Cadence Pharmaceuticals: The Ofirmev Launch is a Spectacular Success, but Investors are Focused on Patent Litigation (CADX, $4.99)

Investment Thesis

By every measure, the launch of Ofirmev which began in January 2011, has been a spectacular success and continues to exceed investor expectations and management guidance. The revenue guidance was just raised for the third time this year to $107 to $109 million, up from $105 to $107 million and $102 to $105 at the beginning of the year. For the time being, investors are ignoring these operating results as their focus is on the decision on patent litigation against Ofirmev that is expected by yearend or early 2014.

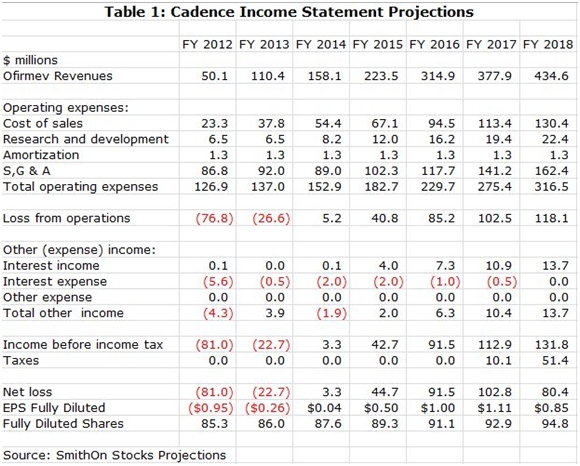

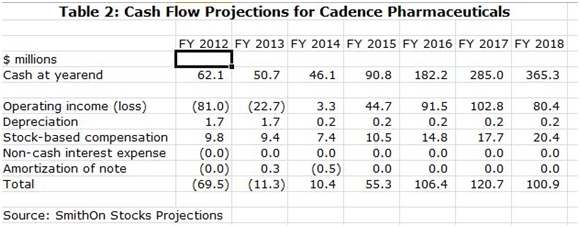

At the conclusion of this report, I have included my income statement and cash flow projections for Cadence (CADX) through 2018 on the assumption that the Ofirmev patents are effectively upheld and the product retains exclusivity through then. My projections show continued strong growth in that period with sales reaching $435 million in 2018 and with EPS of $0.85. I expect the Company to turn cash flow positive in 2Q, 2014 and see the potential for cash reaching $365 million in 2018 or $3.85 per share. (This is for illustrative purposes as I expect that the cash would not sit idly on the balance sheet, but would be used for acquisitions or share buybacks.)

These powerful dynamics should allow Cadence to mature into a very successful company and provide excellent stock price appreciation, if the patent case is favorably resolved. The market is not focused on the strength of the Ofirmev launch but is fearful that the outcome of the patent case will go against Cadence and result in generic competition for Ofirmev in the 2014 to 2016 timeframe.

I can’t predict confidently what the judge will rule on the patents. In the worst case, he might find all claims invalid on both patents. Cadence would then appeal and it would likely take another two years or longer for the appeals process to run its course. During this time, the generic company, Exela, that is challenging the patents might launch at risk. However, if Cadence prevailed upon appeal, it would likely bankrupt Exela.

The recent re-examination of the Ofirmev patents by the patent office suggests the possibility that the most likely outcome will not be binary in the sense that the patents are valid or not valid, but rather that some claims are upheld and others are denied. In this case, the scope of the claims in the patent could be narrowed, but the duration of the patents might stand.

I think that the bear case has been based on the belief the patents will be ruled invalid and generics enter the market in 2014. As I have argued, this binary outcome is unlikely. I think that it is more likely that even if Exela prevails, it would have to work around the claims structure to come up with its own process and formulation for injectable acetaminophen. They would then have to build a plant and gain regulatory approval for manufacturing. This is a long drawn out process of several years in my opinion.

If I am right, Cadence will have the opportunity to realize significant profits and cash flow from Ofirmev before sales begin to erode from generic entries. The question is how many years and i think this could be anywhere from 2016 to 2021. Using this cash flow and the competitive advantage of its sales and marketing structure in the hospital market, it can build a diversified product line through licensing of products, acquisition of products or acquisition of companies with products. This is why I continue with my Buy on the stock.

Third Quarter Results

Net product revenue was $29 million in 3Q, 2013, an increase of $15.1 million or 109% compared to the third quarter of 2012. For the first nine months of 2013, net product revenue was $77.2 million, an increase of 134% compared to the first nine months of 2012. Ofirmev’s 3Q, 2013 revenues were 17% higher sequentially than 2Q, 2013. For the 3Q, unit sales of Ofirmev were 2.5 million vials, an increase of 82%. The commercial launch of Ofirmev can only be described as a spectacular success from both a commercial and medical standpoint.

Ofirmev is clearly benefitting from the demand for alternatives to non-narcotic analgesics that are used extensively for pain relief in the hospital. Ofirmev’s share of the IV unit market increased from 2.4% to 3.8%. This seems to indicate that it has a long way to run before reaching peak sales. The metrics used to measure demand were all strong:

The number of unique accounts that ordered OFIRMEV as of September 30, 2013, increased to over 4,600.

As of September 30th, over 3,900 accounts or approximately 85% of customers placed multiple orders for OFIRMEV. This is an increase of 39% over the same time last year.

Average order size grew by 22% in the third quarter of 2013, compared to the third quarter of 2012.

The average number of orders per customer grew by approximately 8% compared to the same period of 2012.

For the first time, the Company referred to data from the Premier healthcare alliance database that includes over 400 hospitals and approximately 4.5 million surgical patient discharges per year. According to the Premier database more than one out of every eight surgical patients was treated with Ofirmev in Q2, 2013. These data also reflect significant increases in the average number of vials being used. As of Q2 of this year surgical in-patients in the database were receiving more than three vials per patient, an increase of 13% over Q2 of 2012.

Studies Illustrate Medical Value of Ofirmev

The Company cited two studies that illustrated the value of Ofirmev in the hospital. One showed that based on retrospective analysis of orthopedic procedures, reported that Ofirmev reduced opioid usage and length of hospital stay. Another study in pediatric patients demonstrated that an Ofirmev plus opioid combination was both more effective and less costly than opioids alone and led to fewer side effects and reduced hospital stay.

Other Issues

Management was asked if they had any insight as to when a decision will be made by the Delaware Court in the patent litigation suit might be made. They said that they expect the decision by late this year or early next. They have no visibility on this.

They were also asked about the Black Box warning that was included in the label during the 3Q, 2013. The Company said that they had not seen any formulary reviews or other actions that might affect usage. The same warning was previously in the label but not in a Black Box. It is a reminder to physicians to maintain dosing within the recommended range of 4 grams per day for adults with of normal weight; of course there are weight-based dosing adjustments for children and low-weight adults. It was an attempt to increase awareness so that patient safety could be maintained.

SmithOnStocks Projections

I have included my income statement and cash flow projections for Cadence through 2018 in the following tables.

Tagged as Cadence Pharmaceuticals, CADX, Ofirmev, Q3 Results + Categorized as Smith On Stocks Blog