Cadence Pharmaceuticals: The Ofirmev Launch Has Gained Traction (CADX, $2.72)

Cadence Pharmaceuticals: The Ofirmev Launch is Gaining Traction (CADX, $xx)

Investment Thesis

I believe that Ofirmev, an intravenous formulation of acetaminophen, has significant potential as an alternative to intravenous opioids and non-steroidal anti-inflammatories analgesics that are used broadly in the hospital. This potential is well illustrated by its launch in the UK where it is branded as Perfalgan. In its first year of introduction Ofirmev/ Perfalgan captured 2% of the UK injectable analgesic market. By 2009 it had captured 35% of the UK market with 75% of its use being in combination with opioids, the therapeutic objective being to reduce opioid consumption. In 1Q, 2012, Ofirmev just one year after its introduction captured 1.41% of the US injectable analgesic market. If it follows the same rate of penetration in the US as that in the UK, by 2017 it would reach sales of around $600 million.

Cadence has been a poor performer over the last nine months as the Ofirmev launch that began in January of 2011 was slower than expected by both investors and management. This resulted in management having to raise $77 million in 4Q, 2011 to maintain sufficient capital to get through the launch period with an adequate cash balance. The company was also forced to restructure to reduce costs. Both of these moves were alarming to investors and contributed to significant pressure on the stock.

During the first quarter conference call, Cadence issued guidance for 2Q, 2012 sales that was disappointing relative to expectations and added to concern about the Ofirmev launch and resulted in further pressure on the stock. My analysis suggests that management guidance of $10.0 to $10.5 million for Ofirmev sales in 2Q, 2012 is conservative and I am projecting a range of $10.5 million to $11.1 million. I think that if I am right and 2Q Ofirmev sales surprise on the upside, it could trigger a round of upward revisions in sales estimates for 2012 and beyond. This could be the catalyst for renewing investor confidence that Ofirmev has the potential to be a major product and result in a sustained upward move in the stock. I recommend purchase at these levels.

My specific sales estimates for Ofirmev project 2Q, 2012 sales of $11.1 million, 3Q of $14.7 million and 4Q of $18.8 million. This would result in full year 2012 sales of $52.7 million which compares to $11.5 million in FY 2011. Interestingly, my 2Q, 2012 sales estimate equals sales achieved in all of fiscal 2011. The annualized run rate by the end of the year could reach $75.3 million by my estimates. I think that the rubber is hitting the road with the Ofirmev launch.

Metrics for Gaging Ofirmev’s Growth

In 1Q, 2012, 2,700 hospital accounts had placed as least one order for Ofirmev, a 20% sequential increase from 4Q, 2011. Originally, Cadence had targeted a universe of 1,700 accounts so that hospital penetration is going significantly better than expected. Approximately 2000 accounts or 75% of active customers placed multiple orders; this was a 26% sequential increase. This was despite a product recall in January that caused a supply disruption that may have had a negative impact on orders shipped. Another important metric, the average order size, increased sequentially by 16% in the first quarter.

Given this already high penetration, the rate of increase in the number of new accounts placing orders is likely to slow in the future. Ofirmev now has broad reach within the hospital so that the key to growth lies in improving “same store” sales through increasing the number of patients being treated and the number of doses they receive. Currently, it is estimated that the doses per patient are about 2.0 to 2.5, but the potential is believed to be on the order of 4.0 to 6.0.

The sales process within the hospital following formulary approval begins with the anesthesiologist who is usually the first physician specialist to adopt Ofirmev; this is the Cadence sales rep’s initial focuses. Promotion next expands to surgical specialties and emphasizes colorectal and bariatric surgeons who tend to be treat patients’ pain for a longer period of time. The progression from anesthesiologist through surgeons and staff leads to more vials consumed per patient. The anesthesiologist is usually responsible for the first dose that is given during or after surgery. Then surgery and hospital staff accounts for the second, third and fourth doses as the patient progresses through the recovery room and onto the general floors.

