Cryoport: Initiating Coverage of this Highly Unique Health Care Company with a Buy (CYRX, Buy, $2.25)

Introduction

I am recommending purchase of Cryoport, which has developed a first mover, business model for providing cold chain logistics for high value life science products requiring cryogenic temperatures during shipment. This is report is divided into four sections:

- Investment Thesis: The first 11 pages of this report summarize the reasons why I am recommending purchase. You don’t necessarily have to read other sections of this report if you are willing to accept my financial projections and don’t want to look at more in-depth details of Cryoport’s business model and the industry in which Cryoport is operating.

- Development of the Cryoport Business Model: This section discusses Cryoport’s dewar technology and its logistics solutions. This is sometimes heavy reading and I wouldn’t blame you if you initially skipped over it.

- Building a Sales and Earnings Model: Cryoport is a small company, but it very complex to model. I have had to make a large number of assumptions in order to build my model, some of which involve intuitive guesswork. I would caution you that while my projections may give the impression of great precision, this is not the case. You should look at trend and magnitude in interpreting my projections.

- Overview of Cold Chain Logistics Industry: Cryoport is involved primarily in an emerging and still small part of the overall cold chain logistics industry that requires shipping frozen biological specimens at cryogenic temperatures. This section provides a backdrop of the much broader cold chain logistics industry. Given the expertise Cryoport has built, there may be opportunities to expand into other market segments.

Investment Thesis

Macro-Economic Forces Provide Powerful Tailwinds

The emergence of pharmaceutical products based on using living cells (Cryoport refers to these as regenerative therapies) has spurred the growth of a new area of cold chain logistics. These therapies must be suspended at temperatures below minus 150° Celsius (minus 238° Fahrenheit) and maintained at that temperature as they are transported on a global basis between clinical and manufacturing sites, a process that can take several days. Examples of biological specimens that require continuous cryogenic temperatures throughout transportation to prevent degradation and loss of efficacy include:

- Pharmaceutical products based on live cells such as CAR-T and other genetically engineered T-cells, gene therapy products, cancer vaccines, and others,

- Stem cells.

- Other types of vaccines,

- Eggs, semen and embryos used for in vitro fertilization,

- Biological specimens used for diagnostic purposes e.g. determining PD-L1 expression in tumor cells, and

- Infectious agents such as viruses (Ebola, HIV).

This presents both a technological challenge to create storage devices for shipping and then the logistical expertise to assure that the product being shipped does not change because of a temperature deviation between the time it is picked up and delivered. Cryoport has achieved a leadership position in this area. The Company was initially formed to develop novel cryogenic shipping containers (dewars) and then evolved into creating a sophisticated and comprehensive logistics solution for their transportation about five years ago.

Logistical handling is an integral part of the clinical process needed to gain regulatory approval of regenerative therapies and is equally critical to maintain integrity of products after they are commercialized. Regulatory agencies will require data that shows that shipping of the product does not alter the characteristics of the product. This requires thorough documentation of what happens during the chain of custody and chain of condition. A temperature deviation can affect the efficacy of the products that are being shipped, which could therefore change the dynamics of a clinical trial or affect patient outcomes.

The logistics methods used will be an integral part of the Biologic License Application (BLA). This is very important because once this is established, if the Company sponsor were to try to decide to change its logistics system, regulatory agencies require evidence that the alternative way of shipping meets all of the data endpoints that Cryoport provides and thus doesn’t alter the therapy’s characteristics. This requires extensive work and possibly additional studies. Because of this, once Cryoport solutions are successfully incorporated into the clinical trial process, it will likely continue to be used as products go commercial and through the life cycle of the product with minimal chance of losing the business to a competitor or an in-house solution.

Similarity to Repligen

One of the best investment ideas that I have had since starting SmithOnStocks was the recommendation of Repligen in an initiation report on December 4, 2012. What excited me about Repligen was a business model that I have described as among the best that I have encountered. The macro force driving its business is the development of monoclonal antibodies which is currently the major driver of the biopharma industry in terms of both current sales and research focus.

Companies developing monoclonal antibodies are in a high-risk game in which perhaps 90% or even more products that enter into development will not be commercial successes or may not even be approved. However, Repligen found a way to capitalize on this huge industry effort that is reminiscent of the 1849 California gold rush. Many prospectors panned for gold, but only a few were successful. However, the merchants who sold shovels and pans and other supplies profited from those who failed as well as those who succeeded.

Repligen is essentially selling shovels and pans to the monoclonal gold rushers. Its products are used to improve the manufacturing quality and productivity of monoclonal antibodies and it has pioneered the use of disposable products. Repligen products are used by a very large percentage of these drug developers. In addition to its innovativeness, the appealing aspect of Repligen is the stickiness of its business. In manufacturing of proteins, any change in the manufacturing process can change the characteristics of the product. Consequently, once Repligen’s products are incorporated in the manufacturing process during clinical trials, they are likely to be maintained through the approval and life of the product.

Needless to say, I have been looking for a business model like that of Repligen and I think I have found it in Cryoport. The similarities are striking. The macro-force that Cryoport is riding is regenerative therapies which are based on the use of living cells and tissues to treat disease. Some believe that this represents a major step forward for drug development because it addresses the causes of disease rather than symptoms. It promises to be a driver of the biopharma industry that could over decades reach the same scale as monoclonal antibodies. Cryoport is beautifully positioned to be a major beneficiary of this mega-trend.

Five Year Operational Trends: 2012 to 2016

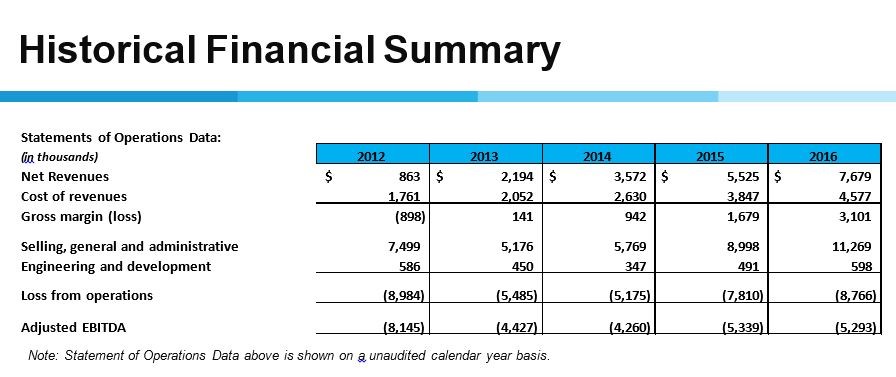

Cryoport has reported dynamic sales growth over the last five years as sales have grown from a small base $863,000 in 2012 to $7.68 million in 2016, a compounded annual growth rate of 73%. The focus on regenerative therapies only began in 2015; sales increased 55% in 2015 and 39% in 2016. Note that adjusted EBITDA which is a measure of operating cash flow or cash burn as the case may be was $4.2 million in 2014, $5.3 million in 2015 and $5.3 million in 2016. Rapid sales growth has been obtained with no surge in cash burn. This is shown in the following table.

Click to enlarge and click back arrow at upper right hand corner of page to return to document.

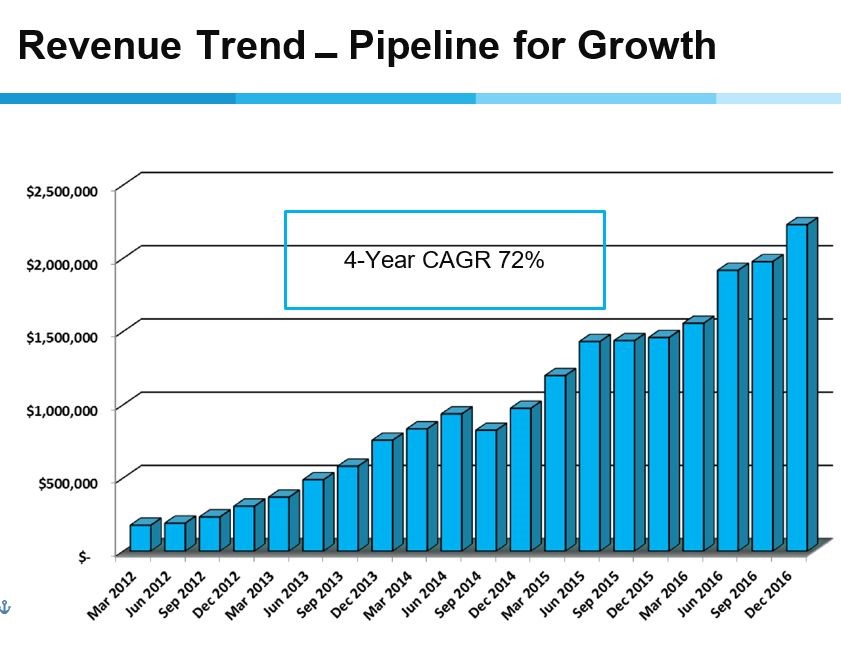

The quarterly trends since the March 2012 quarter have also been impressive as the compounded annual growth rate has been 72%. There has been no quarter that has not shown year over year growth and only one quarter (September 2014) showed a decrease in sequential growth.

Click to enlarge and click back arrow at upper right hand corner of page to return to document

External Validation of Cryoport’s Business Model

For an analyst like me who specializes in biotechnology drug development, Cryoport poses an analytical challenge. There are no clinical trials that I can turn to for validation nor external audits estimating sales for its products. However, there is powerful external validation that supports the Company’s representation that it is the industry leader in providing logistical support for products that require shipment at cryogenic temperatures. I find this evidence to be overwhelming.

Bulk Shipment Carriers Validation of Cryoport’s Logistics Solution

I think that one of the most impressive external validations is that the three major bulk air carriers- FedEx, UPS and DHL- all base their cryogenic shipments on technology licensed from Cryoport. Their solutions carry the words “Powered by Cryoport” which is reminiscent of the “Powered by Intel” tag found on so many computers. Each of these carriers concluded that Cryoport could deliver a better and cheaper solution than if they tried to develop a comparable system in-house. The following link is an excellent description of how FedEx has incorporated Cryoport into their cryogenic shipping offering.

