Current Recommended Stocks and an Analysis of Past Recommendations, March 5, 2014)

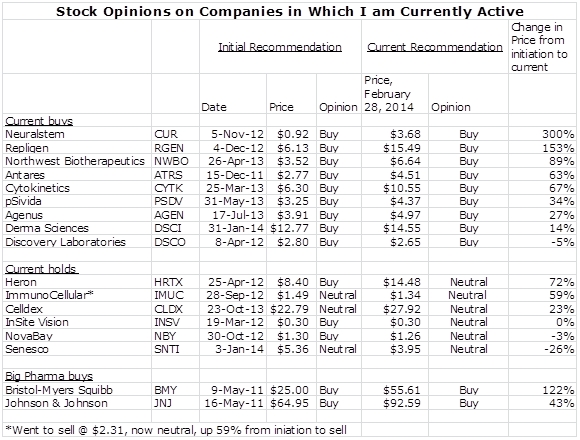

Current Recommended Stocks

I only started offering research on my website on a subscription basis in early December, 2013 so that there is still a lot of shakedown going on for the content on the site. One of the issues that has been pointed out to me is that there is so much information on the site that it is sometimes difficult to find out what I am emphasizing. Several have suggested that I provide a summary of my current recommendations and my coverage list. Obviously, this is important and I will now be doing this on a regular basis.

I want to make sure that you know that I invest in all of my recommendations. For a new recommendation, I will not buy the stock until at least three days after the recommendation. The same three days applies for a downgrade on a stock. Most of the stocks that I deal in are emerging biotechnology companies that I believe have asymmetric upside potential if events (usually clinical trial outcomes) unfold positively, but also considerable risk. My personal approach is to hold as many names as possible and to limit the aggregate investments in emerging biotechnology to about 10% to 15% of my portfolio.

My personal experience is that if you can pick one winner out of three investments, you will do OK. I strive to do better, but the one certainty is that some of my ideas will not work. You should not put yourself in a position so that a 50% loss in value of a stock would have an impact on your quality of life. No matter how good the story, I urge that you strive for diversification.

I think that most of you know that I am a buy and hold investor. I usually am looking at a series of events that will occur over not hours or days but over months and more likely years. I don’t trade in and out of stocks based on some factor like technical analysis or reading sheep entrails. I believe that rapid fire trading is not a way to make money. I generally focus on the fundamentals and the potential stock price that could result if fundamentals develop as I forecast. As long as there is no major change in fundamentals, I stay the course. Obviously, if I am wrong on something like a major clinical trial outcome (a not infrequent happening), I change my position.

Let me give you the example of Cadence Pharmaceuticals. I recommended the stock on May 9, 2011 at $7.11 and the stock traded steadily down to $2.72 on May 31, 2012 due to what was perceived as a disappointing launch of its first product Ofirmev and uncertainty about the strength of patents covering Ofirmev. I recommended it all the way down to $2.72. Then I recommended it all the way up to the present time; Mallinckrodt is in the process of acquiring the company for $14.00.

This style of investing has some disadvantages. The emerging biotechnology companies in which I specialize are extremely volatile and upside and downside moves based on uncertainties arising can be huge. Some investors at early signs of uncertainty like to run for the door and try to return to the stock when things are more certain. If that is your style, I will give you all of the possible information that I can to successfully implement it and at times might even join you. I hope you know that I try to put all of the positive and negative issues on the table. I am flexible and not all situations warrant my stubbornness with Cadence.

I have included all of the companies that I have buys and neutral recommendations on. I don’t usually issue short recommendation although you never know. For all of the companies listed below, I provide the date the recommendation was initiated and the price at that time. I also provide the price as of February 28, 2014 and recommendation at that time and the change in price between the two time periods.

The companies are separated into buys and holds. You may also notice that I have listed two buys on big pharma companies. When I started my website, I did work on both emerging biotechnology companies and big pharma and big biotech. However, found that there was so much information available that my value added was modest and didn’t warrant the huge investment of time. However, these are two of the largest holdings in my portfolio and these would be recommendations in the big cap space if I were active. Caution, I probably won’t be writing on them.

