Antares Pharma: Detailed Sales and Earnings Model Through 2021 (ATRS, $2.85, Buy)

Investment Thesis

Recently, I have received a couple of sarcastic comments to the effect that this stock has gone nowhere for the last five or so years and you have consistently recommended it. Why don’t you just admit were wrong and move on. I share the frustration. I buy stocks that I recommend and hold them until my investment thesis is proven or disproven. I do not trade in and out of positions in the interim so that the vast majority of stocks in my diversified portfolio (Antares included) have been there for years. Of course, I have sold stocks when my premise for investing was shown to be wrong. My investment thesis on Antares has been based on the ability to create a broad portfolio of products for its own account and partners using injector technology to differentiate those products. I have consistently believed that this would lead to the creation of a fast growing, highly profitable specialty pharmaceutical company.

There have been some major setbacks along the way starting with the disappointing launch of Otrexup in late 2013. I thought then and now that this product filled an important niche in the treatment of rheumatoid arthritis by allowing patients to remain on methotrexate, the gold standard therapy, for a longer period of time before being moved to very expensive biologic drugs. However, Otrexup came to market just shortly before a competitive product (Rasuvo) from Medac, which was a privately owned company. It decided to take an aggressive pricing strategy to gain market share at the expense of sales and profit. It is highly unlikely that a public company would have taken this strategy and even surprising that Medac did. Also unexpected was that managed care emphasized the use of biologics at a cost of $20,000 or so per year over a more effective Otrexup at $4,000 per year. Why? Because the biologics offered huge discounts to managed care. Because of these factors, I was just dead wrong on Otrexup.

The next major product in the portfolio was a partnered AB rated generic to EpiPen that is marketed by Teva, which originally thought that approval would be received in 2013 or 2014. However, EpiPen’s marketer Mylan, skillfully used citizen’s petitions and other strategies to delay approval until August of 2018. For reasons explained in this report, the full launch of the AB generic will occur in 2H, 2019. I haven’t changed my thinking that this will have a major impact on profits for Antares. The timeline was just set back.

The second proprietary product for Antares was the testosterone supplementation product Xyosted, which I believe is the best in class of injectable products based on all important pharmacokinetics. Investors and the Company were geared up for approval in October of 2017 and a launch later that year. Instead, Antares received a Complete Response Letter, the reasons for which have never been completely clear. The Company was able to address the CRL without any new clinical studies and Xyosted was approved and launched in early 2019. It is still early, but it looks like the launch is going well and Xyosted will live up to its promise.

The next problem for the investment thesis related to the Makena subcutaneous injector developed for AMAG. This product got off to a strong start. However, in late March 2019, AMAG reported that Makena had shown no differentiation from placebo in the PROLONG phase 4 study that was intended to confirm the efficacy of Makena. Some investors fear that Makena will be pulled from the market. In this report, I go through my thinking that leads me to believe that Makena will continue to be widely used. However, mine is a minority view

This history is important to understand because for some it paints the Company as being poorly managed and operating under a dark cloud. There is no question on the latter, but when we step back and look at this, only Otrexup was a clear failure. We are at a point of time when the pipeline promise that has attracted me to the stock is coming to fruition. The Xyosted launch is in full swing and the full impact of the launch of the AB rated generic to EpiPen is imminent. Makena remains highly controversial, but if I am right it will provide a major impact in comping quarters. Incidentally, I would continue to be positive on Antares even if Makena were pulled from the market.

Oh, by the way, I should mention that along the way, there was a successful launch of the AB rated generic to sumatriptan in 2017, the economic impact of which is comparable to the AB rated generic to EpiPen. Not everything went wrong.

In looking ahead, Teva has predicted that it will launch the AB rated generic to Forteo in 4Q. 2019. This product could have perhaps twice the profit impact on Antares as EpiPen. As importantly, the pipeline looks exciting. Pfizer is working with Antares on an undisclosed product and Antares should begin clinical work on its third proprietary product later this year.

