Northwest Biotherapeutics: Blinded Data from DCVax®-L Phase 3 Trial is Extremely Encouraging, But We Still Need to See Unblinded Data (NWBO, Buy, $0.29)

Overview

This report starts with a summary of the key aspects of my investment thinking on Northwest,updated for the just reported refresh on blinded data from the DCVax®-L phase 3 trial in newly diagnosed glioblastoma multiforme (GBM). This is followed by further discussion on why I believe the blinded data strongly hints at a medically important improvement in survival and an impressive survival tail for DCVax®-L. It is the survival tail that has so excited the medical community about other immuno-oncology drugs, notably Opdivo and Keytruda.

It is important to understand that the blinded data lumps together results for all 331 patients in the trial. This includes about 232 who were initially given DCVax-L plus standard of care (SOC), roughly 66 who were given SOC and then switched to DCVax-L when their cancer progressed and around 33 who received only SOC. Until the trial is unblinded, we can’t separate out the effects of DCVax-L. However, because 90% of patients in the trial received DCVax-L at one point in the trial it seems a reasonable speculation that DCVax-L drove the overall results.

When we compare the median overall survival (mOS) in the blinded results for the 331 patients to historical results seen in past trials, there is a marked improvement. Measures of survival also show a striking improvement in survival (percent of patients alive) at one, two and three years when compared to historical SOC. I would speculate that the 66 SOC patients who progressed and were switched to DCVax-L and possibly the 33 SOC-only patients, did not do as well as the 233 initially treated with DCVax-L. However, only when the data is unblinded can we know if my speculation is correct that the results for DCVax-L upon the unblinding of the trial will be better than the blinded results discussed in this report.

There are, however, counter arguments to my interpretation of the unblinded data that have been presented by naysayers and need to be considered. The first counter argument would be that results with SOC have improved dramatically over those reported in other trials so that all of survival improvements seen in the trial are due to this. This is highly unlikely as the results for SOC have been largely consistent across many trials over the last 13 years.

The other counter argument is one advanced by the wolfpack (naturally). They are claiming that Northwest Biotherapeutics has distorted the results by cherry picking patients enrolled. They claim that NWBO selected only the healthiest of patients; young patients (age<50) with complete resections and who were MGMT-methylated (MGMT-m). This is contrary to the facts which were set forth in detail in NWBO’s publication in May which laid out all of the patient demographics in detail. For example, 75% of the patients in NWBO’s trial were over the age of 50 – not under. Also, more patients have unmethylated MGMT than methylated. On an additional point, we also know that NWBO indicated that in the 100 patients who have lived longest in the trial,only 8 had all three of the favorable risk factors: age< 50, complete resection and MGMT-m status.

I have even seen one claim on Seeking Alpha that NWBO purposely enrolled patients in the trial who did not have GBM (this is preposterous). Let me make one thing clear. NWBO did not and could not select individual patients enrolled in the trial. This selection was done at over 80 worldwide clinical sites by independent investigators in accordance with the trial protocol and who were not employed by NWBO nor had any financial interest in NWBO. The wolfpack is essentially alleging that these investigators conspired to purposely mislead investors and defraud innocent short sellers; I don’t think so.

I continue to feel that there is a strong probability that DCVax-L will be approved as an addition to standard of care (SOC) in treating newly diagnosed glioblastoma patients (GBM). If so, there is asymmetric upside from the current stock price of $0.29 and market capitalization of $290 million. Note that this market capitalization is based on the assumption that every outstanding warrant, option and share attributable to convertible securities is exercised. This comes in around 1 billion shares made up of 461 million basic shares and 522, 000 potentially dilutive securities. Potentially some of these dilutive securities are enough out of the money that they won't be exercised, but I wanted to take the most conservative approach.

As explained later in this report, I estimate that the addressable market in the US for DCVax-L could be $2.4 billion and Europe could be a comparable $2.4billion. I believe that approval would lead to a very significant penetration of this addressable market. The standard of care has not effectively changed for newly diagnosed GBM since temozolomide was added in 2005 and there is an urgent medical need for improving outcomes in GBM. As a rule of thumb, emerging biotechnology companies can trade significantly in excess of 10 times revenues in the initial stage of a launch of their first significant product. If so, each $100 million of revenues for DCVax-L would create $1 billion of market capitalization.

