Relypsa: An In-depth Analysis of Early Results of the Veltassa Launch (RLYP, Buy, $13.26)

Investment Perspective

Relypsa is about two months into the launch of Veltassa, its first product. There was a time (several years ago) when a new product launch coincided with excellent stock performance as one might expect. Paradoxically, now launches more often than not lead to disappointing stock performance. The most important reason for this in my view is that managed care has become enormously powerful and has developed a bag of tricks to purposely slow the uptake of new products.

Managed Care Obstacles

Central to managed care strategies is the requirement for a new product to gain formulary acceptance in order to be routinely reimbursed. This is a process that can take six months or more. During this time, a product can be prescribed, but getting the prescription filled and paid for is a whole other matter. The patient walking into a retail pharmacy often finds that their prescription can’t be filled because the drug is not on the formulary of their insurer. It can then take hours or days of effort to try to get reimbursement and even then the effort may not be successful. Also, it is probable that the pharmacy will not have a new product in stock. In line with managed care goals, patients very often walk away without filling the prescription and could be so discouraged that they give up. Later in this report, I describe Relypsa’s well thought out strategy to deal with these factors.

Even after a product gains formulary acceptance, there are substantial hurdles to overcome. The formularies have tiered preference systems. In diseases in which there are generics available (fortunately not the case in hyperkalemia), the patient must first be prescribed a generic unless the physician goes to great lengths to justify the prescribing of a branded product. If the treatment with a generic is not effective, the patient is then eligible for a tier two product. This is the branded product preferred by that managed care organization because the manufacturer has entered into a favorable deal involving discounts and rebates. Other branded products are then placed on tier three. To encourage use of generics, a very low co-pay is established. The tier two brand has a more substantial co-pay and tier three branded products have much higher (sometimes prohibitive) co-pays.

The practices of managed care have a predictable, negative impact on physician prescribing. In order to prescribe a new product, the physician often has to take on part of the responsibility of seeing that the product will be reimbursed. The interchange with managed care can take up substantial amounts of their valuable time and their staff. Hence, many physicians will delay prescribing a new drug until they are confident that the patient has insurance that covers the cost of the drug. In addition, some physicians want to see how the drug performs in the clinical setting for some period of time before they prescribe the drug. Even then, they try the drug on a limited number of patients before deciding whether to incorporate it into their standard of care.

Because of these factors, the initial launch period can be a time of great confusion over the success of the launch. Prescriptions written are enormously slowed by these factors and give limited insight into the ultimate potential for a drug.

Hedge Fund Shorting Can Have a Significant Effect on Stock Prices

There is also another factor at work in poor stock performance that is so often seen with new product launches. For those of you who follow my work, you will know that I believe that some hedge funds often work together to manipulate the prices of small biotechnology companies (and many other companies). Shorting stocks if done in a concerted manner by a broad group of hedge funds carries much greater near term payoffs than buying stocks. If there is a reason for investor uncertainty as in the case of the initial stages of a product launch, a full scale shorting attack (sometimes involving naked shorting) can allow hedge funds to have great control over stock prices.

I think that Relypsa is much less vulnerable to hedge fund manipulation than many biotechnology companies with its relatively strong balance sheet. Also hedge funds must be concerned that this company is an attractive takeover target and they cannot take the kind of risk positions they might assume with an earlier stage, less well funded biotechnology company. However, Relypsa is not immune to this pressure and after the February 25th conference call in which the Company presented metrics for the first two months of the launch, the stock traded down from $16.78 to $14.24 and has continued to trade lower since then.

What About Early Prescription and Sales Trends?

I think that at this early period, it is very hard to project the sales trend for the coming year or so and declare the launch to be either a success or disappointing. This is not unique to Veltassa; it is the case with virtually all new drug launches. We are seeing slow product launches for the new cholesterol lowering drugs Praluent and Repatha and the congestive heart failure drug Entresto; I expect each of these to ultimately have US sales in excess of $1 billion. The ultimate key to success is building formulary acceptance and reaching contracts with Medicare regional payors and private managed care. However, the factors that persuaded me to recently recommend the stock are the great unmet medical need for a safe and effective potassium lowering agent and the apparent huge commercial opportunity. Please refer to my recent report Relypsa: New Buy Recommendation on Relypsa for my detailed thinking.

