ImmunoCellular: Post Hoc Analysis of Disappointing Phase II Trial of ICT-107 (IMUC, $1.02)

Investment Conclusion on ImmunoCellular

The results of the phase II trial of ImmunoCellular's (IMUC) ICT-107 were disappointing as they did not reach the specified endpoint of a 9.0 month improvement in median overall survival. The data suggests median overall survival of 2.0 months based on an intent to treat analysis of all 124 patients enrolled in the trial and 3.0 months based on a per protocol analysis of 117 patients. However, these are Kaplan Meiers estimates and could potentially increase as the data matures. ImmunoCellular believes that the data supports doing a phase III trial. It expects to meet with regulatory agencies in 2Q, 2014 and perhaps start a phase III in 1Q, 2015 that might provide topline data in 2018; these are my estimates not the company's.

The stock declined precipitously on the news because market expectations far exceeded the actual results. There was an expectation among some investors that the trial endpoint would be reached and that the Company could then file for approval. This was a vivid example of a company not properly controlling expectations. With perfect hindsight, the Company should have done a better job of setting the expectation that this was a small, exploratory phase II trial and that the primary endpoint was very aggressive and difficult to achieve. (In fact, this is exactly what the CEO has been saying for some months, but perhaps he should have been more emphatic). If so, consensus expectations might have been for a biological and clinical signal that would allow the planning for a phase III trial. This is what the trial actually achieved and I think that the data might have been favorably received if this was what investors were expecting.

I wrote in a November 11 article on IMUC that I felt that the most likely outcome of this trial would be a failure to achieve its very aggressive endpoint and that in that case there would be a sell-off in the stock. I expected that there would be evidence of a biological and clinical effect that would warrant a phase III trial and that this could be a buying opportunity. I think that the data potentially does warrant a phase III trial, but I have changed my mind on this being a buying opportunity. Let me explain my reasoning.

I go through later in this report why I think that ICT-107 could be approved on the basis of a 2.0 month increase in median overall survival. However, I see huge hurdles to clear that lead me to believe that there is a low probability of a phase III trial being completed. It could be 2018 to complete a phase III trial and fund the remaining parts of the Company. As importantly, the probable start of a huge trial of Bristol-Myers Squibb's (BMY) checkpoint inhibitor drugs in treating glioblastoma could begin in the summer of 2014. This could make recruiting for a phase III trial of ICT-107 very difficult and slow. These timing, financing and enrollment issues cause me to believe that this is not a buying opportunity.

One of two major factors that now cause me to not view this as a buying opportunity is that the data is not robust. If the data indicated median overall survival of 4.0 to 5.0 months if would have been exciting as this is generally viewed as a major clinical advance in an aggressive cancer like glioblastoma. If there is only a 2.0 month improvement, it will require a much larger and longer phase III trial. Also, it would have been easier to attract funds at reasonable terms through partnering or capital raises. The second major new issue is the BMY trial, which is something that I have just learned about in recent days.

So what should one do with the stock? On a trading basis, I am inclined to think that the stock can bounce somewhat off of current levels. The decline in the stock after the announcement of the phase II results was a total capitulation by investors and understandably so. However, some Wall Street analysts are still recommending the stock on the basis that there could/ should be an improvement in median overall survival when a second analysis is made, probably in 2Q, 2014; there is a reasonable chance for this in my opinion.

Also, the FDA will likely approve a phase III trial if IMUC requests such approval. There is the suggestion of moderate efficacy and the side effect profile of ICT-107 is benign. The FDA would probably feel that there is some potential for benefit without great side effect risks. There will be an end of phase II meeting with the FDA in 2Q, 2014. Less predictable but possible, we may see other data that is encouraging as the trial results are more closely analyzed. I think that the stock could trade higher by mid-2014 but this is a trading call not an investment idea.

Investment Conclusion on Northwest Biotherapeutics

The market closely associates Northwest Biotherapeutics and ImmunoCellular on the basis that they are both developing dendritic cell vaccines for glioblastoma. The stock of NWBO has been pulled down in the draft of this disappointing news on ICT-107. The assumption is that NWBO's DCVax-L and ICT-107 is the same product. There is, of course, a pronounced similarity in that they are both developing dendritic cell based vaccine therapies for glioblastoma. Does this mean that DCVax-L might produce disappointing results in its phase III trial in which topline results are probable in 1Q, 2015? Let me address the issue of whether DCVax-L and ICT-107 is the same product.

