Cryoport: Stock Has Been Attacked by Short Sellers (CYRX, $14.57, Buy)

Opinion on Stock

The recent sharp price decline has not been attributable to any change in perceived or actual fundamentals of Cryoport. (See the appendix of this report for a discussion on price behavior over the last month.) I have stated repeatedly that Cryoport has one of the best business models that I have seen in my career and that I believe that I will own this stock for the next five years or longer. The Company has increased revenues from $5.5 million in 2015 to my projection of $31.6 million for 2019. My latest published report forecasts $79.9 million in 2024 and this is with purposely conservative assumptions. I perceive very strong growth beyond then. No change here.

The price decline was coincident with two articles published on Seeking Alpha. The articles were by anonymous writers using the pseudonyms Mako Research and The Capitolist. In their disclosures, they clearly stated that they shorted Cryoport stock before the articles were published with the intent to drive down the stock price and profit. The writers appear to be employees of hedge funds or receive benefits from hedge funds to write negative articles. Both have been associated with numerous other short selling raids on the stocks of other companies using Seeking Alpha as a venue.

The articles are fatuous although cleverly contrived. The writers are clearly skilled in doing research and even more skilled in deception. This type of stock manipulation has become a standard business practice on Wall Street practiced by a group of hedge funds collaborating with broker/dealer arms of some of the elite Wall Street investment banks. I have written extensively about this in a series of blogs on illegal naked shorting.

This stock manipulation scheme is done on a routine basis. A few years ago, when I first became aware of it, the targets primarily were small companies who faced meaningful uncertainties in their business or who had experienced a disappointing event. This scheme has now evolved to attack companies like Cryoport who have delivered extraordinary growth. Sadly, stock manipulation has to be a key consideration for any investor in emerging growth stocks.

Such an attack can be devastating for companies who are dependent on future equity financings to execute their business plan. The manipulation scheme is intended to pressure the stock price down and force companies to finance at very depressed stock prices usually with warrants and on a repeated basis. This leads to extraordinary share dilution and precipitous stock price declines. This tragedy has been repeated over and over. As an owner of Cryoport, it is critical to understand that Cryoport is close to achieving positive cash flow and has a warchest of over $100 million. Cryoport can execute its strategy without the need for financings and clearly over the next one, two or three years no stock financing is needed. This is extremely important for investors.

Cryoport clearly has first mover advantage in temperature controlled shipping of biological materials. This is important because new potential clients will want to go with a company they can trust. They will almost certainly conclude that if biopharma giants such as Novartis, Bristol-Myers Squibb and Gilead have chosen to go with Cryoport that is good enough for them. Of equal importance, Cryoport has now established the scale and has the financial resources to continually evolve and upgrade their model to make it ever better.

I do not want to be quoted as saying that no other company can ever compete and gain market share. This is America and competition and innovation are constants. However, we are at the dawn of a major new product development opportunity with regenerative medicine that offers explosive growth opportunities for Cryoport. The entry of another competitor(s) gaining modest market share would not alter this.

Overview of Short Selling Attack

Cryoport has been the subject of a coordinated, highly sophisticated stock manipulation scheme that has led to a sharp decline in the price. The first phase of the attack was an article published on Seeking Alpha on August 23 called “Cryoport Is a Wildly Overvalued No-Moat Business”. The authors of the article belong to an anonymous group that calls itself Mako Research. In its disclosure Mako Research states that it was short the stock and the intent of the article was to drive the stock price down and profit. In what appears to be a closely coordinated follow-on, a second article appeared on Seeking Alpha on October 8 called “Cryoport: The Sell Side Does It Again, 80% Downside Risk” by another group of anonymous writers who call themselves The Capitolist. Their disclosure also indicates they were short the stock prior to the article and wrote the article to drive the stock price down and profit. The Capitolist acknowledges that it has a connection with Mako Research. It could very well be the case that they are one and the same, differing only in the pseudonym they write under.

An internet search reveals no information footprint for either Mako Research or The Capitolist. They have no websites and are not on Linked In, but do surface occasionally on Twitter (always with negative comments). They appear to have been created for the sole purpose of writing articles on Seeking Alpha intended to drive stock prices down and benefit short sellers like themselves. Mako Research has published 29 articles on Seeking Alpha and all were short sells. They have made 1,065 comments on articles appearing on Seeking Alpha and all were negative on the companies being written about. The corresponding numbers for The Capitolist are 38 and 47, Disturbingly, Seeking Alpha allows such authors to write under pseudonyms so we have no idea who they are. My hypothesis is that they are employees of hedge funds shorting the stock and/or people who are paid by hedge funds to write negative articles to facilitate short selling.

