Cryoport: Updated Sales and Earnings Model (CYRX, Buy, $9.69)

Purpose of this Report

With the commercial launches of the CAR-T products Kymriah and Yescarta, I am expecting a significant upward inflection in sales for Cryoport. The primary objective of this report is to formulate an improved sales and earnings model in order to show this. First quarter results from Cryoport, Novartis and Gilead have provided new information which allows me to more accurately project sales using the methodology in this report.

In numerous prior reports, I have written extensively on the Cryoport business model and why I think that it is one of the most promising that I have seen as an analyst. Hence, I am not going to repeat my reasoning other than to touch lightly on it.

Why I Love the Cryoport Business Model

Cryoport has developed a highly dependable solution for shipping cryogenically preserved live cells. We are in the early dawn of the age of cell based therapies which include gene therapy, gene editing, cancer vaccines and CAR-T cells (actually this is just a sub-set of gene therapy). These are sometimes referred to collectively as regenerative medicine. Most of these products require shipping of cryogenically preserved live cells.

The first two successful applications of gene therapy have been the CAR-T products Kymriah and Yescarta. The next major product to be approved may be another CAR-T product from a collaboration of Celgene and bluebird bio-also supported by Cryoport. There are some 30 or so other companies developing CAR-T therapies and almost all have chosen Cryoport to support their clinical trials.

These examples show that Cryoport’s shipping solution is the one of choice for industry leaders and most other companies in the CAR-T space and indeed in all aspects of regenerative medicine. I believe that there really are no viable competitors to Cryoport at this time other than in-house solutions. That companies with enormous resources have chosen Cryoport over an in-house solution speaks volumes.

It is also important to understand an absolutely critical aspect of the Cryoport business model and that is the extremely long life cycle that its products and services will have. If Cryoport logistics are used in the clinical development stage of a product, they become part of the BLA filing in the Chemistry, Manufacturing & Controls (CMC) section. The FDA requires that manufacturing and quality assurance processes used in clinical development be the same when the product is commercialized because it is possible that a change in the logistics in the case of cryopreserved cells could lead to a change in the product characteristics. Importantly, if a company were to decide that it wanted to change the logistics technology, it would have to demonstrate to the FDA’s satisfaction that the change did not alter product characteristics. This could very well require clinical trial data. The same holds true once a product is commercialized. This gives rise to the most critical aspect of the business model as I see it. Once Cryoport logistic solutions are used in clinical development that leads to a BLA filing it is close to a certainty that it will be used throughout the commercial life of a product. This results in a long, secure predictable life cycle.

Another highly positive aspect is that Cryoport is not tied to binary clinical outcomes on any single product, but rather to the success of the whole field, be it CAR-T or some other product stemming from regenerative medicine. In point of fact, CAR-T applications are only a small part of potential product development opportunities in regenerative medicine. There are now many companies executing hundreds or perhaps thousands of clinical trials in regenerative medicine, of which some (history suggests around 10%) will become approved products. This makes for an extremely large pipeline of products for Cryoport to support.

For those of you who want more details on the Company I recommend that you read my initiation report of April 12, 2017 Cryoport: Initiating Coverage of this Highly Unique Health Care Company with a Buy (CYRX, Buy, $2.25). You might also want to read a report that I wrote on July 19, 2017 entitled My Approach to Investing in CAR-T Drug Development.

Price Target

One of the big pushbacks I get from subscribers who haven’t yet bought the stock is just too expensive citing my projected revenues for 2018 of $18 million and net loss of $7 million when viewed against a $230 million market cap. I won’t try to offer some valuation model that justifies the price other than to say that the market valuation to sales ratio for 2018 is 13. In my world of emerging growth companies who have not yet achieved profitability, this is not an unusually high ratio.

In justifying my buy recommendation, I am going to rely heavily on my investment experience that has repeatedly taught me that stocks of great companies in all industries at almost all times always seem too expensive. However, if you recognize a great business model like Cryoport in the early stages of its development and hold for the long term (several years), the rewards almost always are great. Shut your eyes, hold your breath and click Buy on your internet brokerage account.

