Bristol-Myers Squibb: Why I Believe Its Dominance in Cancer Immunotherapy Promises to Make BMY a Great Long-Term Investment (BMY, $62.70, Buy)

Investment Opinion

Conceptual Reason for Recommendation

My recommendation of Bristol-Myers Squibb is in contrast to the small, not well-researched biotechnology companies on which I usually focus. BMY is a large, complex and well analyzed multinational company with a broad product portfolio and burgeoning pipeline. It requires as much time to analyze as several small biotechnology companies. It also receives overwhelming coverage from Wall Street as there are well over a dozen large brokerage firms providing coverage with teams comprised of 3, 4, 5 or more analysts. It is difficult for me to put in the time needed to compete with these teams. So why I deviating from my modus operandi and recommending BMY?

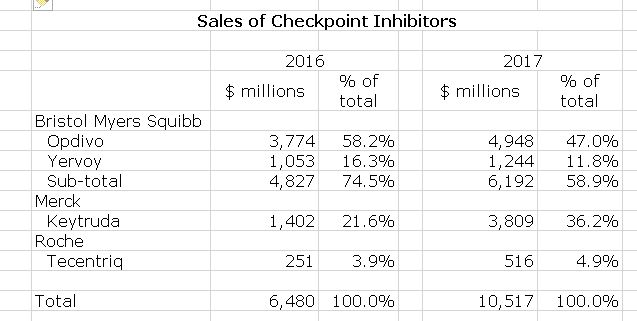

BMY is at the forefront of the biopharma industry in ushering in the age of immunotherapy for cancer through the development and commercialization of checkpoint inhibitors. Many key opinion leaders believe (and I am with them) that over time combinations of immunotherapy (I/O) drugs will supplant much or all of chemotherapy. Without any exception that I know of, Wall Street analysts are expecting explosive growth that will perhaps explode I/O sales from about $11 billion in 2017 to perhaps $25 billion or more in five years. As the first mover in the space with the checkpoint inhibitors Yervoy and Opdivo, BMY currently has about 60% of the market and is at the absolute forefront in development of I/O drugs. I believe that this dominance will continue for the next decade providing a very strong tailwind for BMY to grow at probably the fastest growth rate of any of the large biopharma companies.

BMY’s Strong Competitive Edge in I/O Therapy Explained

The initial cancer targets for Yervoy and then Opdivo were advanced, late stage cases (third line) of melanoma and non-small cell lung cancer (NSCLC). Subsequently usage has increased rapidly across many other solid tumors and into less advances stages (first and second line). Being first to market is a huge advantage because using a drug requires many different skills in administration, patient management and selection and reimbursement procedures. Administering a drug is much more complex than just hooking up an IV bag, it requires an algorithm linking several disciplines and there is a long learning curve for care givers. Once a drug becomes part of a treatment regimen at a facility, it is very hard to dislodge it by another drug that might be comparable. Even if a markedly superior drug comes on the scene, medical practice changes slowly.

Approvals in new cancer indications build on top of prior approvals. New drugs are usually first approved in advanced stages of cancer, such as patients who have failed one, two or more treatment regimens. Then over time, it is used in earlier stages of disease. Usually approval requires showing that a drug improves outcomes over the previous standard of care so that the combination of a new drug with standard of care is compared to standard of care. If the new drug meaningfully improves outcomes, it defines a new standard of care. This makes it difficult for a comparable drug to establish that it improves over this recently established, new standard of care.

Once approval is gained in one cancer indication, it may be easier to move on to other cancer types. Of course, this is also dependent on mechanism of action (MOA) of the drug. Some may be limited to one or a small number of cancers. However, the MOA of checkpoint inhibitors and many I/O drugs makes them potentially applicable across a broad number of cancers. Investigators gain experience and confidence in using the drug and managing side effects. Hence, initial approvals in melanoma and non-small cell lung cancer in advanced stages of the disease were important springboards for the checkpoint inhibitors to treating other cancers. And of course, the profits earned from commercial sales can be poured into additional clinical trials leading to ever broadening approvals.

