Antares (ATRS, Buy, $3.51); AMAG Pharmaceuticals (AMAG, $11.73) First Thoughts about How the PROLONG Study Could Affect Makena Usage

Introduction

On Friday, the PROLONG clinical study was released that showed no difference in outcomes between Makena and placebo. This was a major surprise and disappointment and caused a sharp decline in the stock price of AMAG and to a lesser extent Antares. This note goes over my preliminary thinking on the possible outcome of this perplexing and unexpected development. I usually put my conclusions up front in a report, but because of the complexity of this situation and difficulty in predicting its outcome, my conclusions are at the back of this report. It is important to understand the history and use of Makena in order to put this situation in perspective

Makena has been a great success for AMAG since its introduction in 2011. It achieved maximum sales of $387million in 2017, but then generic competition entered the market in 2018. As a product life cycle extension strategy, AMAG introduced a subcutaneous version of Makena which has been on track to reach sales of $160 to $200 million in 2019. In addition, it has marketed an authorized generic that could reach sales of perhaps $30 million in 2019. AMAG has given guidance that corporate sales in 2019 could reach $365 to $415 million in 2019 so obviously, this is a critical product for the Company. Antares receives royalties and profits from injector sales that may amount to 8% of sales of Makenna or roughly $13 to $16 million. Antares has given guidance that its sales could reach $95 to 105 million in 2019, which is about 15% of 2019 projected sales.

What is Makena and How Is It Used?

Biological Basis

The active agent of Makena is a synthetic progestin called 17-alpha hydroxyprogesterone caproate or17P for short. Progestin refers to a group of drugs that mimic effects of the female hormone progesterone that has various functions, one being to help maintain a pregnancy. Makena draws on this biological property and is indicated to reduce the risk of preterm birth in women pregnant with one child (singleton) who have previously delivered a singleton pre-term infant. It is given as an intramuscular injection once a week that is started between 16 and 20 weeks of gestation and is continued through 37 weeks of gestation or delivery, whichever comes first.

Preterm birth is defined as birth before 37 weeks of gestation and in the US is estimated to account for 85% of all perinatal morbidity and mortality; it is a serious health risk to mother and child. The most frequent predisposing factors are a previous singleton preterm delivery at less than 37 weeks of gestation, multiple gestations, short cervical length, and body weight less than 50 kg (110 pounds), bleeding, and African-American ancestry. The most common of these risk factors in a history of preterm birth. The American College of Obstetricians and Gynecologists (ACOG), has recommended 17P as standard of care in these patients since 2003.

The drug ingredient 17P was introduced in 1956 by Bristol-Myers Squibb under the trade name Delalutin. It was initially approved for use in non-pregnant women for several indications including advanced uterine cancer, amenorrhea (absence or skipping of menstrual cycles), and uterine fibroids. Because of the advent of better drugs, BMY decided to withdraw the product from the market in 2000.

NIH Trial Results Reported in 2003 Shows Strong Evidence of Efficacy

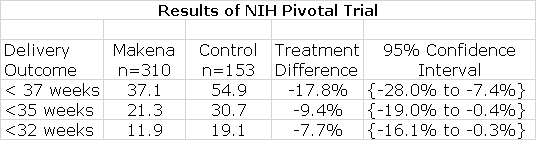

The mechanism of action of 17 P relaxes myometrial muscle and blocks oxytocin which led to the hypothesis that it might be useful in preventing pre-term delivery. This encouraged the National Institute of Child Health and Human Development (NICHD), which is part of NIH, to undertake a randomized, double-blind study conducted; the results were positive and were reported in the New England Journal of Medicine in 2003. The endpoint was reduction in the number of preterm deliveries in women who previously had a singleton preterm delivery. The study enrolled 310 women on Makena and 153 on placebo who had previously delivered preterm and were considered to be at particularly high risk of another preterm delivery. The results were as follows:

As shown by the confidence intervals, Makena showed statistically significant improvement over control in reducing premature delivery at these three stages of pre-term delivery. On this basis, ACOG recommended 17P as standard of care for prevention of pre-term birth in women who had previously had a singleton pre-term delivery.

Makena Comes to Market in an Unusual Way

The FDA did not actually approve 17P as a drug at that time as there was no drug sponsor for the NICHD trial. The surge in usage following the NICHD trials and resultant ACOG recommendation was supplied by specialty pharmacies. An injectable drug like 17P must be made under stringent manufacturing conditions in order to assure sterility. The FDA was concerned that specialty pharmacies lacked the quality assurance controls necessary and that this could lead to serious infections.

KV-Pharmaceuticals saw the opportunity to develop a standardized pharmaceutical ingredient in which the FDA could have confidence and developed an IM version of 17P. AMAG acquired this product from KV and received approval on February 4, 2011. Makena was approved under the FDA’s Subpart H accelerated approval process and was given Orphan Drug status. The FDA was eager to replace specialty pharmacy preparations with Makena.