See my May 18, 2018 report for additional detail on the phase 3 trial.

I hypothesized that NWBO’s dendritic cell vaccine technology is an elegant,powerful and as or more promising approach to treating cancer than monoclonal antibodies and CAR-T cells. Each cancer differs from patient to patient and even within a patient there may be different types of tumors. DCVax-L targets most of the mutations/antigens that characterize each patient’s cancer, while monoclonal antibodies and CAR-T target just one antigen. Also, NWBO appears tohave a dominating lead in this technology whereas there are perhaps 20 to 30 ormore companies pursuing CAR-T and 100s are developing monoclonal antibodies. The current market capitalization of NWBO must be viewed against the acquisition price of the two leading CAR-T companies-Kite by Gilead for $12 billion and Juno by Celgene for $9 billion.

Key Reasons for My Positive Investment Thesis

Lead Investigators in Phase 3 DCVax-L Trial are Optimistic

Although the data in the phase 3 trial of DCVax-L in newly diagnosed glioblastoma (GBM) remains blinded, the two lead investigators in the trial have both stated that,patients appear to be living much longer than would be expected with standardof care (SOC). See this report.

Both are hopeful that DCVax-L will be a major advance in the treatment of newlydiagnosed GBM.

Dr. Linda Liau is the lead US investigator in the DCVax-L phase 3 trial and Dr. Keyoumers Ashkan is the lead European investigator. Both are distinguished brain surgeons with impeccable credentials which I have summarized in the last section of this report. Their enthusiasm is based on “hands on” experience with DCVax-L and is very influential to my hopeful view that DCVax-L will be successful in its phase 3 trial.

Survival Tail is Key to the Success of Checkpoint Inhibitors

DCVax-L is an immunotherapy like the paradigm changing checkpoint inhibitors, Yervoy (introduced in 2011), Opdivo (2014) and Keytruda (2014). These drugs have been spectacular medical and commercial successes with worldwide sales projected to reach $15 billion in 2018. The hallmark characteristic of these immune therapies is that in many cancers, a meaningful subset of patients experience unprecedented lengths of survival which is referred to as a survival tail. The lead and other investigators are hopeful that we are seeing a meaningful survival tail in the DCVax-L trial.

Blinded Data from DCVax-L Phase 3 Trial Suggests a Strong Survival Tail

We all know that until the trial is unblinded and the data analyzed, no definitive conclusions can be drawn. That said, we have now had two looks at blinded data that gives very encouraging information on how all patients as a group are doing. We don’t know who received the drug and who didn’t. However, the aggregated results for all patients in the trial are much better than we would expect if patients had just received standard of care (SOC); we can speculate that DCVax-L is driving the impressive results.

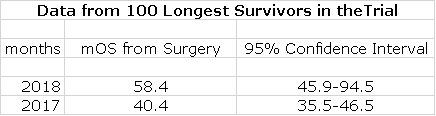

The trial enrolled 331 patients with about 232 initially randomized to DCVax-L plus SOC and about 99 to SOC. There is particularly tantalizing data on 100 patients who have lived longest in the trial. Of these 100 patients, we now know that the Kaplan Meier derived median overall survival (mOS) is currently 58.4 monthsfrom time of surgery. This means that at least 50 patients (15%) of the 331 patients enrolled have survived 58.4 months or longer from time of surgery. Historical data from other trials suggests that if these patients had been treated just with SOC,only 5% or so would be alive at this time point. The inference is that DCVax-L is the driving force for this apparent increase in survival.