Hospital Adoption Issues were Initially a Stumbling Block

Acetaminophen in an oral dosage form is used everywhere in the hospital because of its safety and efficacy, but until Ofirmev there has been no intravenous version because formulation issues that made it difficult to keep acetaminophen in solution. Ofirmev is the first and only successful intravenous formulation of acetaminophen after 60 years of unsuccessful development efforts by the pharmaceutical industry. If fills a significant unmet need in the hospital.

Patients in the operative and post-operative settings often are not able to swallow a pill and even if they can swallow, absorption from the gastrointestinal tract can be poor making the oral dosage form ineffective. Such patients have been treated with IV non-steroidal anti-inflammatories and opioids, but these products have issues. The NSAIDS cause gastrointestinal bleeding and carry a black box warning. The opioids cause constipation, sedation, nausea, vomiting, respiratory depression, cognitive impairment and headache. The general determinant of when a surgical patient can leave the hospital is when they can move their bowels so that reducing opioid consumption can lead to less constipation and shorter hospital stays. Also, opioids negatively affect the functioning and mobility of patients making care more difficult for the nursing staff.

Ofirmev is an easy sell to doctors and nurses and the thinking of the company and investors was that this would result in a quick launch. However, the initial ramp in sales was disappointing. During the first three quarters of introduction over the January to September 2011 period, there was a large bolus of formulary approvals. However, this did not translate into immediate demand because of unexpected bureaucratic delays in implementing the formulary approvals. Beyond the formulary process, there were additional committees involved in determining how the product would be used in the hospital; these created bureaucratic delays. Cadence feels this issue has run its course.

The pharmacist proved to be a high and unexpected hurdle to broad adoption in the hospital. They bear responsibility for the pharmacy budget and feared that the ubiquitous use of oral acetaminophen at a penny per pill would be replaced by vials of Ofirmev costing $10 per vial. After all, many hospital patients have an IV line and it is almost as easy to connect Ofirmev to that line as to give a pill. They were narrowly focused on this potential cost issue for the pharmacy and were not balancing this against the potential positive effect on overall costs due to improved safety, shorter hospital stays and reduction in opioid use.

The initial demand from physicians was sometimes purposely blunted by pharmacists who were afraid that it would bust their pharmacy budget. In some cases, a tactic used was to stock Ofirmev in the central pharmacy. In order for the physician to use Ofirmev, it had to travel from the central pharmacy to the point of care and a surgeon was not willing to wait for ten to twenty minutes to get Ofirmev to the surgical floor.

Cadence has focused its marketing efforts throughout the hospital to educate all personnel on the cost and medical advantages of Ofirmev over opioids and NSAIDS. It has made a special effort to convince pharmacists that the product will only be promoted for use in the operative and post-operative setting to replace IV opioids and NSAIDs. This is easing the concern that many oral doses of acetaminophen will be switched to Ofirmev. The sales force is also working with surgeons to stock Ofirmev in the operating room or in the satellite pharmacy on the surgical floor.

Hospital Analgesic Market Trends

The overall hospital injectable analgesic market experienced an 11% decline in vials shipped in 1Q, 2012 versus 4Q, 2011. Cadence believes that this resulted from a combination of factors starting with a 4% decline in the overall surgical procedures. The first quarter is always the weakest of the year for all hospital products as I show later in this report. There are also issues of patients switching healthcare plans that sometimes result in delays in surgeries as they come to grips with coverage and deductible issue differences. The slow economy and persistent high unemployment also played a role.

There have been a number of shortages of the IV morphine and fentanyl opioids and the NSAID ketorolac over the last six to nine month. This has been both supplier-specific and region-specific. This has contributed to lower volumes of vial shipments. However, this may have been offset to some degree by splitting large dose vials. These shortages may continue and this can only help Ofirmev.

Despite these broad market issues, the vial shipments of Ofirmev increased 37%. It increased market share from 0.94% to 1.41%. As a side note, Ofirmev (called Perfalgan) in the UK obtained a 35% market share of injectable analgesics in the UK in 2009 following a 2004 launch. In the UK 75% of its usage is in combination with opioids to reduce the use of opioids.

