Cryoport: Observations on 1Q, 2017 Results (CYRX, Buy, $3.05)

Investment Section

Overview

This report is a follow-up to my April 12, 2017 report “Cryoport: Initiating Coverage of this Highly Unique Health Care Company with a Buy (CYRX, Buy, $2.25)”. If you are unfamiliar with or need a refresher on Cryoport’s business, I would suggest that you read that report before continuing.

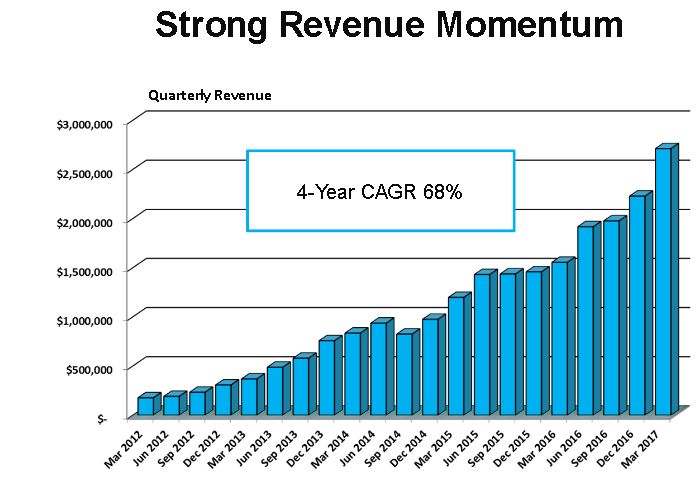

By every measure this was an explosive quarter as Cryoport reported a 74% increase in revenues to $2.7 million led by a doubling in revenues derived from logistics services for biopharma clients, which is their key business focus. Sales growth for reproductive and animal health were an impressive 26% and 28% respectfully. The rate of sales growth accelerated in each business area. This quarter continues a four year period of extraordinary growth in which the compounded annual growth rate for quarterly sales has been 68% as shown below.

I am very enthusiastic about this stock and consider it as one of my top recommendations. I see a lot of parallels with Cryoport’s business model and that of Repligen although their actual businesses are quite different. Repligen has been my best recommendation since starting SmithOnStocks as the stock has increased from $6.13 at the time of my initial report on December 4, 2012 to a current price of $38.40. I think that Cryoport has the same explosive stock potential. By the way, I still have a buy on Repligen.

Revenue Model 2017-2020

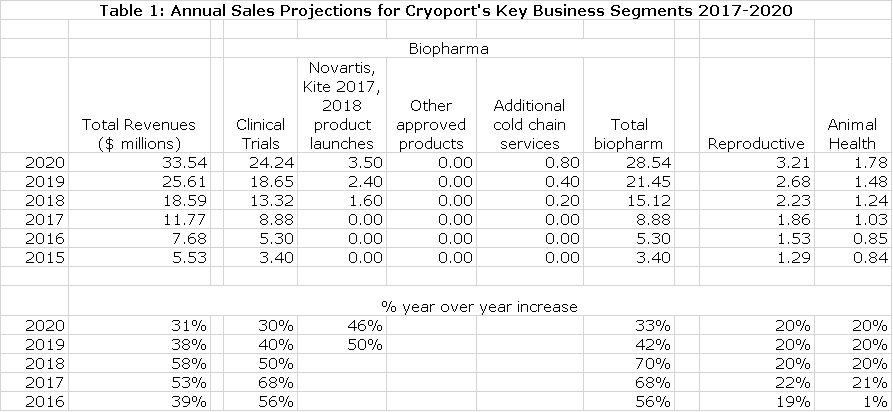

At this point in time, I am focusing on revenue growth to gage the success of Cryoport. The Company breaks out revenues for three end markets: biopharma, reproductive and animal health. In this report, I further estimate revenue contributions from four segments of biopharma that are not provided by the Company:

- Clinical trial based revenue

- Possible commercial revenue from the CAR-T products of Novartis and Kite. I am using conservative assumptions and would not be surprised to see significant upside.

- Possible commercial revenue from additional products. There are four other BLAs that are scheduled to be filed in 2017 and 2018 and numerous others in subsequent years. In addition, Kite and Novartis are developing Axi-Cel in six new hematological cancers. For the time being I am factoring in no sales from these as I analyze the potential for approval and then for Cryoport revenues. Obviously, this is conservative.