DCVax-L and ICT-107 are similar in the type of immune cell (dendritic) they use as the active ingredient, but they are quite different in regard to how they target the cancer. Both DCVax-L and ICT-107 start with monocytes (which are precursors of dendritic cells) that are taken from the body through a blood draw, differentiated into dendritic cells in the laboratory and loaded with cancer antigens (I go into more detail on this later). The cancer antigens are the big difference in the two products: DCVax-L exposes the dendritic cell to the full set of antigens on the cancer; ICT-107 uses peptide fragments of 6 pre-selected antigens. Overall, there may be hundreds of antigens on each cancer cell and ICT-107 is addressing just a small fraction of these and it is possible that some or all are not expressed in a specific cancer.

NWBO believes that targeting the full set of antigens on a cancer cell makes it much more difficult for the tumor to get around the immune therapy and "escape" than targeting just a handful of selected antigens. NWBO has long emphasized this point as a key differentiator between its DCVax products and competing products such as ICT-107. IMUC is pre-selecting six antigens to be targeted; limited data from earlier trials of ICT-107 indicates that not all of these antigens occur in cancers treated. We may find that in this trial that some or even all of the pre-selected antigens were not expressed by the patient's cancer. The NWBO approach aims to load the dendritic cell with all of the antigens expressed by the patient's tumor. We do not have the clinical data to evaluate this difference in approach at this point in time, but it could be a major difference in the two products.

The clinical trial situation is also different. The ICT-107 clinical trial was essentially an exploratory trial that has to be followed by a phase III. DCVax-L is in a phase III that will report out topline data in 1Q, 2015. With success in that trial, the product could receive regulatory approval. The phase III trial of DCVax-L has more 300 patients versus 124 in the ICT-107 trial. This gives it more statistical power to reach its endpoint. The phase III trial design also has built into it the ability for the data monitoring board to perform an interim look at sample size (while the Company and the trial sites remain blinded), probably in the summer of 2014, to consider adding more patients to the trial to further enhance the statistical powering. This interim look is in addition to two interim analyses by the data monitoring board for safety and efficacy, in which the Company and the trial sites also remain blinded. This ability to expand trial size is a very important feature of the trial which increases the chances for success.

With success in the phase III, financing or partnering issues would not be an issue for NWBO. Also, NWBO does not face the timeline and financing hurdles that IMUC now faces to get to phase III topline data. For example, the enrollment concern due to the upcoming trial of the checkpoint inhibitors in glioblastoma is less of an issue for DCVax-L. Most of its enrollment will be completed before that trial ramps up and the Company is recruiting patients in the UK and Germany as well as the US.

My macro reason for being interested in dendritic cell vaccines is based on my interest in immunotherapy, which I think could be the next major area of innovation for the biotechnology industry. The success of Bristol-Myers Squibb's (BMY) Yervoy has generated enormous interest in immunotherapy. It was introduced by Bristol-Myers in March 2011 and has current sales of nearly $1 billion. There are several comparable drugs in late stage development, the anti-PD 1and anti-PDL 1 inhibitors that are among the most exciting new cancer drugs in development with Street estimates for over $5 billion of sales in 2020. These drugs are referred to as checkpoint inhibitors and their mode of action is to block the mechanism that cancer cells use to turn down the activity of T cells. The result is increased T-cell activity against cancer. There is also a great deal of buzz about autologous T-cell therapy in cancer.

The dendritic cell vaccine technology has the same therapeutic goal as the checkpoint inhibitors and autologous T cell therapy. All try to enhance T-cell activity against cancer. I don't know if DCVax-L will be successful in its phase III trial. It is a paradigm shifting approach, and such approaches always carry a high risk of failure. My recommendation of NWBO is not based on certainty that the phase III trial will be successful, but rather that there is a sound scientific basis for the product and a reasonable chance of success. In the event of success, the upside potential significantly offsets the possibility of substantial loss in the event of failure. This is the basis of my asymmetric approach to investing in emerging biotechnology stocks.