Building a Sales and Earnings Model for Cryoport

I spent a lot of time pondering how to formulate an informative sales and earnings model for Cryoport. There is a significant problem in doing this because there are likely to be numerous new indications for Kymriah and Yescarta and probably new product approvals as Cryoport is supporting five or more products that may file BLAs and gain approval in the next three years. It is extremely difficult to project which are likely to be approved and the timing of approval. I think that there will be substantial contributions over the 2018 to 2020 time frame, but it is just utter guesswork to include these in my sales projections.

This caused me to take a different approach. I constructed a sales and earnings forecast based only on sales projections for Kymriah and Yescarta based on their two approved indications and included no estimate for sales of several other indications for which they are likely to gain approval in the next three years. Likewise, I did not include any sales projections stemming from the approval of any other supported product.

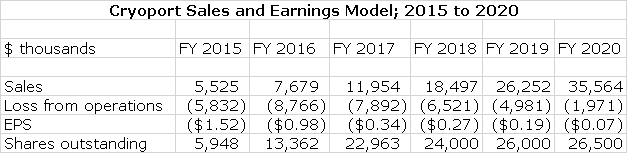

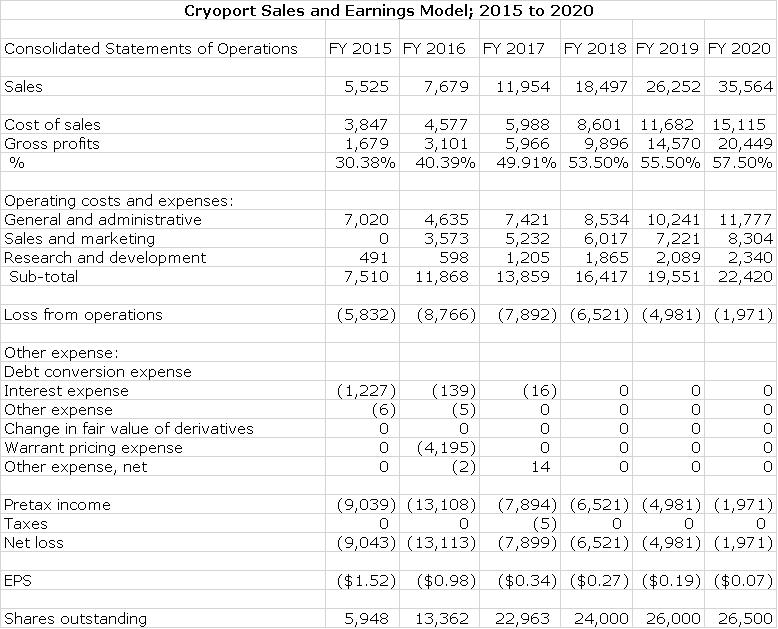

The sales and earnings model I come up with in this report does not reflect what I think actual results could be. What it tells us is that this is the potential of the Company based on existing approvals. There are likely be significant upward adjustments as Kymriah and Yescarta are approved for new indications and other products are approved. So what does my model show? It suggests that as the Company now stands, sales could nearly triple from $12 million in 2017 to $36 million in 2020 and the Company could be approaching profitability in 2020.

I note that other analysts following Cryoport have sales estimates of over $50 million in 2020. Honestly, I would not be surprised if this happened. However, I think it is more prudent to start with the base case as presented in the following table and then adjust upward as new approvals arise. I believe that this presents a more meaningful way to look at Cryoport and its growth prospects.