Let me just add a word on the progress of the launch which will be discussed in more detail later. The average weekly rate of outpatient prescriptions filled in January was 25 per week and in the first two weeks of February was 67 per week. Institutional units (sold to hospitals, the VA and other institutions) averaged 14 per week in January and 21 per week in February. I estimate that the realized price per prescription (containing 30 daily doses) is $476 and the realized price per hospital/ institutional unit (containing four daily doses) is $63. Doing the math indicates that the weekly revenue run rate in the first half of February was $33,000 per week and this translates into an annualized revenue run rate of $1.8 million. This is quite a small number, but I don’t think this gives too much of an insight into potential 2016 and 2017 sales potential. For the record the Street consensus is $30 million of sales in 2016 and $100 million in 2017. Later in this report, there is a much more detailed analysis of the results for the first two months of the launch.

Financial Issues

The expected operating expenses for Relypsa in 2016 are about $285 million and the gross profit margin of Veltassa is about 60%. At this level of operating expenses, Veltassa would have to achieve about $475 million of sales to reach breakeven. The Company had $285 million of cash on hand at the beginning of 2016. I estimate that it will have to raise about $200 to $250 million of cash in 2016. These are big league spending and capital requirement numbers, but we are talking about a big league product with billion dollar plus sales potential.

Key Events That Will Affect the Stock Price in 2016 and 2017

These are listed below and not necessarily in order of importance or timing.

- Over the next six months, Relypsa will report details each month on metrics that will help investors gage the Veltassa launch. For example, February results will be reported in an 8-K released in mid-March and so on.

- About 60% of the potential market for Veltassa is reimbursed by Medicare. In an encouraging move, CMS has announced that Veltassa will be reimbursed when Medicare regional carriers/plans (there are six) add it to their formularies. Usually it takes six to nine months for this but the CMS action may speed the process. Anyway, watch for announcements of the product being added to the formulary of a regional carrier.

- The PDUFA date for ZS-9, the competitive product of Astra Zeneca, is May 2, 2016. Investors are eagerly awaiting this to see if ZS-9 has a better label in regard to drug to drug interactions. They will also be watching to see how much concern the FDA has about the mode of action of ZS-9 which exchanges sodium for potassium. Many of the patients who are candidates for ZS-9 and Veltassa have hypertension, congestive heart failure or diabetes which requires restriction of sodium intake.

- Relypsa will have to raise about $200 to $250 million of cash in 2016 by my calculations. The timing and execution of this fund raising will be important. Management suggests that not all of this will be done with equity offerings.

- Relypsa will file a sNDA in mid-2016 with results of in vivo drug to drug interactions studies with the objective of improving the label. We should learn of the FDA’s intent in early 2017.

- An application for approval of Veltassa in Europe will be made in mid-year and suggests approval in 1H, 2017. The launch process in Europe is also slow and arduous like the US so that it is unlikely that there will be meaningful revenues until 2018, but like the US the commercial opportunity is huge.

Relypsa’s Launch Strategy for Veltassa

The customer base for Veltassa is about 60% Medicare, 30% commercial pay with the remainder divided among Medicaid, the VA system and hospitals. Uncertainty about reimbursement that exists in the first six to nine months of a drug launch particularly complicates the launch of a Medicare Part D product like Veltassa. In the initial stages of a launch when a patient goes to a retail pharmacy to fill a prescription, patients will not get a lot of service or help in understanding their insurance coverage, co-pay and other reimbursement issues. Even if this hurdle is cleared, it is unlikely that they will get the drug on the same day as most retail pharmacies do not stock specialty products, especially new ones like Veltassa.

Relypsa is using a system (strategy) called Veltassa Connect to deal with the disruptions to getting a prescription filled in the initial stage of a launch.. When a physician writes a prescription, the patient is directed into this Veltassa Connect hub and their case is assigned to a case manager who will assist in anyway necessary to secure reimbursement. If that reimbursement can’t be secured, the patient will be provided a free 10 day supply of drug by Relypsa.