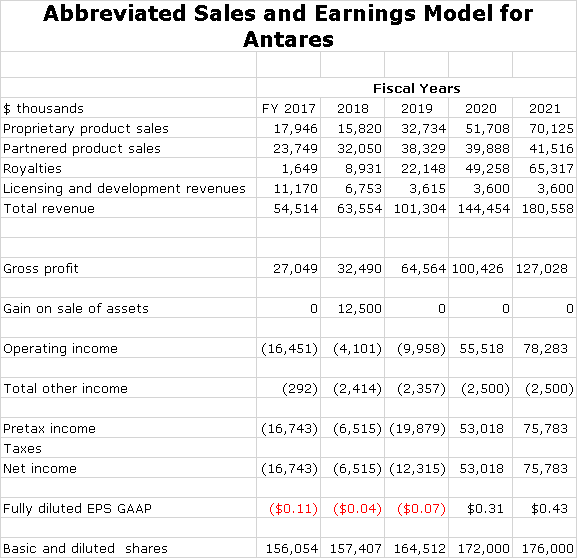

The point of all of this is to get you to focus on the future and not the past. Yes, those who have held the stock for five years have probably not made any money. However, stocks are about the future. We are now dealing with a Company that is in the early stages of, or about to roll out four major product- Xyosted, AB rated generics to EpiPen and Forteo and Makena SC. This report goes though how I have built up my sales and earnings model for Antares. A summary of that model is as follows:

There are many, many assumptions that go into the above model. This report goes through those assumptions. I have tried to err on the side of conservatism with the exception of Makena SC. While this model gives the appearance of great precision, it is almost certain that actual results will be very different. However, I hope that the trend and magnitude are captured in this model. The Company has given guidance that 2019 sales will be in the range of $95 to $105 million. My estimate of $101 million, a 58% increase, falls in this range. The Company has broadly hinted that it could reach cash flow breakeven late in 2019, but hasn’t issued formal guidance.

In terms of a price target, you don’t have to be a genius to conclude that if my sales and EPS estimates for 2020 and 2021 are anywhere near correct, that this stock is going to trade up dramatically.

Projections for AB Rated Generic to EpiPen

The AB rated generic to EpiPen was approved in August of 2018, but the full launch is only just beginning. This was because epinephrine only has a shelf life of 16 to 18 months and because of the uncertainty on the timing of approval, Teva could not build much of a pre-launch inventory. They did not want to launch and run out of inventory. Teva expects to be in full launch mode in 2H, 2019.

Teva has publicly stated that by the end of 2019, they expect to have 50% of the EpiPen market as measured in prescriptions. Remember that the Teva product is an AB rated generic. This means that if a prescription is written for Mylan’s EpiPen, the pharmacist can be fill it with the AB rated product from Teva. Market share then is determined by commercial relationships with pharmacies that result in stocking of either EpiPen or the AB rated generic. A pharmacy is unlikely to stock both.

During the 1Q, 2019 conference call, Antares said that it is seeing strong week-over-week sequential growth for devices used in the AB rated product. As far as device sales, Antares trying to stay ahead of the full commercial launch and so there is some stocking of devices, but it's in the normal course of the forecast. Antares is basically producing to their forecasts and expects a pretty significant increase in the sales of the AB product in the second half of the year.

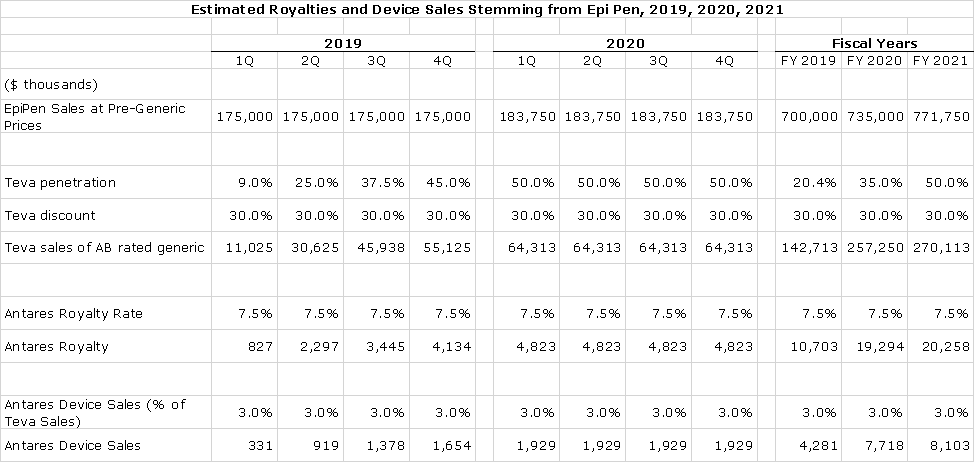

The very latest Rx numbers show Teva with about a 30% share according to Antares. Teva has said that by the end of 2019, they expect to have 50% of the market. It is estimated that Mylan’s sales of EpiPen were $700 + million in 2018. Here is how I a built the sales model for Teva’s AB EpiPen.

