Relypsa: Update Following 1Q, 2016 Conference Call (RLYP, Buy, $14.15)

Investment Thesis for Relypsa

The investment issues for Relypsa are complex. Its key drug Veltassa was launched in December of 2015 so that we are now about five months into the launch. Over the last several years it has become increasingly apparent that there is a new paradigm for drug introductions. Managed care has been skillful in setting up hurdles for reimbursement and adoption that are designed to slow uptake of a drug in its launch period. This has the further effect of frustrating physicians who must endure a lot of red tape to prescribe a new drug. There is also more physician caution in adopting a new drug than in the past as they seem inclined to try the drug on one, two or a few patients before incorporating it into their broad practice.

Wall Street analysts have been a bit behind the curve in recognizing and adjusting for these new facts of life and as a consequence have consistently overestimated initial sales. This has certainly been the case with Veltassa as Street estimates late last year called for $50 to $75 million of sales in 2016. My estimate for 2016 sales is $17.8 million and I think this is close to current Street consensus. As a result of this, the Veltassa launch has been viewed as disappointing and the stock price has floundered. In late December 2015, just after the launch, the stock price reached $29 and its current price is $14. Of course, weakness in the biotechnology sector as a whole also contributed.

Some investors have taken the slow (so far) launch as an indication that Veltassa has limited sales potential. I continue to believe that this drug has $1+ billion sales potential in the US and a like amount in Europe. Vifor Fresenius licensed this drug for Europe and has just filed an MAA seeking regulatory approval. Please refer to my February 25, 2016 report in which I initiated coverage of Relypsa with a Buy for more detail on my sales projections for the US and Europe.

The next issues with this investment story relate to a competitive drug developed by ZS Pharma called ZS-9 which has a PDUFA date of May 26, 2016. I initiated coverage of ZS Pharma with a Buy on April 25, 2015. See this report. The first thing to note is that ZS Pharma was purchased by Astra-Zeneca for $2.7 billion on November 6, 2015. Relypsa currently sells at a market capitalization of about $634 million. Investors are naturally asking if Relypsa is a potential takeover candidate and this is certainly a distinct possibility.

The next question is how Veltassa will fare if ZS-9 is approved and enters the market late this year. This all depends on the label for ZS-9. In terms of product attributes with one important exception I give ZS-9 an edge over Veltassa, but this hyperkalemia market potential is huge so that this is not a zero sums game. Both products can be blockbusters. However, the one exception may be huge and could give Relypsa a critical advantage. ZS-9’s mechanism of action traps potassium by exchanging sodium. This could develop into a (huge) issue affecting both approval and the label.

Many of the patients who are the intended patient population for Veltassa and ZS-9 have hypertension and congestive heart failure and are generally placed on diets low in sodium because it exacerbates their condition. How will the FDA treat this increase in sodium that results from ZS-9 usage? I don’t know but in approving Veltassa, which does not have the sodium concern, the agency was extraordinarily cautious and included a black box warning about drug to drug interactions which seemed uncalled for in my opinion. This conservatism could cause the FDA to put cautionary language in the ZS-9 label or potentially approve it only for acute usage. The latter would be a disaster for ZS-9 as both ZS-9 and Veltassa are intended for chronic use. Veltassa would essentially own the market.

Launching a new drug for a broad market like hyperkalemia is incredibly expensive. Relypsa has guided that cash operating expenses in 2016 are expected to be $255 to $275 million. My base case estimate for Veltassa sales projects $18 million in 2016 and $85 million in 2017. (I would caution that these sales estimated are very preliminary and there is the potential for substantial error.) The Company recently entered into a six year term loan facility for $150 million and with this I estimate Relypsa’s yearend 2016 cash balance will be $133 to $153 million of cash. I project that the Company may need to bring in an additional $200 million if it wants to end 2017 with a cash balance of $150 million.

