Repligen: Initiating Coverage with a Buy (RGEN, Buy, $6.13)

Investment Opinion

Repligen (RGEN) has gone through a metamorphosis that has dramatically changed its business model and investment outlook. For years, it was focused on drug development but it was also building a high quality bioprocessing business that provides consumable products used in the manufacturing of biological products. The acquisition of a major competitor, Novozymes (now Repligen Sweden), in 2011 provided the critical mass for a standalone business in bioprocessing; management and the board decided to exit the drug development business to focus on bioprocessing.

The bioprocessing business has outstanding investment characteristics:

- The major macroeconomic force driving Repligen's business is the clinical development and commercialization of biological products, especially drugs based on monoclonal antibodies. Monoclonal antibodies are a $57 billion global market growing at 9% or more per year; there are about 50 approved products and 300 new products in development.

- Repligen's most important business area is manufacturing protein A which is used to purify monoclonal antibodies during the manufacturing process. Repligen supplies over 95% of the world market.

- Long term, multi-year contracts to supply protein A give great stability and predictability to sales and earnings.

- The organic sales growth of the existing line of businesses is on the order of 10% to 15%.

- Weighed down by the costs of the now exited drug development business, pretax operating income (before royalties) in 2012 is projected as a loss of 9.1 million. I project that by 2016, the pretax operating income of the bioprocessing business will be $11.8 million.

- The company has a strong cash position and will produce an estimated $10+ million of annual free cash flow beyond 2013.

- By the end of 2013, Repligen could have $70 million or $2.20 of cash per share.

- Repligen has the opportunity to use its cash and attractive stock valuation to make accretive acquisitions that could significantly increase the growth rate over and above that for organic growth.

I view Repligen as an ETF for investing in monoclonal antibody drug development without the binary risks presented by commercialization uncertainties, clinical trial outcomes and regulatory rulings associated with an investment tied to a single product. The company reminds me of a documentary that showed how people who supplied picks, shovels and Levi jeans to miners in the California gold rush made fortunes without having to take on the risk of finding gold.

With its exit from drug delivery, Repligen's stock price will be driven by earnings. In the period 2012 to 2014, there are a number of issues that must be assessed in order to understand the true earnings power of the company. R&D expenditures will be cut in half in 2013 and there are operating efficiencies arising from the Novozymes acquisition that will also reduce costs. I project that bioprocessing revenues of existing businesses will grow at 10% to 15% and the improving cost structure can lead to significantly faster operating earnings growth. Net operating loss carry-forwards and tax credits of $60 million will be used to offset taxes until 2017, by my estimates.

Investors must be aware of and understand the reason for a sharp drop in projected EPS from $0.54 in 2013 to $0.27 in 2014. Through its drug development efforts Repligen holds a patent that Bristol-Myers Squibb (BMY) licensed for the development of its large selling anti-inflammatory drug Orencia, which has current sales of over $1 billion. This licensing arrangement expires at the end of 2013 with the result that Orencia royalties will drop from $14 million or $0.43 per share in 2013 to zero in 2014. Beyond 2014, the company will derive all revenues and profits from bioprocessing.

Price Target and Stock Opinion

In setting a price target for Repligen in 2013, I would suggest that investors focus on 2014 EPS. It is misleading to value the company on 2013 EPS, which contain such a huge component from Orencia royalties which disappear in 2014. The question is what multiple should be placed on 2014 EPS of $0.27 which is the basic earnings power of the bioprocessing business. In addition to valuing the base business, investors must also look at the cash on the balance sheet. Because Repligen can fund operations out of operating cash flow, it does not need to depend on its cash to fund a burn rate as do drug development companies.

I start the valuation process by subtracting the projected yearend 2013 cash of $2.20 and from the current stock price of $6.30. This indicates that the enterprise value of the bioprocessing business is $4.10 per share. Based on 2014 operating EPS of $0.27, the company is selling at approximately15 times. Given my projections for EPS to grow at 23% per annum over the 2014 to 2016 period and the predictability of future EPS, I would argue that this business could command a 20 to 30 P/E ratio; this results in an estimated enterprise value of $5.40 to $8.00 per share. Remember, this is before estimating the additional value of the cash.