Background on the Phase II Trial of ICT-107

ImmunoCellular released the topline results of its phase II trial of its dendritic cell cancer vaccine ICT-107, in glioblastoma. This was a 124 patient trial in newly diagnosed glioblastoma patients whose tumors had been surgically resected. The trial was randomized so that one third of patients or 41 received standard of care, which is surgery to remove the tumor, followed by radiation plus the cancer drug temozolomide. The other 83 patients received standard of care plus ICT-107. ICT-107 was given as four injections administered sub-cutaneously, one week apart, for the first four weeks of the trial. It was then given on a maintenance basis until the tumor started to progress.

The primary endpoint of the trial was median overall survival and the trial was powered on the expectation that median overall survival in the ICT arm of the study would be nine months better than in the standard of care arm of the trial. A key secondary end point was the median progression free survival or the time until the cancer started to grow again. Based on the statistical assumptions and design of the study, the trial would reach its endpoint after 64 deaths in the 124 patients treated. The goal was to show that at this point, ICT-107 would have a median overall survival advantage of 9.0 months over standard of care. The study was stopped when 67 deaths had occurred.

Kaplan Meiers Analysis of ICT-107 Phase II Trial

The following attempt on my part to describe Kaplan Meier analysis is very simplistic; I do not have a good grasp of the complexities. Still, I hope that it conveys the gist of how the data was analyzed and reported. Kaplan Meier plots display data using a graph in which the y axis could represent the number of patients or percentage of patients alive and the x axis is time; at various points in time the estimated number of patients alive is plotted against time.

Each time a patient dies (if the KM plot is of overall survival) or has their tumor recur (if the KM plot is of progression free survival), the line graph steps down a notch. At time zero, all patients are alive and at some future point most or all patients in the case of glioblastoma will be dead so that the curve would be stepping downward from left to right, with each step-down constituting a patient's death or tumor recurrence. There is one curve for the ICT-107 treated arm of the trial, and another for the control arm, that are plotted against each other. The Kaplan Meier analysis estimates the difference in outcomes between the ICT-107 treated arm and the control arm.

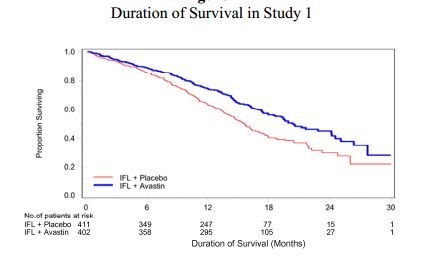

I have included an example of Kaplan Meiers analysis of median overall survival of Avastin in colorectal cancer as an example of overall survival curves that are generated in a trial. This compares Avastin plus standard of care versus standard of care alone. The blue line is the Avastin arm and the red line is the standard of care arm. It is the separation of the curves that is the basis of the analysis.

It is not as simple as just plotting the number of people alive at any one point. The status of patients is not always known. They may have dropped out of the trial or their status may not have been recorded at that particular time. The Kaplan Meiers analysis uses a technique to adjust for this by predicting the rest of the data based upon the data in hand. Also, based on the shape and separation of the two curves at interim looks, the analysis projects the final outcome for the trial even though not all deaths have occurred. For example, only 67 deaths have occurred in the ICT-107 trial although there will ultimately be 124 deaths. The KM analysis gives an estimate of the outcome on median overall survival before the final results are known. A KM analysis was performed by IMUC for median progression free survival.

Analysis of Phase II Results for ICT-107

The results as reported by IMUC were that the endpoint of median overall survival did not reach statistical significance in regard to the difference between the patients treated with standard of care plus ICT-107 versus the patients treated with standard of care plus a placebo. IMUC had expected to show a 9.0 month improvement for patients treated with ICT-107 plus standard of care versus standard of care and a placebo. The results indicate that all patients given ICT-107 (this is called the "intent to treat" patient population) had a median overall survival of 2.0 months longer than patients in the SOC/placebo arm of the trial, and those treated in accordance with the trial protocol had median overall survival of 3.0 months longer than patients in the SOC/placebo arm of the trial. Obviously, this was not statistically significant.

IMUC also reported the results in regard to the endpoint of progression free survival (PFS). The Company said that there was a 2.0 month improvement in PFS in patients treated with ICT-107 versus patients in the control arm, and that this was statistically significant with a p value of 0.014.

The final shape of the Kaplan Meier plots for overall survival in both arms of the trial will only be known when all 124 patients have died. The current results were based on only 67 deaths, so there might be potential for the curves and the results to change meaningfully over time. It is not possible to know, currently, how much of a chance there is for such change because IMUC has declined to disclose the distribution of the 67 deaths that have occurred so far, as between the ICT-107-treated arm and the control arm of the trial. The time of survival for 57 patients is still unknown. The data set for progression free survival is more complete as the status of 103 of the 124 patients is known and it is not likely to change much.