Relypsa has two broad strategies open to it. Going it alone and retaining all rights to Veltassa produces the most significant long term return for investors, but it will result in enormous upfront losses and the need to raise a lot of capital which may prove challenging if current capital market conditions for biotechnology companies persist. Selling the Company would be a quick and tempting out for management. If this is the strategy, the label that ZS-9 receives will significantly affect the valuation that a larger company would pay so Relypsa and potential acquirers would almost certainly wait until May 26 to get a gauge on how the FDA weighs the sodium issue with ZS-9.

The final thing to consider is that hedge funds have recognized that new product launches have generally been disappointing to Wall Street and often short a Company that is launching a new product. This can have a major impact on the stock as hedge d funds often run in packs to launch a short attack on a stock. I believe that this is affecting Relypsa at this point in time. Moreover, the use of naked shorting which is routine in the hedge fund world gives them enormous power to manipulate stock prices down. This is an unfortunate aspect of investing in emerging biotechnology stocks. See my report Illegal Naked Short Selling Appears to Lie at the Heart of an Extensive Stock Manipulation Scheme for more details on this. https://smithonstocks.com/illegal-naked-short-selling-appears-to-lie-at-the-heart-of-an-extensive-stock-manipulation-scheme/

So how do you put this altogether? I believe strongly in the potential of Veltassa even if ZS-9 is approved with a clean label. I am rooting for the Company to succeed as a standalone company but I recognize the risk due to the huge capital needs of the Company and the concern with hedge fund stock manipulation. If there are further stumbles in the Veltassa launch and/or concerns about the need to raise capital, hedge funds might attack the stock more so than they have been doing. However, Relypsa management has the trump card to play and that is to sell the Company which even at this current and uncertain point of time is likely to be much higher than today’s price. I think this limits my downside risk and hence, my Buy recommendation on the stock.

Modeling Veltassa Sales for 2016 and 2017

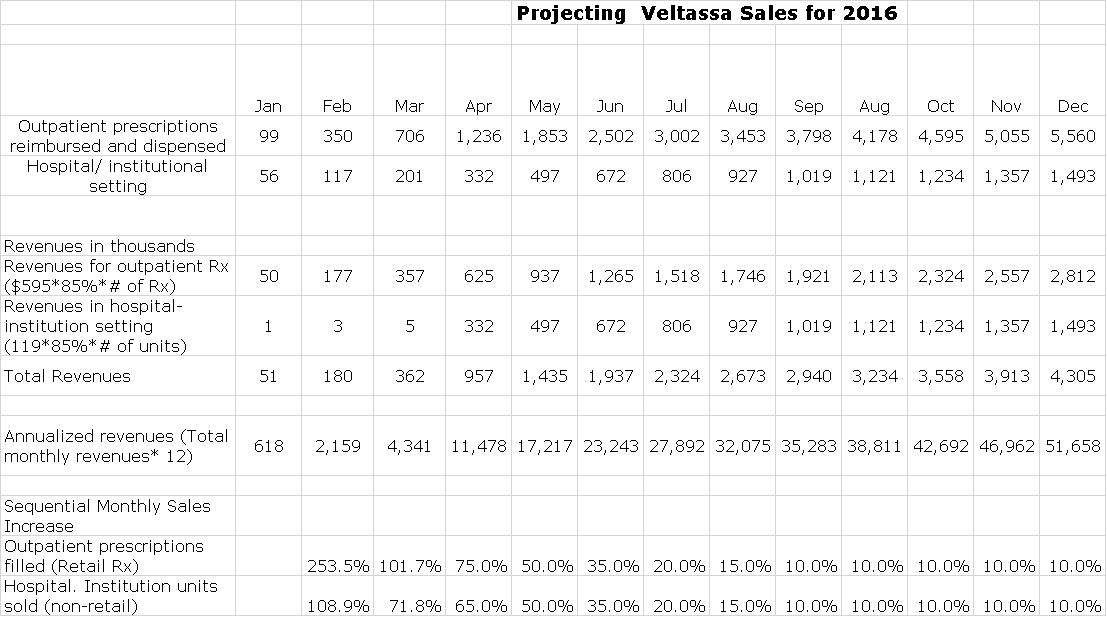

Projecting Veltassa sales with any degree of accuracy or confidence for 2016 is extremely difficult due to the numerous reimbursement hurdles and physician education issues that have become an integral part of the launch period for a new drug. Projecting sales at this point for 2016 and 2017 is just guesswork, but I will give it a go. Here is the starting point. The Company reports actual retail prescriptions and hospital unit sales on a monthly basis. The increase in prescriptions for February over January was 254% and for March over February was 102%. Comparable increases were hospital units were 109% and 72%. These increases are off low bases.

