Antares: An Outstanding Product Pipeline Promises Dramatic Growth Through 2022 (ATRS, Buy, $0.92)

Investment Thesis in Brief

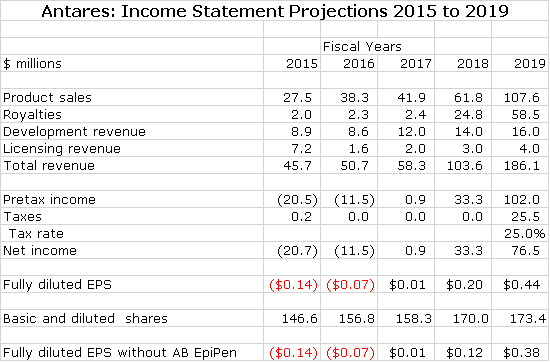

If you like numbers, you will like this report. It is a very detailed analysis of the contribution to Antares sales and profits of 7 new products that will drive growth in coming years. As summarized in the following table, I am looking for Antares to roughly breakeven in 2017 and then experiences explosive EPS growth in the period beyond 2017.

I think that both sales and earnings in 2016 could surprise on the upside primarily because of the AB Imitrex launch. I think investors underestimate its profit potential. I note that the Company is guiding to a 10% sales increase in 2016 to about $50.3 million. My estimate of $50.7 million is consistent with this guidance. They have given no EPS guidance.

I am taking a conservative view on Otrexup. Sales in 2015 were $13.2 million and I am projecting $14.8 million in 2016 and $18.8 million in 2017. I believe strongly that this is a very good product and perhaps it will gain more traction in 2016 and 2017 than I am estimating. The profit breakeven point is about $20 to $22 million of sales. Eventually, I see the product reaching $50 million of sales.

Currently, I think that investors are dismissive of, or not paying attention, to the dramatic new product potential for Antares. This is understandable due to the disappointment with the Otrexup launch and the CRL that has delayed or possibly eliminated the prospect of a launch of AB EpiPen. In contrast, I believe that there is tremendous earnings potential from the new products. This report goes into detail on my assumptions for sales and profits for each of these.

Both QST and Makena SC are products with very meaningful sales and profit potential that could be launched in early 2018. This could be followed by the launch of AB Byetta in 2019 and AB Forteo in 2020. A significant uncertainty in the story is AB EpiPen which also could be approved in early 2018. On the other hand, there is the possibility that it may not gain approval. Hence, I look at Antares both with and without an EpiPen launch in 2018 as shown in the above table. My 2018 price target is $5.70 in 2018 without an AB EpiPen launch and $6.60 with a launch. This is based on applying a 15x P/E ratio to projected 2019 EPS.

I estimate that the operating cash burn in 2016 will be about $10 million and that capital spending will be $6.0 million bringing the 2016 cash burn to $16 million. If so, the Company will end 2016 with about $32 million of cash down from $47 million at the beginning of the year. This is not a strong cash position, but still I do not see a compelling need for the Company to finance at currently distressed stock price levels.

Overview of Report; a Look at Key Assumptions

The most intriguing aspect of the Antares investment story is its ability to rapidly develop: (1) proprietary products, (2) complex generics that are AB rated and (3) collaborations with innovators on product life extension strategies. This report attempts to analyze the potential commercial opportunities for six new products that could come to market between now and 2020 and also Otrexup. I have thought about how to convey the potential of this research pipeline in a meaningful way and decided to start with my spreadsheet analyses. Let me first point out caveats in looking at my models.

The first thing I would emphasize is that for each product there are many possible scenarios and I present just one which I think is most reasonable. These numbers give the appearance of great precision which just isn’t there. I would be the most surprised man on the planet if there were not some (many) major differences from my projections. For example, I am including estimates for AB EpiPen in this model starting in 2018, but it could be the case that Teva can’t satisfactorily answer the Complete Response Letter (CRL) and the product never comes to market. Nevertheless, these models show the extent and promise of the pipeline in a way that words can’t do.

The proprietary products that Antares is developing and marketing (Otrexup QST and Makena SC) are based on the combination of generic drugs in patented auto injectors. There are likely to be competitive products using the same generic drug and different injectors aimed at the same disease target. However, I assume that potential competitors will not be able to develop AB rated generics because of Antares patents on its injectors. Instead, they will have to gain regulatory approval through the NDA route and then use sales forces to market their drugs. This greatly reduces the incentive although it does not eliminate the potential for competition.

In terms of some the AB rated products that Antares is developing with Teva (AB Imitrex, AB EpiPen, AB Byetta and AB Forteo) these are complex generics and I assume that competition will be slower to develop and less intense than is seen with oral dosage forms. We have seen how difficult it has been for Antares to develop AB rated products as witnessed by CRLs on AB Imitrex and AB EpiPen.

Another key uncertainty is timing of FDA approvals. The FDA is overloaded and has trouble meeting PDUFA dates so that it uses CRLs as a way of buying more time for a review. While I have tried to be conservative on my timelines for approval, I could be overly optimistic.

Every new proprietary product launch is met with high hurdles to reimbursement by managed care that sharply limit sales in the first year or so. I have tried to take these issues into account, but there is lots of potential for disappointment in the pace of a launch. Interestingly, for the AB rated products and Makena SC, reimbursement hurdles may not be an issue and we could see rapid uptake. Teva will bundle the AB rated products in with a broad generic product line which leads to rapid uptake and Makena SC has a viable strategy that may allow it to quickly replace all of Makena IM with Makena SC.

Because the active agents of all drugs being developed by Antares are based on generic (or soon to be generic) drugs, there are numerous other development efforts from other using different technologies aimed at the same disease target. I may not be aware of some of these or may not be able to correctly assess their competitive profile.

I hope that you understand the limitations of my analysis. However, what stands out as you look at the following tables is the breadth and promise of the pipeline. Let me give you a metaphor as a way of thinking about this. This pipeline is like a basketball team with several great players. On any given night some players will have good games and some bad, but the team as a whole will have a reasonably consistent and strong performance. Think of the products in the Antares pipeline as great players and the pipeline as the team.

