Portola: Detailed Spreadsheet Projecting Sales and Earnings Through 4Q, 2021 (PTLA, Buy, $28.00)

Key Points:

- The sales model presented in this report projects sales for Portola of $119, $264 and $402 million for 2019, 2020 and 2021.

- While the numbers presented in this model appear to be precise, the assumptions used in putting it together involve a lot of judgments (guesswork) and are imprecise. You should take the estimates with a grain of salt. However, I think that the trend and magnitude could prove to be reasonable.

- My price target range for Portola is $42 to $51 at the end of 2020 and $65 to $78 at year-end 2021.

Overview

The current investment story for Portola is almost entirely based on the sales ramp for Andexxa (called Ondexxa in Europe). Investors have become very cautious in recent years about new product introductions and this is particularly the case for hospital-based products like Andexxa. The first major challenge is gaining reimbursement and as important, gaining acceptance on hospital formularies. Despite this foreboding backdrop, sales of Andexxa in the US following its 2Q, 2018 introduction have been impressive (in my eyes) and I think that most investors will agree that the launch has met or exceeded expectations. Trailing twelve-month sales are $97 million.

During the 2Q, 2019 conference call, management reported that they had conducted an extensive benchmarking analysis of nearly 50 hospital product launches over the last 30 years. Of those, 10 went on to have US sales between $600 million and $2.5 billion. Based on the trajectory of the first five quarters of revenue, Andexxa is on track to be one of the top five hospital drug launches over this 30-year period and suggests that peak sales could well fall in the $600 million to $2.5 billion range in the US. Management on the call said “We are clearly off to a fantastic start.”

Portola has decided that it will be a fully integrated company marketing Andexxa/ Ondexxa on its own in both the US and Europe rather than licensing the drug. I believe that this maximizes returns for investors over the long term, but it also results in a ferocious cash burn. This has been and continues to be a drag on the stock. I think that there is considerable uncertainty among investors as to when the Company will be earnings and cash flow positive and the implications for more equity financings.

Key Projections of This Report

This report shows my model for quarterly sales and earnings through 4Q, 2021. My key projections are as follows:

- Sales grow rapidly from $24 million in 2018 to $128, $264 and $402 million, for 2019, 2020 and 2021, respectively.

- GAAP profitability is reached in 2Q, 2021 as sales of $96.2 million result in $3.4 million of net income and EPS of $0.04.

- Cash flow from operations turns positive in 4Q, 2020 at $6.7 million.

- The cumulative cash loss from operations for the period beginning in 4Q, 2019 and ending in 3Q, 2020 is just $60.9 million. It is possible that the company will require additional cash to fund working capital. For example, in 3Q, 2019 this required $15.6 million. I just can’t make reasonable estimates on this number. Capital spending is not an issue for cash flow as it amounts to less than $1 million per quarter.

- With a cash balance of $433.2 million, Portola seems to be very well funded.

Price Target

Valuing emerging biotechnology stocks in the early years of a product launch (especially the first product as in the case of Portola) is extremely difficult. The metric of price earnings ratio is meaningless as heavy spending on the launch results in large losses. Also, these companies are usually spending heavily on research for new products and additional indications for their existing products which compounds losses.

Some analysts arrive at a price by projecting an income statement (say) five years in the future when a company begins to show earnings and use a discounted cash flow model to come up with a net present value. This approach is essentially worthless. There is a reasonable chance of predicting sales, but earnings are an entirely different matter as spending on marketing and research several years hence is well-nigh impossible to predict. However, the biggest flaw in this approach may be selecting a discount rate at which future cash flows are discounted. This is completely arbitrary and oftentimes, analysts select a price target that fits their view of the stock and then assign discount rate that delivers that price.

