Antares: The Future Looks Really, Really Bright (ATRS, Buy, $4.18)

Investment Thinking

The fourth quarter conference call was very encouraging to me. The investment thesis is coming together much better and faster than I had hoped a year or so ago. Total sales for 2020 increased by 21%% to $149.6 million and the Company is guiding to a 17 to 33% increase in 2021 to $175 to $200 million. The upper end of this range assumes that the AB rated generic to Forteo is approved in 2Q, 2021. For the first time in its history Antares was profitable on a full year basis as non-GAAP net income was $9.9 million and non-GAAP EPS reached $.06. This excludes a non-recurring tax benefit of $46.3 million recorded in the fourth quarter. Note that a tax loss-carry forward offsets taxes due.

I have constructed a sales and earnings model based on the assumption that the AB rated generic to Forteo is approved shortly. My sales estimate for 2021 is $201 million (up 35%) and for 2022 is $259 million (up 29%). My fully diluted EPS estimate for 2021 is $0.21 and for 2022 is $0.38. Note that tax loss carry forwards will offset taxes due so these are untaxed EPS. Antares will probably start paying taxes in 2023.

The price/ earnings ratios for 2021 and 2022 are 20x and 11x. If we assume that Antares paid a 25% tax rate in those years, the P/E ratios would be 27X and 15x. I do expect that ATRS will pay taxes starting in 2023. The current market capitalization is $711 million and the market capitalization to sales ratio for 2021 is 3.6x and for 2022 is 2.8x. These valuation metrics are very low within the biopharma universe and especially so given my expectation of very strong growth.

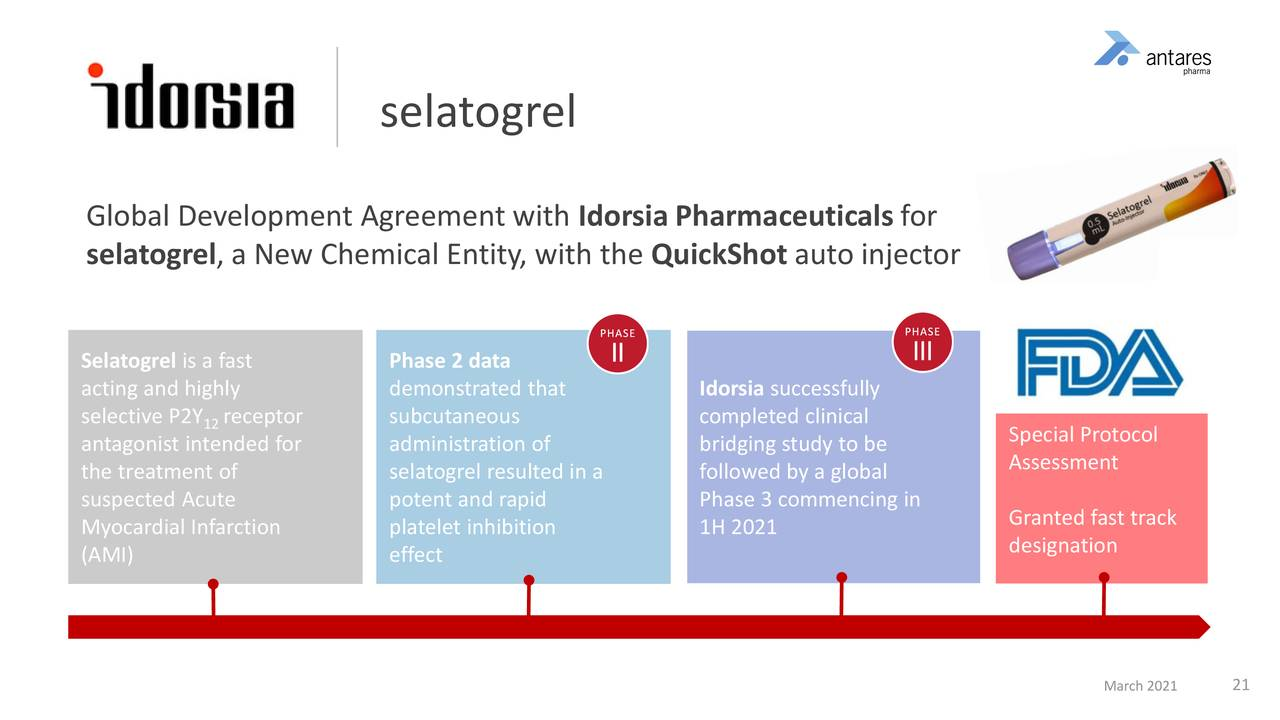

I think that the pipeline prospects are simply outstanding. I am particularly excited about the Antares partnership with Idorsia for the commercialization of selatogrel. Both companies believe that peak sales could reach $5 billion on which Antares will receive a 10+% royalty which on $5 billion of sales would be $500 million which is essentially pretax income. The company will also achieve profit from selling the finished product to Idorsia. This product is just entering phase 3 with approval possible in 2024. Antares’s CEO has called this product transformational for his company and I agree.

Antares also has a partnership with Pfizer on a product which has not yet been disclosed for competitive reasons. However, my thinking is that Pfizer would not develop a product with less than $1 billion of sales potential given its size. Antares will receive a 10+% royalty on sales so that every $1 billion of sales translates into about $100 million of pretax income. Pfizer plans to file an NDA later this year so there is a potential for approval in late 2022.

Antares plans to file INDs on two internally developed products which it hopes to be the next Xyosteds. One might be approved in 2022 and the other in 2023. The products have not been disclosed.

Antares is also looking to expand its commercial footprint through business development. In line with this, it reached an agreement to license Nocdurna in the U.S. from Ferring Pharmaceuticals.

I think that this stock could double in 2021.

Xyosted

I cannot say enough about how well Antares has marketed Xyosted over the last year. When the COVID pandemic started I thought “oh no”. Here was this small, unknown company trying to introduce its first significant product into a totally unsettled marketplace in which patients were afraid to make office visits and in the initial phase of the pandemic, many doctor’s offices were closed. Antares swung quickly and smoothly toward broader use of virtual detailing. Their execution can only be labeled as brilliant as judged by the following results.