Model for Proprietary Products

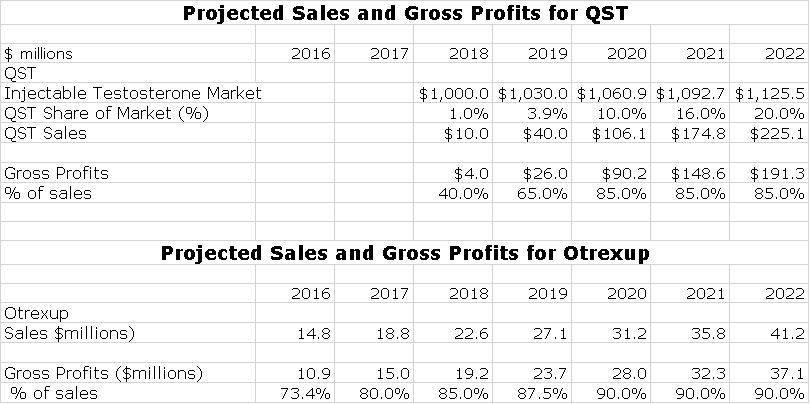

Antares has one marketed proprietary product with Otrexup and my model shows QST being launched in early 2018. Antares has announced that following QST it hopes to launch one proprietary product per year. I do not include any estimates for these potential products. In order to give some idea of the potential impact on earnings. I also estimate their gross profit contribution. Here is the model for proprietary products.

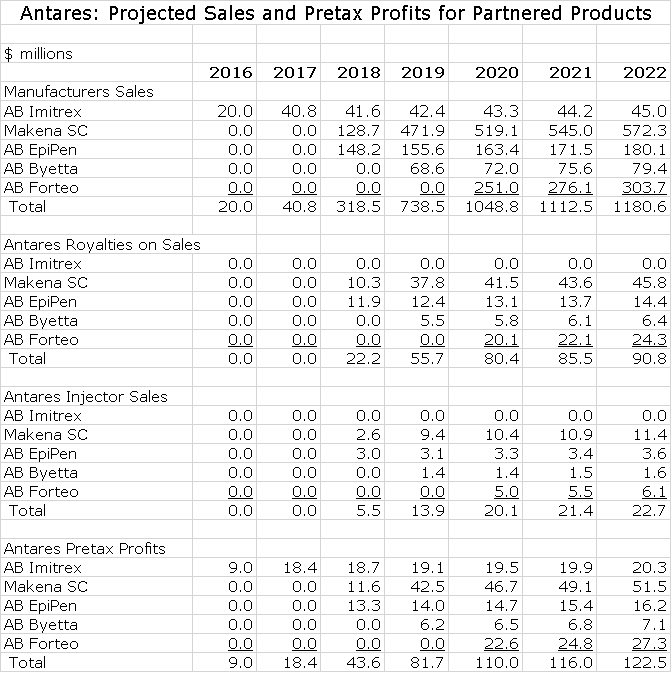

Model for AB Rated Products and Collaborations

Antares is developing four AB rated generics in collaboration with Teva and Makena SC as a product life extension strategy with AMAG Pharmaceuticals. In the Antares income statement, revenues from these ventures with the exception of AB Imitrex are based on royalties and injector sales. Royalties drop straight to the pretax line and the only cost associated with injector sales is cost of goods sold so that about 50% of these sales fall to pretax income. The following table shows my estimates for manufacturer’s sales of these products and the economics of these sales to Antares.

Discussion on Outlook for 2016

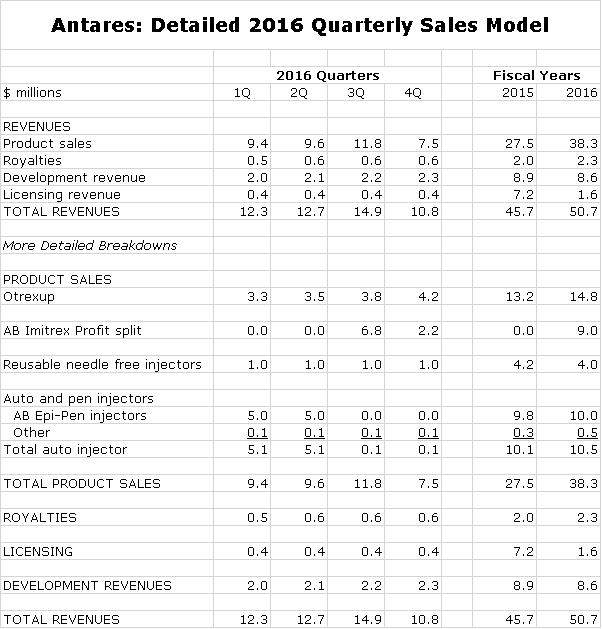

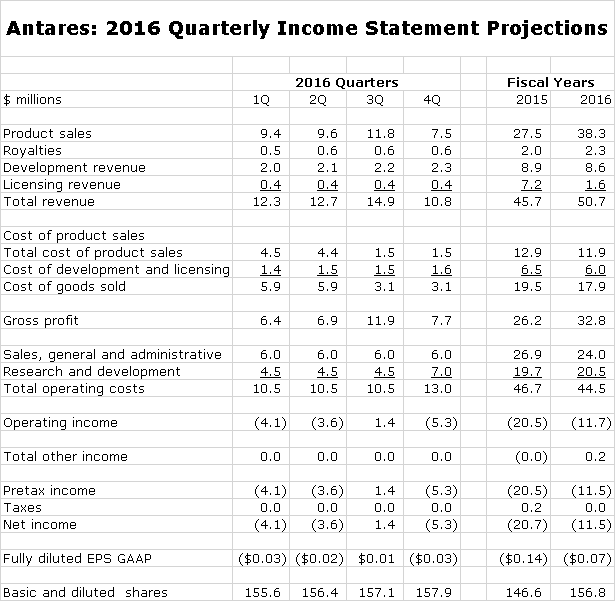

Antares has given guidance that sales could increase 10% to $50.3 million in 2016 which compares to $50.7 million in my model (this comparability just happened, it wasn’t contrived). The following table shows my detailed sales forecast for each quarter of 2016. There are three items in the forecast that drive my estimates.

- In the past two years, I have consistently overestimated the growth of Otrexup for reasons I will discuss shortly. I am still confident that Otrexup will eventually reach sales of over $50 million. However, I am now taking a very conservative approach to estimates (perhaps an over-reaction) so that I am estimating that sales only will increase from $13.3 million in 2015 to $14.8 million in 2016.

- The contract under which Antares manufactures and ships auto-injectors in anticipation of the launch of AB EpiPen in still in effect and I am estimating $10 million of shipments in the first half of 2016.

- The most important event of 2016 will be the launch of AB Imitrex in June 2016. I think that investors may be underestimating the potential of this launch. I am estimating that 2H, 2016 sales will be $9.0 million with a disproportionate $$6.8 million of this occurring in 3Q, 2016 due to the initial stocking.

- It is a guessing game in terms of estimating licensing and development revenues. Because of the work on Makena SC, AB Byetta, and AB Forteo and undisclosed other products, there could be a good increase in 2016 for each category. However, because of the lack of visibility, I have sales in these categories as roughly flat.

