Antares: Makena Has the Potential to Make a Very Significant Contribution to EPS (ATRS, $0.85. Buy)

Investment Thesis

Investment Overview

The launch of Otrexup has been extremely disappointing in contrast to my high expectations. Medac launched a competitive product Rasuvo shortly after Otrexup. It was my expectation that Medac would focus on educating physicians and expanding the market to the benefit of both products. In my experience, this has been the normal course of competition in situations like this. Instead, Medac focused primarily on maximizing unit market share with aggressive pricing. I also expected that managed case would embrace Otrexup and Rasuvo as cheaper and more effective alternatives to the expensive biologics after patients fail on oral methotrexate. However, the higher rebates that biologics offer actually makes them more profitable for managed care if not the people for whom they provide coverage.

Along with the slow launch of Otrexup, investors were dealt another sharp blow on expectations that an AB rated generic to EpiPen would be approved in 2016. Teva had given very strong indications that this approval was probable and imminent. Teva had indicated that it expected a Complete Response Letter, but thought the issues would be minor and easily resolved. Upon receipt of the CRL, Teva was surprised at the questions raised by the FDA and reversed its guidance saying that the product would not be launched in 2016. There is now a legitimate concern as to whether an AB rating is possible.

Otrexup and the AB rated version of EpiPen were the two primary drivers of the stock and their problems resulted in the stock getting crushed. Investors appear to have written off these two products and perhaps the impressive pipeline of Antares. The first pipeline product is an AB rated version of sumatriptan that will be launched in 2H, 2016. Antares’ second proprietary product after Otrexup is the QST injectable testosterone product could be in launched in 2018 (almost certainly with a partner). Antares plans to introduce one proprietary product per year after 2018. The Company is also likely to announce a number of development efforts like the Epi-Pen and sumatriptan projects and indeed it was announced in early April that in partnership with Teva, it is developing an AB rated version of Forteo (teriparatide) which treats osteoporosis in both older men and menopausal women. There are likely to be other such collaborations to come.

In January 2016, AMAG Pharmaceuticals announced that it is collaborating with Antares to develop a subcutaneous auto-injector dosage form of Makena (subsequently referred to as Makena SC). I think that Makena SC can be a very significant product for Antares. I am in the process of preparing an in-depth report on the sales and profit potential of Antares which should be published shortly. Before doing this, I had to do some basic research to gauge the potential of Makena and that is the purpose of this report. One of the striking things about my analysis is the significant potential impact of just this one product on Antares. Other pipeline products may have more or less potential, which puts a spotlight on the promise of the Antares pipeline.

Impact of Makena SC on Antares

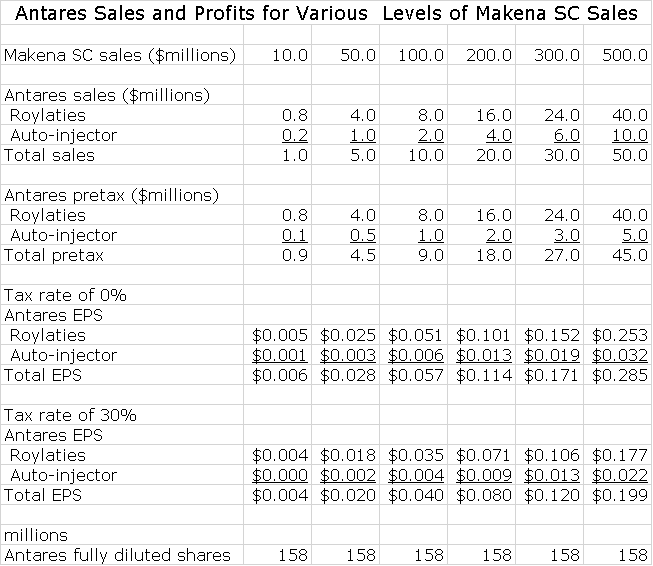

In this report, I have estimated the potential contribution to Antares sales and pretax profits from Makena SC. For each $100 million of Makena SC sales Antares might record $10 million of sales and pretax earnings of $9 million (assumptions underlying these estimates are detailed later). If Makena SC were to reach sales of $500 million in 2020 (best case scenario), Antares would record related sales of $50 million and pretax profits of $45 million. Because of tax loss carry forwards, it is possible that earnings will be untaxed in 2020 and if this is so Makena SC would contribute $0.29 to EPS. Based on a 30% tax rate, the EPS contribution would be $0.20. This contribution is almost purely incremental to whatever the remainder of the Company does as marketing costs will be borne by AMAG.