I have set up a model that projects sales for 2016, but it is just a model and will have to be refined continually as we go forward. It is based on estimating sequential month over month increases in retail prescriptions and hospital units. The current list price for a prescription of Veltassa is $595 and for a hospital unit is $119. I then assume a 15% discount to buyers and this allows me to calculate sales. In the following table, I have guesstimated the sequential monthly increases in retail prescriptions and hospital units for each of the remaining months of 2016. I show continued rapid increases in the next few months and then a slowing in the rate of increase in the latter half of 2016 as the bases build. My assumptions are shown in the two bottom rows of the following table.

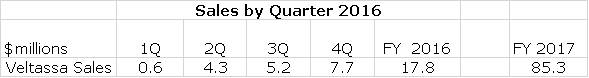

The resultant quarterly sales for Veltassa per the above base case model is shown in the next table. I have also included a sales estimate for 2017 that results from the assumption that each month in 2017 will show a 7.5% increase in monthly retail prescriptions and hospital unit sales. You can see that this results in a 2016 sales estimate of $17.8 million and a 2017 sales estimate of $85.3 million. Although these numbers give the appearance of great precision, they are subject to substantial change as we get further into the launch and gain more data.

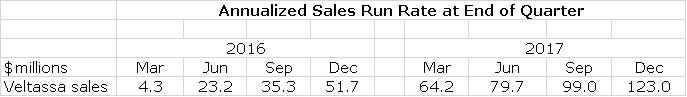

It is interesting to look at the build of annualized sales rate in the base case as shown in the next table. This is calculated by taking sales in a particular month and multiplying by 12. Using the same assumptions for monthly sequential increases as used in the prior two tables yields the following estimates. You can see that this projects a run rate of $51.7 million by year end 2016 and $123.0 million by the end of 2017.

Financials: Operating Cash Burn is Enormous

On April 27, 2016, Relypsa entered into a six year term loan facility for $150 million which bears an interest rate of 11.5% per annum. The basic terms call for interest only quarterly payments of $4.3 million until December 15, 2018. Thereafter, quarterly principal payments of $10.0 million begin and the outstanding balance is to be repaid on April 27, 2022. The agreement allows for some change in terms of repayment based on sales levels achieved and also allows for prepayment in the case of a change in control, i.e. Relypsa gets acquired.

The closing fee on the deal was $1.5 million and Relypsa issued 239,872 warrants exercisable at $18.76. There is also an exit fee of 2.0% on any prepayments that are made so that if the loan, e.g. is prepaid in full before December 15, 2018 there will be a fee of $3.0 million. Of the proceeds, $17 million will be used to repay another loan facility so that the Company will add net cash of $131.5 million to its balance sheet. Relypsa ended 1Q, 2016 with $205.2 million of cash so this beings the pro forma cash to $336.7 million.

The cash burn in 1Q, 2016 was $80.1 million. Of this $22.4 million was used to fund working capital primarily for an inventory build of $16 million. This indicates that the burn rate based on sales less operating expenses (excluding working capital) was about $57.7 based on $0.5 million of Veltassa gross profit less operating expenses of $58.3 million. Relypsa has guided that all in cash operating expenses are expected to be $255 to $275 million in 2016. In this early stage of the launch there are usually launch expenses that are not recurring but Relypsa has not broken them out. My base case is that Relypsa will record sales of $17.8 million in 2016 and I assume a 70% gross profit margin resulting in gross profits of $12.5 million that modestly reduce the operating cash burn to $242 to $262 million for the year and $184 to $204 million for the remaining three quarters of 2016. This results in an estimated yearend cash balance of $133 to $153 million at the end of 2016.