I think that Seeking Alpha is a tremendous platform that sometimes brings information of great value to individual investors. But sadly, it has become the venue of choice for short selling attacks with the same modus operandi as the attack on Cryoport. Cryoport is not a unique situation. The reports follow a well-established template that uses much the same tactics over and over and over and over with the firm intent of trashing the management and technology of a company. As one hedge fund manager wrote on Seeking Alpha, we are going to make this company and its management so toxic that no investor will go near it. Seeking Alpha has hosted hundreds of such articles. Yes, it is hundreds. Even more disturbing is that the editors of Seeking Alpha who “reviewed” the Cryoport articles designated them as Editors Picks thereby stamping on the Seeking Alpha seal of approval. I think that Seeking Alpha has an obligation to be a neutral platform. To publish articles like this is questionable as a business practice and to endorse them is reprehensible. Net, net, Seeking Alpha gives the appearance of having been captured by short selling hedge funds.

Let me emphasize that I do not for a moment think that these articles, scurrilous as they are, could singularly have been the reason for the sharp stock decline. Mako Research and The Capitolist have no meaningful footprint of any kind in the real world. What knowledgeable or even unsophisticated investor would listen to authors who disclose they are short sellers trying to drive the stock price down? I think that the articles were simply cover for the attack on the stock by a group of hedge funds. Using coordinated shorting, with considerable illegal naked shorting, they have demonstrated time and again that they can manipulate stock prices of small companies almost at will in the near term. The Mako Research and The Capitolist articles only provide cover and plausible deniability of criminal activity. The hedge funds and collaborating broker dealers who actually perform illegal naked shorting could have manipulated the stock in the same way without the articles.

Putting the Mako Research and The Capitolist Articles Under Scrutiny

After reading the Mako Shark and The Capitolist article, I am certain that numerous people were involved in their construction. They were not the works of a single person as the reports show considerable research sophistication. However, close reading of the articles shows a sophistry based on of a gossamer web of cleverly constructed misstatements and upside down reasoning. They try to dazzle with smoke and mirrors and there is a total lack of balanced arguments. This is not surprising as the authors tell us that they are short the stock and trying to drive the stock price down in order to profit and who hide behind the cloak of anonymity. Mako Research and The Capitolist writers are masters at spin and deception.

Reading the articles is like going through a haystack in order to try to ascertain where are the needles that form the key arguments made by Mako Research and The Capitolist. I think that both base their short thesis primarily or entirely on the argument that Cryoport is engaged in a commodity business with no barriers to entry. It is not surprising that they agree as they were probably written by the same people. The overriding intent of The Capitolist report published two weeks or so after the Mako research article was to reemphasize this point. They offer a lot of verbiage and specious and circular thinking to support this argument and trying to understand them is a bit like grabbing a handful of silly putty. Let me offer a parody of their thinking.

" Even the smallest company can compete effectively with Cryoport as there are no barriers to entry. There are numerous dewars (the shipping container) available from other companies. All a potential competitor has to do is select a container and phone one of the large logistics companies like FedEx to pick the container off a loading dock and ship it wherever. Maybe Amazon could do it.

Current customers of Cryoport like Novartis and Gilead attribute no real value to the Cryoport service so they will be keen to a new, unknown company coming in and offering price concessions and this will result in Cryoport losing huge chunks of market share. A lot of idiots (investors who own the stock) argue that shipping therapeutic cells cryogenically is a critical part of the manufacturing process and a change of logistics suppliers would result in potential for a change in the characteristics and viability of the cells that would require new clinical trials to assure the FDA that such a change would not alter the cells. This is ridiculous, so say Mako and Cap.

The FDA is indifferent to quality control and manufacturing. Novartis and Gilead can decide on their own to potentially alter the characteristics of the cells used in their CAR-T product by changing to another logistics service provider. They could just lob in a call to the FDA or maybe not and say by the way, I am making a major change in the way cells are delivered for manufacturing in case you are interested although we know you probably have better things to do. By the way, you will be happy to know that this change maybe result in a cost reduction of as much as $300 on this product that we are selling for $300,000.

Above all, you investors can trust us to be looking out for your interests. We do this by knocking the stock price down before existing investors can possibly react to our singularly narrow focused regurgitation of every possible uncertainty and casting it as the end of the world. We are just straightforward, honest short sellers for whom making a profit is secondary to protecting you from the exploitation of hundreds of small emerging growth stocks. Unfortunately, we missed exposing Amazon before it became one of the greatest companies on Earth. We can’t catch them all”

Another part of their argument is that the stock price at the time they launched their short attack and even the current stock price was/is wildly overvalued. I grant that the valuation of emerging growth stocks is extremely subjective. It is very easy to gin up arguments one way or another on the valuation. My judgment is that Cryoport is an exceptional growth story (one of the best I have seen in a 40 year career) at a very early stage of growth. I think that all great investments come from recognizing a great story and staying with it. It is inevitable that there will be moments of exultation and despair leading to swings in stock price. In my opinion, it is a mistake to try to trade in and out of the stocks of great companies. No one I have ever met or know of can make trading calls to take advantage of price swings. Ominously, selling great stocks too early is one of the greatest mistakes an investor can make.