Capitalizing the fully taxed EPS estimate of $0.20 at 15 times EPS would suggest that Makena SC at a $500 million run rate would have the potential to contribute on a total standalone basis $3.00 to the share price in 2020. Each $100 million of Makena SC sales is estimated to contribute $0.60 to the share price in 2020 by my analysis. Could Makena SC achieve sales of $500 million in 2020? This is the best case estimate, but well within the realm of possibilities. The worst case would be a failure to successfully develop Makena SC, but I give this little chance. There are all kinds of in-between scenarios, but I think that even if Makena SC does not achieve the best case, that it will reach $100, 200 million or so of sales around 2020.

Medical Need for Makena SC

The principal and very important advantage offered by Makena SC is much less pain on each injection. Pregnant women on average now receive about 14 consecutive weekly intramuscular injections of Makena (subsequently referred to as Makena IM) to help them carry full term. AMAG will be conducting a study that will have the goal of establishing superiority of Makena SC over Makena IM based on less pain on injection. If this is achieved, much of the Makena IM franchise will be switched to Makena SC and Makena SC probably will be granted orphan drug exclusivity which confers seven years of marketing exclusivity.

AMAG has announced plans to do a head to head study of Makena SC and Makena IM with the objective of establishing Makena SC as superior. The measure of superiority would be a meaningful reduction in pain on injection as opposed to an efficacy endpoint. AMAG believe that it can complete this superiority trial in time to get the results included in the label of the sNDA approval for Makena SC that has a timeline of late 2017 or early 2018.

There is a Generic Issue for Makena IM

The goal of AMAG is to gain approval of Makena SC prior to the loss of orphan drug exclusivity for Makena IM on February 2, 2018.It is possible that a generic to Makena IM will enter the market around or sometime after February 2 which complicates the situation.

Makena SC Sales Potential

AMAG is projecting that Makena IM sales in 2016 could reach $310 to $340 million which would represent a 23% to 35% year over year sales increase. AMAG also suggests that Makena IM has only 35% of its addressable market and suggests that there is substantial room for growth. I see a plausible scenario in which Makena SC sales could reach $500 million by 2020 if the FDA is convinced that trial data establishes superiority to Makena IM.

Before engraving this $500 million sales estimate into a 2020 sales and profit model, one must be aware that the bioequivalence study needed for approval of Makena SC has not been completed. There is no guarantee of success, but this is a relatively straightforward development project. Likewise the superiority trial has not yet been completed, but it seems reasonable to think that a subcutaneous injection will cause much less pain than intramuscular. As a further note of caution one should consider that based on its well established playbook, managed care would be expected to do everything possible to promote the use of a generic to Makena IM and to block conversion of Makena IM to Makena SC. However, they would then be in the position of forcing pregnant women trying to avoid a preterm birth to undergo a meaningfully more painful weekly injections over 14 weeks. Very importantly, if Makena SC is judged to be superior to Makena IM, management care would have to acquiesce and the conversion would be rapid.

What is Makena?

The Active Pharmaceutical Agent

The active agent of Makena is a synthetic progestin called hydroxyprogesterone caproate. Progestin refers to a group of drugs that mimic effects of the female hormone progesterone that has various functions, one being to help maintain a pregnancy. Makena IM draws on this biological property and is indicated to reduce the risk of preterm birth in women pregnant with one child (singleton) who have previously delivered pre-term infants. It is given as an intramuscular injection once a week that is started between 16 and 20 weeks of gestation and is continued through 37 weeks of gestation or delivery, whichever comes first.

Hydroxyprogesterone caproate was introduced in 1956 by Squibb under the trade name Delalutin and obviously is generic. Delalutin was approved for use in non-pregnant women for several indications including advanced uterine cancer, amenorrhea (absence or skipping of menstrual cycles), and uterine fibroids. Makena IM was approved by the FDA on February 4, 2011 under sub-part H accelerated approval for the very different indication of preventing preterm delivery in pregnant women with a history of preterm delivery. For this indication, Makena IM was given orphan drug status that expires on February 2, 2018. The FDA withdrew Delalutin from the market in 2000 at the request of Squibb, which decided to no longer market the product.

