Antares: Multiple New Product Launches Make for Extreme Complexity in Earnings Forecasts for 2019 to 2021 (ATRS, Buy, $3.59)

Investment Thesis in Brief:

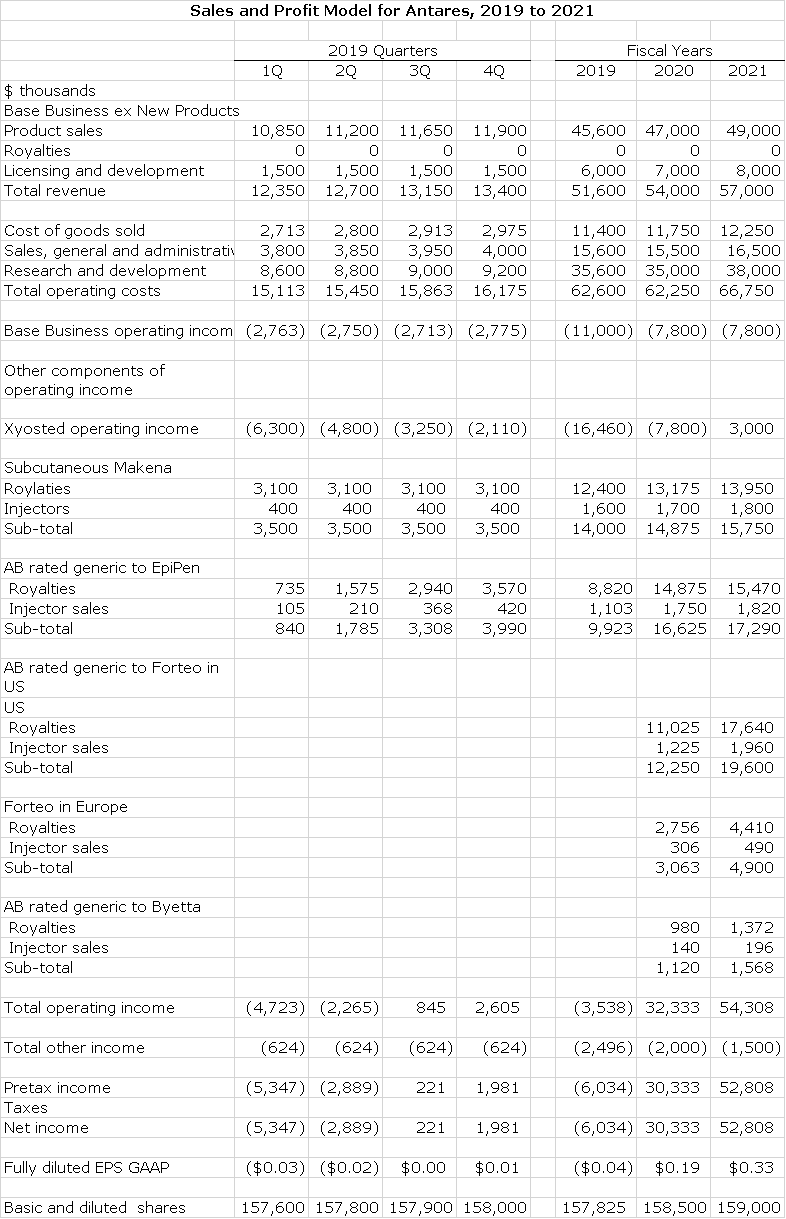

In this report, I have put together an earnings forecast projecting EPS of (0.04) in 2019, $0.19 in 2020 and $0.33 in 2021. There are so many variables involved in my forecast that the error bars around these numbers are huge and they should be taken with a grain of salt. Still, I think they give an insight into the potentially impressive trend and magnitude of EPS over the next three years. If in 2020, the Street consensus EPS estimate for 2021 is indeed $0.33, I think that the stock could sell at 20 to 30 (or more) times earnings resulting in a stock price of $6 to $9 or more.