- Revenue from large biopharma companies that are not linked to clinical trials. This represents an extension of the business model into a different segment of cold chain logistics. There should be small initial contributions from relationships with Bristol-Myers Squibb, Sanofi and Johnson & Johnson in 2017 to 2020 period. I would expect the relationships with these companies to deepen and for the number of client relationships to expand over time more than my model allows for.

The following table summarizes my revenue projections through 2020. The reasoning behind these estimates is discussed in the initiation report that I previously cited. Cryoport’s goal is to achieve gross margins of 60% as the sales run rate reaches $15 to $16 million. My model suggest that Cryoport would be profitable at this sales level. I am projecting 2018 sales of $18.6 million which should result in profitability. Here are my sales projections for 2017 to 2020.

Investment Caveat

The small companies on which I focus can be extremely volatile and while there is great potential there is also great risk. My personal approach, which I recommend to my subscribers, is to make stocks like those I recommend a small part of your portfolio. In my case, it is about 12% and I buy a basket of stocks. No matter how positive I may be, I never put so much money at risk that a complete blow-up of the stock would have a major impact on my portfolio. In general, my recommendations have asymmetric upside in which the upside from one success outweighs the risk of catastrophic outcomes in other situations. One success can have a major impact on a portfolio even in the event of other (more than one) failures.

Expansion of Business Model

I do want to call your attention to the section at the end of this report. In my initial report I focused on Cryoport’s strong position in providing logistics services for products that are shipped at cryogenic temperatures. I think that there is enormous potential in this segment, but I also think that the skills and expertise of the Company will allow it to expand into other segments of cold chain logistics which increases the addressable market several fold. Let me use an analogy to make my point. The initial business effort of Cryoport can be compared to a biotechnology company first gaining approval for a severe end stage cancer (a difficult disease target with limited sales) and then expanding usage into less advanced forms of the cancer that have much greater commercial potential.

First Quarter Overview

Historical Results

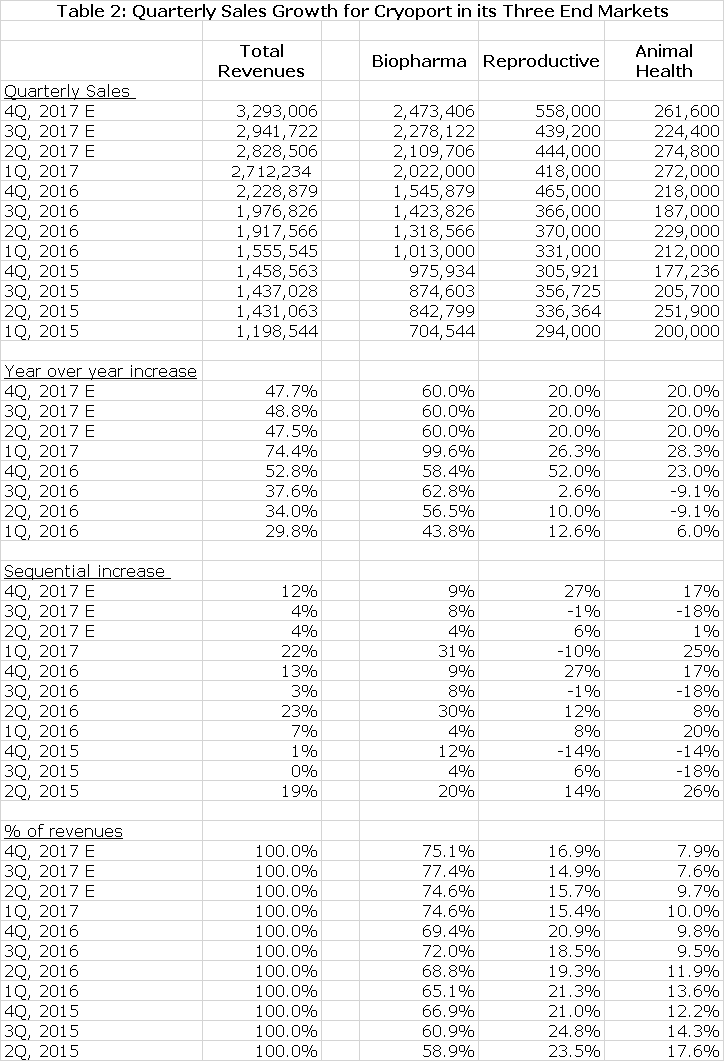

Before reading my discussion of quarterly results you may want to examine the following table that traces sales growth in the three key end markets from 1Q, 2015 to the current quarter; this has been a period of extraordinary growth. I have also included my projections for the remaining three quarters of 2017.