Clinical Trial that Led to Approval

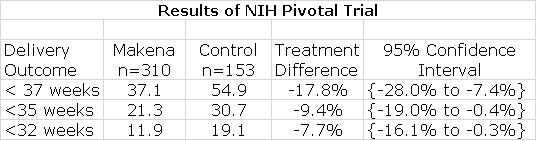

The approval of Makena IM was based on a randomized, double-blind study conducted by NIH and published in the New England Journal of Medicine in 2003. It enrolled 310 women on Makena and 153 on placebo who had previously delivered preterm and were considered to be at particularly high risk of another preterm delivery. The results were as follows:

As shown by the confidence intervals, Makena showed statistically significant improvement over control in reducing premature delivery at these three stages of delivery and this was sufficient for FDA approval.

Makena’s Commercial Success has been Stunning

The company that originally gained FDA approval of Makena IM in 2011 using the subpart H filing strategy was KV Pharmaceuticals. The FDA awarded orphan drug status which gave Makena IM seven years of marketing exclusivity. Prior to Makena IM’s approval, formulations of hydroxyprogesterone caproate for injection could be obtained for a specific patient from a number of compounding pharmacies across the nation. KV announced that the price would be $1,500 per injection which compared to $10 to $20 for a dose prepared by a compounding pharmacy. This caused an enormous uproar at the time and in response KV cut the price to $750 per injection, which is probably discounted by about 20% to $600. Based on an average of about 14 injections per pregnancy, this amounts to a total cost of about $8,400 per patient. AMAG subsequently purchased Makena IM in August 2014.

Makena IM enormously benefitted from an FDA statement in June 2012 in which FDA recommended using an FDA-approved drug product, such as Makena IM, instead of a compounded drug except when there is a specific medical need (e.g., an allergy) that cannot be met by the approved drug. This action was prompted by deaths resulting from the use of injectable steroids that were formulated by compounding pharmacies. They did not adhere to good manufacturing practices allowing pathogens to grow in the (what were supposed to be) sterile vials for injection resulting in a number of deaths. This FDA action essentially created an open playing field for Makena.

Makena was introduced in late 2011 and at the time of acquisition of Makena IM by AMAG in September 2014, revenues for the 12 month period ending August 31, 2014 were $130 million up 75% from the comparable prior year sales of $75 million. Under AMAG’s control, Makena’s revenues in 2015 were $252 million up from a pro forma $166 million in 2014. The guidance for sales in 2016 is $310 to $340 million. It has been an enormous commercial success story in the biopharm industry. The guidance for 2016 is based on the prospect for 30% growth in Makena IM. There has been a 5% price increase, but most of this growth is based on increased unit volume. Taking share from compounders figures in importantly in this guidance based on life extension strategies.

Makena Product Life Extension Strategies; Where Antares Comes In

Orphan drug exclusivity for Makena IM expires on February 2, 2018 and this could lead to generic competition then or sometime after that date. AMAG has formulated an impressive strategy to improve the medical value of the Makena franchise and to extend marketing exclusivity. The first product life extension strategy is based on the recent approval of Makena IM in a single dose, preservative free vial. Currently, it is supplied as a vial containing five doses. The single dose has significant advantages that may transition much of the market away from the current five dose vial.

The second important strategy involves a partnership with Antares to develop Makena SC, the subcutaneous auto-injector. Makena IM is an oily and viscous solution (like testosterone solutions). Each dose is administered as a 1 milliliter injection containing 250 mg of hydroxyprogesterone caproate that uses a 21 gauge needle with a length of 1.5 inches. Gauge is a measure of needle diameter and somewhat paradoxically the smaller the gauge, the larger the needle diameter; the larger the gauge, the less the pain of injection. The product is supplied in a vial containing enough for five doses.

Makena IM must be injected intramuscularly by a health care professional, at a physician’s office or in the home health care setting because of difficulty in giving the intramuscular injection and the pain of that injection. In the NIH study, the most common side effect of Makena was 35% incidence of injection site pain which was about the same as 33% in the control group Obviously this was due to the diameter and length of the needle used for injection in both groups. The pain of injection is the greatest drawback to Makena IM therapy. This is made vividly clear when you read the experiences of women who have taken Makena IM as reported on a website.

