Repligen: A Business Update and Reiteration of Buy (RGEN, Buy, $34.11)

Investment Overview and Thesis

A Long Buy Recommendation of Mine

I first recommended Repligen in an initiation report in December 2012. At the time and on many occasions since, I have described its business model as being one of the very best I have seen. On a macro-basis its business sail is driven by the hurricane force winds from development and commercialization of products based on monoclonal antibodies (mAb). I have never changed my buy recommendation on the stock since I initiated coverage with a Buy.

Great Business Model

Repligen’s focus is not on developing new mAb products, but on the production processes used to manufacture them so that it is not exposed to the extreme binary risk of drug development. I analogize this to supplying pots and pans to gold miners. Very importantly, once a Repligen product is incorporated into a manufacturing process, it is extremely difficult for a competitor to dislodge it. Any change in an element of a manufacturing process runs the risk of changing the characteristics of the drug and requires FDA review and probably clinical trials demonstrating that the change does not affect the characteristics. This makes for very long, predictable revenue streams with very high barriers to competition.

Rapid Growth is Expected to Continue

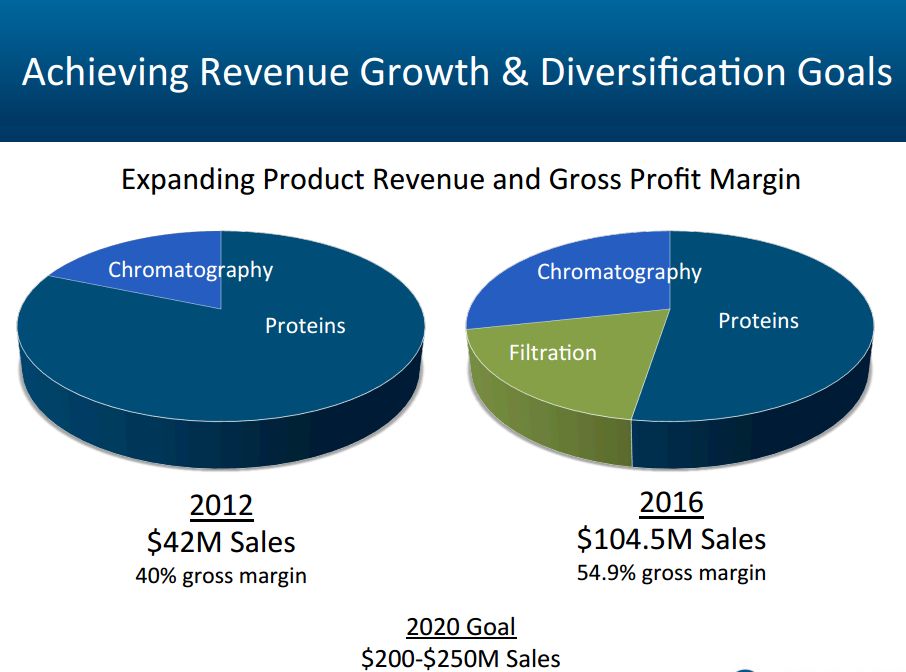

Repligen has increased revenues from $42 million in 2012 when I began covering the Company to $104 million in 2016, an increase of 149%. Management has set a goal for the next four years of achieving sales of $200 to $250 million in 2020, an increase of 90% to 140%. This growth is expected to come from both internal product development and well-conceived bolt on acquisitions. In 2012, the business was dominated by the protein A ligand business with a small chromatography segment. In 2016, the protein A ligand business was still quite important, but chromatography sales had doubled led by explosive growth of the internally developed OPUS line. Bolt on acquisitions then led to a third business segment of roughly the same size as chromatography.

Click to enlarge image

Lack of Transparency on Product Trends is a Concern

Nothing is ever perfect about a stock investment and this is one issue that worries me. As Repligen has grown, it has acquired or internally developed several key new products. Unlike drugs (that I usually deal with) it is difficult to judge product characteristics (no clinical trials) and how the products are faring or may fare against competition. Lack of visibility for us outsiders is a real concern as we must rely heavily on management guidance. This is not to say that I don’t have trust and confidence in management, it is just that is difficult to externally confirm and judge their guidance.

Valuation Is Very High

A second issue is the price of the stock. Repligen is guiding investors that it anticipates that revenues will increase 19% to 21% in 2017 to $121 to $126 million and that GAAP adjusted EPS will increase 23% to 34% to $0.54 to $0.59. Using the mid-points of these estimates, the stock is selling at 19 times projected 2017 sales and 61 times projected 2017 EPS. These are extremely high valuations.

