Antares Pharmaceuticals: Projecting Very Strong Growth in Xyosted Sales for 2020, 2021 and 2022 (ATRS, Buy, $3.89)

Key Points

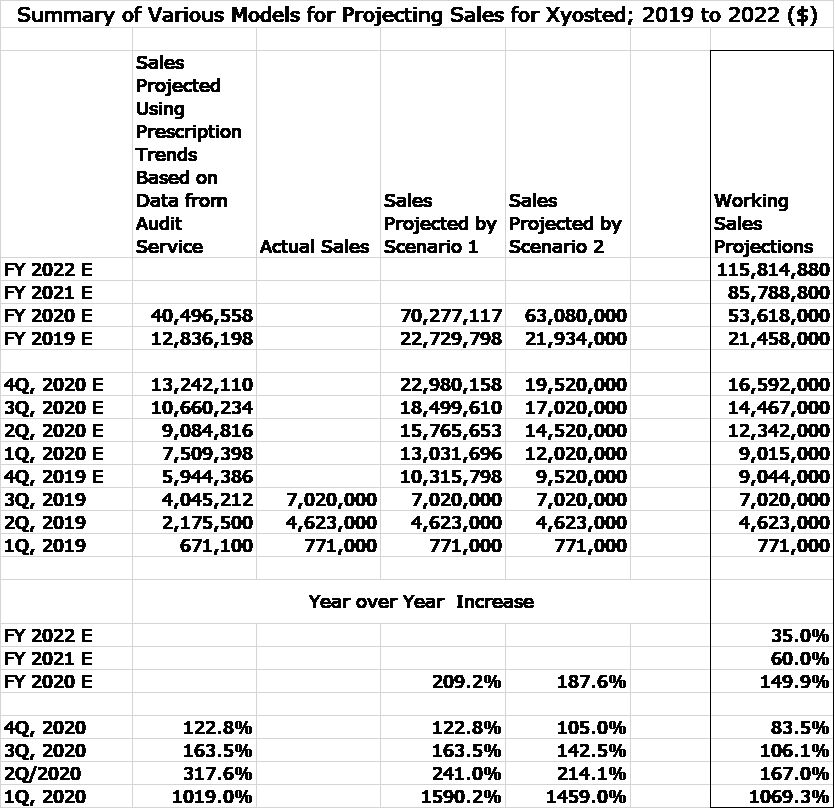

- In my sales and earnings model for 2020, I will be using a working estimate of $53.6 million for sales of Xyosted in 2020.

- My working estimate is lower than two alternative scenarios laid out in this report. In Scenario 1, I arrive at a sales estimate of $70.3 million for 2020 and in scenario 2 it is $63.1 million.

- My intuition is that the assumptions underlying both Scenarios 1 and 2 are conservative. However, we are at a very early stage in the launch and have only sketchy data so that I have “haircut” my working estimate to $53.6 million.

- Quite recently, the consensus Street estimate for 2020 sales was $45 to $50 million.

- My working estimate for 2021 sales is $85.8 million and for 2022 is $115.8 million.

Investment Overview

This report shows two scenarios (models) for projecting Xyosted sales in 4Q, 2019 and the upcoming four quarters of 2020. Scenario 1 is based on projecting forward the trend in prescriptions estimated by an audit service and assuming that sales trends will be comparable. At this early stage of the launch, prescriptions reported by auditing services appear to be significantly underestimating the actual number of prescriptions written, but do seem to be capturing the trend. Since the introduction of Xyosted in December 1019, on average, new prescriptions have experienced a sequential increase of 21 from the prior week and the corresponding number for refilled prescription has been 22. Scenario 1 is significantly based on extrapolating these sequential trends for each week through the end of 2020 (See table in the appendix). Scenario 2 is based on sequential sales which for 2Q, 2019 were $3,9 million and for 3Q, 2019 were $2.4 million. Scenario 2 assumes that sequential sales growth for each of the next five quarters will be $2.5 million.

In the following table, I show the projections that result from Scenario 1 and scenario 2. Scenario 1 projects 2020 sales of $70,3 and Scenario 2, $63.1 million. As a point of comparison, 3Q, 2019 sales of Xyosted annualize to a $28 million full year run rate and my working estimate for 2019 is $21.0 million. Consensus sales estimates for 2020 prior to the 3Q, 2019 call were about $45 to $50 million and could be increasing. Sales projections from both Scenario 1 and Scenario 2 are eye popping, but they could be conservative because:

- The target physician universe for Xyosted is 12,000 physicians and so far, only 3,500 have written a prescription.