Here is a detailed sales forecast for each quarter of 2016.

Otrexup needs to reach sales of perhaps $20 to $22 million to reach breakeven according to the Company. It will not reach this level in 2016, but it should contribute a lesser loss in 2016 than 2015. Otrexup represents 29% of my estimated sales for 2016.

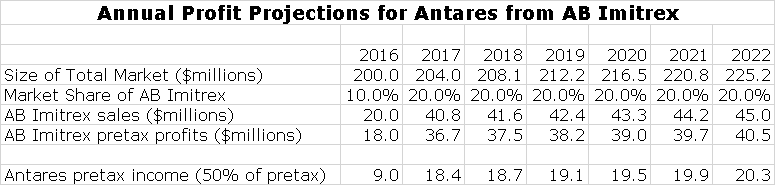

The big swing factor for 2016 and 2017 is the scheduled launch of AB Imitrex in 2H, 2016. Antares is splitting pretax profits with Teva on this product so that on the Antares income statement, the line item in the income statement looks at first glance to be a sales number, but in reality it is pure profit that goes straight to pretax profit. I am estimating that Antares share of profits from AB Imitrex will be $9.0 million in 2016 or 18% of revenues.

I am forecasting a slight decline in selling, general and administrative spending caused in part by a sharp drop in litigation expenses. My forecast for research and development calls for a modest increase. The forecast estimates a $2.5 million filing fee 4Q, 2016 assuming the QST NDA is filed; this is part of research and development expenses. Note that I am estimating a profit in 3Q, 2016 thanks to the AB Imitrex stocking.

I estimate that the operating cash burn in 2016 will be about $10 million and that capital spending will be $6.0 million bringing the 2016 cash burn to $16 million. If so, the Company will end the year with about $32 million of cash down from $47 million at the beginning of the year. I do not see a need for the Company to finance at currently distressed stock price levels.

The Outlook Beyond 2016

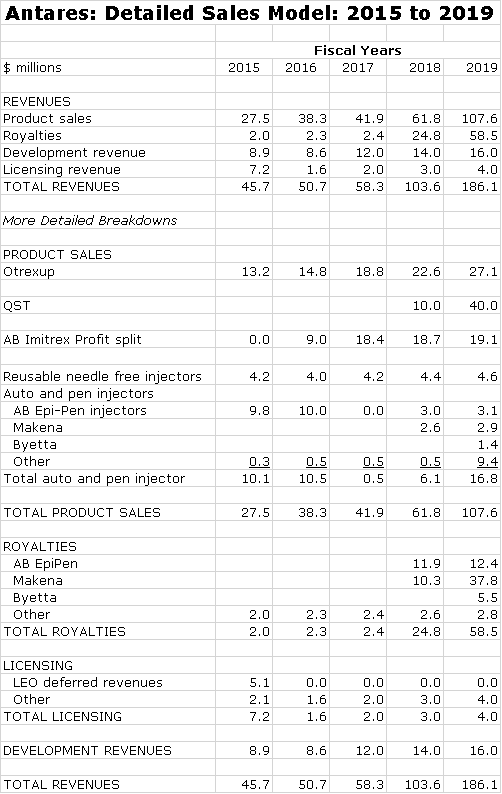

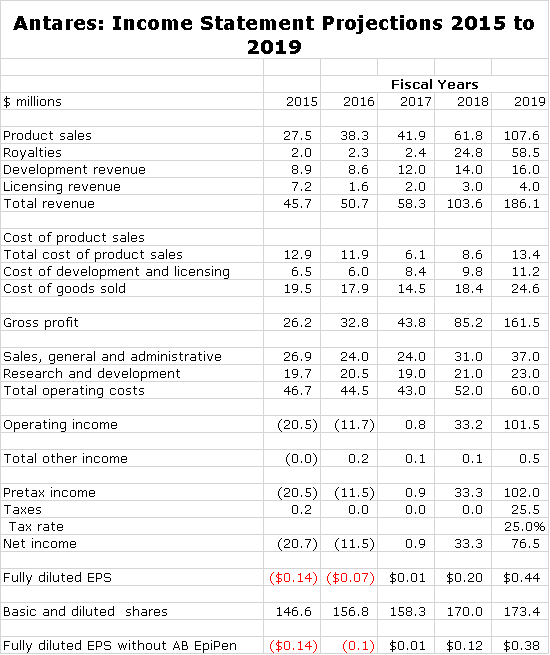

Later in this report I discuss in detail the assumptions underlying my sales and profit projections for Otrexup, AB Imitrex, QST, AB EpiPen, Makena SC, AB Byetta and AB Forteo so at this time I am not going to go into any detail. You can see from the following table that I am projecting a sharp increase in sales in both 2018 and 2019. While I don’t show estimates for 2020 to 2022, I would continue to look for very strong growth in those years. The wild card in this outlook is AB EpiPen. I have it being launched in 2018 and being a major contributor to sales in that year. Here are my detailed estimates.

The next table shows my income statement projections for 2016 through 2018. I am projecting roughly breakeven operations in 2017. Then in 2018, I anticipate a sharp increase in EPS to $0.20 per share led by the launch of Makena SC and AB EpiPen. The launch of QST is likely to cause a loss. Then in 2019, I see another sharp increase in EPS to $0.59.

As I have previously said, the launch of AB EpiPen is a wild card and it may be the case that it does not ever come to market. In that case, my 2018 and 2019 EPS estimates would be decreased from $0.20 to $012 in 2018 and from $0.59 to $0.51 in 2019.

Investment Considerations

Reasons for Poor Stock Performance

The launch of Otrexup has been extremely disappointing in contrast to my high expectations. Medac launched a competitive product Rasuvo shortly after Otrexup. It was my expectation that Medac would focus on educating physicians and expanding the market to the benefit of both products. In my experience, this has been the normal course of competition in situations like this. Instead, Medac focused primarily on maximizing unit market share with aggressive pricing. I also expected that managed case would embrace Otrexup and Rasuvo as cheaper and more effective alternatives to the expensive biologics after patients fail on oral methotrexate. However, the higher rebates that biologics offer actually makes them more profitable for managed care if not the people for whom they provide coverage.

Along with the slow launch of Otrexup, investors were dealt another sharp blow on expectations that an AB rated generic to EpiPen would be approved in 2016. Teva had given very strong indications that this approval was probable and imminent. Teva had indicated that it expected a Complete Response Letter, but thought the issues would be minor and easily resolved. Upon receipt of the CRL, Teva was surprised at the questions raised by the FDA and reversed its guidance saying that the product would not be launched in 2016. There is now a legitimate concern as to whether an AB rating is possible.