This relationship with bulk carriers supports the thesis that Cryoport has the best in class logistics solution for frozen products and indicates that there is a formidable time and cost barrier facing potential competitors. If FedEx, DHL and UPS chose to license rather than develop their own solutions, what are the chances for smaller potential competitors? Note that a key barrier to entry is the software underling Cryoport’s solutions, the cloud-based Cryoportal.

CAR-T Companies Endorse Cryoport

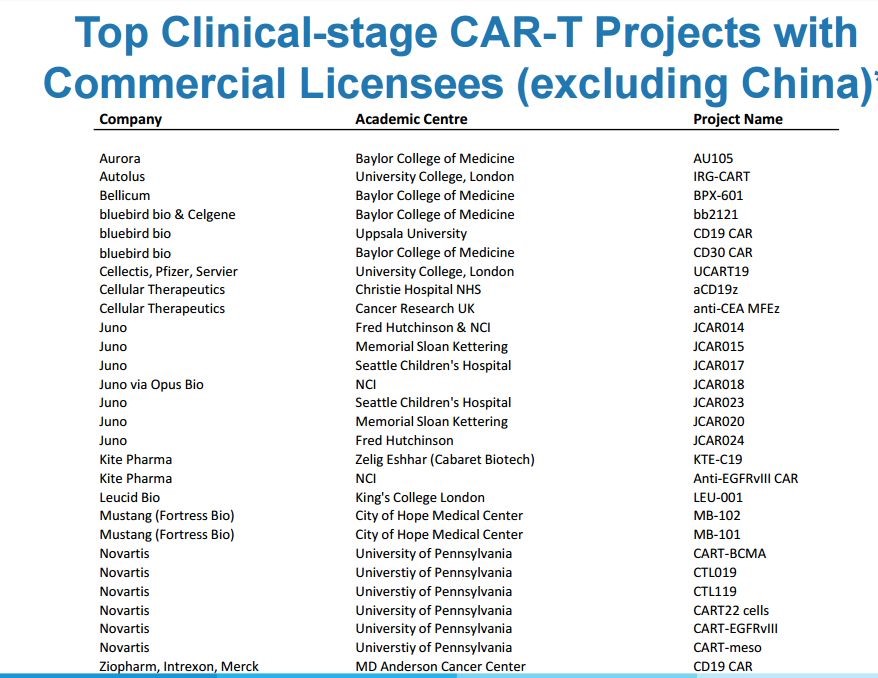

In regenerative therapies, the development of CAR-T products is at center stage. Investors are enormously excited about this area and have invested enormous sums of money in companies developing CAR-T products. For example, Kite has raised nearly $1 billion since going public in 2014 and there are 50 or more companies focusing on the engineering of T-cells using CAR-T and other technologies.

In late 2017, investors are expecting that Novartis and Kite will be the first to receive approval for their CAR-T products. Cryoport provided the logistical support for these products in their clinical trials and will most likely (almost certainly) continue to do so as they are commercialized. Cryoport currently provides clinical trial support for 23 of the top 28 CAR-T therapy programs. Their client list as partially shown below is a Who’s Who of CAR-T developers-Novartis, Kite, Juno, bluebird, et al.

Click to enlarge and click back arrow at upper right hand corner of page to return to document

Cryoport Has Quickly Gained Market Share in Regenerative Therapies

Research in regenerative therapies really began to take off in 2014 and 2015 with the success of the checkpoint inhibitors Opdivo and Keytruda in immuno-oncology. While these were monoclonal antibodies, not regenerative therapies, they sparked immense interest in all things immunology. This led to investor financing support and an explosion in the number of clinical trials requiring logistics support for regenerative therapies projects that Cryoport supports. Note that the Company only began to focus on this business segment in 2015.

The great opportunity for Cryoport is to offer emerging biotechnology companies a logistics solution for frozen products shipping. These companies have enormous clinical and regulatory challenges so that they do not want to divert resources to developing an in-house logistics solution which is a very different technology challenge. This seems to have caught traction as the number of clinical trials supported by Cryoport has grown from 27 in 2014 to 61 in 2015 to 129 in 2016. In this short period of time, it has captured significant market share of 16% of the 804 clinical trials underway in regenerative therapies. This is highly suggestive that Cryoport offers great value to regenerative therapy developers.

The remaining market share seems to be accounted for by in-house solutions of companies or where the clinical trial is carried out in one center and does not require cryogenic transport. I am not aware of any companies with the business model of Cryoport although I think we will almost certainly see efforts to replicate what Cryoport is doing. The 16% estimate of market share I just presented understates the true market position.

Big Pharma Companies Contract with Cryoport

In mid-2016, Cryoport announced that it was working with Bristol-Myers Squibb to provide logistical support for an as yet unidentified product of BMY. This is described as a monoclonal antibody with $1 billion of sales. (My guess is Yervoy). Cryoport will provide logistical support for the transfer of cell lines used in manufacturing.

In early 2017, Cryoport announced similar business arrangements with the Genzyme division of Sanofi and Janssen division of Johnson & Johnson. In all three cases, Cryoport will be replacing in-house solutions. I find it very encouraging that big pharma companies with vast financial resources turned to Cryoport to replace parts of their existing logistics operations. Due to regulatory issues as previously described, this changeover requires a year or more of work.

Moffitt Hospital Signs on as a Client

On December 21, 2016, Moffitt Cancer Center announced that it had contracted with Cryoport to provide cryogenic logistics for its immunology program, cancer research and lab moves. It will ship biologics, regenerative therapies, and tissues, to and from other cancer centers and research facilities worldwide. Moffitt is ranked 6th on U.S. News & World Report's Annual List of Best Hospitals for Cancer and is the only National Cancer Institute designated Comprehensive Cancer Center based in Florida.

Extensive Experience is a Key Competitive Advantage

As a final validation measure, Cryoport states that they have delivered over 30,000 shipments to over 100 countries in their existence. This extensive real-life experience is extremely valuable in honing their solution, something that a new challenger could not replicate.

Financial Issues to Consider

Cryoport recently completed a financing that had a dramatically negative effect on the stock price. On March 27, 2017 the day before the offering, the stock traded at $3.75 and the offering on the next day was done at $2.00. I believe that this creates a nice buying opportunity for us new investors. Before I discuss the reasons for the sharply discounted offering, I want to review a few key financial issues.

The cash burn for the four calendar quarters of 2016 was $5.7 million (burn in the December quarter was only $758,000). Capital expenditures in 2016 were $1.1 million. This is not a capital intensive company that needs to spend heavily on R&D and capex and as revenues grow.

Cryoport ended 2016 with cash of $4.5 million. The offering of 5.5 million shares netted $9.9 million and exercise of the Green shoe of 850,000 shares brought in another $1.5 million. The cash position pro forma for this offering would have been $15.9 million at December 31, 2016. If my projections for cash burn are anywhere near correct, Cryoport may not need to do another financing in 2017 or 2018 or ever. This increases the share count to 23.2 million so that at the current price of $2.15 the market capitalization is $50 million.

The question I would be asking if I were reading this report rather than writing it would be why would the Company issue shares at such a sharp discount. Doesn’t this signal that investors are less than enthusiastic? I think there a number of reasons.

- Cryoport is an obscure company from a Wall Street view point It came public in 2005 in a reverse merger into a shell company which is often a danger sign.

- It has almost no research coverage.

- The business model is unfamiliar and not well understood by Wall Street; there are no peers other than perhaps Repligen but even that Company is not well understood.

- The financials were not (cosmetically) compelling as the Company was losing money at a high level relative to its sales base. Sales for calendar 2016 were $7.18 million and the total cash burn was $5.88 million. Cryoport looked to be struggling financially to unfamiliar investors.

- This offering was too small to attract most big investment firms

- And finally, the Company did not want to issue warrants which are almost always required by investors on small offerings for small companies.

I think that the thought process of management was that it needed visibility as there is almost no analytical coverage and the stock was only trading 10,000 to 40,000 shares per day or $35,000 to $140,000 in dollar terms. This offering was led by Cowen and Needham which are respected for research in emerging health care companies and research from these firms should broaden awareness. Last but not least, Cryoport had a target on its back (due to the reasons just cited) for attracting manipulative short sellers who prey on small companies. Had they not acted and had the wolfpack launched an attack, the stock could have been highly vulnerable.

I think that management could have delayed the offering or sought to raise capital from sources other than the public equity market and perhaps have avoided as much stock dilution. However, I strongly support their actions. They are now in a strong cash position that should allow them to reach profitability and thereafter to have positive cash flow without the need for more equity financings. I also think that broader recognition in the investment community was needed. In my opinion, they did the right thing for shareholders.

Projections of Key Income Statement and Cash Flow Items: 2016 to 2020

The following table brings together my key sales and earnings projections through 2020. The assumptions underlying these are explained in detail later. I am projecting that sales will grow to $37 million in 2020 for a compounded annual growth rate of 48%. I am also projecting that 2020 will be the first year of profitability with net income of $4.36 million and EPS of $0.18.

