Cryoport: Reiterating My Buy Recommendation (CYRX, Buy, $14.20)

Investment Perspective

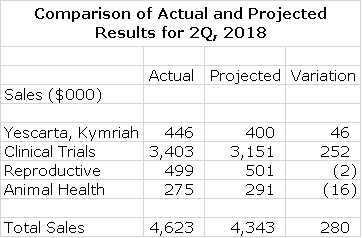

On May 16, 2018, I published a report entitled Updated Sales and Earnings Model. The purpose of that report was to build a detailed sales model for the Company that for the first time incorporated Cryoport revenues arising from the sale of commercial products-the CAR-T drugs Kymriah and Yescarta. You may want to review that report before going on. The support of commercial products has much greater revenue potential for Cryoport than products in clinical trials. Cryoport just reported second quarter results which were encouragingly close to my projections as is shown in the next table. Based on these results, I am slightly increasing my full year 2018 sales projection from $18,497,000 to $19,278,000.

I have had a chance to review the reports of Wall Street analysts following the Company and second quarter results generally matched or slightly exceeded their sales expectations. The stock has been weak since the results were announced, but this doesn't appear to be attributable to some kind of fundamental disappointment. It is my hypothesis based on extensive experience that hedge funds routinely manipulate the stock prices of small companies. I have seen this many times before that the stock price behavior of Cryoportand other small companies in the short term does not correlate with the current performance and future prospects of the Company.

Results are tracking so closely with my expectations at this point that I really don’t have any new thoughts on the stock. I remain highly enthusiastic. By my analysis, Cryoport and its stock are coiled like a spring for future strong performance. I see this stock as having enormous potential and I envision holding this stock for the next five years (or more).

The next two sections taken from earlier reports may help you to understand my enthusiasm for Cryoport.

Macro-Economic Forces Provide Powerful Tailwinds

The emergence of pharmaceutical products based on using living cells (Cryoport refers to these as regenerative therapies) has spurred the growth of a new area of cold chain logistics. These therapies must be suspended at temperatures below minus 150° Celsius (minus 238° Fahrenheit) and maintained at that temperature as they are transported on a global basis between clinical and manufacturing sites, a process that can take several days. Examples of biological specimens that require continuous cryogenic temperatures throughout transportation to prevent degradation and loss of efficacy include:

- Pharmaceutical products based on live cells such as CAR-T and other genetically engineered T-cells, gene therapy products, cancer vaccines, and others,

- Stem cells.

- Other types of vaccines,

- Eggs, semen and embryos used for in vitro fertilization,

- Biological specimens used for diagnostic purposes e.g. determining PD-L1 expression in tumor cells, and

- Infectious agents such as viruses (Ebola, HIV).

This presents both a technological challenge to create storage devices for shipping and then the logistical expertise to assure that the product being shipped does not change because of a temperature deviation between the time it is picked up and delivered. Cryoport has achieved a leadership position in this area. The Company was initially formed to develop novel cryogenic shipping containers (dewars) and then evolved into creating a sophisticated and comprehensive logistics solution for their transportation about five years ago.

Logistical handling is an integral part of the clinical process needed to gain regulatory approval of regenerative therapies and is equally critical to maintain integrity of products after they are commercialized. Regulatory agencies will require data that shows that shipping of the product does not alter the characteristics of the product. This requires thorough documentation of what happens during the chain of custody and chain of condition. A temperature deviation can affect the efficacy of the products that are being shipped, which could therefore change the dynamics of a clinical trial or affect patient outcomes.

The logistics methods used will be an integral part of the Biologic License Application (BLA). This is very important because once this is established, if the Company sponsor were to try to decide to change its logistics system, regulatory agencies require evidence that the alternative way of shipping meets all of the data endpoints that Cryoport provides and thus doesn’t alter the therapy’s characteristics. This requires extensive work and possibly additional studies. Because of this, once Cryoport solutions are successfully incorporated into the clinical trial process, it will likely continue to be used as products go commercial and through the life cycle of the product with minimal chance of losing the business to a competitor or an in-house solution.

Similarity to Repligen

One of the best investment ideas that I have had since starting SmithOnStocks was the recommendation of Repligen in an initiation report on December 4, 2012. What excited me about Repligen was a business model that I have described as among the best that I have encountered. The macro force driving its business is the development of monoclonal antibodies which is currently the major driver of the biopharma industry in terms of both current sales and research focus.

Companies developing monoclonal antibodies are in a high-risk game in which perhaps 90% or even more products that enter into development will not be commercial successes or may not even be approved. However, Repligen found a way to capitalize on this huge industry effort that is reminiscent of the 1849 California gold rush. Many prospectors panned for gold, but only a few were successful. However, the merchants who sold shovels and pans and other supplies profited from those who failed as well as those who succeeded.

Repligen is essentially selling shovels and pans to the monoclonal gold rushers. Its products are used to improve the manufacturing quality and productivity of monoclonal antibodies and it has pioneered the use of disposable products. Repligen products are used by a very large percentage of these drug developers. In addition to its innovativeness, the appealing aspect of Repligen is the stickiness of its business. In manufacturing of proteins, any change in the manufacturing process can change the characteristics of the product. Consequently, once Repligen’s products are incorporated in the manufacturing process during clinical trials, they are likely to be maintained through the approval and life of the product.

Needless to say, I have been looking for a business model like that of Repligen and I think I have found it in Cryoport. The similarities are striking. The macro-force that Cryoport is riding is regenerative therapies which are based on the use of living cells and tissues to treat disease. Some believe that this represents a major step forward for drug development because it addresses the causes of disease rather than symptoms. It promises to be a driver of the biopharma industry that could over decades reach the same scale as monoclonal antibodies. Cryoport is beautifully positioned to be a major beneficiary of this mega-trend.

Tagged as Cryoport, Cryoport Second Quarter Results + Categorized as Company Reports, LinkedIn

I thought the earnings report was very positive but there is one point that made me concerned. That point is Cryoport’s commercial revenue. In Q1, Cryoport had revenue from commercial products of $318,000 which is roughly .61% of the $52m in combined revenue from the Novartis and Gilead/Kite products. In Q2, Cryoport reported $446,000 in revenue derived from those same two products or .53%. The incremental revenue was $128k on $32m or .40%.

If the 40 basis point number of what we can expect once we get to scale then, then to earn the $8m – $10m in revenue the company has projected for each of Yescarta and Kymriah, those drugs would have to generate $2-2.5b in revenue. That’s quite plausible for the drugs but that does seem to be rather optimistic for each indication for those drugs.

Looking at the math a little differently, Cryoport will earn $100m in annual revenue for commercial products when those products collectively approach $25b in revenue.

Personally, I’m a little disappointed by these numbers. Of course, we don’t know the contract terms involved, and I probably am jumping to conclusions, but generally speaking, one could expect that unit prices would decrease as volume increases. Now, I doubt that pricing has dropped by a third on the relatively low volumes we’ve seen so far. Rather, the numbers would seem to indicate that Cryoport has some sort of fixed price at the client or individual drug level (Say $50k/quarter) that of course would become less and less significant as volume increases.

That’s just one guess. There could be issues with the timing of revenue recognition for example.

Still, for the first time, I’ve become a little concerned about the Cryoport’s upside potential.