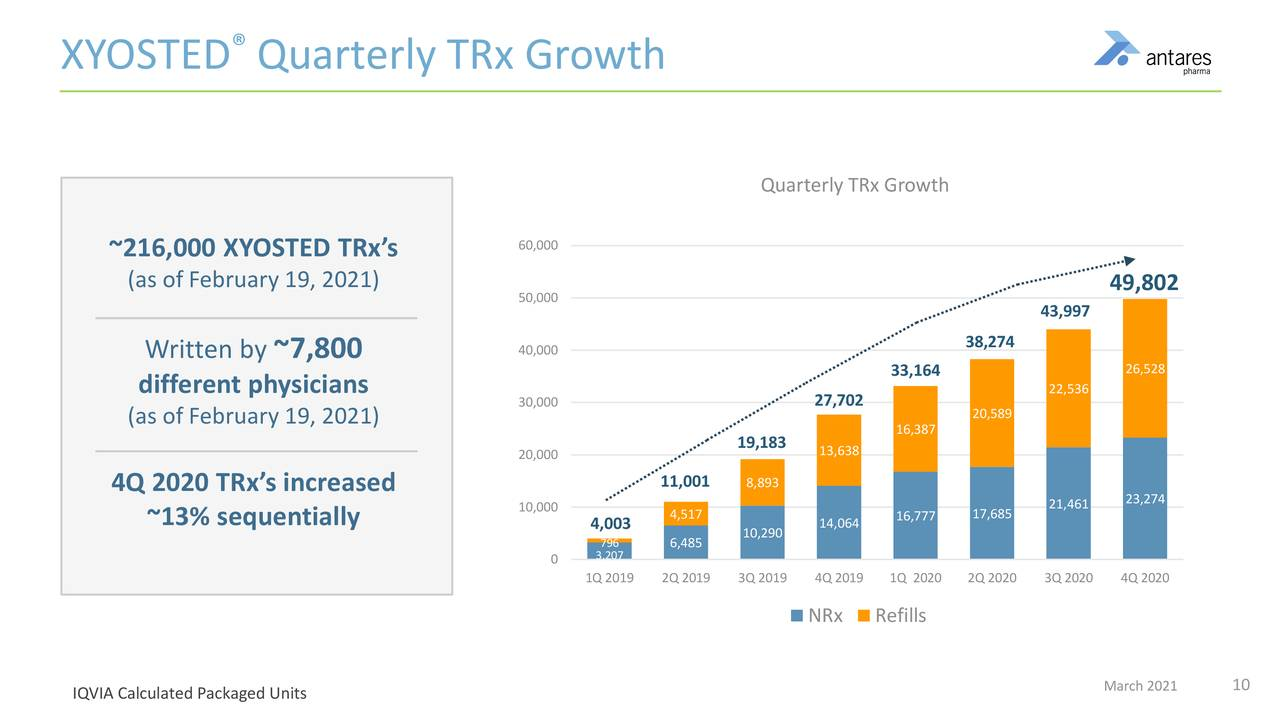

- 2020 full year sales increased 124% to $46.6 million

- 2020 full year total prescriptions written increased 167% to 165,000

- 4Q, 2020 sales increased 71% to $14.4 million.

- 4Q, 2020 total prescriptions increased 80% to 49.8 thousand

- 4Q, 2020 sales increased sequentially over 3Q, 2020 by 17%.

- 4Q, 2020 total prescriptions increased sequentially over 3Q, 2020 by 13%

If someone would have suggested last spring that Xyosted would perform like this in 2020, I would have been incredulous. This performance convinces me that the physician marketplace is coming to believe that that it is the best of the injectable testosterone products. It also tells me that Antares has constructed an extremely effective sales and marketing organization. The outlook in 2021 is extremely promising as Antares builds on the momentum of 2020. It is is probable that patient visits to doctors offices will increase meaningfully in 2021. Currently patient visits are down around 50% from pre-pandemic levels. In addition, Xyosted has the important attribute that a patient can self-administer the drug safely and painlessly at home. Most other testosterone products require a weekly visit to the doctor’s office to receive a more painful intramuscular injection. This is a major draw for patients who want to minimize physician office visits. I am currently projecting 2021 sales at $81.2 million, a 74% increase, and 2022 at $113.8 million, up 40%

There is no doubt in my mind that Xyosted reached a tipping point in 2020 and is poised for very strong growth in 2021 and beyond. Street consensus has generally projected peak sales at $200 million, but I think this could be low. In 2020, there were 5.6 million prescriptions written for injectable products. After discounts and rebates, Antares receives about $260 per prescription. At these prices, the addressable market in the US is $1.5 billion. If I annualize 4Q, 2020 total prescriptions for Xyosted, I calculate that the current annual run rate is 199,200 total prescriptions which translates into a market share of just 3.6% of the injectable testosterone market.

Given the early trends seen with Xyosted, it seems clear that the market is coming to view Xyosted as clearly the best injectable testosterone product in the market. Most competitive products are given intramuscularly (more painful than sub cu) and must be given in a physician’s office. It has truly outstanding pharmacokinetics relative to competitive products as determined by being able to maintain stable blood levels during treatment. The $200 million of peak sales corresponds to about 13% of the injectable testosterone market. However, it seems reasonable given the success of the early launch to look for perhaps 20% or more of the market which suggests peak sales of $300 million or more.