I would expect the operating expense burn in 2017 to be less than 2016 as meaningful expenses associated with the launch are non-recurring. However, for the sake of conservatism let’s assume that the operating cash burn in 2017 is about the same as 2016 or about $250 million. My base case calls for Veltassa sales of $85.3 million in 2017 and using a 75% gross profit margin results in $64 million of gross profits. Hence the overall cash burn for 2017 would be $186 million.

Recall that my estimated cash balance for the beginning of 2017 is about $143 million which is obviously$43 million short of the $186 million burn rate I project for 2017. This indicated that Relypsa will need to raise additional capital to fund 2017 operations. Assuming that they want to end 2017 with perhaps $150 million of cash, the Company will have to raise about $200 million in the next year or so.

Clinical Update

Relypsa plans to submit a sNDA in the middle of 2016 based on a phase 1 study in healthy volunteers that requests a change in the label in which the six hour separation between dosing Veltassa and other medications is changed from six hours to three hours. It also will request that the black box warning on drug to drug interactions be removed and results of the phase 1 studies be added to the label. Management has said at the time of the launch and continues to maintain that the black box warning and six hour separation have not been major deterrents to prescribing but if these changes are approved it can only be a positive.

International Update

Ex-U.S. partner Vifor Fresenius has submitted a marketing authorization application for Veltassa to the European Medicines Agency. This could lead to approval in late 2017 or early 2018. It can take one year after approval to obtain widespread reimbursement so that the drug can be sold. The mechanism is different but has the same effect as in the US as making sales in the first year after launch minimal. Hence, we should not see much contribution from European sales until 2019 or 2020. The royalty rate in Europe increases with increasing sales levels and could ultimately reach the low 20s.

Intellectual Property Position

The composition of matter patent for Veltassa lasts until 2029 so this provides a long period of patent protection. This promises a long commercial life with nearly 13 years of marketing exclusivity remaining for Veltassa in the US.

Tagged as Relypsa, RLYP, Veltassa Launch, ZS-9 + Categorized as Company Reports, LinkedIn

Larry, please explain the six hour rule in a little more detail. Assuming Veltassa is a once a day medication it would seem to be hard to achieve that separation from all other meds given that people with heart disease are often taking multiple medications at multiple times of the day. Is the separation rule applicable only to certain very specific medications that also tend to be taken only once a day?

Thanks very much.

What will happen if ZS-9 gets approved with a black box label (like Valtessa) that makes the usual mention of associated risks but doesn’t restrict it to acute usage? My guess, and it’s only a guess, is that this is how ZS-9 will be approved. Valtessa can overcome the 6-hour rule limitation, so Rylpsa strongly believes based on their most recent trial data and recent meetings with the FDA. They believe they can get their label changed. I guess we’ll have to wait on the ZS-9 PDUFA outcome to see how that label reads. Even if it’s not a clean label will it matter to prescribing physicians? Every RA biologic has a black box warning, and those drugs remain the best selling drugs in the world.

Wouldn’t the FDA have asked for an ADCOM if they thought ZS-9’s sodium mechanism of action was a genuine reason for concern?

Script data April 1-30, 2016

In the outpatient setting:

– 1,216 new patients started taking Veltassa with a free starter supply.

– 928 outpatient prescriptions were covered by payers and dispensed (retail TRx).

In the hospital/institution setting:

– 288 units were sold to hospitals and other institutions (non-retail).

Comparison to Previous Month

Outpatient setting (flat mo/mo)

– March 1-31, 2016

New patients who started taking Veltassa with a free starter supply 1,277 (average 290 patients/week)

– April 1-30, 2016

New patients/week who started taking Veltassa with a free starter supply 1,216 (average 290 patients/week)

Outpatient prescriptions covered and dispensed (retail TRx)

– March – 706 (average 160 prescriptions/week)

– April – 928 (average 221 prescriptions/week)

Hospital/institution setting (non-retail)

– March 1-31, 2016

Units sold 201 (average 46 units/week)

– April 1-30, 2016

Units sold 288 (average 69 units/week)

Weekly averages were calculated assuming 4.4 weeks in March and 4.2 weeks in April.