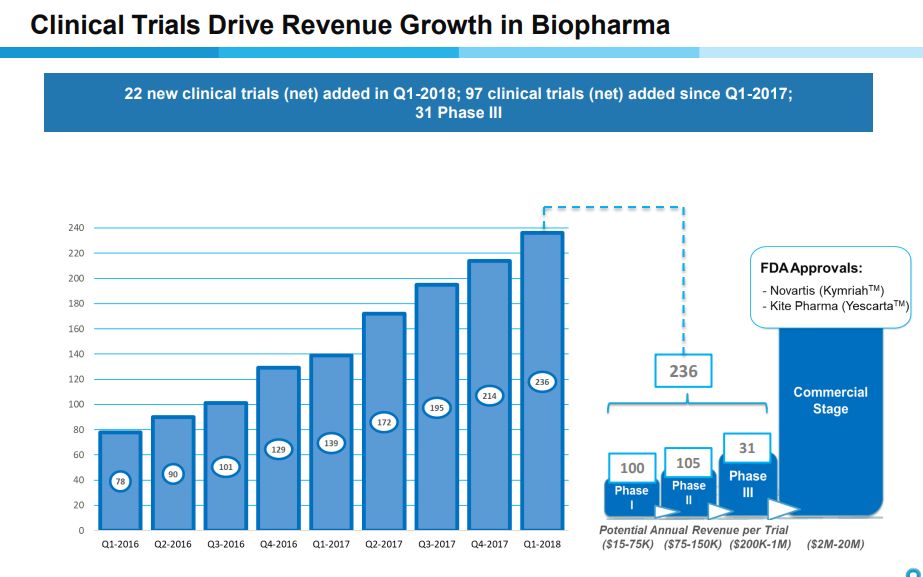

Phenomenal Growth in Number of Clinical Trials Supported

Cryoport for some time has provided a table as shown below that shows the number of clinical trials that it is supporting by their stage of development- phase 1, phase 2, phase 3 and approved products. It then estimates the range of annual revenues that it might realize from each trial. It also shows the growth in all types of clinical trials over the last nine quarters. The growth has been extraordinary as the number of clinical trials supported has increased from 78 in 4Q, 2016 to 236 in 1Q, 2018. Beginning in 4Q, 2017 Cryoport for the first time reported sales from the commercial launches of Kymriah and Yescarta.

Click to enlarge

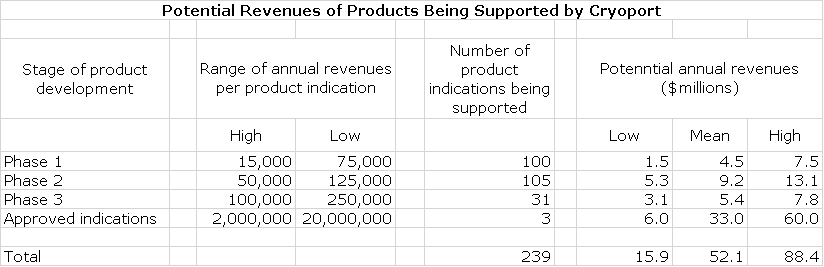

Potential Sales Stemming from Products in Clinical Trials Being Supported by Cryoport

Cryoport in the above table provides guidance on potential revenues it might realize from support of product indications in phase 1, 2 and 3 and then when the products are approved. Note that one product can have several indications, each of which constitutes a clinical trial. The revenue potential increases as the product indication advances later into clinical trials and jumps enormously upon approval. The Company also breaks out the number of clinical trials by phase of development. I have multiplied these numbers to provide a sense of the revenue potential of the Cryoport portfolio at this point in time.

The above table gives some sense of the potential of the portfolio based on what is a snapshot in time of a dynamic process. This will change substantially as new products are added, some products advance through to approval and other products fail. Please note that one product can be studied in several indications so that the number of products being supported is less than the number of clinical trials. For example, there are now 3 approved product indications for only two products. Kymriah is approved for r/r pediatric ALL and for r/r DLBCL while Yescarta is approved only for r/r DLBCL. There is a lot of good information in this table, but it is a little hard to use to build a sales model just from this table and prior to first quarter results this was all we had to work with.

New Information Arising from 1Q Financial Report Provide Some Useful New Metrics for Projecting Sales

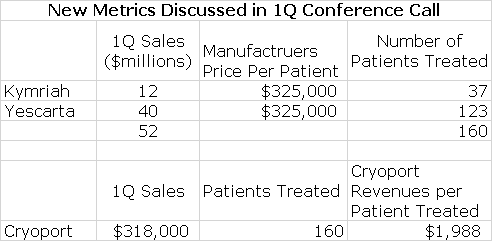

During the 1Q conference calls, new information was presented that aids significantly in sales modeling. Novartis revealed that it had recorded sales of $12 million for the r/r pediatric ALL indication; it was only recently approved for r/r DLBCL and this indication made no sales contribution in 1Q, 2018. Gilead revealed that Yescarta had achieved $40 million in sales in the r/r DLBCL indication. Cryoport also reported that support of the commercial launches resulted in $318,000 of revenues.

