Portola: Update and Reiteration of Buy Recommendation (PTLA, Buy, $39.31)

Investment Thesis in Brief

This report is based on presentations by management at recent brokerage conferences. It is an update and not a comprehensive analysis of Portola. For more detailed analysis, you may want to refer to a series of reports on my website. I am reiterating my Buy recommendation on Portola. I have a price target of $110 to $136 in 2023 based on the prospects for Andexxa alone. There is additional and meaningful upside on top of this from Bevyexxa and cerdulatinib but it is harder to quantify. I believe that the critical catalyst in 2018 for a major upward price movement is FDA approval of the Gen 2 manufacturing process for AndexXa which could occur in early 2019. The current, inefficient Gen 1 manufacturing process is unable to meet substantial demand. A second catalyst could be the approval of Andexxa in Europe in late 2018 or early 2019. I do not expect a sales inflection point for Bevyexxa until sometime in 2019. With two approved products in Andexxa and Bevyexxa and a third, cerdulatinib, entering a potentially registrational trial in 2019, I think the Company is a prime acquisition candidate in the period of the next two years. Its acquisition could have a meaningfully positive effect on the biggest of biopharma companies.

Investment Overview and Thesis

All emerging biotechnology firms strive for the wholly grail of gaining approval for a new drug although shockingly few are ever successful. Even approval in a small indication is a significant valuation inflection point that can lead to a sharp upward price movement. I find it extraordinary that Portola has been successful in gaining approval in the last year for two new drugs that uniquely address large commercial opportunities, but the stock has not responded as much as would be expected.

The anticoagulant Bevyexxa is a factor Xa inhibitor like the blockbusters Xarelto and Eliquis. It is the only drug approved in the US for the prevention of blood clots in hospitalized, acute medically ill patients. Both Xarelto and Eliquis tried and failed to gain approval in this indication. Portola estimates that there are 8 million such hospitalized patients each year in the US and of these 100,000 die from blood clots. AndexXa is even more significant from a medical standpoint because it is the only drug approved to reverse the anticoagulant effects of Xarelto and Eliquis. Each year about 2-3% of patients treated with factor Xa Inhibitors develop life threatening major bleeding that results in approximately 117,000 hospital admissions and causes 24,000 deaths.

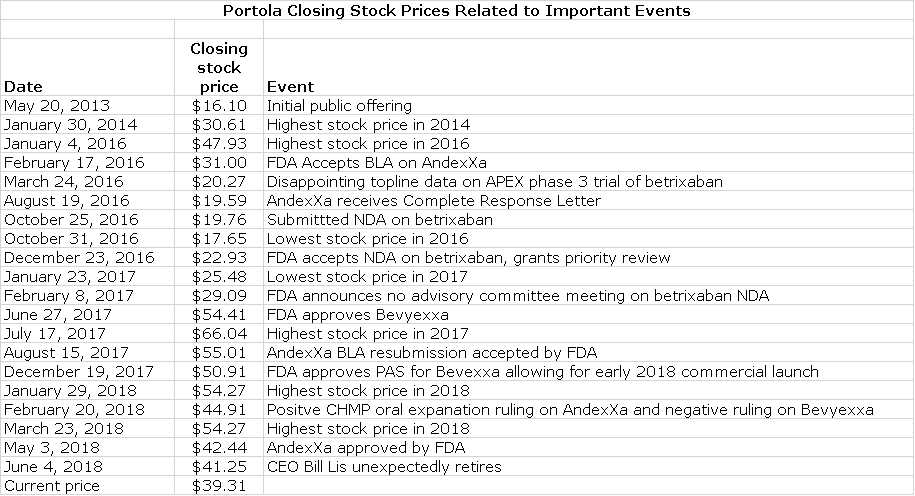

The stock price behavior on Portola leaves me a bit baffled. Let me show you the price of the stock at key points over the last five years.

One would think that the approval of Bevyexxa and Andexxa in the US enormously derisk the stock and would lead to higher stock prices. Looking back to January 4, 2016, before the NDA on Bevyexxa and BLA on AndexXa were even submitted the stock price reached $47.93 which is 22% higher than the current price after both drugs have been approved in the US. The all-time high for the stock was $66.04 on July 17, 2017 after the FDA approved Bevyexxa. Since then the price has been in a downward trend and is even lower now than when Andexxa was approved on May 3, 2018. Wouldn’t you think that the stock price should be in an upward trend and significantly higher? I do.

