Repligen: A Detailed Update; Recent Price Drop Makes Me More Positive (RGEN, Buy, $28.50

Repligen’s Outstanding Business Model

Repligen (RGEN) has gone through a metamorphosis that has dramatically changed its business model and investment outlook. For many years, it was a small biotechnology company focused on drug development but it was also quietly building a high quality bioprocessing business that provides consumable products used in the manufacturing of biological products. The acquisition of a major competitor, Novozymes (now Repligen Sweden) in 2011 provided the critical mass for a standalone business in bioprocessing; Management and the board decided to exit the drug development business to focus on bioprocessing.

I think that Repligen has one of the best business models that I have seen in my many years as an analyst. Products used in bioprocessing have very long product lives because changing the manufacturing process for a biological product once it is approved or after it has completed phase 3 trials can change the characteristics of the product. Hence, a change in the manufacturing process at virtually any level can create troublesome regulatory issues as the FDA will require assurance that the product is unchanged. The agency may request new studies, possibly including clinical trials in humans that demonstrate that there is no change in the product. The economic benefits of any change in manufacturing efficiencies are trivial in comparison to lost profits if output is interrupted by the need to validate a change in the biomanufacturing process.

This means that once Repligen’s products are adopted in a biomanufacturing process (be it for clinical or commercial stage production) they are unlikely to be switched out. Consequently, its products enjoy very long life cycles and, once established as a platform technology, have minimal vulnerability to competition. Sales of Repligen’s products are like annuities.

About 53% of 2015 product sales are projected to come from sales of protein A and I estimate that Repligen has over 95% of this market. Protein A is used in the production of almost all products that are based on monoclonal antibodies. Its other key products are also driven by commercial and clinical trial production of biologic drugs, particularly monoclonal antibodies and with some products, recombinant proteins and vaccines as well.

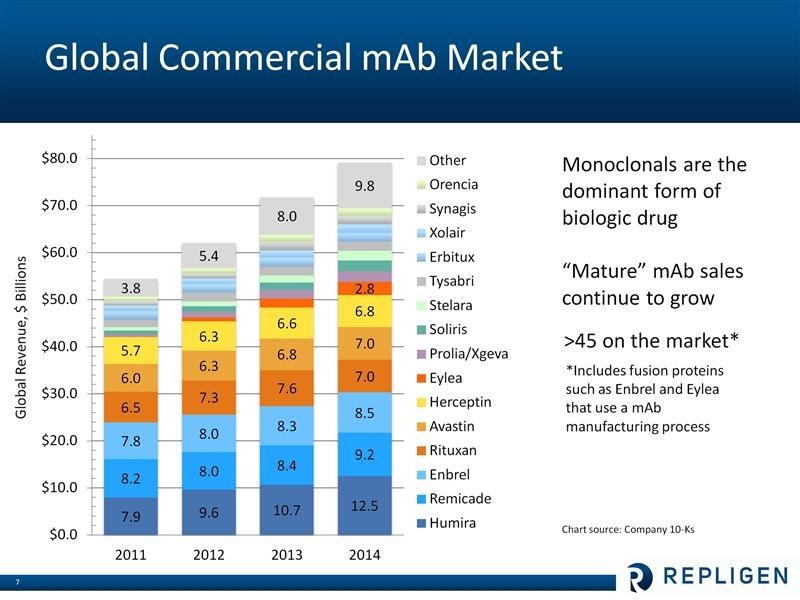

Repligen is a direct play on the growth of monoclonal antibodies which are an $80+ billion global product category that historically has grown at 8-9% or more per year. There are 50 or more approved products based on this technology and it is an area of intensive research interest as there are estimated to be 350 new monoclonal products in development. Six of the ten best selling drugs in the world in 2014 were monoclonal antibodies and included Humira, Remicade, Enbrel, Rituxan, Avastin and Herceptin. Monoclonal antibodies sales are responsible for 40% of the $200 billion global biologics market. The advent of checkpoint modulators in oncology and PCSK9 inhibitor cholesterol lowering agents appears to be accelerating this growth to perhaps the 10% to 12% range.

