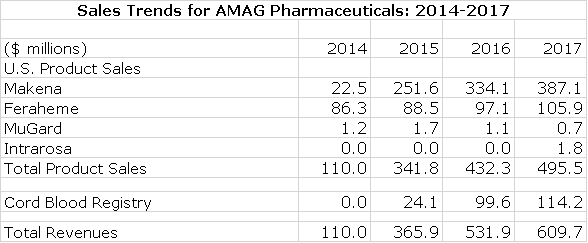

AMAG Pharmaceuticals: Trying to Project 2019 Sales for the Makena Franchise (AMAG, $24.45, Buy)

Investment Thesis

The investment outlook for AMAG in 2019 is primarily about Makena and this report focuses almost entirely on how much of the franchise can be maintained by the new auto-injector dosage form in the face of generic competition to the older intramuscular formulations. The Wall Street consensus 2019 sales estimate of around $200 million for the Makena franchise is consistent with the auto-injector retaining 60% of the unit market at a 20% price discount; this compares to Makena sales of $387 million in 2017 when there was no generic competition. There are innumerable scenarios for Makena and my intuition is that the consensus 2019 sales estimate will prove to be too low. However, at this point the story is just unfolding and it will take time to gain some measure of confidence in projecting 2019 Makena sales which are critical to the investment outlook. Management is providing no guidance of any sort on 2019.

I will spend little time discussing other products and AMAG related issues in this report and I suggest that you refer to my April 13, 2018 report Upgrading to Buy Based on an In-Depth Analysis of the Outlook for Makena Over the 2018 to 2020 Period (AMAG, Buy, $21.10) for a discussion of two other key products-Feraheme and Intrarosa- but briefly:

- Feraheme is an intravenous iron product. On February 5, 2018 the FDA approved a supplemental NDA to broaden the label beyond chronic kidney disease to include all eligible adult iron deficiency anemia patients who are intolerant or have had unsatisfactory response to oral iron. This label expansion doubles the number of patients that can be addressed and is causing a substantial acceleration in sales as shown by a 37% increase in 2Q, 2018 sales. I am projecting a 29% increase in 2019 sales to $177 million and continuing strong growth beyond; importantly Feraheme carries a very high gross margin. There is unlikely to be generic competition before July 2022 based on a recent patent settlement.

- Intrarosa is a new product for dyspareunia (pain during sexual intercourse) that was just introduced in 3Q, 2017 and is in its launch phase. It is meaningfully differentiated from estrogen products that dominate this market (current US sales are estimated at about $1.4 billion) as it has a different mechanism of action and carries no black box warning. The Company has hired a new sales force to market this product and has indicated that it is spending $80 million on the launch. I am estimating that sales will increase from $16 million in 2018 to $32 million in 2019. At this level of sales, it likely will remain in a loss position.

- The pipeline for AMAG is generally ignored by investors as being unpromising and is not factored into the stock price in my opinion. The Company has a March 2019 PDUFA date for bremelanotide, a product for female sexual dysfunction. Further back in development is Velo for the treatment of severe pre-eclampsia. Both bremelanotide and Velo are totally off the radar screen of investors and Intrarosa is a small blip. There is the potential for upside surprise from these products at some time in the future,

- AMAG has been laboring under a heavy debt burden. As of March 31, 2018 it had two major outstanding debt obligations: a $320 million convertible bond at 3.25% due in 2022 and a $475 million senior note at 7.875% due in 2023. Proceeds from the recent sale of Cord Blood Registry will be used to retire the senior note resulting a $37 million reduction in interest expense.

Later in this report I have made projections for AMAG’s sales and earnings in 2019 based on three different scenarios for the Makena auto-injector:

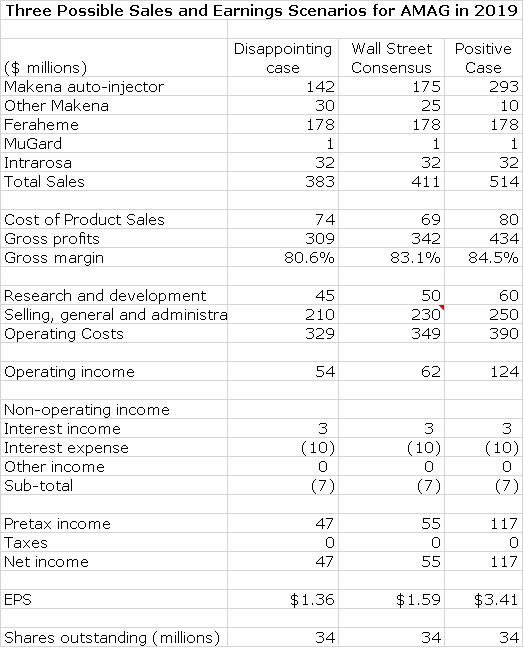

- Positive case is auto- injector captures 80% of the unit market at a 10% price discount. In this case I project auto-injector sales of $293 million and EPS of $3.41.