AMAG and KV did not perform any new clinical trials. The FDA approval was based on the premise that because 17P is a sterile injectable drug produced in accordance with strict FDA guidelines that it would provide greater assurance of safety and equal efficacy. Makena achieved considerable success in replacing 17 P prepared by specialty pharmacies and by 2017 over 50% of 17P sales were from Makena.

It is important to point out that the original 17P efficacy study reported in 2003 was conducted by a branch of NIH and was a good sized, randomized trial that demonstrated clear efficacy. It is equally important to understand that the widespread use of Makena/ 17 P was the result of ACOG issuing guidelines that recommended Makena/ 17P as standard of care for preventing preterm delivery in women who had previously had a singleton pre term delivery. It was not the case that AMAG performed the clinical trials and then through its sales efforts created the market. The clinical trial was performed by the NIH and the widespread market adoption stemmed from the ACOG recommendation.

PROLONG Produces Disappointing Results

As a condition of FDA approval, AMAG committed to doing a randomized, double-blind, placebo-controlled clinical trial evaluating Makena® in patients with a history of a prior spontaneous singleton preterm delivery-PROLONG (Progestin’s Role in Optimizing Neonatal Gestation). This trial enrolled 1,700 pregnant women of whom 75% were outside the US.

AMAG reported disappointing results from the PROLONG trial last Friday on the two co-primary endpoints of the trial. The trial did not demonstrate a statistically significant difference between the treatment and placebo arms for the co-primary endpoints:

- The incidence of preterm delivery at less than 35 weeks was 11.0% for the Makena treated group and 11.5% for placebo, p=.72) and

- a pre-specified neonatal morbidity and mortality composite index showed 5.4% for Makena patients and 5.2% for placebo, p-0.84

The adverse event profile between the two arms was comparable. Adverse events of special interest, including miscarriage and stillbirth, were infrequent and similar between the treatment and placebo groups.

AMAG’s Initial Comments on PROLONG

AMAG’s initial comment on this trial was that it was difficult to enroll women in the trial in the US because Makena was accepted as standard of care and doctors were reluctant to put women on placebo. As a result, there was very substantial enrollment of women from Eastern Europe. The trial enrolled approximately 1,700 pregnant women, over 75% of whom were enrolled outside the U.S.

The company said that the results were inconsistent with prior trials and said that there were very different demographic characteristics as compared to the NICHD trial reported in 2003. The Company seemed to hint that Eastern European women enrolled in PROLONG were not at as high of risk, but they did not provide any data to support that nor to interpret how that might have affected results.

AMAG said that In light of these recent findings and the inconsistencies with prior clinical evidence, they plan to conduct additional sub-group analyses of the PROLONG data, particularly focusing on patients at the highest risk of preterm delivery and the subset of patients enrolled in the U.S. They said that they would work closely with the publications committee to further assess the data, submit the findings to the FDA, and prepare the data for a peer reviewed publication.

View of One Key Opinion Leader Gives an Insight into How Some Doctors will Potentially View Results

The Chair of the Prolog Publications Committee made this statement: “Our committee will be reviewing the trial data in detail and we will be actively involved in the analysis and interpretation of the findings. It is clear that the overall study population of PROLONG is significantly different than those who participated in the NICHD trial with respect to race, socioeconomic status, and severity of disease. Thus, we need sufficient time to thoughtfully interpret these findings in the context of the prior clinical trials.”

My Initial View on the Potential Impact of PRLONG on Makena Utilization

Let’s first consider two extreme outcomes as to how the results of PROLONG might impact Makena utilization. The most extreme negative case would be that the FDA and medical community will accept the findings as conclusive and regulatory approval is withdrawn and sales decline to de minimis levels. I give this scenario little to no chance of occurring, but at this point I can’t totally dismiss it. The most optimistic case is that the FDA and physicians conclude that flaws in the PROLONG trial means that the results must be viewed with skepticism or disregarded and the impact on Makena/ 17P usage might be minimal. Supporting this view are the very positive results of the 2003 NICHD study. Also, it is difficult to believe that there after 15 years inclusion as standard of care that the medical community based on real life experience could not determine or suspect that it had a placebo effect as suggested by PROLONG.

It is impossible for an outside observer to judge which of these extremes or some in between case will reflect the ultimate response of the FDA and medical community. Indeed, the FDA and key opinion leaders are probably as perplexed as we investors. One of the key things that the FDA will focus on are characteristics of patients enrolled in PROLONG. Is it the case that patients enrolled in Eastern Europe are markedly different than those who used the drug in the US? There will also be an intensive analysis comparing results in the roughly 1300 Easter European women to roughly 400 American women. If the results in the American women are as expected, then it would go a long way to shedding doubt on the study.

I don’t have a firm and clear insight on what conclusion the FDA will come to, but let me make some observations. The PROLONG trial does not point to any safety risk involved with the use of Makena. Even if Makena is no more than a placebo, patients being given the drug would not be at risk. This suggests that the FDA will not need to act precipitously in reaching a decision. It will want to carefully derive all of the possible information it can from PROLONG. In addition, it will want to draw on all information possible from the real world experience.