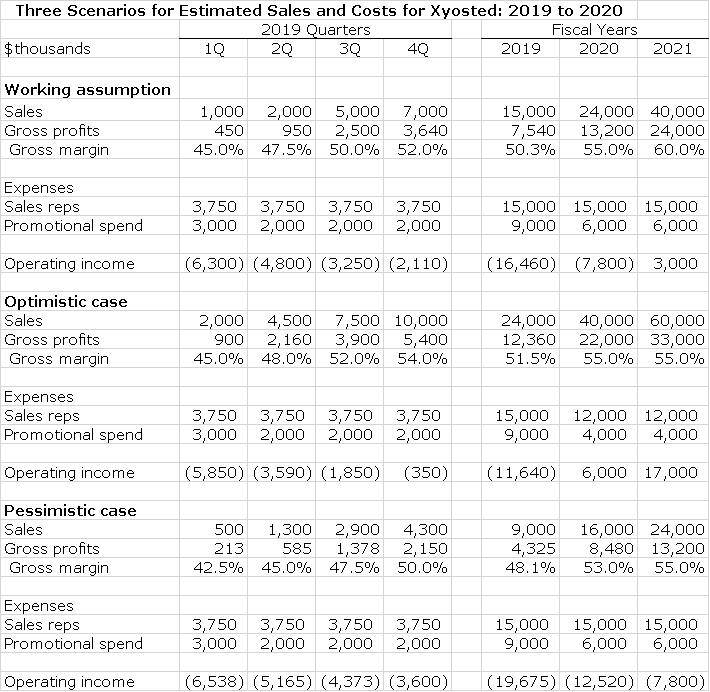

The launch of Xyosted is a company changing event. The goal of management is to reach peak sales of $200 million over the next five or more years and I think this is quite achievable. If so, it could power explosive earnings growth for some years beyond 2021. I do want to make you aware that in 2019 there may be investor angst about the pace of the Xyosted launch. My estimate for sales in 2019 is $15 million. This is close to Street consensus but who knows. Reimbursement and formulary acceptance hurdles grow higher each year and the first year of launch for a new product can be difficult. Seemingly, each new product launch is more disappointing than the last.

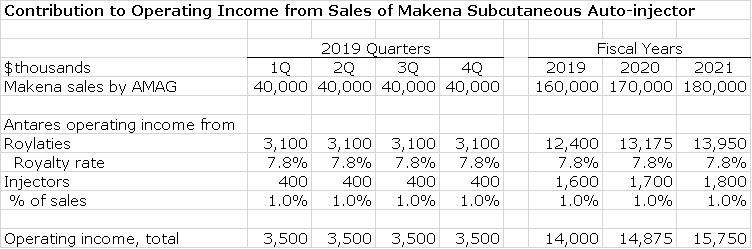

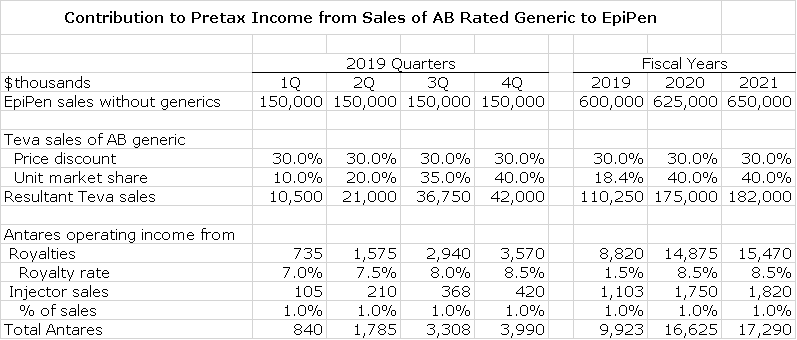

I am also not sure that the Street has figured in the costs of launching Xyosted; hiring 60 new reps could cost $15 million and promotional expenses associated with the launch could add another $9 million. I am estimating that Xyosted will have an operating loss of $16 million in 2019. Some analysts may not be expecting a loss of this magnitude. At the same time, I project that the 2019 operating income from subcutaneous Makena will approximate $14.0 million and the operating income from the AB rated generic to EpiPen could add $10 million. Management has not given any guidance on earnings for 2019. I am flying solo with these forecasts.

Investment Overview

The time is past when an investment in Antares hinged on an evaluation of the pipeline potential for Antares. Now three key new products are being commercialized and two other are close to coming to market. The stock outlook for the next two or three years will be largely determined by how these products perform in the marketplace.

- The subcutaneous dosage form on Makena has been on the market since April 2018 so we have an initial read on its sales in the third quarter.