There is a significant unmet medical need to reduce the pain and discomfort caused by the pain of Makena IM injections and this is where Antares comes in. Like older testosterone solutions which QST is intended to obsolete, hydroxyprogesterone caproate solutions are oily and viscous and require intramuscular injections. The technology developed by Antares in developing QST can also be applied to Makena. This gives rise to the promise that Makena SC can be delivered like QST using a larger gauge needle (smaller diameter) that can be given with a much less painful subcutaneous injection. It may also be important that it has the potential to be administered by the patient at home. In my opinion, every patient and almost every physician would prefer Makena SC over Makena IM. The stumbling block to rapid acceptance would be managed care which I will address later.

The Marketing Opportunity for Makena IM Afforded by the Single Dose Vial

Market Factors

Makena IM has 35% of its addressable market and compounding pharmacies have 38%. This implies that at the price charged for Makena IM, the US addressable market in dollar terms is about $750 million. From a reimbursement standpoint, about 50% of U.S. births are covered by Medicaid and about 50% are covered by commercial payors. AMAG’s business had been more oriented toward the commercial side. However, they have had considerable success recently on the Medicaid side so that sales to that sector have been growing faster. AMAG is guiding for a 50-50 mix in 2016.

How Single Dose can Take Market Share from Compounding Pharmacies

AMAG received approval for a single dose preservative-free vial on February 23rd, 2016 and is planning to launch early in the second quarter of 2016. The single dose provides meaningful opportunities to take significant market share from compounders. Remember that Makena IM today has about a 35% market share and compounding pharmacies have about 38%.

Currently, Makena IM is supplied in a vial that has enough drug for five injections (remember there is one ejection per week). Each week, one fifth of the drug is withdrawn and given as an injection. Over the course of five weeks, the vial must be stored for the patient for whom Makena IM was prescribed. Storage is at room temperature but the product must be stored upright and out of sunlight. The package insert requires that Makena IM must be given by a health care professional so that the majority of injections are given in OB/GYN offices or by home health care professionals. These providers must deal with the logistics of the five dose vial and while this is not a foreboding issue, it is time consuming. Also, the five vial doses costs about $3,000 so if the vial is misplaced or contaminated, it can be costly for the provider to replace. The one vial dose greatly simplifies the logistical issues of storage and safe keeping of the vial.

I emphasized earlier that the great success of Makena IM was a result of an FDA statement that recommended the use of FDA approved products over products made by compounding pharmacies. The FDA stated that the only reason to use a compounded product is if there is a valid medical reason. In the case of Makena IM this reason can be a concern that the patient might be allergic to the preservative used in the five dose vial. Right now, physicians can point to the need for a preservative free product as a reason to use compounding pharmacies. This would now be obviated and the physicians prescribing a compounded formulation would be at more legal risk for violating FDA guidance to use FDA approved products. Remember that compounding pharmacies can’t offer the quality control inherent in FDA approved manufacturing facilities for FDA approved products and this makes the risk of contamination of the product much higher. As was seen in the case of compounded steroids, this can lead to severe infections.

Increasing the Number of Doses per Pregnancy

AMAG believes that the single dose vial can increase the number of doses used per pregnancy from the current 13.7 doses to what it believes is a more optimal 18 to 20 doses. As a woman nears 36 weeks of gestation at which time treatment may stop or she delivers, the physician might have to order another five dose vial for which all doses may not be needed. This leads to wastage of the product and to avoid this the treatment may end a few weeks early.

There are some commercial plans that still have a prior authorization for Makena IM so that when first trying to fill a prescription there may be a delay while waiting for reimbursement authorization. In these cases, AMAG may offer a free five vial supply until reimbursement is obtained. If reimbursement is obtained at say three weeks, AMAG is not paid for two or three doses. The single dose vial does not have this issue and this can then result in more paid for doses per patient.

Launch of the Single Dose Vial

The single-dose, preservative-free vials have already been produced and are ready to ship. They only need to be labeled and packaged so that AMAG is set to launch early in 2Q, 2016. The AMAG reimbursement team has been talking to insurers to make sure that this product is on formulary and that the proper NDC reimbursement code is loaded into their systems, so that as those first prescriptions come through there are no issues.

