Antares: Detailed Sales and Earnings Projections for 2020, 2021 and 2022 (ATRS, Buy, $4.86)

Objective of This Report

Antares is an extremely difficult company to model on a sales and earnings basis. Its core technology is based on the use of sophisticated, subcutaneous injector devices to deliver injectable drugs, both patented and generic. This has resulted in two business models. One is based on its proprietary products, Xyosted and Otrexup and an emerging pipeline of products for its own account. This business has the cost structure of a commercial biopharma company with COGS, S, G & A and R & D costs.

The second is based on partnering with other companies. It participates in the marketing of an AB rated generic version of sumatriptan in a joint venture with Teva in which it records 50% of profits and no sales. In early 2019, Teva launched an AB rated generic to EpiPen and plans on launching AB rated generics to Forteo and Byetta in 2020. Antares receives royalties on sales of these products and also sells injectors to Teva. It has a deal with AMAG in which it developed a subcutaneous form of Makena in return for royalties. In each case other than sumatriptan it also books revenues from injector sales. The royalties are essentially pure profit that go straight to pretax income. Of far greater potential are collaborations with other biopharma companies to develop proprietary, patented products.

In estimating revenues for Antares, investors have to project sales for Xyosted; Otrexup; Makena; and Teva’s AB rated generics to sumatriptan, EpiPen, Forteo and Byetta. Then for EpiPen, Forteo, Byetta and Makena, they have royalties and injector sales to forecast. This requires a lot of estimates and assumptions which can lead to significant errors in my models. The final complexity is estimating COGS; S, G & A; R & D; and taxes. Most of these, but not all, are attributable to the proprietary drug business.

This objective of this report is to produce: (1) a comprehensive model for sales broken down by key products and product categories and (2) a sales and earnings model. If you like numbers, you will love this report.

Investment Thesis and Why My One Year Price Target is $13

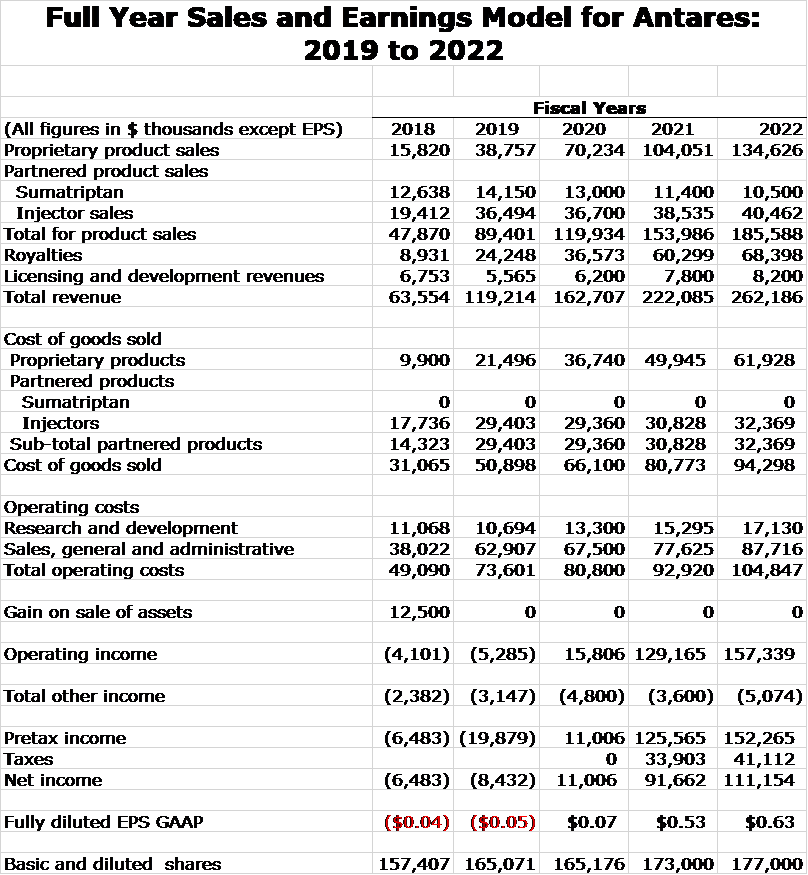

For some years, I have been projecting a breakout in sales and earnings for Antares and we are now in the initial stages of that breakout. This report attempts to model sales and earnings through 2022. The estimates I present appear to be precise, but in actuality are subject to considerable variation. I urge you to look at them as portraying trend and magnitude. If this model is roughly correct, the growth should be explosive as I project revenues for the period 2020 to 2022 as follows:

