Cryoport: Update on My Investment Thinking (CYRX, Buy, $49.35)

Investment Thinking

I believe that the stock of Cryoport can deliver exceptional returns over the next five, ten or more years. The current correction in the stock off of its January 22, 2021 high of $82.11 is disheartening, although these types of periodic corrections are inevitable in an investor’s life. You probably want to know if there is more downside and if so, how much? I don’t know, but I will offer some thoughts on what is going on. Premier growth stocks have soared to hefty valuations as determined by price to sales ratios (not price to earnings ratios). For example Shopify is selling at 50 times 2020 sales, Tesla 25x, Teladoc 18x, Etsy 21 x, PayPal 14x, Square 13x, Airbnb 17x and Repligen 28x. Concern about rising interest rates is causing a significant downward adjustment in these multiples. There is really not a concern about growth prospects for these companies by investors, it is a valuation judgment.

Some investors point to these valuations as being evidence that we are in a bubble for growth stocks. They see a crash as inevitable. Others see the valuations as warranted because these companies have unprecedented growth opportunities. The internet has made their addressable markets the population of the whole world instead of the US and Europe and their technologies are disrupting industries they compete in. This will lead, they say, to exponential growth. They point to Amazon as an example of what these companies and their stocks may be able to do even from current lofty valuations. Over the last decade, many investors to their chagrin incessantly argued that Amazon was over-priced. The truth lies somewhere in between the bubble and the “these are all new Amazons” theses. I am more in the latter camp, but certainly the pendulum of investor support has swung away from growth stocks in recent days.

The selling has been amplified because of their heavy concentration in portfolios. If you look at investors like Cathy Woods (whom I admire) whose growth oriented strategies have been so successful over the past few years, they are being forced to sell stocks that they like very much to meet redemptions. Also, investors are moving from growth to value stocks. Cryoport has been caught up in this perfect storm.

In terms of valuation, we can’t really look at EPS because Cryoport is in an aggressive growth phase with the goal of maximizing market share. In 2020, non-GAAP EBITDA was breakeven and it will probably be run to have breakeven operating cash flow in the near future. (Importantly, it has a solid cash position of about $381 million so there is no concern about financing from weakness nor impairing its ability to make acquisitions if opportunities arise.) So we can only look at the market capitalization to sales ratio. Based on my estimates, CYRX is selling at 15x 2020 sales of $173 million (this is a pro forma estimate of what sales might have been if MVE and CRYOPDP had been part of Cryoport for the full year) and 12x my 2021 sales projection of $202 million. This places it at the lower end of the range of the premier growth stocks listed above.

I don’t know when this storm will pass. Over my 40 year career as an investor, I have always chosen to ride through these gut wrenching times and this has always served me well. I have no confidence that if I sell, I will know when to get back in and there is the very real risk that I will never get back in and could miss out on what I believe will be one of the best growth stories for the next decade. But, that’s just me.

I consider Repligen to be the closest peer company to Cryoport. Both provide critical service to the biopharma industry. Repligen is driven by sales of monoclonal antibodies and Cryoport by cell based therapies. They have strong competitive positions although I think Cryoport’s competitive moat may be stronger. The organic growth of Repligen has been 10% to 15% per year but has risen to 15% to 20% as it is a major beneficiary of COVID vaccine and drug development. Cryoport reported 36% organic growth in 4Q, 2020 and I think that it will march or surpass the organic growth of Repligen in the next few years. Both employ strategic and bolt on acquisitions to drive sales substantially faster than organic growth. Repligen is selling at 28x 2020 revenues and 20 times 2021 revenues. If Repligen were to maintain this market capitalization to sales ratio and if Cryoport was given a comparable ratio and if my $202 million sales estimate in 2021 is correct, Cryoport could sell at $82 per share by late 2021. I don’t think that I need to overly discuss that the Repligen price to sales ratio might come down considerably. Still!!!