One way of estimating the value of the cash is calculate its effect on EPS if the $70 million is used to buy back stock. Assuming a share repurchase price of $6.30, the company could repurchase 11.1 million shares and decrease shares outstanding from 31.7 million to 20.6 million. This factor alone would increase EPS from $0.27 in 2013 to $0.41. Applying a price earnings ratio of 20 to 30 would results in a price target of $8.10 to $12.30.

I think that there is almost no chance that Repligen will use its cash to buy back stock. I just wanted to illustrate that the cash should be seen as providing substantial value over and above the enterprise value. In actuality, I think that the cash will be used to acquire assets or entire companies. If management is shrewd and I believe that they are, this should produce more value for shareholders than a stock buyback program.

Taking all of these factors into account, I am setting a one year price target of $9.00 for the stock. I also think that the business model can lead to sustained, predictable above average growth for perhaps a decade beyond 2013. This is the basis of my buy recommendation.

Repligen's Business Model

Repligen has a unique and highly attractive business model that is directly tied to the rapidly growing global market for biologic drugs, especially monoclonal antibodies. The core of its current business is the manufacture of bulk protein A that could account for $29million or roughly 69% of the $42 million of bioprocessing sales that I am projecting for 2012. The remainder of product sales comes from other chromatography products that are projected to reach $7 million in 2012 and growth factors with projected sales of $6 million in 2012.

Protein A is used in the manufacturing of virtually all monoclonal antibodies and Repligen has over 95% of the current world market. For reasons that I will touch on shortly, I believe that Repligen's commanding position is virtually unassailable. For perspective, there are about 50 commercially approved monoclonal antibodies and some 300 in clinical trials. While the majority of these 300 products may fail, if 10% reach the market, it could have a substantial impact on the demand for protein A.

Monoclonal antibodies are generally produced in living cells that are grown in fermentation tanks. These cells have been genetically engineered to incorporate a gene that expresses a desired monoclonal antibody. This protein must then be separated from the cellular debris and other unwanted molecules in the fermentation broth. Separation starts with centrifuging and straining the contents of the tank to remove solid contents. The remaining liquid solution contains the monoclonal antibody as well as unwanted proteins. It is next pumped through a chromatography column that contains porous beads which allow the liquid to pass through. Attached to the chromatography beads is protein A which has an unusually high affinity for monoclonal antibodies. The monoclonal antibody binds to the protein A while other molecules in solution pass on through. The column is then chemically treated to release the monoclonal antibody from the protein A.

Once a drug company incorporates protein A manufactured by Repligen in its manufacturing process, it is nearly impossible to switch to another product. In living cell manufacturing, even the slightest change in the manufacturing process can lead to a change in the end product. If a manufacturer were to change to another supplier of protein A, regulatory agencies might require studies, possibly even new human clinical trials, to demonstrate that the product characteristics have not changed. This would involve high risk for the manufacturer with little potential for cost savings. Hence, drug products that use protein A made by Repligen in their manufacturing process effectively incorporate it for the commercial life of the product.

Repligen has developed significant internal technical expertise and a strong brand in bioprocessing. It has a reputation for quality and service that has enabled it to emerge as a technology partner of choice to whom market leaders turn for collaboration on the development, scale-up, and manufacturing of new protein A related products. Its principal customers are the leading manufacturers of chromatography beads, GE/ Amersham, EMD Millipore and Life Technologies; each uses Repligen to manufacture protein A for their chromatography bead products under long term contracts exceeding five years.

Chromatography beads from one of these three manufacturers are used in almost all monoclonal antibodies in clinical trials and then in commercialization if the products are approved. Hence, protein A manufactured by Repligen will be used in almost all monoclonal antibodies that go into clinical testing and will of course be used if the products are ultimately commercialized. It is this nearly impregnable market position of Repligen in the protein A market that is the bedrock of its business model.