- 2020 --- $162.7 million, an increase of 36%

- 2021 --- $222,1, up 37%

- 2022 --- $266.1, up 20%

I project that Antares will reach full year profitability for the first time in its history in 2020 with EPS of $0.07 per share. My 2021 EPS estimate is $0.53 and for 2022, it is $0.64. Antares has considerable net operating loss carry-forwards that may offset tax payments for some time, but the calculation of the applicability of these NOLs to reduce taxes is complicated and beyond my ability to forecast. To be conservative, I am assuming that Antares pays no taxes in 2020, but that earnings are fully taxed in 2021 and 2022. My guess is that the NOLs could significantly reduce taxes in 2021 and 2022. If so, this would result in higher EPS being reported.

I believe that Antares is laser focused on becoming a profitable and cash flow positive company by carefully controlling costs. This is important to existing investors for two reasons. The universe of potential investors is greatly expanded when a company emerges into profitability and becomes cash flow positive. A significant number of investors just won’t invest in companies that are unprofitable and may need to raise equity on an ongoing basis. The strong earnings growth I am projecting, if achieved, should attract a very large number of new, growth stock investors.

For those of you who have read my blogs on illegal naked shorting and its role in stock manipulation, you will understand that I believe that the trading divisions of elite Wall Street firms collude with a closely connected group of hedge funds to use illegal naked shorting to manipulate price declines to the benefit of short sellers in many, many stocks and especially for emerging growth stocks like Antares. This is one of the largest criminal enterprises in the US, but is a routine and highly profitable practice on Wall Street. The power of this scheme is such that they can actually cause price declines when companies report positive news. Long term investors in Antares can easily recall numerous situations in which Antares’ stock price declined on the reporting of good news and was devastated when there was a disappointment. It was much easier to perpetrate this scam on Antares prior to the spate of new and pending product approvals that are driving the company to strong earnings and positive cash flow.

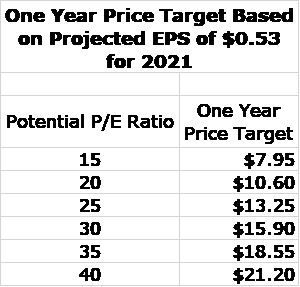

So, what kind of a price target does this result in? I think that if my earnings projections are reasonable correct, the market will begin to value Antares on the basis of applying a P/E ratio to anticipated EPS. The P/E ratio applied is primarily dependent on the rate of growth in earnings and sustainability of that growth alongside the potential for new product introductions. The primary current driver of growth for Antares is Xyosted. I am projecting that Xyosted will reach sales of $52 million in 2020 and $88 million in 2021. Street estimates for peak sales range from $200 to $300 million. If so, Xyosted should drive EPS growth well into the second half of the decade starting with 2020.

The pipeline potential of Antares beyond the products mentioned in this report is not yet clearly defined. We are aware of three products at this time that could come to market in the 2023, 2024 timeframe. Antares is developing a product in collaboration with Pfizer, but we do not know the active pharmaceutical ingredient. Antares is developing ATRS 1701 for its own account; again, we do not know the active pharmaceutical ingredient. Management indicates that there will be meaningful information released on these products in 2020. In the case of the Pfizer product, it could have huge potential. Pfizer is so large that it has to focus on products with sales potential of at least $500 million and more likely $1 billion. So, we shall see. The technology of Antares potentially lends itself to the development of a broad number of AB rated generics and proprietary products. I would expect significant new product development efforts to be announced over the next few years.

There is one new product that we do know something about. Antares announced on November 19 that it had entered into a global agreement with the Swiss company Indorsia Pharmaceuticals, to develop a novel, drug-device product combining selatogrel, a potent, fast-acting and highly selective P2Y12 receptor antagonist that has completed phase 2 development, with the Antares subcutaneous Quick Shot auto injector. Selatogrel is a new chemical entity being developed for the emergency treatment of a suspected acute myocardial infarction in adult patients with a history of AMI. It is an emergency medicine similar to EpiPen in its marketing characteristics. This product might be applicable tens of millions of people on a global basis and could really be a mega-blockbuster if is successfully developed.

The most commonly used valuation measure on Wall Street is to apply a P/E ratio to future EPS projections, usually about one year forward. In the following table, I have prepared a table that calculates the one-year price target for Antares or put another way the potential price in late 2020. This is based on the assumption that at year end 2020, my 2021 EPS estimate of $0.53 is Street consensus. I then look at a number of potential P/E ratios ranging from 15 to 40. You can see from the following table that the one-year price target would be $7.95 with a P/E of 15 applied to projected EPS of $0.53 in 2021 and $21.20 with a P/E of 40. My subjective judgment is that the P/E ratio will be 30 or more.

