Cryoport: The Acquisition of CRYOPDP Looks to Be a Major Coup (CYRX, $36.51, Buy)

Overview

Cryoport announced the acquisition of the French company, CRYOPDP on Thursday, August 20, 2020. The stock market gave the acquisition a thumbs up as the stock closed at $38.82, up 4.7% on the Friday. Today, the stock has given up part of this gain. My initial reaction (in line with the market) is that this is a very good strategic fit that greatly extends CYRX’s global footprint and significantly expands the product offering from a focus primarily on cryogenic shipping to now covering the entire breadth of temperature controlled shipping ranges. These acquisition benefits are exactly in line with the key strategic objectives of CYRX. Importantly, this acquisition goes far toward accomplishing these goals much sooner than if Cryoport were to build this infrastructure on its own.

The financial terms of the deal seem quite attractive. Cryoport is paying about 1.2 times projected 2020 revenues. The acquisition will probably double 2020 revenues of Cryoport to over $90 million and will be immediately accretive. CRYOPDP is said to be profitable and cash flow positive although no figures have been released on net income or EBITDA. Cryoport will pay for the acquisition with about $58 million of cash. This will still leave it in a strong cash position of $150 million and the combined companies should be cash flow positive in 2021. It has more than ample firepower for more acquisitions and capital spending needs

My View of the Acquisition

While I agree with the market that this is a great deal for Cryoport, I must express some caveats. My analysis is based on press releases and going over the CRYOPDP website. This is certainly less than thorough and at this point, I have only a rudimentary understanding of CRYOPDP. It may take a year or two for me (and other investors) to really analyze this acquisition. This is a big bite for Cryoport and such large acquisitions can sometimes create unexpected integration problems. Also bear in mind that this is a French company and will be operated as a separate subsidiary so that we stockholders will be dependent on execution from a management team that we know nothing about. Cryoport’s small management team could be stressed in the integration effort.

That said, I have come to have great confidence in the management of Cryoport. This causes me to trust their judgement that there will be powerful synergies in merging Cryoport and. My initial view then is that this is a very positive strategic acquisition acquired at an unbelievably cheap price.

The acquisition is anticipated to create substantial synergies. It immediately adds over 250 new clients which nearly doubles the base of 265+ clients now served by Cryoport. CYRX management believes that they can create over $100 million of sales and cost savings over the next five years. I am not exactly sure how this breaks out between sales and costs, but it looks to be pretty significant.

Global Footprint Will Be Significantly Extended

CRYOPDP has 200 employees and operates 22 facilities in 12 countries that serve 150 countries. It has a strong presence in Europe, Middle East, Africa and Asia Pacific; India is an area of special focus. Cell and gene therapy research and commercialization is a global business, needing global logistics support. As a small company, Cryoport was initially focused on the US and was just beginning to expand its global presence. In 2019, only 15% of revenues came from outside the US and it had just two facilities outside the US, one in Amsterdam and another in Singapore. Cryoport estimates that it costs about $4 to $6 million to build a new logistics facility. This suggests that Cryoport might have had to spend perhaps $100 million over a few years to duplicate the CRYOPDP logistics network.

Extending Cold Chain Support Service Offerings

Cryoport has brilliantly carved out a niche in cell and gene based therapies that require cryogenic shipping. It currently is supporting 66 phase 3 trials which is an amazing 68% of phase 3 clinical trials in regenerative medicine. The Company is now focused on broadening its support services in other temperature ranges:

- cryogenic -196 C to -150 C

- deep frozen -78 C to -20 C

- frozen -25 C to -15 C

- refrigerated +2 C to +8 C

- controlled ambient +15 C to +25 C

Cryoport’s current customer base has needs to ship other products at temperature ranges warmer than cryogenic temperatures. CRYOPDP supports all temperature-controlled ranges allowing for the support of valuable products that are not shipped cryogenically, e.g. viral vectors and monoclonal antibodies as well as clinical supplies needed to support clinical trials.

Why Was the Purchase Price So Cheap?

This deal looks to be very synergistic from a business standpoint and accretive from a financial viewpoint. The purchase price of about $58 million (€49M) was about 1.2 times 2019 revenues of around $50 million (€42M). Management indicated that revenues would be flat in 2020 so the purchase price is also about 1.2 times 2020 estimated revenues. Over the period 2017 to 2019 revenues grew at about 5% and the company is cash flow although EBITDA has not yet been disclosed. I would have thought that the purchase price would be 3 to 5 times revenues. So what gives?