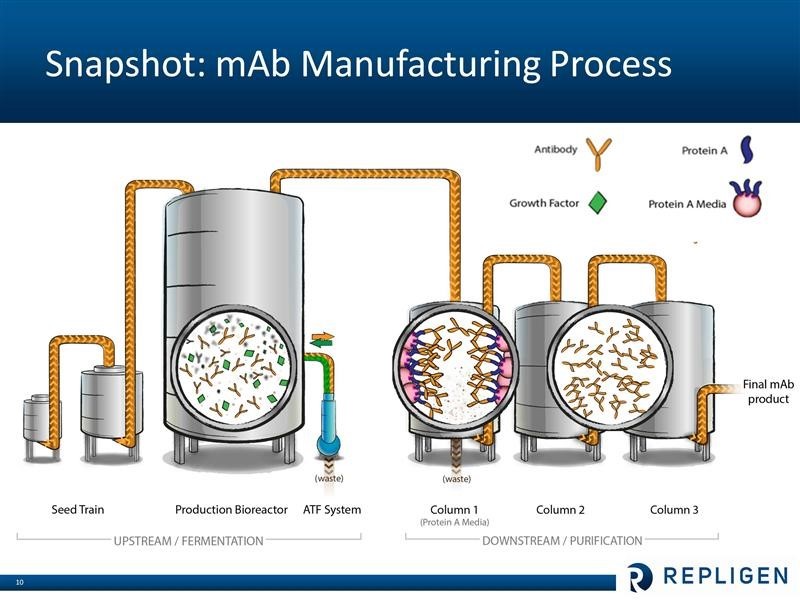

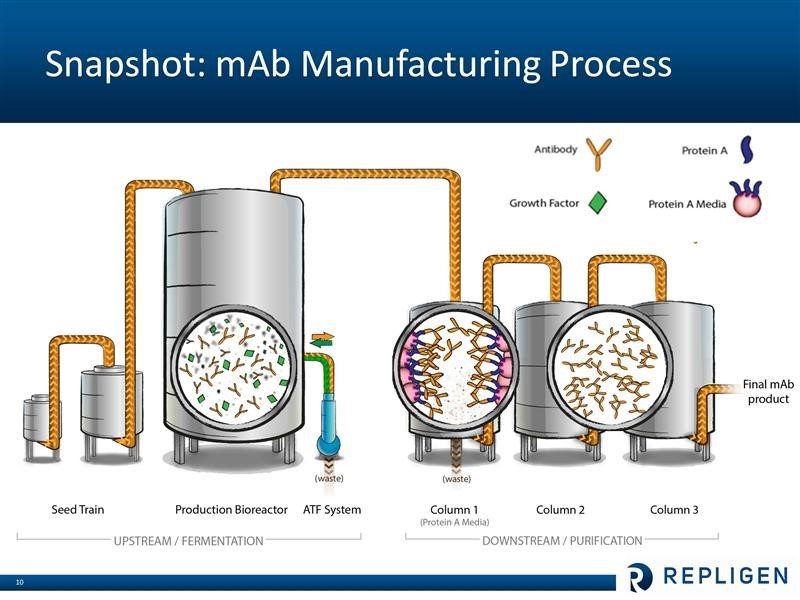

The following is a schematic of the bioprocessing manufacturing cycle that is used both in clinical trial and commercial processes.

Bioprocessing products that are used in and before the production bioreactor are referred to as upstream and those used afterwards in the purification process are called downstream. The four major product groups of Repligen address various stages of the process at the clinical level, commercial level or both.

· Protein A affinity ligands are used downstream to purify monoclonal antibodies and also other biologics like recombinant proteins or vaccines. They are used in both clinical and commercial operations.

· Alternating tangential flow (ATF) filtration is used in upstream processes to improve product yield and increase capacity of a given bioreactor. ATF is currently used primarily in monoclonal antibody manufacturing.

· OPUS disposable chromatography columns are used in downstream purification of a variety of biologics. The primary use is in monoclonal antibodies, but it is also used for recombinant proteins and vaccines. OPUS is most applicable to clinical stage manufacturing. At commercial stage – unless the drug is a small volume orphan biologics – traditional (more permanent stainless steel) columns are likely to be used. OPUS 60 centimeter in diameter columns are the largest columns on the market and are displacing glass column packing. Columns of this size and purifying content can be used in 2,000 liter bioreactors that are often used in clinical trials.