AB Rated Generics to EpiPen and Forteo

EpiPen

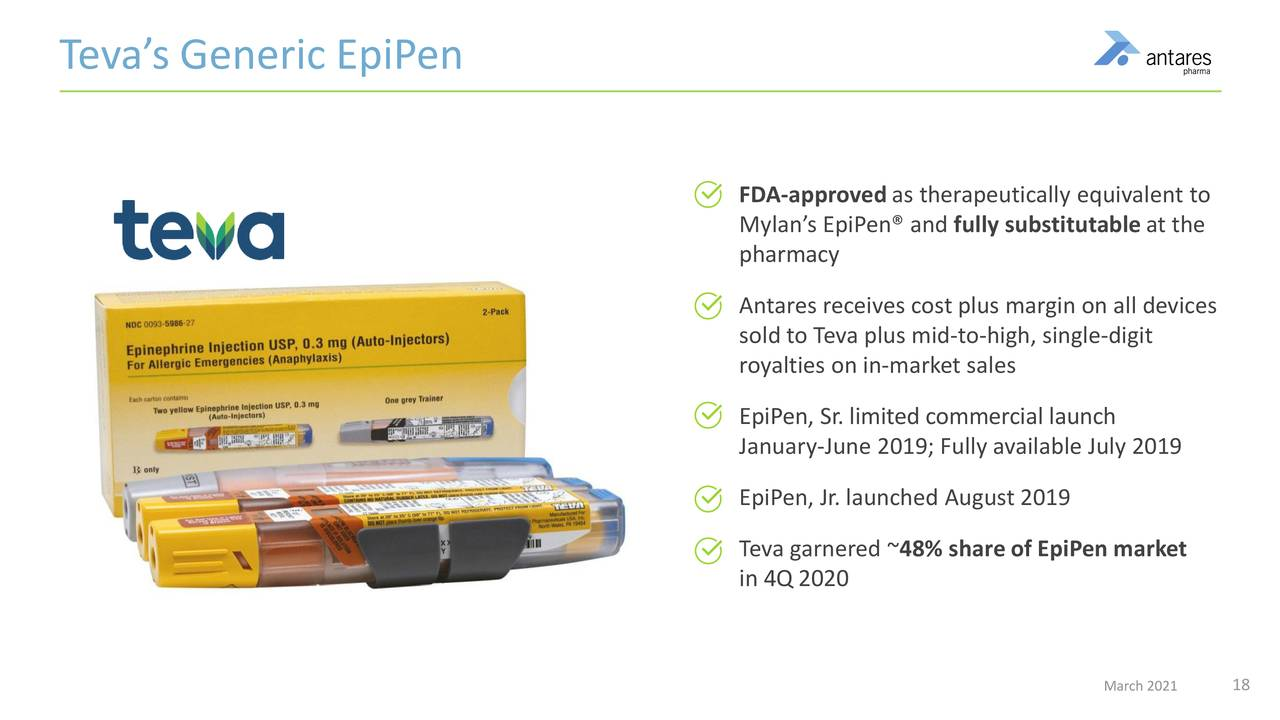

In the current product mix, two partnered products should be quite important to results in 2021 and 2022. These are the AB rated generics to EpiPen and Forteo. The AB rating means that even if a physician writes a prescription for EpiPen or Forteo, it can be filled with Teva’s generic product. Teva has done a tremendous job since its product was approved in August 2018. They have reached a 50% market share overtaking Mylan, the product innovator which previously had a monopoly and is the only other product in the market. Last year’s total prescriptions for both EpiPen products fell nearly 20% as the pandemic unwound. I am expecting a strong rebound in in 2021. In 2020, EpiPen contributed $50 million of sales to Antares; I estimate that royalties were $18 million and sales of finished product to Teva were $32 million.

A new and unexpected driver of 2021 sales is that EpiPen is being stocked at COVID vaccination locations in the event that the shot causes an anaphylactic reaction. This should have a major impact on 1Q and 2Q sales of EpiPen and then wane as the rate of vaccinations declines in 2H, 2021.

Forteo

We have been waiting for the approval of AB rated Forteo seemingly forever. Teva has said that approval could be anytime. Forteo could be as meaningful as EpiPen. Antares has issued guidance that 2021 total sales could increase 17% to $175 million if Forteo is not approved this year and 34% to $200 million if it is approved. This implies that it could contribute perhaps $25 million in 2021 if approved shortly. With a full year of marketing in 2022, total sales might reach $50 million comparable to EpiPen

One important point to understand about AB rated generics is that they quickly reach maximum penetration of the market and sales potential and then flatten or decline. Hence their effect is short term. By 2023, combined sales of these two products could flatten.

Pipeline of Partnered Products

As positive as I am about near term products, I am more excited about the pipeline. I have heard some investors say on conference calls that Antares doesn’t have a pipeline. Perhaps this is because the next two internally developed products ATR-1901 and ATRS-1902 are filing INDs in 2021. However, this conclusion misses the mark. After reading my comments on selatogrel (partnered with Idorsia) and a still undisclosed product being developed with Pfizer, in reality Antares has one of the most exciting pipelines in all of biopharma.

Selatogrel (Developed by Idorsia)

Antares is truly excited about selatogrel and so am I. This is a drug that has just started a phase 3 trial in which Antares provides the finished product to Idorsia in a subcu injection, rescue device. This product is designed to be carried by people at risk of a heart attack. If they sense a heart attack beginning, they would self-administer the drug to prevent blood clots from forming in the coronary arteries. It is in essence an EpiPen for heart attacks.

At the recent Cowen conference, Antares’ CEO Bob Apple commented that selatogrel has peak sales potential of $5 billion. Antares receives a modest profit margin on providing the finished product, but more importantly receives a sales adjusted royalty of up to low double digits as sales increase. The probability for success in the phase 3 trial is quite good based on encouraging phase 2 results. If the phase 3 is successful, this drug could be approved in 2024. Peak sales of $5 billion could occur by 2030 and the royalty received by Antares at a 10+% rate would be $500+ million. There are no offsetting costs so this $500 million would drop straight to pretax income. At a tax rate of 25%, this would represent EPS of $2.19.

Undisclosed Pfizer Drug

Pfizer is developing a product in conjunction with Antares. Like Idorsia’s selatogrel, Antares is providing the finished product in an injection device that is given subcu. The royalty structure is much the same as for selatogrel. We know nothing about this product other than it is a rescue pen like that used with selatogrel and the AB rated generic to EpiPen. Pfizer will file an NDA on this product in 2021. So what kind of takeaway is there? I would say this. Pfizer probably has to see at least $1 billion of sales potential to develop a new product given the size of the Company. If we assume that the product is approved in 2022 and reaches peak sales in 2028. Every $1 billion of sales leads to royalties of $100+ million and at a tax rate of 25%, this would represent EPS of $0.44. We should learn more about this drug later this year as Pfizer files its NDA.

Products Being Developed for Antares” Own Account

Antares is aiming for the next Xyosteds with two internally developed drugs. ATRS-1901 is a weekly formulation that uses an auto injector like Xyosted. Details of the product have not been released other than to say that it is targeted at the urology/ oncology space and that it is a once weekly injectable that is intended to be a vast improvement over the currently available oral dosage formulation. They are on track to file the IND for ATRS-1901 in the first half of this year and point toward a possible approval in 2024 .ATRS 1902 is an endocrinology asset rescue pen. Again, Antares has not disclosed what this product is. The IND filing is likely in 2H, 2021 and approval is possible in 2022.

Specialty Sales Component Is Still a Another Dimension to the Story

Another important element to the Antares story is the potential that comes from having an effective commercial sales force as is demonstrated by the success with Xyosted. This allows the company to acquire products from other companies to sell with its the existing sales force. With the sales force and marketing structure in place there are modest incremental costs associated with marketing so that most of gross profits drop straight to pretax. We have seen many specialty pharmaceutical companies leverage their sales forces effectively in this way to create large and highly successful commercial enterprises. Antares will also follow this path. It has just acquired Nocdurna from Ferring which achieved only limited sales with the product. Antares is relaunching the product now.

Financial Issues

The weakness of the Antares story for several years has been a strained financial condition characterized by a modest cash balance and operating at a loss. In 2020, it turned cash flow positive with a non-GAPP EBITDA of $21.3 million which compares to a loss of $10.6 million in 2019. Given the strong growth expected from Xyosted and the contribution of the AB rated generic to EpiPen and potentially form the AB rated generic to Forteo, I would expect good positive cash flow in 2021. Antares now has $51 million of cash on its balance sheet.

