Kite Pharma: Analysis of Six Month Data from ZUMA-1 That Led to 40% Price Increase (KITE, Neutral, $72.53)

Report Preface

In the event that you are unfamiliar with acronyms used widely in this report such as CAR-T, DLBCL, TFL, ORR, CR etc. I would suggest that before going further that you click on this link for definitions. I often put what I consider to be key points, the investment opinion and target price at the beginning of a report to spare impatient readers the necessity of wading through an entire report. However, in this case I have decided to put them at the end of the report. I just don’t feel like I can distill some of the issues in bullet points.

Stock Zooms on Release of Interim Data from ZUMA-1

Wall Street overwhelmingly endorsed the release of six month interim data from the ZUMA-1 trial of KITE’s new CAR-T therapy Axi-Cel (axicabtagene ciloleucel). On February 27, the day before the announcement, the stock closed at $56.83 and then soared to a close of $79.62 on March 3. The Company announced and equity offering of 4.75 million shares on March 2 which was priced at $75.00 to net gross proceeds of $356 million ($410 if the Green shoe is exercised). The stock has eased slightly since to $72.53.

This dramatic move and subsequent substantial equity offering reflects the current consensus belief that the engineered autologous T-cell technology, the first generation of which is CAR-T, is a paradigm changing technology that has the potential to be a major driver of biotechnology industry revenues for the next several decades. Optimists compare its potential to the enormous impact on the biotechnology industry of monoclonal antibodies. As a first mover in the space, some see KITE as having the potential to be to eACT what Genentech was to monoclonal antibodies.

As a counter argument, I would point out that it may take decades if eAct is to emerge to have monoclonal antibody impact on the industry. Monoclonal antibodies are now the engine of growth for biopharma, but this has taken over 30 years. There are lots of technological bumps in the road for eACT; it is early days. Also, numerous competitors have emerged and competition is fierce in the eACT space. Being a first mover and enormously well financed is very powerful for KITE, but it doesn’t mean that it can’t be eclipsed by technology advances of other companies. Genentech was not the first monoclonal antibody company.

Overview of ZUMA-1 Trial Design

Let’s start by reviewing the design of the ZUMA-1 trial. It has enrolled two cohorts of patients with aggressive forms of non-Hodgkin’s lymphoma. The first cohort of 71patients is made up of DLBCL types and the second cohort of 41 is made up of TFL and PMBCL patients. It is a small phase 2, open label trial (no placebo group). The endpoints of the trial measure tumor shrinkage (ORR, CR and PR). Because of the short life expectancy of patients, mOS should also be determinable, perhaps by the end of the year. This type of trial design is usually undertaken to gain information to plan for a phase 3 trial that would be randomized, significantly larger and would use mOS as an endpoint.

Seldom is this type of trial design sufficient to gain regulatory approval. However, patients enrolled are desperately ill and have very short survival expectations. They are refractory to chemotherapy or have relapsed after hematopoietic stem cell transplants. Historical data suggests that mOS is about 6.9 months with currently available chemotherapy treatments. Because of this, Kite argues that the FDA will not require an additional, larger, more definitive phase 3 trial if there is strong (not necessarily definitive) evidence of efficacy. I agree. The checkpoint inhibitors Opdivo and Keytruda as well as other cancer drugs have been approved for some refractory cancers on the basis of similar trial designs.

A Close Look at Interim Data for ZUMA-1

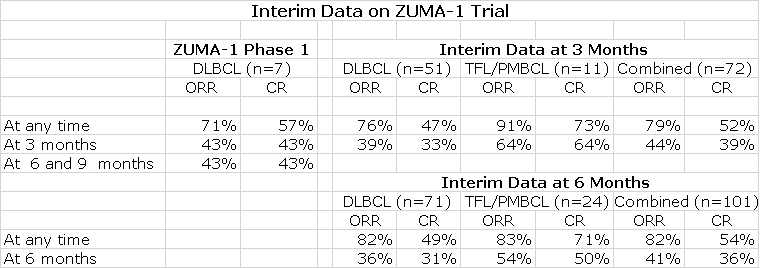

Kite has made two releases on interim data. The first was on September 26, 2016 and presented three month data and also results from seven patients treated as the phase 1 led in to the 102 patient phase 2 segment. The second release on February 28, 2017 showed six month data. Here is how the data was presented by KITE.