- I first estimate that unit sales of both EpiPen and the AB rated generic are growing at about 5% per annum. This allows me to estimate what sales for EpiPen would have been without generic competition. So, in 2019 they would have been $750 million, $735 million in 2020 and $772 million on 2021. Of course, price discounting will reduce those levels.

- I next estimate how much Teva is discounting in order to gain share. The goal of both Teva and Mylan is to maximize revenue and profit. Because this is an oligopoly of two firms, I do not expect aggressive price discounting that would devastate revenues. This makes no economic sense to either participant. I am estimating that Teva is discounting the price of EpiPen by 25%.

- I am assuming that Teva’s current market share of 30% will ramp up to 50% by the end of the year.

- Antares has not given precise guidance on royalties that it will receive but general statements suggest that my assumption of 7.5% is conservative.

- In regard to device, I am estimating that they account for about 3% of Teva’s sales. Management has given only rough guidance on this. In the following table I show device sales growing in line with revenues, but this is not accurate. There can be swings from quarter to quarter due to inventory fluctuations.

Here is the resultant model projecting royalty and device sales for Antares.

Makena SC Outlook

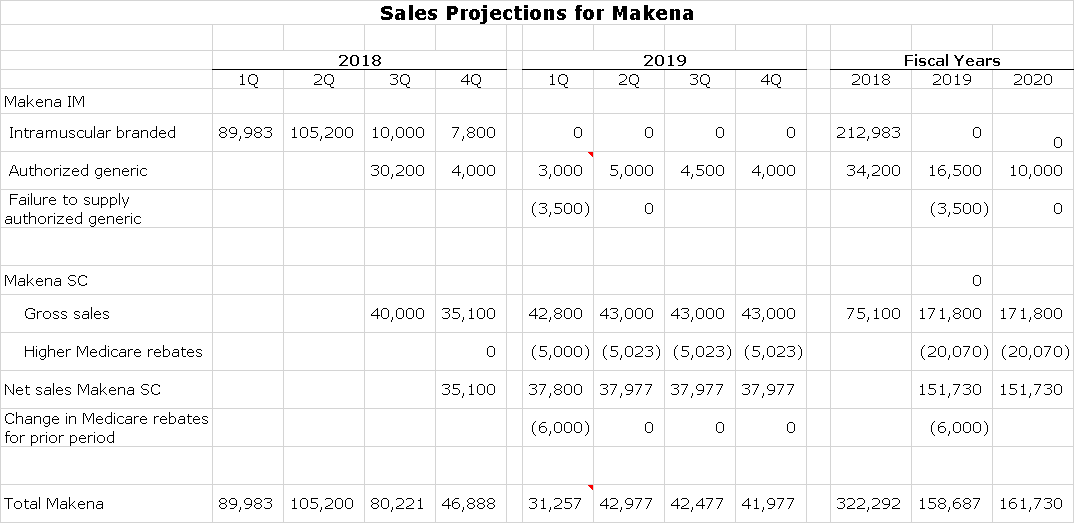

Investors are confused and generally pessimistic about the prospects for Makena. The product achieved peak sales of $387 million in 2017; this was with an intramuscular (IM) injection. Then the IM product lost Orphan Drug exclusivity in February 2018. As a life extension strategy, AMAG introduced Makena in a subcutaneous (SC) injector that was developed by Antares. There have been three generic entries against Makena IM (not Makena SC); these were Slayback (December 28, 2018). Sun Pharma (April 9, 2019) and Eugia (April 16, 2019). AMAG launched an authorized generic in early 2019. There is much jockeying for position between Makena SC, the authorized generic to Makena IM and the three generics to Makena IM. AMAG will no longer marker the original Makena IM.