- Wall Street consensus case is consistent with the auto- injector capturing 60% of the unit market at a 20% price discount. This would suggest auto-injector sales of $175 million and EPS of $1.59.

- Disappointing case is that the auto-injector captures 50% of the unit market at a 30% price discount. In this case, I would project auto-injector sales of $142 million and EPS of $1.36.

I should point out that earnings in 2019 will still be impacted by heavy investment spending on Intrarosa which will create a drag on earnings. If the product is commercially successful, there is the potential for a major turn from loss to profitability in the period beyond 2019. Also, Feraheme seems poised for very strong growth in 2019 and beyond and has projected sales of $177 million. It is emerging to be as or more important than Makena. Also, if bremalanotide is approved at the March 2019 PDUFA date, its launch could lead to significant spending which is not accounted for in any of these three scenarios. Here are my 2019 price targets for the three scenarios I have laid out

- I think that in the disappointing case that AMAG could sell at 10 to 13 times earnings resulting in a price target of $14 to $18.

- If Wall Street consensus estimates are met I could see a slightly higher P/E of 11 to 14 resulting in a price target of $17 to $22.

- If the positive scenario proves correct, I would estimate a P/E of 12 to 15 resulting in a price target of $41 to $54.

My intuition is that Makena sales will be closer to the positive case than the Wall Street consensus. This is the reason as to why I have a Buy on the stock.

You may wonder why I am focusing so much on 2019 and not on 2H, 2018. My reasoning is that generic competition to Makena just started in early July and through early August had made little impact; also the auto-injector is still in the launch phase. Hence the 3Q may have only a very modest impact from the one generic competitor. Management warns that there could be more generics entering later in the year that could lead to greater pricing pressure. This would put more pressure on 4Q, 2018 sales of Makena, but the real impact would be in 2019.