In regard to physicians, the near term opportunity is to target those physicians who are prescribing compounded product. AMAG says that many have indicated that they might change to Makena IM if it were available in a single-dose preservative-free vial. Importantly, some physicians are reluctant to prescribe new products because of hassles with reimbursement. These reimbursement hurdles have been removed over the three plus years that Makena IM has been on the market so that the final hurdle for a physician using compounding pharmacies is the dose size and the preservative. Hence, conversion could be rapid for this physician group.

Payors don't like the multi-dose vial in its current configuration because they really prefer reimbursing for a month of treatment and with five doses there is more than a month. By going to a product that is packaged in individual vials in a tray that is holding four single-dose preservative-free vials, it is easier for payors to process claims. I would think that the price will be the same for the single dose vial as for the multi-dose vial, so I see no issue with payors that would hinder conversion.

Makena SC is The Next and Most Important Product Life Extension Strategy

Working Relationship with Antares and AMAG

AMAG says that it chose Antares as its partner because of that company’s experience and expertise with subcutaneous auto-injectors. AMAG cited the example of sumatriptan SC which was approved with an AB rating. They also emphasized that Antares has moved QST through clinical trials preparatory to filing an NDA. Importantly, the testosterone solution in QST has viscosity similar to Makena IM and presents the same development challenges. The Antares device stands out for its ability to administer viscous products subcutaneously using an auto-injector. AMAG said that Antares is absolutely the right partner.

Strategy for Filing a sNDA for Makena SC

The two companies are working on parallel paths to finalize the design of the device and at the same time to do the initial bioequivalence work. This sets the stage for starting a pivotal bioequivalence study later in 2016 that will be the basis of the regulatory filing. The activities of each company are geared to achieve this. Pilot pharmacokinetic (PK) studies are being done in small groups of healthy volunteers. Of course, AMAG knows the PK profile of Makena IM and is making small adjustments in the pilot PK studies to ensure that Makena SC mirrors the PK profile of Makena IM to the greatest extent possible.

The work necessary for the chemistry, manufacturing and control (CMC) section of the sNDA is also ongoing in parallel. For example they are doing stability studies in which the cartridges that will be used within the auto-injector are filled and then put on a shelf in order to test stability. AMAG thinks there is no scientific risk to the development of Makena SC, just execution risk. They are looking to file a sNDA filing in 1Q, 2017.

Advantages of Makena SC over Makena IM

There is an important difference between the size of the needle used with Makena IM which is a 21 gauge needle and Makena SC which uses a much smaller 27 gauge needle. This means that Makena SC needs only to penetrate just under the skin to inject the product while Makena IM requires a much deeper intramuscular injection. This will result in significantly less pain upon injection and this is a critical differentiation.

Clinical Trial Plans and Potential Orphan Drug Status

AMAG has had a dialogue with the FDA on the design of a trial that could establish superiority of Makena SC over Makena IM based on pain scores. AMAG believes that the FDA will accept a reduced pain score as a satisfactory endpoint for a superiority trial. They further believe that the success in such a trial would make Makena SC eligible to apply for an additional seven years of orphan drug data. The FDA hasn’t officially signed off on this as the agency always retains the right to make a decision based on the data submitted. However, AMAG is confident that there will be a pretty significant difference in pain scores for a deep intramuscular injection versus a sub-cutaneous auto injection that will be persuasive for the FDA.

The current plan is to first submit a sNDA based on a single dose PK study in healthy volunteers. The pain study aimed at showing superiority of Makena SC will be on a separate, but slightly later track. It is not required that the pain study be submitted at the same time as the sNDA. However, the goal is to submit the superiority study during the FDA review so that the results would be included in the label at the time of approval. AMAG also hopes to be granted orphan drug exclusivity at about the same time as drug approval which would give provide seven years of marketing exclusivity.

Reimbursement

One of the most troubling aspects of investing in biopharma companies is obtaining reimbursement. Time after time, new launches have disappointed investors as managed care implements measure such as co-pays, prior authorization, tiered formularies and other measures to slow or block reimbursement. The positive aspect about the Makena franchise is that AMAG has already worked through these issues with managed care. It has also done this with cash strapped Medicaid programs who often opt for low cost alternatives as compounding pharmacies are to Makena. AMAG has been successful in gaining reimbursement in both arenas.

It should be very easy to extend reimbursement to the single dose vial so that this does not seem to be a hurdle to product uptake. In the event that generic Makena IM is available at the same time as Makena SC, managed care may be restrained in trying to force pregnant women to use the cheaper but more painful generic to Makena IM instead of Makena SC. However, if the superiority study for Makena SC is successful and the FDA includes that data in the label, it seems probable that Makena SC would replace all of Makena IM usage and there would be no opportunity for a generic to Makena IM.