I asked management why the purchase price was so cheap. Their answer was that CRYOPDP as a part of the French company Air Liquide was a non-core asset that it decided to dispose of. CRYOPDP was put up for sale and was purchased by a private equity group called Hivest Capital in March 2020. Jerry Shelton, CEO of Cryoport, said that the deal was struck with Hivest before he found out and could get to Air Liquide. He asked Air Liquide to reopen the bidding, but they said that they would honor its commitment to Hivest.

Mr. Shelton then went to Hivest to see if they would be willing to flip this asset. As explained to me, Hivest has invested in food logistics businesses and viewed CRYOPDP as an extension of this strategy. However, after detailed discussions with Mr. Shelton, they apparently came to the view that this was a more complex and very different business from others in their portfolio. Mr. Shelton was able to convince them to take a small profit by flipping the asset to Cryoport.

I can’t really offer anything more on how this deal came to Cryoport. I take management at their word. This appears to be a highly strategic acquisition at an incredibly cheap price.

Pro Forma Sales for the Combination

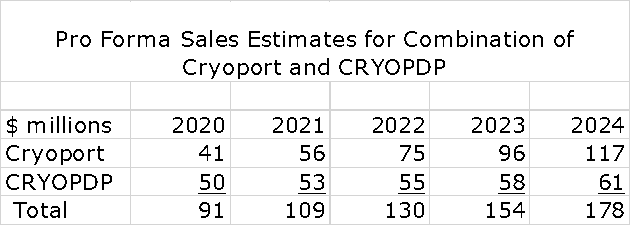

So what might the sales of the combined companies look like over the next few years? Let me approach this in a series of steps. I just published a report with my projections for Cryoport revenues through 2024. See this link. The assumptions used were by intentionally ultra conservative as I will discuss shortly. I have taken these estimates and combined them with a CRYOPDP projection that shows its sales growing at 5% per year which was the rate of sales growth for 2017 to 2019; this essentially assumes no synergies are realized. As shown in the following table, this leads to an estimate of $91 million in pro forma sales in 2020 and $178 million in 2024.

Let me emphasize that $178 million is not my actual expectation for sales in 2024. This is just a starting point. It is not unreasonable to think that sales could exceed $300 million in 2024. Here is why.

- My projection of sales for the “old” Cryoport of $117 million in 2024 could be extremely low. The all important commercial sales component which will drive revenues in coming years is based only on the approvals of about 10 or so BLA/MAA approvals for products of clients in the 2020 to 2024 time frame. However, Cryoport is expecting 6 BLA/ MAA filings in 2020 and 17 in 2021. I am omitting any sales estimates for products that have not been approved with the exception of Ryoncil which was just recommended for approval by a vote of 9 to 1 by an FDA advisory panel and liso pro which looks to be a pretty certain approval. So, I am not including any sales projections for perhaps 13 other potential BLA/MAA approvals through 2024. In addition, Cryoport is currently supporting 66 phase 3 trials and 425 phase 1/ phase 2 trials. If successful, each of the phase 3 trials will lead to the filing on a BLA/MAA as will many but not all of the phase 1/ phase 2 trials. I am also not including any sales projections for these. Why not? It takes a lot of work to arrive at a sales estimate for unique new products and I just haven’t had the time to do this for many products that are likely to come to market in the immediate future. Rather than just making a wild guess, I will wait until I can make a reasonable estimate.

- This table does not include any sales synergies from the acquisition. Cryoport anticipates $100 million of cost and sales synergies due to the acquisition.

- There are over 500 clinical trial under way to deal with COVID. As of the start of 2020, this was not expected. This frenetic activity is largely in addition to the trials underway in regenerative medicine and could substantially increase the growth rate in clinical trial revenues. My model doesn’t take this into account.

- There is the potential for more acquisitions given the market presence of Cryoport and its strong cash position. These could have a marked effect on sales, but I have no estimates in my model.

Why My Sales Projections for the “Old” Cryoport Are Probably Way Too Conservative

I re-emphasize that these projections are quite conservative. The driving force behind Cryoport’s projected sales through 2024 and beyond will be the support of commercial products. These sales are driven by new regulatory approvals- called BLA in the US and MAA in Europe. A BLA/ MAA can be for either approval of a new product or a significant new indication for an already approved product. The potential commercial potential for a BLA/ MAA approval can vary widely, but in general the sheer number gives a meaningful, but imperfect insight into the Cryoport/ client companies pipeline.