· Growth factors are used in upstream cell culture processes to improve product yield. Added to cell culture media, they improve productivity for any stage of drug development – preclinical through commercial

Investment Thesis

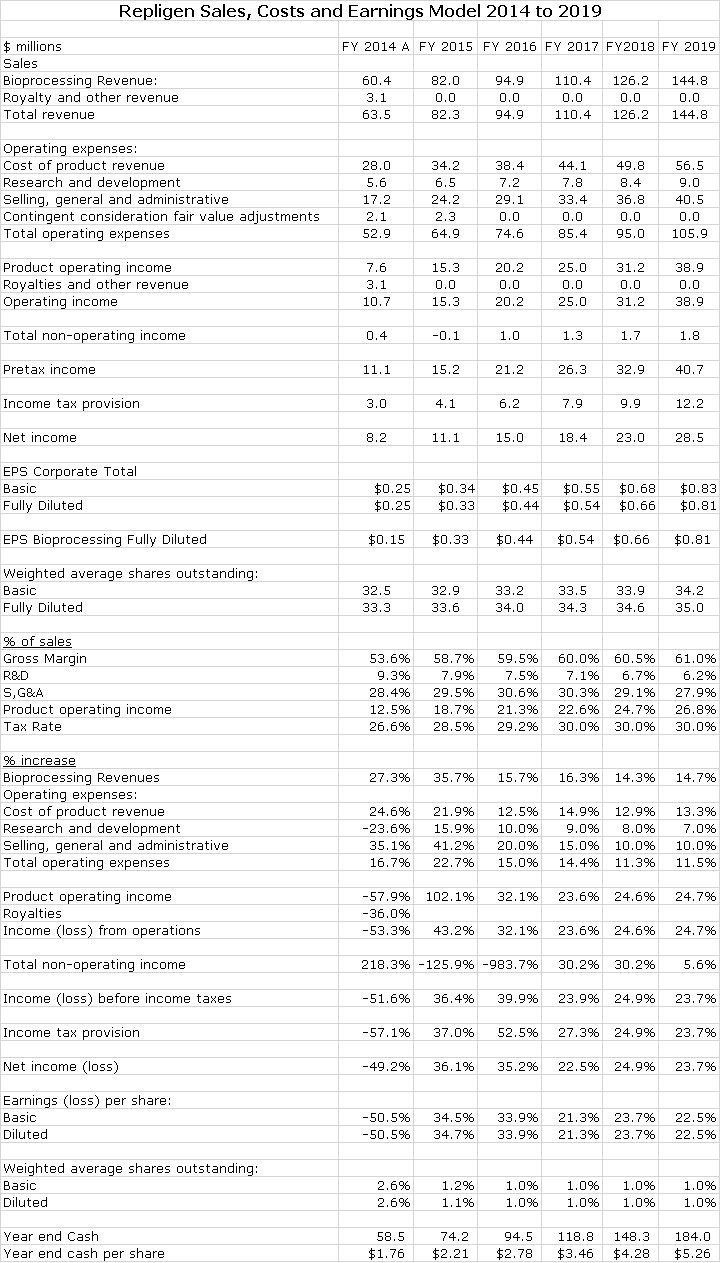

Great companies always look too expensive on near term sales and earnings projections and indeed this is the case with Repligen. Based on my 2015 and 2016 EPS projections of $0.33 and $0.47 the respective 2015 and 2016 P/E ratios are 86 and 61 times. The market capitalization ratio to projected 2016 sales is 10 times. Based on my projections, EPS will increase by 35% in 2015 and 34% in 2016. Beyond 2016, I am projecting EPS growth of 20+%.