Sales Model for 2021 and 2022

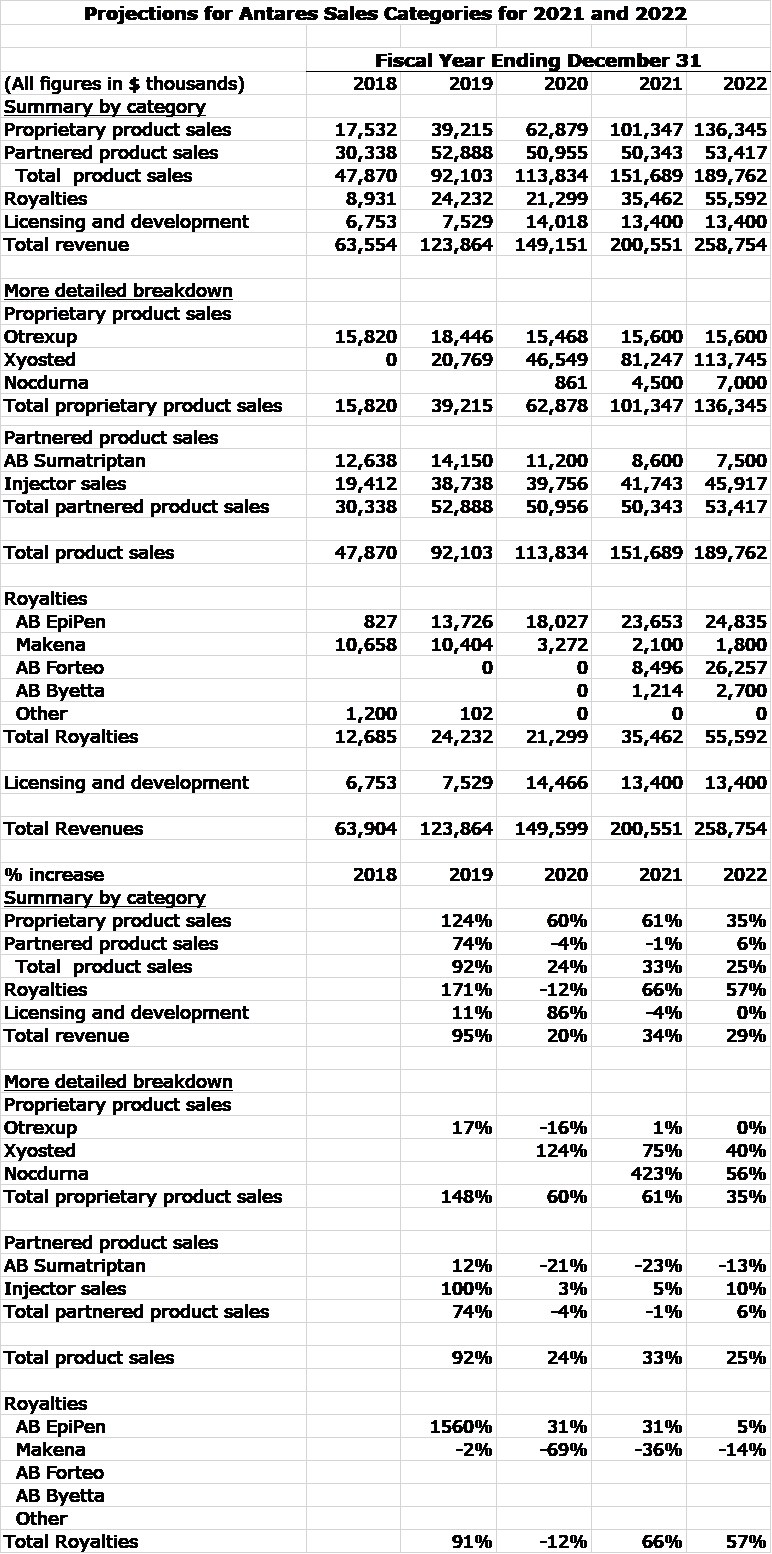

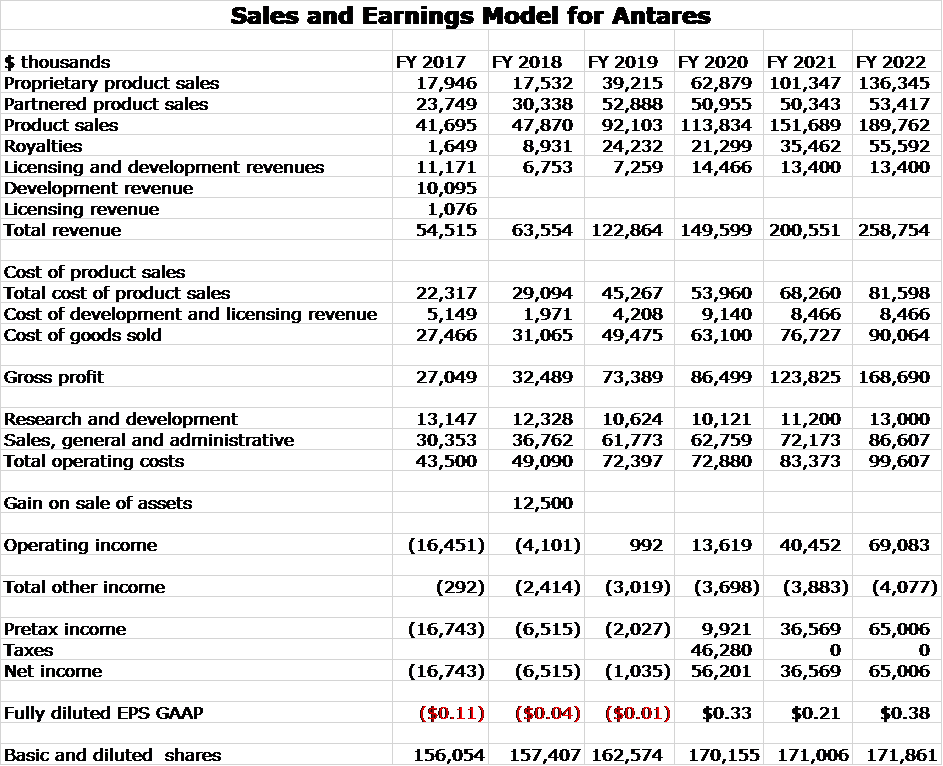

Antares reports sales in four categories and has a complicated sales mix. The four categories are proprietary products, partnered products, royalties and licensing and development. In the following table, I try to break these areas down further. The Company does provide sales data for Otrexup and Xyosted. The other numbers are my own estimates. I hope this gives a somewhat clearer picture as to what is driving sales.

My 2021 sales estimate assumes that Forteo is approved in 2Q, 2021. My resultant sales estimate for 2021 is $201 million. Antares has provided guidance that sales will reach $175 to 200 million in 2021. The upper end of the range assumes that Forteo will be approved in 2021.

The following table summarizes my preliminary thinking on profits that could result if these sales estimates are achieved. The Company has not given much guidance on costs do the profit numbers should be viewed as preliminary.

I listened to the fourth quarter conference call and comments made at some recent brokerage conferences, The following sections summarize in bullet points my key takeaways.

Full Year and Fourth Quarter Results

- Full-year 2020 revenues were $149.6 million, a year over year increase of 21%. This beat Street estimates and came in at the very top end of the revenue guidance range for the year

- 4Q, 2020 revenues increased 17% to $44.1 million.

- Full-year 2021 revenue guidance is $175 million to $200 million, which represents 17% to 34% increase. The upper end of this range assumes near term approval of the AB rated generic to Forteo. The low end assumes no approval. Teva has signaled that approval is imminent, but they were also optimistic at this time a year ago.