For over two decades, Repligen was also involved in the development of biotechnology drugs. However, it announced in August 2012 that it had decided to exit the drug development business and focus all of its resources on consumable products for bioprocessing. The catalyst for this decision was the December 2011 acquisition of the Novozymes subsidiary of the Swedish company Lund. Novozymes (now known as Repligen Sweden) was the only effective competitor to Repligen in the protein A market. This acquisition moved Repligen from supplying about half of the market to something over 95%. Very importantly, Repligen now has two different plants that can supply protein A as well as a third contract manufacturer. It is critical to customers to have two or more distinct sources of supply in the event that an issue arises that affect production at one plant. This multi-plant capability removes an important incentive for its customers to look for a backup supplier.

Repligen's business strategy is to build a best in class life sciences company focused on the development, manufacture and sale of high value added consumables for the growing bioprocessing market. Protein A is currently its critical product but the company has other promising products such as growth factors that are used in a wide range of recombinant therapeutic proteins, monoclonal antibodies and vaccines; other tests and products used in chromatography and pre-packed chromatography columns. Repligen can identify additional opportunities to grow the bioprocessing franchise through a combination of continued sales growth for existing products; co-development of new products with existing partners; product innovation, including additional disposable technologies for biomanufacturing; and selective acquisitions of products or companies to expand its product portfolio.

Prior to the acquisition of Novozymes, Repligen had already begun to diversify its product offering. In 2010, it acquired a company that out-sources the development of chromatography columns for clinical trials. This allows drug developer to use Repligen's expertise to develop chromatography columns instead of trying to build this expertise internally. This reduces costs and reduces the burden on the customer's quality assurance group.

Repligen also develops products in collaboration with other companies. For example, it collaborated with GE/Amersham (GE) to develop a ligand comparable to protein A, called protein L, that is used in the separation of new products based on antibody fragments; these antibody fragments may offer advantages over conventional monoclonal antibodies.

I refer to products used in chromatography other than protein A as "other chromatography products". This segment is projected to have sales of about $6.9 million or 17% of total sales in 2012. The final segment of Repligen's business is its "growth factors" business that is used to manage the growth of living cells in fermentation tanks. This is upstream of the chromatography purification products. This business could have sales of $5.9 million in 2012 or 14% of total product sales.

The decision to focus on bioprocessing provides a clear investment thesis and a unique vehicle for investors to invest in the rapidly growing biologics business, especially in the global market for monoclonal antibodies, without the binary risk inherent in drug development. Repligen is not dependent on clinical trial outcomes or regulatory decisions on a single product. Another critical investment feature is that the strong market position and long term supply contracts promise highly predictable and sustained growth of protein A sales.

The December 2011 acquisition and successful integration of Novozymes provided a critical mass of bioprocessing products. From this base, Repligen can identify additional opportunities to grow the bioprocessing franchise through a combination of continued sales growth for existing products; co-development of new products with existing partners; product innovation, including additional disposable technologies for biomanufacturing; and selective acquisitions of products or companies to expand the product portfolio.

Purification of Biological Drugs

Drugs based on monoclonal antibodies such as the blockbuster cancer drugs Rituxan (sales of $6.6 billion) and Avastin (sales of $5.6 billion) are manufactured through cell fermentation. The cells are genetically engineered to produce the particular proteins which are the basis of these drugs, specifically the proteins rituximab and bevacizumab. The cells are bathed in a liquid medium that contains molecules that promote cell growth and expression of the proteins such as growth factors, hormones, and transferrins

The desired monoclonal antibody which is expressed or produced is dissolved in the fermentation broth and must be separated. The first step in the purification process is to remove all solids such as cells, cellular debris, lipids and clotted material by centrifugation followed by filtration. This leaves a liquid solution containing the monoclonal antibody and impurities. This liquid is then pumped through a glass or metal column that is packed with a chromatography media made of agarose. This is a porous gel like substance that allows liquid to pass directly through.