Is There Any Hope for the Stock?

Against this backdrop of disappointment, investors seem dismissive of management guidance that revenues could increase 10% this year. With this type of sales increase it is possible that the company quarterly earnings breakeven in 3Q, 2016 and fiscal 2017. Indeed, my estimates and those of some other analysts project this. If this is the case, I think that the Company could end this year with $32 million of cash and could end 2017 with $26 million of cash. I think that the stock is being weighed down by the expectation that it will have to an equity financing in 2016 at a distressed stock price, but this may not be the case.

I also think that the stock price seems to give no awareness of an extremely impressive new product outlook. There are 6 products in the pipeline, anyone of which could have a significant or dramatic impact on profitability and the stock price. These are QST, AB Imitrex, AB EpiPen, AB Byetta and AB Forteo and a product like extension strategy for Makena.

New Product Potential is Outstanding

One of the most positive aspects of the Antares investment thesis is its rapid product development capability for which there are two strategies. The first is developing proprietary products which it can either market on its own, co-market with larger companies of out license completely. The first of these was Otrexup for rheumatoid arthritis which was introduced in January 2014. The second is QST for treatment of low testosterone for which an NDA should be filed in late 2016 or early 2017. This could potentially lead to approval and marketing in 1H, 2018. Thereafter, the plan is to introduce one proprietary product per year. At this point, the Company has not identified the next proprietary product.

The second aspect of product development is forming partnerships or collaborations with other companies. Antares has an exceptionally close and important tie with Teva. Here the strategy is to develop AB rated generics to injectable products. The first of these to reach the market is AB Imitrex (sumatriptan) which the companies will introduce in 3Q, 2016. The interesting aspect of this strategy is that these products will be incorporated in Teva’s generic product offering. This allows them to gain widespread distribution with virtually no marketing expense. According to my estimates, each $10 million of AM Imitrex sales will produce about $8 million of gross profits which essentially are pretax profits which in this case are split equally between Antares and Teva. I will discuss this in more detail later.

There are a substantial number of product opportunities that Teva and Antares can work on together to develop AB rated generics. We know of Imitrex and EpiPen, Astra Zeneca’s Byetta (exenatide) and the companies recently announced a new development effort for Forteo (teriparatide); this is Eli Lilly’s product for osteoporosis in women and men. I suspect there are a good number of other products in development that have not yet been disclosed.

Antares also has the potential to work with other companies on product life extension strategies. Such an agreement with AMAG Pharmaceuticals was announced in January for that company’s key product Makena. I just completed an extensive report on that product. There are likely to be (many) others.

Estimating Potential Sales and EPS Going Forward

In this report, I first estimate sales and EPS in 2016 and 2017 on the basis of the current products, the most important of which are Otrexup and the AB generic to Imitrex. My estimates are as follows for 2016 and 2017. The new product flow begins in late 2017. It is likely that QST could be approved in 2H, 2017 and be introduced in early 2018, probably in partnership with a larger company. The project on Makena could result in a product introduction in 2H, 2017 or 1H, 2018. The timelines for the AB generics to Byetta and Forteo could lead to an introduction in 2019 and 2020.

AB Generic to EpiPen is the Wild Card in the Investment Thesis

The wild card is the outlook is AB rated generic to EpiPen. After receipt of a Complete Response Letter in late 2015, Teva told that investors that the product would not be approved before 2017. I wrote a brief report on this. It gave no details on the contents of the CRL and if and when the issues are resolvable. If you want to take an optimistic tact, you can say that this was not an outright rejection and that the FDA has now defined the issues that Teva and Antares must answer and indeed they are working on this. I note that in the case of the AB generic to Imitrex, a CRL was received and the issues were resolved. This leads me to think that there is still hope for approval, but because of the lack of clarity there is also a possibility that approval will not be gained. I reiterate that this is a wild card, but I think that the marker has literally written this product off and there is no expectation in the stock price.

Makena SC Has Great Promise

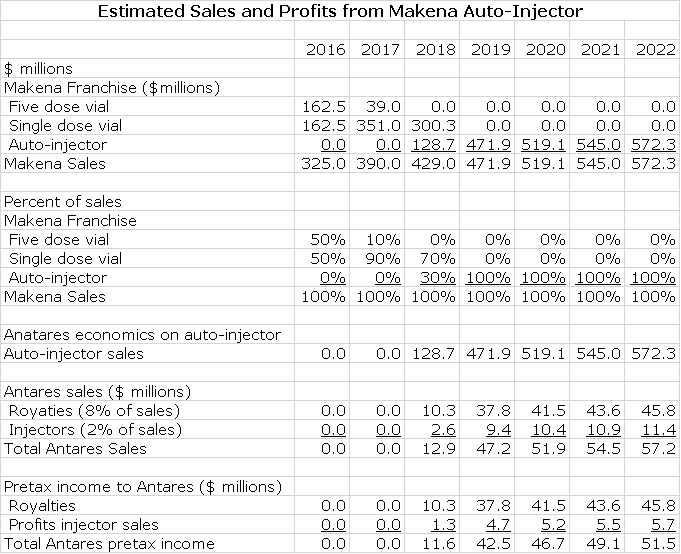

Makena SC could contribute $52 million of pretax profits in 2022. It is the most important of the new products in the 2016 to 2020 time frame.

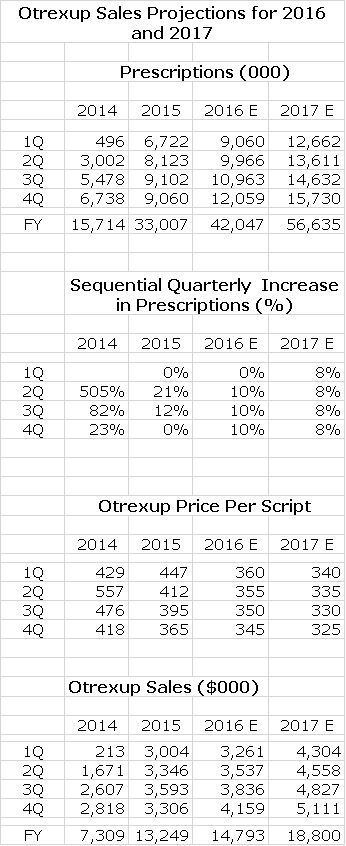

Otrexup Estimates for 2016 and 2017

The next table shows the performance of Otrexup in each quarter since its introduction in 1Q, 2014 for prescriptions, price per prescription and sales along with projections for each quarter of 2016 and 2017. The prescriptions are estimates based on audits done by Symphony Health. Accounting treatment requires for the time being that Antares reports sales based on prescriptions filled and not on shipments to distributors. Hence, Antares must estimate the average price of each prescription and multiply it by the estimated number of prescriptions. This means that reported sales are based on multiplying one estimate by another and are subject to inaccuracies.