- Teva announced that it began a limited launch of the AB generic to EpiPen on November 27, 2018, and will have a full launch in early 2019. This is meant to assure that Teva has sufficient supplies on hand to meet demand.

- Antares launched Xyosted on November 29, 2018.

- Importantly, an AB rated generic to Forteo could be approved in late 2019. This probably has somewhat greater profit potential than subcutaneous Makena or the AB rated generic to EpiPen.

This note focuses on issues that will affect the sales potential of each of these products and then tries to come up with a sales and earnings model for 2019 to 2021. Given the large number of variables, you can appreciate how difficult a task this is. As always, I caution that while my numbers look precise there are large error bars around my projections and you should focus on trend and magnitude.

Xyosted

A very important part of investor focus in 2019 will be on Xyosted, the most important asset of the Company. I am a bit uneasy about how the launch will unfold and the resultant stock market reaction. The testosterone supplementation market is all about pharmacokinetics (PK) and Xyosted by this all important measure appears to be best in class of any of the gel and injectable formulations. Management is suggesting that peak sales (time undefined but perhaps five or so years out) could be $200 million. The US testosterone market as a whole has current sales of about $1.8 billion and is growing at 5% per annum.

I think that this goal of reaching $200 million of sales has a high probability of being reached. My concern is near term. Every year, managed care builds higher the barriers to reimbursement and formulary acceptance. These delays are intended to give managed care the time to negotiate discounts and rebates and account for the product in their budgets. It seems that each new product launch is slower than the last and makes sales forecasting difficult. The other factor is that Antares has hired 60 new reps and at an estimated expense of $250,000 per rep, this is an incremental cost of $15 million while other promotional efforts needed to support the launch could be another $9 million. Without great confidence, I am estimating first year sales of Xyosted of roughly $15 million. If so, Xyosted could have an operating loss of $16 million by my estimates. While reimbursement and launch expense issues are common to all new products, they can cause a lot of investor hand wringing as sales results in the early going are modest. There are a large group of hedge funds and market makers (I have dubbed them the wolfpack) who often attack a small company like Antares during a product launch.

Subcutaneous Makena and AB Rated Generics to EpiPen and Forteo

The subcu Makena launch appears to be going very well as AMAG management is guiding to $40 to $50 million of sustainable and growing quarterly sales. The AB rated generic to EpiPen will almost certainly be an important profit contributor in 2019 and beyond. In late 2019, approval of an AB rated generic to Eli Lilly’s Forteo is probable. This product has somewhat more US potential than the AB generic to EpiPen and unlike with EpiPen, Teva also plans to commercialize it in Europe.

Pipeline and New Product Prospects

The pipeline continues to expand as ATRS recently announced a collaboration with Pfizer on an undisclosed product (new molecular entity) and before the end of the year ATRS is expected to announce a new product that it will develop for its own account. Both the Pfizer product and the new Antares product are rescue pens like the AB generic to EpiPen. Beyond that, nothing has been disclosed. However, the injection technology of Antares can improve and differentiate a large number of drugs that Antares can develop in collaborations with large biopharma companies or on its own. It promises to be an ever greening pipeline.

With the addition of the 60 Xyosted reps and the existing 30 Otrexup reps (who will also promote Xyosted), Antares now has a meaningful commercial structure. This allows the Company to pursue products developed by other companies if they are a fit. As we have seen time and time again, product acquisitions can meaningfully spur the growth of a specialty pharmaceutical company.

Sales and Earnings Model for 2019 to 2022

Building a sales and earnings model for Antares is an analyst’s nightmare because its business model combines development of products for its own account and collaborating with corporate partners to develop products in return for royalties, sales of injection devices to the partners and licensing and development fees. Each of these have very different cost structures associated with them. Antares provides a reasonable breakout of sales by different products, but the costs are all lumped together. This has caused me to take an approach in which I focus on operating income. In this report, I have built a distinct operating income model for:

- Xyosted that is based on sales projections and the directly associated costs of new sales reps hired to promote the product and launch expense.

- Subcutaneous Makena and AB generics to EpiPen, Forteo and Byetta. These are based on estimates of royalties and profits from injector sales to partners.