Protein A is chemically bound to the chromatography media. It has a highly specific affinity for monoclonal antibodies so that most of the monoclonal antibody molecules bind to the protein A while other molecules pass through. Then a change in conditions caused by washing the column with a low Ph solution results in the release of the monoclonal antibody from Protein A, yielding a solution that contains about 97% of the bound monoclonal antibody. Further chromatography processes are then used to still further purify the monoclonal antibody.

Protein A

Over the last ten years, Repligen has established itself as the pre-eminent manufacturer of protein A. It sells protein A to manufacturers of chromatography media such as GE/ Amersham, EMD Millipore and Life Technologies (LIFE) who incorporate it in their proprietary products. Repligen now manufactures the native form of protein A and four other recombinantly produced versions of protein A that are genetically engineered to achieve certain performance characteristics. With the 2011 acquisition of Novozymes, which was the second leading producer of protein A, Repligen accounts for over 95%% of worldwide sales of protein A.

The first or native form of protein A was found on the surface of Staphylococcus aureus. About 40 years ago, it was discovered that it binds readily to human antibodies and was easy to collect and purify. Amersham (now owned by GE) developed a way of attaching it to an agarose bead and marketed it as a laboratory reagent to isolate human antibodies. With the advent of monoclonal antibodies, the pharmaceutical industry saw this as a very effective way to purify monoclonal antibodies.

The first supplier of native protein A was the Swedish company Lund. Repligen recently acquired its manufacturing facilities for protein A with the Novozymes acquisition. Repligen first began to look at protein A as a potential cancer drug in the early 1980s. This project didn't work out, but in the process they developed a next generation recombinant form of protein A that they began selling for purification of monoclonal antibodies. In 1999, the company stuck a formative deal to begin supplying GE/ Amersham with protein A.

There are now four recombinant versions of protein A and the original natural form. Repligen has developed two recombinant DNA products and the major chromatography suppliers have developed two others. Repligen manufactures all four of these recombinant versions; they each have features which distinguish them from one another and the natural form. For example, one may provide better binding or greater resistance to degradation from the clearing agent used to separate the monoclonal from protein A in the chromatography columns. The natural form is no longer used with new products, but for reasons previously detailed continues to be used with older products such as Rituxan.

GE/Amersham, Millipore and Life Technologies are focused on the production of chromatography beads. Agarose was the first bead used, but there are now many different types, which have different characteristics such as flow rate and capacity. These manufacturers are primarily interested in creating higher value added chromatography media. They have elected to use Repligen as their supplier of protein A. When Repligen was bidding for Novozymes (then the second largest supplier of protein A), none of these companies appear to have been competitors. By affording Repligen a second manufacturing plant, it made Repligen a more dependable and valuable supplier. In fact, following the Novozymes acquisition, GE extended the supply agreement for protein A from 2015 to 2021. All of the protein A used by GE is manufactured by Repligen.

Repligen is able to maintain its dominant market share because protein A sales are very sticky. Once a company begins development and commercialization of a monoclonal antibody, it is very reluctant to change any aspect of its manufacturing process as this can lead to a change in the characteristics of the product. Regulatory agencies usually require validation to show that there is no change and may demand in vitro or human clinical trials to demonstrate this. Manufacturers are reluctant to change even the smallest component of their process. This leads to long term supply contracts with suppliers of chromatography media and the subsequent long term contracts of chromatography media companies with Repligen for protein A.

Perspective on the Markets for Repligen's Products

Repligen sells consumable products that are used in the manufacture and purification of biological products produced through cell culture, which is a $150 billion global market. The major factor determining demand for Repligen's product line are those drug products based on monoclonal antibodies. This market segment is about $57 billion and is growing in high single digits. By 2014, six of the ten largest selling drug products in the world are expected to be based on monoclonal antibodies.

There are about 50 approved monoclonal antibody products, but the sector continues to be a major focus of research spending as there are currently another 300 products in clinical trials. If even a small fraction of these become significant products, the market for monoclonal antibodies will expand significantly and drive future growth for protein A products. The most important current monoclonal antibody products are used in oncology and inflammation. However, focus is now shifting to other major therapeutic areas.