Any and all prescriptions written by a physician for Veltassa will come through the Veltassa Connect hub. This strikes me as a very thoughtful approach to solving issues which have been major problems in other new drug launches. All prescriptions and 10-day starter supplies are turned over to one of a small number of specialty mail order distributors to actually fill the prescription. Patients will automatically be shipped drug for next day delivery regardless of reimbursement status.

Tracking the Launch

Since Veltassa’ s approval last October, through the end of January the combined Relypsa and Sanofi sales force has made more than 30,000 calls on customers. The Relypsa reps have met with more than 8,500 unique physicians and reached 82% of their targets with a frequency of approximately two calls per target.

Relypsa has decided to block for competitive reasons third party prescription data which investors use for tracking product trends. However, in place of third party data, for the first six months or so they are providing extensive prescription information on a monthly basis. In addition to prescriptions, they will provide the number of new patients who have received the free 10 day starter supply of Veltassa. This will be done for the first six months of 2016 via 8-K filings in mid-month, e.g. February numbers will be provided in mid-March. In the second half of 2016, these results will be reported on a quarterly basis. .

Estimating Revenues per Veltassa Prescription

Veltassa sales will initially be recorded on a sell-through basis, as is customary under GAAP accounting in a launch period. This means that initially the Company will recognize revenue in the retail setting when the prescription is filled and Veltassa is sent to the patient by a specialty pharmacy. In the hospital or institutional setting, revenues are recorded when the product is delivered. The 10-day starter supplies do not count as prescriptions and will not be recognized as revenues.

The list price of Veltassa is $595 for a 30 day supply. However, the actual price is reduced by discounts and rebates that vary from payor to payor and in some cases there may be product returns. As a working estimate, I am using a 20% discount on each prescription so that the realized price per prescription is $476. Sales can be estimated by multiplying the number of prescriptions by $476. In the hospital and institutional setting, Relypsa is delivering units comprised of four daily doses as opposed to the 30 days so that sales can be estimated by multiplying the number of units shipped by $64. ($476 x 4 / 30).

Key Launch Metrics

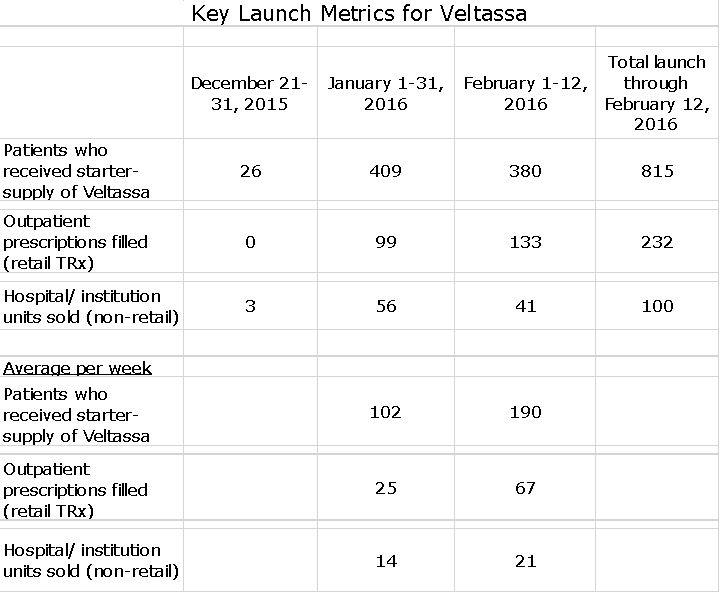

Relypsa is providing great transparency on the initial stages of the launch. These are the metrics that were just provided on a February 25th conference call and which will be updated on a monthly basis.

In interpreting the above table, it is important to understand that each patient received a prescription for Veltassa. However, as I have previously discussed, there are significant barriers to prevent a prescription that is written to being turned into a filled prescription that creates revenues. Most patients who receive a prescription will not immediately have approved reimbursement so that the prescription can’t be filled. In that case, Relypsa will give the patient a 10 day starter supply and then help with the laborious process of gaining reimbursement. Once, reimbursement is achieved, the patient is then counted as having received a prescription.