- The current base business that on the sales side is primarily driven by Otrexup and the AB rated generic to Imitrex and on the cost side includes all corporate expenses other than those attributable to Xyosted.

The underlying assumptions for each of these is explained in respective sections of this report. Obviously, the resultant model is very different but much more informative than the way that Antares reports sales and earnings. The resultant operating income model is shown below:

I want to reemphasize that while the numbers in the above table give a sense of great precision, in reality this represents only one of a vast number of possible outcomes. The purpose of this table is to get you to think about the importance, trend and magnitude of the key components of the operating income model. I would be amazed if there are not several major deviations from my estimates. Some of the key things to consider are:

- The operating loss for the base business stems from my allocating to it all the fixed coasts of selling, general and administrative and all research and development expense. An accountant would argue that these costs should be allocated to other products.

- The assumptions on other components of operating income reflect only the variable costs associated with the product.

- The most important factor in the table is the operating loss that Xyosted gives rise to. This is very subject to sales and next in this report, I present an optimistic and pessimistic sales case that compare to my best case analysis to illustrate this.

- Estimating the operating income of subcutaneous Makena is reasonably accurate as we have seen sales from the first two quarters of its launch and AMAG management has provided guidance on future quarterly sales.

- For the AB rated generics to EpiPen, Forteo and Byetta I have estimated a royalty rate for each that is in the upper single digits range. In addition, gross profits from injector sales to partners may amount to 1% of the partners’ product sales.

- For the AB rated generics, I have to estimate how much of the unit market they will take from the branded product and what the price discount will be as well as how fast the sales ramp. This involves a lot of guesswork.

- I am showing an operating losses for Xyosted in each quarter of 2019 that diminishes as sales ramp and I am also showing an operating loss in 2020.

- My estimates show that operating income from Makena and the AB rated generics offsetting the operating losses of Xyosted and resulting in profits for 2019. Management has offered no guidance on profitability.

- This model show that as Xyosted operating losses diminish in 2020 and turns to profitability in 2021 and as Forteo enters the model in 2020 that profits begin to literally explode.

Xyosted Overview

Sales Reps Detailing Xyosted

Antares will hire 60 new reps to detail Xyosted and in addition, the 30 reps who are detailing Otrexup will also promote Xyosted. All hiring and training was completed and the product was launched on November 29, 2019. These 90 reps will be targeting about 12,000 urologists, high prescribing general practitioners and endocrinologists. This is roughly 130 doctors per rep. An advantage for Xyosted is that testosterone prescribing is dominated by a targetable number of high prescribing physicians; there is not much of total prescribing that comes from physicians who prescribe just one or two prescriptions per month.

Gaining Reimbursement

The infrastructure necessary to manage formulary access and reimbursement was put in place with Otrexup. This suggests little incremental expense will be necessary for new personnel and perhaps more importantly, the organization is well up the learning curve in understanding how to deal with payors. About 70% of testosterone use is covered by private insurance and 30% by government. Making the launch somewhat easier is that testosterone replacement is already well understood by physicians and reimbursement for other dosage forms of testosterone are nearly universal. This is a significant positive in terms of gaining physician acceptance and managed care acceptance. Antares has said that they have already had significant contact with.

Issues for Marketing Xyosted

The challenge for the Antares reps is to convince physicians that Xyosted is a much better product than the gel and intramuscular dosage forms. Testosterone replacement is all about pharmacokinetics (PK) and I am convinced that the PK data shows Xyosted by this measure is best in class for both gels (30% of market) and intramuscular dosages (70%).

Relative to the IM dosage forms that dominate the market, the administration of Xyosted is much easier and much less painful. In its clinical trials, 99% of patients said there was no pain upon administration. The IMs are given with a large 19 gauge needle every 2-3 weeks in the buttocks and this usually requires administration by a medical professional. Xyosted uses a 27 gauge needle (the same small size used by diabetics) and can be self-administered in the abdomen as is the case with diabetes. The patient never sees the needle during the administration and after injection, the needle is retracted and the device discarded. The gels are messy to administer and raise the risk of transmission of testosterone to family members. Most also must be administered once a day as opposed to weekly for Xyosted. These extremely positive attributes would suggest that Xyosted should gain wide market acceptance.