Perhaps the biggest risk to the stock would be if I am wrong on forecasting that Makena stays on the market and instead, FDA decides to pull it from the market. See this link. If Makena is taken off the market, I estimate that 2020 EPS would be reduced by $0.06, 2021 by $0.04 and 2022 by $0.04. If this is correct, the withdrawal of Makena would just be a passing blip.

Antares Revenue Model

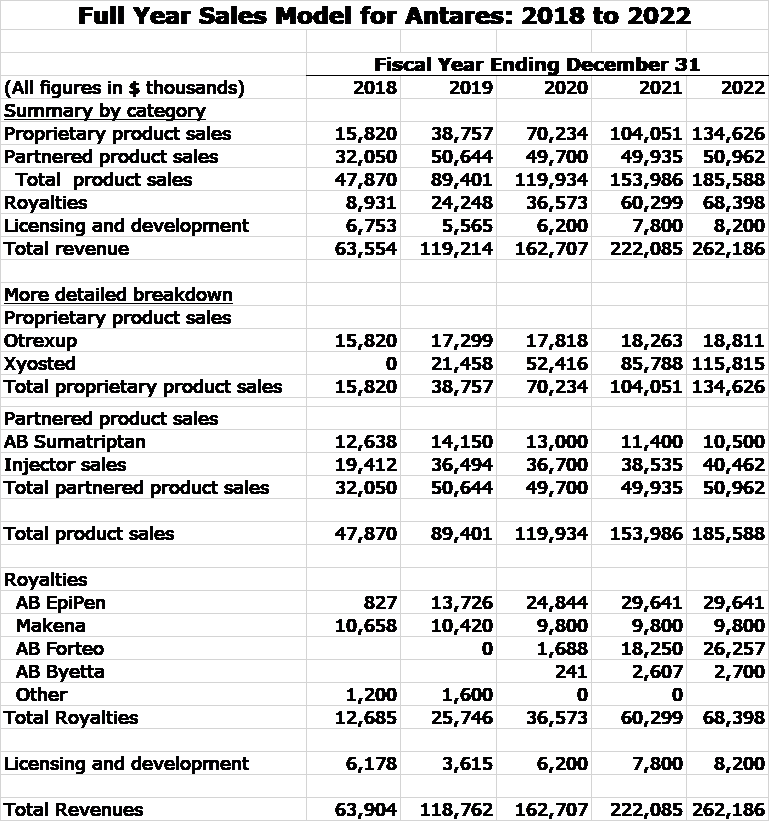

My model for Antares revenues resulting from sales of proprietary and partnered drugs in shown in the next table. Assumptions underlying these estimates are outlined later in this report. Projections are presented for full year sales and royalties for 2019 through 2022. Corresponding quarterly estimates are shown later in the report if you are interested. Including them in this table is just too cumbersome.

I am projecting that revenues will more than double between 2019 and 2022. Xyosted is emerging as a blockbuster product for Antares and is a major driver of revenues as I see its revenues increasing five-fold in this time frame to $116 million. By 2022, I estimate royalties of $68 million up from $26 million in 2019. Bear in mind that these royalties are essentially pretax income.

Sales and Earnings Model for Antares

I next put together detailed income statement projections for Antares through 2022. The estimates on a yearly basis are presented in the next table. Quarterly estimates are shown later in the report.

Antares is providing no guidance on sales or operating costs for 2020 through 2022 so all of the estimates are my own. Management would not opine on any of my projections. Some of the key assumptions in the model are:

- No revenues from new proprietary or partnered products through 2022. I think this is a good assumption as I see the partnered products with Pfizer and Indorsia not coming to market until after 2022. It is possible that Antares’s ATRS 1701 could reach the market in late 2022.

- No revenues from acquisitions. I think it is likely that Antares will acquire new products to sell through its newly established sales force, but this is impossible to forecast.

- Injector revenues are extremely difficult to project as shipments to partners don’t always correspond to end product sales. There can also be meaningful shipments to partners during clinical development and in anticipation of a launch. Of all the elements in my model, I believe this may have the greatest variability on a quarter to quarter basis.

- Cost of goods sold for proprietary products in 2019 are estimated at 55% of proprietary product sales and I show a gradual decrease to 46% in 2022 which is driven by strong sales growth of Xyosted.