While in my mind, the approvals in the US for Bevyexxa and Andexxa are significant positives that far outweigh any negatives, there are some negatives in the story.

- Bevyexxa is experiencing a slow U.S. launch as is usually the case for newly introduced products and management does not see an upward inflection in sales trajectory until 2019.

- The CHMP (European equivalent of the FDA) has indicated that it may not approve Bevyexxa in Europe based on the current data base that led to US approval.

- The demand for Andexxa (just introduced on May 23) is very strong. However, supply is limited because the current Gen 1 manufacturing process has a very low yield. The new Gen 2 manufacturing process can adequately supply what I think will be enormous demand in both the US and also Europe if it is approved there as management expects in early 2019. However, there is uncertainty that the FDA and CHMP may have issues with Gen 2 that could delay approval.

- CEO Bill Lis just recently resigned. This was unexpected and the reasons for the resignation are unclear.

- The Company had about $500 million of cash going into 2Q, 2018 and I am estimating that it will end the year with around $300 million. There could be extraordinary demands for cash going forward as the Company expands the launches in the US of Bevyexxa and Andexxa. If the Company decides to launch Andexxa and Bevyexxa in Europe on its own, it will have to make an enormous investment in infrastructure. I think that we could see a meaningful equity offering in 2018 or 2019.

I think that the major catalyst for the stock going forward would be approval by the FDA and CHMP for the Gen 2 manufacturing process and in the case of CHMP, approval of AndexXa as well. While most new products experience slow takeoffs, I think that the urgent need to treat major bleeds in patients on factor Xa inhibitors will lead to an explosion of sales in the US once Gen 2 is approved. I expect European approval with the Gen 2 process in early 2019. I think that investors are cautious or negative on Bevyexxa based on the slow US launch and the uncertainty as to whether CHMP will ever approve it with the current data base.

While nothing is a sure thing in biotechnology, I think that if Gen 2 is approved that the readily addressable market in the US for Andexxa is about $800 million and roughly the same in Europe. I would expect a quick and high penetration of this market so that it is highly possible that AndexXa could achieve sales of $1 billion by 2023. Applying a typical market valuation to sales ratio of 8 to 10 times for Andexxa would result in a market capitalization of $8 to $10 billion for Portola in 2023 and based on about 73 million outstanding shares (allows for a $400 million equity offering), the stock price target in 2023 would be $110 to $136 based only on Andexxa.

I am not implying that Bevyexxa has limited commercial potential and no value, just that it is really not currently contributing much to the stock price. Remember that this is the only approved product for preventing clots in acute medically ill hospitalized patients. I think that it will be a product that achieves several hundreds of millions of sales in the US market and perhaps even a billion. Lost in the discussion and investment thinking on Portola is that its hematological cancer drug cerdulatinib could be entering a pivotal trial in peripheral T cell lymphoma in 2019. If we were to hypothesize that this was the lead drug of an unrelated company, that company would probably sell at a $500 million market valuation or $6 per share.

The potential for an acquisition of Portola by a larger biopharma company is quite high. Larger companies with in place sales forces could quickly fit in Bevyexxa and Andexxa and their sales potential could make a noticeable, positive impact on even a large company like Pfizer.

On a final note, I think that a major reason for the poor stock price performance is stock manipulation techniques that are used ubiquitously against emerging biotechnology and emerging companies in other industries. A broad and very powerful coalition of hedge funds and market makers (from household name investment banking firms) use dark pools which mask trading, high frequency trading which allows a thousand transactions in the blink of an eye, and illegal naked shorting to not just manipulate, but to actually set the price of a stock. They also use paid for bloggers to disseminate false information that gives cover to the blatant manipulation.

This stock manipulation scheme mints money. An illegal naked short is an exchange of a worthless digital entry for cash from a buyer. It is in essence a counterfeiting scheme that substantially increases the number of shares outstanding. I have seen this technique blatantly used against many companies. The general criteria for selecting a company is if there has been recent bad news or a controversy and if there is the potential for an equity offering. Portola fits both criteria and I believe that this may be the most important cause of the recent disappointing stock performance.