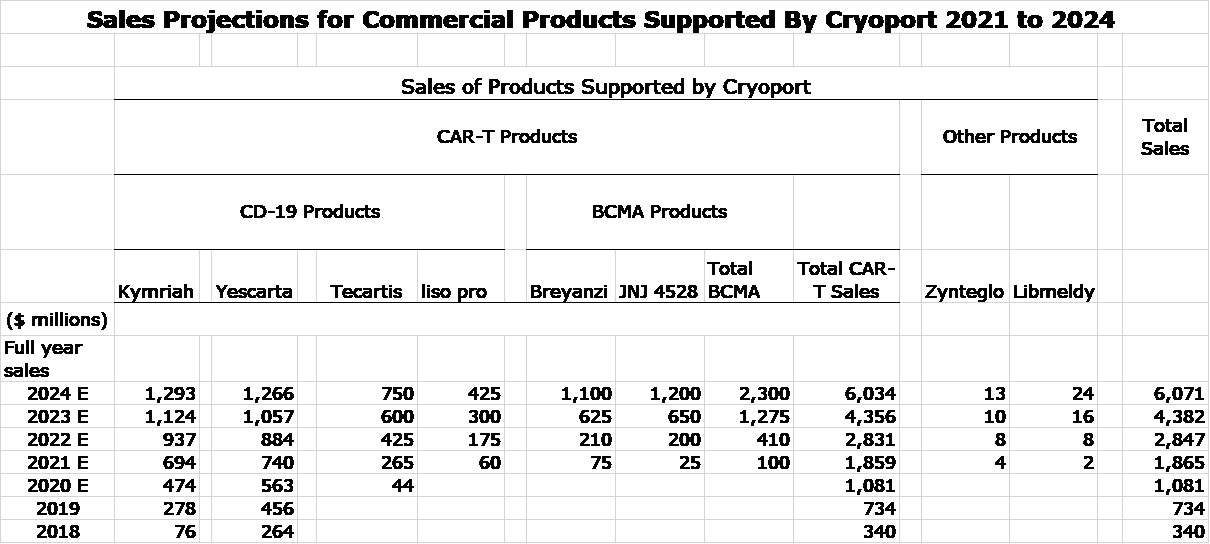

One thing in this report that I would urge you to focus on is my projection for sales of commercial cell based therapies supported by Cryoport. Currently, there are three major products approved and that are responsible for almost all of Cryoport’s revenues from commercial products. These are the CAR-T drugs- Kymriah, Yescarta and Tecartis- that are targeted at cancers (lymphomas and leukemias) that express the CD 19 antigen. In 2021, I have very high confidence in three major new drugs being approved. Two of these products, Breyanzi and JNJ 4528 target the BCMA antigen on multiple myeloma. I think their combined potential is comparable to that of the CD-19 drugs. In addition, I expect the CD-19 targeted liso pro that is a direct competitor to Kymriah and Yescarta to also be approved. Cryoport, of course, supports each of these products.

I am projecting that sales of these six products increase from $1.1 billion in 2020 to $6.1 billion in 2024. This should lead to corresponding impressive growth for Cryoport sales stemming from support of these products (the key growth driver of the company), but this does not fully capture the full potential. This does not include any sales projections for any other products over this time. This is ultra conservative. Cryoport expects 21 BLA/MAA filings from clients in 2021 that will almost certainly lead to very meaningful sales in the 2022 to 2024 time frame. Moreover, I would expect continued surges in BLA/ MAA filings in 2022, 2023 and 2034 to further bolster sales. I would urge you to read my report Cryoport: We Are Just in the First Inning for an in-depth discussion of the exciting potential of cell based therapies.