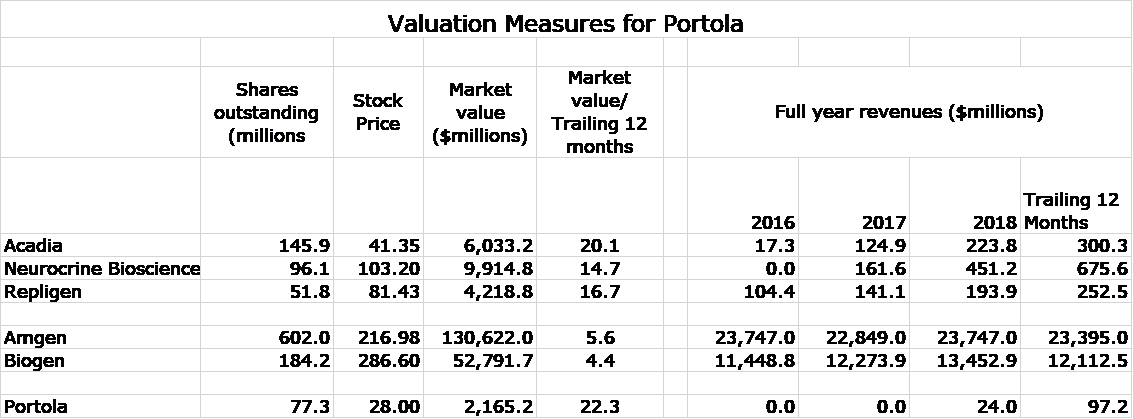

In my view, the only metric this leaves investors to try to value Portola is sales. They can look at the current market capitalization to sales ratio of peer companies to arrive at future price targets for Portola. The peer companies I have selected are Acadia Pharmaceuticals, Neurocrine Biosciences and Repligen.

- Acadia: In April 2016, the FDA approved the Company’s first and only marketed drug, Nuplazid (pimavanserin), for the treatment of hallucinations and delusions associated with Parkinson’s disease psychosis. In the nearly three years since introduction, sales have exploded and on a trailing 12 months basis have reached $300 million.

- Neurocrine Biosciences: In April, 2017 the FDA approved Ingrezza (valbenazine) for tardive dyskinesia and since then sales have soared and on a trailing 12 months basis have reached $676 million. The company also developed Orilissa (egalolix) for endometriosis and licensed it to AbbVie. It was approved in July 2018. For the first nine months of 2019 it achieved sales of $58 million and contributed $4.0 million in royalties to Neurocrine.

- Repligen: This long-time recommendation of mine is not a biotechnology company, but provides products used in the production of biotechnology product such as monoclonal antibodies and cell therapies which drive its growth. It also has experienced explosive growth.

In the following table, for each of these three companies, I show sales for 2016, 2017, 2018 and for the trailing twelve months (period ending September 30, 2019). I then calculate the ratio of current market capitalization to trailing twelve-month sales. Just for illustrative purposes, I have also done the same calculations for the industry pioneer companies in biotechnology, Amgen and Biogen) which are mature companies.

The current market capitalization to sales (trailing twelve months) ratios for Acadia, Neurocrine and Repligen are 20,15 and 17 respectively while for Portola it is 22. Portola is just at the beginning of its second year of marketing Andexxa and sales, while respectable, are just starting to take off; this is in part due to its being a hospital-based product. I am projecting sales of $128, $264 and $402 million in 2019, 2020 and 2021 respectively. I think that it is reasonable to assume that Portola could be valued at 15 to 20 times revenues at the end of 2020 and 2020. The following table shows the resultant stock price for various ratios.

If my sales projections are reasonably accurate, I would argue that based on a comparison to where peer companies are now trading that Portola could be valued at 12.5 to 15.0 times trailing twelve-month sales at the end of 2020 and 2021. This results in a price target range of $42 to $51 at year-end 2020 and $65 to $78 at year-end 2021.