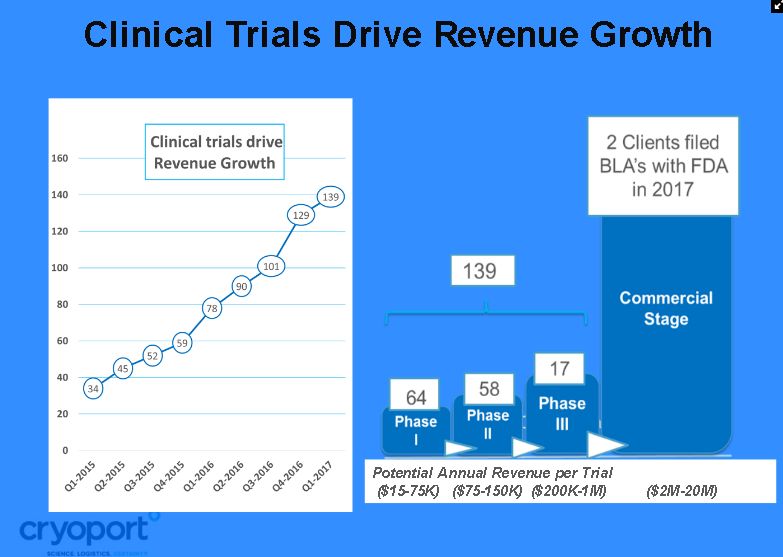

Key Points about 1Q, 2017 Biopharma Results

The regenerative medicine space in which Cryoport operates is absolutely exploding in terms of the number of clinical trials being started and conducted. Cryoport is supporting 139 clinical trials and the growth has been breathtaking from 1Q, 2015 when the company supported just 34. Growth is obviously driven by adding new clients but perhaps more importantly, there can be dynamic growth from a particular client over time. As a therapy progresses from phase 1 through phase 2 and 3 and ultimately to commercialization the Company states that its annual revenue potential may increase as below. This can be likened to same store sales growth in retail businesses.

- Phase: $15,000-75,000 of revenues for Cryoport

- Phase 2: $75,000-$150,000

- Phase 3: $200,000-$1,000,000

- Commercial: $2,000,0000-20,000,000

In addition, if Cryoport performs well on one trial, it is to be expected that a manufacturer likely will hire the Company for subsequent trials. For example, Cryoport supported Kite’s ZUMA-1 registrational trial of Axi-Cel in r/r DLBCL and is now supporting Axi-Cel trials in six other cancer indications. This further increases same store sales growth.

There is a very high attrition rate from phase 1 to phase 3 and many therapies just outright fail in phase 3 trials. This makes it very hard to model sales for the Company on a trial by trial basis. Consequently, my sales projections are based on momentum, i.e. extrapolating recent trends forward. This is intellectually unsatisfying, but I don’t know what else to do. In this extrapolation, I do pay a lot of attention to the number of therapies in phase 3 and BLA filings as these are the big revenue drivers.

In 1Q, 2017 sales increased by 99.6% to $2.7 million. This was all driven by drugs that were in clinical trials as the Company does not yet provide services for any therapy approved for commercial use. Let me remind you that there is the potential for a huge surge in revenues if a therapy is approved. A look at table 1 indicates that over the last four quarters the year over year sales growth rate for clinical trial revenues is accelerating. Given the strong trends driving research spending in regenerative medicine, this is not surprising.

While investors do not have access to sales trends by individual clients, Cryoport does and actually budgets sales on a client by client basis. I asked management if there were any unusual or one-time events in 1Q, 2017 that could account for the acceleration in sales growth to 99.6% from the roughly 60% year over year growth of the three prior quarters. I was told that the growth was not affected by unusual or one-time events. This suggests that the high rate of growth is sustainable.

I am projecting that the rate of quarterly sales growth in the last three quarters of 2017 will increase 60% in each quarter. Why am I projecting a slower rate than the 99.4 % increase in 1Q, 2017? This is because of the difficulty in modeling and an intention to be conservative which is driven by Smith’s Law for projecting future sales growth; it says that small companies have a propensity to hit unexpected bumps in the road. That said, I would not be that surprised to see the doubling in growth comparable to 1Q, 2017 continue over the remaining three quarters of 2017.