Recap of Stock Price Behavior; It’s Been A Wild Ride

Cryoport stock has had a wild ride over the past year. The following table shows key inflection points since the beginning of 2020.

| Date | Price | |

| 1/2/2020 | $16.53 | Beginning of year price |

| 1/16/2020 | $13.56 | Low reached during COVID induced market sell-off |

| 8/21/2020 | $38.82 | Joined in market surge of companies not much affected by COVID |

| 8/25/2020 | $51.51 | Favorable reaction to acquisitions of CRYOPDP and MVE |

| 12/31/2020 | $43.88 | Year-end price |

| 1/22/2021 | $82.11 | Incorrectly perceived to be a COVID play |

| 1/16/2021 | $72.07 | Bluebird bio suspends marketing of Zynteglo |

| 3/1/2021 | $62.49 | Incorrect assumption that Zynteglo was important to growth |

| 3/2/2021 | $55.00 | Drop partially due to CYRX re-emphasizing on conference call that it was not a COVID play. However, there is overall weakness in the market and some investors are moving money from growth stocks to economically sensitive stocks. Also, concern about potential increases in interest rates is negatively impacting growth stocks. |

| 3/3/2021 | $49.76 | Low price of day. |

Revisiting Cryoport’s Business Model

Jitters about rising interest rates have been the major factor in the recent decline in the stock. However, volatility on both the upside and downside has also stemmed from investors not yet fully understanding how powerful Cryoport’s business model is. From a macroeconomic standpoint, it is driven by cell and gene therapy drug development which is emerging as one of the most dynamic forces driving biopharma sales. Cell based therapies must be shipped at cryogenic temperatures of minus 238 degrees Fahrenheit. This obviously requires sophisticated logistics technology to maintain a drug at these extreme temperatures over a period of days and this is the service that Cryoport provides. Excursions from this temperature can ruin the drug product and is extremely costly. Loss of a shipment of cells for a single patient would lead to a loss of final sales of $325,000 for CAR-T drugs and as much as $1,000,000 for orphan drug therapies.

At first glance, many investors think that the key investment aspects of Cryoport are the shippers (dewars) in which the cells are transported. While this is extremely important and Cryoport has state of the art technology, I think that an even more important competitive advantage is its cloud based software system. Cryoport is very much a software as service (SAAS) company. In my view then, the two most important investment variables for Cryoport are the explosion in cell therapy drug development (the key macroeconomic driver) and SAAS (its most important competitive strength). I just don’t think that this has yet been fully appreciated by the stock market.

The acquisitions of CRYOPDP and MVE are confusing investors. Both of these businesses were small parts of large companies that did not fit into the business models of the much larger companies in which they were embedded. Left alone and largely unsupported, they were only registering sales growth of 5% to 10% per year. However, Cryoport did not acquire these businesses for what they have been but rather for what they can become as part of CYRX. These acquisitions would be a major disappointment to management if they only maintain past growth trends. For CYRX, these are strategic acquisitions that provide significant synergies. Management has said that it sees $100 million of synergies over the next five years or so. But how do you model synergies? I think that analysts and investors are taking a show me attitude and modeling only modest growth for MVE and CRYOPDP. That is what I am doing. However, I have great confidence in management and I would be disappointed if we don’t see faster growth. More importantly, these acquisitions bring important infrastructure that meaningfully strengthens the services that Cryoport brings to its clients.

