales grew 3% year-over-year with a slight decline in unit volume. (Sales increases 13% sequentially from 2Q, 2015 with 8% due to volume.) In 4Q, 2015 sales were up 4% with roughly flat year-over-year unit sales.

Quarterly sales in 1Q, 2016 were the biggest of any quarter in the 7 years that Feraheme has been on the market. Sales increased 13% year over year with more than half due to unit volume growth. AMAG expects Feraheme sales to grow approximately 10% in 2016 versus 2015. The 2016 commercial strategy is aimed at driving growth in hospital segment, where penetration has been increasing over the last two years. In addition, they have a strong contracting group that’s been very effective in implementing paid performance-based contracts with partners to optimize our net revenue per gram and to expand the share of Feraheme.

In 2015, the IV iron market experienced growth of about 12% so there is the opportunity to grow with the market. AMAG has taken price increases in each quarter really for the past three years and they believe this can be continued as a strategy. They also are aiming to expand market share through label expansion. During the first quarter, they initiated a phase 3 clinical trial in IDA for non-CKD patients which if successful could lead to approval in 2018.

-Clinical Trials

In 1Q, 2016 AMAG initiated a phase 3 trial with Feraheme aimed at expanding the label to include non-CKD patients. If successful this could be an important driver of future growth as it basically doubles the market opportunity for Feraheme. This is a head-to-head trial versus Injectafer which is a newer IV iron supplement product. This is a 2,000-patient randomized, double-blind, non-inferiority study comparing the incidence of hypersensitivity reactions including anaphylaxis, as well as moderate to severe hypotension between Feraheme and Injectafer.

AMAG hasn’t discussed details around the non-inferiority margin but indicates that it is large given that anaphylaxis (hypersensitivity) and hypertension are rare events. Because of this they will need a large number of patients to be able to show that non-inferiority with a margin that is reasonable enough to be able to distinguish between the two products. They won’t disclose the specific margin, but based on discussions with the FDA and their internal analysis, they believe they have the right number of patients to power the study.

In addition to looking at safety issues, it will also track efficacy measures such as the increase in hemoglobin per milligram injection of iron. Current data suggests that Injectafer needs to be given with 50% more iron than a comparable dose of Feraheme to achieve a comparable therapeutic effect. The reduced iron dosing requirement could be a therapeutic benefit in favor of Feraheme.

AMAG is anticipating topline data in 2017 and plans to get this data in the labeling by the end of 2018. Although this is a large study, its relatively simple design allows AMAG to keep the per-patient cost significantly lower than what is required in most clinical trials. The trial will cost approximately $30 million over the next two years.

-Intellectual Property and Patent Challenge

Feraheme has six Orange Book listed patents, the longest of which potentially provides protection through 2023. AMAG received the notice in early 2016 of an ANDA by Sandoz, seeking FDA approval for a generic version of Feraheme. Sandoz has challenged each of Feraheme’s six Orange Book listed patents. Patent challenges are common in the industry and AMAG is confident in the strength of all of its patents.

These challenges often lead to agreements that allow the generic to enter the market somewhat before the patent expires. Based on historical precedent this is the most likely outcome and, if so, could lead to a generic introduction in say 2020 or so. At this point, there is no way of knowing the legitimacy of the Sanofi challenge. Under Hatch Waxman, there is a 30 month stay if AMAG goes to litigation which it definitely will. The earliest time for a generic entry would be 3Q, 2018.

Management also states that certain manufacturing knowhow could further protect Feraheme from generic competition. There have not been a lot of generics introduced into the IV iron market in the U.S. The market leader in dialysis and the largest volume player in non-dialysis is the product Venofer. There have been several attempts to genericize that product, which have been unsuccessful. Without getting into specifics, AMAG indicated that there is unique aspect to this market from a regulatory and manufacturing perspective that makes it difficult to develop and get approved generics for Feraheme.