I have also projected cash generation from operations less capital spending for the 2016 through 2020 time frame and year end cash. I am projecting that Cryoport will have a cash burn of only $0.89 million in 2017 and becomes cash flow positive in 2018. I project that the yearend cash balance will grow from $15.9 million in 2016 (pro forma for the March equity offering) to $32.13 million in 2020.

|

Key Financial Projections: 2016 to 2020 |

|||||

| Income statement items | |||||

| $ millions | 2016 | 2017 | 2018 | 2019 | 2020 |

| Regenerative Medicine | |||||

| Clinical Trials | 5.31 | 8.23 | 12.56 | 18.83 | 27.78 |

| Commercial products | |||||

| Kite, Novartis | 1.60 | 2.40 | 3.50 | ||

| Other | 0.00 | 0.00 | 0.00 | ||

| Big Pharma Relationships | |||||

| Bristol-Myers Squibb | 0.20 | 0.40 | 0.80 | ||

| Genzyme, Janssen | 0.40 | 0.80 | |||

| Reproductive Medicine | 1.53 | 1.84 | 2.21 | 2.65 | 3.18 |

| Animal Health | 0.83 | 0.92 | 1.01 | 1.11 | 1.22 |

| Total Revenues | 7.68 | 10.99 | 17.57 | 25.79 | 37.28 |

| Net income | (10.04) | (5.51) | (3.74) | (0.75) | 4.36 |

| EPS | ($1.69) | ($0.41) | ($0.16) | ($0.03) | $0.18 |

| Shares outstanding | 5.95 | 13.36 | 23.20 | 23.66 | 24.14 |

| Cash flow items | |||||

| Cash from operations | (4.78) | 0.43 | 2.99 | 6.87 | 13.02 |

| Capital spending | (1.10) | (1.32) | (1.58) | (1.90) | (2.28) |

| Cash flow | (5.88) | (0.89) | 1.41 | 4.97 | 10.74 |

| Yearend cash position | 15.90 | 15.01 | 16.42 | 21.39 | 32.13 |

Investment Opinion

I am initiating coverage with a Buy. You can tell that I am excited by the business model and I see it tracking the business model of Repligen. I am happy to have the equity offering behind us and to see that Cryoport is on a solid financial footing. I see the Company as the first mover and industry leader in creating a solution for cryogenics logistics. The demand for this will be drive by research in which living cells and tissue are the basis of drug development which creates a very powerful tail wind.

I don’t have a particular one year price target in hand. I just think that this can create sales in the hundreds of millions of dollars in the next ten years and. if so that the stock price will be many times higher. I intend to buy and hold for that period. I do think that the Company is approaching a major inflection point in late 2017 and early 2018 as the first of the products it is supporting are approved and launched. This suggests to me that understanding could increase and with that excitement with the stock could have a substantial positive effect on the stock price.

For those who would still like some kind or price target, I note that Repligen is selling at about 9.4 times estimated 2017 sales. If we were to apply this ratio to projected 2020 sales of Cryoport, it would result in a market capitalization of $350 million and stock price of $14.50.

Development of the Cryoport Business Model

The Original Business Model Was Based on Developing Dewars

Cryoport came public through a reverse merger in 2005. Its initial focus was on the development of technologically advanced cryogenic dewars for the transportation of frozen products. This research effort led to the development of state of the art, patent protected dewars. You can think of the Company’s dewars as super sophisticated thermos jugs that can maintain products at cryogenic temperatures of minus 150 degrees Celsius (minus 238 degrees Fahrenheit) for ten days or more in dynamic shipping conditions.

Cryoport has branded its dewars as Cryoport Express® Shippers. They employ liquid nitrogen in dry vapor form which has significant advantages over competing technologies that are based on dry ice and liquid nitrogen. The dry ice technology is markedly inferior in that its temperature is warmer than cryogenic temperatures. Liquid nitrogen is as effective but requires the use of bulky and costly containers. Because of the danger of liquid nitrogen spilling and because of the noxious gas that is given off as dry ice sublimates, both of these competing technologies are classified as hazardous materials while liquid nitrogen in dry vapor form is not so classified. Cryoport Express® Shippers are state of the art cryogenic dewars.

History of Dewars

The shipping container used in cryogenic shipments is called a dewar. The origin of this term came from Sir James Dewar, a Scottish chemist and physicist who was born in 1842. He invented a vacuum flask which he used in his extensive research into the liquefaction of gases, e.g. changing liquid nitrogen in nitrogen gas. His flask was used for storing cryogens such as liquid nitrogen or liquid helium that have boiling points that are very much lower than room temperature.

Dewars have walls constructed from two or more layers. A high vacuum in-between the layers provides thermal insulation between the interior and exterior of the dewar. This reduces the rate at which the contents boil away. In the design of the dewar, care must be taken to safely manage the gas released when the liquid slowly boils in order to prevent an explosion. The simplest designs allow the gas to escape either through an open top or past a loose-fitting stopper to prevent the risk of explosion. More sophisticated dewar designs trap the gas above the liquid, and hold it at high pressure. This increases the boiling point of the liquid, allowing it to be stored for extended periods. Excessive vapor pressure is released automatically through safety valves.

Cryoport’s Dewar Technology

The Cryoport Express® Standard Shippers are lightweight, low-cost, re-usable dry vapor liquid nitrogen storage containers that combine the best features of packaging, cryogenics and high vacuum technology. A Cryoport Express® Standard Shipper is composed of an aluminum metallic dewar flask, with a well for holding the biological material in the inner chamber. The dewar flask, or “thermos bottle,” is an example of a practical device in which the conduction, convection and radiation of heat are reduced as much as possible. The inner chamber of the shipper is surrounded by a high surface, low-density material which retains the liquid nitrogen in-situ by absorption and surface tension.

This material absorbs liquid nitrogen several times faster than currently used materials, while providing the shipper with a hold time and capacity to transport biological materials safely and conveniently. The space between the inner and outer dewar chambers is evacuated to a very high vacuum (10-6 Torr). The specimen-holding chamber has a primary cap to enclose the specimens, and a removable and replaceable secondary cap to further enclose the specimen-holding container and to contain the liquid nitrogen. The entire dewar vessel is then wrapped in a plurality of insulating and cushioning materials and placed in a disposable outer packaging made of recyclable material.

Cryoport’s Dewar Product Offering

Cryoport has developed a dry vapor cryogenic shipper that uses liquid nitrogen in dry vapor form, which is suspended inside a vacuum insulated bottle. It can provide storage temperatures below minus 150° Celsius for ten days or more in dynamic shipping conditions. It is designed to prevent spillage of liquid nitrogen and pressure build up as the liquid nitrogen evaporates. A proprietary foam retention system is employed to ensure that the liquid nitrogen in vapor form stays inside the shipper, even when placed upside-down or on its side, as is often the case when in the custody of a shipping company. Biological specimens are stored in a specimen chamber called a well inside the container and the shipper maintains the cryogenic temperatures by the harmless cold nitrogen gas circulating from the liquid nitrogen entrapped within the foam retention system surrounding the well.

The Company currently features three sizes of Cryoport Express® Shippers: the Standard Dry Shipper (holding up to 75 2.0 ml vials), the High Volume Dry Shipper (holding up to 500 2.0 ml vials) and the most recently introduced Cryoport Express® CXVC1 Shipper (holding up to 1,500 2.0 ml vials). They are reusable devices that are based on a patented vacuum flask uses application of “dry vapor” liquid nitrogen technology. They are certified by the International Air Transport Association (IATA) and validated to maintain stable temperatures of minus 150° C and below for a 10-day dynamic shipment period.

An important feature of the Cryoport Express Shippers is their compliance with the stringent packaging requirements of IATA Packing Instructions 602 and 650, respectively. These specifications include meeting internal pressure (hydraulic) and drop performance requirements. Under IATA guidelines, Cryoport Express® Shippers are classified as “Non-hazardous” while dry ice and liquid nitrogen are classified as “Dangerous Goods.” Cryoport shippers are also in compliance with ICAO regulations that prohibit egress of liquid nitrogen residue from the shipping packages. The International Civil Aviation Organization (ICAO) is a United Nations organization that develops regulations for the safe transport of dangerous goods by air.

Here are what these dewars look like.

Click to enlarge and click back arrow at upper right hand corner of page to return to document

Here are dewars being prepared for loading.

Click to enlarge and click back arrow at upper right hand corner of page to return to document

Competitive Dewar Technologies are Inferior

Most of Cryoport’s competition utilizes the older technologies of dry ice or liquid nitrogen. Dry ice does not deliver cryogenic temperatures and cells degrade. It was initially thought to be acceptable but it is readily being replaced. Liquid nitrogen is effective but is bulky, expensive and has special handling requirements. Both dry ice and liquid nitrogen are classified as hazardous” by shipping companies and regulatory authorities. In addition to being ineffective and/or classified as “dangerous goods,” they are inefficient when compared to Cryoport solutions. Conversely, Cryoport’s solutions are classified as non-hazardous.

Expansion into Logistics was a Critical Move

The business model was expanded in in 2011 to develop a global cold chain logistics system to support products shipped in Cryoport Express Shippers. Dependable logistics support is critical for products which must be maintained at cryogenic temperatures during shipping. Cryoport provides comprehensive solutions and services utilized for frozen shipping in the life sciences industry. This includes cell therapies, stem cells, cell lines, vaccines, diagnostic materials, semen, eggs, embryos, cord blood, bio-pharmaceuticals, infectious substances, and other commodities that must be shipped at cryogenic temperatures.

In a recent presentation, the Company listed essential elements of Cryoport’s logistics offering:

- Chain of custody – Clients need continuous information on the condition of their materials during shipment. Clients need to know where their package is and the condition of the contents at every time point in the journey.

- Maintaining cryogenic temperatures – The dewar must maintain temperature integrity for more than the period of time required for shipping time and customs clearance (if applicable). One temperature excursion can impact the integrity or destroy a shipped item.

- Security of the materials – Clients need to ensure that materials have not been tampered with.

- Quality validation – For their own records and to meet regulatory quality assurance requirements, companies must be able to validate the condition of the dewars and the materials being shipped in them throughout the shipment period.

- Viability in transport – Shock-absorbing packaging is necessary to reduce cell membrane-disruptive vibrations so that cells can be delivered in the same condition as when they were shipped.

- Customs clearance – Clients want to know they have someone working for them that can respond to issues that may arise as their package goes through customs. Customs documentation is critical and if not completed correctly can delay shipments.

- International regulations – It is important to understand the various regulations related to shipping biomaterials internationally. These differ materially from country to country.

- Challenges in emerging markets – In certain emerging markets, there can be insufficient temperature-controlled storage facilities, inadequate shipping resources and a lack of understanding of shipping biomaterials.