- Xyosted and the AB rated generic to EpiPen were the big drivers of growth.

- Xyosted sales were $46.6 million for the full year, up 124% and 4Q, 2020 revenues were $14.4 million up 71% year over year and 17 % sequentially for 3Q, 2020

- Teva's EpiPen achieved over $50 million in revenue in 2021 and increased 46% from 2019. This combines both device sales and royalties.

- Net income was $56.2 million for the full-year. A credit of $46.3 million was recorded in 4Q, 2020 as it was determined that Antares would achieve enough future profitability to utilize tax loss carry forwards. This resulted in $0.28 per diluted share.

- Excluding the tax benefit, net income was $5.1 million for 2020 and fully diluted EPS were $0.05.

- Antares generated $21.3 million in cash from operations in 2020 as compared to using $10.6 million of cash in 2019, a $31.9 million reversal.

- December 31, 2020, cash and cash equivalents were $53.1 million.

Xyosted

- Total prescriptions in 2020 for Xyosted were 165,237, up 76% in 4Q, 2020 they were 49,802, up 80%.

- 4Q, 2020 prescriptions were up 13% sequentially from 3Q, 2020.

- The fourth quarter was particularly challenging due to the pandemic as in-person calls to targeted customers, occurred on average only about 50% of the time.

- Virtual detailing was able to offset the lessened ability to make in-person calls. It was critical when access to offices and providers was hampered due to the pandemic.

- Virtual detailing continued to be key in 4Q, 2020 as the COVID spike resulted in a reduction in in-person calls and patient visits relative to 3Q, 2020.

- The combination of an effective sales force, the attractive pharmacokinetic profile and the safety and convenience of at-home administration have been instrumental to the success of Xyosted.

- Momentum continues to be strong as January 2021 was the second strongest month for Xyosted prescriptions and follows on a very strong December.

- Antares believes that in-person, face-to-face interaction with customers is still the most effective way to sell. The hope is that as the year evolves, they will have more face-to-face interactions.

- The most important factor for Xyosted growth is patients coming back into the doctors' offices. Obviously, this is nowhere close to where it was before the pandemic.

- Physicians of all practices are indicating that patient visits are down 25% to 50%, because of the pandemic. There should be a significant uplift if and when the pandemic starts to wane.

- While virtual detailing was effective in 2020, Antares believes that sales would have been much higher had it not been for the sharp decline in patient visits. Antares is hoping that the rollout of the vaccines will start bringing back visits to more normal levels.

- The average price per prescription after discounts is $260 to $270. This is about a 50% gross to net deduction. This should be consistent going forward.

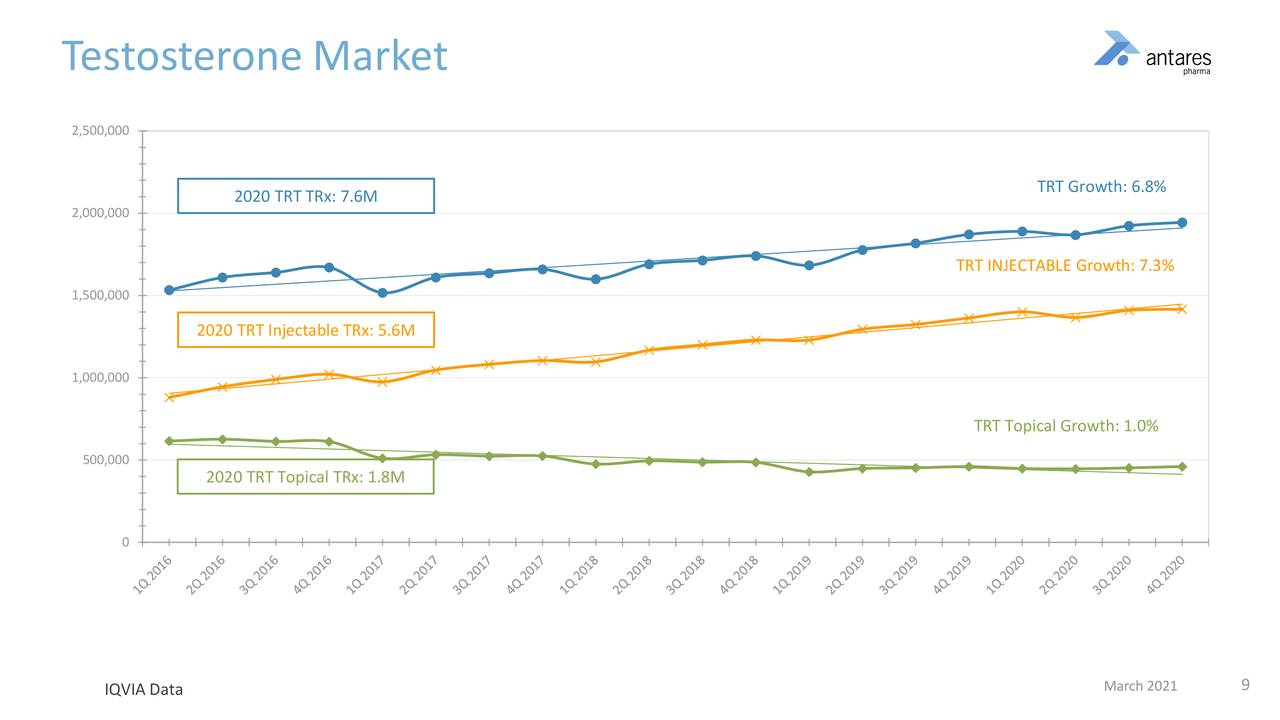

The testosterone market is approximately 7.6 million total prescriptions, primarily led by injectables which comprise account for 5.6 million total prescriptions or 74% of the market. Injectables have grown at 7.3% per annum since 2016 but flattened out in 2020. Most of the injectable products are generic products which are given as IM injections and require an in-office visit.

At the Xyosted price of $260+ per prescription, the 5.6 million total prescriptions for injectable testosterone products represents aa addressable market of $1.4 billion. The appeal of Xyosted versus the cheaper generics is its superior pharmacokinetic profile, ease of administration and not requiring an office visit for administration. The next image shows trends in the testosterone market since 2016.

Xyosted has shown consistent and impressive total prescription growth since its introduction in 4Q, 2019. If we annualize 4Q, 2020 prescriptions of 49,800 to 199,200, based on 4Q, run rate, it has a still very small part of the 5.6 million market, i.e. 3.6%. It seems possible that it could climb to 20% or more so it has a long way to go.

AB Rated Generic to EpiPen Marketed by Teva

- The pandemic led to challenges throughout 2020 and especially in the very important third quarter back-to-school season, which historically is the strongest EpiPen quarter.

- Teva has achieved a market share in exess of 50%.

- Antares anticipates that COVID-19 vaccinations will provide an atypical and temporary boost in demand in EpiPen in 1Q and 2Q, 2021 due to the risk (albeit low) of an allergic reaction to the vaccine in some patients.