Gaining Formulary Acceptance and Reimbursement

It sometimes seems that every new product launch in biopharm is more disappointing than the last as managed care grows ever more sophisticated in putting up hurdles to early adoption. It is often the case even for products representing a major therapeutic advance that the first year of marketing is difficult and traction doesn’t occur until the second year or even later.

Getting on the formulary based on medical importance is the first large hurdle for a new product. This should be less of an issue for Xyosted as testosterone replacement is well understood and accepted. Then comes reimbursement; Antares says that it will accept tier 3 status on formularies. This suggests that these issues should not prevent Xyosted from gaining fairly broad and hopefully quick formulary approvals.

Antares management has stated that Xyosted will be available to 30% of lives covered by managed care in 1Q, 2019 and 70% by yearend. In the US, there are estimated to be 300 million covered lives. Having access to a covered life doesn’t always mean that a prescription is automatically filled, but there is a process available to do so. This may include gaining prior authorization or issuing a co-pay card to the patient. However, in all cases it allows third party contractors representing Antares to work with a payor to help the patient get the prescription filled.

The wholesale acquisition price (WAC) of Xyosted is $475 for a prescription that has four injectors or a month’s supply. Managed care plans will demand rebates so that the realized price to Antares will likely be in the $375+ range. This is roughly in line with the price of many generics. Management notes that the WAC of AndroGel, the leading gel product, is $625 per month. However, this price allows for huge rebates to managed care so that the net price for AndroGel may be roughly the same as Xyosted. These numbers have a good deal of guesstimating but if they are roughly correct, managed care plans would get a rebate of $100 on Xyosted and perhaps $250 on AndroGel. There will be an economic incentive for managed care to emphasize AndroGel. Of course, AndroGel is not that large a part of the market. I am not sure about rebates on IM products in this highly genericized market, but Xyosted rebates are probably much more competitive.

As a tier 3 product on formularies, the patient co-pay will probably be $40 to $50 per prescription. Antares intends to reimburse the patient for the co-pay so that his out of pocket cost will be zero. Interestingly, the co-pay for a generic could be $30 per prescription. From the patient standpoint, there may be less out of pocket expense with Xyosted than with a generic.

Size of the US Testosterone Market

The current annual run rate for testosterone replacement therapy in the US is about 7 million per year and is growing at 5% per year. In dollar terms it is about a $1.8 billion annual market. As I mentioned before, about 70% of the market is IM formulations and 30% is gel. I expect Xyosted to take share from both.

When CEO Bob Apple was asked about the sales potential for Xyosted at a brokerage conference, he answered that analyst expectations are that it will gain 10% to 20% of the market or $150 to $250 million. Actually, 10% of $1.8 billion is $180 million and 20% is $360 million. I guess that he supports these estimates or he wouldn’t have brought them up. He didn’t comment on how long it would take Xyosted to reach peak sales, but as a rule of thumb, it might be five years or so.

Costs of Launching Xyosted

Moving on to the cost structure, keeping a rep in the field costs about $250,000 per year or $62,500 per quarter (this includes salary and all other costs). The annual cost of the 60 new reps that were hired is roughly $15 million. To break even, a rep might have to generate 667 prescriptions per year ($250,000 divided by $375 net price per prescription). On an annual basis, each patient receives 12 prescriptions so that 56 patients could create this number of prescriptions on an annualized basis.

In addition to the cost of the reps, Antares will have to provide some promotional support to make doctors and patients aware that Xyosted is available. These further costs are due in part to free samples, buying out patient co-pays, advertising and marketing materials. I have seen large companies spend hundreds of millions in launching a new drug. Antares can obviously not afford anything like this and indeed there is no need to spend this much as doctors are very much aware of and don’t have to be convinced of the medical benefit of testosterone replacement therapy. I am guessing that Antares will spend about $9 million on promotional items associated with the launch in 2019

The final item to estimate is the cost of goods sold or gross margin on Xyosted. Antares already has facilities in place for making injectors so that they will not have to build new facilities to produce the injector so that its costs should be variable and roughly the same as other injector products. In the case of Makena, they are providing the injector and also doing the filling of the product. They have to buy the active drug ingredient and then fill the product. I think that the ultimate gross margin could be 60% or so. In the early going, it should be less, but not that much.