At the interim look at three months, the CR for 51 DLBCL patients was 33% (17 patients). It also shows that 47% (24 patients) had at one point experienced a CR indicating that the CR was not maintained at three months for some patients.

The interim look at six month data was presented for 71 patients and showed that 31% (22 patients) had a CR at six months while 49% (35 patients) had experienced a CR at some point. You can see that the CR rate for 24 patients in the TFL/ PMBCL cohort of 50% was much better than the 31% for the DLBCL cohort. These patients fare better than DLBCL patients.

This data base is subject to changes in the CR rate as the data matures. In its latest conference call, KITE added some additional and important information that has the potential to change the six month data:

- Four patients in the DLBCL cohort continue to experience highly durable PRs at month six with minimum abnormalities in PET scans. One of these PRs converted to a CR at month nine. The Company suggests that these patients should be viewed as having a clinically relevant response at month six. If we add these four PR patients to the 22 CRs, the percentage of clinically meaningful responses would be 37% which is better than the CR rate of 31%. In earlier CAR-T trials done at NCI, some PRs have been durable for as long as five years.

- Four of the 101 patients had an ongoing CR at three months, but have not had a tumor assessment at six months. They currently are currently not categorized as CRs, but there is the potential that their CRs will be shown to persist at month six. Management didn’t specify as to how many of these were DLBCL patients. In the event that all four patients maintain their CRs and are DLBCL patients, the clinically relevant response rate for DLBCL could be 42%.

- On the other hand, there is no data to indicate whether CRs may be lost after six months. Management maintains that CRs that occur at six months will be durable and maintained at nine months and beyond. They point to results in studies done t NCI, but the NCI hasn’t presented any comprehensive data on this.

I Have a Concern about the Presentation of the Data

At this point, I want to make another point that is important to me. KITE failed to show what happened to the 17 of 51 patients who experienced a CR at three months. Did they all maintain the CR at six months or did some relapse. When asked about this, KITE did not provide an answer. If a meaningful number did relapse, this could be a concern.

One way of looking at this issue is that there were 20 more patients reported on at six months than at three months and there were five more CRs. Hence, the CR rate for these incremental patients was 25%.Throughout my research on Kite, I have found several situations in which Kite, as is this case, was not transparent about its data and appeared to be making an effort to present the data in the best possible light. This may not be important in the long run, but as an analyst, this disturbs me. I look forward to all of the data that will be presented at ASCO to more fully allow investors to assess what is going on with the CR rate over time.

The Catalyst for the Price Movement

Once again, I would point out that this trial enrolled patients who were desperately ill having failed chemotherapy options or having relapsed after a stem cell transplant; their life expectancies were short. The catalyst that caused the dramatic 50% price movement was specifically due to the CR rate in the DLBCL cohort of ZUMA-1 remaining at roughly one-third of patients treated at six months as was the case at three months. Specifically, the percentage was 33% (17 patients) for DLBCL at three months and 31% (22 patients) for DLBCL at six months.

These are pretty small numbers of patients on which to be making investment decisions. However, there is a total buy-in from the investment community that this is convincing evidence of durability in CR that will translate into an impressive survival advantage. Historical results from the SCHOLAR-1 meta-analysis suggest that current standard of care results in an 8% CR rate at six months and median overall survival of 6.6 months. The median follow-up for ZUMA-1 is 8.7 months and median overall survival has not been reached which is suggestive that OS will be substantially better than 6.6 months.

Additional Data to Come from ZUMA-1 Will Be Critical

The key question that everyone now is asking is just what will be median overall survival? Kite is adamant that CRs are very durable so that if a CR is obtained at six months it will persist through nine months and much longer. They then further predict that this will be a harbinger of increased survival. Experience with NCI trials of CAR-T products have supported the hypothesis that the CRs seen with Axi-Cel will lead to meaningful increases in survival over current standard of care. This is most likely to be the case, but there have been trials with other oncology drugs in which objective responses have not translated into meaningful increases in survival.