- Cost of goods sold for partnered products is primarily due to injector sales and are I am guessing they are around 80% of partnered product sales

- Antares is not planning to meaningfully expand its sales force for Xyosted and Otrexup in 2020 so I am not looking at big increases in S, G& A in 2020.

- R&D expenses should begin to ramp up in late 2020 as Antares begins clinical trials for ATRS 1701.

- Net operating loss carry forwards offset all taxes in 2020, but Antares is fully taxed in 2021 and 2022. The calculations that allow past operating losses to offset current income are quite complex so these are an out and out guess.

- No new equity offerings needed to fund operations. However, I think that if the price appreciates significantly that Antares might raise a war chest to pursue acquisitions which could be accretive to earnings.

Detailed Sales Projections for Xyosted and Otrexup

I recently wrote a detailed report with my sales projections for Xyosted. See this link. Otrexup has been showing only modest sales growth over the past few years and I am expecting modest sales increases to continue.

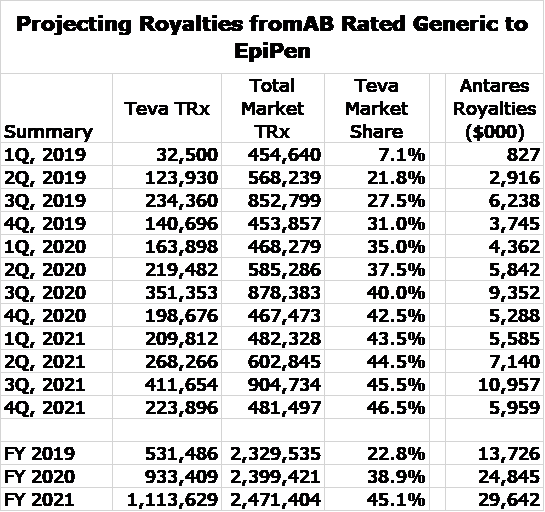

AB Rated Generic to EpiPen Royalty Projections

In building my model for the AB rated generic to EpiPen, I depended on comments from the 3Q, 2019 conference call in which management said:

- The adult targeted product was launched in 1Q, 2019 and the Junior product for kids in June 2019.

- Prescriptions were 29,000 in 1Q, 2019: 125,000 in 2Q, 2019 and 237,000 in 3Q, 2019

- The market share in 3Q was 27% and currently is 34%. Teva’s goal is 50%.

- Mylan continues to encounter production issues with EpiPen.

- 4Q is seasonally slower than 3Q for prescriptions.

- Teva’s sales have primarily come from pharmacy sales. They have only scratched the surface for sales to schools and other institutions.

I was able to estimate EpiPen royalties in the 3Q, 2019 from royalties in 3Q, 2019 as follows. Total royalties in the quarter were $8.4 million and these derived from Makena and the AB rated generic to EpiPen. AMAG disclosed that revenues of Makena in 3Q, 2019 were about $34 million and Antares management broadly indicated that the royalty rate is a little less than 7% indicating that Makena royalties were about $2.2 million so that it follows that EpiPen royalties were about $6.2 million.

I used prescription audit data for 2019 to estimate total prescriptions for both EpiPen and the AB Rated generic to EpiPen in each month of 2019. I next assumed that total prescriptions increase by 3% (each month over month) throughout 2020 and 2021, which I then summarized on a quarterly basis. The audit data also gave market share data for the AB rated generic, which indicated that it had about 27.5% of the market. Teva has indicated that its goal is to reach a 50% market share. I gradually build up the market share to 46.5% by 4Q, 2021.

With these assumptions, I was able to project monthly and quarterly total prescriptions for AB EpiPen through the end of 2021. The final assumption was that the royalty rate per prescription is roughly the same for each month through the end of 2019. This is incorrect as the royalty rate escalates as sales increase so that the royalty rate is lower early in the year and higher at the end. I tried to adjust for this in my model, but Antares and Teva have not disclosed the levels of sales at which escalations occur. So here are the results, based on all of these assumptions.

I think that these projections are subject to meaningful errors, but I think that this captures the magnitude and trend for monthly sales of the AB rated generic to EpiPen. Note the seasonality in total prescriptions in which 3Q is the biggest quarter of the year as kids return to school.