I am not sanguine with these valuations, but I continue to recommend purchase. Have I gone mad? Let me explain this approach which has stemmed from over 30 years of investing in emerging growth stocks. If the business continues to meet my expectations for growth, I usually don’t make investment decisions on the basis of price. This can be embarrassing as in the case of Repligen. With perfect knowledge I would have sold the stock at $42.15 on July 7, 2015 and then re-purchased it on February 5, 2016 at a price of $21.04. This sounds great but it has a great drawback because no one can consistently pick highs and lows. And very importantly, investors more often than not don’t get back into a stock after they sell it. They may watch forlornly as over time the stock appreciates many fold. The great investments like Amgen, Genentech, Amazon, Google, et al. always seem over-priced in the early stages of their development. Repligen may not quite be in this class, but I think that it is going to grow very rapidly for many years and be a very large company, if it is not acquired in the meantime.

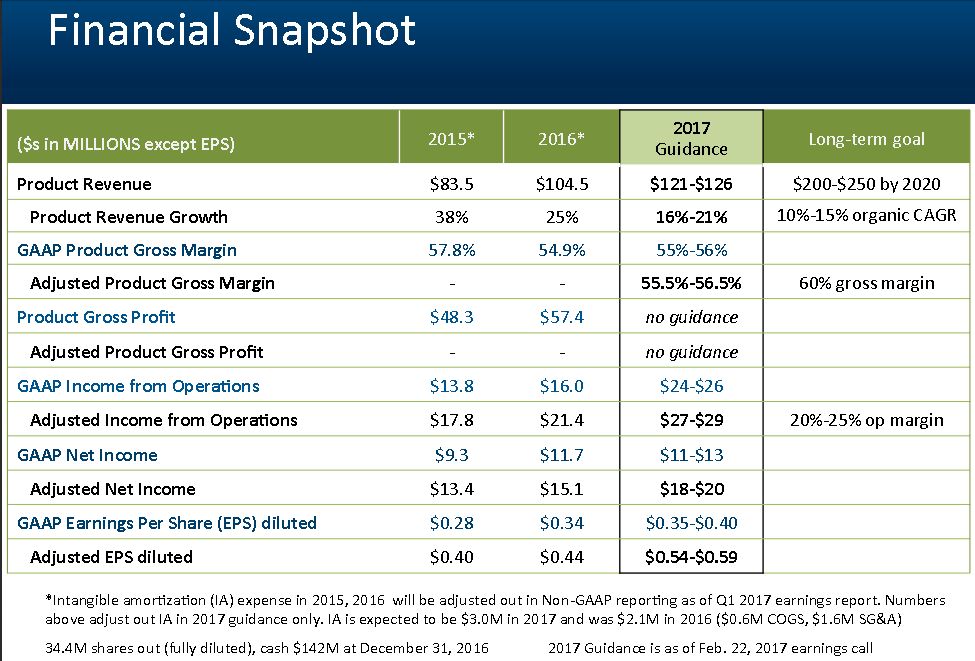

Repligen’s Financial Guidance Promises Strong Growth

Repligen has given detailed guidance for 2017 sales and income. The Company is expecting a 16% to 21% increase in product revenues to $121 to $128 million and a 23% to 34% increase in adjusted GAAP EPS to $0.54 to $0.59. I would note that the projections make the assumption that there will be no contributions from acquisitions which could lead to upside surprise.

It is important to note that a basic part of Repligen’s strategy is bolt on acquisitions. These have generally been done at a price of 5 to 6 times one year forward revenues. Thanks in part to a $100 million convertible offering, the Company ended 2016 with $142 million of cash and expects that free cash flow generation in 2017 could result in $150 to $152 million of cash at year end 2017. Using a rule of thumb of buying companies at 6 times or less sales, $100 million dollars devoted to acquisitions could add as much as $17 million of sales (annualized) which compares to the $16 to $21 million sales increase expected without any acquisitions. Usually, these acquisitions are accretive within a year.