I want to reemphasize that we don’t know how many of these 100 patients were treated with DCVax-L. We do know that the crossover design of the study allowed patients randomized to SOC to receive DCVax-L if their cancer progressed. As aresult, over 298 patients received DCVax-L at one point in the trial. Until the trial is unblinded, we can’t separate out the effects of DCVax-L, but I think we can speculate that the trial effects are probably reflective of what will be seen with DCVax-L when the trial is unblinded. Actually, there are strong arguments to be made that the results for DCVax-L could be better, but for the time being let us take the results for all 331 patients in the trial as being a proxy forwhat the unblinded results will be for DCVax-L.

How Might the Survival Tail of DCVax-L Compare to the Checkpoint Inhibitors?

The data suggests that for every 100 patients treated with DCVax-L, we might expectat least 15 to be alive at 58.4 months while only 5 of 100 patients treated with SOC would be expected to be alive at that time point. This is a delta (difference) of 10 patients.

This delta is at least comparable to (maybe better than) what was seen in trials involving checkpoint inhibitors. In this report, I show the survival tail (delta)for two trials of Opdivo: CHECKMATE-017 in advanced squamous non-small celllung cancer (NSCLC) and CHECKMATE-057 in advanced non squamous NSCLC.Obviously, these are very different types of cancers than newly diagnosed GBM, but the commonality is that all three are aggressive cancers as judged by survival expectations. At three years, the delta for Opdivo relative to SOC in CM-017 was 10 patients of every 100 treated and in CM-057 was 9 patients which compares to 10 at five years in the DCVax-L trial. I don’t need to remind you thatmaking comparisons across trials is generally viewed cautiously by the medical community

The analysis of the 100 best performing patients in the DCVax-l trial suggests a delta of 10 at five years. This suggests a strong survival tail for DCVax-L comparable or perhaps better than seen with checkpoint inhibitors in the two trials cited above.

Comparison of Blinded DCVax-L Phase 3 Data with Data from the Optune Phase 3 Trial, EF-14.

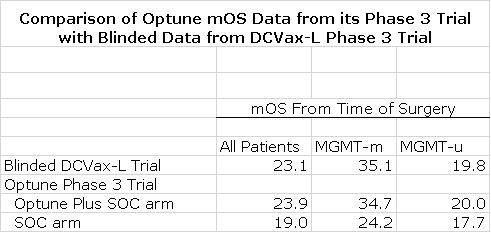

Optune is a medical device that was approved in 2016 for the treatment of newly diagnosed GBM. This was based on a randomized trial with 446 patients in the Optune plus SOC arm and 229 in theSOC arm. The next table compares mOS data for all 331 patients in the still blinded DCVax-L trial to mOS data for the Optune plus SOC arm and the SOC arm in its pivotal phase 3 trial.

NWBO presents its mOS data from the time of surgery. The Optune trial reports mOSdata from time of patient enrollment. Reporting from time of surgery seems to be the more informative way to look at survival. Treatment of a GBM patient starts with a surgical resection. This is then followed by rounds of radiation and temozolomide. If the patient did not progress, DCVax-L and Optune were added to SOC. The enrollment for both Optune and DCVax-L starts about three months after surgery.

This delay is needed to assess the status of the patient to determine if the cancer is or is not responding to treatment, and to allow time for the patient to undergo 6 weeks or so of daily radiation and daily chemotherapy (temozolomide) after surgery. Some patients may start to progress shortly after surgery and are excluded from the trial. Others are psuedoprogressors who also are excluded and there are other reasons for exclusion. In the case of DCVax-L the process from time of surgery to beginning treatment took about three months. The Optune trial didn’t release this figure, but based on my research, I think it was comparable to DCVax-L or about three months. In order to make an apples to apples comparison I have added three months to the reported mOS results of the Optune trial to derive mOS from time of surgery.

The results in the following table show mOS results from time of surgery for 331 blinded patients in the DCVax-L trial to the two arms of the Optune phase 3 trial. It also shows a further breakdown as to whether the promoter to the MGMT gene is methylated (MGMT-m) or unmethylated (MGMT-u). Note how much better MGMT-m patients fare. In looking at this table it can be seen that the DCVax-L mOS for the blinded phase 3 is almost exactly the same as the data that led to the approval of Optune. Note that this only looks at the mOS of the whole intent to treat population and does not look at OS at various survival points (years) or at the tail. From a medicalstandpoint these are more important measures than mOS.