Sales Ramp in 2019

I think that reaching peak sales of $200 million in five years is a reasonable possibility. I almost throw up my hands at projecting first year sales; I am gun shy because investors (me included) seem to always over estimate. The superior product characteristics (the PK) of the product is a big selling point, but they will still have to educate doctors and this will take time. The reimbursement process is Byzantine and seems designed to prevent product uptake until managed care is comfortable as to how the product will affect their economics.

Because of this, I don’t have great confidence in my first year projections. I have put together three cases for Xyosted in 2019 which are based on achieving my working estimate of $15 million of sales as well as a more pessimistic case of $9 million and an optimistic case of $21 million. This is pure guesswork on my part, but the $15 million appears to be in line with Street expectations. In each case, I assume that the costs for reps, promotional spend on the launch at a combined $24. This allows me to calculate the operating income (loss) per quarter. The following shows my calculations for each level of sales.

Subcutaneous Dosage Form of Makena

Makena is sold by AMAG pharmaceuticals, a company which I follow closely. In 2017 Makena reached peak sales of $387 million, but was facing the loss of orphan drug exclusivity in February 2018 and with that the entry of generics into the market. Makena is indicated for the prevention of preterm birth in mothers who previously delivered preterm. It is given as a weekly injection for 16 to 19 weeks with a deep intramuscular injection in the buttocks. Antares developed a subcutaneous injector with meaningful advantages over the IM product. The generics entering the market will all compete against IM Makena, they cannot be substituted for the subcu.

The subcutaneous dosage was launched in April, 2018 and the first generic to the IM was approved in July. Other generics are expected to be approved by year end and early 2019. AMAG is trying to convert as much of the usage as possible to the subcu formulation. During the 3Q conference call, AMAG management reported sales of $40 million for the subcu and offered tentative guidance that it expected that sales of the subcu Makena would be durable and grow despite generic competition to the IM and indicated that near term quarterly sales could be in the range of $40 to $50 million.

In my analysis, I am assuming that Makena sales will remain flat at $40 million per quarter throughout 2019 and 2020. In actuality, I expect sales to grow, but given that we can’t yet assess the dynamics of generic competition, I am taking what I think is a conservative view. In the third quarter, royalties from Makena were about $3.1 million on $40 million of sales indicating a royalty rate of 7.8% which I am using going forward. In past reports on Antares, I have estimated profits on injector sales and applying that estimate in this case would results in a pretax profits contribution equal to 1% of Makena subcu sales. With all of these estimates, here are my projections for Makena.

AB Generic to the EpiPen

After an eternity of waiting, Teva finally received approval of the AB rated generic to Mylan’s EpiPen and launched the product on November 27, 2018. An AB rated generic means that when a prescription is written for EpiPen, a pharmacist can either fill the prescription with EpiPen or the AB generic. Teva does not have to persuade a physician to write a prescription. The dynamics of an AB launch are very much different from a situation in which a new, non-generic drug is launched to compete with an existing product. The AB launch is all about contracts with pharmacies in which manufacturers usually bundle numerous generics in a package. With its huge generic portfolio and extensive experience, Teva is a powerhouse in the launch of an AB generic. The decision to either fill the prescription with EpiPen or the AB generic is an economic one for the pharmacy. This comes down to contracting with pharmacies like CVS and Walgreen’s (Teva’s two largest accounts) in which the AB rated generic is likely part of a bundle.

Mylan no longer breaks out EpiPen sales, but Antares estimates that EpiPen has current sales of $600 million and there are four million prescriptions written each year (a prescription includes two EpiPen injectors). Mylan has publicly said that it expects to lose 40% or more of unit sales of EpiPen to the AB generic. I am using 40% in all of my projections. It has been widely reported that there are supply issues with EpiPen related to manufacturing. I can’t estimate how much of an effect this will have on the launch of the AB generic, but it can only be a positive.

To my knowledge and that of Antares, there is not another company that is anywhere close to gaining approval for a second AB rated generic to EpiPen. Given the difficulty that Teva had in gaining approval, it is likely that the entry of a second AB rated generic is some years out, if at all. Ordinarily when a first generic is launched, the price is discounted perhaps 40% from the brand name product. Then as multiple generics enter, prices can collapse. The pricing dynamics are very different here as for the foreseeable future we could have an oligopoly of two firms. It is not to the advantage of either Mylan or Teva to get into a price war. I expect that Teva will come in at a 30% price discount and that Mylan will cede perhaps 40% or more of the market to Teva.

