Spectrum Pharmaceuticals: The Bull and the Bear Case (SPPI, $15.72)

Reason for Report

At the request of some subscribers to my website, I have been asked to take a look at the bull and bear case on Spectrum Pharmaceuticals and try to fairly represent the positives and negatives of each point of view. There is strong bearish sentiment as short interest accounts for 52% of the float.

Background on Fusilev

Spectrum Pharmaceuticals (SPPI) is subject to wide differences in opinion on the prospects for its key drug Fusilev. Taking advantage of manufacturing issues that have plagued suppliers of a competitive product, generic leucovorin, sales of Fusilev have soared from $16 million in 2009 to $32 million in 2010 to $153 million in 2011. Sales in the first quarter of 2012 were $51 million and the Street is looking for about $60 million in the second quarter of 2012, up from $34 million in 2Q, 2011. Based on my research, I think that 2Q, 2012 sales could reach $65 million or possibly more; this would be an upside surprise versus consensus expectations.

The stock went on a strong run in 2009 and 2010. The price was $4.57 on January 4, 2011, $7.04 on January 3, 2011 and $14.63 on December 30, 2011. This performance, which was almost totally driven by Fusilev, transformed the company. In 2009, product sales were $28 million and they soared to $181 million in 2011 with 85% of those sales coming from Fusilev. In 2009, the company lost $19 million and in 2011 it made $48 million of net income. The balance sheet is exceptionally strong showing $186 million of cash and equivalents at the end of 1Q, 2012. Fusilev has enabled Spectrum to transform from just one of a large number of struggling biotechnology firms to an earnings driven “player”.

Fusilev was launched in 2008; sales were modestly up and down in 2009 and in the first quarter of 2010 were only $600,000. Then, manufacturing issues with generic leucovorin surfaced and worsened throughout 2010 and 2011. The leucovorin situation is just one of a number of manufacturing problems encountered by injectable cancer drugs. There is speculation that razor thin margins for injectable generics have made it difficult to continue to make the investments needed to maintain manufacturing facilities. Injectable manufacturing is much more difficult and expensive than for oral dosage forms. Any slight quality issue can raise the concern of contamination and can have profound impact when the product is injected into humans. Hence, the FDA is more demanding and manufacturing is more expensive and subject to a shutdown at the slightest hint of quality or control issues. It may be the case that this will cause ongoing issues with leucovorin supplies; the jury is out on this issue, but it is worth watching.

Bears and Bulls

Spectrum’s stock has been locked in a battle between the bulls and bears in 2012 with the bulls having a slight edge as the stock has increased from $14.70 on January 3, 2012 to $15.97 on July 11, 2012. The issue that dominates the stock and will continue to do so for the balance of 2012 will be what happens with Fusilev. The divergence between the bull case and the bear case is as wide as the chasm separating the rims of the Grand Canyon. There are numerous bears as witnessed by the 52% short interest in the stock. Subscribers have asked me to take a balanced look at the bear case and the bull case and report back. Let’s start with the bear case.

The bear case is straightforward and seems intuitively obvious. As manufacturing issues are resolved and generic leucovorin becomes available, Fusilev sales will start to decline and the most ardent bears suggest the decline will be as rapid as the ascent. Generic manufacturers will see this as a juicy opportunity and cost conscious insurers will give further push to a conversion back from Fusilev (costs about $150 per vial) into generic leukovorin (about $40 per equivalent dosage).

Bears also point to firm indications that supplies of generic leucovorin are beginning to come back in significant quantity. Market research data bears this out. Six months ago and certainly a year ago, there were definitely shortages in the market. However, field checks now indicate that most hospitals and physician groups can find leucovorin if they want it. I think that the leucovorin shortage is effectively over, at least for the present.

The tenets of the bull argument are more subtle:

- Fusilev and generic leucovorin is not the same product. Leucovorin is a racemic mixture of two isomers which are mirror images of each other. One isomer produces the therapeutic effect while the other is believed to have no known benefit. Fusilev is based on the therapeutic isomer alone. I think that the bear case seems to assume that Fusilev and generic leucovorin will be viewed as freely interchangeable and I don’t think that this is the case.

- The argument that insurers will force the switchback to generic leucovorin may be over-estimated by the bears. Insurers tend to muster their cost control efforts on huge therapeutic categories such as hypertension and cholesterol lowering where they are reimbursing for multi-billions of sales. Fusilev at $200 million of sales may still be below their radar screens. Moreover, insurers’ preferred modus operandi is to induce physicians to substitute generics for a branded product having the same active pharmaceutical ingredient; it is much harder for them to persuade physicians to use one drug for another that has a different active ingredient as is the case with Fusilev.

- Physicians and caregivers will not quickly forget the sudden shortfall of generic leukovorin supplies. This forced them to ration the product and have to decide in some cases which patients would and wouldn’t receive drug. It will take some time for them to gain confidence that there won’t be more shortages in the future. This provides an important incentive to stay with Fusilev.

- There is also the reimbursement issue that favors Fusilev. A physician is reimbursed under Medicare Part B at average selling price plus 6% for Fusilev and generic leukovorin. Fusilev sells at about $150 per vial versus $40 for generic leukovorin. This markup of $9.00 for Fusilev versus $2.40 for generic leukovorin makes a difference to purchasing groups when spread across thousands of vials. Also under Medicare Part B, the higher ASP of Fusilev allows Spectrum the flexibility to offer attractive discounts that further increase the profits to users relative to generic leucovorin.

- Spectrum has entered into long term contracts with some of its customers that will lock them into Fusilev usage for a period of months or years.

- Familiarity brings comfort and physicians are now comfortable with Fusilev. There is no compelling therapeutic reason for them to go back to generic leucovorin. Some physicians even believe that because less Fusilev has to be injected (half as much), there may be a safety advantage.