Andexxa

Andexxa Uniquely Addresses a Critical Unmet Medical Need

The blood clotting process (hemostasis) is essential to life, but excessive clotting can lead to life threatening strokes, heart attacks and other cardiovascular morbidities. When this occurs, it is necessary to give drugs which reduce the ability of blood to clot. These drugs are referred to as anticoagulants or anti-thrombotics. Warfarin and low molecular weight heparin were the mainstays of anticoagulant therapy for many years but warfarin is an especially difficult drug to dose and requires constant monitoring. There was a need for new drugs like the factor Xa inhibitors, e.g. Xarelto and Eliquis, which reduce the monitoring and dosing issues associated with warfarin and the dosing issues with low molecular weight heparin.

While the factor Xa drugs were an important advance in anticoagulation therapy, they had a major drawback. The anticoagulant effect that is sought with these drugs can also be a life threatening side effect in cases in which coagulation is so much reduced that major bleeding occurs. In the case of major bleeds with the factor Xa drugs, there is no antidote that can reverse the effects of these drugs when a major bleed occurs. Many physicians and patients still perceive warfarin as safer because there are reversal strategies for when major bleeding occurs. The need for an antidote for the factor Xa inhibitor drugs was critical. Portola developed Andexxa as the first drug that can reverse the anticoagulant effects of the factor Xa drugs. I consider AndexXa to be one of the most medically important drugs developed in the last decade or so.

Great Demand for Andexxa but Supply is Currently Limited

As you would expect and as I will discuss shortly, there is great demand for Andexxa, but currently supply is limited. Portola used recombinant genetic technology to skillfully design Andexxa; it is a protein that is structurally similar to naturally occurring factor Xa. Like factor Xa, there is tight binding to factor Xa inhibitors such as Xarelto, Eliquis, Savaysa and Bevyexxa as well as non-direct factor Xa inhibitors such as the low molecular weight heparin drugs enoxaparin and fondaparinux. Andexxa is a decoy molecule which by binding to these drugs prevents them from binding to factor Xa. Thus the amount of drug in the blood available to produce an anticoagulant effect is sharply reduced.

Portola made modifications to naturally occurring factor Xa so that Andexxa:

- Unlike factor Xa, does not convert prothrombin to thrombin so that it has no effect on coagulation.

- Like factor Xa, can bind tightly to the factor Xa inhibitors-Xarelto, Eliquis and edoxaban well as non-direct factor Xa inhibitors such as enoxaparin and fondaparinux.

- Another adjustment was made so that it has no effect on the binding and coagulation effect of naturally occurring factor Xa.

- And still another adjustment was made so that it would not be recognized by the body as foreign and trigger an immune reaction.

The approval of Andexxa was based on a manufacturing process which Portola refers to as Gen 1 which is a relatively inefficient and low yield process. Portola is moving rapidly to change manufacturing to a Gen 2 process in early 2019. The Gen 1 process and inventory built under Gen1 can only support Andexxa demand in 30-40 hospitals. Thus Portola will initially only provide product to centers that participated in the Andexxa trial and certain other highly expert centers. While this will limit initial sales, it does have the advantage that the product will be used correctly in the initial part of the launch and provide valuable learnings that can be communicated to subsequent hospital users. The much more efficient Gen 2 process can supply demand in the US and also Europe if and when the product is approved. Portola is building Gen 2 inventory in anticipation that the FDA will approve it for producing Andexxa.

With Gen 2 Portola has improved the overall yield of the process while not causing any changes to the molecule which would require a brand new BLA. They used exactly the same CHO cell line (a mammalian cell production technique) in Gen 2 as was used in Gen 1. A key difference is that they provide different nutrients in the media to help the cells grow better and increase the overall titer of the drug. They have tried to make sure that along the way that the new feeding of the cells does not change the molecule. The second key change was in purification. Here they simply added a purification simplification technology as is commonly used in monoclonal antibodies to purify the first step and increase the downstream yield. Neither of these changes are expected to have an effect on the general properties of the molecule.

The submission for approval of the Gen 2 process will be importantly based on bioanalytics that show comparability between Gen 1 and Gen 2. Additionally, the data package reports on how Gen 2 behaves in patients and healthy volunteers. Management says that results are encouraging that the molecules are comparable in efficacy and safety. Gen 2 has been tested in 120 healthy volunteers and 100 patients. Management cautions that while they are very encouraged by the data, regulators often have their own and sometimes unanticipated questions so that approval of Gen 2 is not a slam dunk.