In my projections, I first project what EpiPen sales would be in the absence of AB generic. I then make an estimate of the price discount that Teva will offer and the percent market share it will obtain. I am assuming that EpiPen unit sales grow modestly in the 2019 and 2021 time period. For 2019, I first estimate that sales of EpiPen would be $150 million per quarter without a generic entry. I then assume that after some short period of a few quarters that the AB rated generic will capture 40% of the market at a 30% price discount.

I estimate that Antares will receive a royalty of 7.5% of sales. As I explained in the section on Makena, I think that the pretax contribution from sales of the injectors to Teva will amount to 1.0 % of sales. These estimates are the basis of the following model.

AB Rated Generic to Forteo (teriparatide)

Another product in the Teva collaboration is an AB generic to Forteo (teriparatide). Teva submitted an ANDA for Eli Lilly’s Forteo (teriparatide) and Eli Lilly then filed a paragraph IV certification on March 16, 2016. This triggered the 30 month stay under Waxman Hatch before AB Forteo can be approved by the FDA. Eli Lilly has told shareholders that it expects generic competition to Forteo in the latter half of 2019. This refers to the Teva product.

Unlike the other AB rated generics, Antares is pointing to the potential approval of teriparatide in Europe as having significant potential as this is a global (not just US) deal. Marketing authorizations are being gained on a country by country basis in Europe. Antares believes that the majority of the countries that have been filed in could be approved in 2019.

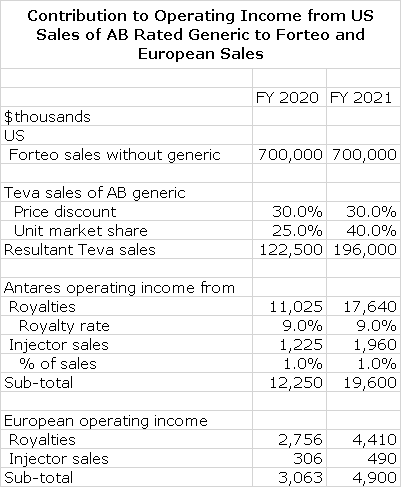

In 2019, I estimate that US sales of Forteo will approximate $700 million and European sales $700 million also. I am assuming that Teva will begin to realize US sales from the AB Rated generic in the US in late 2019 or early 2020 and will realize European sales at about the same time. I am assuming that the AB rated version in the US will be priced at a 30% discount and will capture 40% of the unit market. This is comparable to the pricing on the AB rated generic to EpiPen. I am assuming that Antares will receive a royalty of 9% of sales and that pretax profits on injector sales amount to 1.0% of revenues that Teva realizes.

Europe does not have an AB rated generic system, but has other methods to encourage the use of generics. I really don’t have any historical experience to estimate the profit potential for Antares. Still, it seems to be meaningful. As much as any as a placeholder, I am assuming that Europe will contribute about 25% of the operating income of the US. This is a pure guess.

AB Rated Generic to Byetta (exenatide)

Teva has announced a settlement of their patent litigation with AstraZeneca relating to Byetta, an injectable product for type 2 diabetes. As a result of this settlement Teva will be able to commercialize a generic version of Byetta in the U.S. upon FDA approval. The ANDA is under active review at the FDA and Teva will launch the product upon FDA approval.

I estimate that US sales of Byetta will be about $100 million in 2018. Astra Zeneca has aggressively switched patients from Byetta to Bydureon, a comparable product which requires an injection once per week as opposed to twice per day for Byetta. In 2018, I estimate US sales of Bydureon will be $500 million. The relatively small and declining sales base of Byetta presents a limited opportunity as the AB rated generic. I will only be substitutable for Byetta and not Bydureon. However, some managed care plans may require that patients prescribed Bydureon must first be given generic Byetta. This could significantly increase the potential of the Teva/ Antares AB rated Byetta.