I build my model by estimating the sequential increase in quarterly prescriptions. Trends in late 2014 and 2015 were hurt by aggressive price competition from Rasuvo and I am estimating that this will continue. I note with some concern that 4Q, 2015 prescriptions were flat with 3Q, 2015. Antares has also signaled that a change in the auditing methodology by Symphony Health will be a factor in an expected flat prescription performance from 4Q, 2015 to 1Q, 2016. Ongoing reimbursement pressure and Rasuvo price completion could lead to continuing decreases in price per prescription. This is all shown below.

Details on Pipeline Products

AB Imitrex

The FDA approved Teva’s AB rated generic to Imitrex (sumatriptan) on December 15, 2015. Antares will manufacture the product and sell it to Teva at cost. Teva will then distribute it and profits will be split 50/50. Interestingly, in the fourth quarter of 2013, Antares received a complete response letter (CRL) on AB Imitrex from the FDA and received another in January 2015. It was able to address the issues and gained approval in a little less than one year. This timing may or may not have implications for the time for a potential approval for AB Epi Pen, which I will discuss shortly.

This product was the first ANDA approval of a complex generic and the second product approved using the VIBEX auto injector platform. In this case, Vibex acccepts a standard pre-filled syringe and rapidly completes an injection (0.5 ml in less than 1 second). It requires only a shallow 2.5 mm penetration allowing for subcutaneous injection. The needle is hidden which reduces patient apprehension and provides a comfortable injection.There is also a retracting collar with a lock-out to avoid accidental needle-sticks. In this case, the product is delivered as a one time or STAT dose to treat migraine headaches. The FDA approved a 4 mg/0.5 mL and a 6 mg/0.5 mL dosage.

Teva will include this product in its bundling agreements for generics with pharmacies such as CVS and Walgreen’s. Because the product is AB rated it can be substituted for any prescription written for Imitrex or its authorized generic. It is not a matter of having a physician write a prescription. It is a matter of having the pharmacy stock the product. The broad generic product line of Teva in its bundle gives Teva a major advantage over other generic companies in the market in terms of getting the product stocked. Remember stocking is everything as all of the products are interchangeable. The current market for Imitrex is $200 million and there are three major competitors as shown in the next chart.

Each 10% share gives rise to about about $20 million of sales.There are no selling costs and only minimal distribution costs so that the only major cost is that of the device is cost of goods sold which I estimate as about 10% of sales. Hence the pretax profit on each $20 million of sales is about $18 million which is split evenly between Teva and Antares. Teva may launch this product on June 1. If so, Antares will record its share of the profits with a one quarter lag so that revenues will first appear in 3Q, 2016.

Teva and Antares are confident that they can muscle into this market and gain a meaningful market share. I am assuming that they reach a 20% market share in 2017 ( I think they are shooting higher) which would translate into about $40 million of sales and $36 million of profits split 50/50. This would mean about $4.5 million of pretax profits per quarter for Antares in 2017 or $18 million for the year. In 3Q, 2016, the initial stocking should cause a surge in sales as the initial stocking is made. Here is what I think is is a reasonable projections for sales of AB Imitrex and the resultant profit split to Antares by quarters in 2016.

Annual sales projections through 2022 are shown in the following table.

QST Injectable Testosterone

QST Product Attributes Promise to Make It the Injectable Product of Choice

The viscosity of testosterone is high and this means that it has not previously been possible to deliver testosterone in fine gauge needles in a subcutaneous injection. Consequently, current testosterone injections require a large diameter needle and intramuscular injections that require 20 to 30 seconds for administration which leads to pain and discomfort. A great advantage of QST is that it is delivered with a fine gauge needle subcutaneously in 5 to 10 seconds and is virtually painless. Its once a week dosage is ideal for a patient administered medication allowing QST to be given at home whereas intramuscular injections often require a physician visit. Patient acceptance throughout the clinical review program was outstanding.

The product also successfully addresses the transference issue experienced with topical testosterone gels in which testosterone is inadvertently transferred to a spouse, partner or others. It is a once weekly injection and provides a better peak to trough ration than intramuscular formulations. Side effects experienced with testosterone (possibly cardiovascular) may occur if blood levels exceed the peak recommended level and the product is ineffective if blood levels are below the minimum range.

Importantly, the pharmacokinetic profile of QST shows that it produces much more stable blood levels for testosterone than gel formulations and intramuscular injections. In clinical trials there were no excursions above the maximum or below the minimum targeted blood levels which are desired for testosterone replacement. Intramuscular injections are very subject to excursions outside of both the upper range of the desired level of testosterone in the blood (causing side effects) when first injected and over the course of a week drop below the lower range (sub-effective). The PK profile of QST results in testosterone levels being in the desired range the whole time. Because of this, QST could be the best in class for injectable and perhaps all testosterone products in terms of safety and efficacy.