The I/O Market Will Be Much More Than Checkpoint Inhibitors

A final point I would like to make is that the checkpoint inhibitors are just the first in what will likely be hundreds of new I/O drugs with different mechanisms of action. As new drugs come along, they will usually be tested in combination with Opdivo or Merck’s comparable product Keytruda; these two drugs now dominate the market. For example, there are trials planned or underway to combine CAR-T drugs and cancer vaccines like DCVax-L with checkpoint inhibitors. Remember that experience so far suggests that combinations of two, three or more I/O drugs are likely to be the future. So as this I/O drug development effort explodes, Opdivo and Keytruda will be parts of backbones upon which combinations are built. Every drug developer with a novel approach will want to (need to) do its trials in combination with Opdivo or Keytruda. If successful commercialization occurs, Opdivo and Keytruda will both benefit. By the way, combinations with Opdivo and Keytruda will not be limited to just I/O drugs. They may be synergistic with all types of cancer drugs.

The Current I/O Landscape

The landscape of I/O drug development is staggeringly complex and there are many competitors trying to gain a foothold in this area. Since 2011 when Yervoy was first introduced, sales of checkpoint inhibitors have exploded reaching about $11 billion of sales in 2017. Currently, almost all I/O sales for cancer are checkpoint inhibitors. Wall Street projections for 2022 for checkpoint inhibitors are $25 billion or more. However, checkpoint inhibitors are only the first of what will be many new I/O drugs so that the I/O market could be much, much larger-perhaps $40 to $50 billion over the next decade. We are very early in the I/O drug development game and admittedly these estimates are more guesswork than science. They could be high or perhaps low, but I think that it is certainly the case that I/O drug development opportunities have huge, huge promise. It will be a major driver of the pharmaceutical industry for decades to come.

In previous paragraphs, I spent a lot of time making the point that being at the forefront provides enormous competitive advantage which manifests in commercial sales. If my argument is true, then current leaders are most likely to be the same in five, ten or twenty years. In Looking at 2017 sales, BMY and Merck are the clear leaders in sales with Roche being a somewhat distant third as shown in the following table.

This is not to say that there will be no other players. Even a 1% share of a $25 billion market is $250 million and a 4% share could be a billion. All large pharmaceutical companies would love to get a foothold in this market. It looks like Astra-Zeneca and Pfizer have products in late stage development that could lead to small market positions. Also, there are many small companies developing novel I/O agents that could potentially hit home runs as they are combined with checkpoint inhibitors.

Market Perception Differs From Mine

The picture I have built is in contrast to current perceptions of many investors about BMY. Through 2016, analysts viewed BMY as the nearly untouchable leader in I/O drug development. There was particular focus and anticipation of major growth in non-small cell lung cancer. However, Merck staged two unexpected major clinical trial coups. First, Merck conducted a trial with Keytruda in first line NSCLS patients with PDL-1 expression greater than 50% that was successful while a BMY trial with Opdivo across a much greater range of PDL-1 expression was not. In my opinion, this was almost certainly due to patient selection as the Keytruda trial was in high PDL-1 expressors who are most likely to benefit while the Opdivo trial was across a broader range of PDL-1 expression. The Keytruda success and Opdivo failure was due to trial design in my opinion.

In a second setback, BMY and many option leaders were skeptical that I/O drugs could be synergistic with chemotherapy and BMY was focusing on I/O combinations in lung cancer. To the surprise of many, MRK was successful in showing that a combination of Keytruda and chemotherapy improved outcomes in first line NSCLC. For a more in-depth discussion of these trials see Implications of Potentially Earlier than Expected Introduction of Keytruda Combined with Chemotherapy in the First Line Lung Cancer Setting.