Because of the very high cost of CAR-T therapy and severe side effects associated with it that will be expensive to treat, payors will demand evidence of a meaningful improvement in median overall survival. There is a general rule of thumb that a 4.5 month increase in median overall survival for a cancer therapy is a significant advance so I think that Axi-Cel will need to show a meaningful median overall survival increase over the 6.6 months of standard of care. At a minimum, it should be about 11 months and possibly much longer. My guess is that it will surpass this 11 month mark. In any event, this will certainly be the next major data hurdle for the clinical data.

FDA Decision Regarding Approval of Axi-Cel

So what will go into the FDA decision on whether to approve Axi-Cel based on this data? In interpreting results from ZUMA-1, I believe the agency will focus primarily on the DLBCL cohort. The annual incidence of DLBCL is about 22,000 patients. Chemotherapy regimens (principally R-CHOP) are curative in about 60% of patients which indicates that Axi-Cel initially will target the approximate 8,800 DLBCL patients who don’t respond to R-CHOP. The estimates that I have seen suggest that the annual incidence of PMBCL that Axi-Cel can address is 670 patients and the comparable number for TFL is 540. Hence, the combined addressable market is about 10,000 patients and 88% are DLBCL patients. For these reasons, I think that the FDA will put great emphasis on data from the 71 patients DLBCL cohort rather than the combined results for 102 patients.

KITE will begin the submission of a rolling NDA by the end of the first quarter of 2017 and is suggesting that the FDA will approve the product by late 2017 or early 2018. By that time, the median follow-up time from enrollment should be 16 or more months. We will either know the median overall survival at that time or will know that median overall survival has not been reached at 16 months. This mOS data point will be very critical to assessing the role of Axi-Cel in the treatment of DLBCL and gaining approval from FDA and reimbursement from payors.

Based on ZUMA-1, it seems that Axi-Cel produces a durable CR in perhaps 30% of patients at six months or as I discussed earlier could improve to as much as 42% in an absolute best case. Proponents of Kite believe that once a CR is achieved at this time interval, it will be durable for a much longer time frame. This takes a certain leap of faith with the current data, but is probably correct. As with bulls on the stock, I think that the product could be approved late this year or early next.

The Commercial Launch Will Likely Be Difficult and Slow in 2018 and Perhaps Longer

I think that Axi-Cel faces commercial challenges which are being glossed over by the Company and investors. Kite estimates that the price of Axi-Cell for the single infusion of cells that constitutes treatment could be on the order of $300,000 to $500,000. This was based on looking at prices for drugs used in somewhat comparable cancer indications and also stem cell transplants which can cost $1 million. However, the cost of using Axi-Cel does not just end with the infusion of cells. In addition, there is; (1) the cost of chemotherapy that is necessary to ablate the patient’s T-cell population prior to infusion, (2) treatment of serious side effects from both the chemotherapy and cell infusion and (3) possibly hospitalization to treat the side effects. Note that in the ZUMA-1 trial all patients were hospitalized. The all in cost could be $500,000 per patient treated or possibly more.

It appears that roughly one in three patients treated will experience a meaningful benefit. At this point in time, there is no way of predicting beforehand who will benefit prior to cell infusion. It is also important to understand that there is just one infusion of Axi-Cel unlike most cancer drugs that are given in a series of treatments. In the latter case, if the drug isn’t working, it possibly can be discontinued defraying the full cost of therapy. Everyone treated with Axi-Cel will bear roughly the same cost.

This means that if all comers are treated, managed care would be paying perhaps $1.67 million per effective outcome. (Ten patients treated multiplied by $500,000 and then divided by three patients benefitted). This probably isn’t going to happen and Kite and other CAR-T companies must make concessions to address this issue. One way of doing this would to price the product on an outcomes basis. Let me make up an illustrative example.