Market Exclusivity Issues

The seven years afforded to Makena SC by orphan drug status would be in addition to existing issued patent protection that covers Antares devices. AMAG also has filed provisional patent applications which pertain to the specific drug device combination and some of the novel discoveries are related. There is substantial patent protection for Makena SC

Potential for Generic Competition to Makena IM

Timing of Generic Entry

The strategy behind the single dose preservative free vial and Makena SC is to improve the therapeutic profile of Makena IM and to also blunt a potential generic challenges after orphan drug exclusivity ends on February 2, 2018. In this regard, the first question to address is when a generic drug to Makena IM might reach the market.

FDA may not approve a generic before the period of exclusivity for an orphan drug ends which in this case is February 2, 2018. However, it may accept and approve the same active moiety (hydroxyprogesterone caproate) for a different indication and indeed this has occurred. Aspen received an approval from the FDA for an abbreviated new drug application (ANDA) for a generic to Delalutin in October 2015 and plans to market it through an as yet unnamed distributor in 2016. Remember that Delalutin has the same active ingredient as Makena IM, but it is approved for a different indication.

Because there is no market for Delalutin, it is obvious that the intent of Aspen is to use this ploy to develop a generic to Makena IM. With the ANDA approval for the generic to Delalutin, they have manufacturing approval in place for producing a generic to Makena IM. I would think that they have already filed an ANDA for a generic to Makena IM, but it is difficult to predict how quickly after February 2, they may might receive approval. Their product is supplied in the same way as Makena IM, i.e. a vial containing enough hydroxyprogesterone caproate for five doses.

AMAG’s View on Generic Competition

Aspen will be launching at midyear with an as yet unnamed partner and will come to market as a multi-dose vial. While the active ingredient of the Aspen generic and Makena IM are the same, the indications are entirely different as the generic is for treating non pregnant women for very different conditions. The only way to sell the generic is to promote it off-label, and the FDA can be pretty aggressive when this happens. AMAG has spoken to the FDA in advance about its concern for potential off-label promotion. AMAG says that they have various regulatory and legal avenues if that were to happen.

AMAG also says that there really isn’t any reason from the perspective of the patient and physician to move from Makena IM to a generic. Reimbursement procedures are established and is not a hassle for physicians. Also, AMAG’s co-pay assistance programs aim to make out of pocket expense (if any) affordable for patients. AMAG feels they don’t have much to worry about in terms of generic completion through February 2, 2018. What about after that?

AMAG management notes that FDA approval for ANDAs based on recent experience is roughly 36 months from the time of submission. Aspen will need to prepare a separate ANDA for Makena IM from that for Delalutin. In order to have a 2018 launch, the dossier would have had to have been submitted in 2015 if the historical experience of a 36 month review holds. Even before this, they would have had to have conducted bioequivalence studies, perhaps in 2014. However, in 2014 Makena did not have high visibility for the commercial that has subsequently been seen. This raises the question of whether the generic approval could be meaningfully later than February 2, 2018.

Following the approval of the single dose vial, AMAG will move aggressively to convert the market from the five dose vial to the single dose. It may be hard to launch a generic product into a multi-dose market that may no longer exist. AMAG has the option to pull the 5 milliliter vial from the market from a commercial standpoint, i.e. they would no longer offer the product. However, they could not remove the regulatory approval because all of the bioequivalence work for Makena SC is really based on data from the initial approval of Makena IM.

How Would a Subcutaneous Formulation of Makena Do Commercially?

The goal of AMAG is to transition the Makena IM market to Makena SC as entirely and quickly as possible so that there is no reason to use compounded products or to give a generic. There are many moving parts to this strategy that can lead to a broad number of possible scenarios. This section illustrates the difficulties in forecasting one specific outcome.

The first thing to consider is the market opportunity. It appears that at the current trajectory, sales of Makena IM in 2016 could be around $325 million and if sales increase say 20% in 2017, Makena IM sales would be $390 million. Makena IM has only 35% of the addressable market so that there is substantial opportunity for market share growth through 2020. In a best case, Makena SC sales could exceed $500 million in 2020. In order to assess the probability of this, I have asked myself a number of questions. For most of these questions, I can’t give a definitive answer but I do have some thoughts.