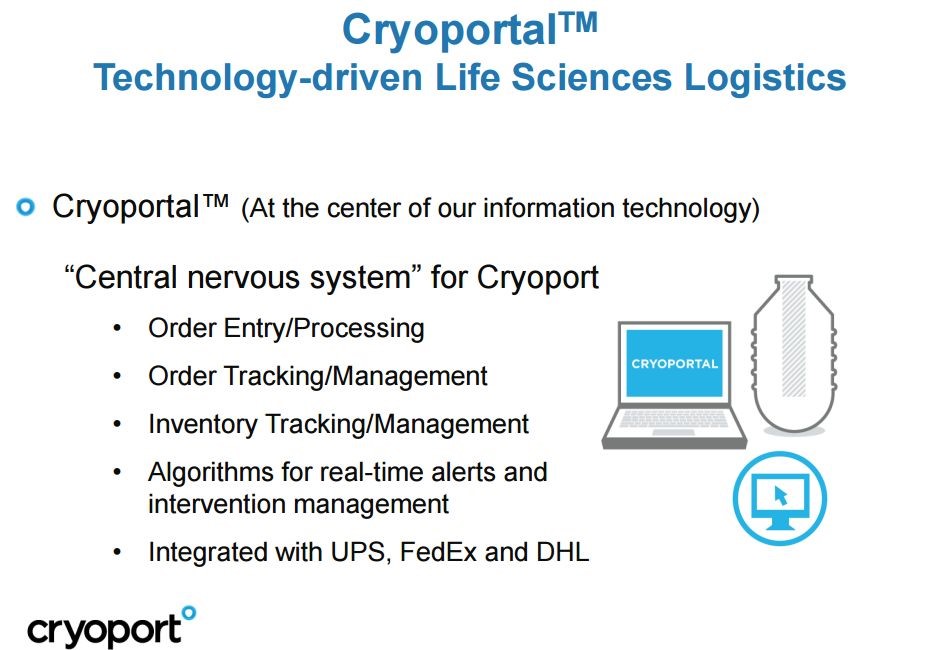

The Cryoport Cryogenic Logistics Solution

The Company’s cold chain service uses a sophisticated cloud-based logistics operating platform, which is branded as the Cryoportal. It supports the management of the entire shipment and logistics process through a single interface. It includes initial order input, document preparation, customs clearance, courier management, shipment tracking, issue resolution, and delivery. The Cryoportal records and retains a fully documented chain-of-custody and, at the client’s option, chain-of-condition for every shipment. This information allows clients to meet exacting requirements necessary for scientific work and for proof of regulatory compliance during the logistics phase.

This solution incorporates purpose-built packaging, information technology and specialized cold chain logistics solutions. A typical shipment consists of three legs.

- Before shipping Cryoport’s shipper must be charged or conditioned with liquid nitrogen. Next the Cryoportal produces all the documentation that will be needed and the logistics team at Cryoport attaches the necessary paperwork on the appropriate flaps of the outer box. Leg one occurs when the shipper is sent from Cryoport to the customer. The customer simply loads their therapy or clinical sample and closes the shipper.

- The second leg of transit is from Cryoport’s customer to the ultimate destination of the therapy. The pick-up for the second leg of transit has already been arranged for by the Cryoportal. When the shipper is received at the point of destination, the lab tech or scientist removes the therapy and closes the shipper with the B flap on top.

- The B flap has attached to it the shipping documentation to send the shipper back to Cryoport’s nearest facility, known as leg 3. Again, the Cryoportal has already arranged for the shipper to be picked up. All of these legs can occur domestically, internationally or a blend of both.

The essential functions of the Cryoportal are shown in the next picture.

Click to enlarge and click back arrow at upper right hand corner of page to return to document

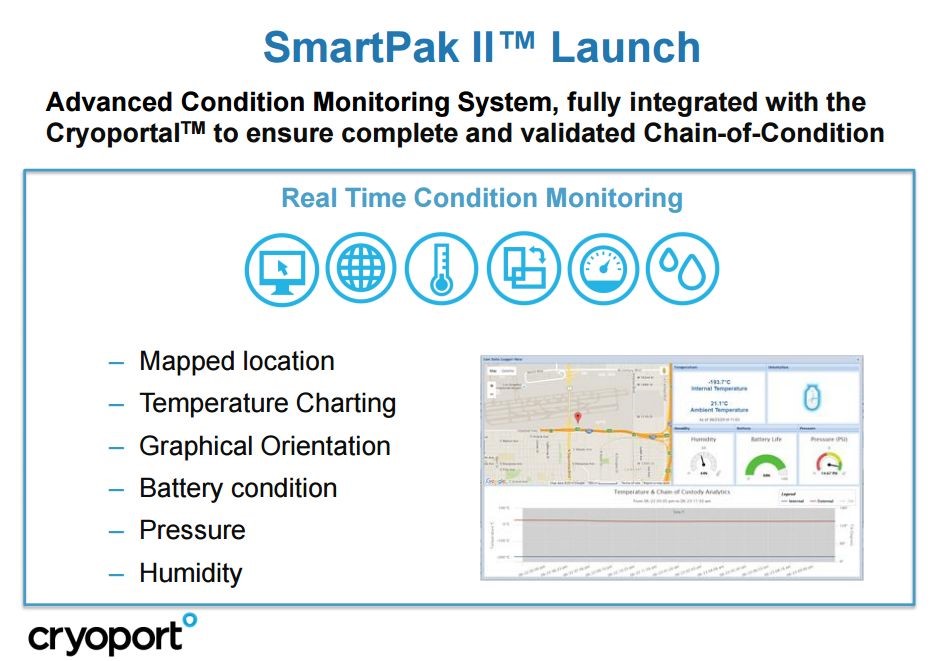

There must be methods to track the location of the dewar and to determine if the temperature is being maintained at the proper level. Frozen products are quite vulnerable to temperature increases that can injure or destroy the living cells. Importantly, all of this must be documented for regulatory purposes. This was achieved by Cryoport through the development of the SmartPak II which is described below:

Click to enlarge and click back arrow at upper right hand corner of page to return to document

Real Life Example of What Cryoport Provides

Cryoport was responsible for the logistics used in the conduct of Kite’s Zuma-1 trial that is the basis for its seeking approval for its CAR-T product Axi-Cel (axicabtagene ciloleucel). The manufacturing process starts at the site of treatment with drawing blood from a patient and then separating T-cells. These T-cells were cryogenically frozen at various sites in the US and Israel and shipped to a central manufacturing site near Los Angeles. There, they were thawed and genetically engineered to express a chimeric antigen receptor, refrozen and shipped back to the various clinical sites. It gets a bit complicated to make sure that each site has dewars that are available and that they are shipped to the right places.

In many cases, the cost of cold chain logistics can be several thousand dollars per patient. Of course, this cost can be justified because a breakdown in the logistics chain can invalidate results and compromise a study. It can also destroy the end product which would be an economic disaster; Kite’s Axi-Cel may be priced at $300,000 per cell infusion. Cost aside, the biomaterial may be irreplaceable.

Building a Sales and Earnings Model

Overview

Cryoport is still in an early stage of business development as the logistics business was only started in 2011 and the focus on regenerative medicine only began in 2H, 2015. Current sales are running at an annual rate of about $10 million. Before the focus on regenerative medicine began, the business was focused on reproductive and animal health. An agreement was signed with Zoetis in 2012 for providing cryogenic logistics for a poultry vaccine which needed to be shipped frozen. Also through 2015, the business benefitted from the practice of using surrogate mothers for couples who could not conceive children. This involved shipping frozen eggs and sperm both domestically and to third world countries where a surrogate mother would bear the baby for the couple. While some governments have changed their policies on “medical tourism” Cryoport did support a record number of IVF shipments in 2016.

I think the real future of Cryoport began in 2014 when the promise of immune-therapy caught the attention of the scientific community based on the success in oncology of the PD-1 inhibitors Opdivo and Keytruda and the CTLA-4 inhibitor Yervoy. In years prior, scientists had been skeptical of small biotechnology companies developing novel immuno-oncology products like stem cell, cancer vaccines and CAR-T cells, generally dismissing product development projects as science projects. Suddenly, the scientific community realized these were more than science projects as did the investment community as evidence by their showering Juno and Kite with many hundreds of millions of dollars raised in public offerings.

Opdivo, Keytruda and Yervoy are monoclonal antibodies that do not need to be shipped at cryogenic temperatures. However, the success of these products drew financial and scientific resources to a large number of products that did-notably CAR-T cells. Suddenly Cryoport was in the right place at the right time. The immuno-oncology products are still in the clinical development stage so that only small numbers of patients are being treated. It is when these products become commercial that revenues will begin to takeoff. It is difficult for an investor to get a handle on Cryoport’s pricing of its services. Its primary offering is a turnkey solution, but is has chosen to unbundle so that there are some 2500 possible combinations available to clients.

Potential Sales Contributions from Clinical Trials and Commercialization

Let me reiterate that the reader should view my sales projections cautiously, but hopefully they are indicative of magnitude and trend. It is clear, however, that the rubber really meets the road when a product gains regulatory approval. Now let me make an important point once again. Regulatory agencies will require that logistics methods used in clinical trials must also be used when the products are commercialized. This is part of the manufacturing process that must be validated. Because of this, I think that once Cryoport logistics is successfully incorporated into the clinical trial process it will continue to be used as products go commercial in almost all cases. Moreover, clients are extremely unlikely to change to another provider after approval. This makes for very long and dependable revenue streams.

For those of you who have followed my work, this long product life cycle is strikingly similar to the business model of Repligen. The difference is that Repligen’s business is driven by the development of monoclonal antibodies which are a major commercial growth driver for biopharma. The living cell products which Cryoport are involved with are largely in clinical development.

Cryoport Sales by End Market

With the exception of the Zoetis poultry vaccine and the reproductive medicine business, most of Cryoport’s revenues are now coming from clinical trials. I think that it is very difficult for outside investors to model this business. I would note that management believes that with its current and planned cost structure that it could breakeven at the point when annualized revenues reach $16 to $18 million.