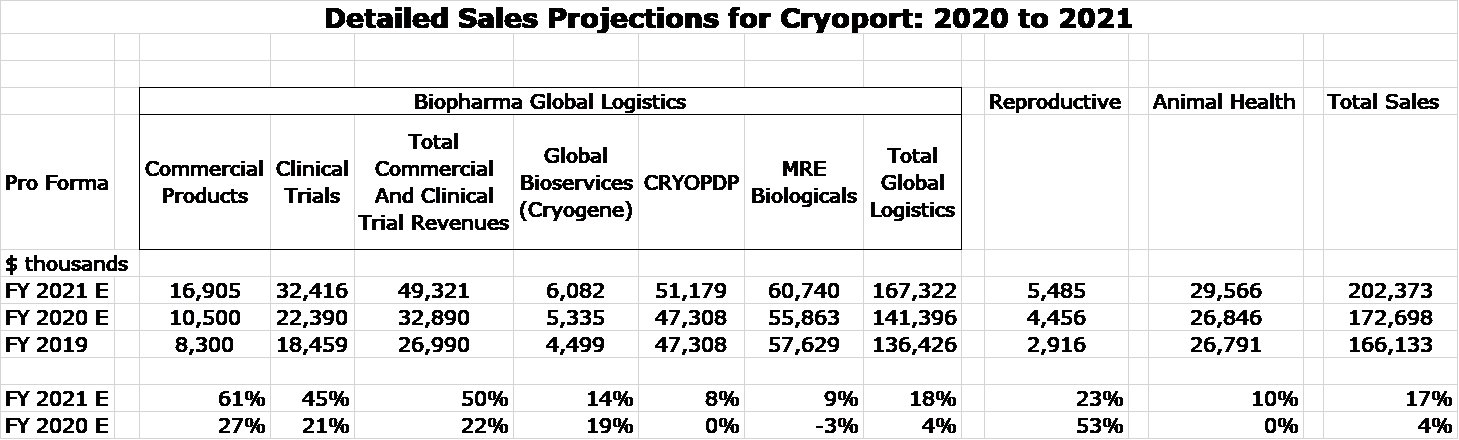

Building a Sales Model for 2021

Modeling sales for Cryoport has been made much more complex due to the acquisitions of MVE and CRYOPDP. There is only limited historical data on MVE and CRYOPDP. Regulatory filings post acquisition have only shown historical results for 4Q, 2020; 9 months 2020; and FY 2019. There is no breakout on their key products or services. Based on this limited information, I have tried to reconstruct what sales might have looked like in 2020 and 2019 on a pro forma basis if MVE and CRYOPDP had been part of Cryoport in those years. This provides a base on which to build a sales model. This required a fair amount of guesswork on my part.

The results for “old” Cryoport in 2021 should be pretty exciting. I expect that sales of the three major commercial products supported-Kymriah, Yescarta and Tecartis- should show strong growth in 2021. Tecartis was just introduced in 3Q, 2020 and seems to be on a rapid sales trajectory. The pandemic had a meaningful effect on these products in 2020 as some hospitals heavily involved in CAR-T therapy turned their focus to treating COVID patients. Novartis and Gilead, especially Novartis, were capacity constrained, but new manufacturing capacity has eliminated this. Reimbursement is much improved. I also expect sales to be aided by approvals for new indications and for use in earlier lines of oncology treatment. I am expecting strong sales growth for Kymriah, Yescarta and Tecartis in 2021.

This year should also be a big year for new products. Kymriah, Yescarta and Tecartis are CAR-T drugs targeted at the CD19 antigen that appears on many lymphomas and leukemias. In 2021, I am expecting approval of BMY’s Breyanzi and Johnson & Johnson/ Legend Biotech’s JNJ 4528. These products are targeted at the BCMA antigen on multiple myeloma cells, a new and promising market opportunity not addressed by the CD19 targeted drugs. I think that the sales potential for the two BCMA CAR-T drugs is comparable or larger than for Kymriah, Yescarta and Tecartis. In addition, BMY will likely introduce liso-pro, a drug comparable to Kymriah and Yescarta. BMY has claimed that liso pro has a better safety profile that could allow it to be used in a non-hospital setting. If so, this would meaningfully expand its market opportunity. Cryoport is also supporting two other commercially approved drugs, bluebird bio’s Zynteglo and Orchard’s Libmeldy. Neither of these are meaningful for CYRX. There are likely to be other approvals in 2021, but they are not likely to contribute much until 2022.

I have put together the following sales model for these drugs for the period 2020 to 2024. It shows sales increasing from $1 billion in 2020 to $6 billion. Cryoport sales from supporting these drugs will grow apace.

I fully expect that a number of other drugs will be introduced in this time frame so that the $6 billion projected from these drugs should be (substantially) exceeded. Cryoport has disclosed that the following client companies are expected to file MAA’s or BLA’s between now and the end of 2021. I am taking a very conservative approach to this. My model does not yet include any contributions from these filings other than Gilead, Novartis and Johnson & Johnson, but it will as I understand their potential for approval and commercial potential.

- Abeona Therapeutics

- Agenus

- Atara Biotherapeutics

- Athersys, Inc.

- bluebird bio

- DiscGenics

- Gamida Cell

- Gilead

- Gradalis

- Iovance Biotherapeutics

- Johnson & Johnson/Legend

- Mesoblast Ltd.