Question: Will the first trial of Makena SC show bioequivalence to Makena IM?

Comment: I think that based on the experience with QST that it will likely show superior pharmacokinetics.

Question: Will AMAG be able to file a sNDA for Makena SC in 1Q, 2017?

Comment: Companies are usually too optimistic on timing for completion of clinical trials, but this is a simple bioequivalence trial and AMAG does have a sense of urgency. Also, this is not a complex trial to run. This is likely.

Question. Will AMAG be able to complete the superiority trial and submit the data to FDA in time for inclusion in the package insert for the sNDA.

Comment: This is AMAG’s goal.

Question: Will FDA approve the NDA within 6 to 10 months of the submission in 1Q, 2017?

Comment: This is not a complex filing, but the FDA is notorious for not meeting timelines and then issuing Complete Response Letters to buy themselves more time. The approval of the sNDA before the expiration of the orphan drug exclusion of Makena IM on February 2, 2018 is possible, but I would not be shocked to see it approved later than this.

Question: How will patients and physicians respond to Makena SC?

Comment: I think that both groups would be very excited about the potential for experiencing less pain on injection. If it were there were their decision, there would be a rapid conversion from Makena IM and generic competitors, if any.

Question: How will managed care respond to Makena SC?

Comment: With most new products, managed care does everything possible to prevent patients from quickly gaining access to a new product using tools such as formulary tiering, high co-pays and prior authorizations. However, this situation may be different in that the patients are pregnant mothers who are experiencing significant pain from the injections. Managed care might be less inclined to be as ruthless because of fear of adverse publicity. If Makena SC is considered by the FDA as superior to Makena IM, managed care would have to stand aside and allow rapid conversion of the market to Makena SC.

Question: Will Makena SC be judged as superior to Makena IM and receive orphan drug exclusivity based on less pain on injection?

Comment: It is very likely that this will be the case. Subcutaneous injections are made just under the skin and are substantially less painful than deep intramuscular injections.

Question: When might the trial comparing Makena SC to Makena IM lead inclusion of results in the label if results show superiority?

Comment: AMAG is aiming to supply the information to the FDA while the sNDA for the bioequivalence study of Makena SC versus Makena IM is under review. If so, the information would be included in the package insert for Makena SC. If AMAG meets its goals and the FDA also meets its timelines, this approval could occur up to seven months prior to February 2, 2018. However, when the FDA is involved, there is always uncertainty.

Question: Will there be generic competition at or slightly after February 2, 2018.

Comment: It seems probable to me that Aspen has filed an ANDA and would like to launch a generic in February 2018. They already have their manufacturing in place via the Delalutin ANDA. However, the FDA is even slower on ANDA approvals than NDAs and this approval could be meaningfully later as I discussed earlier.

The Potential Economics of Makena SC for Antares

Antares has said that the economics for Makena SC are similar to those for EpiPen. On the latter, it has suggested that for each dollar of sales that Teva achieves in marketing EpiPen, Antares will archive revenues in the low double digits and I have used 10% of EpiPen sales in my model. The Company has not given guidance but it has suggested that the majority of this 10% comes from royalties with some smaller part coming from sales of of the auto-injector. I have assumed that auto-injector sales are 20% of this 11% and royalties are 80%. In regard to Makena SC, the Company has indicated that the economics are somewhat better than for EpiPen. However, for the sake of conservatism, I will assume that they are the same in the following example.

The economics to Antares are linear as sales increase. What do I mean by that? Royalties increase directly with sales and so do auto-injector sales. As sales go from $1 to $100 million the ratio of Antares revenues to Makena SC sales remains the same or 10% by my assumption. In terms of profits, royalties obviously drop straight to pretax income. I assume that gross profits for auto-injectors is 50% of sales and that also drops to pretax income. Using these assumptions, we can calculate the pretax income contribution for various levels of sales as shown in the next table. I have also made assumptions on the tax rate in order to come up with contributions to EPS. For a number of years, Antares will have significant tax loss carry forward and will pay little or no taxes; eventually the tax rate will increase to perhaps 30%.