Cryoport breaks out operating results for its three end markets: biopharmaceuticals, reproductive health and animal health. The major focus of the Company is on biopharmaceuticals which accounted for 69% of total revenues and for which revenues increased 56% in 2016.

|

Quarterly Sales Growth for Cryoport in Three Key End Market Segments |

||||||||||||

| 2015 | 2016 | |||||||||||

| ($ millions) | 1Q | 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | 4Q | FY 2015 | FY 2016 | ||

| Biopharma | 0.70 | 0.84 | 0.87 | 0.98 | 1.02 | 1.32 | 1.42 | 1.55 | 3.40 | 5.31 | ||

| Reproductive | 0.29 | 0.34 | 0.36 | 0.31 | 0.33 | 0.37 | 0.37 | 0.47 | 1.29 | 1.53 | ||

| Animal Health | 0.20 | 0.25 | 0.21 | 0.18 | 0.20 | 0.23 | 0.19 | 0.22 | 0.83 | 0.83 | ||

| Total Revenues | 1.20 | 1.43 | 1.44 | 1.46 | 1.56 | 1.92 | 1.98 | 2.23 | 5.53 | 7.68 | ||

| % increase | ||||||||||||

| Biopharma | 45% | 56% | 63% | 58% | 56% | |||||||

| Reproductive | 13% | 10% | 3% | 52% | 18% | |||||||

| Animal Health | 0% | -9% | -9% | 23% | 0% | |||||||

| Total Revenues | 30% | 34% | 38% | 53% | 39% | |||||||

Growth in Support for Clinical Trials in Regenerative Medicine

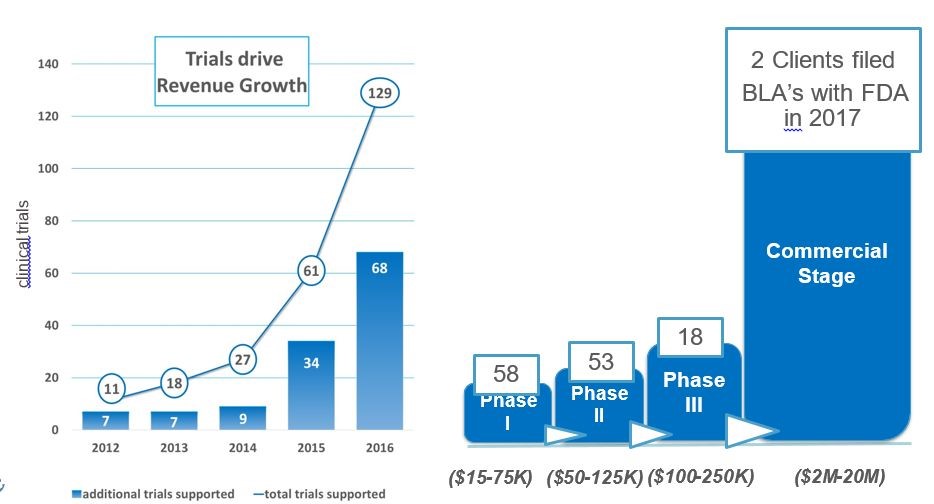

A significant driver of biopharma revenue growth is due to bringing in new clients and supporting one or more of their trials. The table below shows that the number of trials supported increased from 27 in 2014 to 129 in 2016. This was spurred by a major push of biopharma companies into developing drugs for regenerative medicine and the marketing focus of Cryoport in this area. In 2015, they added 34 new supported trials and in 2016 added 68. These trials represent new clients and new trials by existing clients.

The revenue model, however, is not just driven by new clients. As clients move forward with their products through phase 1, 2, 3 and then commercialization, the need for logistical support also increases and with that revenues grow. This is shown as follows:

- The company estimates that a typical phase 1 trial will lead to $15,000 to $75,000 of revenues,

- Phase 2 of $50,000 to $125,000 and

- Phase 3 of $100,000 to $250,000.

- Upon commercialization, the Company estimates revenues can range from $2 million to $20 million.

The bulk of trials supported in 2016 were in early stage as phase 1 accounts for 58; phase 2 for 53; and phase 3 for 18. The Company projects that at least two companies will file BLAs in 2017 which will be the first commercial products supported by Cryoport. These are the CAR-T products of Kite and Novartis for which I expect approvals in late 2017 or early 2018.

The business is not unlike a retail store model in which companies open new stores and then increase revenues within stores (same store sales growth). For Cryoport this same store sales growth results from trials progressing from phase 1 to phase 2 to phase 3 to commercialization. For those of us who follow biopharma closely, experience suggests that many of the trials in phase 1 and 2 and a good number in phase 3 will fail. However, there will be some that flow through phase 1 to commercialization and this will be the major grower of revenues in 2018 and beyond.

Click to enlarge and click back arrow at upper right hand corner of page to return to document

Cryoport’s Market Share

In its slide presentation, Cryoport provides an estimate of the number of trials underway throughout the regenerative medicine industry. Based on these estimates Cryoport is supporting 22% of phase 1 trials, 11% of phase 2 and 26% of phase 3. This is pretty impressive penetration given that Cryoport only began to focus on this area in 2015. The remainder of the market not covered by Cryoport is primarily companies trying to manage the logistics themselves or using older technologies or trials being conducted at a single site that do not require shipping. The Company believes that it is the only company with a fully integrated cryogenic solution. There are lots of opportunities to expand market share.

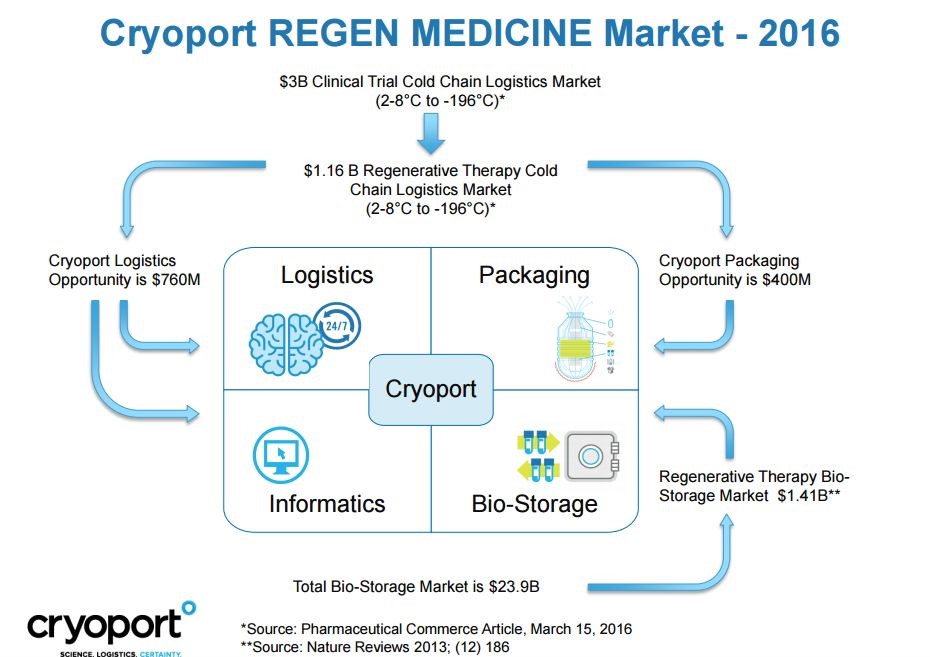

The Addressable Market for Cryoport in Regenerative Therapies

The cold chain addressable market as seen by Cryoport has several components as shown in the following picture. There are three segment with estimated market size:

- Logistics and information-$760 million,

- Packaging $400 million and

- Storage of biomaterials-$1.4 billion

- Resulting in a total addressable market of $2.6 billion.

Please note that these estimates include shipments for products that require temperatures of 2 to 80 Celsius. Most of Cryoport’s current shipments are performed for product shipments requiring temperatures as low as 1960 Celsius for which the addressable market is much lower. Also, the Company is only beginning to build a presence in Biostorage. Over time, there is the opportunity to expand its presence in each of these segments through marketing of its current product line, innovating new solutions and acquisitions.

Click to enlarge and click back arrow at upper right hand corner of page to return to document

Assumptions Made in Building a Sales and Earnings Model

It is very difficult to find metrics to help project revenues growth in biopharma. The Company was supporting 129 clinical trials at the end of 2016 and they added 34 new trials in 2015 and 68 in 2016. Before constructing my sales and earnings, I always ask the Company how they budget for sales and costs. Cryoport has a bottoms up approach in which they project sales for each trial they are supporting and also project the number of new trials they will bring in.

Pre-Commercial Clinical Trials

The Company provides investors with the number of trials being supported in phase 1, phase 2 and phase 3 and of course the range of possible revenues for trials in these stages. From this public information, it is not possible to construct a model in the same manner as the Company. There are just too many unconstrained variables. The only viable option is to extend the trend line of sales. I think there are strong arguments for using a trend line approach:

- Cryoport has shown the ability in ramp up in under two years to a 16% penetration of trials being conducted. It is reasonable to assume that they can expand this market share meaningfully,

- As trial progress from phase 1 to phase 2 to phase 3, revenue potential increases,

- As companies expand their pipeline, they are extremely likely to hire Cryoport for new trials. This was seen in the situation of Kite.

Based on this reasoning, I am estimating that revenues from pre-commercial clinical trials in 2017 and 2018 will grow at very high rates comparable to the 56% increase in 2016. I am projecting 55% growth in 2017, 53% in 2018, 50% in 2019 and 48% in 2020. This leads to revenues increasing from $5.3 million in 2016; to $8.2 million in 2017; $12.9 million in 2018; $18.8 million in 2019; and to $27.8 million in 2020. This is step one of my revenue model for Cryoport.