During the conference call on February 7, 2019 call discussing 4Q, 2018 results management indicated that Makena SC sales were about $35 million in 4Q, 2018, which compared to $101 million of Makena IM sales in 4Q, 2017. It indicated that it had captured something under 50% of the unit market with Makena SC and thought this could increase. Management was confident that Makena SC could achieve sales of roughly $40+ million per quarter or $160 million in full year sales in 2019.

On March 8, 2019 AMAG startled investors by announcing that the PROLONG study had failed to show any difference between Makena IM and placebo. As a condition of approval, AMAG had agreed to run a large phase 4 study (PROLONG) to verify its safety and efficacy. The drug was initially approved on the basis of a study conducted by NIH involving 310 patients given Makena IM and 153 given control that showed superiority of Makena IM. Significant sections of the investment community think that this will cause Makena SC sales to plunge to minimal levels or even be removed from the market. All of this caused AMAG’s stock to plummet and also had a meaningfully negative effect on Antares. I acknowledge that I am in a distinct minority, but I think that this may not cause such a dramatic effect on Makena SC sales. The article at this link explains why. The FDA will hold a meeting later this year to discuss the PROLONG results and what to do, if anything.

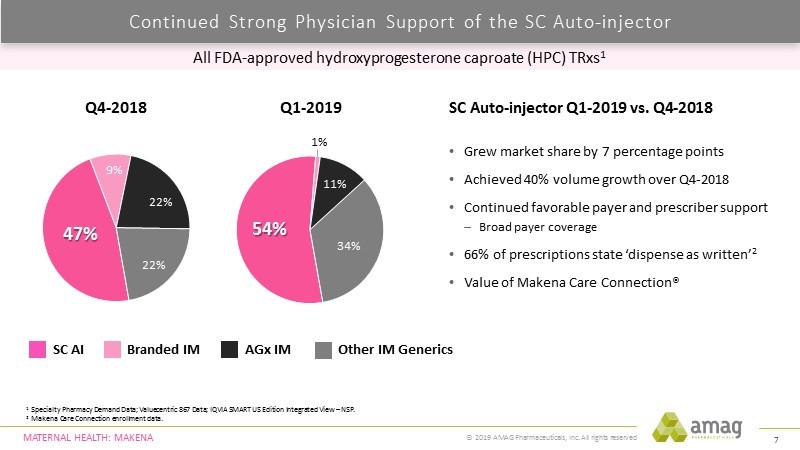

At a June brokerage house health care conference, AMAG presented the following chart which compared the unit market shares for Makena SC, Makena IM, the authorized generic to Makena and the three generics combined for 1Q, 2019 in comparison to 4Q, 2018. This showed an increase in unit market share for Makena SC from 47% in 4Q, 2018 to 54% in 1Q, 2019. A supply shortage of the active ingredient in Makena contributed to a sharp drop in its market share for Makena IM and the authorized generic which was picked up by generics. Makena IM sales were minuscule in 1Q, 2019 and going forward will vanish.

The next table shows results for Makena IM, Makena SC and the authorized generic for each quarter of 2018 and 1Q, 2019. There were some adjustments in 1Q, 2019 that I am not going to go into detail on. As can be seen in the table, I am projecting quarterly sales of $35 to $40 million for the remaining three quarters of 2019. I am probably an outlier on the upside with these estimates as the most bearish case calls for removal of Makena from the market.

When asked about Makena SC during the 1Q, 2019 conference call on May 7, AMAG management said that they were not changing their sales guidance for 2019 that was given on February 7, 2019 during the 4Q, 2018 conference call. Note that this was before the announcement of the results from PROLONG on March 8, 2019. So AMAG management is agreeing with me or me with them, whatever, that sales of Makena won’t collapse.

During its 1Q, 2019 conference call on May 2, 2019, Antares management said that 1Q, 2019 was very strong in terms of injector shipments and they hadn’t seen any slowdown in 2Q. They concluded that physicians are still using and writing RXs for Makena.

Here are my sales projections for Makena SC and the authorized generic for the remaining quarters of 2019 and full year 2020 and 2021.