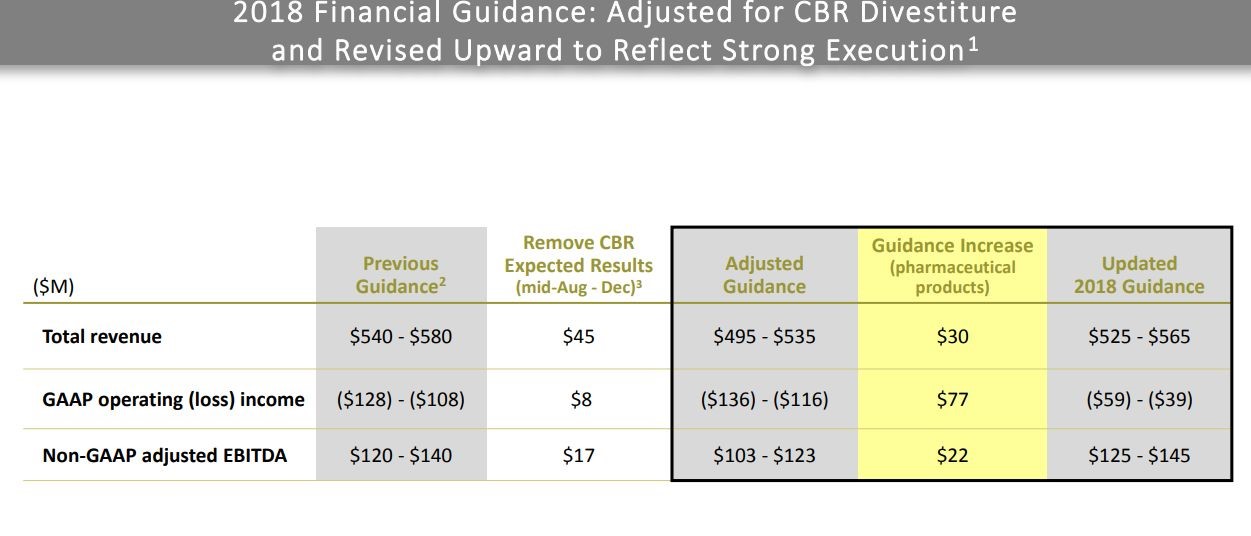

Management has given only indirect guidance for Makena in 2H, 2018. They are indicating that total sales of AMAG will approximate $525 to $565 million. The 2018 sales of Feraheme, Intrarosa and Cord Blood Registry (through its August divestiture) are relatively predictable so that subtracting their aggregate sales projections indicates that Makena sales for 2018 would be $300 to $340 million. In the first half of 2018, Makena sales were $195 million so management guidance (by my calculation) is indicating that 2H, 2018 sales of $105 to $145 million. This compares to 2H, 2017 sales of $198 million. Hence, AMAG guidance is consistent with a 27% to 46% decrease in Makena sales.

In my opinion, management guidance is extremely conservative for 2H, 2018 and that Makena sales likely will be better than guidance would suggest. The real test for Makena will come in 2019. It is my feeling that investors will not pay much attention if Makena sales exceed management guidance for 2H, 2018. Instead they will focus on metrics such as the percentage of Makena enrollments accounted for by the auto-injector, the percentage of auto-injector prescriptions written as dispense as written (DAW) and price discounting by the generics to build sales models for 2019.

2019 Is Almost All about Makena

As can be seen in the following table, Makena has been an enormous commercial success and in 2017 accounted for 63% of AMAG’s corporate sales. Feraheme accounted for 17% and Cord Blood Registry 19%. Intrarosa was just introduced in 3Q, 2017 and is in the early stages of its launch. MuGard is insignificant.

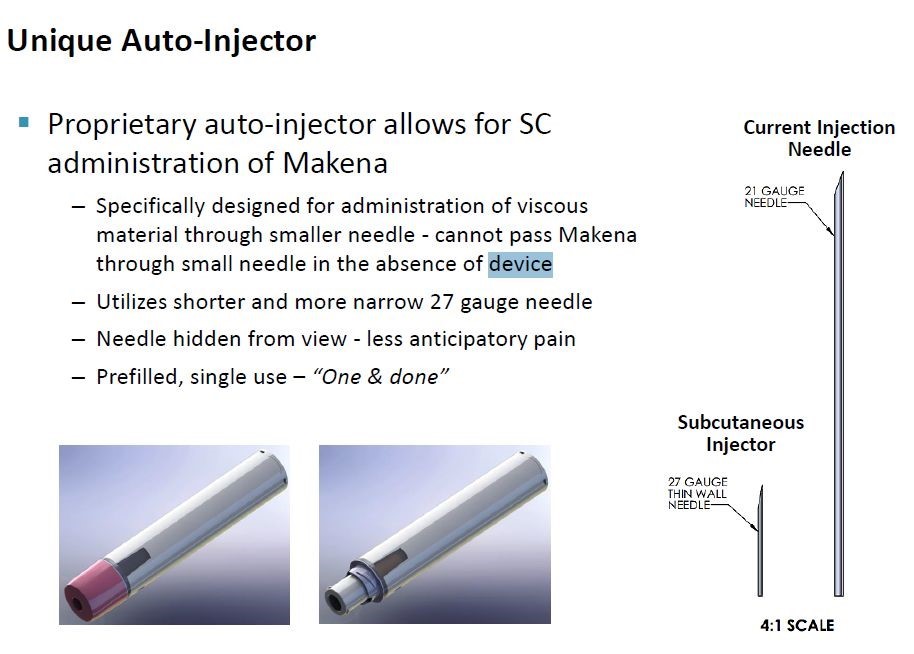

Projecting overall corporate results in 2018 and 2019 is very difficult for investors as the Makena franchise is changing dramatically. All of Makena sales through 2017 and early 2018 were from an intramuscular (IM) dosage form. On March 26, 2018 the subcutaneous, auto-injector dosage was approved and the first patient was treated on March 28. The auto-injector has meaningful advantages over the IM in causing less pain and anxiety for the patient and is much easier to use and more cost efficient for the physician. In my opinion, if there were no difference in price, almost all of the Makena franchise would quickly convert to the auto-injector; it’s just a superior product.