- The large vaccination sites and other locations that aren't typically attached to a pharmacy stocking of EpiPen are now doing so in case patients have an allergic reaction to the vaccine.

- This has led to a pretty significant increase in sales through January that is expected to continue for the first two quarters.

- Because of this 1Q, 2021 and 2Q, 2021 should be exceptionally strong. The extent hasn’t been quantified. As the vaccinations wind down so will this effect. It is a temporary impact.

- They are hoping regular or full back-to-school quarter this year, in 2021, with the pandemic, hopefully being behind most parts of the US by September.

- Last year, there was about a 20% decrease in the market, because of the pandemic.

The next image highlights some key aspects of the AB rated generic to EpiPen.

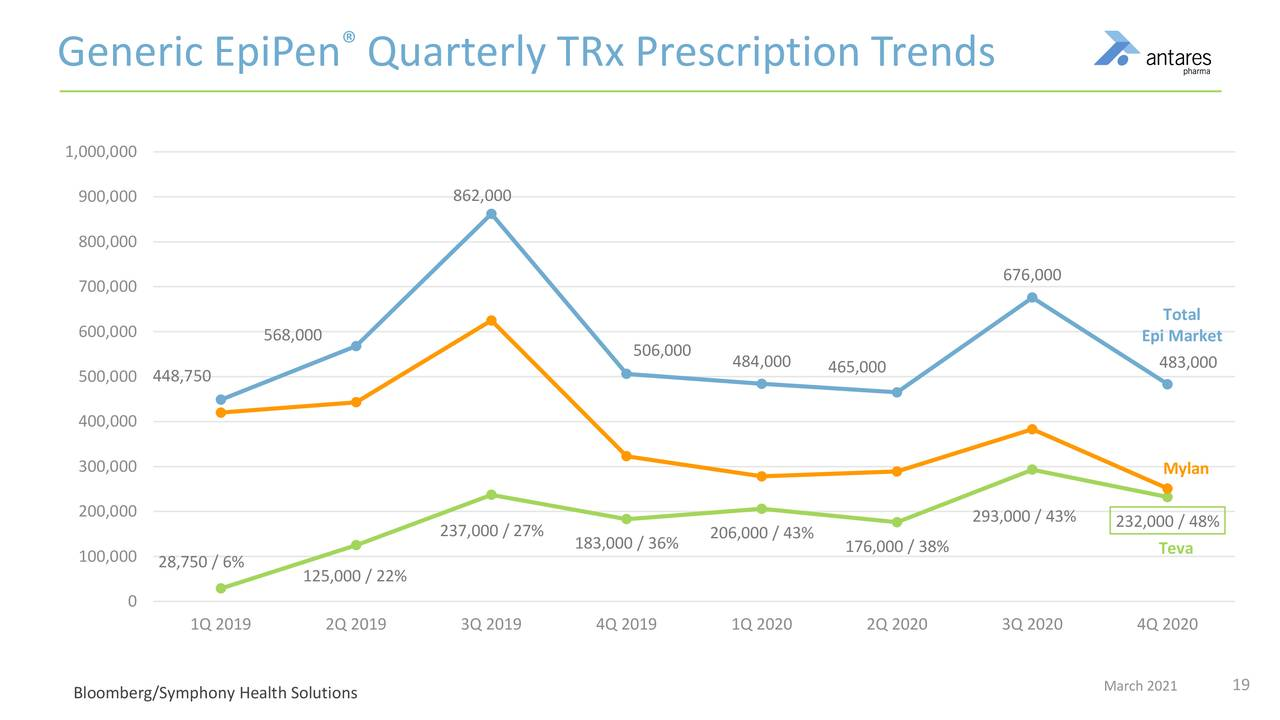

Prescription trends for the EpiPen market are shown in the next table. Note that in 3Q, 2020 total market prescriptions dropped over 40%. Also note that Teva’s market share has increased to over 50% currently from 43% in 3Q, 2020.

Teva’s AB Rated Generic to Forteo

- Teva expects approval of Forteo at any time. Unfortunately, with ANDAs, there are no real timelines that FDA has to follow. There are PDUFA-like dates, but they are not enforceable so that it's really up to the FDA as to when approve the product.

- I estimate that it the AB rated generic to Forteo is a comparable or bigger opportunity to AB rated generic to Epi Pen. In 2020, Antares stated that EpiPen produced $50 million of revenues, I estimate that $18 million stemmed from royalties and $32 million from device sales.

- This product is fully substitutable for Eli Lilly’s branded product Forteo. If doctor writes a Forteo prescription, the AB rated product can be used to fill it

- Teva will immediately ship upon approval.

- Teva launched generic Forteo in 11 European countries, Canada and Israel in 2020, but the more significant opportunity remains in the U.S.

- This AB rated product has first-to-file status so that Teva will have at least six months of exclusivity.

This image provides details on Forteo.

AB Rated Generic to Byetta

- Teva also expects approval of the AB rated generic to Byetta in 2021.