Assumptions Underlying Sales Model

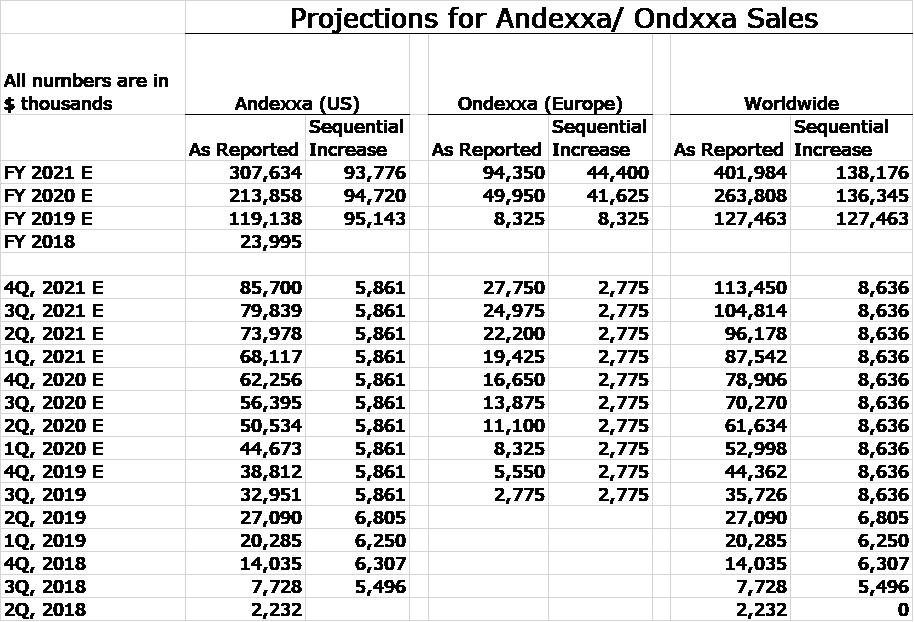

Much hinges on the trajectory of the sales curve and at this early stage, it is very difficult for outside analysts to make projections. Even management is non-committal and has not issued any sales guidance. It says that it may or may not issue guidance at the 4Q, 2019 conference call in February 2020. So how do I go about projecting sales for Andexxa? I have put together a sales model based on estimating sequential quarterly sales increases through 2021. There just aren’t ready metrics like prescriptions to look to.

In the US, the sequential sales quarterly growth for the five quarters following the 2Q, 2018 launch has been in a tight range of $5.5 million to $6.8 million and in 3Q, 2019 it was $5.9 million. My model assumes that sequential sales growth in the US for each quarter through 4Q, 2021 will be $5.9 million. This seems to me to be a very conservative estimate. As reimbursement issues are resolved, physician awareness increases, further penetration of the hospital market is made and the sales base enlarges; I would argue that sequential quarterly sales should increase over time. People who disagree might argue that we can’t really determine end market sales right now. Andexxa has an interesting market characteristic in that hospitals stock it in anticipation of using it on a DOAC caused bleed at some point in the future. Hence, reported sales of Andexxa may not reflect actual usage there is a meaningful component of inventory stocking. We shall see.

Portola realized sales in Europe for the first time in 3Q, 2019. Sales were $2.8 million which is obviously a sequential quarterly increase of $2.8 million. As in the US, I am assuming that sequential sales in each quarter through 4Q, 2021 will be $2.8 million and again this intuitively seems to be conservative.

I would be amazed if sales develop anywhere close to what my resultant sales model suggests. However, it is a starting point and as I pointed out I think that my basic assumptions on sequential sales growth seem conservative. Here is the resultant model.