Complicating the situation is that on June 25, 2018 a generic competitor to the IM Makena single dose vial was approved and was followed by a launch in early July 2018. This triggered the launch of an authorized generic by AMAG and its partner Prasco. Note that this is a generic to IM Makena; there is no generic to the auto-injector now nor in the foreseeable future. AMAG is trying to switch much of the usage of Makena to the auto-injector. So at this point in time, there are five products competing in the market:

- Makena subcutaneous auto-injector

- Makena IM in preservative-free, single dose single vial

- Makena IM in five dose vial

- Generic competitor to Makena IM, preservative-free single dose vial

- Authorized generic to Makena IM preservative free single dose vial

The advent of generic competition always triggers alarm for investors and in many (most) cases for good reason. It is often the case that when a product given as a pill goes generic, sales can erode by 85% to 90% in a year. However, I don’t think that this type or erosion will hit Makena. In the case of a pill, the brand name drug and the generic are virtually identical and physicians can be indifferent from a medical standpoint about which the patient receives. This is not the case in the choice between the Makena auto-injector and the generic to IM Makena.

In my opinion, if there were no difference in price, almost all of the Makena franchise would quickly convert to the auto-injector. The patient is a pregnant woman about 16 weeks post gestation who previously delivered prematurely and is more at risk for another premature birth. She is probably uncomfortable with the pregnancy and anxious that she might again be premature. She is prescribed hydroxyprogesterone caproate, the active ingredient in Makena, which is given as a weekly injection for up to 21 weeks.

With the intramuscular products, each injection requires that the patient disrobe. She then is given an intramuscular injection in the buttocks that uses a 21 gauge needle that is about 1.5 inches long. The injection lasts for about one minutes and causes pain comparable to a flu shot injection. This is obviously an unpleasant experience for the woman that has to be repeated for perhaps 21 consecutive weeks.

The experience with the auto-injector is quite different. It uses a much smaller 27 gauge needle which is the size that is used daily by diabetics to inject insulin. The needle is only 0.5 inches long. The injections can be given sub-cutaneously in the back of the upper arm without requiring the woman to disrobe. It takes about 10 seconds to deliver the drug. The needle is hidden at all times so the patient and healthcare provider never see it. After administration the needle retracts into the device to avoid inadvertent needle sticks and the whole injector is discarded.

Based on anecdotal comments and not on data from a clinical trial, it is my understanding that about 25% of women given the subcutaneous auto-injector experience an injection site reaction. The remaining 75% appear to experience minimal if any injection site pain or reaction. If the pain occurs it is different from an IM injection. With the auto-injector there is a stinging, burning sensation that is transient and seems to result from some interaction of the drug and tissue, not the injection.

I think this will encourage physicians to write DAW prescriptions for the auto-injector. Likewise, it seems to me that managed care may not put a lot of pressure on physicians to prescribe generics. I think that most physicians would opt for the auto-injector unless managed care puts up major roadblocks that forces usage of the generic. However, managed care might be more circumspect in trying to force substitution of the generic. It could be a public relations nightmare if they were portrayed as being oblivious to the plight of pregnant women in order to save some money for their clients and in doing so, increasing their profits. However, managed care has strong mechanisms in place to promote prescribing generically and my arguments that the auto-injector is better for the patients and physician may not offset the ingrained drive to substitute generics for brand name drugs.

Let’s turn now to price issues. My estimate is that the price of Makena for non-Medicaid patients is about $6,000 for 16 weeks of treatment and for a Medicaid patient it may be $3,000. AMAG has priced the auto-injector at the same price as the IM. The initial generic competitor to IM Makena was priced at a 15% discount to the $6,000 price although special deals offered to some accounts might result in a greater discount. Later this year and into 2019, as expected new generics come into the market, we can expect the discounts to be greater. A 15% discount on patients covered by managed care would save the payor $900 if AMAG elected not to lower the price of the auto-injector.

The question is whether generics can price at some level where the advantages to the patient and physician are secondary to saving money. I don’t think so in the great majority of patients. I believe that much of Makena sales will switch to the auto-injector, but at this point in time it is too early to tell.

Update on Makena Based on 2Q, 2018 Conference Call

Second Quarter Sales of Makena

Second quarter sales of the Makena franchise grew 2.5% to $105 million. There were no price increases and management said that there were no meaningful inventory adjustments; hence the 2.5% increase reflects true unit demand. Management estimates that the market share increased slightly to 51%. About 30% of eligible patients are not treated in accordance with guidance from the Society for Maternal Fetal Medicine which recommends using the drug ingredient in Makena and 19% are treated with a pharmacy compounded product.

The subcutaneous auto-injector was launched on March 26, 2018 and the first patient was dosed on March 28, 2018 so that it was available for the entire second quarter. A generic to the single dose, preservative free vial of IM Makena was approved on June 21st, but did not launch until early July and did not factor into the second quarter. Management did not break out Makena 2Q sales of the auto-injector and the IM dosages other than to say that the great majority of sales were in intramuscular dosage formulations. The auto-injector should be a much more important contributor to Makena sales in the third quarter.