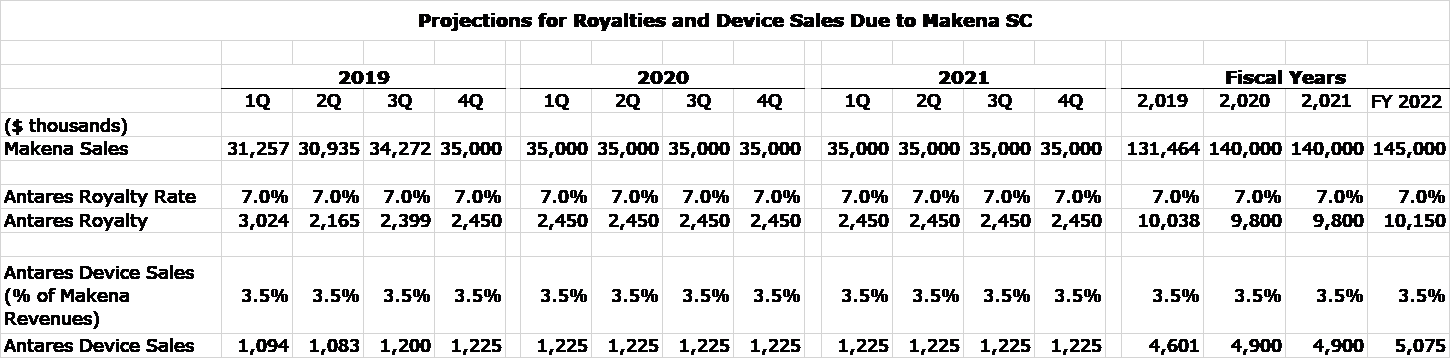

Makena Royalty Projections

Makena was required to do a post approval study called PROLONG to confirm the original study that led to its approval. This study failed to show a difference between Makena and placebo. However, there were meaningful differences in patients enrolled in these two trials that raise questions about how to interpret the results for PROLONG. Also, there is considerable physician support for Makena. The FDA could decide to pull Makena from the market, but it is not required to do so. To aid in its decision making, the FDA called for an advisory committee meeting. See this link for more detail. https://smithonstocks.com/antares-atrs-buy-3-51-amag-pharmaceuticals-amag-11-73-first-thoughts-about-how-the-prolong-study-could-affect-makena-usage/?co=amag

The FDA AdCom meeting voted 9 to 7 to withdraw Makena from the market. However, 6 of 7 practicing OB/GYNs on the panel voted to keep Makenna on the market and to do additional studies to properly define its role in the management of women with singleton pregnancies who previously have had a preterm birth. I wrote on October 29 that I thought there was only a 5% chance of Makena being removed from the market. This vote was a bit surprising to me as Makena (active ingredient 17-P) demonstrated a very positive effect in the MEIS trial that was the basis for its approval. On the endpoint of preventing preterm birth in women with singleton pregnancies who had previously delivered prematurely, the p value was very positive at p=0.0003. The PROLONG trial was done in a population at much less risk than MEIS and I think this was why it failed to confirm MEIS.

Opinion leaders believe that 17-P is an effective drug as it is included in the treatment guidelines for high risk patients by both the American College of Obstetricians and Gynecologists and the Society for Maternal-Fetal Medicine. Their recommendations are driven by clinical experience as well as results from the MEIS trial. Importantly, there is no safety issue with the drug.

There is no alternative to 17-HP in this condition and the product is safe. I think that as in the AdCom meeting, the great majority of OB/GYNs believe that the drug is effective. Practicing OB/GYNS have known about the PROLONG results for nearly nine months and it does not seem to have much effected usage of the drug. I doubt that the AdCom meeting in which members who do not actively practice medicine believed the drug should be removed from the market while those who practiced medicine believed that it should not be removed will alter the consensus professional opinion.

The FDA is not required to follow the advice of the AdCom meeting and I believe that key opinion leaders will likely advise FDA that Makena should remain on the market. I think that the FDA in the end will keep Makena on the market. If so, the FDA will have to decide on how to put the results of the PROLONG trial in the label and whether and how to conduct further studies. Bottom line, in spite of the AdCom vote, I believe that Makena will remain on the market and that usage will not be that much affected.

My model assumes that Makena sales are roughly flat on a quarterly basis through 2022. My intuition is that Makena sales will actually grow, Of course, this AdCom decision could well cause many (most) investors to disagree with me and act on the belief that Makena will be removed from the market. It may take a few weeks or months for the FDA to formally speak and to determine who is right.

