Portola: Andexxa Looks to be a Blockbuster (PTLA, $30.00, Buy)

Overview

The investment story for Portola is virtually 100% based on the sales ramp for Andexxa. Skepticism and/ or uncertainty have been running high because new drug product launches in general are slow and disappointing and this is particularly true for hospital products like Andexxa. I have been taken aback at the poor stock performance. After a strong first quarter in which Andexxa sales meaningfully exceeded expectations, the stock declined from $36 to $26. It certainly wasn’t due to disappointment with the early trend of the Andexxa launch. I guess you could look to the poor performance of emerging biotechnology stocks in general as a contributing cause.

Some might also point to PTLA’s ferocious burn rate and the inevitable need to raise new capital. Management says that it has cash to last until the end of 2020, but clearly they will have to bring in new capital before then and probably in 2H, 2020. The company just filed a shelf offering which lends credence to that. Some consider raising equity to be a negative citing the increase in the number of shares as diluting current shareholders. In some cases this might be true, e.g. for a company that has an uncertain or mediocre outlook. However, the dilution argument is pure baloney in the case of Portola in which this capital would be used to accelerate sales growth of Andexxa, for which the return on capital should be extraordinary and accretive to both current and new shareholders.

I also see the hand of stock manipulation in this puzzling, poor stock performance. For those of you who have read my series of reports on the role of illegal naked shorting that is a lynchpin in widespread and routine manipulation of emerging companies, you might suspect as I do that PTLA stock has been the target of such manipulation.

Background on Andexxa

In my opinion and more importantly the FDA’s, Andexxa is a breakthrough drug for the reversal of the anti-coagulant effects of Factor Xa inhibitors, most notably Xarelto and Eliquis. These are life saving drugs that are used by several millions of patients throughout the world, but sometimes their mechanism of action (preventing strokes by making it more difficult for blood to clot) can cause life threatening bleeds. Andexxa is the only approved treatment if this occurs. It was approved by the FDA in May 2018, under its Accelerated Approval Program.

The FDA designated Andexxa as a breakthrough drug and its approval was based on a non-randomized study conducted in healthy adults which used the biomarker Factor Xa inhibition as an endpoint. As a condition of approval, Portola was required to do an ongoing, post approval study in patients who were actually suffering from severe or life threatening bleeds resulting from the use of Factor Xa inhibitors; this is the ANEXXA-4 study. So far, a series of interim reports from this trial have been encouraging. Please refer to this link if you would like to see the most recent data from ANNEXA-4.

The paucity of data on which Andexxa was approved and its conditional approval is an uncertainty for the longer term that slightly constrains my enthusiasm. However, the signs from the early launch are extremely encouraging and points to Andexxa being a blockbuster drug with peak sales of $1 billion and probably much more. I continue to be very positive on the stock.

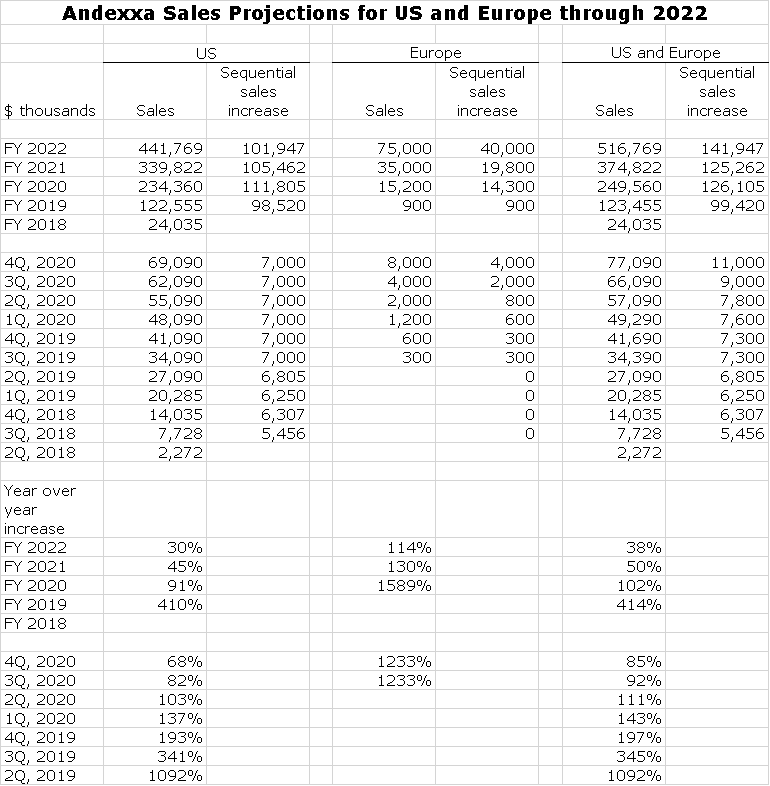

Andexxa Sales Projections

It may be a bit early to declare that the Andexxa early launch returns assure it’s becoming a blockbuster but it sure looks like it to me. The following table shows the impressive sales growth since its 2Q, 2018 launch and my projections through 2022. It is still so early in the launch that projections are based on very limited information and are frankly sheer guesswork. My most important near term assumption for the US is that sequential sales growth for the remaining two quarters of 2019 and 2020 will be $7,000 in line with the sequential sales increases seen in 2Q, 2019 and 1Q, 2019. My intuition is that it will be much better, but let’s wait and see. Europe is even more of a guessing game. A lot depends on obtaining reimbursement and sometimes this can take 12 to 15 months. You should be cautious in interpreting these numbers, but we have to start some place.