Judging the Seasonal Effects in the Hospital Market

I recently completed a major study on antibiotics used primarily in the hospital. Cubicin is the most successful new product launch in the last ten years. I looked at how Cubicin sales, early in their launch phase, behaved sequentially from the fourth quarter of a year to the fourth quarter of the following year. This is shown below:

|

Table 1: Cubicin Sales In Early Launch Phase ($millions) |

|||||

|

2003 |

2004 |

2005 |

2006 |

2007 |

|

|

1Q |

6.3 |

21.0 |

37.3 |

57.5 |

|

|

2Q |

13.3 |

25.6 |

45.6 |

68.3 |

|

|

3Q |

18.0 |

30.3 |

50.3 |

75.4 |

|

|

4Q |

1.7 |

21.0 |

36.6 |

56.3 |

83.3 |

|

Source: Cubist financial reports |

|||||

This table shows very clearly the seasonal pattern of sales experienced by Cubicin. The sequential change from 4Q to 1Q of the following year in the above table was 0.0% in the 2005, 1.9% in 2006 and 2.1% in 2007. This was followed by a bounce back in 2Q sales in every case which were 22%, 23% and 19% respectively. The Cubicin numbers demonstrate the historical seasonal slowness in the first quarter.

Ofirmev behaved differently and more strongly in that 1Q, 2012 sales increased by 36% sequentially. Cadence’s guidance calls for a 30% increase in 2Q, 2012 sales on Ofirmev over 1Q, 2012 which is roughly consistent with the Cubicin sales trend.

Cubicin is an intravenous antibiotic that is used for severe infections and was priced initially at $150 per dose versus $10 for Ofirmev. They have significantly different product and market characteristics so that drawing comparisons between them may be misleading. However, this data, such as it is, implies that Ofirmev may be on a faster trajectory than Cubicin experienced and that Cadence’s guidance for 2Q, 2012 which are in line with the Cubicin experience may be too conservative.

Cadence Sales Guidance for 2Q, 2012 Appears Conservative

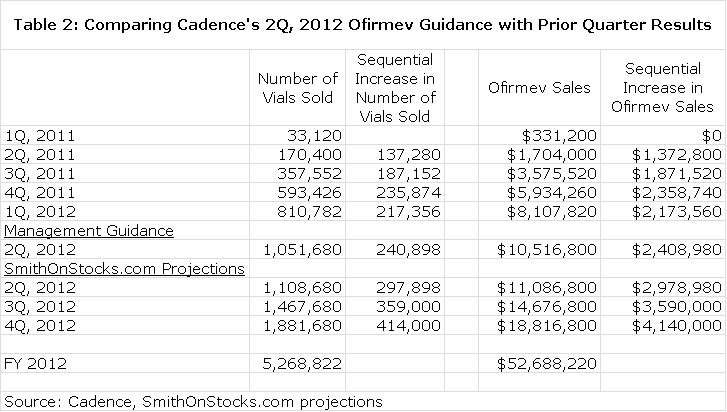

Cadence issued guidance that 2Q, 2010 sales of Ofirmev could fall between $10.0 million and $10.4 million. This represents a $2.0 to $2.4 million increase over the $8.0 million reported in 1Q, 2012. Each vial of Ofirmev has a net price of $10.00 so this implies a sequential increase of 200,000 to 240,000 vials sold in 2Q, 2012 versus 1Q, 2012. I looked at the performance of quarterly sales over the brief marketing history of the company to see how guidance compares with past quarterly sequential increases.

The guidance given by Cadence assumes roughly the same sequential increase in number of vials sold that was achieved in 4Q, 2011 and slightly more than 1Q, 2012. Intuitively, this guidance seems conservative. Broad reach in the targeted hospital base has been achieved and most of the metrics used to measure “same store” sales growth suggest strong “same store sales” growth. As I previously demonstrated, there is seasonality in the hospital business that suggests a strong resurgence in 2Q, 2012. Finally, if a parallel is drawn with UK experience, the market share of 1.41% is very low relative to peak potential.