Addressable Market for Andexxa

Management estimates that major bleeds are associated with about 2-3% of factor Xa usage each year. In 2016, there were there were approximately 117,000 hospital admissions and 24,000 deaths attributable to bleeding caused by anti-coagulant drugs that inhibit factor Xa. Portola says that it believes that the most medically urgent need for Andexxa is in patients with intracranial hemorrhage which account for 15% of admissions and for a number of other urgent needs that account for another 10% such as gastrointestinal and unstable compartment bleeds. There are also about 1% of factor Xa users who need major surgery and some that are involved in trauma. Management indicates that Andexxa should be rapidly employed in approximately 25% or 29,000 patients per year. On average, patients in the clinical trials, received about one gram of Andexxa and the WAC price of Andexxa is $27,500 per gram. Hence, the addressable market in this very high need segment is about $800 million in the US. The European potential is about the same. The unit growth of factor Xa drugs is about 20% per year so the addressable market for AndexXa is growing at the same rate.

Even before approval, the American Society of Hematology issued guidelines that recommend that Andexxa be used as first line therapy for reversing bleeds caused by the use of factor Xa inhibitors such as Eliquis, Xarelto and indirect factor Xa inhibitors such enoxaparin and other low molecular weight heparins. The initial label only covers use in Eliquis and Xarelto patients which is a majority part of this factor Xa inhibitor market. I don’t have any good estimate on this, but I would guess it is well over 50%. I think that the label will be expanded to include enoxaparin, probably in 2019. I think that use will expand over time so that AndexXa will be used extensively beyond the immediate part of the market (25% of 117,000) that Portola believes most urgently need the drug will be targeting.

The Andexxa Launch in the US

The US launch of AndexXa is going extremely well according to management. The drug was approved on May 4, 2018 and became available on May 23. Because of the limited Gen 1 manufacturing supply, they are initially targeting only 30 to 40 hospitals. They are receiving requests from many other hospitals, but cannot meet these until Gen 2 supply is available.

The first 30 to 40 sites were handpicked by Portola and half participated in the ANEEXA-4 trial. These are characterized by high factor Xa usage. Their use of the drug is almost exactly what Portola predicted. The next 600 hospitals they will be going after with Gen 2. These are hospitals that see a lot of intracranial bleeds, gastrointestinal bleeds and compartment bleeds. They will then broaden out to level three and community hospitals. It will be harder to get on formulary and there will need to be extensive education.

Andexxa is being sold into many of the same hospital that were involved in the ANEXXA-4 study. The decision on which hospitals to target was based on selecting some of the more robust recruiting sites for ANNEXA-4. These are large trauma centers and stroke centers. Portola is of course very familiar with them and the centers know the drug well. Portola must work carefully with the hospitals to make sure that the hospitals are treating the patients who will benefit the most.

The process for gaining approval of Gen 2 is moving along very well. The FDA reviewed the initial clinical data package and gave the green light to move ahead into the ANNEXA 4 study that now has over 100 patients treated. Management describes the drug as well behaved and well tolerated and showing the same therapeutic activity as Gen 1.

They will submit the PAS package later this summer. There will probably be a six month reviews time with the FDA and if the FDA is satisfied, they expect approval of Gen 2 in 1Q, 2019. They European CHMP opinion approval is scheduled for 4Q, 2018. Management is anticipating approval as there was a positive trend vote based on the oral explanation. They will have ample Gen 2 inventory to meet demand if approval is gained for Andexxa Gen 2 in the US and Europe.

In their current hospital base price has not been an issue, they are getting a lot of incoming interest. The 600 hospitals that are level one or two trauma centers are also anxious to get the drug. Management expects the level of use to parallel what was seen in the ANNEXA-4 study. There are many hospitals inquiring about the drug which they are not going to be able to supply until they get Gen 2 approval. These will be prepared for when Gen 2 inventory becomes available. They will expeditiously get them up to speed. They have manufactured enough GEN2 drug to treat thousands of patients.