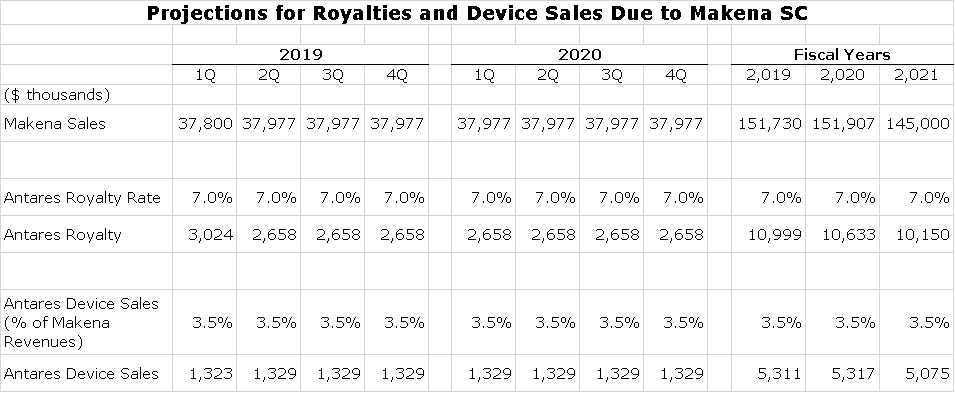

Here are my assumptions for royalties and device sales that Antares will receive in the next three quarters of 2019 and full year 2020 and 2021.

- The 2019 sales estimates for Makena are from the prior table and I am projecting slight decreases in 2020 and 2020. I expect some growth in the market which I think is realistic if Makena remains on the market. I am assuming that generics will cause some price erosion. Makena SC is priced at a premium and in some case must still make some price concessions.

- I am estimating that Antares receives a royalty of 7.0% on sales which I think is conservative.

- I am assuming that device sales are about 3.5% of Makena SC revenues

Here is my model projecting royalties and device sales for Antares.

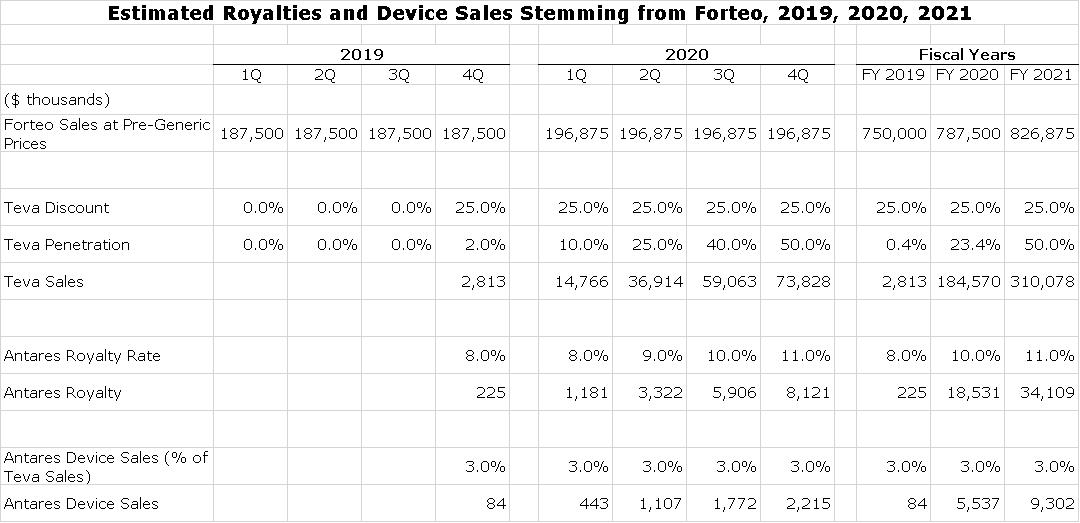

Projections for AB Rated Generic to Forteo

Antares has developed the injector that will be used in Teva’s AB rated generic to Eli Lilly’s Forteo. In 2018, this product had sales of about $750 million in the US and $850 million abroad. There do not appear to be any other potentially AB rated generics close to approval. Teva has said publicly that it expects to launch in the US before the end of 2019. In contrast to the EpiPen situation, Teva will also be launching its product in Europe, probably in 2020 although it has given no guidance. This looks to be a much bigger opportunity than either EpiPen or Makena. Here is how I a built my model based on US sales. Here are the assumptions.