Click to enlarge image

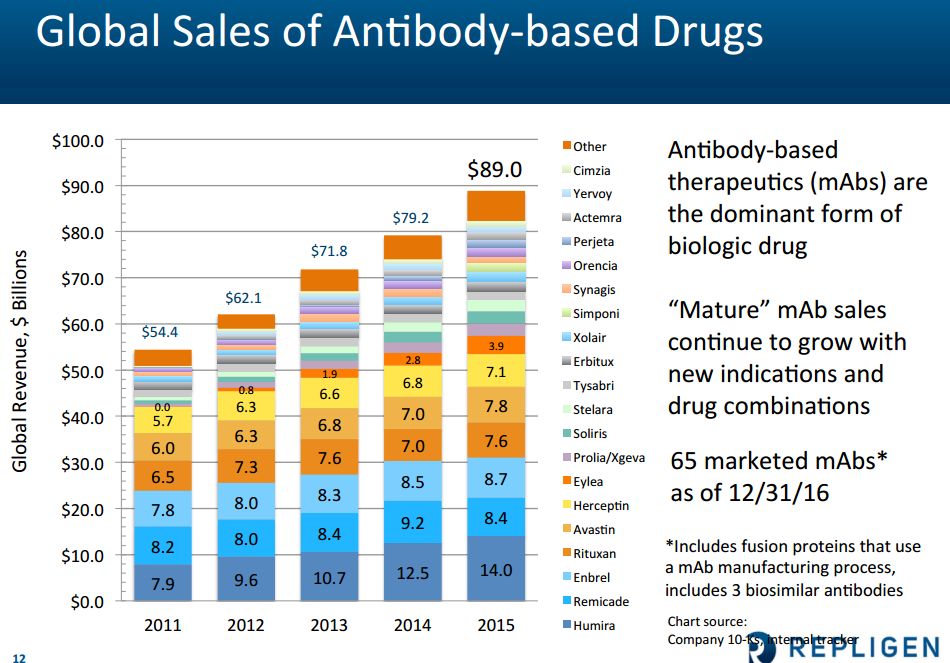

The Major Macro-Economic Driver of Repligen’s Business is the Development and Commercialization of Monoclonal Antibodies

Beginning in the late 1980s, products based on monoclonal antibodies (mAb) have become the most important driver of world biopharma sales and focus of research and development efforts. As of 2015, worldwide sales of monoclonal antibodies were $89 billion of the $360 billion global biopharma market. As of 12/31/ 2016, there were 65 marketed mAb products. The following table shows some of the marketed mAb products.

Click to enlarge image

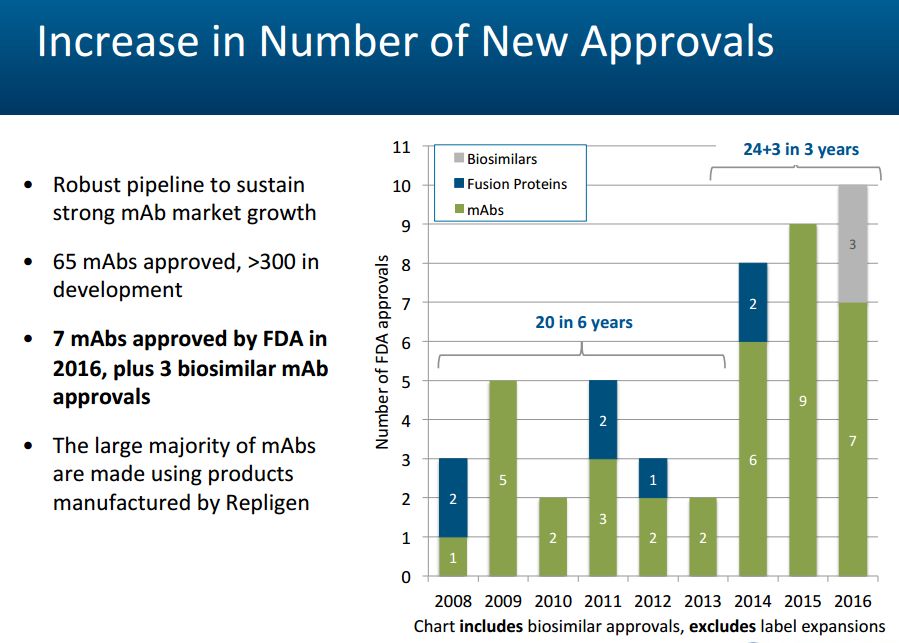

mAb research and development is by no means peaking. While 65 mAbs have been approved, there are more than 300 others in development. The following table shows the sharp pickup in mAb approvals. Repligen states that to some extent it is involved in the majority of these new product efforts.