- Novartis

- Orchard Therapeutics

- Poseida Therapeutics

- SanBio

- TCR2

- TiGenix

Detailed Sales Model for 2021

The following model estimates sales for 2021. Cryoport only owned MVE and CRYOPDP in 4Q, 2020 and this is the only period in which their results are included. I have estimated what results would have been in 2020 and 2019 if MVE and CRYOPDP had been part of Cryoport in those years. Here are key assumptions for 2021:

- Sales from commercially supported products are driven by the previous model.

- Sales from supporting clinical trials are difficult to predict. Sales in 4Q, 2020 were up 40%. With the biotech industry awash in cash and the easing of the negative effect of COVID, I am looking at a 45% increase over pandemic affected 2020 results.

- Reproductive and animal health results are projected to grow at pre-pandemic levels. Note that animal health sales now include about $7 million of revenues each quarter due to MVE.

- MVE and CRYOPDP are projected to grow at the mid-point of their pre-COVID growth rates of 5 to 10%.

The resulting model shows that pro forma sales in 2020 were $173 million and are projected to increase 17% to $202 million in 2021. My 2021 sales estimate compares to a consensus estimate of $200 million.

Sales Beyond 2021

The Outlook for Cell Based Therapies is Awesome

Please see my report Cryoport: We Are Just in the First Inning for an in-depth discussion of the exciting potential.

What About MVE and CRYOPDP

Here is what CEO Jerry Shelton said about MVE and CRYOPDP on the 4Q conference call.

“We certainly didn't buy these companies for what they had been doing. We bought them for what they will do for Cryoport and carrying out its mission. Both companies were part of very large companies in which they were insignificant. Not much attention was paid in terms of direction, support, et cetera.

Within Cryoport, MVE and CRYOPDP are strategically very important. They will perform differently than in the past. It will take time to make these transitions, but investors will see metrics moving in a positive and upward direction. Top line growth rate will accelerate and margins will improve because of Cryoport’s market position, they will be participating in a much more important way in markets in which they heretofore have either not participated in or participated on a very limited basis. Cryoport has identified $100 million of synergies from these acquisitions over the next five years as they benefit from being a part of Cryoport.”

A Close Look at Cryoport’s Competitive Advantages

A significant competitive advantage in Wall Street slang is called a moat. In my judgment, CYRX has an extremely wide moat.

Cryoport Express Shippers and SmartPak

The shipping vessel or dewar used in cryogenic shipping is only modestly important to CYRX’s competitive advantage. It certainly is state of the art, but it is something that a potential competitor could match in terms of technology given enough time and money. It is important to note that MVE was the manufacturer of dewars; its acquisition blocks any competitor from gaining access to the technology underlying Cryoport’s shippers.

Cryoportal Logistics Management Platform

The real competitive advantage, in my opinion, lies with Cryoportal, a sophisticated, cloud-based, logistics management platform, that is branded as the Cryoportal Logistics Management Platform which supports the management of shipments through a single cloud based interface, and among other things provides:

- order entry,

- document preparation,

- customs documentation,

- courier management,

- near real-time shipment tracking and monitoring,

- issue resolution,

- regulatory compliance requirements.

- a fully documented history of each shipment including chain-of-custody, chain-of-condition, chain-of-identity, and chain of compliance information for each shipment to ensure that the stability of shipped biologic commodities are maintained throughout the shipping cycle.

- a record which shows proof of meeting exacting regulatory requirements that are necessary for scientific work and/or proof of regulatory compliance during the logistics process.

- traceability of the equipment, equipment components and processes supporting each client or patient therapy during shipment.

- precise history of each container including client(s) it supported, the commodity transported, performance during transit, and each step performed before the shipper is put back into service. This includes performance and requalification history, commodity history, courier handling and performance history, calibration history, and correlation competencies that can link in field events to equipment performance.

All of this information can be readily provided to a client through the cloud based portal. It is doubtful that even very large pharmaceutical companies have this type of expertise in house and it is certainly the case that emerging biotechnology companies do not.