All of my sales and EPS projections are based on growth of existing products and do not include acquisitions. However, acquisitions have been an integral part of Repligen’s success. Its current sales of about $82 million place it in a unique position in the bioprocessing industry. It is an attractive acquirer of companies with sales of $5 to perhaps $30 million which are not big enough to be on the radar screens of industry giants like GE and Millipore. Management reports that there are a good number of potential acquisitions in this sales range. In looking at acquisitions, it is important to understand that Repligen is a cash flow machine. I project that free cash flow in 2015 will be $15 million in 2015 and $20 million in 2016. Assuming no acquisitions, the yearend respective cash balances will be about $75 million in 2015 and $95 million in 2016. This allows Repligen to pay cash for acquisitions if it wants.

The impact of an acquisition can be profound. Let’s hypothesize that Repligen makes an acquisition of a company with $10 million of sales and a 50% gross profit margin. Past acquisitions have been folded into the existing marketing and manufacturing infrastructures of Repligen so that much of their operating expenses can be largely eliminated. In this hypothetical example, this would mean that the $5 million of gross profit would fall to pretax.

As a ballpark number, these acquisitions command a price of 4 to 6 times sales. Let’s assume that Repligen pays $50 million of cash (five times sales) to pay for the $10 million of sales acquisition and in doing so loses $0.5 million of interest income (assumes a 1.0% interest rate on investments. The net effect would be to increase pretax income by $4.5 million. Assuming a tax rate of 29%, this would contribute $3.2 million in net income or $0.09 per share.

Let’s assume that this acquisition were to take place on January 1, 2016. I am not suggesting that an acquisition will occur at that time, this is just for illustrative purposes. In my example, 2016 EPS would increase from $0.44 based on organic growth to $0.53. Year over year EPS growth from 2015 would be 61%. The 2016 P/E ratio based on this would be a more palatable (but still hefty) 54 times. This explosive potential has to be considered in the investment analysis although I cannot predict when or if an acquisition will be made.

I think that investors have and will continue to value the EPS stream of Repligen at a much higher level than would be the case for a rapidly growing small biotechnology company. It offers competitive growth rate potential without the enormous risk that a setback to a single product can have on biotechnology companies. This is because of the long lived nature of its assets for reasons I previously described and its products being used over a very broad portfolio of biologics. I also think that a premium will be awarded based on the potential that Repligen could be a very attractive takeover candidate down the road.

My basic thinking on the stock is that the P/E ratio will hold in 2016 so that stock price growth would be in line with EPS growth. If so, the stock could increase by 34% in 2016. There is the further wildcard upside in the stock price that could result from an acquisition increasing EPS growth significantly. I think that the stock is attractive and a Buy at this level. You may recall that I was cautious on the stock as it soared towards $42, but I consistently stated that you could not pry the stock out of my portfolio with a crowbar. The recent price decrease to the $28+ range causes me to be more positive.

There is risk in any stock and while I perceive the risk in the business model as low, it is not zero. Recently, the stock plunged by $10 from $36 per share because an analyst lowered his opinion from buy to hold based on his judgment that the stock price was too high. There is also the possibility that a major customer could bolster inventory in one quarter and draw it down in subsequent quarters to cause a downside earnings surprise. The latter likely would be a buying opportunity.

My detailed sales and earnings model for Repligen is shown in the following table:

Comments on Key Sales Groups

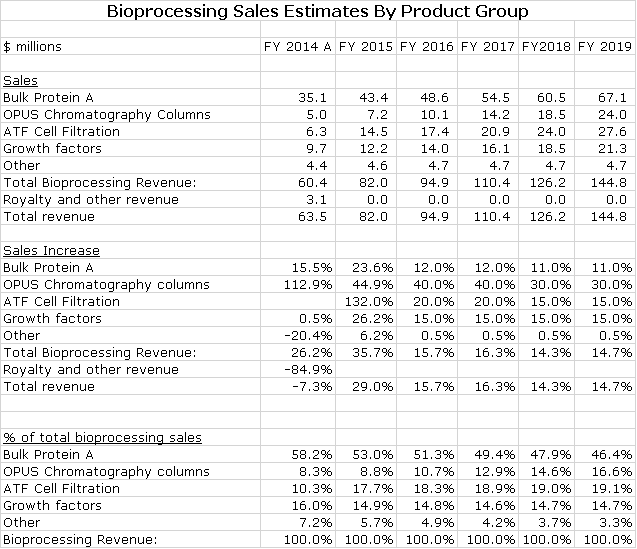

The following sections describe recent trends in sales of key product groups. Repligen does not give precise breakdowns but enough information is provided to make reasonable estimates. My sales projections for key bioprocessing product groups is as follows:

Protein A Ligands for Chromatography Resins

The product upon which Repligen was founded and its core business is Protein A ligand which is used in perhaps 95% of more of all chromatography resins. This business has been a stable 8-9% grower that is driven by the growth of monoclonal antibodies. In 2015, growth accelerated to over 20% which was driven by two factors.