Clinical Data is Excellent

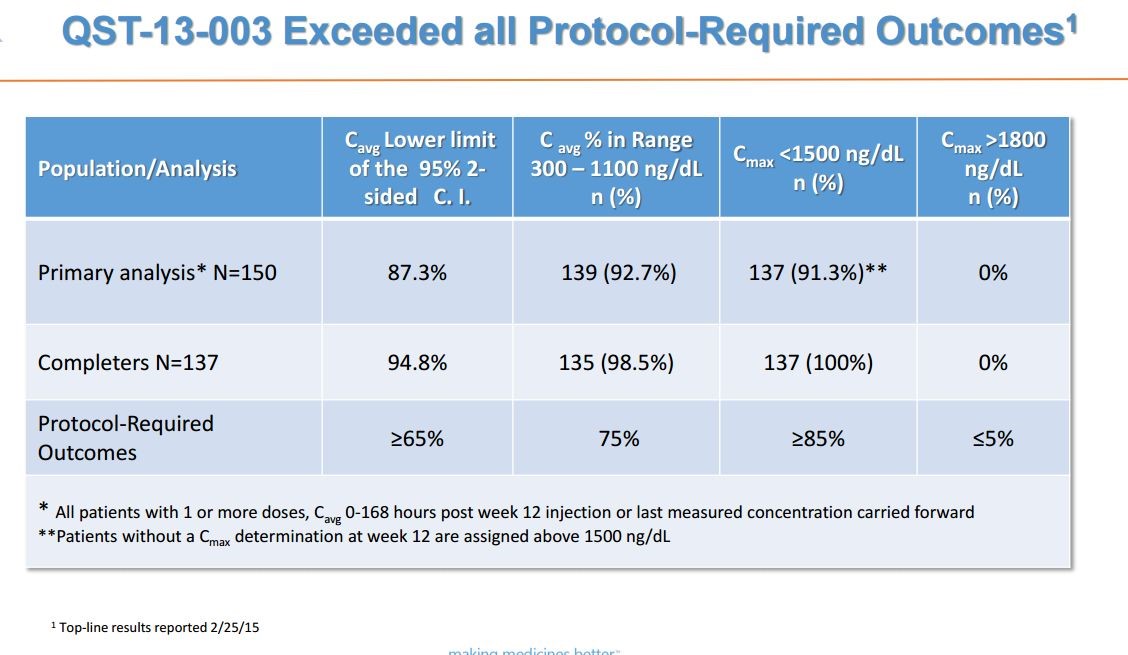

The final data from the 52 week phase 3 study QST-13-003 was announced on March 16, 2016. This was a 12 week efficacy and 52 week safety study in150 adult males with hypogonadism (low testosterone) and testosterone blood levels less than 300 ng/dL received a starting dose of 75 mg of subcutaneously administered testosterone. The dose was titrated if necessary.

The phase 3 trial met all of its 12 week efficacy primary endpoints. The protocol required that: (1) at least 75% of all patients’ testosterone blood levels were within the range of 300 to 1100 ng/dL, (2) at least 85% of patients’ Cmax was less than 1500 ng/dL and (3) no more than 5% of patients had a Cmax greater than 1800 ng/dL. In the overall analysis for efficacy, the primary endpoint was met by 139 out of 150 patients, or 92.7% with a 95% confidence interval of 87.3% to 96.3%. Among the 137 patients that completed all 12 weeks of dosing and PK sampling, 98.5% were within the pre-defined range. This is shown below:

The FDA asked that Antares have a safety database of approximately 350 subjects exposed to QS T in total with approximately 200 subjects exposed for six months and approximately 100 subjects exposed at twelve months. This required ab additional study for which enrollment completed ahead of schedule in November 2015. There were 133 patients are enrolled in the study who received treatment for six months. Antares anticipates that the last patient in the study will complete their final visit by late Q216

Timing of Approval and Launch

The targeted NDA filing targeted for QST is late 4Q, 2016 16 or early in 1Q, 2017. If the FDA finds no issues and meets it PDUFA target. I am projecting approval in late 2H, 2017 and for commercial marketing to start at the beginning of 2018.

Comments on the Testosterone Replacement Market

Testosterone replacement therapy was popularized as “the low T” market and as a result of direct to consumer advertising sales were surging. In 2013, sales were increasing at 25+% per year. The market was thrown into upheaval in early 2014 when the FDA reacted to findings in retrospective studies that suggested an increased risk of cardiovascular side effects (with all testosterone products). This also heightened an ongoing FDA concern that there was overprescribing of these products for non-approved indications.

The outlook became unsettled for a broad array of existing gel formulation and injectable testosterone products and of course those in development like QST. In the aftermath, sales of gel based products plunged on this controversy and have continued weak but interestingly the injectable market has showed stability and some growth. Over half of the prescriptions in the testosterone replacement market currently are for injectables.

In 2015, Symphony Health estimated that 6.8 million prescriptions were written with 3.5 million (51%) coming from injectable dosage forms, 2.7 million (39%) from gels and the remaining 0.6 million (10%) from implantable and transbuccal dosage forms. In 2013, the market peaked at 8.1 million prescriptions and then went into a decline due to the cardiovascular side effect issue. This decline was due to the gels as injectable prescriptions grew over this time period. In 2015, the entire market stabilized as concerns about draconian actions from the FDA in regard to these cardiovascular side effects eased. Prescription trends are shown in the following table.

The retail market for testosterone product is estimated at $2.8 billion in 2015. After taking into accounts discounts and rebates, manufacturer’s sales were probably around $2.0 billion. Based on percentage of prescriptions, injectables were about $1.0 billion of sales.

Potential Competition from an Oral Testosterone Product

Liposone is developing an oral testosterone product LPCN 1021 that has a PDUFA date of June 28, 2016 so that it is possible that it could be launched in early 2017 one year ahead of QST. There may be a tendency for investors to try to determine which product is better and I favor QST. Before doing so, let me make the point that h this is a $2 billion market with slightly less than $1 billion of sales coming from gels which have lost favor in the market and about $1 billion from intramuscular injections which have pain issues. This is a huge market and I don’t see this as an either/or situation. There is opportunity for both products and I don’t see a head to head encounter.

At first glance some investors might think that an oral product would have a dosing advantage over an injectable product. I do not agree that this is an advantage for LPCN 1021. It requires dosing in the morning and at night with meals of high 800 to 1000 caloric intake. This is an awkward dosage form and may be a deterrent to many patients because this is not how they eat during the day or because they are obese. In contrast, a once a week injection with a virtually pain fee auto injector is very easy to comply with.

I also think that the FDA may have some problems with LPCN 1021. If for whatever reason, the patient takes a dose with a light meal or without eating we could see a spike in Cmax levels of testosterone in the blood which increases the potential for side effects. The same concern arises if doses are missed. This along with difficulty in complying with twice a day dosing might cause the FDA concerns. The compelling point about QST is its ability to keep patients in the acceptable blood level range over one week with just one injection.

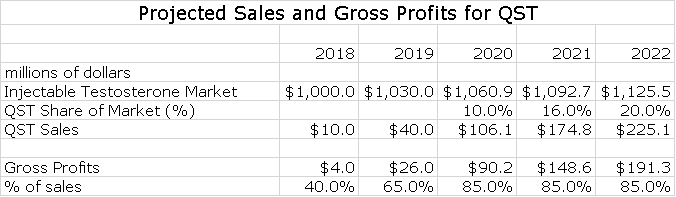

Sales Projections for QST

I am estimating that QST will be introduced in early 2018. I think that there is a high probability that it will be launched in a partnership with a larger company, but for the time being I am modeling it on the basis of Antares going it alone. The first and obvious question is how this launch might compare with the disappointing launch of Otrexup. The similarity is that there will be managed care hurdles to leap and in the case of almost every newly launched product, this means that first year sales are limited.