And as a still further effort at conservatism, I am projecting no revenues in 2017 from the launches of Kite and Novartis’s CAR-T products. I expect Novartis to receive approval for CTL-019 in r/r ALL in 3Q, 2017 and for r/r DLBCL in 4Q, 2017. I also expect approval for Kite’s Axi-Cel in r/r DLBCL in 4Q, 2017. For modeling purposes, I am assuming that each of these launches occur at the beginning of 2018. That said, there is a strong potential for some small revenue contributions in 2017 from each of these product launches.

Reproductive

This segment is even harder to model than biopharm as there are no metrics like the number of clinical trials to peruse. Revenues increased by 26% for the first quarter. Management only said that there was a 52% increase in the U.S. market and a decline in international revenue of 12%. International revenue continued to be impacted by the restriction of reproductive tourism in certain countries. Management did not single out any particular reason for the strong US growth other than evolving relationships with fertility clinics and marketing efforts.

I again asked management if there were any unusual or one-time events in the quarter and was told there were none. Again, this suggests that the 26% rate of increase is likely sustainable. However, for reasons cited for biopharma, I am assuming that revenues in the next three quarters of 2017 will grow at 20%; again this is an effort to be conservative.

Animal Health

Until 4Q, 2016 growth in this area was slow due to a delay in shipments of poultry vaccines from Zoetis, the dominant client in this area. This led to a decline in year over year sales growth of 9% in both 2Q, 2016 and 3Q, 2016. In 4Q, 2016 sales increased by 23% and then 28% in 1Q, 2017. This bounce back was the result of more normal business patterns with poultry vaccines and the addition of new clients. I am projecting 20% sales increases in the remaining three quarters of 2017.

The Business Outlook for 2018 and Beyond

Cryoport is in a very early stage of development and its future is joined lockstep with that of regenerative medicine, some of whose leading research efforts are based on engineering living cells to create drug therapies. The best known initial programs are engineering T-cells (Kite, Juno, Novartis and 20+ other companies) and gene therapy (Spark, bluebird and many others). Regenerative medicine seems destined to have the same impact on biopharma as recombinant and monoclonal antibody technologies that have created such phenomenal success stories as Amgen, Biogen and Genentech.

Let me use an analogy to demonstrate this. Let’s categorize the whole field of regenerative medicine as analogous to an emerging biotechnology company. The latter starts with an idea for a developing a drug. It then begins a clinical trial program that starts with phase 1 and 2 clinical trials in which the Company tries to determine safety dosage and the types of patients for whom the drug might provide benefit. It then uses the information to conduct a phase 3 clinical trial in an effort to demonstrate in a statistically significant manner that the drug is safe and effective in a proscribed disease state. It then seeks regulatory approval and if gained, will introduce the drug to the market. The profits from this initial product success then funds another drug development effort and then another and another.

On a purely hypothetical basis and intended only to suggest magnitude and trend, the clinical progression through commercialization might create shareholder value as measured by market capitalization in an emerging biotechnology company as follows:

- Pre-clinical: $50 million

- Phase 1 and 2: $150 million

- Phase 3: $300 million

- Two years after successful commercial launch: $1 billion

- Successful launch of a second product: $3 billion and so on

By this analogy, Cryoport (and the field of regenerative medicine as a whole) would be in phase 3 of its corporate development. Remember that Cryoport is not developing drugs for its own account, but rather is providing logistics solutions for a highly meaningful percentage of companies in regenerative medicine. Its success in providing solutions for any single product will produce step-ups in value creation as previously described.

Obviously, the value of providing logistics is much less than for successfully developing a drug. On the other hand, Cryoport does not have the binary risk of drug development and benefits from industry wide drug development. I compare Cryoport providing logistic services to regenerative medicine companies to merchants providing picks and shovels to gold miners in the 1849 gold rush. The point I am trying to make is that regenerative medicine and Cryoport are poised to enter the commercial stage of product life cycles and there is the potential for dramatic increases in shareholder value if my analogy holds.