The hottest area of research and product development in oncology and indeed in all of biopharma is checkpoint modulation. This is based on using monoclonals to increase the activity of T-cells by either blocking mechanisms that cause T-cell activity to be dampened or activating mechanism that increase T-cell activity. The first two commercial products were introduced in 2014; these were Bristol-Myers Opdivo and Merck’s Keytruda. Opdivo sales increased from $6 million in 2014 to $900 million in 2015 and Keytruda’a sales increased from $50 million to $550 million. Also, there is a mad scramble by other pharma companies to get into checkpoint modulation. Several Wall Street analysts see this as a $20 billion market in 2020.

The next exciting new area for monoclonals is PCSK9 inhibitors. This is a highly effective way of lowering LDL cholesterol. The first two products in this field are Amgen’s Praluent and Regeneron’s Repatha which were introduced in 2015. Managed care (as always) is trying to slow the uptake of these agents. This is easier to do with cholesterol lowering drugs than cancer drugs. I expect a slower uptake than with Opdivo and Keytruda. In 2015, there was likely some inventory building or Protein A resins in anticipation of the launch and this helped sales.

The growth rate of Protein A should accelerate beyond the traditional 8-9% rate that we have seen. The 20+% rate of 2015 was probably affected by inventory builds for the PCSK9 inhibitors and possible the checkpoint modulators. At this point, I am projecting 12% growth for Protein A in 2016 and 2017. I estimate 2015 sales at 43.4 million and 2016 and 2017 sales at $48.6 million and $54.9 million.

Alternating Tangential Flow (ATF) Filtration

Bioreactors use growth factors and nutrients to stimulate cell growth. Cell metabolism leads to the generation of waste. As the amount of metabolic waste increases, the growth and division of cells is negatively affected. This makes it necessary to remove as much of the waste as possible. The traditional technology used to remove waste has been spin centrifugation; this has the disadvantage of causing damage to some cells.

Repligen obtained the ATF technology through the acquisition of Refine Technology in 2014. This is a filtration technology that can continuously remove waste from fermenters during bio manufacturing. ATF can increase cell densities in fermenters by 2 or 3-times the levels achieved with spin centrifugation. It increases product yield and can reduce the size of a bioreactor required to manufacture a given volume of product. While waste material removal is a key feature of ATF, it is not the only feature and does not define the product.

ATF is far ahead of competition and is virtually alone in providing this technology. The current market application in bioreactors that typically could be around 10,000 liters; this addressable market is estimated by Repligen to be about $40 million and ATF has about 30% of this market. However, there is significant potential to move upstream of the bioreactor to seed train reactors are around 2500 liters. In the first quarter of 2016, Repligen is introducing a disposable ATF system that is targeted at the upstream production market as well as clinical trials. This could increase the size of the addressable market by threefold to $140 million.

Sales of ATF were $6.8 million in 2014, but this was only from seven months of sales. I estimate that organic sales growth was over 20% in 2015 and with inclusion of ATF for 12 months that sales reached $10.5 million in 2015. I am projecting sales increases of 20% in both 2016 and 2017 that would result in ATF sales of $12.6 million and $15.1 million. I think that if Repligen is successful with the new disposable product that these estimates could be low.

OPUS Disposable Chromatography Columns

The concept of disposable chromatography columns has been around for about four years. And Repligen introduced its first OPUS column in 2012. There were initially several market participants but the filed has narrowed down to two major players, with about 40% of the market and GE with around 60%. GE and Repligen products are most applicable to clinical trials and sometimes small scale commercial operations such as orphan drugs. There is less or no advantage to using disposable columns in large commercial operations. For example, one of largest columns is 40 centimeters in diameter. It is useful in 2000 liter bioreactors that are generally sufficient for phase 1 and 2 trials. Disposables are less (or not) applicable to commercial operations that use 5,000 to 10,000 liter bioreactors.