*Note All numbers are in months and I have added 3 months to the mOS data for the two arms of the Optune EF-14 registrational trial as was explained in the prior paragraph.

Unblinding the DCVax-L Phase 3 Trial

Northwest has announced that it will soon start the process of unblinding the phase 3 trial.They have not given any guidance on how long this will take other than to say that this is a complicated process. They have said that that there are a series of stages to go through and each stage takes multi-months.They have to go to all of the 80 centers in the trial and check and recheck the multitude of data on each patient to make sure it is correct; this is a an enormously complicated but critical exercise. At this point, I don’t want to speculate on how many months it will take to unblind the trial other than to say the end is in sight.

How Will The FDA View the Data?

In my judgement, The FDA will scrutinize median overall survival for DCVax-L as well as its survival tail. Based on blinded data, the mOS for all 331 patients in the trial is 23.1 months. As was just discussed, this is the same mOS that led to approval for the medical device Optune. Again, I would speculate that the mOS for DCVax-L could be better than 23.1 months. If the FDA review of the data confirms that the mOS for DCVax-L is 23.1 months or longer and if the agency agrees that there is a robust and medically meaningful survival tail, I believe that DCVax-L will become part of SOC for newly diagnosed GBM.

In their deliberations, the FDA will compare the 232 patients treated only with DCVax-L to the 66 who crossed over to DCVax-L when their cancer progressed andthe 33 who only received SOC. They are also likely to compare DCVax-L to these latter two groups combined. The original primary endpoint was median progression free survival (mPFS) and the secondary endpoint was median overall survival (mOS). Even though it is the primary endpoint, I think that mPFS will not be that important for the FDA. We have learned with other immunotherapies that improvements can be seen in mOS even after the cancer has progressed. Remember that at the time the DCVax-L phase 3 trial started, immunotherapy had not come on the scene and while mPFS and mOS are appropriate for chemotherapies, mOS and survival tails are the best measures for immunotherapies.

Thewolfpack claims that the mOS analysis will be fatally flawed by the cross overdesign that allowed SOC patients to switch to DCVax-L if their cancer progressed. However, this argument ignores the fact that mOS is a surrogate to help the FDA judge how long patients will survive. The long running nature of the DCVax-L trial means that we will have three year survival data for the very last patient enrolled in the trial and meaningfully longer for other patients.We can also see the survival tail. This data is much more informative than mOS.

Importantly, the FDA commissioner Scott Gottlieb has said that in oncology trials like the DCVax-L trial in which there was a cross-over design, that the FDA will likely look at results as a one armed trial in which results would be compared to historical results. In thius event, the FDA will focus closely on the patient risk factors to see if the patient characteristics of the DCVax-L trial are comparable to those in other trials that had SOC arms.

Amazingly Benign Side Effect Profile Is a Major Positive

The lack of side effects with DCVax-L is extremely impressive and this will also factor importantly into the FDA review. Only 2.1% of patients in the trial had grade3 or 4 adverse events that were deemed at least “possibly related” to theDCVax-L treatment. There were 3 cases of cerebral edema, 2 seizures, 1 nausea and 1 lymph gland infection. These side effects could be the result of the cancer itself so that not all of these may actually be due to DCVax-L. Non-serious side effects attributable to DCVax-L were injection site reactions, fatigue, low grade fever and night chills. These can be treated with OTC medications. This side effect profile is amazingly benign in comparison to chemotherapy, checkpoint inhibitors and CAR-T cells that produce much higher levels of grade 3, 4 reactions and indeed sometimes can be fatal.

I also want to emphasize that DCVax-L is very easy to administer as it is given as a series of intradermal injections in an out-patient setting.