Cryoport Provides Mission Critical Cryogenic Shipping for Manufacturers

In regenerative medicine, the active therapeutic agent is living biological material, usually living cell lines or tissues comprised of different cells. In many cases, to keep the cells alive during transport, they must be maintained at cryogenic temperatures of minus 238 degrees Fahrenheit during shipment. If something happens that results in a modest increase in temperature, the cells may begin to divide and this alters their characteristics, most likely rendering them useless. So the essential and core mission of Cryoport is to rigidly control the temperature to make sure that the integrity of the biological material is maintained during shipment.

This shipping can cover thousands of miles over the course of several days. During this time, the living cell cargo is being banged around airplane cargo holds and airports and subjected to varying ambient temperatures. If not effectively dealt with, the integrity of the cells can be destroyed. It is also extremely important to document the shipping process so that the FDA and other regulatory agencies are assured that the cells delivered are in accordance with quality control specifications. If the FDA is not confident that the documentation is sound, they would likely consider results of any clinical trials involving the cells to be invalid and in the case of commercial products might not allow the cells to be used to treat patients.

Importance to Manufacturer

How important is this to the manufacturer? One therapeutic dose of cells for a single patient can lead to revenues of $300,000 to $1,000,000. More importantly, it would take several days or weeks to manufacture a new batch of cells and it is quite possible that they just could not be replaced. The logistics service provided by Cryoport is mission critical to the manufacturer. Only a short seller can claim this is a commodity service. According to my calculations, manufacturers of CAR-T cells pay Cryoport about 1% of their net revenues for its services.

Dominant Logistics Companies Have Chosen to Partner with Cryoport

To reemphasize, Mako Research and The Capitolist tried to convince us that that barriers to entry to compete with Cryoport are infinitesimally small so that even small, start-up companies can easily grab chunks of market share. If this argument is correct, then it should be even easier for large companies with strong finances and infrastructure so why haven’t they done it.

To me, one of the most important validations of the uniqueness of what Cryoport provides is that the three major bulk air carriers- FedEx, UPS and DHL- all base their cryogenic shipments on technology licensed from Cryoport. These would be the most likely companies to try to compete. Their solutions carry the words “Powered by Cryoport” which is reminiscent of the “Powered by Intel” tag found on so many computers. Each of these carriers concluded that Cryoport could deliver a better and more profitable solution (for them) than if they tried to develop a comparable system in-house. FedEx, DHL, UPS, who collectively, have more than 87% of the express logistics aircraft in service and have been expanding other parts of their temperature controlled offerings for the life sciences industry.

CAR-T Manufacturers Have Embraced Cryoport

The first major commercial application of regenerative medicine is CAR-T technology as applied to hematological cancers and there are three dominant players-Novartis, Gilead and Bristol-Myers Squibb. Each has chosen Cryoport to handle cryogenic shipping. If the logistics service provided by Cryoport was easy to duplicate, we would expect that these companies would simply have taken this process in-house? Without blinking an eye, they can spend as much as $1 billion or more on research to develop a commercial product. Given the mission critical importance of cryogenic shipping, spending a ten million dollars or so on logistics would not be a big deal if they thought it was the best way to protect the integrity of their products. But instead, they have chosen to go with Cryoport. Enough said.

It is not just the current big three of regenerative medicine who have stamped the seal of approval on Cryoport. They have an enormous list of clients who are members of the Who’s Who of regenerative medicine that grows steadily. See this link for a partial listing.

Elements of the Cryoport Service

When I sat down to write this report, I was thinking of how to illustrate the complexity of what Cryoport does and destroy the canard that Mako Research and The Capitolist have put forward that Cryoport is providing a commodity service that is easy to compete with. As a first step, I read the 2018 10-K filing again and I urge you to do the same. The technology, software and logistics intricacies described in that filing document are mind boggling both in number and complexity. Here is a partial list of key services provided:

- Maintaining cryogenic temperatures – The dewar (shipping container) must maintain temperature integrity for more than the period of time (usually days) required for shipping and customs clearance (if applicable). Even after arrival, it may still be required to maintain the temperature for some time. One temperature excursion can impact the integrity or destroy a shipped item

- Provide chain-of-custody, chain-of-condition, chain-of-identity, and chain of compliance information for each shipment, which is necessary to ensure and document that the stability of shipped biologic commodities is maintained throughout the shipping cycle.