From the launch of Veltassa in late December through February 12th, physicians wrote more than 1,200 out-patient prescriptions for Veltassa; each of which went through the Veltassa Connect hub. When a physician sends in a prescription, they can check a box to request to have a free quantity of Veltassa. The Veltassa Connect team then works on the patient’s insurance coverage. In most cases, the patient will first receive a starter supply rather than a prescription. Of these 1,200, 815 have received a free starter 10-day starter supply. This is similar to a sampling program; the Veltassa starter supply will not show up in prescription audit data from third parties.

From the date of launch in late December, through February 12th, 232 out-patient retail prescriptions have been filled and 100 units (remember these are four days supply as opposed to 30 for retail) have been sold to hospitals and other institutions. This 232 patients include those whose prescriptions were filled initially and patients who received starter supplies and went on to receive a prescription; the Company did not specify how many prescription came from patients started on the 10 day starter supply.

The difference between the number of retail prescriptions written (over 1,200) and those that have been filled with a prescription (30-day supply) is driven by payer reimbursement issues. It can take six months from when a new drug becomes commercially available to make a formulary decision. During such a review period, the reimbursement process takes longer and has hurdles such as prior authorizations. Once on the formulary, reimbursement for new prescriptions is much quicker and easier.

The Company reports encouragingly that there have been very few outright denials of prescriptions. Through the Veltassa Connect program, case managers can help patients navigate the coverage and reimbursement process. They can run benefits investigations, cover prior offs, provide co-pay assistance, and most importantly can ship a free starter quantity of Veltassa so that patients can start taking the drugs as soon as possible. The majority of Veltassa scripts are requiring prior authorizations and this delays the building of prescriptions.

As is the case with all drugs, it is not likely that all of the 1,200 scripts that have been written so far will ultimately get filled. Some patients will be uninsured and will move to receive free drug through Relypsa’s patient assistance programs. Also, some patients or physicians may decide they no longer want this prescription filled for various reasons.

Not all of the 409 patients who in January received Veltassa 10 day starter supplies and presumably started therapy will automatically go on to receive a prescription. If a patient receives more than one 10 day supply, they still count as just one patient. The Company has not disclosed how many patients have gotten a second (or more) 10 day starter supply. They would only say that the majority of those 409 patients are still on just their first 10-day supply. As previously discussed, whether or not a starter supply is converted into a filled script is dependent on a lot of different factors, in particular the type of insurance coverage and whether the patient is uninsured.

Looking At Early Results from a Revenue Standpoint

The critical commercial issue is the number of prescriptions filled. In January, there were 99 outpatient prescriptions filled and in the first two weeks of February there were 133. At an estimated net price of $476 per prescription, this results in estimated revenues of $47,000 and $63,000. The corresponding hospital and institutional units (four daily doses instead of 30) were 56 and 41 resulting in respective revenues of $3,500 and $2,600. Hence, estimated sales for the first half of 1Q, 2016 were about $116,000.

A somewhat better way of looking at current trends is to look at weekly prescription trends. On a weekly basis, out-patient prescriptions filled in January averaged 25 per week and then in first two weeks of February averaged 67 per week. Institutional units averaged 14 per week in January and 21 per week in February. Based on the February weekly numbers, the weekly revenues were $33,000 (67 times $476 plus 21 times $63). This would be an annualized sales rate of $1.8 million.

Other Items Relating to the Launch

The vast majority of patients receiving a prescription were actually a part of the free drug program. There have been a small number of instances where the physician does not request the Veltassa starts, but in vast majority of the cases they do. It is fair to say though that those 99 prescriptions filled in January and the 133 in the first half of January are coming from those patients that received the Veltassa starter supply in the vast majority of cases in December or January.

If the reimbursement is not gained in the first 10 days then a second (or third) starter pack may be sent. In the case that the reimbursement might take longer than 20 days, there are three ways that this can be dealt with. One option is to continue to extend the starter supply. The second is that they can move to Relypsa’s patient assistance program, a program which provides free drug to those who can’t pay. This can be on a temporary basis until the authorization actually comes through? One of the positives of the distribution model is that they keep checking the reimbursement status and if a plan starts covering the drug patients flip back to paid drugs. A third possibility is that that the co-pay is too high in which case that patient can go to the Company’s commercial co-pay assistance program or be referred to an independent co-pay assistance.