IMUC believes that there is the potential for the median overall survival to improve from 2.0 months (intent to treat) or 3.0 months (per protocol). Here is the reasoning. In the phase I trial, 8 of 16 patients or 50% experienced very long term survival of more than five years; this compares to about 4% or less in the broad population. It has generally been true of immunotherapy that there are a subset of patients who experience unusually long survival times as in the ICT 107 phase I trial. IMUC holds out the possibility that as the overall survival data matures (more people die) there will be an improvement in median overall survival for ICT-107. There should not be much of a change in progression free survival since most of that data has already been collected.

There is one aspect of what IMUC has said or rather hasn't said that is troubling. They said that they would not break out the timing or number of deaths in the ICT-107 treated arm of the trial versus in the control arm. IMUC also did not provide any breakout or details on the timing or numbers of tumor recurrences (progression free survival numbers) in the ICT-107 treated arm versus the placebo control arm of the trial. These are very important pieces of information because in a trial of this size, results from a handful of patients can meaningfully change the reported results.

The breakout or distribution information on both OS and PFS is also crucial to enable investors and analysts to really see what the performance of ICT-107 was in this trial. Management said that disclosing the breakout of deaths would somehow affect blinding, but I am baffled on what they mean by this. IMUC itself must know the breakout, and no longer be blinded, or it could not have calculated the difference in the treated versus control arm, nor calculated the p value of this difference. Since IMUC itself is clearly no longer blinded, there does not appear to be any other blinding issue that could somehow still be present and provide a reason for not disclosing this very important information.

I am inclined to believe that we will see an improvement in median overall survival. I couldn't hazard a guess as to what it might be. We are dealing with very small number and potentially results in more patients could meaningfully change outcomes. This is brought home by the 3.0 months improvement in median overall survival seen in 117 patients treated per protocol versus 124 patients on intent to treat basis. The difference of just 7 patients evaluated produced a very significant change in median overall survival.

What Comes Next

ImmunoCellular started its conference call on the ICT-107 phase II results by saying that it believes that it has demonstrated a biological effect against glioblastoma and that the phase II data is sufficiently promising to warrant starting a phase III trial. It is now preparing for a discussion with regulatory agencies on how to design and execute a phase III trial.

There is an enormous amount of data that has to be analyzed and they have barely scratched the surface. At this point, they have looked primarily at the data for median overall survival and progression free survival. This data needs to be looked at on a more detailed patient by patient basis. There is also important additional data on other secondary endpoints, patient sub-groups and immunological response that needs careful analysis.

IMUC will need time to go over the trial data and it will call in outside experts to give an independent view on the interpretation and clinical relevance of the data. Also, the Company wants to let the survival data mature (more deaths) in order to see if the median overall survival improves as the number of deaths increases from the current 67 toward the ultimate 124. It will make one more cut of the data to analyze median overall survival, possibly in 2Q, 2014.

After this preparation is completed, an end of phase II meeting will be scheduled with the FDA and EMA, probably in late 2Q, 2014. They will present all of the data and subsequent analysis to determine if these agencies will approve a phase III trial and the design of that trial. I think that the announcement on whether the Company will start a phase III trial could be made in 3Q, 2014.

Potential for Approval of ICT-107 in Glioblastoma

Let's for the time being assume that ICT-107 can show a median overall survival increase of 2.0 months in a future phase III trial. This was what was shown in the phase II trial on an intent to treat basis. Is that clinically significant and could that be the basis for approval? My answer is maybe, or probably.

Temozolomide is the standard of care chemotherapeutic drug approved for the treatment of newly diagnosed and surgically resected glioblastoma. It was approved on the basis that it showed 2.5 months improvement in median overall survival over surgery and radiation therapy. Surgery and radiation alone produced 12.1 months median overall survival, and the combination with temozolamide produced 14.6 months. The improvement in median progression free survival was 1.9 months.