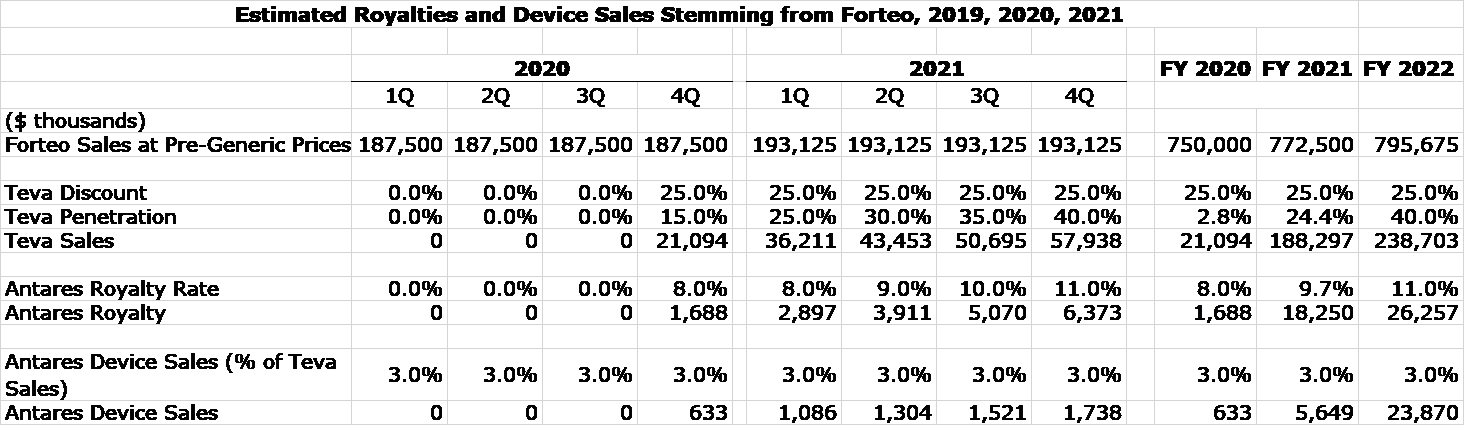

Royalty Projections for AB Rated Generic to Forteo

Here are some recent comments made by Antares about the potential for AB Forteo.

- The product remains under FDA review. Teva originally guided to a 4Q, 2019 launch. It is now guiding for a 2H, 2020 launch,

- The product is approved in 18 foreign countries, but Teva apparently is waiting for US approval before launching.

- There are difficult reimbursement issues for branded generics in many foreign markets.

- Forteo had US sales of $750 million in 2018 and foreign sales of $750 million.

- I think the potential in the US to Antares for the AB rated generic to Forteo is comparable or better than the AB rated generic to EpiPen.

I am only making projections for royalties from US sales at this time. The following table shows my estimates of what sales of Forteo might be if there were no generic competition. I then apply my estimates for the price discount that Teva will offer and the market share that Teva will achieve so that I can calculate Teva’s sales. Finally, I apply my estimates for royalty rates to project the royalties that Antares will receive. This is all shown in the following table:

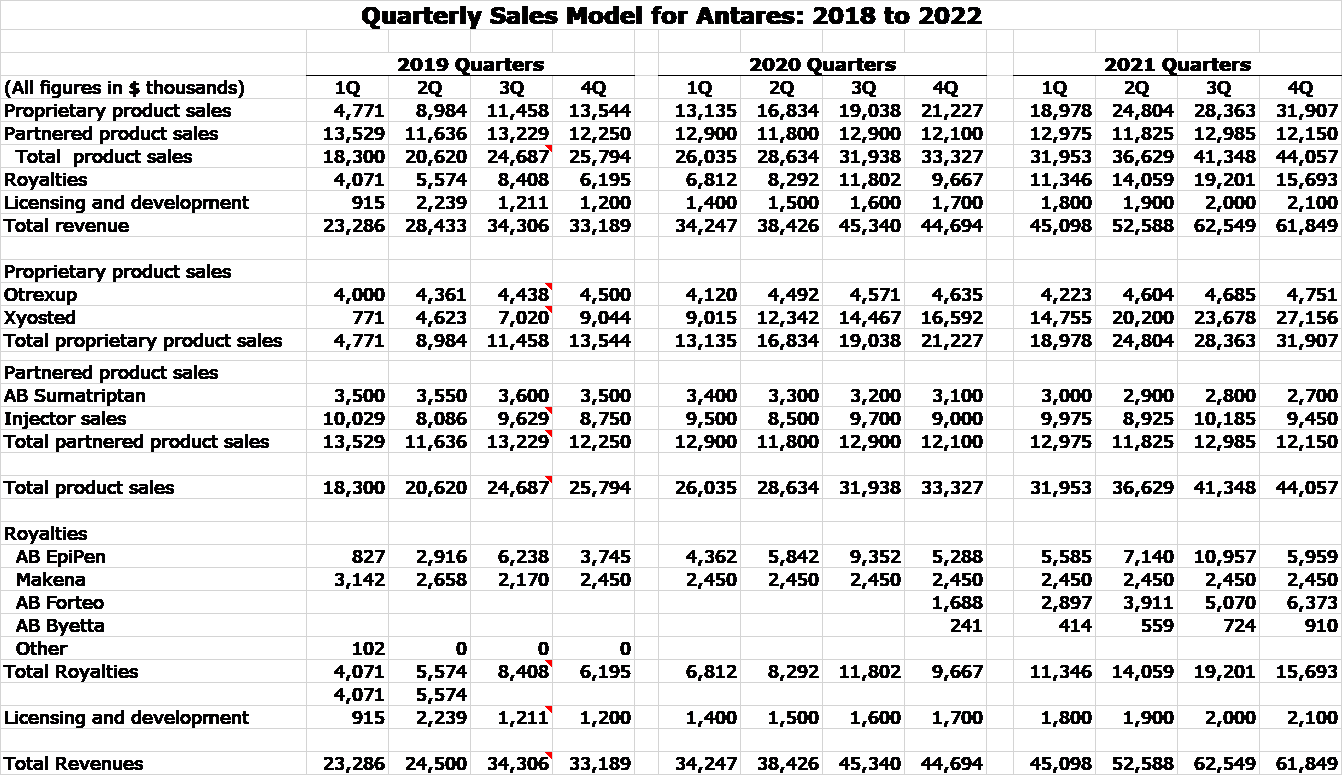

Quarterly Sales Model for 2019, 2020 and 2021

Here is my detailed quarterly sales model for that period.

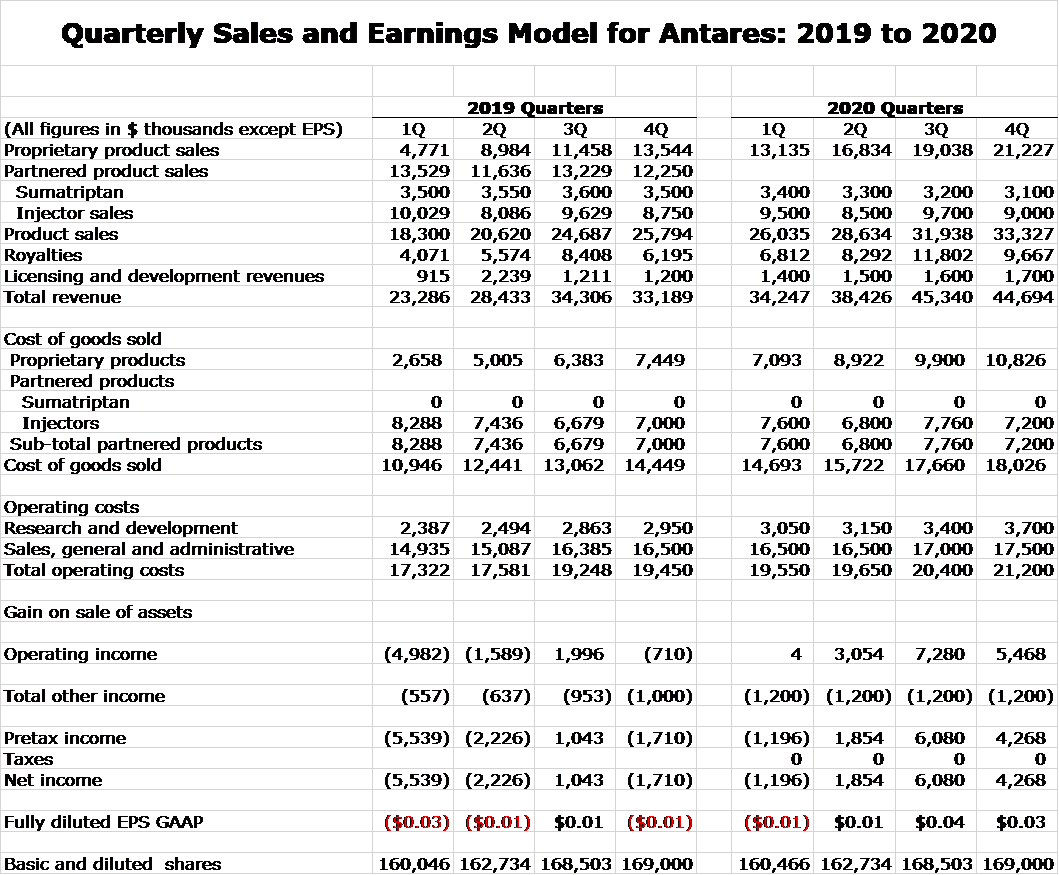

Quarterly Sales and Earnings Model for 2019, 2020 and 2021

Here is my detailed model.