Some percentage (probably very small) of the prescriptions filled were for greater than one month duration. I would also point out that a refilled prescriptions are going to get approved much more quickly than a new prescription even if the drug is not on formulary.

Reimbursement Progress is Encouraging

On February 11, CMS published its current year formulary reference file and Veltassa was included. This means that CMS will reimburse Part D plans for Veltassa if and when the six regional Medicare carriers add it to formulary. This requires those carriers to make formulary decisions within the next six months. It is hard to see how they could justify not adding Veltassa to formulary given the severity of hyperkalemia and the lack of any effective chronic therapy. If this argument is correct, those 60% of Veltassa patients who have Medicare coverage will be eligible for reimbursement. It is important to note that Medicare carriers can reimburse Veltassa before they make their official coverage decisions. In fact of the scripts filled through February 12th, the majority are for Medicare patients.

Relypsa has also signed agreements with Express Scripts and CVS Caremark commercials, the two largest PBMs in the country to cover Veltassa. The details of the agreements with Express Scripts and CVS Caremark are confidential and are viewed as competitively sensitive. Hence, management will not disclose the percentage rebates that were given. They did say that their goal is to be in the branded preferred position and consider these agreements in line with that goal. My guesstimate is that the rebates are on the order of 20%.

They also have a federal supply schedule interim price agreement which allows access to Veltassa at the VA and other federal markets. Management noted that Veltassa was added to the New York State Medicaid program as the preferred drug with no access restrictions. Hospital Reimbursement

The hospital industry is viewed as an important market and through February 12th, they shipped 100 cartons to hospitals. It can take up to nine months to gain formulary approval in hospitals after a drug becomes available. Sales and marketing efforts remain focused on generating demand in the hospitals as well as in out-patient settings.

Comparing to Other Launches in the Cardio-Renal Space

Comparing data from the initial 8-week launch period (that included the holidays) with other recent launches in the cardio-renal space must be done with considerable caveats. Recent launches include Novartis’ Entresto, Regeneron’s Praluent and Amgen’s Repatha, each of which are viewed as having blockbuster potential and have been on the market for over one-half year. In addition, Shire has launched Naptara and Keryx Auryxia. A rough comparison is to look at the 409 patients started on Veltassa and 99 who received prescriptions in January in comparison to prescriptions written in the same time frame for these five products which ranged from 100 to 318. At time points much later in their launches than Veltassa, none of these five are clearly a success as judge by their performance to date.

New Clinical Studies and Regulatory Filings

On January 25th Relypsa announced the results of our Phase 1 drug-drug interaction (DDI) studies which they viewed to be very positive. The results have been discussed with the FDA On the basis of those discussions, they plan to submit a sNDA requesting a label update for Veltassa. Relypsa is requesting that:

- The black box be removed and that the language currently in the box warning be moved to another appropriate section of the label,

- the six hour separation between administration of Veltassa and other medications be shortened to three hours,

- the results of the Phase I DDI in vivo studies to be added to the label.

Relypsa expects to submit this sNDA to the FDA by mid-2016 and anticipates a standard review time of approximately six months. Hence, investors should hear of the FDA’s decision on these issues in early 2017.

Outside of the United States the Company is working closely with Vifor Fresenius on the application for Veltassa for Europe and are on track to submit this to EMA in the first half of 2016.

The Company will be initiating new phase 4 clinical studies of Veltassa this year. Currently, the label requires Veltassa to be given with food. The TOURMALINE study just began enrolling and will evaluate the efficacy and safety of once daily Veltassa when given with food compared to without food. This would provide more flexibility around dosing for patients. It will be a 100-patient study with the primary endpoint of being the proportion of subjects that are maintained in the target range of 3.8 to 5 MEq/L.

They are also evaluating additional phase 4 studies evaluating Veltassa safety and efficacy in other patient sub-groups. This could include a study in patients with resistant hypertension and another in hemodialysis patients. The goal is to start these trials this year and details will be announced later. They have also made a post marketing commitment to conduct pediatric studies with Veltassa and these are expected to begin late this year.

Tagged as Relypsa, RLYP, Treatment pf hyperkalemia, Veltassa, ZS-9 + Categorized as Company Reports, LinkedIn