Relypsa: Analyzing March Results of the Veltassa Launch (RLYP, Buy, $17.60)

Investment Perspective

Investors are closely watching the launch progress of Veltassa following its December 2015 introduction. Medicare and managed care have set up barriers to prescribing that makes getting a prescription filled for a new drug laborious and time consuming and sometimes futile. With very few exceptions, most new product launches have disappointed investors to the point that many hedge funds routinely short companies like Relypsa that are launching new products. I initiated coverage of Relypsa with a Buy on February 2016.

Analyzing the Monthly Data

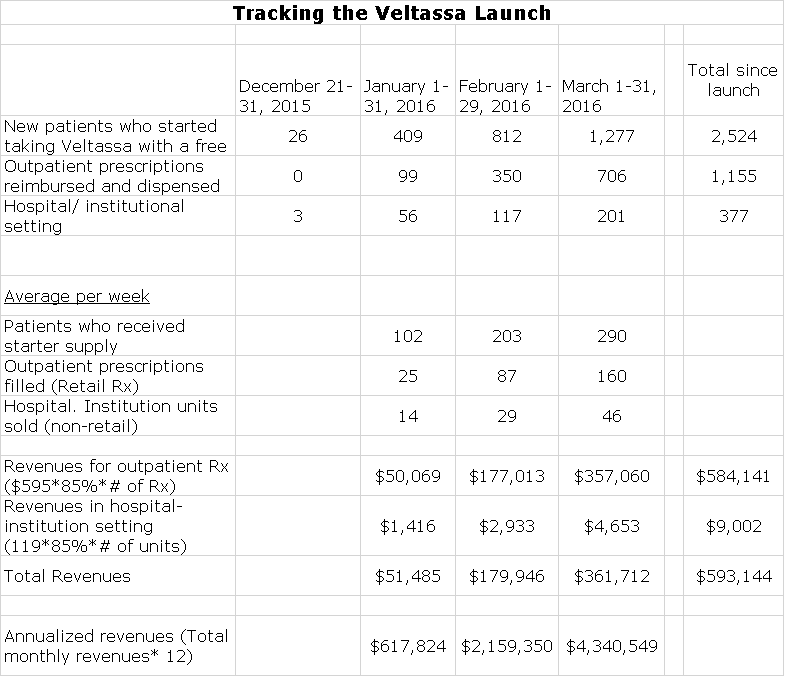

In my report An In-Depth Analysis of Early Results of the Veltassa Launch I explained Relypsa’s well thought out strategy to deal with the impact of managed care and I urge you to read that report. Relypsa is releasing monthly data pertaining to the launch that adds some transparency. Let me briefly explain the data being released:

- New patients who started taking Veltassa with a free starter supply: Relypsa makes sure that every patient for whom a doctor writes a prescription receives a starter supply of ten days while the Company works with the patient to secure reimbursement and to get the prescription filled.

- Outpatient prescriptions reimbursed and dispensed (retail Rx): These are prescriptions that have been approved by payors and filled by pharmacies.

- Hospital/ institutional setting: These are sales made directly to hospitals and institutions.

- Relypsa gives data on both a monthly and a per weekly basis for these three sets of data.

Let me provide some additional information that is useful in understanding this data.

- Obviously, there are no revenues associated with the free starter supply. The key issue for Relypsa is turning these into paid prescriptions. This does give some insight into physician enthusiasm for the product.

- The list price of each retail prescription for a one month supply is $595 and this is generally discounted by 15% so that the realized price is about $506 per prescription.

- The hospital unit contains 4 singlepacks and each unit is prices at $119. Assuming a discount of 15%, the realized price per unit is $101.

- The above assumptions allow the calculation of monthly revenues for both the retail and hospital/institutional settings.

- I have annualized revenues for Relypsa by multiplying estimated monthly sales by 12.

The following table summarizes all of these numbers;

.How is Relypsa Doing?

The impact of managed care in restraining uptake of new products grows with each new product launch is more disappointing than the last relative to investor expectations. In looking at the above table, you can see that if we annualize March results, annualized sales for Veltassa are now at about $4.3 million. Prior to the launch, analyst expectations were around $50 million of sales for the full year 2016 which compares to actual 1Q, 2016 revenues of about $593,000. So what do I make of this?

I think that analysts have not caught up with the new realities of managed care in which I believe that much of the first year is adjusting to managed care restraints on usage and reimbursement. In the early stages, it is not just about how physicians feel about the product. The only thing I can say right now is that the momentum is strong on every measure of product performance, but the numbers are small. I continue to believe that Relypsa has enormous long term potential, but I am struggling to project sales this year and next.