Revenue Projections for Commercialized Products

In addition to pre-commercial clinical trials, there are at least two products that will go commercial in 2018. Novartis and Kite have both filed BLAs for their CAR-T products and both are Cryoport clients. Cryoport has given guidance that commercial products can lead to $2 to $18 million of annual revenues which compares to $50,000 to $125,000 for phase 3 products. However, Cryoport does not give metrics that explain these numbers.

In order to estimate potential revenues for Cryoport from the launch of these two products I started by estimating the number of patients that might be treated annually if these products are approved. I then compared those estimates to the number of patients treated in the phase 2 trials. Kite enrolled 112 patients in its phase 2 ZUMA-1 trial and Novartis enrolled 130 patients in the JULIET trial; both of these were in patients with r/r DLBCL, r/r PMCL and TNF. In addition, Novartis enrolled 50 pediatric r/r ALL patients in the ELIANA trial. So altogether, there were 292 patients enrolled in these three phase 2 trials.

The addressable market for patients with r/r DLBCL is about 7,900, for r/r PMBCL 900 and TFL 600. For pediatric r/r about 900. However, not all of these patients may be treated. Cost could be a factor as the cost of infusing cells as I am estimating that the cost of one infusion could be as much as $300,000; managements of Novartis and Kite have not announced pricing as of the time of this note. In addition, a chemotherapy regimen is required before infusion to reduce the native T-cell population and the side effects from the therapy are severe. In clinical trials patients were hospitalized before cell infusion to deal with potential side effects. These can create additional costs of about $300,000 bringing the all-in cost of treatment to perhaps $600,000 per treatment.

Kite has said that clinics will find a way to get reimbursed implying that most eligible patients will be treated based on the rationale that these patients have exhausted all other treatment options and on average have only seven months or so to live. In the case of pediatric r/r ALL I would agree as the complete response (CR) is over 80% promising significant benefit for all patients and we are dealing with a younger, stronger population. But what about r/r DLBCL where the CR is 31% and where there is not yet any data that indicates what this means for survival. (Kite maintains that a CR is tantamount to a cure.) In order to get one CR in r/r DLBCL, three patients might have to be treated at a cost of $1.8 million. Will Kite and Novartis be able to provide convincing evidence to managed care that this is a good investment? Also, most of these patients are frail from previous treatments and may not be able to endure the sometimes severe side effects of CAR-T drugs.

So how many of these 10,300 patients will be treated? If Kite is correct and most of the 10,300 are treated at $600,000 per patient, the cost to managed care would be $6.2 billion. I again point out that at this point in time, there is no definitive data to indicate what the benefit of this therapy might be. For example in the r/r DLBCL patients we only know that at six months following cell infusion 31% had a CR in which the tumor shrinks to the extent that it can’t be detected with imaging; tumor cells are still likely to be present. The critical missing information is what does this mean to patient survival. Kite suggests that achieving a CR is tantamount to a cure based on results from small NCI studies, but this is yet to be determined.

I don’t think we have enough information at this point in time to determine if Kite is correct that most of these 10,300 patients will be treated or if it will be some lesser number. If the CR rate drops over time and if it is not the case that a CR is tantamount to a cure, the penetration could be quite small. At this point, projecting market penetration is pure guesswork.

Investors should also take note of another important issue. Clinicians and patients are excited about the CAR-T products. I have heard anecdotes that some of the larger and more sophisticated hospital are already geared up to treat hundreds of patients. These are institutions like M.D. Anderson, Sloan Kettering, and Moffett et al. However, Kite says that it is targeting 72 leading cancer clinics and many of these are still far down the learning curve in understanding how to deliver this technology. The treatment regimen is complex and most clinical sites are likely to start with small numbers of patients to hone their treatment protocols. We can also expect that managed care will put up significant reimbursement barriers.

So here is my guesswork. I think that the high CR rate in pediatric r/r ALL patients will result in rapid penetration of the market. I think that within three years most of the 900 pediatric r/r ALL patients will receive CAR-T therapy. I don’t really have a good idea on the penetration of the r/r DLBCL market, but with the low CR rate, it is hard for me to agree with Kite that almost all patients will receive CAR-T, certainly in the first two to three years of the launch. I am guessing and it is a guess that only a limited number of patients will be treated in r/r DLBCL. The CRs in r/r PMBCL and TNF are a little better and penetration will be higher.

In this note, I am assuming that in 2020, 850 r/r pediatric r/r ALL patients will be treated, 1500 r/r DLBCL, 500 r/r PMBCL and 400 TNF. This would result in 3,250 patients being treated. This compares to 292 in the three phase 2 trials. Cryoport does not give guidance on how patients treated relates to revenues. Initially, I thought that just taking a ratio of the number of patients that I am estimating will be treated after approval and dividing by the number treated in clinical trials would provide a good way of estimating commercial sales.

This would suggest that the revenues received by Cryoport in 2020 would be eleven times that achieved in the phase 2 trials (3,250 divided by 292). Cryoport doesn’t disclose how much revenues were received in the phase 2 trials for the CAR-T products other than to say that revenues for a phase 2 trial range from $50,000 to $125.000. The three phase 2 trials by this measure could have brought in $150,000 to $375,000 or $500 to $1300 per patient. If this is anywhere near correct, the 3,250 patients treated in three years could bring in $1.6 to $4.2 million in 2020.

The above analysis basically assumes that revenues are primarily tied to shipments of drug and number of patients treated. As I did more work on Cryoport, I have come to believe that this is only the starting point. The CAR-T products are autologous which has important implications. Regulatory agencies and scientists will be able to track the course of a product from the time when a needle is inserted to withdraw cells until the time they are re-infused with the final product. I envision an ecosystem of software and resultant algorithms that focuses on this process. An integral part of this ecosystem will be tracking what happens to the product through this whole chain of custody and Cryoport’s data will be an essential component of this. This ecosystem will produce demands on Cryoport to supply and retain data for regulatory, research, quality control and manufacturing purposes which will lead to more revenue streams. Also, Cryoport will probably be able to use its data and knowledge base to derive consulting fees from customers, new and old. Paradoxically, I came to the conclusion that revenues per patient will likely increase as the product becomes available commercially.

I have gone to great length to discuss how we might potentially project revenues for the two CAR-T products. Using my previous analysis which was based on a per patient treated basis, I came up with a sales estimate in 2020 of $1.6 to $4.2 million collectively in 2020. The mid-point of the guidance range of $2 to $18 million would suggest $10 million for each of three initial indications or $30 million at peak sales which would probably occur in 2023. Along this line sales in 2020 would still be building and might product $15 million of revenues to Cryoport. The estimates based on movement of product suggesting $1.6 to $4.2 million in 2020 appear to be quite low.

If you are frustrated by all of these widely varying estimates based on an important amount of guesswork, so am I. I think that we need a lot more experience and information to make more reasonable estimates, but you do have to start somewhere. For the purpose of modeling, I am assuming that Cryoport revenues from Kite and Novartis will be $1.6 million in 2018, $2.4 million in 2019 and $3.5 million in 2020. Remember that based on using the different methodology of taking the mid-point of the estimated $2 to $18 million that Cryoport suggest, I could come up with a sales estimate for the Kite and Novartis products of $15 million. I sense that Cryoport thinks that I am low, but they don’t offer guidance.

In addition to the CAR-T products of Kite and Novartis, Cryoport has projected that four other BLAs for regenerative therapies will be filed in 2017. It doesn’t disclose who will file these BLAs and which ones it might provide logistics for, but it does imply that one or more will be clients. I am not making any projections at this time, but I think there are likely to be revenues from these products over the next three years.

Revenue Projections for Big Pharma Relationships

In June of 2016, Cryoport negotiated and signed its first commercial agreement with Bristol-Myers Squibb to provide logistics support for the manufacturer of a drug which has not been directly identified. Indirectly, Cryoport has said that it is a monoclonal antibody that has blockbuster sales ($1+ billion). The project relates to the logistics for the cell lines used to manufacture the product. This program will phase in over the coming quarters as the relevant quality and regulatory elements are completed. The length of time (approaching one year) required to make this transition underscores how difficult it is to change logistics for a marketed product.

The Company also commented in March, 2017 that it has been successful in landing two additional large pharma support projects supporting their worldwide biologics manufacturing. I believe these also relate to cell lines. These are the Genzyme division of Sanofi and the Janssen division of Johnson & Johnson. These will take time to implement; they entail each client dissolving its own cryogenic fleet and shifting all cryogenic logistics support to Cryoport.

The developing relationship with Bristol-Myers Squibb and the two other big pharma companies is of importance beyond that of the immediate dollars. BMY is pursuing multiple drug platforms in immune-oncology and gene therapy treatments, among others, and it seems logical to think that they will turn to Cryoport to support the logistics for products requiring shipment at cryogenic temperature. The same can be said for Genzyme and Janssen. Cryoport believes that its logistics platform could also provide cost-effective support for pharmaceutical such as monoclonal antibodies that require cold chain distribution, but not cryogenic logistics. If this were to happen, it might be a major opportunity.

Cryoport has given no guidance on how to model sales for these relationships so I can only guess at how much they might contribute. I am guessing that they are somewhere between $250,000 (top end of guidance for a phase 3 product) and $2 million (low end of guidance for a commercial product. This leads me to estimate that peak sales at three years (2020) will be roughly $800,000 each for Bristol-Myers Squibb, Sanofi and Johnson & Johnson. The resultant combined revenues are $200,000 in 2018, $800,000 in 2019 and $1.6 million in 2020.

Revenue Projections for Reproductive Health

This business segment deals with the transportation at cryogenic temperatures of human eggs, sperm and embryos used in in artificial insemination. This is a surprisingly large market comprised on 6.7 million women. Prior to the focus on regenerative medicine begun about 18 months ago, this was a major drive of sales. An important component was using foreign women as surrogate mothers to carry a baby for a woman who couldn’t do so on her own. However, some foreign governments became disturbed at this practice and banned or reduced activity causing an impact on sales.