- Chain of custody – Clients need continuous information on the condition of their materials and their handling during shipment. Clients need to know where their package is and the condition of the contents at almost every time point in the journey and to be able to readily provide this information to physicians and regulators. Cryoport delivers non-stop monitoring of the location and condition of dewars and their contents, essentially on a real time basis using

- Chain of compliance- This provides an audit trail that can verify the in-shipment condition in which the life sciences commodity, material, product, vaccine or therapy was shipped and/or stored. Information is recorded and archived for each shipment for scientific, quality assurance and regulatory purposes in a secure cloud-based system that can be accessed globally.

- Quality validation – For their own records and to meet regulatory quality assurance requirements, companies must be able to validate the condition of the dewars and the materials being shipped in them throughout the shipment period. Cryoport can do this in real time.

- Ability to address issues during shipment- If a shipment has been mishandled and is sitting in the wrong location at say the Miami airport, this can be detected and action taken to protect the viability of the cells which have a potential value of $400,000 to the manufacturer in the case of commercial product like CAR-T cells.

- Viability in transport – Shock-absorbing packaging is necessary to reduce cell membrane-disruptive vibrations so that cells can be delivered in the same condition as when they were shipped.

- Customs clearance – Clients want to know they have someone working for them that can respond to issues that may arise as their package goes through customs. Customs documentation is critical and if not completed correctly can delay shipments.

- Cryoportal® Logistics Management Platform- The Cryoportal® supports the management of shipments through a single interface, which includes order entry, document preparation, customs documentation, courier management, near real-time shipment tracking, issue resolution, and regulatory compliance requirements.

- International regulations – It is important to understand the various regulations related to shipping biomaterials internationally. These differ materially from country to country.

- Challenges in emerging markets – In certain emerging markets, there can be insufficient temperature-controlled storage facilities, inadequate shipping resources and a lack of understanding of shipping biomaterials.

The above points are still just a partial list of things that Cryoport does.

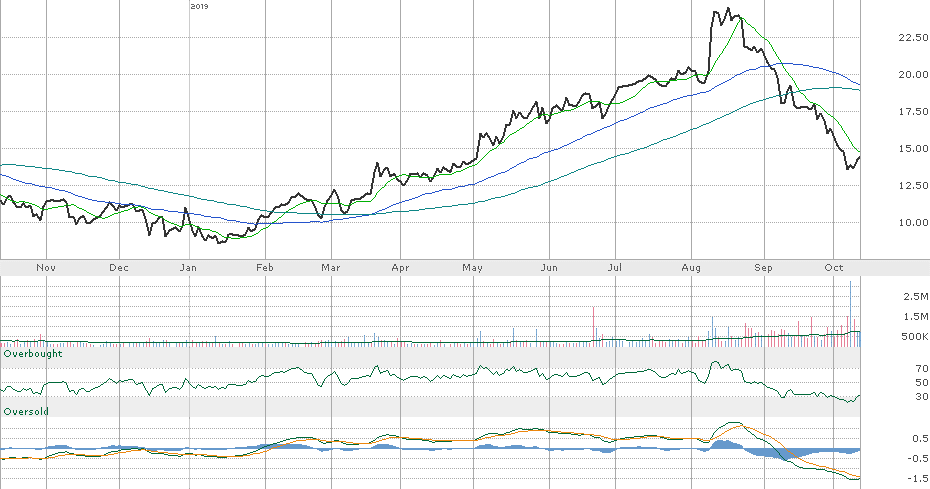

Recent Price Action

The low closing price for Cryoport this year was $8.97 which was posted on January 14, 2019. A succession of strong quarterly results reported sequentially through the year showed that sales rose 72% in 4Q, 2018, 65% in 1Q, 2019 and 85% in 2Q, 2019. This contributed to a steady rise in the stock price to $19.37 on August 7, 2019. A number of brokerage firm analysts picked up coverage with a buy recommendations and generally had price targets in the mid-20s.

Here are some prices at various time points:

- January 14: $8.97 Low price for the year

- August 7: $19.37 Steady price rise throughout the year

- August 22: $23.73 Day before Mako Research article

- October 7: $13.59 Stock was walked down by shorting following the Mako Research report

- October 8: $13.59 The Capitolist Report was published trying to panic investors into further selling with no effect

- October 18 $14.57

I am suspicious that the jump in price in early August may have been a hedge fund created increase to sucker in momentum traders and allow their shorts to be executed at higher prices. I have seen this before. The following is a chart showing year to date price action on Cryoport.

Tagged as Cryoport, illegal naked shorting + Categorized as Company Reports, LinkedIn