Cryoport: I View the Just Completed Equity Offering as a Major Positive (CYRX, Buy, $18.00)

Overview of Equity Offering

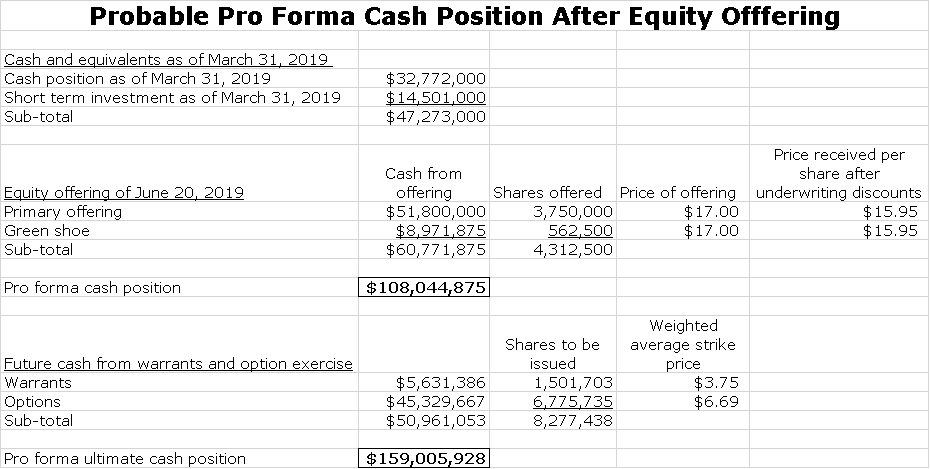

Cryoport quickly and very successfully executed an equity offering after the close on June 19, 2019. It sold 3,750,000 shares at a price to investors of $17.00 per share. This was at a discount of about 9% from the closing price of $18.62. After underwriting discounts, Cryoport received $59.80 million which translates into $15.95 per sold share. It is highly probable that the Green Shoe will be exercised which will result in 562,500 additional shares being sold at $15.95 which should bring in an additional $8.97 million.

I think that this deal is a significant positive for investors for a number of reasons listed below which are not necessarily in order of importance:

- Cryoport has already established itself as the clear market leader in services and equipment needed for cryogenic shipping, which is mission critical to rapidly emerging cellular and gene therapy technologies. Remarkably, it has achieved this in spite of being a tiny, not that well known, company with limited financial resources. This speaks to the quality of its services and lack of competitive alternatives. The strong, new cash position meaningfully strengthens and cements this leadership. Customers who might have had concern about financial soundness and staying power have been assuaged by this capital raise.

- It raises institutional investor awareness. Ownership of Cryoport has been concentrated in retail and small institutions. This deal introduces CYRX to a much broader pool of larger growth stock investors, some of whom participated in the deal.

- Along with this, we may see wider and more appropriate analyst coverage. The Company has not been widely covered and some of the analysts covering the Company are/were logistics analysts covering companies like railroads. Coverage of Cryoport requires some understanding of cellular and gene therapy.

- Market capitalization is now of sufficient size to move CYRX from a micro-cap company to mid-cap. This enlarges the number of potential institutional investors who might consider investing in the stock. The well-received offering further bolsters awareness.

- Cryoport should become cash flow positive later this year and it now has a cash position of about $108 million assuming issuance of the Green Shoe. Investors do not have to be concerned that CYRX will need to do future offerings to offset operating losses.

- Cryoport has a nice warchest to pursue acquisitions. It recently announced the acquisition of Cryogene which moves Cryoport in a meaningful way into the biostorage business. It now has the resources to pursue a number of other acquisitions.

- The new, very strong balance sheet enhances the attractiveness of Cryoport to companies it might want to acquire.

- Biopharma is a global business and Cryoport has started and will continue to build a global infrastructure. There should be no cash restraint to building out its global infrastructure.

- Cryoport came public through a reverse merger with a shell company in May 2005. This can be a stigma for a stock. However, the strong operational performance of Cryoport and this well executed and received offering should establish the Company’s position as a high quality growth stock.