The Addressable Market for DCVax-L

There are roughly 12,000 newly diagnosed patients in the US each year. The net selling price of immunotherapies and the recently introduced CAR-T cellproducts is over $300,000 per course of treatment. Management of NWBO has indicated that it will price DCVax-L meaningfully lower than this price point. If the realized price per course of therapy were $200,000, the U.S. addressable market would be $2.4 billion and the European market would be a comparable $2.4billion. If approved as part of SOC, I would expect a rapid penetration and to reach a very high percentage of this addressable market over a five year timespan.

More Discussion on the Survival Tail

What Is a Survival Tail and How Does It Figure in Evaluation of Immunotherapies?

Chemotherapy and monoclonal antibodies are the current mainstays of cancer therapy. Accepted clinical trial endpoints most frequently used for these types of drugs include median overall survival (mOS) and median progression free survival (mPFS). The median, of course, is the point of time at which half of patients have reached the endpoint and half have not. In aggressive cancers like GBM, such endpoints are reached in a matter of one or two years or sometimes months.

Immune-oncology came on the scene starting with the approval of the checkpoint inhibitor Yervoy(against CTLA-4) in 2011 for metastatic melanoma. This was followed by the approval of the PD-1 inhibitors Opdivo and Keytruda in 2014. Investigators soon saw that there was something about these drugs that was different and which excited them. With these drugs, a relatively small group of patients experienced unexpected, impressively long survivals. The CHECKMATE-017 and CHECKMATE-057 of Bristol-Myers Squibb’s Opdivo provide good examples:

- CM-017 enrolled patients with squamous NSCLC: 16% of Opdivo patients were alive at three years(21/135). The then standard of care was the chemotherapy drug docetaxel. 6% of the docetaxel patients (8/137) were alive at three years. The HR was 0.62showing a profound benefit. Put another way, out of every 100 patients treated, 10 more Opdivo patients would be expected to be alive at three years than if they were treated with docetaxel. This defines the survival tail.

- CM-057 enrolled patients with non-squamous NSCLC: 18% of Opdivo patients were alive at three years (49/292) versus 9% of docetaxel patients (26/290). The HR was 0.73 again showing a profound benefit. Out of every 100 patients treated, 9 more Opdivo patients would be expected to be alive at three years than if they were treated with docetaxel.

It is the survival tail that has so excited the medical community and has been a major, major factor in projected combined sales of Opdivo and Keytruda of $15 billion in 2018. The conventional endpoints of mPFS and mOS do not capture the effect of the long tail. Here is why. In looking at CM-017 and CM-057, the 16% of patients who live beyond three years are obviously past the mOS point at which 50% of patients are alive or dead. The mOS endpoint gives no insight intothe survival tail because no matter how long the patients who most benefit remain alive, the mOS for the trial does not change.

The Unblinding of the DCVax-L Phase 3 Trial Has Been Delayed in Order to Assess the Survival Tail

The trial of DCVax-L began in 2007 which was long before Yervoy, Opdivo and Keytruda completed their clinical trials and were approved. At the time, no one had any inkling of the survival tail that so importantly characterizes immunotherapies. The trial was designed with two traditional endpoints: median progression free survival (mPFS) was the primary endpoint and median overall survival (mOS) was the secondary endpoint. Both endpoints are designed to be statistically powered for significance at 248 progression events and 233 deaths in accordance with trial assumptions about how DCVax-L will compare to SOC.

Although Northwest has not said, it is likely the case that 248 progression events have occurred and perhaps the case that 233 deaths have occurred. Many investorswere expecting that the trial might be stopped one or even two years ago. This raised concern with investors. Why didn’t management stop and unblind thetrial? The answer was that management made what I think was the absolutely right decision (actually they relied heavily on a distinguished scientific advisory board) to keep the trial blinded and ongoing so that they could define the survival tail. The lastpatient was enrolled three years ago or approximately three years and threemonths from their surgery. There is now over three years of survival data onthis very last patient. Moreover, the median time of enrollment was May of 2014 which means that 50% of patients are four and one half years out from when they enrolled and four and three quarter years from their surgery.

The highly criticized decision of management not to stop and unblind the trial until there was data to define the survival tail now appears to have been the absolutely correct decision. The recent refresh of the blinded data gives an importantinsight into the survival of tail.