In late 2016, Cryoport began to launch the CryoStorkSM Next Flight Out cryogenic logistics solution for the Reproductive medicine market. CryoStorkSM is the fastest solution in the market for reproductive health patients, providing express transportation across the United States for human sperm, eggs and embryos. Cryoport believes that CryoStorkSM will become a primary method of delivery for the reproductive medicine market within the next few years. Many couples struggle with fertility problems; in fact, approximately 6.7 million women in the United States are unable to have a child per the American Society of Reproductive Medicine.

Worldwide sales were up 19% in 2016 and sales in the December 31, 2016 quarter increased 52%. Cryoport guides that it expects steady growth but that it is difficult to project sales. I am estimating that sales grow at about 20% per year

Revenue Projections for Animal Health

Cryoport signed a contract in 2012 with Zoetis for providing logistics for a poultry vaccine that requires cryogenic shipping. This is the primary driver of sales in animal health. Production issues with this product resulted in flat sales in 2016, but there was a 23% rebound in the December 31, 2016 quarter. Based on a return to growth for the chicken vaccine and new clients, I am projecting growth of 10% going forward, there are four other major animal health care companies that compete with Zoetis and provide an opportunity for future growth. Additionally, Cryoport signed on Jackson Labs recently, which should lead to some growth in 2017.

Cost Assumptions

- Cost of Goods Sold: A major component of cost of goods sold are payments to bulk carriers like UPS, FedEx and DPL and specialty couriers. Other costs related to depreciation and care of dewars and operational centers at their headquarters in Irvine and third-party run centers in Rotterdam and Singapore. In 2016, the gross margin was 40.4%. The Company looks for steady improvement in gross margins with a goal of reaching 60%.

- General and administrative: Much of these costs are related to the costs of running a public company. There is also some stock based compensation. Cryoport doesn’t look for G&A to grow anywhere nearly as fast as sales.

- Sales and marketing: These relate to sales expenses and the costs of bring new trials on line. These should grow rapidly but somewhat less than sales

- Research and development: There is ongoing work primarily with third parties on software and development and a little on dewars. These should grow somewhat less than sales.

Sales and Earnings Model 2016 to 2020

The following table brings together all of the above assumptions to create sales and earnings projections through 2020. I am projecting that sales will grow to $37 million for a compounded annual growth rate of 48%. I am also projecting that 2020 will be the first year of profitability with net income of $4.36 million and EPS of $0.18.

I have also projected cash generation from operations less capital spending for the 2016 through 2020 time frame and year end cash. I am projecting that Cryoport has a cash burn of only $0.89 million in 2017 and becomes cash flow positive in 2018. I project that the yearend cash balance will grow from $15.9 million (pro forma for the March equity offering) to $32.13 million in 2020.

|

Cryoport Sales and Earnings Projections 2016-2020 |

|||||

| $ millions | 2016 | 2017 | 2018 | 2019 | 2020 |

| Regenerative Medicine | |||||

| Clinical Trials | 5.31 | 8.23 | 12.56 | 18.83 | 27.78 |

| Commercial products | |||||

| Kite, Novartis | 1.60 | 2.40 | 3.50 | ||

| Other | 0.00 | 0.00 | 0.00 | ||

| Big Pharma Relationships | |||||

| Bristol-Myers Squibb | 0.20 | 0.40 | 0.80 | ||

| Genzyme, Janssen | 0.40 | 0.80 | |||

| Reproductive Medicine | 1.53 | 1.84 | 2.21 | 2.65 | 3.18 |

| Animal Health | 0.83 | 0.92 | 1.01 | 1.11 | 1.22 |

| Total Revenues | 7.68 | 10.99 | 17.57 | 25.79 | 37.28 |

| Cost of Goods Sold | 4.58 | 6.37 | 9.66 | 13.15 | 17.52 |

| Gross margin | 40.4% | 42.0% | 45.0% | 49.0% | 53.0% |

| General and administrative | 4.63 | 5.56 | 6.12 | 6.73 | 7.40 |

| Sales and marketing | 3.57 | 4.47 | 5.36 | 6.43 | 7.72 |

| Research and development | 0.60 | 0.69 | 0.79 | 0.91 | 1.05 |

| Operating costs | 8.81 | 10.13 | 11.64 | 13.39 | 15.40 |

| Operating income | (5.70) | (5.51) | (3.74) | (0.75) | 4.36 |

| Non-operating income | (4.34) | 0.00 | 0.00 | 0.00 | 0.00 |

| Pretax income | (10.04) | (5.51) | (3.74) | (0.75) | 4.36 |

| Taxes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net income | (10.04) | (5.51) | (3.74) | (0.75) | 4.36 |

| EPS | ($1.69) | ($0.41) | ($0.16) | ($0.03) | $0.18 |

| Shares outstanding | 5.95 | 13.36 | 23.20 | 23.66 | 24.14 |

|

Calculation of Cash Burn 2016 to 2020 |

|||||

| $ millions | 2016 | 2017 | 2018 | 2019 | 2020 |

| Net income | (10.04) | (5.51) | (3.74) | (0.75) | 4.36 |

| Depreciation and amortization | 0.34 | 0.39 | 0.45 | 0.52 | 0.59 |

| Stock based compensation | 4.20 | 4.83 | 5.55 | 6.39 | 7.35 |

| Other non-cash expense items | 0.72 | 0.72 | 0.72 | 0.72 | 0.72 |

| Cash from operations | (4.78) | 0.43 | 2.99 | 6.87 | 13.02 |

| Capital spending | (1.10) | (1.32) | (1.58) | (1.90) | (2.28) |

| Cash flow | (5.88) | (0.89) | 1.41 | 4.97 | 10.74 |

| Yearend cash position | 15.90 | 15.01 | 16.42 | 21.39 | 32.13 |

Overview of Cold Chain Logistics Industry

What is Cold Chain Distribution?

A cold chain is a temperature-controlled supply chain that maintains a given temperature range through both storage and distribution. It is required to extend shelf life of perishable items and/or to prevent degradation or destruction. It is commonly employed for foods such as agricultural produce and seafood and is also used for fine chemicals and pharmaceutical products. Cryoport is totally focused on pharmaceuticals so that this is the focus pf this report.

Importance of Cold Chain Distribution for Biopharma

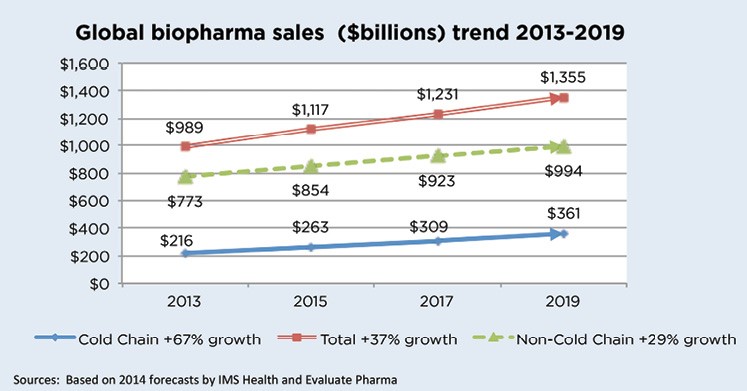

IMS estimated that 2015 worldwide, biopharma sales would reach $1.1 trillion and that products requiring cold chain distribution would account for $263 billion or 24% of the total. This is shown in the following table as well as projections through 2019.

Click to enlarge and click back arrow at upper right hand corner of page to return to document

The emergence in the 1980 of biotechnology products based on proteins has been the major driver of the demand for cold chain logistics; IMS estimated that sales of these products reached $250 billion in 2016. Proteins are sensitive to temperature and require cold chain logistics to maintain quality, first after manufacturing, then when they are shipped and finally when they are stored before usage. Not all biotech products require refrigeration, but the great majority do. In addition to biotechnology products, vaccines, tissue specimens used for diagnostics, and blood products also need cold chain distribution technology.

These products are extremely high value added products in which a single administration of the finished product in some cases can cost thousands or even tens of thousands of dollars for a single injection. Biotechnology products generally made in relatively small volumes for small patient populations. Usually, they are shipped and packaged in vials or syringes for infusion or injection. Some refrigerated products, such as various insulin products can be held at or close to room temperature for some time at the point of use.