- It is a very small product

Pipeline of Internally Developed Products

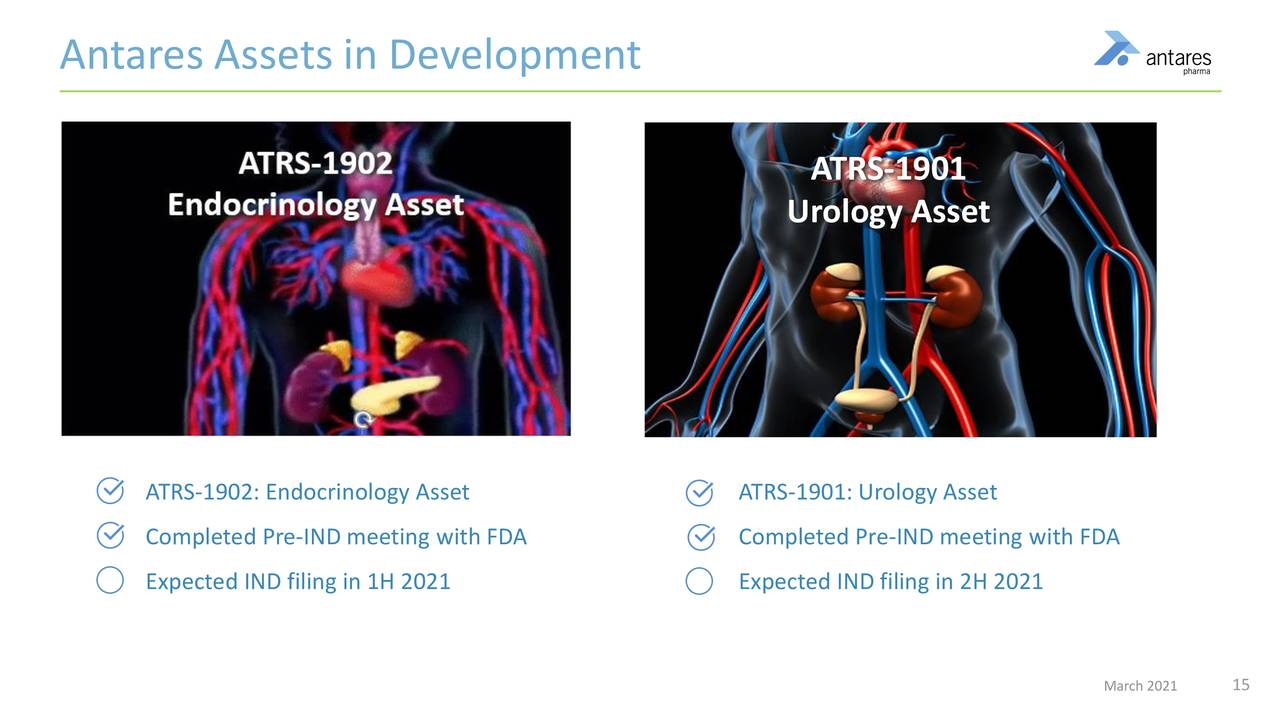

Antares is aiming for the next Xyosteds with two internally developed drugs. Last year, they successfully advanced the internal pipeline, which currently consists of ATRS-1901 a potential weekly auto injector formulation of a product in urology/ oncology and ATRS-1902, which is an endocrinology rescue pen. They are on track to file the IND for 1902 in the first half of this year, and 1901 in the second half of this year.

ATRS-1902

- ATRS 1902 is an endocrinology asset rescue pen.

- An NDA filling is possible in 2022 which could lead to an introduction in 2023.

- It is a development program in which clinical trials could start in 2021, the NDA filed in 2022 and approval potentially in 2023.

- There is no indication as the what this product is.

ATRS-1901

- This is not a rescue pen but more like Xyosted, a once weekly injection for patients in the urology/ oncology space. It is intended to be a vast improvement over the currently available oral dosage formulation,

- Thje currently marketed oral tablets have a food effect and resultant poor bioavilability

- This is a more complicated development program than ATRS-102. The IND will be filed this year, but the NDA probably will not be filed until 2024.

This slide summarizes some of the key information about these two products.

Pipeline of Partnered Products

Selatogrel

Antares beleives that selatogrel could be a transformative product for the company. If successfully developed and commercialized, its profit contribution could be enormous.

- Idorsia completed a very successful phase 2 program with selatogrel using a different injector device. In order to start a phase 3 trial they had to do a bridging study that showed that the Antares rescue pen delivered comparable product characteristics to a different device used in phase 2.

- Idorsia has completed the bridging study demonstrating usability and reliability with Antares’ Quickstart device.

- With that, Idorsia will be able to initiate their global Phase 3 that will enroll approximately 14,000 patients. The first patient will likely be enrolled in July 2021.

- Idorsia negotiated an SPA with the FDA.

- The recent fast-track designation by the FDA highlights the potential importance of this product.

- Approval is possible in 2024

- It has fast track status and will receive a priority review if the phase 3 is successful.

- Selatogrel achieves effective blood levels within 15 minutes.

- Many heart attack patients are on blood thinners which like selatogrel inhibit platelet aggregation. Importantly selatogrel can be used with blood thinners.

- Antares will sell Idorsia the fully packaged drug and also recieve and up to a low double digits royalty as sales increase.

- Idorsia sees $ 5 billion potential sales at peak

Here are some of the details on the past and planned clinical pathway for selatogrel.

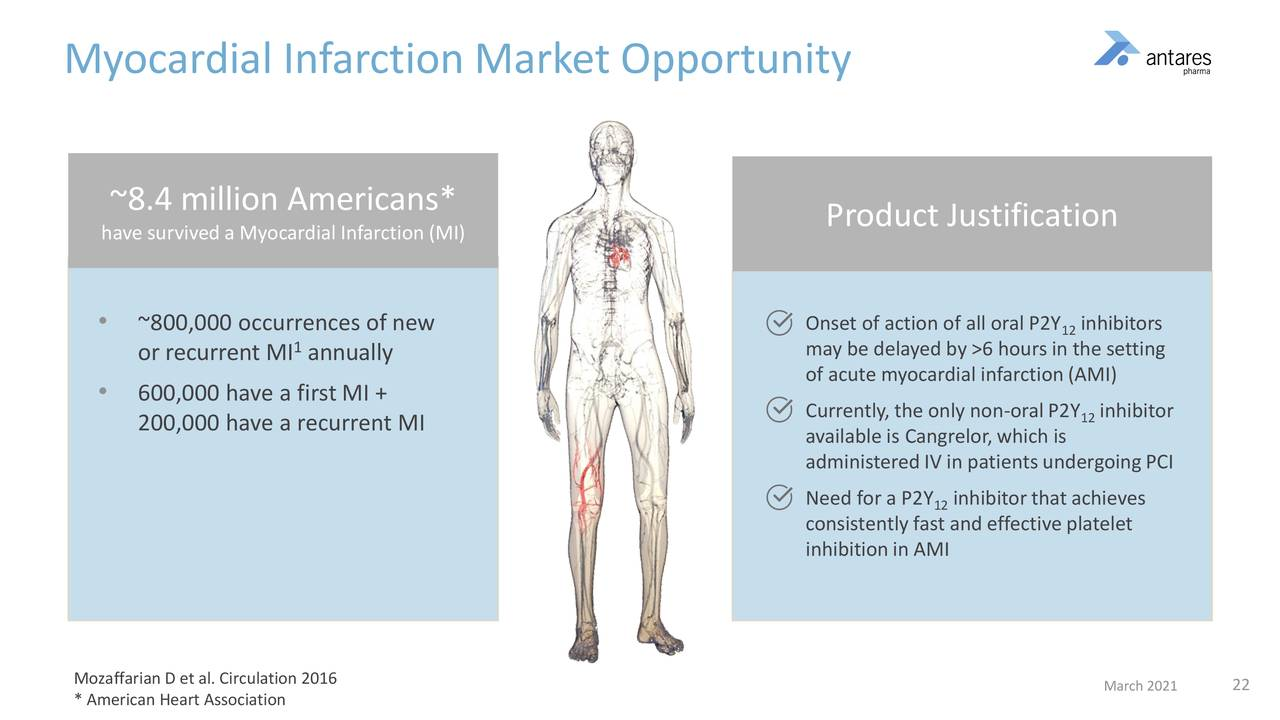

This summarizes some of the key aspects of the market addressed by selatogrel.

Pfizer Product

- The development program with Pfizer remains undisclosed based upon Pfizer's desires for competitive reasons.

- Pfizer is targeting an NDA submission to the FDA this year.

- It is a novel rescue pen that addresses a large market opportunity.

- Antares will provide fully packaged products to Pfizer and receive escalating royalties based on sales up to low-double-digits.

- We could learn more about this product after Pfizer files the NDA.