Repligen has been gaining market share from GE because its columns can be packed with resins of any manufacturer while GE columns only provide GE resins. This greater flexibility has enabled Repligen to increase its market share from about 15% two years ago to a current 40% and this trend should continue. Because GE is also one of Repligen’s largest customers, it raises the question as to whether GE could somehow reduce doing business because of the OPUS competition. Repligen responds that this is not likely as it is common in the bioprocessing business to sometimes compete with customers and that this is a very small part of GE’s bioprocessing business.

I estimate that OPUS sales increased from $5.0 million in 2014 to $7.5 million in 2015. Repligen estimates that the addressable market for disposable columns is about $150 million and is 20% penetrated. This suggests that OPUS could continue to achieve some very high levels of growth. I am estimating a 40% increase in sales in 2016 and 2017 to $10.5 million and $14.7 million.

Growth Factors, Other Businesses

Fermentation growth factor products are essential for proliferation and maintenance of cell lines used in the manufacturing of cell based therapies such as stem cells, monoclonal antibodies and recombinant DNA products. The most important product is LONG R3 IGF-I which is ten times as potent as recombinant insulin and native IGF, which are currently the most widely used growth promotants. It is sold under a distribution agreement with Sigma-Aldridge which extends to 2021 and is now used in several commercial biopharmaceutical products. Other growth promotant products are long epidermal growth factor (LONG EGF), transforming growth factor alpha (LONG TGF-a), recombinant transferrin (rTransferrin) which is as an iron supplement for cell culture and supplements for serum-free or low serum cultures.

It is estimated by Repligen that the current market size for growth factors is $75 to $80 million. Repligen currently has about 15% of the market and is replacing insulin usage. Management suggests that long term growth could be 10% to 15% per years. Sigma-Aldrich is working to increase use in the production of clinical materials for several mid- and late-stage clinical products. If one or more of these products is ultimately approved and successfully launched, it could significantly increase demand.

Monoclonal Antibodies Drive Repligen’s Business

Let me give a perfunctory overview for those who may be unfamiliar with Repligen. The macro-driver of Repligen’s business is research and commercialization of monoclonal antibodies, which is a major driver of the world pharmaceutical industry. The worldwide pharmaceutical market is estimated to be about $740 billion and is growing at about 4% per year. Of this, in 2015, 50 or more monoclonal antibody-based drugs accounted for about $80 billion in sales. Monoclonals continue to be one of the fastest growing segments of the pharmaceutical market at about 8% to 10% per year. The largest selling biopharmaceutical in the world is the monoclonal antibody Humira which had $12.5 billion of sales in 2014, a year in which six of the top ten selling drugs in the world were monoclonals. Sales of leading monoclonal antibody drugs are shown below:

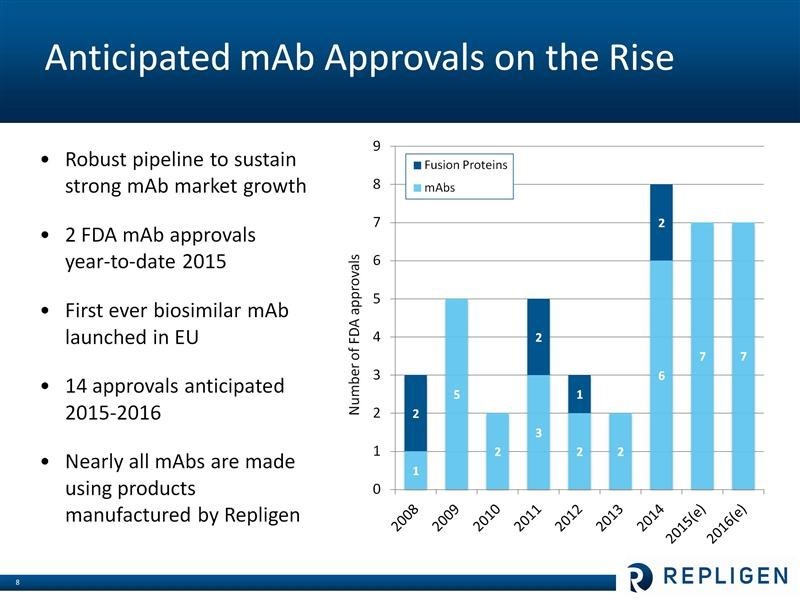

It is estimated that 40% of the bioharma industry’s current R&D pipeline is based on monoclonal antibodies. Eight monoclonal antibodies were approved in 2014 and there are >350 in various stages of phase 1, 2 and 3 development. Probably the two hottest new types of monoclonal antibody drugs are the checkpoint inhibitors for treating cancer led by Merck’s Keytruda and Bristol-Myers Squibb’s Opdivo. Some analysts are projecting over $20 billion in sales by 2020. The PCSK-9 inhibitors for lowering LDL cholesterol, which are about to be introduced by Amgen and Regeneron, are also projected to produce blockbuster revenues. Repligen sells products that are needed in the production of all of these products. The following table shows the uptick in new product development in monoclonal antibodies which could accelerate in the future, all to the benefit of Repligen.

Repligen’s Role in Manufacturing Monoclonal Antibody Drugs

Repligen does not research or commercialize any monoclonal drugs. It is involved in helping drug developers manufacture their products. I have only a layman’s understanding of the bioprocessing of monoclonal antibodies, but let me offer a simplistic overview. Broadly, bioprocessing can be divided in two areas. The upstream step is where the cells are cultured that produce the monoclonal antibody product of interest. This is essentially a fermentation process which takes place in large bioreactors. The downstream step is where the monoclonals are separated from the cells and contaminants that are produced during fermentation. Central to the purification process is letting the liquid containing the monoclonal antibody drug pass through columns filled with Protein A chromatography media (beads that are coated with protein A ligands). The Protein A binds very tightly (with high affinity) to the monoclonal antibody (and only the monoclonal), while the waste flows out of the column. The monoclonal antibodies are later separated from the Protein A media. At this point the antibody product is more than 95% pure. Two additional columns with other (less expensive than Protein A) chromatography media are typically used for “polishing” – or to reach virtually 100% purity. These steps are shown in the following diagram.

IMAGE 6

Repligen was a biotechnology development company that happened to manufacture Protein A until 2011 when it acquired the Swedish company Novozymes. At the time, the two companies each had a little under one-half of the protein A market so that the combination gave Repligen over 95% of the worldwide market. Protein A is used in the downstream/ purification process as was just described. At that time the Company made a radical change in its business model as it decided to sell or license its biotechnology assets and to focus on bioprocessing. The dominant position of the Company in the production of Protein A provided a strong foundation to build on.

The Novozymes acquisition also brought growth factors used in the upstream/ fermentation process which brought another building block. The fastest growing product line is OPUS disposable chromatography columns that are used in the downstream/ purification step. The underlying technology for OPUS was obtained through the acquisition of BioFlash in 2010, but Repligen did much of the engineering development. Then in June 2014, Repligen bought the ATF cell filtration and separation business which is used in the upstream/ fermentation process.

Once a drug company incorporates products manufactured by Repligen in its manufacturing process for Phase 2 or Phase 3 clinical trial materials, it is next to impossible to switch to another product. In living cell manufacturing, even the slightest change in the manufacturing process can lead to a change in the end product. If a manufacturer were to change to another supplier of Protein A or another product, regulatory agencies might require studies, possibly even new human clinical trials, to demonstrate that the product characteristics have not changed. Thus a change would involve high risk for the manufacturer against which potential for modest cost savings would be difficult to justify. Hence, drug products that use products made by Repligen in their manufacturing process effectively incorporate it for the commercial life of the product-talk about stickiness of revenues.

Tagged as Alternating Tangential Flow Filtration, OPUS Disposable Chromatography Columns, Protein A ligand, Repligen, RGEN + Categorized as Company Reports, LinkedIn

Based on your previous recommendations, I had RGEN on a watch list. I pounced last month and got in under $27. It’s now a core holding.