- I first estimate that combined unit sales of both Forteo and the AB rated generic are growing at about 5% per annum. This allows me to estimate what sales for Forteo would have been without generic competition. So, if in 2019 they were $750 million, they would have been $788 million in 2020 and $827 million on 2021.

- I next estimate how much Teva is discounting in the US in order to gain share. As in the case of EpiPen, I believe that the goal of both Teva and Eli Lilly is to maximize revenue and profit. Because this is an oligopoly of two firms, I do not expect aggressive price discounting that would devastate revenues. This makes no economic sense to either participant. I am estimating that Teva will discount the price of Forteo by 25%.

- Teva has said that it will launch its AB rated generic in the US before yearend 2019. I am assuming that by yearend 2020, it will have 50% of the prescription market

- Antares has not given precise guidance on royalties, but has said that it expects high single digit to low double digit royalties, which is meaningful higher than for Makena SC or EpiPen. I build my royalty rate assumption starting with 8% and ramping to 11% as peak sales are reached at yearend 2020.

- In regard to device sales, I am estimating that they account for about 3% of Teva’s sales. In the following table I show device sales growing in line with revenues, but this is not accurate. There can be swings from quarter to quarter due to inventory fluctuations.

- Antares expects to receive royalties and device revenues from European sales. Until, I get a better sense of timing, I am not including and royalties or device sales from Europe.

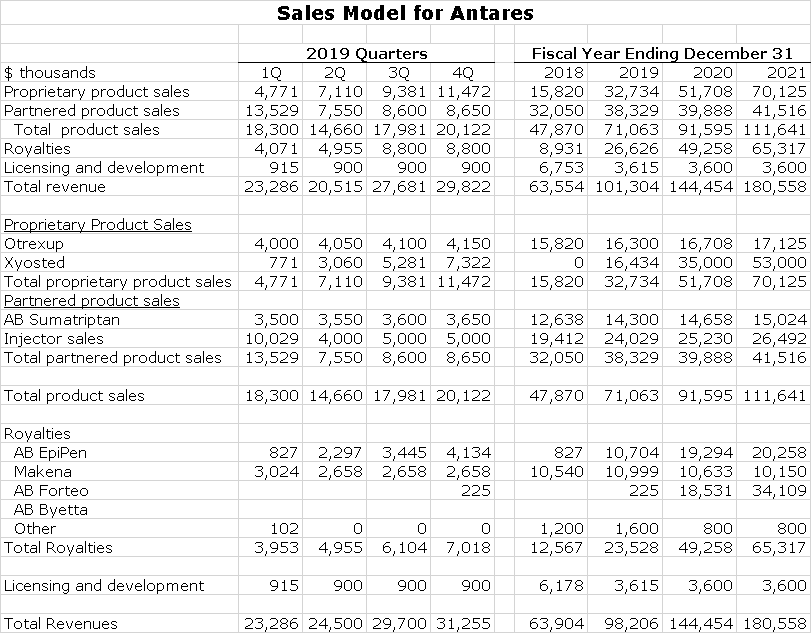

Putting Together a Comprehensive Sales Model for Antares

Antares reports its sales on the basis of proprietary products, royalties and licensing and development revenues. The Company currently has two proprietary products, Otrexup and Xyosted. Otrexup could have sales of around $16 million in 2019. It has shown only modest increases in sales in recent years and Antares is guiding for modest future growth. My detailed estimates for Xyosted were explained in my recent report.

Antares has a joint venture with Teva to sell an AB rated generic to sumatriptan. Antares reports its 50% share of operating income within partnered product sales. Going forward, these results are expected to show modest growth. The other large component of partnered products are injector sales to Teva and AMAG for EpiPen, Makena SC and Forteo. These are almost impossible to project on a quarterly basis due to fluctuations in inventories. As Teva ramps up the launch on EpiPen and prepares for the fourth quarter launch of Forteo, it needs to build inventory. Generally, I estimate that injector sales are about 3% of product sales by Teva and AMAG, but because of inventory swings, injector sales may not track with end market sales on a quarterly basis. My estimates are best guesses and subject to meaningful error.