- A significant number of physicians often take a wait and see attitude toward new products and delay adapting the product until they hear of the results from key opinion leaders and early adapters.

- Reimbursement always limits the uptake of a new product. Many physicians won’t prescribe a product until they are sure of reimbursement. Xyosted started from a very low level, but as of October, Xyosted is now reimbursed by plans covering 70% of commercial lives. This is considered an optimal level by management. Reimbursement hurdles will be much reduced going forward from the first three quarters of 2019.

- Physicians often use a new product with just a small number of patients to ascertain patient outcomes before giving it more broadly.

- About 50% of prescribing of Xyosted is now done by urologists/ endocrinologists and 50% by general practitioners. For other testosterone replacement products, the general practitioner ratio is around 70% and over time Xyosted should trend to this level.

- About 50% of new prescriptions for Xyosted are for new patients and 50% are patients being switched from IM or gel formulations. It could be the case that as information spreads on the lack of pain on injection and superior pharmacokinetics that there can be much greater switching from IM formulations and gel.

In the next table, I show sales projections for Xyosted for the next five quarters under Scenario 1 and Scenario 2. It also shows my working estimates for full year sales in 2019, 2020, 2021 and 2022. Despite my comments which suggest that my sales estimates in either scenario could conservative, my working sales projections for the next five quarters are lower than either scenario. Why? Because we are very early in the launch and I am basing my estimates on a very limited amount of information. There is much we don’t know. It is prudent to wait for more experience against which to judge my estimates. However, I think that we can conclude with a high level of confidence that the Xyosted launch has been a major success for Antares that should be the major factor in achieving positive EPS in 2020 and strong EPS growth in subsequent years. I am in the process of putting together my sales and earnings model for Antares in 2020. Projecting Xyosted sales was critical to this.

The following table shows:

- Sales projections based on my model that uses estimates of prescriptions by an auditing service. This model significantly underestimated sales in 1Q, 2Q and 3Q, 2019.

- Scenario 1 projections for 4Q, 2019 and the four quarters of 2020.

- Scenario 2 projections for 4Q, 2019 and the four quarters of 2020.

- My working sales projections for 4Q, 2019 and four quarters of 2020. These have been discounted by 15% (arbitrary assumption) or more.

- I have also included sales estimates for full year 2021 and 2022.

Assumptions Used in Constructing My Sales Model

Projecting sales for Xyosted involves a lot of assumptions. While my models may appear to be precise because of the detailed numbers, it is not. As I will discuss shortly, my model based on prescription trends estimated by an auditing service substantially underestimates actual quarterly sales reported by Antares in 1Q, 2Q and 3Q, 2019. Hence, I am using this model only to capture trend and magnitude of sales; I need to make an upward adjustment that reflects the difference between estimated and reported sales to arrive at sales estimates for 4Q, 2019 and the four upcoming quarters of 2020. Here are key assumptions in my model.

- My basic model starts with prescription estimates produced by an auditing firm, which are not actual prescriptions, but only estimates. According to management, the audit appears to be meaningfully underestimating the actual number of prescriptions written. This is not unusual in the early stages of a launch. Management says that at this early date, the data from auditing services is not reflective of product shipments. They see the value of this data in showing trend of prescriptions, but having limited value for estimating sales.

- The list price of a Xyosted prescription is $475, but this is not what Antares actually receives. It has to offer rebates to insurers in order to be eligible for reimbursement. In addition, Antares in most cases will offer coupons to patients to reduce their co-payment or pay part or all of their co-payment. In high deductible plans, this co-payment support can be as much as $125 per prescription. About 65% of patients receive some form of co-pay support. Overall, in the third quarter, the net price was significantly lower than the $475 list price. Management said that in the third quarter, the net price was somewhere between 55% and 60% of the list price or $262 to $285 per prescription. Management expects this ratio to remain stable or increase slightly going forward. In the early stages of the launch, the net price was possibly below $250. In my model, I am using $250 as an estimated realized price, just to introduce conservatism into my model. As an aside, this is comparable to prices for generic IM and gel formulations of testosterone.

- In a meaningful number of cases, new prescriptions are not reimbursed; this does not apply to refills This can be either due to sampling of the product or to give the patient access to Xyosted while insurance status is determined. If insurance is not obtained the patient is lost. In the early stages of the launch, I think that as many as 40% of new prescriptions were not reimbursed. Management hasn’t given any recent guidance on this number. However, Xyosted is now reimbursed for 70% of managed care covered lives so this percentage of free new prescriptions should have gone down significantly from 40%. Going forward, I estimate that the percentage is 20%.