Beyond managed care there are significant differences. Otrexup was targeted as a niche in the rheumatoid arthritis market that was intended to keep patients on gold standard methotrexate treatment for a longer period of time before progressing to biologics. This was a new usage for methotrexate and requires a selling effort to educate physicians. Also, managed care makes a lot of money from rebates on biologics and this was an unexpected barrier for Otrexup which promises lower prices for patients and managed care. In the case of QST, physicians are well educated on the use of injectable testosterone and the advantage of subcutaneous injection and much better pharmacokinetics will be quickly understood and appreciated. Perhaps most importantly, there will be no comparable product like Rasuvo vis a vis Otrexup competing on a price basis.

I think that this product with only Antares marketing it can aspire to a 20% share of the injectable market by 2020. Here is an estimate of how sales and gross profits could progress through 2022.

Makena SC

Please refer to my recent detailed report on Makena if you are unfamiliar with this product. I am going to proceed as if you have read and understand the thinking in that report. AMAG is projecting that Makena IM sales in 2016 could reach $310 to $340 million which would represent a 23% to 35% year over year sales increase. AMAG also suggests that Makena IM has only 35% of its addressable market and suggests that there is substantial room for growth at the expense of compounding pharmacy versions. I see a plausible scenario in which Makena SC sales could reach $500+ million by 2020, especially if the FDA is convinced that trial data establishes superiority of Makena SC to Makena IM. Note that I refer to the Antares auto-injector dosage of Makena as Makena SC and the existing intramuscular dose as Makena IM.

Antares has said that the economics for Makena SC are similar to those for EpiPen. On the latter, it has suggested that for each dollar of sales that Teva achieves in marketing EpiPen, Antares will receive revenues in the low double digits and I have used 10% of EpiPen sales in my model. The Company has not given guidance but it has suggested that the majority of this 10% comes from royalties with some smaller part coming from sales of the auto-injector. I have assumed that auto-injector sales are 2% of sales and royalties are 8%. In regard to Makena SC, the Company has indicated that the economics are somewhat better than for EpiPen. However, for the sake of conservatism, I will assume that they are the same.

In my model for sales of the Makena franchise, I project that Makena SC will quickly replace Makena IM. I am assuming that marketing begins in 1Q, 2018. I think that the drugs will be priced at parity and I expect Makena SC to quickly replace Makena IM in the marketplace. While it is possible that a generic to the five dose vial of Makena IM could be introduced in early 2018, I think it will likely be later than that. In 2018, most or all of the market will be switched to single dose, preservative free vial so that there may be no market for the generic if it is approved. Here are my assumptions.

AB EpiPen

Teva filed an 8-K on February 9, 2016 that stated: “Teva received a complete response letter on February 23, 2016 relating to its epinephrine ANDA in which the FDA identified certain major deficiencies. Teva is evaluating the CRL and intends to submit a response. Due to the major nature of the CRL, Teva expects that this product will be significantly delayed and that any launch will not take place before 2017.”

Teva had previously indicated that it expected a CRL. Apparently, the CRL was received on February 23 and the company worked through it for a week before making any announcement. The use of the term major deficiencies suggests to me that there are more difficulties with the ANDA than Teva, Antares and investors had anticipated. The consensus expectation was that the deficiencies would be minor, could be readily addressed and might lead to approval and possibly a launch in late 2016.

The reference to the major nature of the CRL (almost certainly a surprise to Teva) is more than disconcerting as is the statement that any launch will not take place before 2017. Teva seems to be raising the possibility that the product might not be approved with an AB rating. At the same time, it has not definitely stated that there will not be a launch of the AB rated product which keeps hopes alive. It is doubtful that Teva will elaborate on the nature of the deficiencies so as investors we can only say that the product may or may not be approved-not a happy situation.

In terms of historical precedent, I would note that Teva and Antares were able to gain approval of an AB rated version of Imitrex (sumatriptan) after receiving a CRL. I was told that in that sumatriptan CRL, there was actually a fatal deficiency with the device. I make this point only to show that this CRL on the AB rated version of EpiPen could be something that can be overcome. I would note that it took two years from the receipt of the first CRL on Imitrex (there was also a second) until approval was gained. If the same timeline were to hold on AB EpiPen, it would be approved in early 2018, but who knows.

Investors can retain hope that the AB rated version of EpiPen still has a path forward and hopefully Teva may have more to say on this later this year. However, it is only prudent to consider the investment potential of Antares without an AB rated version of EpiPen as well as with.

I have built a sales and earnings model for AB EpiPen which assumes that it is introduced in early 2018. I assume that the price will be discounted 30% from Mylan’s price for EpiPen and that it will capture 40% of the market. I am assuming that Antares receives 8% of Teva’s sales as a royalty and 2% of Teva’s sales for injectors. All of the royalty drops straight to the pretax line and I assume that the gross profit on injectors is 50% and that also drops right to pretax. Here is my model for the sales and earnings contribution to Antares.

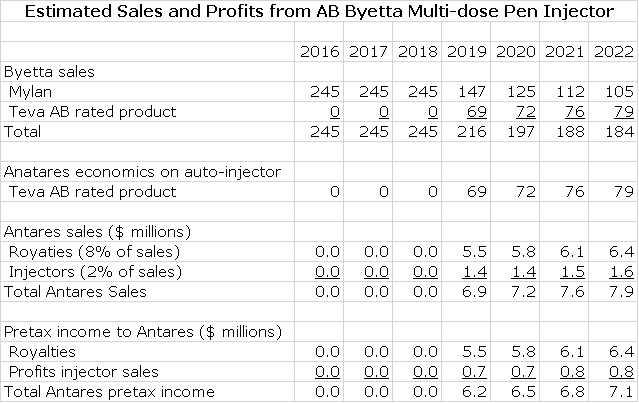

AB Byetta

Teva submitted an ANDA for Astra-Zeneca’s Byetta (exenatide) to FDA that was filed in December 2014. AstraZeneca and Amylin immediately filed a paragraph IV certification in December 2014 which triggered an automatic 30 month stay under Waxman Hatch before AB Byetta can be approved. In the best case, an AB Byetta could come to market in early 2018. In most cases, the product originator Astra Zeneca and the generic challenger reach an agreement that allows the generic to come to market but sometime after the 30 month stay expires. There is no way for me to predict if there will be a settlement and if these is one, when AB Byetta might come to market. As an outright guess, I am estimating it will be marketed in early 2019.

I estimate that Byetta achieved US sales of $245 million in 2015 and I think there that unit growth will decline. I am projecting flat sales for the product based on price increases. I think that Teva will be the first generic to the market and given the difficulty in gaining an AB rating for a complex generic, there will be limited or perhaps no generic competition for some time to come. I am estimating that Teva launches in early 2018 at a 30% discount to the price of Byetta and gets 40% of the market and that after this market shares remain constant.