Antares also reports royalties as a line item in sales. This is now based on royalties from sales of the AB rated generic to EpiPen and Makena; later this year royalties could be received from the AB rated generic to Forteo. In the preceding sections, I detailed my methodology to predict these royalty streams.

The final line item is licensing and development revenues. This is a relatively small category which at present is primarily due to pre-clinical work on an as yet undisclosed Pfizer product. A summary of my sales estimates is shown below:

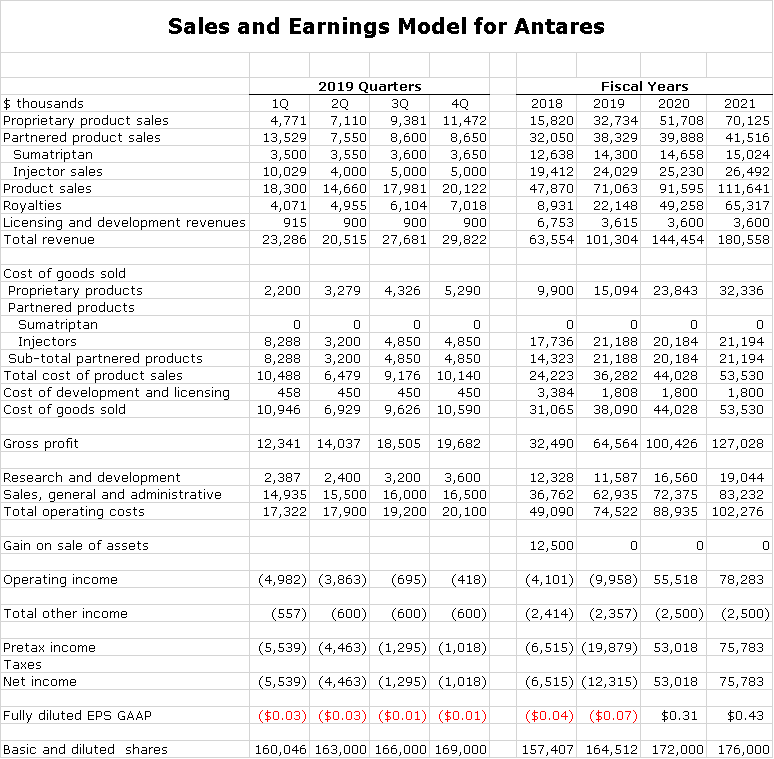

Building a Sales and Earnings Model

The first step in building this model is, of course, to come up with sales estimates as I did in the previous table. The sales categories have very different operating income outcomes.

- The royalty streams and the sumatriptan joint venture stream have no offsetting costs so that revenues and operating income contribution are essentially the same.

- Xyosted and Otrexup revenues are reduced by cost of goods sold and marketing expenses. Otrexup probably contributes modestly to operating income. Xyosted is early in its launch phase and is creating a meaningful operating loss. There is not sufficient public data to make good estimates as to how much.

- Injectors are sold to partners on a cost plus basis and probably have a gross margin of 30% or so and minimal operating expenses.

- Antares at one time released cost of goods sold data for licensing and development revenues that showed that the gross margin was 50%. This is my assumption on future revenues.

The above information allows me to calculate cost of goods sold/ gross profits for the Company. Looking next at operating expenses, I project costs as follows:

- Sales, general and administrative expenses are lumped together in one category. There is a significant increase in 2019 over 2018 due to the launch of Xyosted. This category should continue to increase significantly on a percentage basis in 2020, but less than in 2019, due to the Xyosted launch.

- Research and development expenses slowed in 2019 as Xyosted moved from clinical development to commercialization. I would expect a sharp ramp up in 2020 as clinical work begins on Antares’ next proprietary product ATRS-1701,

- Antares has a significant net operating loss carry forward and will not be paying taxes for some time.

Tagged as Antares Pharma Inc., Antares Sales and Earnings Model + Categorized as Company Reports, LinkedIn

i would not say they were being sarcastic. Just the street must hate ATRS. The stock never reacts to any positive news. Look at the share price and market cap. Even with 63% year over year growth projected it still acts like a lead weight is tied around the stock! Why???