Tagged as Antares Pharma Inc., ATRS, Makena, otrexup + Categorized as Company Reports, LinkedIn

Nice write up Larry. AMAG is highly motivated to get this filing done, quickly. As noted, an sNDA of this type is a fairly simple filing (as far as CT work goes), and ideally AMAG will be granted priority review status by the FDA due to the lifesaving characteristics of the drug. If there is a way for them to accelerate their filing from Q1 2017 to Q4 2016, they’ll find it. Once filed and hopefully approved, they will remain highly motivated to transition all patients to the new injector just in case a generic version does become available in 2018. The FDA has been pretty good about meeting NDA PDUFA dates, and especially over the past few years. Last year I believe they were over 85% approvals for first pass NDA (and/or sNDA) filings. If given a priority review, I’m optimistic the FDA will get it done in 6 months from the date of filing. ANDA’s are a much different story in regards to FDA efficiency.

I am skeptical that a Gx version of this drug will be available by 2018. The FDA gives first pass approval to maybe 15% of ANDA filings, with the bulk of the rest getting CRLs. Though the FDA is improving in the area of ANDA reviews, I wouldn’t hold my breath over getting a first pass approval. They’re pretty rare.

Regarding possible disruptive generic competition (ANDA AB), in looking over the FDA’s Paragraph IV Patent Certifications document, as of 4/19/2016 there have been no paragraph IVs submitted against Makena’s hydroxyprogesterone caproate. Even if paragraph IV challenge would occur in the near future, that still would leave AMAG plenty of time to transition their patients to the single vial preservative free version, then, to the SQ AI version after that. Removing the multi-use vial from distribution within the next few years would remove the possibility of Gx AB competition. If they maintain orphan drug status (and I’ll speculate they will), and coupled with other patent protection, AMAG should have significant barriers to competitive entry for many years to come. That they have the FDA’s blessing (mandate?) vs. pharmacy compounding options, and even more so with their preservative free single use vial is a huge competitive plus. They’ll take share from the compounding pharmacies. The upside for Antares with this opportunity is significant. If anything, the numbers projected sales numbers are low. Thanks again

Of interest, there is an oral hydroxyprogesterone caproate in development (LPCN 1107) for the indication of prevention of recurrent preterm birth. LPCN 1107 has the potential to become the first oral HPC product for the prevention of preterm birth in women with a prior history of at least one preterm birth. It’s currently in P1 or possibly P2 clinical trials (per their pipeline chart).

From Lipocine’s website, “the potential benefits of our oral product candidate relative to current injectable products include the elimination of pain and site reactions associated with weekly injections, elimination of weekly doctor visits or visits from the nurse, and elimination of interference/disruption of personal, family or professional activities associated with weekly visits.” I found no information as to whether or not the pill will be preservative free.

Of additional interest, sub-Q Makena, using the Antares auto-injector, overcomes every potential benefit of the pill mentioned above. Sub-Q Makena will fast, simple to use, virtually painless, and self-administered once a week. AMAG’s product strategy for retaining market share is thought through, achievable, and formidable. Transitioning patients to single use, preservative free vials will be step one and is happening this year. Step two, happening as soon as latter 2017, will be transitioning patients to all the benefits of the sub-Q auto-injector. Trying to oust a strongly established incumbent who possesses a superior “mouse trap” is tough to do. The Lipocine drug may eventually carve out a niche, but it will be slow going as their value prop is largely invalidated due to the benefits of the Makena sub-Q AI.

If AMAG can get another 7 years Orphan Drug protection, Lipocine may not be able to market their LPCN 1107 drug for many years unless it shows to be clinically superior compared to the sub-Q version from AMAG. If AMAG can obtain another 7 years of Orphan Status with Makena – which is their strategy due to the significant patient benefit the painless self-injected sub-q injector brings along with the expected improved efficacy vs. deep muscle injection – that additional 7 years protection would also apply to new versions of the same drug for the same indication unless the subsequent drug can show that it is “clinically superior” to the first drug. Efficacy for the sub-Q administered version of Makena is expected to be stellar and superior to deep muscle administered efficacy. The sub-Q device is also virtually painless to administer (e.g. QS-T has similar viscosity drug and volume vs. Makena, and it registered only a 2 on a scale of 1 to 100 in user studies…the low number of the range meaning “painless”). Sub-Q efficacy is also typically superior to that of orally administered drugs. Time will tell with LPCN 1107 (it’s headed for P3 trails), but sub-Q efficacy is typically tough to beat and Makena sub-q will be painless to administer.