Tagged as Antares Pharma Inc., Antares Sales and Earnings Projections through 2022 + Categorized as Company Reports, LinkedIn

Thanks Larry. I still wonder what surprises (good ones) might be lurking in the shadows for Antares. Their injector IP is exceptional, unique, and valuable. Hard to say how may other partnered deals could occur in the coming months. What we’ve learned is that the deals can happen quickly, and, they can be significant. Any injectable, especially highly viscous injectables that need speed of administration, patient comfort, accuracy of dosing. and bullet-proof reliability wouid benefit from Antares injector IP. What’s known points to exceptional growth and value in the company and stock price. If partnerships expand and do so quickly, and especially for high value drugs, ATRS growth could be explosive.

Here is one of my issues with ATRS. OSM has been twisting in the wind for over 5 years. And we still got nothing. Either put some update up about the drug or terminate it. ATRS is world leader in having Association with potential products that languishes for ever yet they remain in pipeline. Teriparitide ,exenitide and even PFE undisclosed rescue pen gets mentioned every Quarter and then there are no updates for years!

A couple items on my mind:

Regarding insiders selling of stock. My opinion is that regardless if there is outright selling of owned shares on the open market or if the selling is in advance using SEC planned sales per 10b5-1, the result is the perception that insiders are selling meaning there is NO DISTINCTION between a ‘good’ selling of stock or a ‘bad’ sale of stock. The result is the same with downward pressure on the stock until such time that something else overwhelms the overhang of the sales.

Antares has a long history of planned insider 10b5-1 sales and off the top of my head I cannot recall any of these planned transactions to be ‘buys’ which is also a great way to buy the companies stock.

Antares insiders (both past and present) have a long history of taking advantage of this available option. Ex-CEO Wotton used the 10b5-1 selling option with a vengeance and he used and abused that option up until he left the company. And he did because he could. And I cannot blame them for doing so but it comes at the expense of shareholders.

From Antares “Compensation Philosophy Statement it states, ”The main focus of the Compensation Philosophy is to increase stockholder value for stockholders of Antares.” It also states, “For Senior Management, longer-term incentive awards will comprise a significant portion of the total compensation package, as it is necessary to link their compensation to the future growth of the Company, and to stockholder value.” The latest version of this ‘CPS’ was approved by the Board of Directors on September 1, 2016. They need to update the Philosophy Statement to ensure more incentive to employees to BUY (their own stock) as much as incentivizing to SELL (their own stock) and it needs to be clearly stated that it is expected and not just a philosophical statement of benefiting the Antares stockholder. There needs to be a much better-defined balance between the selling of stock (no matter the mechanism) and the buying of stock.

The Board of Trustees is the entity that can do something about this and level the playing field of sales vs buys.

Lastly and as I’ve noted in past posts, I’m pleased with ATRS becoming profitable and stated that this is exactly what is needed to reach the next level. The next level will be another profitable quarter – piggy backing profitable quarters and building on that because Antares is and always will be more a brick and mortar company than a pure biopharma company and I think (as I’ve noted in the past) retail investors lump ATRS in with and unrealistically compare the company to other true biopharma’s. One example being when ATRS or its partner gets a new patent or launches a PH II or PH III trial or even gets the FDA nod of approval of something and investors don’t see the big “POP” that they thought should happen and end up wondering what happened. But when all that finally gets to market and translates to profitability, that’s when the real action starts and that is what we saw with XYO. Once sustained profitability is achieved, that will be the key to drawing in a shift to another brand of Institutional Investors – the type that can drive the PPS to truly new heights. I suspect or maybe I should state ‘expect and assume’ Jack is and should be busy courting the next level Institutional Investment houses. With the share price under $5, he is challenged but with sustained quarterly profits, his job will be easier in attracting the houses that truly can make a big impact.

For the reason of what I believe will be future sustainable profitability, I am bullish.From a yahoo poster:

The above post was from a yahoo poster with the handle of Lane. I thought he hit the issue head on.