The level of stocking will vary at each hospital depending on their size. Right now Portola is controlling how much they can stock. This will change significantly when Gen 2 becomes available. In general, the hospitals have enough to treat two patients. Then as they treat, Portola will supply the next dose.

Andexxa Reimbursement

Andexxa is a hospital based product and because a majority of patients are on Medicare, its reimbursement will be tied to a diagnosis related group (DRGs). This is a statistical system that classifies any inpatient stay into a defined group for the purpose of payment. There are more than 500 DRGs relating to 20 major body systems for the purpose of Medicare reimbursement. In regard to Andexxa, it will be involved in several DRGs covering diagnoses in which here may be major bleeds. Each DRG reimburses a hospital a set price for a particular diagnosis out of which all treatments and services must be funded and what is left over is profit (or loss) to the hospital. The issue with a new drug like Andexxa is that its cost has not been considered in the setting of the price of the DRG so that from an economic standpoint it may reduce the profit of the hospital until it is incorporated into the DRG. Of course, a new product such as Andexxa may meaningfully improve outcomes or be life saving, but this is not immediately captured in the DRG presenting a bit of a conundrum for the hospital.

The Center for Medicare and Medicaid Services (CMS) is the department that sets the price of DRGs. It has a mechanism that may allow the hospital to recover part of the cost of Andexxa before it is covered in a DRG. CMS may increase the reimbursement amount for the DRG if the hospital has a good rationale for the use of Andexxa (this should be almost always the case). In addition to this, there is another mechanism called new technology add on payment (NTAP). If CMS includes Andexxa in the NTAP coverage, it will reimburse the hospital for 50% of the cost of the drug. The cost of Andexxa is $27,500 per dose so that if NTAP picks up $13,750. These two additional payment possibilities will make it much easier for the hospital to absorb the cost into the DRG.

Portola has not yet received the NTAP designation for Andexxa but management says that in the high treating hospitals they are initially targeting they are seeing no resistance on price. Still, they are working diligently to get NTAP designation. They have been closely involved with CMS medical reviewers and in multiple steps have presented data to them. There was then a town hall in February 2018 (before Andexxa was approved) that was open for public comment. The comments they got back were very reasonable, but they were targeted to their first data set that was published two years ago. Portola just had an opportunity to meet with them again in which they went over the latest data as presented at the American College of Cardiology.

The CMS reviewers can’t comment on their views but Portola feels the process is moving along well and they should get the official word on NTAP in August 2018. There are two strong precedents that strongly suggest that AndexXa will be given NTAP status. Kcentra is an antidote to warfarin and vitamin K antagonists and Praxbind is an antidote to the direct thrombin inhibitor Pradaxa. Both have been given NTAP status.

European Approval and Commercialization Plans

In Europe are looking for a final decision on Andexxa approval later this year from the European Medicines Agency (EMA), the European counterpart to the FDA. The EMA is considering the same Gen 1 data that led to the FDA approval. The oral explanation meeting in February and March was based on Gen 1 data. EMA is now focused on Gen 2 and has asked for a package of data on the Gen 2 manufacturing and analytics that is essentially the same package they are giving the FDA. They are requesting an updated pharmacokinetics and pharmacodynamics. Parts of the data requested by EMA will be submitted this summer and parts in the fall. EMA will have reviewed it all by October and render an opinion in November. Management notes that the EMA has given Andexxa a special one off timeline reflecting its interest in Andexxa.

They haven’t made a decision on whether to go it alone in Europe or work with collaborators in targeted countries. They note that they will need to put infrastructure in place a year or so before launch. Europe has been at the forefront of treating thrombosis and there are probably twice as many patients on factor Xa inhibitors as in the US, but pricing is about one-third of what it is in the US. On balance, Xarelto and Eliquis have about the same revenues in the US and Europe. There is much greater factor Xa use in the UK, Germany and France and less in Spain and Italy. There is also opportunity in Austria, Switzerland and the Scandinavian countries.

Bevyexxa (betrixaban)

The Betrixaban US Launch Trajectory is Slow

Management says that the Bevyexxa sales launch trajectory is comparable to what has been seen with other anticoagulants like Xarelto and Eliquis and it has not yet caught traction from a sales standpoint. Investors have become accustomed to slow launches of new drugs owing in significant part to reimbursement hurdles set by managed care and also the difficult and tedious process required to gain formulary status. Management consistently cautioned that the launch would be slow although no specific guidance was given. That said, the sales trajectory has been slower than management and investors had been hoping for.