Investment Significance

Relypsa ran up dramatically to a closing stock price of $24.34 on April 7 based on reports of a possible takeover. The stock drifted down to close at $22.08 on Thursday April 14 and then reported the above Veltassa results on April 15. Since then the stock has slid to a current price of $17.60. Prior to the takeover rumors, the stock was trading at about $14.00.

As I commented on in my report of April 7, I think that the prospect of a takeover is real and stated that if I were CEO of a major biopharma company I would be eager to acquire the Company. As to the stock at a price of $24.34, I said that I would hold the stock but would not be adding to my position. With the decline and at the current stock price of $17.60, I would be buying the stock if you do not have a full position.

In looking ahead, the Veltassa numbers are not likely to excite investors for some time. However, there is a major catalyst aside from this and that is the May 26th PDUFA date for ZS-9. The mechanism of action of ZS-9 exchanges sodium for potassium and sodium can cause an increase in blood pressure. Many or most of the patients eligible for potassium lowering drugs have high blood pressure and it is possible that ZS-9 could exacerbate this. There has been an enormous amount of speculation and I emphasize the word speculation that this will be an issue for FDA and in the worst case, ZS-9 might only be indicated for acute use. This would be a disaster for ZS-9 as hyperkalemia requires chronic treatment.

In this scenario, Veltassa would own the market and this would trigger a major upward move in the stock. I like Relypsa longer term, but it is this potential that causes me to recommend the stock as it could create asymmetric upside potential. If this does not occur, I don’t think that it is not much reflected in the stock price.

Tagged as Relypsa, RLYP, Veltassa March 2016 results + Categorized as Company Reports, LinkedIn

Thanks Larry. From what I’ve learned about ZS-9, I’ll speculate that the best case scenario for that drug would be approval but with a highly restrictive label for chronic use due to the sodium concerns. Worst case, approved but only for acute use. Both would be good for Rylpsa. In the meantime, prior to approval, I think we’ll see the hedge funds keep manipulating the stock, more than likely pushing the stock price down.

The street believes ZS-9 will be approved. The big question remains to what extent will ZS-9 be enabled for chronic treatment?

After showing positive P1 results and having positive meetings with the FDA, Rlypsa is filing an sNDA in order to improve their label and remove the drug interaction warnings.

All eyes are remain on the ZS-9 PDUFA. Will it be approved without a CRL (the street believes it will be approved), and how will the label read (the latter appears to the big question mark)?

$150M debt financing just announced After hours today.

From biopharminsight…

ZS Pharma’s hyperkalaemia drug ZS9 faces safety scrutiny ahead of FDA review – experts

– High hypertension bar could raise agency eyebrows

– Oedema data significance disputed

– Potassium lowering comparisons to Veltassa/kayexalate limited

ZS Pharma’s (NASDAQ:ZSPH) hyperkalaemia drug ZS-9 has elicited expert conflict on its FDA approval prospects following interim Phase III safety data. Physicians questioned its safety/efficacy profile relative to recently approved Relypsa’s (NASDAQ:RLYP) Veltassa (patiromer) for the same indication.

Whilst sound efficacy data was noted, trial design inconsistencies hinder ZS-9, Veltassa and kayexalate comparisons. ZS-9 has a 26 May 2016 PDUFA date.

On 7 November, ZS reported interim data for its Phase III ZS005 study (NCT02163499) of ZS-9 (sodium zirconium cyclosilicate) at a late-breaking poster presentation during the American Society of Nephrology’s (ASN) Kidney Week 2015.

Hyperkalaemia (higher-than-normal potassium levels) follows the kidney’s inability to excrete potassium, mechanism impairment of potassium transport into cells or a combination of both, according to ZS’ website. It can cause cardiac arrhythmia and sudden cardiac death.

ZS Pharma did not respond to a request for comment. A Relypsa spokesperson commented selectively in the article.

Debate over AE profile

According to the ASN poster, the ZS005 trial recorded a 7% hypertension rate (48/684 patients), which analysts presumed to be new cases. ZS’s hypertension threshold was 180/105mmHg, which all experts agreed was exceedingly high. If lower, many more cases would likely emerge, noted Dr Jay Wish, nephrologist, Indiana University Health University Hospital, Indianapolis.

However, hypertension is easily monitored and will unlikely affect ZS-9’s approval prospects, said Wish and Dr Raymond Lipicky, former director of FDA’s Division of Cardio-Renal Drug Products and founder of his eponymous consulting firm in North Potomac, Maryland.

Other hypertension-inducing therapies for similar patients, including erythropoiesis-stimulating agents, were still given regulatory nods, which underscores ZS-9’s potential success, said Wish. Additionally, all chronic kidney disease (CKD) patients are hypertensive, which justifies the higher threshold, said Dr Samuel Blumenthal, professor of medicine, Medical College of Wisconsin, Milwaukee. ZS-9 has excellent approval prospects and unalarming toxicity data, he added.