Recently, promising data has been reported on the anti-PCSK9 monoclonal antibodies which appear to be dramatically more effective than the statins in lowering cholesterol. There has also been a lot of attention on two monoclonals for Alzheimer's disease, solanezumab and bevicizumab that target beta amyloid. While these products produced equivocal clinical results, it highlights the potential for pharmaceutical companies to use monoclonal antibodies against disease targets in most therapeutic categories. Importantly, research continues in oncology as monoclonal antibodies against PD-1 and PD-L1 are in the opinion of many key opinion leaders, the most exciting new drugs in oncology.

Repligen sells consumable products which are used in the manufacturing of monoclonal antibiotics and other biologics; it calls this the bioprocessing market. It does not compete in the capital spending parts of the market. Bioprocessing consumables are estimated to be a $3 billion business that expands steadily in line with biologics market growth. Repligen is most intertwined with monoclonal antibody purification which is a $500 million to $750 million global market, much of which comes from the sale of chromatography media.

Repligen's key products are native and recombinant forms of protein A which are attached to chromatography media and used in the purification of almost all marketed monoclonal antibiotics and also those in clinical trials. Repligen accounts for over 95% of the world global market with sales of $29 million. Repligen offers commercial bioprocessing products in two other categories: growth factors, and chromatography products.

Other Chromatography Products

Repligen sells other products for chromatography. It has an ELISA diagnostic test that is used to determine if protein A has leached from columns during the process that separates monoclonal from Protein A; this test is required by FDA. It also provides tests to manufacturers to determine if the column is performing in line with specifications and if the manufactured product remains free of microbes and endotoxins.

Co-development efforts funded by its strategic partners are an increasingly important business. As an example, the company was funded by GE to develop a new affinity ligand (protein L), which is being used to purify antibody fragments. This product was recently launched by GE/ Amersham. It is comparable to protein A, but more specific for antibody fragments, which offer advantages over larger monoclonal antibodies such as improved tissue penetration.

Repligen receives revenues from R&D contracts performed for life sciences companies. There has been an uptick in interest in doing such projects. In January of 2010, Repligen entered a new segment of chromatography through the acquisition of patented technology from BioFlash Partners. It allows drug developers to use Repligen pre-packed disposable chromatography columns called OPUS; it is intended to be used in clinical trials and small scale niche commercial products such as orphan drugs in which only small amounts of drug are being produced.

The OPUS columns can be plugged into the manufacturing process and allow manufacturers to focus more on drug development and less on manufacturing issues. Repligen can pack specially designed columns with any media, not necessarily protein A media, from a variety of vendors. The OPUS columns are designed to offer customers a flexible, pre-packed chromatography solution that enables customers to choose the media, column size and column bed height. These columns are made in a controlled environment and shipped by UPS to the manufacturer.

OPUS is not targeted for use with commercial blockbusters. It aims at the market for clinical trials and possibly for the manufacture of small scale commercial products such as orphan drugs which produce small quantities of drug. The overall market for sale of all chromatography resins for both commercial and clinical use is estimated to be $500 to $750 million. The market for pre-packed media for clinical trials is estimated by Repligen to be $100 million. Repligen is in discussions with number of orphan drug developers which might result in strategic collaborations on development of columns that could be used in clinical trials and then in commercial manufacturing. One orphan drug manufacturer is already using OPUS in its GMP manufacturing process.

There is a significant increase in value added as Repligen expands its OPUS offering. For a given application, every $1.00 of sales produced from protein A is accompanied by $5.00 or more by attaching the protein A to the chromatography beads and to $6.50 if the bead with protein A is pre-packed in a column. Repligen is now in a position to capture some part of $6.50 commanded by the packed column instead of just $1.00 from protein A.