Makena Care Connections

It is important to understand the role of AMAG’s Makena Care Connections (MCC) in the marketing of Makena. It is a personalized patient care support system that AMAG offers to physicians who prescribe Makena. It offers services that makes filling prescriptions easier, interacts with patients to address financial issues, and encourages adherence to treatment. MCC is currently involved in perhaps 50% to 60% of prescriptions written for Makena.

By the end of 2Q, 2018, about 60% of new Makena enrollments in MCC were being prescribed the auto-injector. The obvious question is what about the 40% to 50% not in MCC. Because MCC facilitates physician decisions to write for the auto-injector, one would assume a higher switch rate to the auto-injector in MCC. That doesn’t mean there is no switching to the auto-injector going on outside of MCC. In fact, management believes that switch rates in MCC will be only slightly higher.

Roughly 40% of prescriptions served by MCC for all dosage forms of Makena (not just the auto-injector) were designated dispense as written (DAW) which blocks the pharmacist from readily substituting a generic at their own discretion. DAW is a really important bulwark against generic substitution.

There are significant factors that encourage a physicians whose patients are covered by MCC to write DAW for the auto-injector in particular, but the IM dosage forms as well. MCC is helpful throughout the patient’s treatment, not only as they go on therapy. It handles the logistics associated with the office, patient compliance and the help with co-pay assistance program programs. These are valuable benefits to physicians for using MCC which may help to retain a good amount of physicians and patients on auto-injector.

Effect of Generic Competition to Makena

There was obviously no effect of the generic on second quarter sales and so far management reports very little impact through early August. Of course, it is very early and there is currently just one generic on the market as well as AMAG’s authorized generic. The price of the generic came in as expected at roughly a 15% discount to the wholesale acquisition cost (WAC) of Makena. As management expected, there is some additional discounting by both the generic and the authorized generic.

AMAG intends to participate in in the economics of the generic market (whatever that will be) with their authorized generic. They partnered with Prasco, an experienced generic company, and immediately following the July availability of a generic to IM Makena, authorized Prasco to launch both the preservative-free single dose vial and the multi-dose intramuscular formulations. The generic is only to the single dose vial and they believe that having both of the IM formulations creates a competitive advantage that will allow Prasco to win a higher share of contracted business. AMAG says that they get the lion’s share of the economics. Obviously, the focus is the auto-injector, but the authorized generic ads a little.

There will be a lot going on in the second half of 2018. Current guidance assumes additional generics entering the marketplace by year-end. If so, it could make market share and price trends erratic and difficult to project. Management says that as multiple generics enter the market, the MCC enrollment data could become a less reliable indicator of revenue if there is significant downstream switching to the generic at the pharmacy. This would likely lead to further discounting in key accounts to retain equal or preferred position for the auto-injector. Hence sales growth for the auto-injector, IM Makena formulations and the authorized generic is likely to be less than unit growth.

In terms of pharmacist switching, it is important to note that the Makena products are in-office injectables that don’t go through a retail pharmacy. It goes through specialty pharmacy and specialty distribution which is a unique distribution channel. Management thinks this is also a bulwark against generics.