I think that a 2.0 month improvement in median overall survival might be enough to gain approval in glioblastoma. First of all, that would be as good or better than the existing drugs approved in this setting (temozolomide, Gliadel wafer and Avastin), and ICT-107 would provide another option and could be synergistic and extend median survival. Secondly, ICT-107 appears to be extremely safe with side effects comparable to a placebo. This would be viewed very favorably by regulatory agencies as most chemotherapeutic drugs have significant side effects. The dosage is quite easy requiring relatively pain free subcutaneous injection.

If ICT-107 were to show a median overall survival of 4.0 to 5.0 months as the data matures, I think that it would be viewed as a major therapeutic advance.

Avastin is approved for the treatment of recurrent glioblastoma. This is for patients whose cancers have been treated and then recurs. It was approved on the basis of an objective response rate of about 20% and four month duration of effect. It did not show any improvement in median overall survival. Two large phase III trials of Avastin in newly diagnosed glioblastoma, the setting that temozolomide is approved for and ICT-107 is being tested in, showed improvement in progression free survival but not median overall survival. Some key opinion leaders still believe that Avastin should be approved on the basis that it improves quality of life.

Phase III Trial Considerations

My best judgment is that ICT-107 is biologically active and is approvable on the basis of a phase III trial that would establish that it has median overall survival of 2.0 months or more. I think that the FDA would give approval to go ahead with a phase III trial that could start as early as 1Q, 2015.

There are, however, two large concerns about whether IMUC will be able to execute a phase III trial. The first issue relates to the size of the trial, and the cost and the time needed to execute the trial. The Company can't yet estimate how many patients would be needed in the trial. Let me make a simplistic and probably wrong assumption that the size of a trial needed to gain approval for temozolomide on the basis of a 2.5 month increase in median overall survival required 573 patients and a similarly sized trial would be required for ICT-107 for a 2 month increase in median overall survival.

ImmunoCellular estimates that it would cost about $100,000 per patient in a phase III glioblastoma trial. At 573 patients, the phase III trial would cost $60 million. I think that if the trial started in early 2015, that it could show topline results in 2018.

Figuring that the non-trial related costs necessary to keep the company operational are about $8 million per year, this would require another $32 million. The Company currently has about $20 million of cash so that this suggests that it would need to raise about $70 million between now and topline data in 2018.

The timeframe for development and cost of development are daunting. However, there looms another major issue. The checkpoint inhibitors are about the hottest new drugs in clinical development on the planet. The first of these drugs was BMY's Yervoy and BMY, Merck (MRK), Roche (RHBBY) and Astra Zeneca (AZN) have anti-PD1 or anti-PD-L1 products in development. Here is the problem. I understand from my sources that there will be a significant trial launched in about 2Q, 2014 that investigates BMY's Yervoy, nivlomab (its anti-PD1) and the combination of the two in treating glioblastoma. This will be a high visibility trial that is likely to capture many of the new patients entering into glioblastoma clinical trials. Other pharma companies with anti-PD1 products may well pursue glioblastoma, too. Having to compete with these hot products would create a major enrollment issue for IMUC.

The issues of trial size, cost, timing and difficulty in enrolling patients may just be too much to overcome. I think that the chances of IMUC completing a phase III trial are very low.

Differences between NWBO and IMUC

The market closely associates Northwest Biotherapeutics and ImmunoCellular on the basis that they are both developing dendritic cell vaccines for glioblastoma. The stock of NWBO has been pulled down in the draft of this disappointing news on ICT-107. The assumption is that NWBO's DCVax-L and ICT-107 is the same product. There is, of course, a basic similarity in that they are both developing dendritic cell based vaccine therapies for glioblastoma. This might mean that DCVax-L might produce disappointing results in its phase III trial in which topline results are probable in 1Q, 2015.

This may be the case, but we don't know that it is and only when we see the clinical data will we really be able to determine that. In the meantime, let me point out that there are some important differences. Dendritic cells are the master immune cells involved in activating the body's adaptive immune system. One of their most important functions is to swallow antigens from invading microbes such as bacteria or viruses and to migrate to nearby lymph nodes. There, through a complex process they present those antigens to T-cells and B cells. Antigens are molecules specific to a microbe and that don't occur normally in the human body. This causes the killer T-cells to seek out and destroy any microbe that displays the antigens that have been presented to the T cells by the dendritic cells.