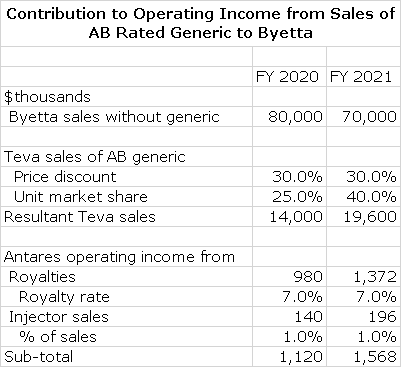

I am assuming that the AB rated generic to Byetta will be launched in the US in 2020 (it could be anytime between now and then). At that time, I would project that sales of Byetta will approximate $80 million. In line with other AB generics, I think that the AB rated product could capture 40% of the unit market at a 30% price discount to Byetta’s price. This would result in Teva sales of $ 22million. Teva is believed to have first to file status that would give it generic exclusivity for 180 days. I assume that Antares will receive royalties of 7% and that injector operating income is 1% of Teva’s product sales.

Tagged as AB rated generic to EpiPen launch, Antares Pharma Inc., Detailed earning forecast for Antares, Subcutaneous Makena launch, Xyosted launch + Categorized as Company Reports, LinkedIn

Today (1-7-19), ATRS announced that it is projecting 2019 revenue of $95-105m. With Larry’s working assumption for Xyosted, his total above comes to $84.4m (45.6m base +14m Makena + 9.9m epipen +15m Xyosted). His optimistic case for Xyosted brings that up to $93.4m or just below the announced range.

Working further off Larry’s numbers, it would seem that such a sales beat would get ATRS roughly to break-even overall for 2019. Very encouraging.

My take on the initial 2019 guidance provided today by Antares management was simply this, their guidance was a conservative hedge on the low side for what’s possible in the coming year. I’m sure they have an idea of what’s possible for 2019, at least on the low end of reality but no chance at this juncture they’ll stick their necks out beyond what is very, very safe to predict. Coming from a highly visible publicly traded company, I can personally attest to the importance of correctly managing topline and earnings expectations. Antares has barely cut their teeth with providing full year guidance. At this point they can’t afford to even cast a shaddow on the “miss” side of the fence. Because they must establish analyst credibility with whatever guidance they provide out of the gate, and with still so many unknown variables still to be defined including speed of Gx epipen share gains, Amag’s ability to retain Makena share and especially with the sub-cu administration, the velocity and trajectory of Xyosted market penetration, the typical regulatory challenges that Pfizer parrtnered program will face in keeping that drug moving along the regulatory pathway, and so forth (e.g. QSM and other), you can rest assured they’ve hedged on the under promise over deliver side of the equation. Potentially, this means that a good amount of upside may exist as the year unfolds. I see their $95M – $105M guidance as a conservative baby step, a good sign. In my opinion, upside does indeed exist beyond this range though we’ll have to wait and see how things play out before we know for sure. My guess is by the Q1 2019 earnings call (around May) we’ll get at least a hint of the upside that’s possible, but that’s just my opinion.

Larry

I started thinking about Antares initial sales projections for Xyosted, along the lines of $200M a year as stated by Antares management. The math to get there might be something along these lines. Starting with a WAC price of $475, then factoring in the typical channel discounts, rebates, and co-pay support, I’ll speculate they’ll end up with roughtly $365 per dispensed script. The current weekly run rate of TRT dispensed scripts is about 154K per week, or 8M per year and still growing. Of those 154K weekly scripts, slightly over 70% of those are for IM injected testosterone which happens to be where the script growth is showing the growth (gels have platued been flat in monthly dispensed scripts since 2017). To reach $200M annually, Xyosted would need to achieve about 10,800 scripts per week, and that’s without factoring in any price increases in the coming years. $200M equates to slightly below 7% market share of the total 154K weekly dispensed scripts tally, and roughly 10% (only 10%) of the injected segment share. For a best in class drug, with many other desirable attributes, plus being conservatively (IMO) priced, the sales projections appear not only doable but strike me as very conservative for a drug of this caliber. The competitive landscape is virtually uncontested as IM injected TRT, along with the gels, have all gone 100% generic (readL not sales forces are pushing/selling any of the generics to MDs). Said differently, there are no large pharmas to sell against – Xyosted has an open and uncontested landscape with a far superior drug (so says the PK) versus any of the other choices available. On a side note, early insurance coverage has been been ramping up impressively for Xyosted. Let’s see how quickly Antares can ramp up script growth. So far, so good.