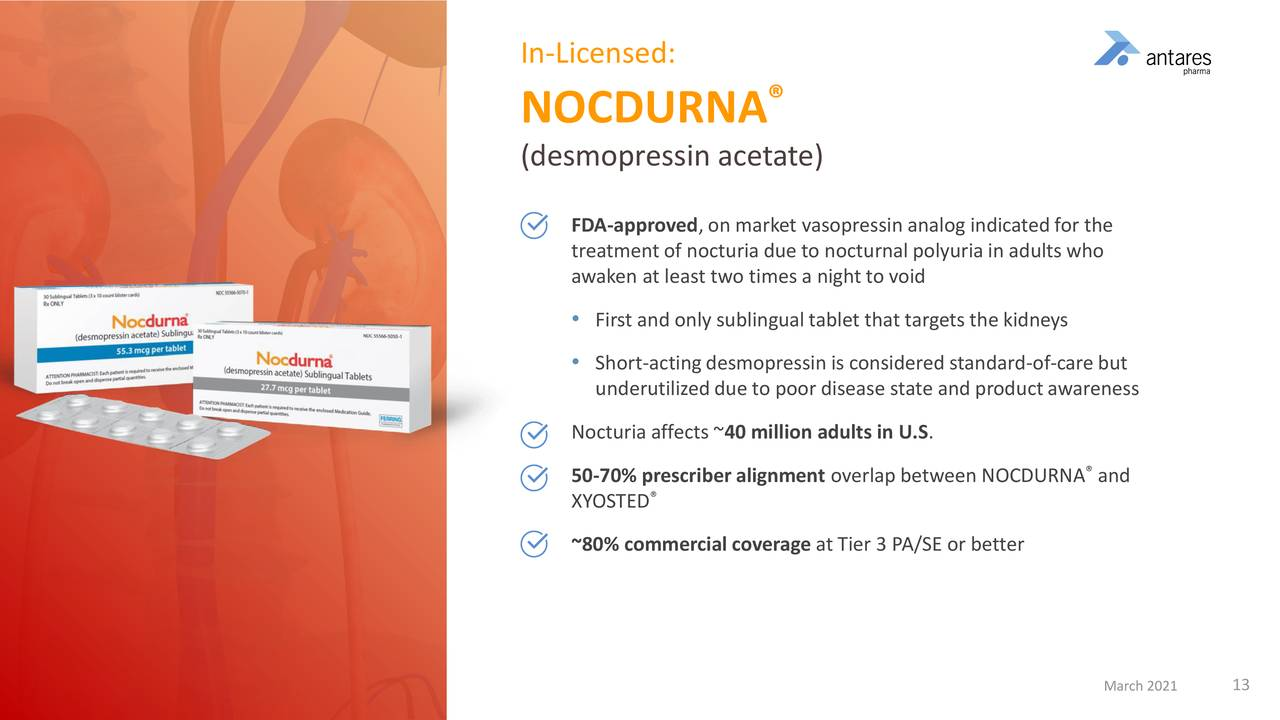

Nocdurna

- As Antares looks to expand its commercial footprint, a key strategic goal is to expand the product portfolio through business development

- In line with this, it reached an agreement to license Nocdurna in the U.S. from Ferring Pharmaceuticals.

- Nocdurna is indicated for a frequent nighttime urination due to a condition called nocturnal polyuria

- This expands their presence in urology.

- They implemented a highly focused soft re-launch in the middle of the fourth quarter with very limited selling materials, and a promotional campaign that we essentially inherited from Ferring Pharmaceuticals.

- The focus for the short period of time Anatres had Nocdurna in Q4, 2020 was to start rebuilding awareness among prescribers. They were careful not to disrupt the momentum of Xyosted.

- For those six weeks of Nocdurna promotion, they were able to generate a modest prescription lift among a focused group of targets.

- A more extensive and thorough re-launch started in early March.

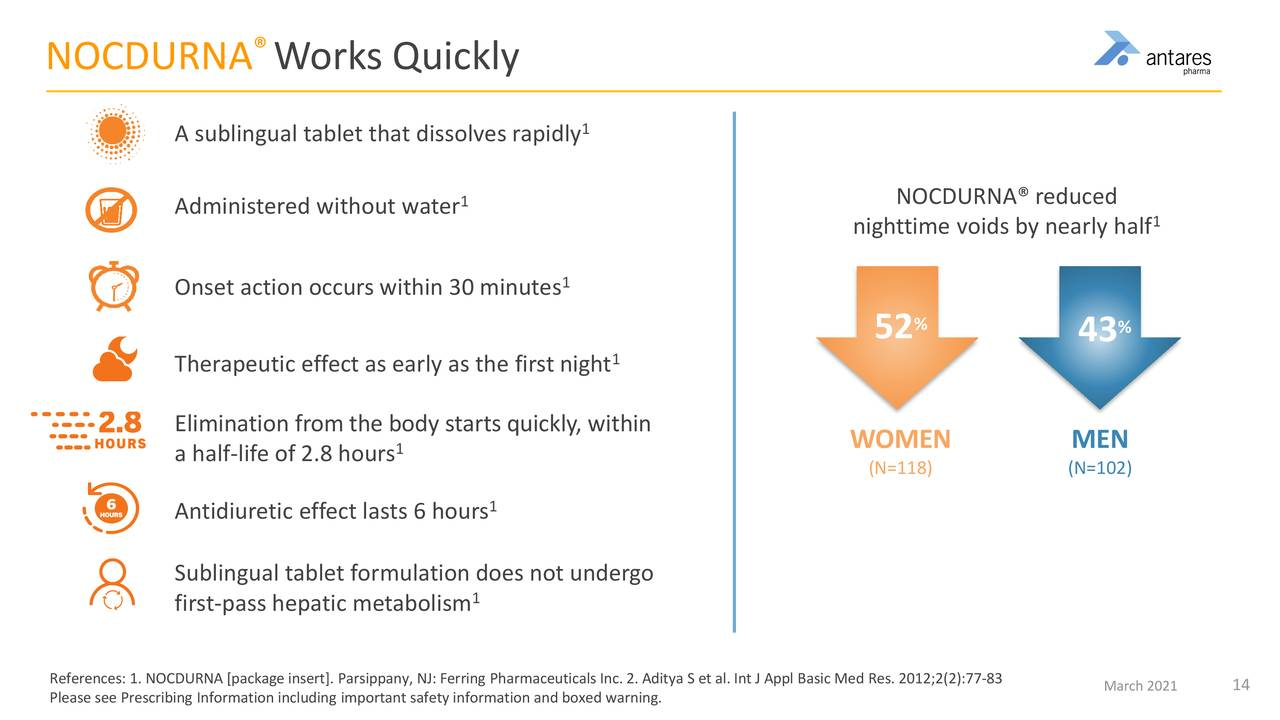

Here are some important aspects of Nocdurna.

Tagged as Antares Pharma Inc. + Categorized as Company Reports, LinkedIn