Bevyexxa is first prescribed in the hospital setting and then continued in the outpatient setting after discharge. In the initial phases of a hospital launch, there is period of educating the hospital staff and gaining formulary acceptance. They have learned that there are two steps necessary in dealing with the pharmacists and the formularies they manage in hospitals. The first step is to meet with the Drug and Therapeutics committees to get the drug on the formulary. They then need to go back and get on the electronic order set. It is a sequential two-step process. This has taken longer than they originally anticipated. There is then the added complication of making sure the patient is reimbursed upon leaving the hospital.

Management remains confident but does not expect betrixaban to see an inflection point for revenues until 2019. They are learning a lot about how hospitals view prophylactic drugs and educating them on the medical value of betrixaban. The data package strongly demonstrates the medical value of the product. The clinical data showing betrixaban reduces the risk of clots without increasing the risk of major bleeds has been endorsed in 15 different publications. The data also shows that it reduces rehospitilization, stokes and other morbidities. There are 5 million acute medically ill patients in the US at high risk or clots in the hospital and when they leave the hospital, about 50% of clots occur outside of the hospital. Management is encouraged that they are seeing adoption wins in high profile hospital systems like Stanford, Harvard and the Cleveland Clinic. They note that these institutions often are followers in adoption, but are seeing them as leaders in this case.

Competition to Bevyexxa

Bevyexxa is the only product approved for clot prevention a hospitalized, acute medically ill patients. Xarelto and Eliquis both failed in earlier clinical trials. Johnson & Johnson launched another trial called MARINER to gain approval in this indication. The MARINER study will readout later this year. In this study, patients are treated with injectable enoxaparin in the hospital and then switched to Xarelto when they leave the hospital whereas Bevyexxa is initiated in the hospital and continued as the patient is discharged. Xarelto attempted to gain approval for this indication in the MAGELLAN trial but failed; the drug was effective but caused an unacceptable high rate of major bleeds. MARINER uses a lower dose of Xarelto than MAGELLAN. Xarelto has the advantage of being a very well known drug. They started out at 10mg QD and dropped down to 7.5 mg QD. In MAGELLAN there was significant bleeding.

Success for Xarelto in MARINER would not change Portola’s go to market, commercial strategy. They believe that oral inpatient and outpatient is the way to treat these patients. In MARINER the patients will have first been given enoxaparin in the hospital and then must be transferred to Xarelto outside the hospital. Hence there will be a time when these patients are between drugs. They believe it is much superior to put patients on the drug in the hospital and continue into the outpatient setting with the same drug. Xarelto is a very well known drug and Johnson & Johnson is a large and effective marketer, but I don’t view this as a major issue for Bevyexxa as this is a huge market and the approval of Xarelto could actually increase awareness to the benefit of Bevyexxa.

European Approval is Uncertain

On February 20, 2018, Portola announced that the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) communicated that there was a negative trend vote for Bevyexxa. A negative trend vote means it is unlikely that the CHMP will adopt a positive opinion on the MAA and that additional steps would be needed to gain marketing approval in Europe.

The CHMP’s position is that Bevyexxa’ s efficacy is acknowledged in the APEX trial, but uncertainties remain regarding a positive benefit risk, which is not supported by a second confirmatory study, biological plausibility for Bevyexxa in another approved indication or external support within the class from other factor Xa inhibitors, which are not approved for the acute medically ill population.

On March 23, 2018 Portola said that it intends to appeal the opinion and seek a re-examination by the CHMP. The re-examination process allows the opportunity to address the CHMP’s questions and provide further clarification as needed, with the goal of making Bevyexxa available to acute medically ill patients in Europe who are at risk for clots. The Marketing Authorization Application (MAA) for Bevyexxa included data from the pivotal Phase 3 APEX Study, which enrolled 7,513 patients at more than 450 clinical sites worldwide. The APEX study evaluated oral Bevyexxa from hospital admission to home (35 to 42 days) compared with injectable enoxaparin given for 6 to 14 days in the hospital followed by placebo in assessing the prevention of clots in high-risk acutely ill medical patients.