The question arises as to whether Repligen is now competing with its large protein A customers and if this could strain their relationship. GE and Life Technologies do sell products which compete with OPUS. However, I do not see this as a problem. The primary interest of GE is to sell chromatography media. In its OPUS products, Repligen is buying the media with protein A attached from GE and other manufacturers and packing it into their specially designed columns. I think that these companies view Repligen as a re-seller that can expand demand for their chromatography media product lines.

Growth Factors

Through the Novozymes acquisition, Repligen acquired fermentation growth factor products that are essential for proliferation and maintenance of cell lines used in the manufacturing of cell based therapies such as stem cells, monoclonal antibodies and recombinant DNA products. Growth factors, like chromatography products, are a fast growing component of bioprocessing. It is estimated by Repligen that the current market size is $50 million to $100 million. This gives Repligen a foothold which it plans to expand through internal development and acquisition.

The most important product is LONG R3 IGF-I which is ten times as potent as recombinant insulin and native IGF, which are currently the most widely used growth promotants. It is sold under a distribution agreement with Sigma-Aldridge which extends to 2021 and is now used in nine commercial biopharmaceutical products. Key customers include Amgen , Roche, and Chugai The other growth promotant products acquired were long epidermal growth factor (LONG EGF), transforming growth factor alpha (LONG TGF-a), recombinant transferrin (rTransferrin) which is as an iron supplement for cell culture and supplements for serum-free or low serum cultures.

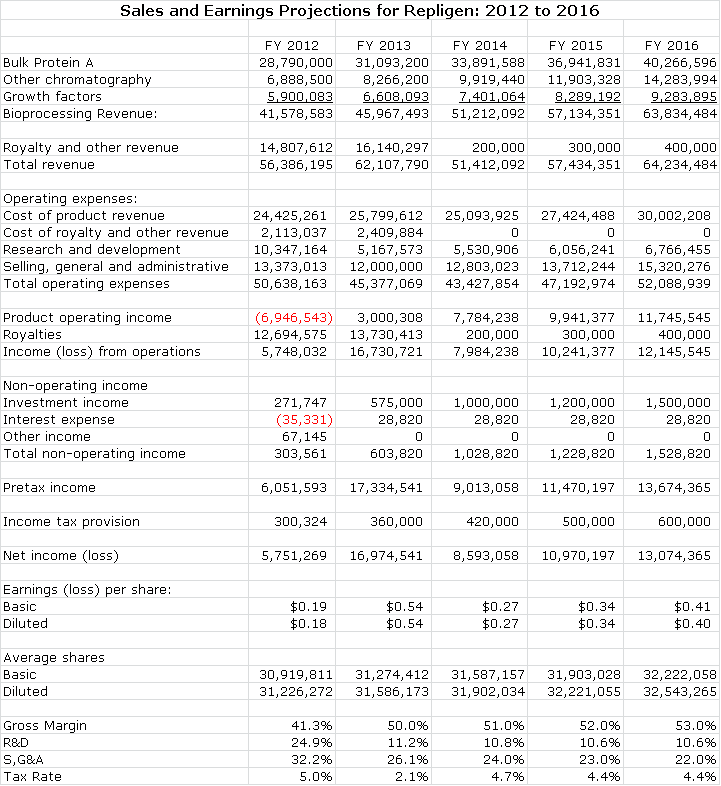

Detailed Projection of Sales and Earnings

This section explains how I come up with my sales, earnings and cash flow projections for Repligen as shown in the following table. I have broken its business into three components: bulk protein A manufacturing, other chromatography products and growth factors. I think that the base Protein A business can grow at a consistent rate of around 9% or possibly more. The other chromatography products can probably grow faster due to their small size base, strong product development potential and opportunities for acquisition. This is also true of the growth factors segment. I see them both growing at 20% and 12% per year over the next few years.

Based on these assumptions, I project a five year sales growth rate of 13%. However, I believe that Repligen will very likely make more strategic acquisitions like Novozymes that will bolster the growth rate. Obviously this is not possible to model and I do not include any estimate of sales from acquisitions in my projections; I think that this may provide meaningful upside to my model.