A Look at the Survival Tail of DCVax-L

The blinded data allows us to look at the 100 patients in the trial who have survived the longest. We don’t know how many of these patients are from:

- the approximate 232 patients initially randomized to DCVax-L,

- the approximate 66 patients who were initially randomized to SOC and then received DCVax-L when their cancer progressed or

- the approximate 33 patents who only received SOC.

Because over 90% of the patients in the trial received DCVax-L at some point, I thinkthat we can speculate that the results in the 100 patients were driven by the effects of DCVax-L. Here is the median overall survival data for those 100patients.

This table indicates that, based on Kaplan Meier estimates, 50 patients in the study are past the median time of 58.4 months and from a statistical standpoint we have 95% confidence that mOS for this group is somewhere between 45.9 months at the low end of the range and an amazing 94.5 months at the high end. Because some number of these patients may still be alive, the mOS could increase or decrease. Statistics is not my long suit, but the widening confidence interval from 2017 to 2018 suggests to me that the mOS will increase from 58.4 months.

If we assume that mOS is 58.4 months, this means that, based on Kaplan Meier estimates, 50 patients have lived at least that long. These 50 patients are 15% of the 331 patients who were treated on an intent to treat basis. Historical data suggest that about 5% of patients treated with SOC are alive at five years. Remember that this is blinded data for all 331 patients in the trial. Key opinion leaders have been saying for some time that patients in this trial are living longer than would be expected with SOC. I think it is fair to speculate that this is being driven by DCVax-L. If so, the mOS for patients initially randomized to DCVax-L could be greater than 58.4 months.

Historical data suggest that about 5% of patients will be alive at 60 months after surgery when treated with SOC. Based on 58.4 months mOS, this defines the survival tail as being 10 more patients out of every 100 patients treated who will be alive at 58 months than if they were treated with SOC.

Let me reiterate earlier what I said about the CM-017 and CM-057 trials of Opdivo.

- In the CM-017 trial in squamous NSCLC, the survival tail was defined as 10 more patientsout of every 100 patients treated with Opdivo being alive at three years than if they were on SOC.

- In the CM-057 trial in non-squamous NSCLCthe survival tail was defined as 10 more patients out of every 100 patients treated with Opdivo being alive at threeyears than if they were on SOC.

- Now in the DCVax-L trial, the Kaplan Meier derived data from the 100 patients suggests that at five years, 10 more patients (and possibly more) out of every 100 patients treated with DCVax-L being alive at five years than if they were on SOC.

Basedon this data, my speculation is thatDCVax-L appears to be producing a survival tail in GBM that is as robust as Opdivo in advanced squamous and non-squamous NSCLC. There are a couple of questions that we still need to address. The first is whether, these three cancers are roughly the same in aggressiveness. In the CM-017 trial 6% of patients were alive at three years when treated with SOC and in CM-057 it was 9% at three years. In newly diagnosed GBM patients, about 15% of patients are alive at three years. By this measure, newly diagnosed GBM is a bit less aggressive but not dramatically so.

The next question to ask is whether there might have been an imbalance in risk factors in these 100 patients. The three major risk factors in newly diagnosed GBM are:

- Age of the patient; patients > 50 years ofage are at more risk.

- The degree of surgical resection. The more ofthe tumor that is removed the higher the likelihood of a better outcome

- MGMT methylation is extremely important. Thetherapeutic effect of temozolomide (the chemotherapy part of SOC) depends on damaging DNA in rapidly dividing cancer cells. The MGMT gene codes for a DNArepair protein that can undo the effect of temozolomide by repairing the damage it does. If the promoter region of the MGMT gene is methylated (MGMT-m), this DNA repair protein is not produced and the effect is unimpaired, but if the promoter region is not methylated (MGMT-u), the effect of temozolomide is blunted. The difference in outcomes for MGMT-m and MGMT-u patients is utterly striking. In point of fact, these are two different cancers.

Investigators reported that only 8 of the 100 patients had all three of these favorable risk factors. Only with the unblinded data can we better judge the possible influence of patients having better risk factors.