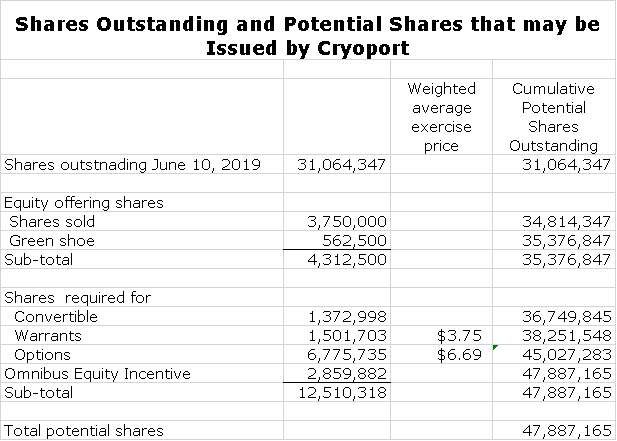

Shares Outstanding After Offering

Cryoport had 31.1 million shares outstanding before the offering. Assuming execution of the Green Shoe this will add 4.3 million shares. In addition, Cryoport will eventually need to issue shares for an outstanding convertible, well in the money options and warrants, and a stock incentive program for employees. All in and as shown in the following table, this could rather quickly bring the total share count to 47.9 million shares.

Valuation Discussion Based on Sales and Comparison to Repligen

At the time of the writing of this report, CYRX is selling at $18.00 per share. Based on 47.9 million shares this would represent a market capitalization of $862 million. What happened to my tiny micro-cap company?In my May 20, 2019 report, I built up a sales model for Cryoport through 2022. This model projects explosive growth for Cryoport even though I tried to used decidedly conservative assumptions in building the model.

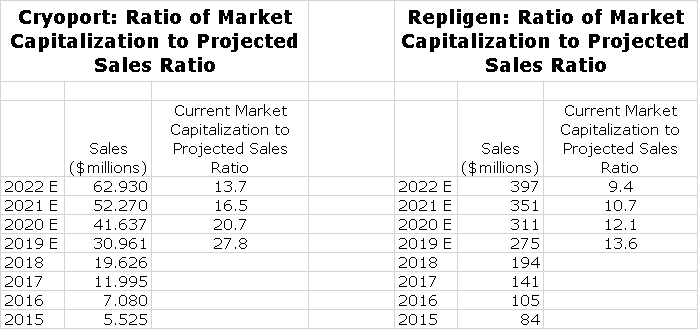

I am currently focusing on sales to judge CRYX’s valuation; the company is still too immature to base valuation on earnings. I think that investors will focus on sales levels and sales growth over the next couple of years. In the following table I show the ratio of market capitalization (price of $18.00 multiplied by 47.9 million shares) to projected sales for each year through 2022. Gulp!! As can be seen in the next table, Cryoport is sporting a pretty hefty valuation.

I often compare Cryoport to Repligen although they address different markets as Repligen is involved with biomanufacturing. The commonality is that both are propelled by strong macro trends driving the biopharma industry that they serve. Repligen is a more mature company than Cryoport although it is still in a young, rapid growth phase. It also has meaningful earnings.

Let’s compare the market capitalization to sales ratio for each. I use my projections for Cryoport as put together in the previously cited May 29, 2019 report. Repligen has given guidance that it expects 2019 sales of about $240 million (the acquisition of C Technologies could bring this to $275 million) and the goal is $450 million of sales by 2023. We can use the 2019 to 2023 compounded annual growth rate to project RGEN sales for 2020, 2021 and 2022. Repligen is currently selling at $82.49 and has 45.5 million fully diluted shares giving it a market capitalization of $3.8 billion. The following table shows the comparison of Cryoport and Repligen based on the ratio of market capitalization to sales.

Repligen’s valuation is not modest and Cryoport’s is roughly twice that of Repligen. However, both companies have the potential to grow significantly faster than shown above through acquisitions. I would also point out that Repligen’s guidance suggests a compounded annual growth rate of 13% for 2019 through 2023 and based on my projections, CYRX sales would grow at 27% per annum over this same time frame. So what to do with the stock of Cryoport? I continue to be a buyer. I think that it remains an undiscovered stock with a superlative business model that promises a decade(s) of strong growth. The one thing I have learned from my many years of investing is not to try to make a judgment on the appropriate price of an emerging growth company and to focus on the fundamentals.

Cash Position Updated

Cryoport ended the March 31, 2019 quarter with $47.2 million of cash and equivalents. The equity offering, assuming exercise of the Green Shoe, will bring the cash position to $108 million. Since I am counting the options and warrants in my share count, I must also include the cash that will flow in as these are exercised. I do this by multiplying the number of shares to be issued by the strike price. Since the strike price is so much below the current market price, I am assuming that all options and warrants will ultimately be exercised. With this consideration, the ultimate amount of cash available to the Company increases to $153 million. On an historical note, Cryoport had $23.7 of cash at the end of fiscal 2018 and $15.0 million at the end of fiscal 2017.

Tagged as Cryoport, Cryoport Equity offering June 20 + Categorized as Company Reports, LinkedIn