Physicians View of Makena

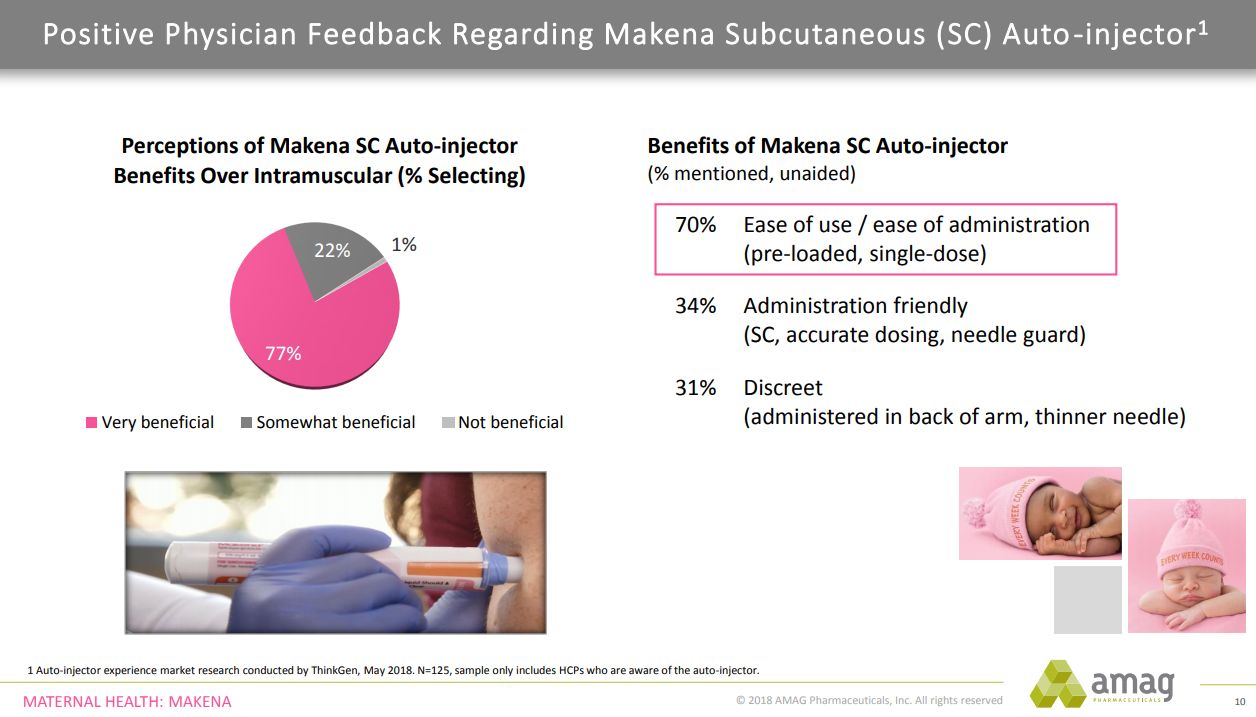

As physicians and nurses gain experience with the auto-injector, AMAG’s market research shows that they like it. This is shown by the significant amount of writing prescriptions dispense as written for the auto-injector at this very early date. This gives management optimism as they head into 2019 that they have good physician support for the branded Makena, and specifically the auto-injector.

As can be seen in the following chart, nearly eight in 10 physicians believe the auto-injector is very beneficial when compared to the intramuscular form. When asked about the benefits of Makena auto-injector, 70% unaided mentioned ease of use or ease of administration as a major benefit. Ease of use helps office staff more effectively manage logistics and optimize patient care.

Formulary Issues

The pricing and co-pays are very similar between the IM formulations of Makena and the auto-injector. This was a key part of the strategy to gain quick formulary access. The generic will be on tier 1 in formularies, the branded IM Makena formulations on tier 2 and the auto-injector on tier 2 or 3. Because of the pricing strategy and contractual agreements, they have virtually universal formulary access so there are really no barriers for the auto-injector from this standpoint.

Comparing the Launch Curve of Makena sub to Makena IM Single Dose Vial

Investors are comparing the launch trajectories for the single dose IM formulation which was a somewhat better product than the five dose vial. It was launched in April of 2016 and within one year accounted for 90% of Makena sales. Management says that this is different from the auto-injector launch in many ways, but it is at least worth a comparison. Management says that the auto-injector launch curve is actually a little bit ahead after one quarter as measured by percentage of enrollments.

Outlook for Makena Sales

The current situation with Makena is extremely volatile and it is difficult to have a great deal of comfort with any projections. Undoubtedly, management has the most information and insight about the situation, but even they can’t project with high confidence. They have been very guarded in giving guidance for Makena in 2018 and silent about 2019. They have taken what seems to be a highly conservative view in my opinion and Wall Street analysts have followed their cue.

My intuitive view is that management is going to great lengths to keep expectations low for the auto-injector and I believe that sales of Makena in all formulations could surprise on the upside. This drives my current buy recommendation. AMAG has issued less than clear cut guidance on their thoughts for Makena sales in 2H, 2018. They have only issued guidance for full year corporate sales that allows us to deduce their sales estimate for Makena.

Let’s focus on the 2018 sales guidance of $525 to $565 million. This has four components: sales of Makena, Feraheme, MuGard and Intrarosa for the full year and sales of Cord Blood Registry through to its divestiture on August 6, 2018. We know what the sales were for the first half of 2018 for these four components. I think that we can have reasonable confidence in predicting Feraheme/ MuGard and Intrarosa sales based on first half trends:

- Based on its new indication, Feraheme is on a tear. Second quarter sales increased 37% and I am assuming the same trend for 3Q and 4Q. This results in full year sales estimate of $137 million.