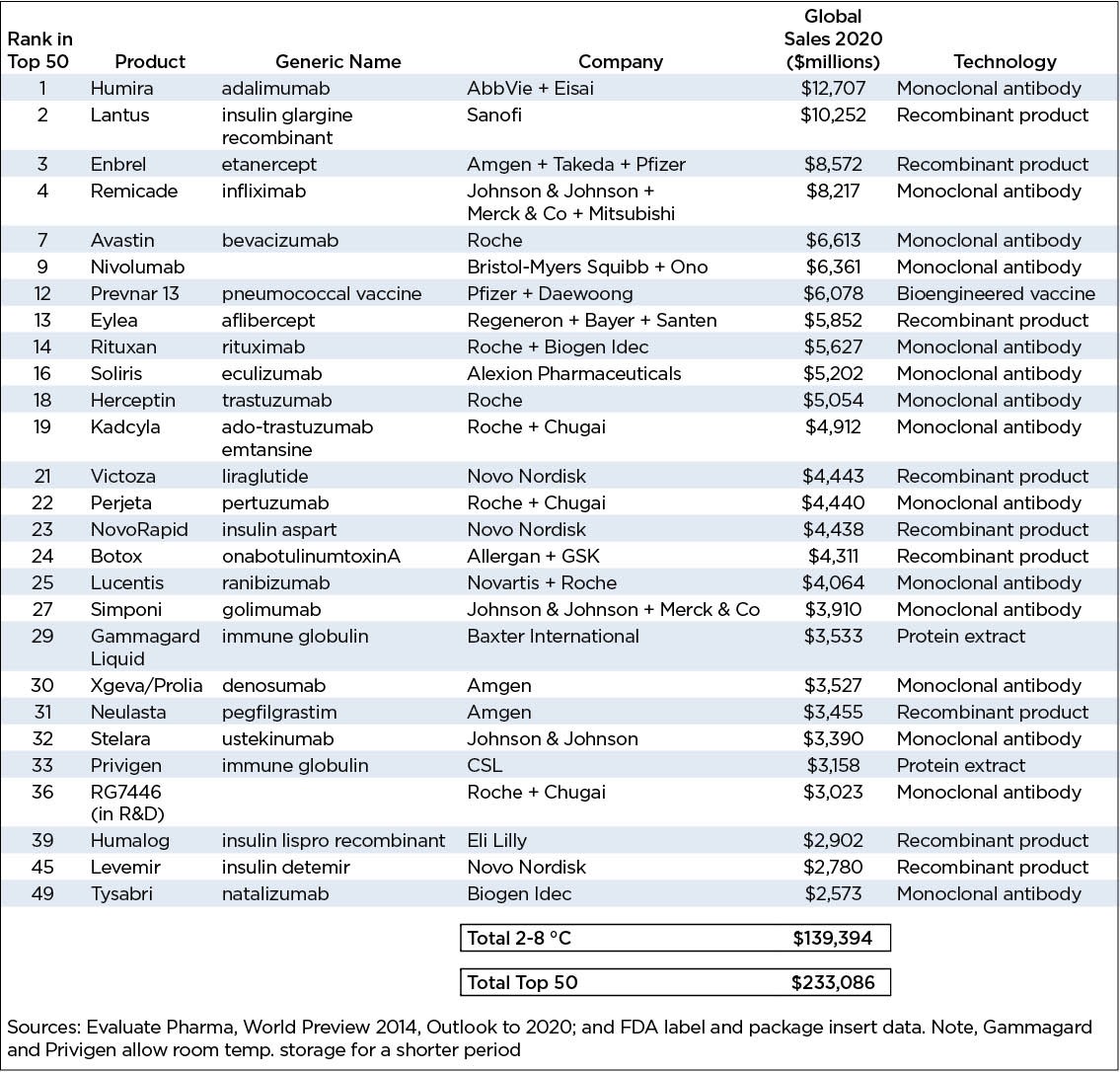

Evaluate Pharma projects that by 2020, 27 out of the 50 largest selling products in the world will be products requiring cold chain distribution. These are overwhelmingly biotechnology products based on monoclonal antibodies or proteins produced by recombinant manufacturing.

Click to enlarge and click back arrow at upper right hand corner of page to return to document

Monoclonal antibodies have been premier products in oncology and autoimmune disease and are currently the most heavily researched area in biotechnology. In clinical trials, following protocols is essential to obtaining meaningful results and maintaining the cold chain is key to achieving validity of tests.

The next great growth area promises to be products based on living cells. These therapies are almost entirely in the clinical development stage and include products such as stem cells, CAR-T cells, genetic therapies, dendritic cell and other types of vaccines, etc. Unlike monoclonal antibodies that are maintained in the cold chain at temperatures of 2–8°C, they must be frozen at cryogenic temperatures; this makes the managing of logistics much more complex. It is this cryogenics sector of cold chain logistics in which Cryoport has established an industry leading solution. These products are just at the very beginning of the commercialization process.

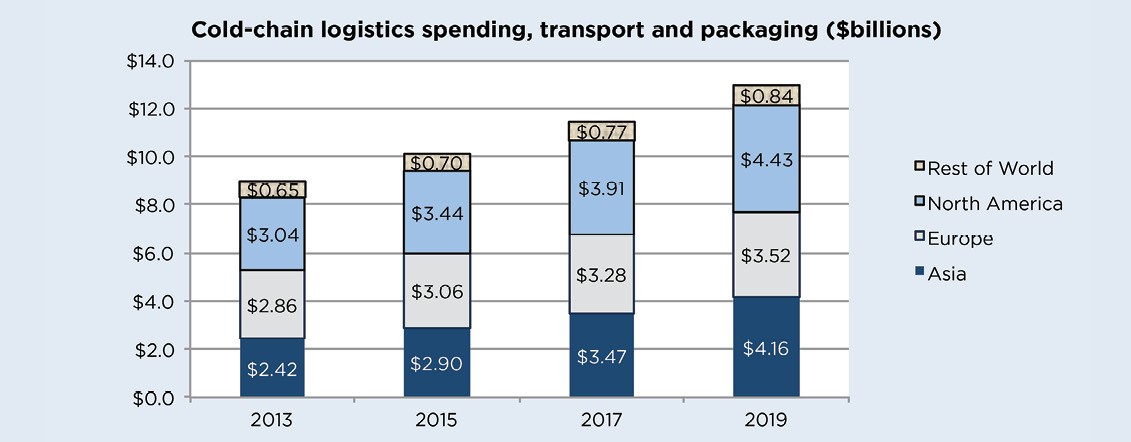

Cold Chain Logistics Spending

According to Pharmaceutical Commerce, cold-chain logistics spending for biopharma in 2016 will be more than $12 billion worldwide. This is 15% of $79 billion of total spending on logistics. Of this $12 billion, it is estimates that $9 billion will be spent on transportation and $3 billion on specialized packaging and instrumentation, such as insulated boxes, blankets, phase-change materials, active-temperature-control shipping containers, and various temperature sensors and recorders. By 2020, Pharmaceutical Commerce predicts that cold-chain biopharma logistics spending will expand to more than $16 billion.

The bulk of this spending is on products based on monoclonal antibodies and other biopharma products that require refrigeration at 2–8°C. It costs more to keep products at 2–8 °C or colder temperatures than products that can be shipped and stored at room temperature. They are more expensive to pack and transport and require quality control measures to make sure that each shipment stays cold throughout the distribution process.

Geographic Issues for Cold-Chain Logistics

Most cold chain products are currently manufactured in the developed world-US, Europe and Japan which account for 20% of the world’s population. These countries consume about 60% of its pharmaceutical products in dollar terms. There is meaningful demand in third world companies and it is growing much more rapidly than in the developed world. Third world countries rely on products manufactured in the developed world. This increases demand for cold chain distribution. The following table that shows IMS projections for sales of products requiring cold chain distribution in North America, Europe, Asia and rest of the world.

Click to enlarge and click back arrow at upper right hand corner of page to return to document

Need for Clinical Trial Logistics

The commercial market accounts for the overwhelming majority of cold chain distribution revenues. Still, clinical trial logistics also require temperature-assured transportation and packaging. It is also more complex as it involves shipment of products to be used in trials to study sites that may be dispersed around the globe, and return of unused medicines, as well as shipment of medical samples to centralized analytical laboratories.

Expanding Cold Chain Infrastructure

Cryoport uses the logistics of the large logistics companies such as FedEx, DHL and UPS for the actual transport of the products they are involved with. These carriers have dedicated, temperature-controlled warehouses and intermediate storage areas for biopharma products. Also, more and more freight forwarders, air carriers, trucking firms and 3PLs (third-party logistics providers) now have branded life sciences services. Technologies for packaging life sciences products and clinical trial materials (CTMs) are advancing, as are digitally based networks and devices for tracking shipments through supply chains.

Regulations

Cold chain distribution has evolved far beyond just dropping a pharma product into a strip foam container packed with dry ice and dropping it off at the local parcel delivery company. Some refrigerated products such as various insulin products, are labeled to allow them to be held at room temperature for some time. In the US, temperature limits for blood, plasma and some vaccines and other specific biological products are written into federal law and, while they overlap with ranges described by USP S

Through collaboration between leading industry organizations, and national and international government regulators, the restrictions on how pharmaceuticals, medical devices and other healthcare products are transported are becoming significantly tighter. A key factor here is the imposition of Good Distribution Practices (GDPs), which are beginning to address not just refrigerated products, but also so-called controlled room-temperature (CRT) ones.

While the industry globally has not, as yet, adopted insulation and cooling systems for CRT products across the board, the use of techniques like thermal blanketing and regulated warehouse room temperatures is become widespread.

Life Sciences Technology Impact of Cold Chain Logistics

Life sciences technologies are expected to have a significant impact on global society over the next 25 years. In the United States alone, the life sciences industry is made up of 6,000 identifiable entities. Moreover, the industry is growing globally as research and manufacturing facilities span the globe.

The total cold chain logistics market on an annual basis has historically grown 70% faster per annum than the total logistics market. For 2011, global cold chain logistics transportation costs were reported to be $7.2 billion; about $1.5 billion within the cryogenic range of requirements. By 2017, transportation cost alone, for global life sciences cold chain logistics, are forecasted to grow to $9.3 billion, a 41% increase, and twice the growth of the overall market.

Cryoport estimates that its current cryogenics logistics services provide comprehensive and technology-based monitoring and tracking for a potential of six to seven million deep frozen shipments globally on an annual basis. They further believe that they can expand to provide solutions to a large portion of an additional fifty-five to sixty million annual shipments requiring ambient (between 20° and 25°C), chilled (between 2° and 8°C) or frozen (minus 10°C or less) temperatures.

Tagged as Cryoport, CYRX + Categorized as Company Reports, LinkedIn

Thanks, Larry. This looks to be a quite thorough report to say the least. It may be a day or two before I can read it all.

You may want to change the trading symbol in the heading. The middle letters have been transposed.

Interesting company and product/service offering. I’m trying size up the management team and get my arms wrapped aroiund past actions.

1) Have they done a reverse stoick split (or two ) in past years?

2) Who else is competing is this space?

3) What are the barriers to market entry?

4) Do they have patents protecting what they do?

5) Wiould it make sense for them to be acquired by someone (?)?

Their business model appears to be solid, and perpetual growth/profit prospects seem to be quite strong. That said, if there’s money to be made you’re going to have cometition.

Thanks

“Short Attack On Cyroport Launched” .Title of a Seeking Alpha aticle refering to ( promoting? ) an assault being conducted by the convicted stock market criminal – Hunter Adams _ on the web site thestreetsweeper.org. Worrysome? Yes, considering what happened to NWBO. This is just the tip. How big is the iceburg? On the other hand this activity may may produce a nice dip and a good buying opportunity.