Click to enlarge image

The Micro-Economic Drivers of Repligen’s Business

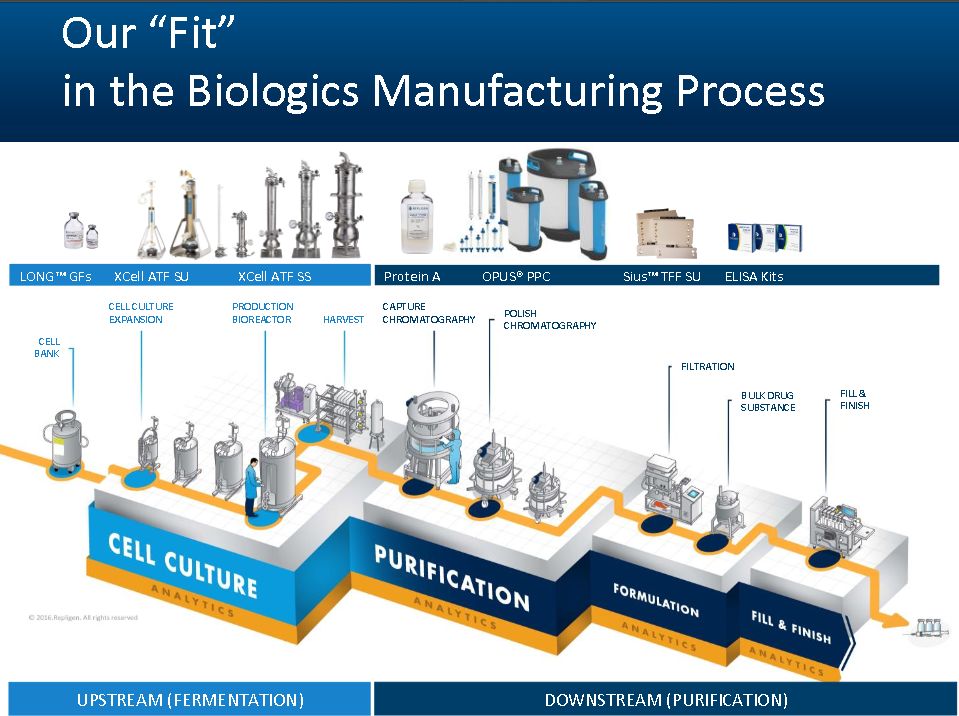

Repligen is positioning itself across the breadth of bioprocessing with both acquisitions and internal product development. It is particularly focused on creating disposable products. The following table illustrates the breadth of the product line.

Click to enlarge image

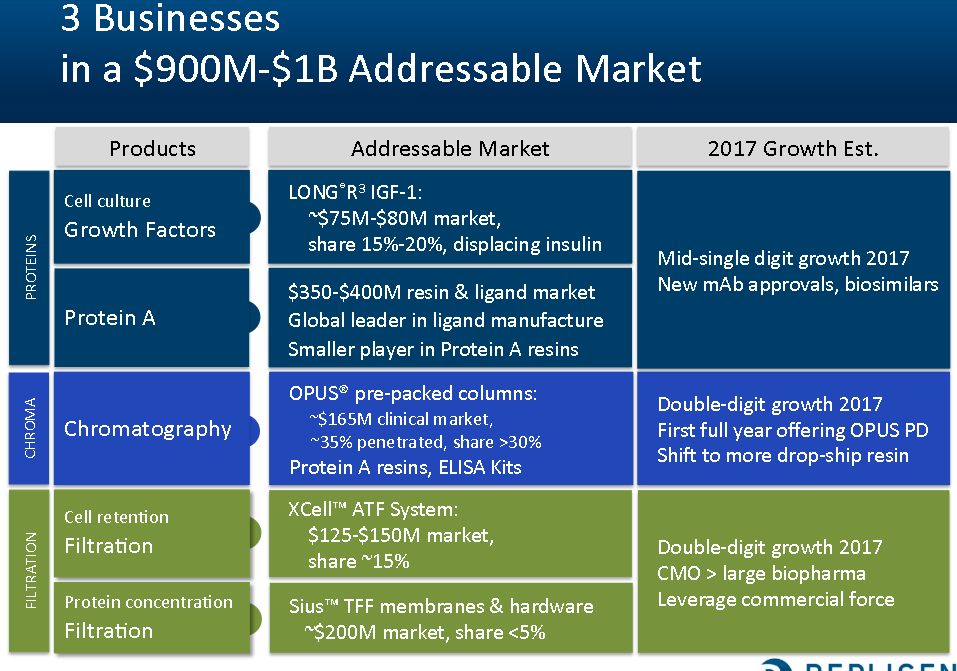

Repligen estimates that the addressable market for its three current business segments is $900 million to $1 billion. The following table shows the size of individual markets, Repligen’s market position and potential growth prospects. The high growth areas are in filtration products and the OPUS pre-packed chromatography columns.

Click to enlarge image

Tagged as OPUS Chromatography columns, Repligen, RGEN + Categorized as Company Reports, LinkedIn