- Xyosted was launched in late December 2019. Since then the average sequential weekly increase in new prescriptions has been 21. A key part of one of my models is that I estimate that in every week through the end of 2020, new prescriptions increase by 21. In my opinion this appears to be quite conservative. Intuitively, we are less than one year into the launch and I think that as the number of physicians increases and as confidence is gained by physicians in the attributes of the product and that patients will gain reimbursement, the weekly increase in new prescriptions should increase from 21.

- The sequential increase in refilled prescriptions has been 22 and I using this going forward. there are two difficult factors to consider. Testosterone replacement does not address disease that is life-threatening or has troublesome morbidity. As a result, a meaningful number of patients could drop out of therapy within a few weeks of starting treatment. Management has not given any guidance on what percentage of patients are dropping out. I think that the ease of use of the injector and its virtual absence of pain on injection would reduce this relative to IM testosterone products. I have received a saline injection and can attest that it was virtually painless and the clinical trials support this lack of pain.

- Some investors have been puzzling why the number of refilled prescriptions isn’t increasing more than we are seeing. One factor is that management states that some refills contain multiple prescriptions, not just one.

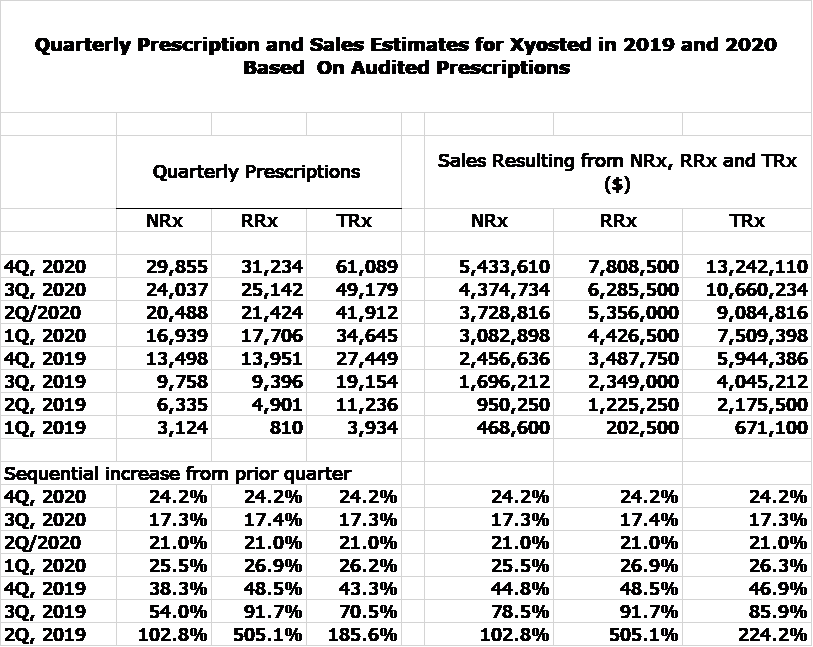

Xyosted Sales Projections Based on Prescription Estimates from Auditing Service Underestimate Actual Sales

In a table in the appendix of this report, you can find my detailed estimates based on prescription trends. It shows the estimates of prescriptions from the auditing service for the period beginning with the week ending December 14, 2018 and ending with the week ending November 1, 2019. Then for each week through the end of 2020, I estimate that the sequential increase in new prescriptions is 21 and is 22 for refilled prescriptions. I then use estimates for the price received for new and refilled prescriptions as described above. This is bewilderingly complex so in this section I show quarterly rather than weekly results to make the projections easier to understand.

Unfortunately, this approach significantly understates sales when compared to Xyosted sales reported by Antares. Actual sales in 3Q, 2029 were $7.0 million versus thismodel’s estimate of $4.0 million For 2Q, 2019 the comparable comparison was $4.6 million versus $2.2 million and in 1Q, 2019 $0.8 million versus $0.7 million. This means that I have to make some kind of adjustment to estimated sales to account for the understatement of my sales model. Present two scenarios.

In scenario 1, I start my projections using actual 3Q sales of $7.0 million as a base. I then assume that the increase in sales reported in subsequent quarters is the same as the projected increase in TRx. For example, my model shows that TRx in 4Q, 2019 increase by 47%. I then assume that Xyosted sales which Antares reports also increase by 47% and so on through each quarter of 2020. In scenario 2, I use a different methodology that assumes a sequential increase in quarterly sales of $2.5 million for the next five quarters in line with the sequential sales increase for 3Q, 2019. This results are shown in the first table of this report.

Appendix

Tagged as 2021 and 2022, Antares Pharma Inc., Sales projections for Xyosted in 2020 + Categorized as Company Reports, Investment Theses