Industry Reputation

There are four large pharma companies that are leading the commercialization of cell based therapies; they are Novartis, Gilead, Bristol-Myers Squibb and Johnson & Johnson. Each is a client of Cryoport.

There are a host of smaller biotech companies focused on the development of CAR-T therapies, both autologous and allogeneic. None have approved products, but most are in a position to launch a product in 2021 or 2022 if their ongoing trials are successful. These are Adaptimmune (ADAP), Allogene (ALLO), Atara (ATRA), bluebird bio (BLUE) Bellicum (BLCM), Cellectis (CLLS), Crispr (CRSP), Precision Biomedicines (DTIL), Fate Therapeutics (FATE) Legend (LEGN) and Poseida (PSTX). This is not an exhaustive list.

Dependability

Cryoport states that over the last 24 months, it has delivered shipments to 9,500 patients with a success rate of 99.89%.

Who Would You Choose for Cryogenic Shipping?

It you were in a position to have to select a company for cryogenic shipping, who would you choose? Cryoport has first mover advantage in this space and I am not aware of any competitors although there may be some. The selection of a dependable provider is critical from a financial standpoint. A shipment of CAR-T cells for a single patient retails at about $325,000 and a modest deviation in temperature can ruin the product. Also faulty documentation during shipment could run afoul of regulatory requirements.

I know that if I were in the position of choosing a vendor for cryogenic shipping, it would be an easy call to choose Cryoport and indeed this is the case. Cryoport is supporting 69 phase 3 trials (many of which will lead to commercial approvals) and 459 phase 1/2 trials across North America (accounts for 79% of trials supported), Europe, Middle East and Africa (16%) and Asia Pacific (5%). This is reflective of the intensity of clinical research on a global basis.

Fourth Quarter and Full Year 2020 Highlights

Cryoport is being run to maximize market presence, not profits at this point in its development. With the acquisitions of MVE and CRYOPDP, financial results are a bit confusing. I have broken down some of the key numbers as follows:

- In 4Q, 2020, reported sales were $48.4 million, compared to $9.2 million for the fourth quarter of 2019, a year-over-year gain of 423% Management stated that organic sales growth was 36%.

- The total revenue for the full year 2020 was $78.7 million, compared to $33.3 million for 2019, a year-over-year gain of 132% with organic growth of 26%.

- The acquisitions of CRYOPDP and MVE were responsible for the surge in sales in 4Q, 2020 and full year 2020. I estimate that they contributed $29 million to full year 2020 sales (37% of total) and also $29 million to 4Q, 2020 sales (60% of total).

- I estimate that full year sales for the “old” Cryoport” were $50 million for the year, an increase of 20%

- I estimate that 4Q sales for the “old” Cryoport were $20 million for the year, an increase of 26%

- Of course, the key driver of Cryoport’s business is support of commercial sales and clinical trials of cell based therapies. I estimate that full year 2020 sales were $32.9 million, an increase of 22%.

- I estimate that 4Q, 2020 sales in support of commercial sales and clinical trials were $9.7 million, an increase of 40%. This rapidly growing and key driver of the business represented 20% of 4Q, 2020 sales.

- Commercial sales are currently driven by sales of the CAR-T drugs, Kymriah and Yescarta. In 4Q, 2020 combined sales were $270 million an increase of 24% from $218 million in 4Q, 2019. However, compared to $260 million of sales in 3Q, 2020, the sequential increase was only 4%. This raises concern that growth has peaked. I do not believe this to be the case as discussed earlier.

- Gilead introduced Tecartis, the third CAR-T product to the market in 3Q. 2020. Sales in 4Q, 2020 were $34 million and $10 million in 3Q, 2020. It has emerged as the third important CAR-T product supported by Cryoport.

- Cryoport is not being run to maximize profits. However, the non-GAAP adjusted EBITDA was a positive $3.9 million for 4Q, 2020 and essentially zero for the full year, Cryoport does not have a meaningful burn rate that will erode its cash position.

Tagged as Cryoport + Categorized as Company Reports, LinkedIn