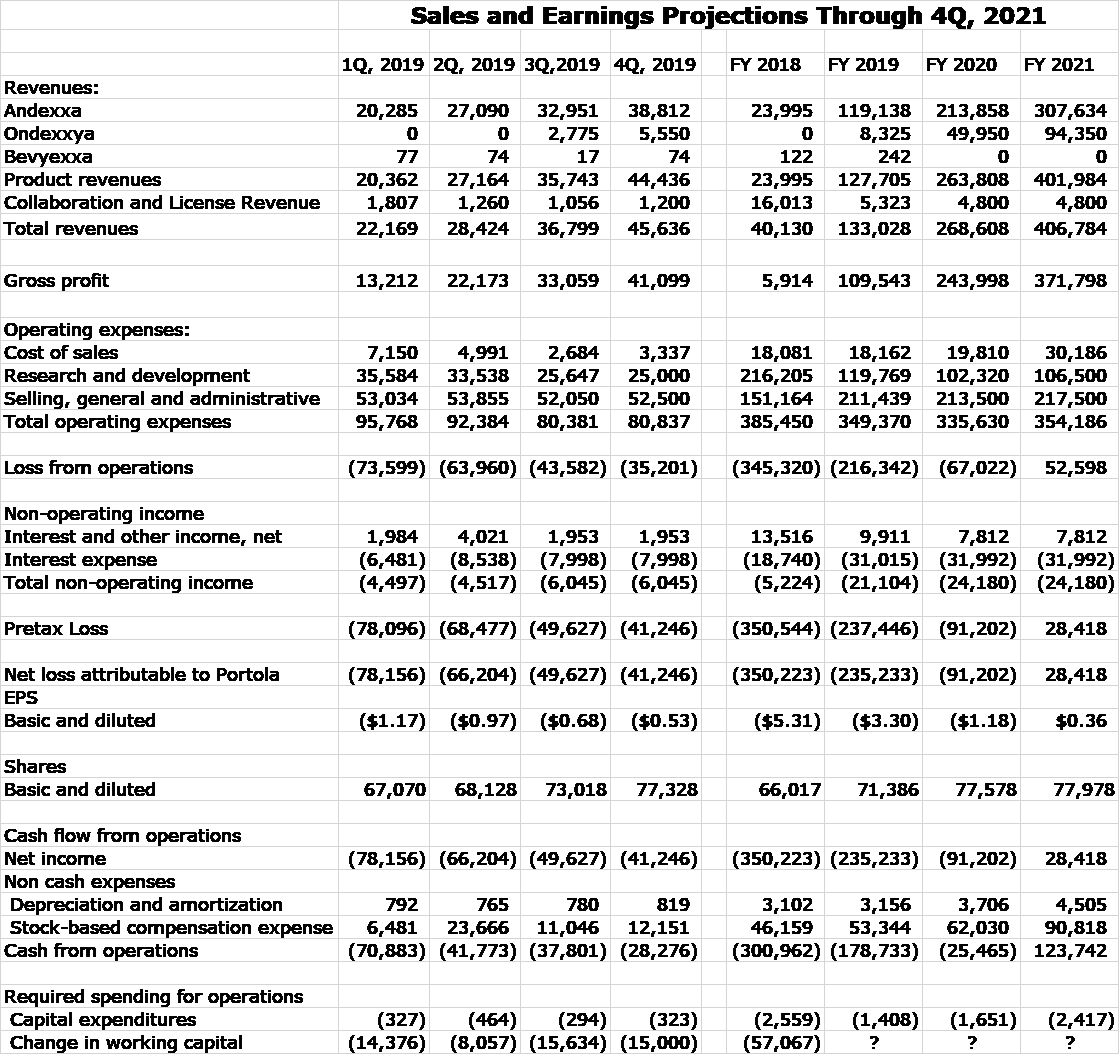

Constructing an Income Statement

For better or worse, this gives me the sales component of an income statement. The next step is estimating operating costs. Because management is giving no guidance on sales, they are obviously not giving any guidance on costs. In terms of cost of goods sold, I am assuming that as a percentage of sales that it remains constant at the level shown in 3Q, 2019 for each quarter through 4Q, 2021. I have assumed that management will keep a tight reign on controllable costs like research and development and selling, general and administrative expenses. However, there might be situations that arise that could cause management to be more or less aggressive than my model assumes. Simply speaking my estimates are a lot of guesswork. The key components of my sales and earnings model are shown below:

In my Excel spreadsheet, I actually make estimates for all quarters through 4Q, 2021 to come up with my full year estimates. I have chosen not to show these because it clutters up the spreadsheet and makes it difficult to read. However, for those who might want to see the details, I include the entire spreadsheet in the appendix. Here are some of my key projections from my model:

- Portola reaches GAAP profitability in 2Q, 2021 as sales of $96.2 million result in $3.4 million of net income and EPS of $0.04.

- Cash flow from operations turns positive in 4Q, 2020 at $6.7 million.

- The cumulative cash loss from operations for the period beginning in 4Q, 2019 and ending in 3Q, 2020 is $60.9 million. It is possible that the company will require additional cash to fund working capital. For example, in 3Q, 2019 thus required $15.6 million. I just can’t make reasonable estimates on this number. Capital spending is not an issue for cash flow as it amounts to less than $1 million per quarter.

- With a cash balance of $433.2 million, Portola seems to be well funded.

Appendix

My detailed quarterly model is as follows:

Tagged as Detailed sales and earnings forecast model for Portola through 2021, Portola, Portola price targets + Categorized as Company Reports, LinkedIn