Credentials of Two Lead Investigators in the DCVax-L Trial

Dr.Linda Liau is the principal investigator for the pivotal phase 3 trial ofDCVax-L in glioblastoma. DCVax-L was developed by NWBO, but Dr. Liau developeda prior version of a dendritic cell vaccine, which used acid eluted peptides as the antigens while DCVax-L used tumor lysate from the patient. Dr. Liau has been working on immune therapies for brain cancer for nearly 20years and has vastly more experience with the drug than anyone else on the planet. Her academic credentials are extremely impressive as one might expect from a skilled brain surgeon.

Sheis currently: (1) the Vice Chair of Academic Affairs, Department of Neurosurgeryat UCLA; (2) Chair of Department of Neurosurgery, UCLA School of Medicine; and (3) Professor and Director of the UCLA Brain Tumor Program. Her clinical expertise is in intra-operative functional brain mapping and use of intra-operative imaging for resection of brain tumors (gliomas, meningiomas,and metastatic tumors). Her research efforts are focused on the molecularbiology of brain tumors, gene therapy, immunotherapy, and brain cancer vaccines. She has treated many patients with DCVax-L and other immune therapies for brain cancer.

Dr. Liau’s academic credentials are extremely impressive:

- Undergraduatedegree from Brown University with B.Sc. in biochemistry and B.A. in political science

- MD degree from Stanford University.

- PhD. in neuroscience from UCLA

- MBA from UCLA

Dr. Keyoumers Ashkan is the clinical lead forneuro-oncology at King's College Hospital in the UK. He has an active researchinterest in brain tumors and movement disorders and heads the NeuroscienceClinical Trial Unit. Dr. Ashkan is one of the most respected neurosurgeons in the UK and Kings College is the premier teaching hospital inthe UK.

Tagged as Northwest Biotherapeutics Inc. + Categorized as Company Reports, LinkedIn

Couple things. –

For all practical purposes this trial began in the fall of 2011. The shorts want to call this a 10+ year trial and this is not really portraying an accurate picture from enrollment. 10 years ago this was a phase II. We are looking at 7 years from the enrollment ramp up and 3.5 years from median as you state. This is just about the right time to capture a tail for an immunotherapy.

I don’t know if 50 have actually reached 58 months. This is the estimate I assume.

If 50 of the 100 reach essentially 5 years and we assume 10 of those 100 long lived patients are from the control arm, then 45(half of 90) of the treatment arm will reach 5 years or more. 45/232 = 19.39%—- Almost 20%, 5 year survival is a 400% increase over the 5% historical SOC number. We are long into this trial so the KM 5 year survival estimates should have a high degree of statistical probability even more so now considering the un-blinding has not occurred and this is roughly 9 months past the previous data collection where the 58 month number came from. Even if the 5 year data declines some, we have more than enough wiggle room to double or triple the 5 year survival probability of a patient with DCVAX, IMO.

Did your addressable market consider many of the lower grade gliomas/astrocytomas that many doctors in my opinion would consider the use of DC VAX as an intervention for? I would assume it would be used off label considering the benign side effect profile if insurance gets on board. 3xSales would value this at 14 bln or ~$16 a share. This 14B is without considering the implications success in “L” would have on other lower grade gliomas/other cancer indications and DCVAX Direct. If this works in a highly lethal aggressive cancer, it could prove even more successful in slower growing cancers where the patient can live long enough to illicit a better immune response. Imaging can now prove an immune response has occurred.

Hold some now and be ready to buy if this data remains as promising once un-blinded. It will be a watershed event – like AMRN.

Dear mr Smith

Thank you for your continuing coverage of NWBO.

I have a question. You seem to fluctuate in your market cap valuation estimates of NWBO if DCVAX were to be approved. My question what is your, present, estimate of the market valuation of NWBO after DCVAX were to be approved by the FDA..?

Thank you for answering.

There could be around 1 billion shares if every potentially dilutive share was exercised. Could be a little less or a little more.