Highlights of 2Q, Conference Call

Here are some of my key takeaways from the 2Q call.

Management’s View of the Andexxa Launch

Management recently conducted an extensive benchmarking analysis of nearly 50 hospital product launches over the last 30 years. Of those, 10 went on to have US sales between $600 million and $2.5 billion. Based on the trajectory of the first five quarters of revenue, Andexxa is one of the top five hospital drug launches over this 30 year period and suggests that peak sales could well fall in the $600 million to $2.5 billion range in the US. Management on the call said “We are clearly off to a fantastic start.”

Still in the Early Phase of Penetrating the Hospital Market

Portola is targeting 2,100 hospitals in the US, which represents about 80% of the market potential for Andexxa. At the end of the first quarter, management estimated that approximately 300 hospitals were stocking Andexxa. They added 125 new accounts in 2Q, 2019 bringing the total to about 425. Management noted that a good number of these adds came late in the quarter. Management had been indicating that it expected about 100 new adds per quarter so this is somewhat better than expected. I should point out that the early phase of the launch, obviously, has been targeted at the large tier 1 hosptials that have the greatest potential.

Sales Force was Expanded

In April, Portola added 40 representatives which gives a total of approximately 116.

To What Degree Will Hospitals Reorder?

Andexxa has an interesting market characteristic in that hospitals stock it in anticipation of using it on a bleed at some point in the future. Hence, the purchase of Andexxa may not immediately translate into usage. This causes analysts to focus on reorders which would indicate that the product was used and the hospital has restocked. In 1Q, 2019 the reorder rate was 55% and in 2Q, 2019 it was also 55%. During the second quarter, 74% of sales came from reorders. This information is difficult to interpret at this early point and it will become more informative as data builds over time. However, it does seem encouraging.

The US Addressable Market for Andexxa is Huge

Approximately 5 million patients in the United States are taking a Factor Xa inhibitor. Of these, approximately 150,000 patients are hospitalized each year with serious life-threatening bleeds. The price of Andexxa is about $28,000 per patient. Based on these numbers the addressable market is about $4.2 billion. Based on sales of $27.1 million in the second quarter and a price of $28,000 per patient, Andexxa treated 970 patients in 2Q, 2019.

So Is Europe

The use of Factor Xa inhibitors in Europe is estimated to be twice that of the US, but the realized price is about half. Hence, the addressable market for Factor Xa inhibitors on a dollar basis is about the same as the US. Perhaps then, the addressble market for Andexxa is about the same or $4.2 billion.

The Market for Andexxa is also Experiencing Strong Unit Growth

Based on the discussion in the two prior bullet points, the number of patients hospitalized in the US as a result of life threatening bleeds following Factor Xa usage is 150,000 and the number in Europe could be 300,000 for a total of 450,000. Factor Xa usage is growing meaningfully leading management to project that this number will increase to 700,000 by 2025. If so, the addressable market for Andexxa would be a staggering $13 billion at current Andexxa prices.

Increase in NTAP Reimbursement is Encouraging

CMS has increased the NTAP reimbursement for Andexxa to a maximum of 65% or approximately $18,000, which is an increase from 50%.This is important to expanding Medicare beneficiary access to Andexxa. It also provides some validation to the thought that Andexxa is a breakthrough innovation.

European Sales are Just Starting

The first sales of Ondexxya (the European name for Andexxa) occurred on August 7. Launching in Europe is a country-by-country process thathappens in stages. The first sales were in Austria and the U.K. The product is also available in the Netherlands, Sweden, Denmark and Finland. Management expects Ondexxya to be available in Germany later this year. These initial launches are generally based on limited reimbursement. Obtaining full reimbursement is a long and time consuming process. For most products, it takes more than a year for reimbursement to be obtained. I don’t know if the urgent need for Factor Xa reversal will make this process quicker.

Urgent Surgery Could be a Major New Indication

A registrational study in urgent surgery is scheduled to start later this year or in early 2020. Portola estimates that approximately 60,000 patients on rivaroxaban or apixaban in the United States must undergo urgent surgery each year and could benefit from the use of Andexxa. This represents a new addressable market opportunity of $1.7 billion at the current price.

The Pipeline; Could Cerdulatinib Have Potential?

In June, data was presented on cerdulatinib in combination with Rituxan in follicular lymphoma at two international hematology conferences. In a group of heavily pretreated patients, cerdulatinib achieved a 45% overall response rate as a single agent and 62% overall response rate in combination with Rituxan. Cerdulatinib was generally well tolerated with a manageable side effect profile. Portola plans to start a registrational study for cerdulatinib MPGCL by year-end.

Tagged as Andexxa launch, Portola + Categorized as Company Reports, LinkedIn