Safety is a key FDA concern, which will likely prompt questioning over hypertensive findings, said Dr Mark Perazella, nephrologist, Yale University School of Medicine, Connecticut. Furthermore, hypertension illustrates CKD progression, potentially raising regulatory, if not market, alarms, he added. Veltassa’s superior safety profile to ZS-9 could deter the latter’s review if the drug profiles are compared, said Perazella. Veltassa produced statistically significant hypertension reductions over one year, according to one analyst report’s independent statistical findings. The compound received FDA approval on 21 October.

However, Veltassa’s reduced hypertension findings may occur due to its gastrointestinal (GI) effects, said Wish. Veltassa induces diarrhoea which typically lowers blood pressure, he said. Veltassa’s prescribing information notes the most common adverse events (AEs) (incidence greater than or equal to 2 %) include hypomagnesemia, diarrhoea and flatulence.

A fellow nephrologist noted preliminary unpublished data suggests Veltassa’s sodium-binding potential could create a negative sodium balance, offering an additional hypertensive advantage, said Dr Richard Glassock, emeritus professor, Geffen School of Medicine, University of California, Los Angeles.

Glassock maintained ZS005’s high hypertension threshold will impact approval or prompt a black-box warning. Lipicky agreed a black box could be issued. Veltassa’s boxed warning states it binds other orally administered medications, potentially decreasing their absorption and reducing effectiveness.

In terms of other safety data, ZS005’s peripheral oedema rate measured at 7.7% (53/684) with 4.2% (29/684) requiring diuretics, according to a press release. Ninety per cent (26/29) requiring treatment had a prior history of oedema. The hypokalaemia (serum K+ less than 3.5 mEq/L) rate was 2.5%; all cases were mild.

Wish was unconcerned of the oedema data affecting approval, noting diuretic treatment is common for these patients. If anything, hypertension/oedema and sodium/water retention go hand- in-hand, he added. No severe hypokalaemia observations is encouraging, added Glassock. However, Perazella said the data is sufficiently discouraging to impact approval.

Efficacy demonstrated, trial design creates doubt

Experts agreed ZS-9’s efficacy data deserves approval, however, some pointed to trial design discrepancies leaving nagging questions on comparisons to standard-of-care kayexalate.

Despite ZS005’s open-label, uncontrolled design, data supports ZS-9’s serum potassium-lowering potential for up to one year, said Glassock, Lipicky and Perazella. However, the trial fails to demonstrate ZS-9 superiority to generic kayexalate or Veltassa, added Glassock, noting patient comparability is unclear.

Kayexalate is usually given acutely, rather than chronically, unlike ZS-9 and Veltassa, which reduces agent comparisons, said Wish. ZS005’s data is similar to Veltassa’s Phase III results, underscoring efficacy for either, he added. During OPAL-HK’s second part, patients taking Veltassa experienced no change in median potassium from baseline, whereas potassium levels significantly increased in placebo (0.72 mEq/L; pless than0.001).

ZS005 reported 99% of patients achieved normal potassium levels on 10g/thrice-daily of ZS-9, whilst mean potassium levels were maintained at 4.6 mEq/L throughout the 12 month, long-term treatment phase. The primary efficacy endpoint was achieved, with 87-92% of patients maintaining an average serum potassium ≤5.1 mEq/L between months three and 12.

Maintaining potassium levels at 4.6mEq/L compared to a serum baseline of 5.6mEg/L for one year is clinically significant, said Glassock. The acute serum potassium decline of 1.0mEq/L at seven days is similar to that achieved with kayexalate (-1.25mEg/L), he added.

In terms of design, Lipicky and Perazella claimed ZS005’s 52-week trial sufficiently determined efficacy, yet Glassock pointed to lack of compliance related drop-out data or discontinuation following AEs.

Additionally, ZS-9 data does not indicate whether patients received renin-angiotension-aldosterone system (RAAS) inhibitors, which is specified in Veltassa’s Phase III. Inhibition of the system is a key treatment strategy of hypertension, and cardiovascular and renal disease. This information is important to know as hyperkalaemia is a significant safety concern in patients with diabetes and advanced CKD receiving RAAS inhibitors, said Glassock and Perazella. RAAS drugs inhibit hyperkalaemia control, added Wish and Perazella.

A well-tolerated drug would allow higher RAAS inhibitor dosing, potentially improving blood pressure and proteinuria control, said Glassock. This may also delay end-stage renal disease progression and major adverse cardiac events, he added.

ZS-9’s trial does not allow any conclusion to be drawn regarding the role of RAAS inhibition in patient response or adverse events, said Glassock, noting the possibly different populations used for each.

ZS Pharma has a market cap of USD 2.3b. Relypsa has a market cap of USD 897m.

by Alexandra Thompson and Jennifer C. Smith-Parker in London