As in the case of Makena and EpiPen, I am assuming that Antares receives 8% of Teva’s sales as a royalty and 2% of Teva’s sales for injectors. All of the royalty drops straight to the pretax line and I assume that the gross profit on injectors is 50% and that also drops right to pretax. Here is my model for the sales and earnings contribution to Antares.

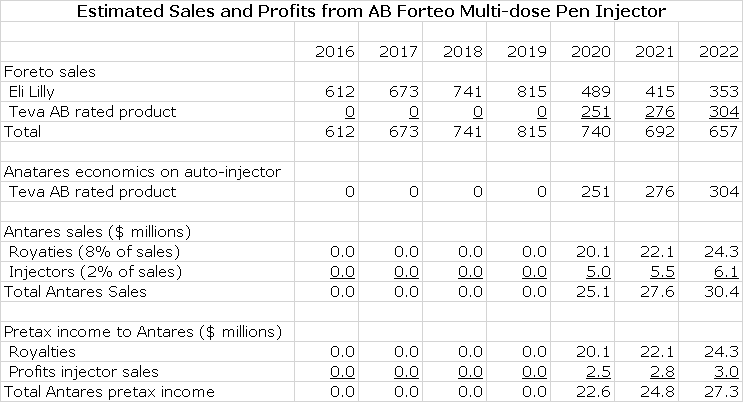

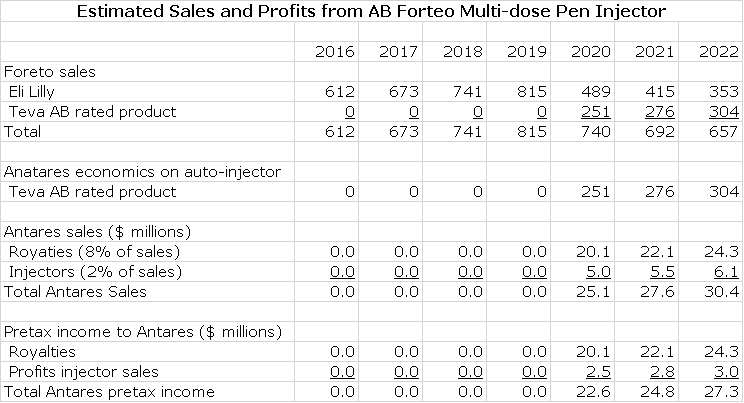

AB Forteo

Teva submitted an ANDA for Eli Lilly’s Forteo (teriparatide) and Eli Lilly then filed a paragraph IV certification on March 16, 2016 which triggers the 30 month stay under Waxman Hatch before AB Forteo can be approved. In the best case, an AB Forteo could come to market in early 2019. In most cases, the product originator Eli Lilly and the generic challenger reach an agreement that allows the generic to come to market. There is no way for me to predict if there will be a settlement and if these is one, when might AB Forteo might come to market. As an outright guess, I am estimating it will be marketed in early 2020.

I estimate that Forteo achieved US sales of $612 million in 2015, an increase of 14% from 2014. I think that through a combination of unit growth and price increases that Forteo can grow at 10% per year through 2020. I think that Teva will be the first generic to the market and given the complexity of gaining an AB rating for a complex generic, there will be limited or perhaps no generic competition for some time to come. I am estimating that Teva launches in early 2020 at a 30% discount to the price of Byetta and gets 40% of the market and that this market share increases slightly over time.

As in the case of Makena, EpiPen and Byetta, I am assuming that Antares receives 8% of Teva’s sales as a royalty and 2% of Teva’s sales for injectors. All of the royalty drops straight to the pretax line and I assume that the gross profit on injectors is 50% and that also drops right to pretax. Here is my model for the sales and earnings contribution to Antares.

Tagged as Antares Pharma Inc., ATRS, otrexup, QST testosterone replacement + Categorized as Company Reports, LinkedIn

Thanks Larry. Superb write up – you outdid yourself on this one. The market is indeed completely ignoring the pipeline that you superbly identified. If anything there is upside to your estimates. I may have missed it, but I didn’t see you make mention of the milestone payment Antares will receive from Teva upon launching Gx Imitrex. I don’t know the amount, but I’m guessing it will be in the millions of dollars (aka perhaps similar to what Leo paid when they partnered with Otrexup). That event will help Antares cash position. I think Antares will finish 2016 in better cash shape than surmised (TBD). As for future products, Teva expects greater market share for first to market exclusive generics than what you identified. They state that as the norm, they expect 30% market share by the 3rd month and 80% share by the 12th month, post launch, for any first to market generic they launch. In their experience that’s what they’ve seen over and over.

I do expect multiple new alliance deals to hit Antares pipeline this year. I believe at least two will come from Teva. Antares patent work gives strong hints as to what these drugs may be (the two I’m speculating are both diabetic drugs). I also believe as you do that other deals are in process. I’ll hold off for now in posting my speculative thoughts on what the partnered drugs may be.

Very very nice report !

About the expected milestone payment upon the launch for Sumatriptan, the amount has not been disclosed.

Hi Larry,

Question about the financials above – why the big drop in licensing revenues from 2015 to 216?

Thanks

Antares is pretty opaque on licensing and development revenues so that it is hard to estimate revenues. Also, they intertwine in ways that Antares does not clarify. I think that in the aggregate, Antares only earnings a modest gross margin on these two line items so that if sales go up or down it is not very important to profits. I would think that with all of the work going on with disclosed and undisclosed new products that sales could rise much more so than I have estimated. Because of the lack of visibility, I try to be conservative.

Thanks Larry

Whats your estimated price target for Antares in Q4 2017

Not Larry, but events that could/should transpire by Q4 2017 include Sumatriptan being launched for 15 months, QST approved by Q4 2017, and Makena approved (if filed Q1 2017 and given priority review status, which is what AMAG believes will happen). Otrexup status remains a wildcard. Not sure what the future holds for Otreuxp. Epi Gx is another wild card, will it be Gx approved by then? Exenatide is another wild card. The branded drug’s 30 month stay ends by June 2017, and Teva’s Gx version could be approved by that time. How many other new alliance deals will be announced this year and next, and what will the future value of those deals be?

Antares should become financially stable later this year. If so, a big positive for the company. The $$$ question becomes how much value will the market award their future pipeline? I’ll defer to Larry to answer that question.

reminder: PDUFA date coming up next week for Liposome LPCN 1021 – could be stock moving ST. I guess whatever the decision, people may arrive at different conclusions to the same set of facts.