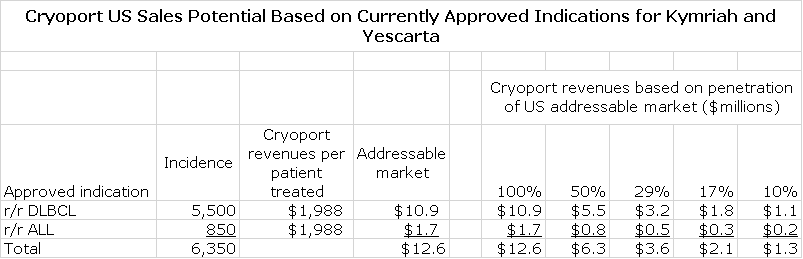

Kymriah was first to the market and was originally priced at $475,000 per patient for r/r ALL. Yescarta then entered the market priced at $375,000 per patient. My sources suggest that after discounts and rebates the realized price for both products now is about $325,000. From this information, as shown in the following table, we can estimate that Kymriah was used to treat 37 patients and Yescarta 123. We can then calculate that Cryoport realized about $1,988 per patient treated; this is the first time I have been able to estimate this and it greatly aids in sales forecasting. I would caution that because of the small number of patients treated that this number could change meaningfully in the future.

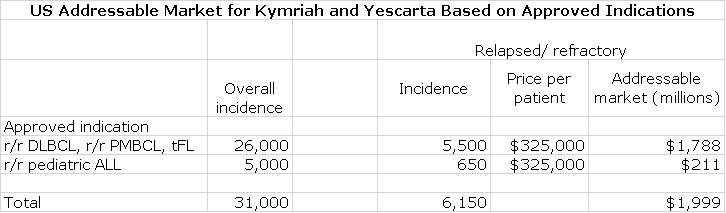

US Addressable Market for Approved Indications of Kymriah and Yescarta

Both Yescarta and Kymriah are approved for r/r DLBCL, r/r PMBCL and transformed FL. Kymriah also is approved for r/r acute lymphocytic leukemia. The following table shows my estimates of the overall incidence of these hematological cancers and the estimated number of relapsed/refractory patients. By multiplying by the number of eligible patients by the estimated net price of $325,000, I calculate that the US addressable market for r/r DLBCL, r/r PMBCL and tFL is $1.8 billion and for pediatric r/r ALL is $211 million. As a rule of thumb, European sales potential is roughly the same as the US.

Not all patients eligible for treatment will be treated so I have calculated the Cryoport sales potential for market penetration from 10% to 100%.

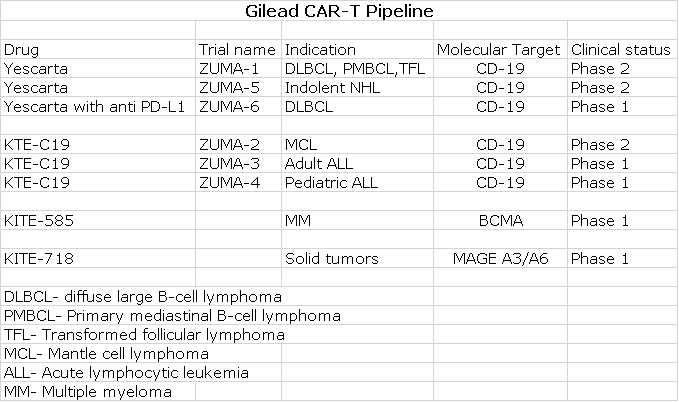

Lots of Potential beyond Current Approved Indications for Kymriah and Yescarta

In this report, I only make sales projections for the currently approved indications of Kymriah and Yescarta. This is meant to be and almost certainly will prove to be quite conservative. The following table shows the CAR- T pipeline that Gilead gained through the Kite acquisition. You can see that Gilead is conducting numerous new trials with Yescarta and has three other new CAR-T products also in clinical trials. Novartis and some of the other 30 or so companies engaged in CAR-T development are likely targeting these and other indications. I would also emphasize that CAR-T drug research is just a small sliver of the products being developed in the regenerative medicine world. There is simply enormous potential for Cryoport in the regenerative medicine market beyond CAR-T.