- MuGard sales are de minimis.

- Intrarosa is in an early launch phase and growing rapidly off a small base. Prescriptions increased sequentially by 41% in 2Q and I am assuming the same type of sequential increase in 3Q and 4Q for both prescriptions and sales. This results in a full year sales estimate of $16 million.

- Cord Blood Registry is a predictable business on a quarterly basis with about $30 million of sales per quarter. I assume that sales in the 3Q would have been $30 million. If so, 3Q sales through August 6 when it was divested would roughly have been $12 million. When combined with first half sales, this would result in contributing $71 million to corporate sales in 2018.

We can subtract the 2018 sales estimates for Feraheme, MuGard, Intrarosa and Cord Blood Registry from total sales guidance of $525 to $565 million provided by management to back into what they are likely estimating for Makena sales in 2018. Doing the math suggests that they are projecting $300 to $340 million of Makena sales in 2018. Let’s next take a look at what this means for 2H sales of Makena. In the first half of 2018, Makena sales were $195 million so this indicates that they are projecting 2H sales of $105 to $145 million. This compares to 2H, 2017 sales of $198 million. Hence, their guidance is consistent with a 27% to 46% decrease in Makena sales. In my opinion, this is likely to be dramatically low.

Let’s next try to figure out what this guidance would mean for 3Q and 4Q sales. We know that the generic has had little effect through early August and that management believes there will be multiple generics approved by year end that will lead to greater price cutting. I would think that 3Q Makena sales might only be down about 10% from $97 million in 2017 to $87 million in 2018. If management guidance is accurate (I am skeptical) the 4Q sales would show a much sharper decline to $15 to $55 million. I think that a $15 million estimate for Makena sales in 4Q, 2018 is ridiculously low and I suspect that the $55 million is also low. I think there will be little impact of generics in 3Q, more in 4Q and that 2019 will really determine the extent of the market that switches to generics. Hence, 2H, 2018 Makena sales are likely to surprise on the upside.

Management has indicated that about 50% to 60% of enrollments for Makena at this early date are for the auto-injector. I believe that physician and patient satisfaction will be so great once they have tried the auto-injector that it will be hard to get them to switch back to IM formulations. I also think that managed care won’t take draconian measures to force the use of a generic IM on pregnant women for reasons earlier cited. I think that it very possible that the percentage of enrollments for the auto-injector could even increase, perhaps to 75% or so later this year and into 2019.

Key Takeaways for 2018 Results

I think that most investors will focus on 2019 prospects for Makena if I am correct that 2H, 2018 sales will not show that much of an impact from generics. I think that in the second half of 2018 investors will focus on certain metrics that are predictive of the Makena auto-injector future sales. The key parameters in addition to sales will be:

- The percentage of enrollments of Makena that are switched to the auto-injector. Recent trends have suggest the current rate is 50% to 60%. I think it could increase

- The number of auto-injector prescriptions that are written dispense as written. Recent data suggests 40%. I think this could increase.

- Price discounting by generics and impact on the price of Makena auto-injector will be watched closely. The price discount of the first generic was 15%, but as new generics enter the market, the discount will likely increase. The key question is whether and how much the price of the auto-injector will need to be decreased due to generic pricing. Remember that the Makena auto-injector has meaningful advantages over intra-muscular formulations that could allow it to retain a price premium.

It seems highly likely that management’s implied guidance for 2H, 2018 sales will be exceeded, probably by a substantial amount. Management guidance on operating expenses in 2H, 2018 are even less clear and I am not going to make any attempt to project costs and earnings in 2H, 2018. I think that the focus of investors will be on 2019 projections of sales and earnings. Again management has given no guidance on Makena sales, sales of other products or operating costs. Hence, my projections for 2019 do not have any support from management.