The theory behind dendritic cell vaccines is to use this proven mechanism for eradicating microbes to bolster the immune response to cancer. The process starts with drawing blood from a patient. This captures the patient's monocytes which are pre-cursor cells to dendritic cells. The blood containing the monocytes is sent to a laboratory where two important things take place. The monocytes are caused to mature into dendritic cells and during this process they are loaded with antigens that are present on the patient's cancer (or, in the case of pre-selected antigens such as in ICT-107, the antigens are hoped to be present). These vaccines consist of activated, "educated" living immune cells that are returned to the body.

Differences in DCVax-L and ICT-107 Product Characteristics

One of the major differences between ICT-107 and DCVax-L is the antigens that each product displays. DCVax-L loads the dendritic cells by exposing them to tumor tissue that has been removed by a biopsy and processed into a lysate. The lysate contains the full set of biomarkers of that patient's tumor. There are two key aspects to this: the fact that it is the full set of antigens, not just a few selected ones, and the fact that the antigens are personalized, which ensures that the antigens in the DCVax-L product are indeed expressed on the patient's cancer and avoids the uncertainty involved with pre-selected, standardized antigens - which may or may not be expressed on a given patient's tumor.

In contrast, ICT-107 is based on six antigens (potentially out of hundreds) that IMUC believes are typically expressed on glioblastoma tumor cells.

Intuitively, one might think that the DCVax-L approach of using the full set of antigens rather than just six is better, but there is no data to prove this. Another key difference is that the six antigens in IMUC's ICT-107 are standardized, not personalized. This means that for any given patient, it is Russian roulette as to whether some or all of those particular six antigens are expressed on that patient's glioblastoma tumor cells. For NWBO's DCVax-L product, this is a non-issue because the antigens are personalized.

The point that I would make is that the antigen element of NWBO's DCVax-L and IMUC's ICT-107 are significantly different, and conceivably this could make the products (and the clinical results) quite dissimilar.

The art involved in manufacturing the vaccines is also different and can produce very different type of dendritic cells depending on how the monocytes are differentiated. There is no way of knowing if NWBO has a better approach than IMUC, but again the end products might be quite different even if you were to start with the same patient specific monocytes.

I would point out that the NWBO manufacturing process has been approved by regulatory agencies for phase III trials in three countries: the US, UK and Germany. Regulatory agencies are very rigorous in their requirements for manufacturing. They put as much emphasis on the product issues (demonstrating batch after batch consistency, composition, potency, purity, etc.) as on the outcomes of clinical trials. Hence, we can assume that NWBO has a high quality manufacturing process. IMUC used two different manufacturers during its phase II clinical trial and has not yet finalized its manufacturing process for phase III or at least regulatory agencies have not signed off on it. Variability in results due to manufacturing differences during the phase II trial is something that needs to be investigated.

There are certainly major differences in DCVax-L and ICT-107 and there is reason to think that they could have meaningful therapeutic differences. There is no objective data to confirm that they are essentially the same product as the market is assuming or if they are very different products. This is why we do clinical trials.

Different Issues for Phase III Trial Outcomes

There is also a very important difference between the phase III trial of DCVax-L and the phase II trial of ICT-107. With success in this Phase III trial, it may be possible for DCVax-L to gain approval without doing a second, supportive phase III trial although ultimately the FDA and EMA will decide this. Importantly, the DCVax-L trial will enroll over 300 patients (two and one half to three times as many as the ICT-107 phase II) and is thus better powered to show differences from standard of care. Also built into the trial is the ability to take an interim look (probably in the summer of 2014) to determine if the trial needs to be enlarged to give it a better chance to achieve the desired statistical significance.

The competition for enrollment with the looming trials of checkpoint inhibitors is less of an issue for DCVax-L than ICT-107 faces if it goes forward in phase III. The enrollment for DCVax-L should be largely completed before the checkpoint inhibitor trial ramps up in a big way. This could be something of an issue if the DCVax-L trial needs to be upsized, but it should be manageable.

The obvious next question is if the checkpoint inhibitors are successfully developed how they will compete against DCVax-L. Their modes of action are potentially synergistic. Essentially, the checkpoint inhibitors override the mechanism which cancer uses to down regulate the activity of T-cells. DCVax-L increases the number of activated T-cells. Recent experience with the checkpoint inhibitors suggests that they are effective as a single agent in about 25 % of patients and in combination in about 40%. There could be meaningful synergy between DCVax-L and the checkpoint inhibitors.

Tagged as ImmunoCellular Therapeutics LTD, IMUC + Categorized as Company Reports