Perhaps Kite would contract with the managed care company that if the patient experienced a clinically meaningful outcome, Kite would be fully reimbursed. This might be defined as durability of a CR at some time point, say six or nine months. For those that did not reach that endpoint Kite would refund all or part of the price of Axi-Cel therapy. This has serious complications for the commercial potential of Axi-Cel. I estimate that the DLBCL patient population addressed by Kite is about 8,800. However, if Kite is only paid for treatment successes, the actual addressable market is a much smaller 2,900 patients. Moreover, the manufacturing cost of Kite would be based on making cells for all patients treated, not just those who benefit.

Is KITE the First Mover in the CAR-T Space? Competition from Novartis and Juno

The overwhelming investor attention in the CAR-T space has been on KITE and JUNO. The problems that JUNO had with JCAR-015 caused it to abandon that program and focus on JCAR-015. As a result, they are two years behind KITE. Management and investors seem to be ignoring any threat from Novartis. However, at the last ASH meeting, in a poster presentation, Novartis showed for the first time that CTL-019 (its CAR-T cell product) can be effectively manufactured in a single centralized facility serving patients across four different continents (North America, Europe, Asia and Australia) at 25 clinical sites. The manufacturing failure rate of 6% was reasonable. In addition, another presentation showed that the 82% CR rate seen in the phase 2 r/r pediatric ALL trial confirms the 90% previously reported in the single-center, phase 1/2 trials at the University of Pennsylvania. Novartis believes that it, not KITE, is the first mover the CAR-T space. Management has said that it will be first to provide regulators with global, phase 2 data in 1Q, 2017 in r/r ALL. I assume that this will be the basis of its initial BLA filing.

Novartis has not provided much information on its JULIET phase 2 trial of CTL-019 in r/r DLBCL and how its structure and timelines compare to ZUMA-1.ZUMA-1 enrolled 102 patients of whom 71 were DLBCL patients with the remaining being TFL and r/r PMBCL patients. JULIET is scheduled to enroll 160 patients, but I am not sure how many of these are DLBCL patients and how many are TFL or PMBCL patients. JULIET started about five months after ZUMA-1 which suggests KITE may have only a small lead over Novartis.

KITE’s Pipeline

KITE has a long list of CD19 CAR-T trials that are ongoing. The WAVE-1 studies include a phase 2 mantle cell lymphoma study, as well as two phase 2 ALL studies, one in adults and one in children. All of those studies are ongoing and KITE projects previously indicated, data release sometime in 2018. In addition, there are is a combination study with the checkpoint inhibitor atezolizumab and Axi-Cel that is enrolling briskly with data expected sometime in 2017. They will also be initiating a phase 2 in follicular lymphoma which we will be initiating in the first half of 2017 and in the second half of 2017will be initiating an earlier line DLBCL study. I would guess that Novartis is doing the same.

Investment Thesis

I was amazed at the 50% move in the stock following the release of six month interim data. Had I known the results beforehand, I would have estimated that the stock might trade up 10% or so. The data is suggestive of an increase in survival for perhaps one-third of DLBCL patients treated as 23 out of 71 patients had undetectable tumors at six months post treatment. However there is actually no data yet on median overall survival. I would have thought that the market would be more cautious because of the small numbers of patients and the still undetermined effect on survival. Let me hasten to add that I think that the data is encouraging. However, I was frankly amazed at the 40% move in the stock and even more amazed that the Company was able to do a huge stock offering after the move.

Wall Street has totally bought in to the Kite story and the stock is priced for perfection. Importantly, I don’t think that the stock price factors in the commercial challenges that Kite faces. By now, everyone knows that managed care poses great initial barriers to uptake of new drugs until it can determine the cost effectiveness of the therapy and more importantly, incorporate that cost into its premium structure; this process can take a year or more. As a result, it has become axiomatic that sales in the first year or two are severely constrained by managed care. The fact that we are dealing with a drug that may save lives of patients without therapeutic options may alleviate this, but won’t prevent it. As a result, I think that sales will be modest in 2018 and perhaps beyond if Axi-Cel comes to market in 2018.