The year 2018 is a breakout year for the biopharma business. It promises to be the first full year of sales for of two new products in three indications:

- Novartis’s CTL-019 in r/r ALL, about an 800 patient market in the US,

- Novartis’s CTL-019 in r/r DLBCL, about 7000 patient market

- Kite’s Axi-Cel which will share the r/r DLBCL market

I think that the strong business trends for biopharma clinical trials should continue into 2018. In addition to this, there is the potential for a very significant sales contribution from the anticipated three new CAR-T product launches. Management does not provide guidance on where in the $2 to $20 million annual sales potential these three approvals lie. Based on the addressable patient populations. I am estimating that the peak potential for Novartis’s CTL-019 in r/r ALL is on the low end of the range or $2 to $3 million. For both CTL-019 and Kite’s Axi-Cel in r/r DLBCL I am estimating that the potential for each is in the $4 to $5 million peak sales range. I want to emphasize that these are guesses based on Cryoport’s guidance that it can realize $2 to $20 million of revenues per year from a commercial product.

Having made a stab at what peak sales, there are a number of other questions that I ask:

- Will these products actually be approved? The FDA has designated each product as a breakthrough medicine so I think they will almost certainly be approved. However, issues with the CMC (chemistry, manufacturing and control) section of the BLA could delay the launch. There is no way for an investor to predict this.

- How much of the market will they penetrate? In the case of r/r ALL, the complete response rates are 80% to 90% so that the almost all eligible patients will be treated. In the case of r/r DLBCL, the complete response rate is 30% to 40% so the penetration could be (substantially?) less. I don’t know how to project this.

- How long will it take to reach peak sales whatever they may be? There are no effective treatments for r/r ALL and r/r DLBCL so this argues for quick penetration of the market. Also, there are only 70 or so targeted transplant centers in the US, a market that can quickly be penetrated.

- How many other important factors am I missing? I can almost guarantee that there are more.

Another area that could provide a potentially important revenue stream is providing logistic services for existing products. For example, Cryoport has been working for nearly a year to provide support to Bristol-Myers Squibb in shipping manufacturing cell lines for an undisclosed, but said to be a blockbuster monoclonal antibody. They are working in a similar vein with Sanofi and Johnson & Johnson and should be providing more services to additional companies.

Cryoport has given no guidance on how to model sales for these relationships so I can only guess at how much they might contribute. I am guessing that they are somewhere between $250,000 (top end of guidance for a phase 3 product) and $2 million (low end of guidance for a commercial product. This leads me to estimate that peak sales at three years (2020) will be roughly $800,000 each for Bristol-Myers Squibb, Sanofi and Johnson & Johnson. The resultant combined revenues are $200,000 in 2018, $800,000 in 2019 and $1.6 million in 2020.

Looking Even Further Out; Expansion into other Segments of Cold Chain Logistics

There is an interesting section in the 1Q, 2017 10-Q that I want to reproduce in its entirety and then discuss. The section reads as follows:

“Life sciences technologies are expected to have a significant impact on global society over the next 25 years. In the United States alone, the life sciences industry is made up of 6,000 identifiable establishments. However, the industry is growing globally in a way where research and manufacturing pipelines span across the globe, which increases the need to mitigate logistics risk.

The total cold chain logistics market has historically grown 70% faster per annum than the total logistics market. For 2011, global cold chain logistics transportation costs were reported to be $7.2 billion; about $1.5 billion within the cryogenic range of requirements. By 2017, transportation cost alone, for global life sciences cold chain logistics, is forecasted to grow to $9.3 billion, a 41% increase, and twice the growth of the overall market.

In addition, with the recent advancements in the development of biologics and cell-based therapies, scientists, intermediaries, and manufacturers require the means for cryogenically transporting their work. Temperatures must be maintained below the “glass point” (generally, minus 136ºC) while shipping these therapies to ensure that the shipped specimens are not subject to degradation that could impact the characteristics and efficacy of those specimens.

While we estimate that our solutions currently offer comprehensive and technology-based monitoring and tracking for a potential of six to seven million deep frozen shipments globally on an annual basis, we also believe that with investment in our services, adaptations of our solutions can be applied to a large portion of an additional fifty-five to sixty million annual shipments requiring ambient (between 20° and 25°C), chilled (between 2° and 8°C) or frozen (minus 10°C or less) temperatures.”

Cryoport has been able to become a dominant suppliers of logistics services for products that require shipping at cryogenic temperatures. I would think that this requires greater skill than for other cold chain products so that it should be possible to migrate into some areas. I haven’t given this a lot of thought as the Company has its hands full right now, but there could be a meaningful opportunity.

Tagged as 2017 Results, Cryoport, Cryoport 1Q + Categorized as Company Reports, LinkedIn