I estimate that Cryoport sales supporting commercial products will be about $12 million in 2020. These revenues stem from one BLA and one MAA for Kymriah and one BLA and one MAA for Yescarta. One other Cryoport supported product, bluebird bio’s Zynteglo has achieved a BLA, but its commercial potential is very small. Essentially all of Cryoport’s current sales are due to two BLAs and 2 MAAs. Cryoport expects that its clients will file 6 BLA/MAAs in the remainder of 2020 and 17 in 2021. The Company is currently supporting 66 phase 3 trials and 425 phase 1/2 trials. If successful, each of the phase 3 trials should lead to the filing of a BLA and MAA as will many but not all of the phase 1/ phase 2 trials.

While these numbers are a bit staggering, it is hard to put them in perspective. Some deal with the treatment of unique new disease, but in some cases, the BLA/MAA could be for a product that competes directly with an approved product. For example, Bristol-Myers Squibb is seeking approval for liso pro which has the same mechanism of action as Kymriah and Yescarta and is seeking approval for the same indications. This product should expand the market, but it could also take sales from Kymriah and Yescarta. Also along this vein, CAR-T products targeted at the BCMA antigen have enormous potential in multiple myeloma. Bristol-Myers and Johnson & Johnson are closest to market, but there are numerous other BCMA drugs in development. This means that not all BLAs/MAAs are unique opportunities. I hope I didn’t lose you in the above discussion. I just wanted you to appreciate that while the number of BLA/MAA filings or potential filings is a valuable metric, it has to be interpreted carefully.

Let me explain why I think that my sales projections though 2024 for the “old” Cryoport were put together and why they are conservative. Please refer to my recent report on Cryoport that resulted in the projection of $117 million of sales in 2024. Here are the key assumptions in my model:

- There are a large number of autologous and allogeneic CAR-T drugs under development that will try to improve on the safety and efficacy of Kymriah and Yescarta. These could erode their sales while expanding the overall market. I can’t really project how sales will break out among a number of products that should be coming to market in the 2022 to 2024 time frame. I am not including them in my sales model. My model probably overstates sales of Kymriah and Yescarta, but omits sales of new drugs. Overall, the number shown in my model is conservative.

- There are a large number of autologous and allogenic products being developed for targeting the BCMA antigen in treating multiple myeloma. This appears to be a very significant opportunity for Cryoport. As mentioned, BMY and JNJ may be first to market, but there are a large number of comparable products in development. I can’t really project sales for each of what might be 10 or more regulatory approvals of different products targeting these indications so I just lumped all products into one category.

- BMY’s liso pro is a direct competitor to Kymriah and Yescarta. BMY claims that it is safe enough to use in the community setting. Side effect concerns limit Kymriah and Yescarta usage to major academic centers so if liso pro can be used in the community setting, it would create very meaningful incremental sales. My model assumes no such safety differentiation for liso pro so that all of its sales come at the expense of Kymriah and Yescarta.

- The recently approved Tescarta that is targeted at unique indications of r/r MCL and r/r CLL which Kymriah and Yescarta are not approved for. It has sales potential may be comparable to Kymriah and Yescarta and will not affect their current sales.

- The only other product I model is Mesoblast’s Ryoncil. This is progenitor cell derived from mesenchymal stem cells. An FDA advisory committee just voted nine to one to approve the product for steroid resistant graft versus host disease. However, the FDA has concerns about quality assurance that creates some uncertainty on timing of approval. This indication has moderate potential, but a similar product in development is in phase 3 trials for congestive heart failure with a data readout anticipated in late 2020; success in the trial would lead to blockbuster sales. This potential is not included in my sales estimates.

- Of the 23 potential BLA/MAA filings in 2020 and 2021, I am including less than half in my sales projections

How Might This All Translate into Profits

So what about profits? Cryoport management has a goal of hitting an EBITDA margin of 30%. If so, the $178 million of revenues could create $53 million of EBITDA and assuming a 22% tax rate could result in EPS of $1.08 based on the current 38 million shares outstanding. My expectation is that revenues and EPS will be much, much higher than $178 million and $1.08 in 2024 so just look at this as a case upon which to build. I also expect Cryoport to remain in a high growth mode beyond 2024 fueled by the explosion in cell and gene therapy development of which we are only in the first inning.

Tagged as Cryoport acquisition of CRYOPDP + Categorized as Company Reports, LinkedIn