I also think that Wall Street has anointed Kite as the first mover in the CAR-T space, but this completely ignores the position of Novartis. Novartis has been quiet on development status of its CAR-T product. However, it appears that it could file a BLA for pediatric ALL in 1Q, 2017 and that this could result in the first approval for a CAR-T product. Relative to an indication in DLBCL, Novartis began the Juliet trial that is comparable to ZUMA-1 about five months later. Will the FDA consider the BLA for Novartis’ CAR-T products in pediatric ALL and DLBCL and Kite’s in DLBCL separately? Given the importance of CAR-T therapy and its side effect concerns, it may want to look at all of the data from both companies and approve the products for DLBCL at the same time. It could approve CTL-019 for ALL earlier. In this case, Kite and Novartis would come to market at the same time creating a pitched battle in a modest sized market place.

I have consistently underestimated the fervor of the market for CAR-T therapy and KITE. However, it just seems to me that at this price the difficult commercialization process and the competitive environment just are not properly factored in. I think that as is always the case that investors will become more aware as time progresses of these serious issues for the stock and this will cause it to underperform the market.

I think the next major catalysts will be information on mOS for Axi-Cel that may be available later this year and potentially approval late in 2017 or 2018. Between then and now, I think the stock will underperform. I think that data on mOS will be encouraging and lead to approval on the late 2017 timeline that KITE guides to. However, this outcome is not a slam dunk I think that there is some chance (probably small) that the mOS data could be disappointing. This would produce a sharp price break.

Looking longer term, Kite must be looked at as one of the two most dominant companies in the CAR-T space along with Novartis. I place Juno as third. Kite has raised a staggering $1 billion dollars since going public in 2014 and this allowed it to spend aggressively on research, clinical trials and building infrastructure. KITE is guiding to spending a staggering $490 to $515 million on operating expenses in 2017. It ended 2016 with $454 million of cash and received a $50 million payment from a partner early in 2017. With the roughly $380 net proceeds from the just completed offering, KITE guides that it has enough cash to last through 1H, 2018. This is before any potential payments from partners. Very few emerging biotechnology companies have the luxury of being showered with this much cash and if they spend wisely they could emerge as the Genentech of the eACT space. To me, this is what the current stock price is assuming.

The immediate research opportunity for Kite, Novartis and Juno is to conduct clinical trials in other lymphomas that meaningful express CD-19 such as MCL and FL. There may also be the opportunity to move into earlier stages of DLBCL, FL and other lymphomas if side effects can be managed- a big if. There are formidable challenges in moving eACT into solid tumors which are likely to take some years to overcome. I am confident that they will be overcome, but while Kite is in a dominant position, that is no guarantee that it will be the Company to solve these challenges.

To summarize my position, I think that Axi-Cell will likely be approved in late 2017 or early 2018. I do not think that the current stock price factors in the difficulties in commercialization that will arise or the potential that it Novartis CAR-T product will come to market at the same time or shortly thereafter. These are primary drivers of my view that the stock will underperform the market in the coming months. I recognize that the long term potential could be great and as I previously mentioned that KITE could be to eACT what Genentech was to monoclonal antibodies if bullish expectations on use of eACTs in other types of CD-19 expressing lymphomas and in earlier stage disease are realized. Also, if eACT can be expanded to solid tumors. Still, I don’t want to own the stock at this price at this time. Expectations are just too high.

Tagged as Axi-Cel, CAR-T Therapy, KITE, Kite Pharma + Categorized as Company Reports, LinkedIn

What is the “r/r” that preceeds the disease designation DLBCL” as used in your report? My wife has recently been diagnosed with this malady (without the r/r) and is recieving an SOC treatment called “R-CHOP” that is said to have a 60% cure rate. So far she is doing well.

Are there clinical studies that are accepting volunteers, in case she should need more treatment after

she completes the SOC protocol?

Don’t mean to burden you with a personal problem – just a request for information.

Regards, Bob Roig

r/r stand for relapsed refractory. Relapse means that the patient has experienced a relapse of the cancer after chemotherapy. They are then given other courses of chemotherapy and if they don’t respond they are refractory. Your wife is in neither category. It sounds like she is responding to R-CHOP which cures (not just temporarily controls the cancer) in 60% of cases. All my best wished that your wife will be cured.