-Europe

Feraheme was approved in Europe with the same label as the US. However, Europe is different in that most IV irons that are approved in Europe have a broad label. As a result of the failure to broaden the label in 2014, they terminated a marketing relationship with Takeda in Europe and took a step back in order to run the phase 3 study. Once they get a broader label, they may reintroduce the product into the European markets with a partner.

Cord Blood Registry

-Management’s Rationale for The Acquisition of Cord Blood Registry

In August 2015, AMAG acquired Cord Blood Registry (CBR) for $700 million in cash. CBR is engaged in the collection, processing and storage of cord blood and cord tissue and has been in business for more than 20 years. Revenues in 2014 were about $126 million and generated EBITDA of $45 million (this is a high margin business). The reasons cited by management for the acquisition were that it: (1) was a complement to Makena in addressing the maternal health market, (2) diversified the business, (3) added a stream of recurring revenues as there is less than 1% attrition in revenues from cord blood and tissue samples stored, (4) is a high-margin business, (5) was immediately accretive to earnings and (6) has significant upside potential.

Management believes that CBR is a natural fit with Makena and adds unique and complementary capabilities. It allows for an even larger maternal health sales effort as it more than doubles the number of AMAG sales reps calling on 16,000 OB/GYNs from 47 to more than 100. It leverages the call point very well as it gives the sales force two products to sell to their customers. CBR’s consumer-driven marketing and sales capabilities also offer an effective way to reach pregnant women that could have even broader applications across the entire AMAG product portfolio.

-The Cord Blood Registry Business Model

For pregnant woman, who choose to store stem cells and/or cord tissue, core blood and tissue are collected by the obstetricians just after birth from the umbilical cord and sent to CBR for processing and storage. New customers pay a one-time upfront collection and processing fee and then an ongoing annual storage fee. The current upfront fee is around $1,500 and the annual storage fee is about $150 per year. See this for a more detailed breakdown of pricing.

Storage and upfront revenues each account for around 50% of annual revenues. As of December 31, 2015, CBR stored approximately 633,000 umbilical cord blood and cord tissue units, which the Company believes is somewhat more than half of all privately stored cord blood and cord tissue units in the U.S. There has historically been less than 1% customer attrition annually providing a very stable base of revenues. As the installed base continues to grow, AMAG expects an increasing percentage of revenues will come from storage revenue, which management says is a higher gross margin business than upfront fees. The stem cells and tissue are stored in a cryogenic facility.

-Background on Cord Blood and Cord Tissue

Cord blood comes from a newborn’s umbilical cord and is collected immediately following birth. After the umbilical cord is cut, some blood remains in the blood vessels of the placenta and the portion of the umbilical cord that remains attached to it. After birth, the baby no longer needs this extra blood and otherwise it would be discarded. Cord blood contains all the normal elements of blood - red blood cells, white blood cells, platelets and plasma. Importantly, it is also rich in it is also rich in hematopoietic (blood-forming) stem cells, similar to those found in bone marrow.

Cord blood stem cells can be used as an alternative to bone marrow for immune system transplantation. If the baby from which the cells are obtained needs these cells in the future, they are a perfect immune match. They don’t cause the immune response that usually arises from the use of allogeneic donor cells and which require immune suppression. This is a huge safety advantage for cord blood stem cells. The match is less perfect with a sibling, but still may provide a much safer alternative than allogeneic bone marrow cells. Cord blood has been used in the treatment of over 80 diseases, including various cancers, blood disorders, immune disorders and metabolic disorders. See this link

Scientists are also investigating the possibility that stem cells in cord blood may be able to replace cells of other tissues such as nerve or heart cells. Whether cord blood can be used to treat other kinds of diseases will be learned from this research.

Cord tissue contains other types of stem cells that may help repair and heal the body in different ways than cord blood through creating structural and connective tissue. While there are not yet any proven indications for the use of cord tissue, most key opinion leaders believe they are useful for conditions such as wounds caused by disease, injury or trauma and burns. They are currently being evaluated in 30+ clinical trials to treat heart disease, stroke and spinal cord damage, among others. This link shows some of the potential uses of cord tissue.