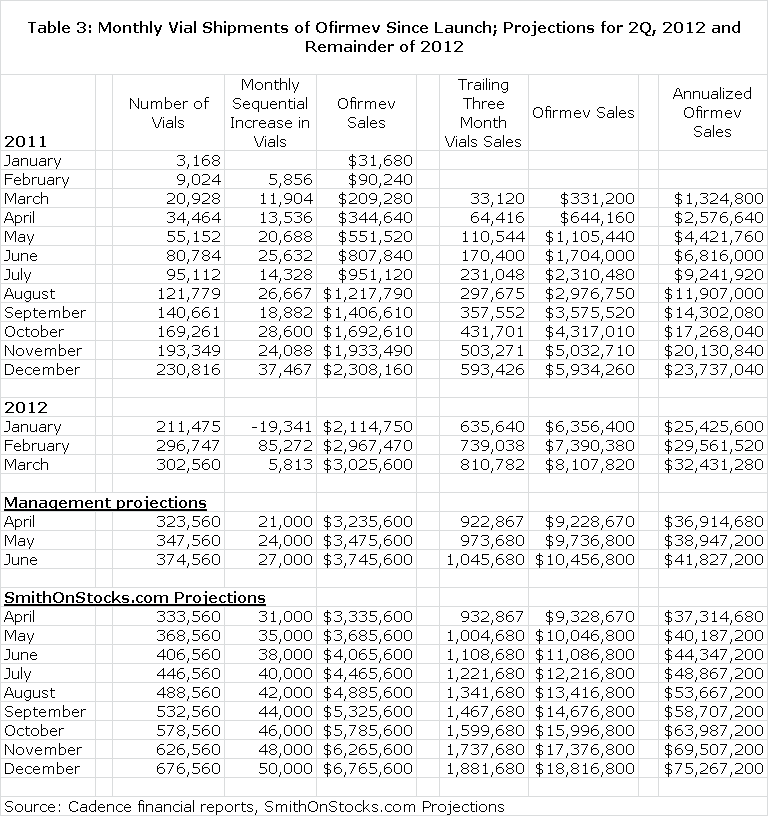

Cadence is very transparent in releasing monthly vial sales. It has been my experience that companies that are confident in sales growth tend to be more transparent. I have included the following table showing monthly vial sales since the launch in January of 2011 through March 2012. In this table, I have then included projections of vial sales that are consistent with management guidance for 2Q, 2012. I next included my estimates for vial sales for the remainder of 2012. I would caution that there is no precise way of predicting monthly vial sales at this early point in the launch. It is a matter of considering all of the variables and making an educated guess. All of this is shown below.

My specific sales estimates for Ofirmev project 2Q, 2012 sales of $11.1 million, 3Q of $14.7 million and 4Q of $18.8 million. This would result in full year 2012 sales of $52.7 million which compares to $11.5 million in FY 2011. Interestingly, my 2Q, 2012 sales estimate equals sales achieved in all of fiscal 2011. The annualized run rate by the end of the year could reach $75.3 million by my estimates. I think that the rubber is hitting the road with the Ofirmev launch.

Disclosure: The author of this article owned shares of Cadence Pharmaceuticals at the time this note was written. This should be taken into account as it may introduce bias into the conclusions and interpretations that are made. In reading this note, you acknowledge that you have not used it as the sole basis of your decision making and that all investment decisions are based on your own analysis. An investment in Cadence Pharmaceuticals carries substantial risk and investors could potentially much of their investment. The reader acknowledges that he/she has carefully read the Investment Approach, Terms/Conditions and Disclosures sections in the About Us section of the website. The reader acknowledges that he/she will not hold SmithOnStocks accountable for any investment loss that may be incurred if a decision is made to invest in Cadence Pharmaceuticals.

Tagged as Cadence Pharmaceuticals + Categorized as Company Reports