How Have My Past Recommendations Done?

For a brokerage firm or a subscription service like mine, this is a difficult question to accurately answer. This is not a portfolio of stocks; it is a list of stocks. I have chosen to highlight the price at which I initiated coverage and the current price as an indication of the success of my recommendations. However, this is not a measure of how people who subscribe to my service would have done. Not everybody buys at the initiation price and the degree of emphasis placed on recommendations varies over time. If there is a big positive change in price from the time of recommendation and the stock price goes up, it only means that there was a good chance that you made money

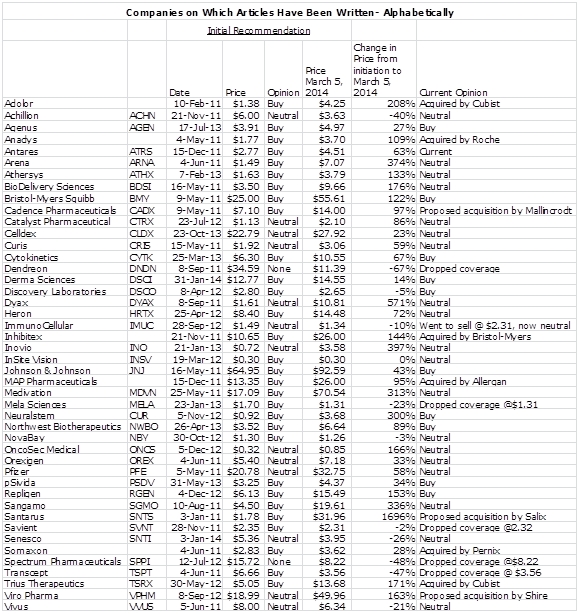

In the following tables, I have shown the change in price from the time I initiated coverage until the price as of March 5, 2014, 2014 or when I dropped coverage or when the Company was acquired. The first table simply shows all of the companies I have initiated coverage on. Please note that some companies were initiated with a buy and others with a neutral. The companies listed in alphabetical order are:

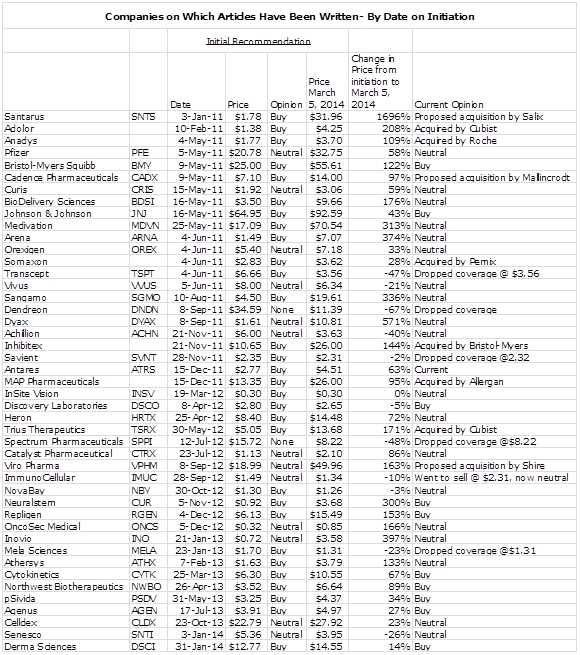

The same companies listed by date of initiation are as follows:

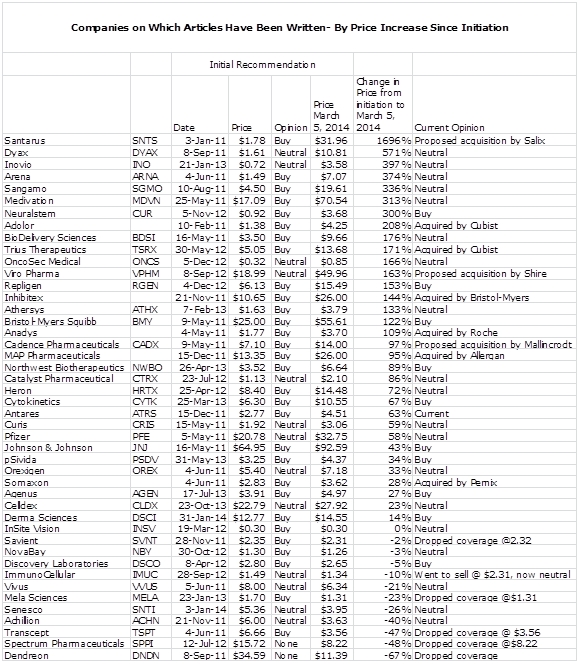

Finally, the companies are listed in order by the change in price from initiation to March 5, 2014 or when I dropped coverage or when they were acquired.

Why do I include companies that I initiated with a neutral? Obviously, I missed them if they appreciated in price. However, I have only written on companies that I issue a buy on or which I think are good companies that I might want to upgrade. You will notice that I have missed a fair number of good sized moves. Why then should I highlight them? Because one on my principal goals in writing reports is to give you as much information, both positives and negative, to come to an independent decision. You may very well have an insight that would cause you to go against my opinion. Take the recent case of Celldex, I recommended it at xx with a neutral recommendation and it is up xx%. I missed it, at least in the short term. I am not the Delphi oracle.

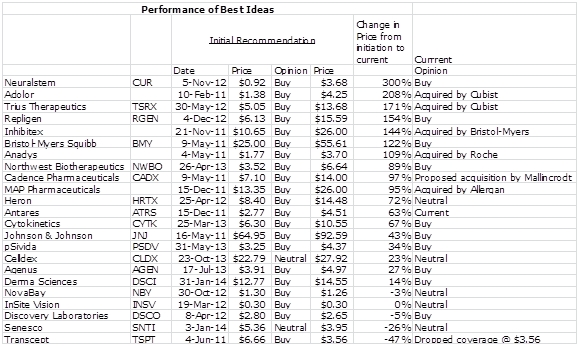

How Have My Best Ideas Done?

There are some stocks that I feel I have been very involved in and others that I haven’t. For example, Santarus has been the best performing stock of any that I have written on. I started writing on the stock at a price of $1.78 on June 11, 2011. I then continued to write for a while, but when the stock started to move above $5.00 and then higher, I didn’t emphasize it because of concerns about patent issues. I didn’t go to a sell; I just didn’t push the recommendation. Hence, I exclude SNTS as being one of my best ideas even though it is up 1,700% from when I initiated coverage with a Buy.

So I have put together a list of the stocks that I believe are the ones that I have had a consistent opinion on. Some of these have been good ideas and a few have been bad. You will just have to trust me on. Here they are.

Acquisitions

Some of the stocks that I have done well on so far may not ultimately be winners, but just because Neuralstem is up 300% doesn’t mean that I have made money for anyone. Kenny Rogers summed this up very well in his song “The Gambler”. I don’t want to imply that we are gambling, but his words are just so appropriate. He said:

“You got to know when to hold up

Know when to fold up

Know when to walk away

Know when to run

You never count your money when it’s sittin’ on the table

There’ll be time enough for counting when the dealin’s done”

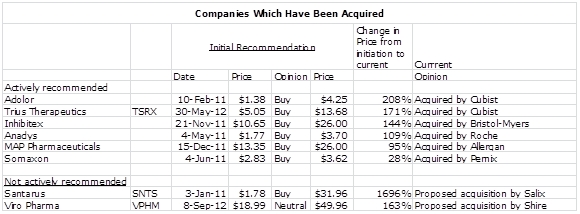

So on my best idea list, most of the money is still sitting on the table. However, there are some stocks where we can count our money and these are acquisitions. The list of acquired companies is as follows. Out of 44 companies that I have initiated on, 8 have been acquired. Santarus and ViroPharma were also acquired, but these were not stocks that I emphasized.

Tagged as reccomended stocks, smithonstocks, stock performance + Categorized as Smith On Stocks Blog