Outlook for AMAG Sales and Earnings in 2019

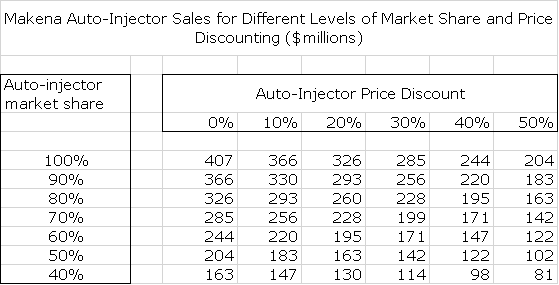

The crucial starting point in 2019 projections is estimating what percent of the current Makena sales franchise will be maintained by the auto-injector. Makena sales grew at 2.5% in 1H, 2018 and at that rate, we can estimate that sales for Makena in 2019 would have been $407 million with no generic competition as the auto-injector is priced at parity to the intra-muscular formulations. Hence we can get an estimate of auto-injector sales by estimating what percentage of the unit market share it obtains and if there is a need for a price discount. As I previously mentioned, the early indication is that perhaps 50% to 60% of Makena enrollments are being given prescriptions for the auto-injector. I think that while the company will match price of generics with intramuscular Makena formulations, it is not yet clear if they will discount the auto-injector.

The following table is a grid that lays out the potential 2019 sales of the auto-injector for various levels of market share ranging from 40% to 100% and price discounts ranging from 0% to 50%. If the auto-injector were to retain 100% of the unit market with no price discounting, its sales would be $407 million according to this grid.

I am making projections for AMAG’s total sales in 2019 using three estimates for auto-injector sales. These are:

- Optimistic case is auto-injector captures 80% of unit market at 10% price discount.

- Wall Street consensus case seems to be that auto-injector captures 60% of unit market at 20% price discount.

- Disappointing case is auto-injector captures 50% of unit market at 30% price discount.

AMAG will also retain some sales of Makena from its branded intra-muscular formulations and its authorized generics. I can only make wild guesses about sales for these. I have previously discussed my sales projections for other products in 2019.

Let’s now turn to costs. AMAG reports cost items on both a GAAP and non-GAAP basis. Due to past acquisitions there can be substantial differences. Also, recent quarters include expenses for the now divested Cord Blood registry. Hence, there is no historical data for cost of products sold, research and development and selling and general administrative expenses in the first half of 2018 which can be used as a base to project 2019 expenses. We have to guess at these. Also, management gas said that as much as 90% of research and development and selling and general administrative expenses are discretionary. This means that if Makena sales are strong expenses will be increased and if sales are disappointing they can be decreased. I won’t go into great detail, but here is my thinking on 2019:

- Cost of products sold: Both Makena and Feraheme are high margin products in which the gross margin has been over 90%. Going forward, the Makena gross margin on the auto-injector will be impacted by a 6% to 9% royalty paid to Antares.

- I roughly estimate that R&D expenses in 1Q and 2Q, 2018 were $11.5+ million. Management has guided that these expenses will trend up in 2H, 2018 and 2019.

- Similarly, I estimate that selling, general and administrative expenses in 1Q and 2Q, 2018 were $55+ million. Management has guided that these expenses will be flat to slightly declining in 2H, 2018 and 2019.

- The proceeds from the sale of Cord Blood Registry will be used to retire the $475 million senior note which will reduce interest expense by $37 million.

- AMAG has tax loss carry forwards which will likely mean that the Company won’t pay taxes until 2020.

In the next table, I have presented sales and earnings for three scenarios that revolve around Makena sales. In each of these scenarios, I use the same estimates for Feraheme, MuGard and Intrarosa. I want to re-emphasize that research and development and selling and general administrative expenses are highly discretionary. The three scenarios then are based on the following three assumptions for the auto-injector (note there will be some sales from intramuscular formulations).

- Positive case is auto- injector captures 80% of unit market at 10% price discount.

- Wall Street consensus case is consistent with auto- injector capturing 60% of unit market at 20% price discount

- Disappointing case is auto-injector captures 50% of unit market at 30% price discount

You must understand that while these numbers appear to have some precision there is an extraordinary amount of guesswork involved. At best, this table conveys some sense of the magnitude of possible results in 2019 and also the enormous variability.

Tagged as AMAG, AMAG Pharmaceuticsals, Makena Auto-Injector + Categorized as Company Reports, LinkedIn

with ~31% of outstanding shares short, it would be good to know the approximate date in time when AMAG will release sales data that provides more certainty about the Makena sales.. If the 3Q report would give us a leg up in that regard, one might buy some at the money Nov calls as a way of establishing a position without full capital commitment…the 3Q report would come before the Nov options expiration later that month. If the 3Q sales report would be too soon for a clearer picture, we would have to wait for the 4Q/full year 2018 release which would likely come after the Feb19 options expire. Any material good news could ignite a short covering rally, I would think. I have to constantly remind myself these days is that algorithmic trading is so pervasive that extreme highs and lows (you pick the asset) go beyond human logic, as do the violent moves while

those computer positions are built or unwound.