Current Trends in the Market

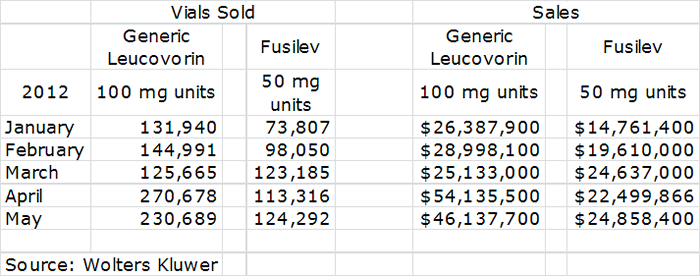

But enough of the theoretical arguments, let’s take a look at what data from the market research firm Wolters Kluwer suggests. The following table shows in the two left hand columns estimates of the number of vials shipped for generic leucovorin and Fusilev in the first five months of 2012. The two right hand columns show estimates of how this translates into sales.

This shows rather conclusively that generic supplies are back in the market as shipments of vials nearly doubled in April and May versus February and March levels. This did not, however, cause a sharp drop in unit sales of Fusilev. The data can be further interpreted that Fusilev unit sales are flattening with the reemergence of generic leucovorin as sales in April and May are below or equal to March sales, the last month before the re-emergence of generic leucovorin. Another interpretation is that Fusilev sales have not really been impacted that much as sales patterns on a quarterly basis tend to go in step function increases as opposed to smooth, upward month over month increases.

If looking at Fusilev sales from a step function perspective, first quarter sales of Fusilev were $57.0 million according to Wolters Kluwer, (the actual figure was $51.0 million according to Spectrum’s financial reports). Fusilev has already recorded $47.3 million of sales in April and May according to Wolters Kluwer and if June sales are the same level as May, second quarter sales would be $72.2. Because Wolters Kluwer seems to overestimate sales, probably because it misses discounts and rebating, the reported sales by Spectrum would probably come in at $65 million or so. My field checks, which are confirmed by contacts (not at Spectrum), indicate that June shipments for Fusilev continued strong.

What about the Stock?

So what do I tell my subscribers about the prospects for Fusilev and the effect on Spectrum’s stock? The bear case calling for a sharp decline in Fusilev sales when generic leucovorin becomes widely available seems to be in serious question, but can’t be dismissed without several more months of data. It is not crystal clear as to how much of an effect generic leucovorin is having or will have on Fusilev sales. It can be argued that Fusilev is flattening, but it might also be the case that the generics are just regaining that part of the market that was not supplied by Fusilev over the last two years and that Fusilev is maintaining its current sales level and perhaps expanding it.

What about the stock? I think that Spectrum could report Fusilev sales in 2Q, 2012 of $65+ million and field checks suggest a good start to the third quarter. The upside surprise on Fusilev sales, if I am correct, could cause the stock to move up and make the bears uncomfortable, possibly resulting in a short squeeze. Based solely on my subjective feel, I can see the potential for an upside surprise and short squeeze driving the stock above $20. I think that the third quarter could also surprise on the upside relative to current thinking. My crystal ball flickers a little as I look into the fourth quarter and I don’t have as much confidence one way or another. I do think that it will be much more uncomfortable for bears than bulls over the next few months.

In looking longer term, 2013 and beyond, I don’t have firm conviction on whether Fusilev sales will grow nicely, flatten or decline modestly. However, I don’t see the case for a meltdown. If this is correct, the company will have strong cash flow from Fusilev to make acquisitions, acquire marketed products and build its pipeline. It is dependable cash flow that allows specialty pharmaceutical companies to succeed as we have seen with pioneers like Auxilium (AUXL), Cubist (CBST) Cephalon, Forest Laboratories (FRX) , Valeant (VRX), Shire (SHPGY) and more recently with ViroPharma (VPHM). Spectrum Pharmaceuticals now has such a cash flow producing asset.

Management is following the widely established recipe for specialty pharmaceuticals success. It points to the potential for invigorating sales of Zevalin, (a $28 million product) as a potential area of future growth. It is trying to acquire Allos Therapeutics (ALTH) to gain control of Folotyn (a $40 to $45 million product); it sees this as a nicely accretive deal. In its 2011 10-K, Spectrum pointed to two drugs, apaziquone and belinostat, that it hoped to file NDAs on in 2012. Apaziquone missed the primary endpoint in phase III trials reported in April, 2012, underlining the risk of new drug development, but there are a large number of other drugs in development and there is always the case that one could achieve the positive clinical results that could drive the stock. This comprehensive pattern of business development, as I just pointed out, has led to the development of very successful specialty pharmaceutical companies. At this point, I have not done the amount of work necessary to gain strong confidence that Spectrum will succeed in any or all of these endeavors. However, I think that it definitely has the right strategy and most importantly the cash flow to implement it.

Let me anticipate the next question. If I am right and the stock moves into the low $20s should I buy more, hold the stock or sell? Let’s see if I am right on the near term and then let me revisit this question.

Disclosure: The author of this article did not own shares of Spectrum Pharmaceuticals at the time this note was written. In reading this note, you acknowledge that you have not used it as the sole basis of your decision making and that all investment decisions are based on your own analysis. An investment in Spectrum Pharmaceuticals carries substantial risk and investors could potentially lose much of their investment. The reader acknowledges that he/she has carefully read the Investment Approach, Terms/Conditions and Disclosures sections in the About Us section of the website. The reader acknowledges that he/she will not hold SmithOnStocks accountable for any investment loss that may be incurred if a decision is made to invest in Spectrum Pharmaceuticals.

Tagged as Spectrum Pharmaceuticals Inc. + Categorized as Company Reports