Addressable Market for Bevyexxa

It is estimated that there are 8 million hospital admissions of acute medically ill patients each year in the US and 24 million worldwide. While not all of these patients need treatment, many will. On a worldwide basis, Portola believes that 100,000 acute medically ill patients die each year from blood clots. Portola believes that the worldwide addressable market could be $3 to $4 billion.

Portola has done extensive clinical studies of Bevyexxa to raise awareness and understanding of the drug and it is much anticipated by its physician target market. It meets a critical unmet medical need to prevent blood clots from forming in acute medically ill patients. For example, a patient might be hospitalized for a heart attack and for several days is relatively immobilized. Blood clots may begin to form in the hospital, but the patient also remains at high risk in the month or so after discharge. In the hospital, the patient may be treated with the injectable product enoxaparin, but it is not practical to continue the drug once the patient is discharged. The important and sometimes life saving role that Bevyexxa plays is that it is an oral drug that can be started in the hospital and continued for 35 days or so after discharge from the hospital.

Cerdulatinib for Hematologic Cancers

Cerdulatinib is an oral agent that inhibits both spleen tyrosine kinase (Syk) and janus kinase (JAK), two key cell signaling pathways that are involved in certain hematologic malignancies and autoimmune diseases. They are believed to promote cancer cell growth and survival. The initial development program is focused first on peripheral T-cell lymphoma (PTCL) and will be followed by studies in cutaneous T cell lymphoma (CTCL) and refractory follicular lymphoma (FL). Portola is currently enrolling patients in a phase 2a study evaluating the safety and efficacy of cerdulatinib in patients with relapsed/refractory hematological malignancies who have failed multiple therapies. In phase 1 and 2a, they have treated 150 patients.

Portola says that it will very likely pursue an accelerated approval strategy for cerdulatinib. Management believes cerdulatinib has broad activity in peripheral and cutaneous T cell lymphomas and also in B cell leukemias and lymphomas. They have decided to focus on the T-cell lymphomas. At ASCO they showed data from a subset of peripheral T-cell lymphoma patients in which there were 5 CRs out of 7 patients treated. The data also showed CRs in two refractory follicular lymphoma patients.

Portola has written communication with FDA on a path forward on a registrational study in peripheral T-cell lymphoma. The plan is to return to the FDA in 4Q, 2018 for an end of phase 2 in which they will have more durability data on the 7 peripheral T cell lymphoma patients. With FDA backing, they will then begin a registrational study early next year in PTCL. This will then be followed by discussions on cutaneous T cell lymphoma similar to those on peripheral T cell lymphoma and later followed by discussions on refractory follicular lymphoma. These are small indications that Portola can do on their own. They would likely need a partner to expand study of the drug into broader indications.

Financial

Portola currently has 65.5 million fully diluted shares outstanding. It ended 1Q, 2018 with $408 million of cash. On February 3, 2018 Portola announced that it signed a $150 million royalty agreement with HealthCare Royalty Partners. Under the terms of the agreement, Portola received $50 million then and another $100 million when Andexxa was approved in May. Health Care will receive a mid-single-digit royalty based on worldwide sales of Andexxa. The agreement is subject to a maximum total royalty payment of 195 percent of the $150 million ($293 million) funded by HCR, at which time the agreement will expire. Adding the $100 million received in May, the pro forma cash position at the end of 1Q, 2018 was $508 million.

I think that the quarterly burn rate for Portola in the next three quarters of 2018 could be $90 million so that based on the estimated current cash position of $508 million, it could end the year with about $300 million of cash. I think that the Company will choose to issue more equity in order to adequately fund the launch of Andexxa and don’t forget that Bevyxxa was also recently approved and is in its initial launch phase. I am guessing that Portola might want to raise another $400 million. At the current price of $40, this would require issuing 10 million shares and would bring the share count to 76 million.

Tagged as Andexxa launch, Bevyexxa US launch, cerdulatinib phase 2 trial in PTCL, Portola + Categorized as Company Reports, LinkedIn

interested to hear your take on apparent disappointment in 2Q sales, and high volume response (albeit in a poor biotech “tape”). Is this the kind of buying oppty that only happens now and then, or has anything changed, or is there a reason to question, your thesis based on this report?

also, whenever you formulate thoughts, please comment on CEO change,thanks