The setbacks in first line non-small cell lung cancer had a dramatically negative effect on the stock. Merck was in a position of being able to promote Keytruda in first line NSCLC while BMY could not. It also meant that BMY would suffer erosion in the second line setting where it was achieving significant sales as it is unlikely that if Keytruda failed in first line that Opdivo would be used in second line because of the comparable mechanisms of action. These were significant near term blows to Opdivo as NSCLC may be 45% of the market for Opdivo and Keytruda. Indeed, Opdivo sales growth slowed markedly so that in 4Q, 2017 worldwide sales of Opdivo increased only 4%. A year earlier, analyst expectations might have been for 30% to 40% growth.

I view this setback in NSCLC as only temporary. I think that BMY has a broader and more comprehensive trial strategy in NSCLC than Merck. The huge 2700+ patient CHECKPOINT-227 trial is likely to give a much clearer view of how Opdivo fits into first line lung cancer as single therapy, as a combination with Yervoy and as a combination with chemotherapy. As these results are reported in late 2018 and 2019, I think that BMY could jump back into the lead in NSCLC. Let me make a point here. Most of the information I have seen suggests that Opdivo and Keytruda are pretty much the same. However, oncologists are data driven and they will not assume that if one drug is effective in an indication the other will also. This means that whoever has the clinical data will get the greatest market share in an indication.

Potential for the Stock

I think that if investors come to believe as I do that BMY will re-emerge as the leader in NSCLC that this will have a dramatically positive effect on the stock price and this is a key reason for my recommendation of the stock. This could occur in 2018 or 2019. However, this is not the most important reason in the long term. The discussions that I presented earlier which argue that BMY and MRK have enormous competitive advantages in the exploding I/O market are my major reasons. Some investors have mistakenly concluded, in my opinion, that the I/O market is a zero sums game in which BMY’s loss is MRK’s gain which is incorrect. I see both as prospering. Similarly, I do not see the explosion of drug development in I/O as being a threat. I think that most novel new drugs will probably be combined with Opdivo or Keytruda to the substantial benefit of their usage and sales.

Please be aware that my recommendation is based on the long term view of BMY being a dominant factor in the I/O market. I am not putting much emphasis on near term earnings. Indeed, guidance for EPS in 2018 is $3.15 to $3.30 which compares to $3.01 in 2017.

There is one other part to the BMY investment thesis that I need to touch on and that is that BMY has a market capitalization of about $102 billion. While it is large, it is not so large that Pfizer with a market capitalization of $209 billion or Novartis at $192 billion could not acquire BMY. Indeed, Pfizer and BMY are frequently linked in press speculation about an acquisition. From a shareholder standpoint, I don’t think that an acquisition by Pfizer would produce a better long term outcome than BMY going it alone, but the near term return might be better.

Fourth Quarter Conference Call Focuses on Yervoy-Opdivo Combination and Tumor Mutational Burden

First Results from CHECKPOINT 227

During the fourth quarter conference call, BMY announced a result from its key CHECKMATE-227 (CM-227) study in first line NSCLS. This is just a small portion of the enormous amount of data that will come out of this trial. This trial will enroll over 2700 patients and allow comparisons in first line NSCLC of: (1) Opdivo used alone, (2) Opdivo combined with Yervoy, (3) Opdivo combined with chemotherapy, and (4) chemotherapy. It will also provide information on the correlation with PDL-1 expression and efficacy for these four arms. In addition, BMY is validating a new biomarker called tumor mutational burden (TMB) that may improve the ability of physicians to predict beforehand which patients will benefit most from the four combinations just described. This is a landmark trial that should go a long way toward addressing the proper use of Opdivo and Yervoy in first line NSCLC. BMY believes that Opdivo combined with Yervoy will be shown to be the superior treatment option.

BMY reported that a combination of Opdivo and Yervoy was superior to chemotherapy as measured by median progression free survival. This was in a patient population defined by the biomarker tumor mutational burden (and regardless of PDL-1 expression. Management said that the data was highly statistically significant and clinically meaningful but provided no details; full results will be presented at a future medical conference. The data monitoring committee also recommended that the trial continue toward the co-primary endpoint of mOS. This is the first time that an I/O combination has produced positive results in first line NSCLC. Of course, the still to be determined mOS endpoint is more important but hitting this mPFS endpoint is highly encouraging that the mOS endpoint will also be met successfully.