There are other aspects of Repligen that complicate P&L projections. Dating from its biotechnology drug development days, it has patents which are critical to the manufacturing of Orencia. This is Bristol-Myers Squibb's drug for inflammatory disease which I project to have sales of over $1 billion in 2012. Repligen receives a royalty of 1.8% of sales of which 15% is then passed on to the University of Michigan. I estimate that this will contribute $14.5 million of royalties to Repligen in 2012 and $15.8 million in 2013. This one item could account for over 95% of pretax profits in 2013. The royalty rights expire after 2013 and this will significantly affect profit comparisons in 2014 relative to 2013. Another important factor to be aware of is that Repligen has operating loss carry-forwards and tax credits of about $60 million so that it is not likely to pay meaningful taxes until sometime in 2017.

Repligen has issued guidance that it expects 2012 bioprocessing revenues of $41 to $43 million. Adding in Orencia royalties, total revenues are expected to reach $55 to $57 million. This should result in GAAP net income of $5 to $7 million. Non-cash operating expenses are expected to be $4 million indicating that the company will generate $9 to $11 million of cash from operations. Recent guidance is unchanged from the second quarter conference call (August 2012), However, it is higher than the guidance given during the first quarter conference call (May 2012) which projected bioprocessing revenue of between $39 million and $41 million, total revenue of approximately $52 million to $55 million and GAAP net income of $4 million to $6 million.

The company expects an organic growth rate for the bioprocessing businesses of between 15% and 20% in 2012. This is faster than market growth as measured by sales of monoclonal antibody based products, which is increasing in the high single digits, Repligen is benefitting from demand arising from the tremendous increase in the number of clinical trials that are being done for monoclonal antibodies. That is driving the protein A sales at a faster rate than the end market commercial sales.

The company has recently provided guidance that it can achieve $16 to $18 million of pretax income in 2013, if bioprocessing sales grow at 10%. This is slower than the 15% to 20% expected for 2012, which was aided by the Novozymes acquisition. Management has indicated that it expects organic growth of the bioprocessing business to be on the order of 10% to 15%.

Repligen expects to take a restructuring charge of $350,000 in 4Q, 2012 associated with a reduction in R& D headcount that was working in drug development. This could reduce R&D expenditures by 50% from the $10 million that is expected to be spent in 2012. Management has indicated that it expects R&D expenditures to grow in line with or slightly faster than sales growth. It notes, however, that some part of R&D is associated with revenue creating contracts resulting from collaborations in addition to that for new product development. In these cases, the R&D expenses give rise to roughly offsetting revenues. This has the effect of increasing sales, reducing gross margins and having no effect on operating income. To the extent, they have a number of such contracts; R&D might trend faster than sales.

Improved manufacturing efficiencies and increased revenues are expected to expand gross margins in 2013. The gross margin could reach 50% in 2013 and could eventually rise to 55%. It also expects that S, G & A growth will be somewhat slower than sales growth going forward. At the end of 2013, the Orencia royalty will expire. This will eliminate roughly $16 million of pretax income. By my projections, this will cause pretax income to drop from $17 million in 2013 to $6 million in 2014.

The company has a net operating loss carry-forward and other tax credits of over $60 million which suggests that it will not be paying US taxes until sometime in 2016 by my projections. The tax liability for 2012 is expected to be $300,000 due to profits earned in the new Swedish subsidiary for which the US tax credits cannot be. I am estimating that the tax rate will be minimal through 2016 and that the tax credits run out in about mid-year 2017. My tax rate estimate for 2016 is about 23% and 35% in subsequent years.

The company is a strong generator of cash. It expects to expand its Waltham manufacturing facility in 2013, with approximately $5 million to $6 million in capital improvements to prepare for anticipated increases in demand in 2014 and beyond. The year-end cash position could reach $31 million for 2012 and $45 million for yearend 2013. The company also believes that it can receive perhaps $20 million or more from the sale of its drug development assets. My projections indicate that this could result in having $71 million of cash on its balance sheet by yearend 2013.

Tagged as Repligen + Categorized as Company Reports