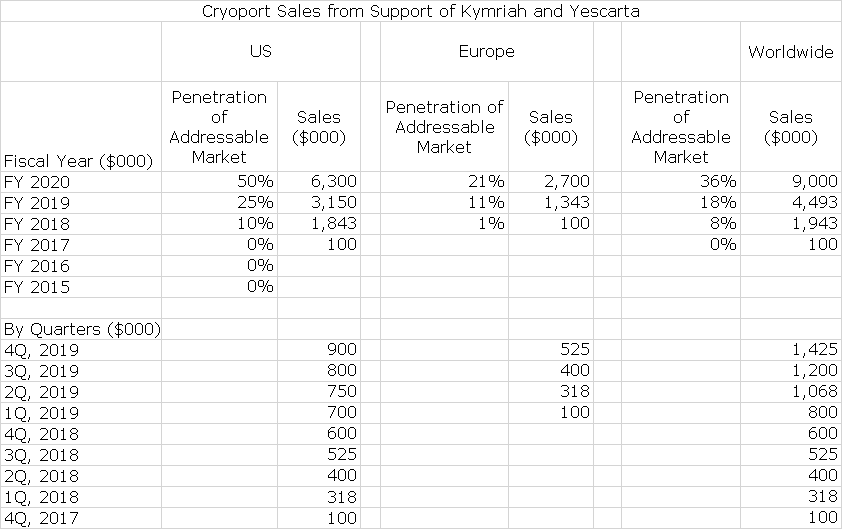

Projection of Cryoport Sales from Approved Indications for Kymriah and Yescarta

To reiterate, I am only making projections for Cryoport revenues from approved indications for Kymriah and Yescarta and include no other indications nor do I assume any sales from other new products. An important assumption is what part of the addressable market that Kymriah and Yescarta will achieve. I am assuming 50%, but again this is on attempt to be conservative. These products are used in a population in which other drug regimens have failed and the life expectancy is about six months. From clinical trials, we note that in r/r DMBCL, r/r PMBCL and tFL that about 30% to 35% of patients experience a complete response; this is striking.

If a CR translates into an effective cure as many hope, it would mean that about one in three patients who are dying would experience a cure or experience a significant prolongation of life. With these odds, we would expect almost all patients to elect for CAR-T therapy. However, at this point in time the data is not mature enough to gauge what a CR means to survival. Anecdotal evidence points to a long duration of effect, but if this proves not to be the case some or many patients might elect not to go through CAR-T therapy with its severe, sometimes life threatening side effects. In my projections for Cryoport sales, I am assuming that half of patients eligible for treatment actually receive it. This is just an educated guess.

The above table is based on the assumption that peak sales are reached at three years when 50% of the market is penetrated. I assume that the US and European launches follow the same trajectory with Europe lagging the US by one year.

Sales Model for Cryoport Through 2020

In the preceding section, I went to great length to estimate sales from approved indications for Kymriah and Yescarta. I want to remind you that I include no estimates for other new products nor for new indications of Kymriah or Yescarta. This introduces extreme conservatism into my projections.

Estimating sales of clinical trials is extremely difficult as there are so many moving parts. Based on the rapidly growing number of clinical trials supported, we would expect to see continued rapid growth, but estimating this on a clinical trial by clinical trial basis is virtually impossible. Hence, I am extrapolating rapid sales growth but at a declining rate of growth due to the ever larger sales bases. There is not a lot of visibility for reproductive medicine and animal health so I am using much the same technique of extrapolating sales growth trends. The following table shows the resultant trend in corporate sales through 2020.

Final Sales and Earnings Model

I have put together a sales and earnings model based on the estimates I have made for sales through 2020. This is meant to be indicative of the growth potential of the Company in the event that Kymriah and Yescarta gain no new indications and that no other new products using Cryoport logistics are approved in that time frame. I consider it extremely likely that this will not be the case and that revenues will be substantially higher than what this model shows. However, this is not enough information to make reasonable estimates on how much this might add to sales so I consider it misleading to just make up a sales number with no framework. I will update my model as better information becomes available.

Tagged as cryogenically shipped live cells, Cryoport, Cryoport sales from launch of Kymriah and Yescarta, CYRX + Categorized as Company Reports, LinkedIn