Tumor Mutational Burden as a New Biomarker in NSCLC.

Biomarkers are key to identifying patient populations that will benefit most from a drug. Years ago, all patients treated for a particular cancer, say non-small cell lung cancer, would receive the same therapy of radiation and chemotherapy. However, over the last decade, great progress has been made both in developing novel new drugs for treating NSCLC and in identifying mutations that distinguish one type of NSCLC from another. The biomarkers can enable physicians to use drugs that are most effective against the tumor mutation that marks a tumor and to use the most effective drugs. To name just a few biomarkers in NSCLC we now have distinct biomarkers such as EFGR, ALK, ROS1, RET PD-L1 and there are others. In the case of the checkpoint inhibitors such as Opdivo and Keytruda, the key biomarker currently used to identify the most responsive tumors is PDL-1 expression.

Briefly, here is why PDL-1 expression is important. T cells are white blood cells that play an integral part in fighting cancer. However, cancer cells can escape T cell attacks by expressing a protein called PDL-1. This protein has the effect of turning off the T cell response to cancer. Opdivo and Keytruda are monoclonal antibodies that block the effect of PDL-1. If you think of PDL-1 as applying the breaks to a T cell response, Opdivo and Keytruda by blocking this protein from attaching to receptors on T cells takes the brake off. It is generally true that tumors that express higher levels of PDL-1 are more susceptible to Opdivo and Keytruda. By identifying and focusing on patients with tumors having high PDL-1 expression, therapeutic results can be improved-we think.

PDL-1 has emerged as the key biomarker for the checkpoint inhibitors, but it is imperfect and the pharmaceutical industry is searching for new biomarkers to use in patient selection. These might be used with or apart from PDL-1. Bristol-Myers has put great focus on tumor mutation burden and is now incorporating this biomarker in its clinical trials. Tumor cells with high TMB may express neoantigens that could make them more visible to the immune system and presumably more responsive to I/O therapy

So why is this commercially important? If tumor mutational burden proves to be a valuable biomarker, biopharma companies will need to incorporate it in the design of clinical trials. They will need to show that their drug are more effective in patients with high tumor mutational burden. Here is a critical point. In a clinical trial a drug company must measure the tumor mutational burden and prospectively define it as a biomarker that helps define a patient population that will best respond to the drug. This is an integral part of the clinical trial. It is probably the case that all checkpoint inhibitors would be approximately of the same effectiveness against tumors with high mutational burden. However, if they do not establish this in clinical trials, they cannot promote this claim to doctors. This would give Bristol-Myers Opdivo an important marketing advantage. Physicians are data driven and they would not presume that another checkpoint inhibitor was as effective as Opdivo without the requisite clinical data.

From a mechanistic perspective, TMB measures the number of somatic mutations that are present in the DNA of a tumor compared to the DNA of normal tissue. BMY believes some of these mutations can drive expressions of neoantigens. And then these new neoantigens could be more visible to immune system and thereby driven an immune response. Bristol-Myers and others have generated data showing improved outcomes for patients with high TMB. They have shown this across multiple endpoints, and those includes objective response rate, PFS and OS across multiple tumor types including non-small cell lung cancer, bladder cancer and small cell lung cancer. And they have shown this for both Opdivo monotherapy and the combination of Opdivo and Yervoy. This supports the hypothesis around TMB being an important potential biomarker.

I think that if TMB proves to be a valuable biomarker that BMY has established a competitive edge by aggressively measuring it in as many as 100 clinical trials. Others will be playing catchup.

Tagged as Bristol-Myers Squibb, checkpoint inhibitors, Opdivo Yervoy combination, tumor mutational burden + Categorized as Company Reports, LinkedIn