Makena has been part of standard of care for a long time. It is also the only approved drug for its indication and as I previously noted, pre-term delivery accounts for 85% of all perinatal morbidity and mortality; it is a very severe health risk. The FDA might be as reluctant to take action to sharply reduce or eliminate its use. A quick decision to withdraw Makena approval or take some action to reduce usage is not likely. If the PROLONG results were ultimately debunked and the conclusion reached that Makena does indeed prevent pre-term delivery, such an FDA action would pose a considerable health risk to mothers and children. The FDA is on the horns of a dilemma as is the medical community. They can’t just ignore or dismiss the data from the PROLONG study. On the other hand, Makena has been accepted as standard of care and at least until now has been viewed as preventing preterm deliveries.

My best judgment is that it will take the FDA and the medical community some considerable time to conclude whether the results of PROLONG are accurate in which case Makena might no longer be considered standard of care or on the other hand if the PROLONG trial was flawed. It may not be possible to reach a clear conclusion. My best judgement is that usage ultimately won’t be sharply affected.

Worst Case Implications for AMAG and Antares

While I am skeptical that the worst case scenario could prevail, I think it is important to look at how such a worst case might affect AMAG and Antares. In the case of AMAG, the withdrawal of Makena from the market would be a severe blow. Makena subcu has been on track to produce $160 to $200 million of revenues. AMAG does have another major marketed product in Feraheme which could reach sales of $190 million in 2019. Feraheme alone and could support a profitable business if SG& A and R&D were sharply reduced. AMAG has been using the profitability of Feraheme and Makena to fund the launch of launch of Intrarosa ($16 million of sale in 2018 and growing rapidly), to prepare for the potential launch of Vyleesi later this year and to conduct clinical trials of two promising drug candidates in ciraparantag (which might be approved in 2021) and AMAG-423. This impressive drug development effort requires significant spending on SG& A and R&D. A sharp drop in Makena revenues might force the Company to change its strategy and reduce spending which could meaningfully impact current development plans.

The impact on Antares of a complete Makena withdrawal would be a significant negative for 2019. The Company has given guidance that 2019 sales could range from $95 to $105 million. At a projected sales level of $160+ million for Makena, this could contribute perhaps $13 million to pretax profits and cash flow in 2019. This is important for funding the Xyosted launch and in an extreme case could force the Company to find other sources of funding. This could put a near term crimp in the Antares investment story. However, the key driver of the investment thesis is the potential for Xyosted which promises to be a major drug. I think that purchase of Antares at this price can be justified by the potential of Xyosted also. Also, the impact of the full launch of the AB generic to EpiPen in 2H, 2019 and the beginning of the worldwide launch of an AB generic to Forteo will make significant contributions to profits in 2H, 2019.

I can live with the catastrophic risk of withdrawal of Makena and maintain my Buy recommendation on Antares. With AMAG, I think that the loss of Makena would not be a fatal blow. There are some very important assets of the Company in Feraheme, Intrarosa, Vyleesi, ciraparantag and AMAG-423. However, the trauma of going through a restructuring in this worst case would be traumatic. I own AMAG and my decision is to hold the shares that I have. In the event that PRLONG does not meaningful change usage of Makena, needless to say, this would be an enormous buying opportunity for AMAG and a good one for Antares. My best judgment at this early date is that the PROLONG trial will not have much of an impact on Makena subcu, but this could change as we receive more information about the PROLONG data.

Tagged as AMAG, Antares Pharma Inc. + Categorized as Company Reports, LinkedIn

Thanks Larry. It will be interesting to see what comes out of the deeper dive into the PROLONG study. Something is amiss with tthat study. Intuitively I say that, but also from a knowledge of research protocol, statistical evaluation, and cognizant standpoint. Some of the variables, especially the patient profiles between the 2003 trial the more recent PROLONG trial, had to be signficant. At first glance there is no other way to explain the divergence between the two studies. As you noted, the sample size for the 2003 trial was strong and the sampling protocol appeared well managed. As for the PROLONG trial, I question the discipline used in the participant selection process. Though the sample size was large for the PROLONG study, I can’t say the same in regards to the sampling being well managed. The PROLONG trial took 10 years to complete. Yes, it involved 1,700 participants, but 10 years is still an extremely long time for a trial of this size to complete and speaks to the difficulty of recruiting patients. Did they compromise in recruiting participants to complete the trial? Was the selection process as disciplined as with the 2003 trial? This sort of trial would be extremely difficult to recruit for – it’s counterintuitive to think that a mom in a high-risk pregnancy would put the life of her unborn child at risk by potentially and willfully taking a placebo – and begs to ask what compromises in the recruitment of 1,700 participants occured in order for the trial to reach completion. I could be wrong, but I’m believing a deeper dive into the data will flush out the patient profile inconsistencies between the 2003 trial and the prolong trial.