Initiation Report on ZS Pharma (ZSPH, Buy, $40.97, Subscribers only)

ZS Pharma Investment Thesis

The Hyperkalemia Market Opportunity is Huge; There Are No Good Current Drugs

The most important piece of the investment thesis for ZS Pharma is the sheer size of the opportunity for treating hyperkalemia. In my recent report, Effective Treatment of Hyperkalemia Promises to be a Multi-billion Opportunity, I provided a framework for gauging this opportunity and if you have not done so, I would urge you to read that report before proceeding. Its key takeaway points were:

- There are no effective options for long term treatment of hyperkalemia (high potassium levels).

- My research suggests that the annual addressable market could be several billions of dollars in the US.

- Two emerging biotechnology companies have almost simultaneously developed effective drugs for hyperkalemia.

- Relypsa’s patiromer could be introduced in the US in late 2015 and ZS Pharma’s ZS-9 is about six months behind.

Two Very Good Drugs-ZS-9 and Patiromer-Are Coming to Market at About the Same Time

This report includes a detailed comparison of Relypsa’s (RLYP) patiromer and ZS Pharma’s (ZSPH) ZS-9. I see ZS-9 as having meaningful advantages over patiromer. One of the most important is clear QD (once a day dosing) versus BID in most patients with patiromer. ZS-9 also has a quicker onset of action and is easier to titrate. Other differentiations are discussed at great length in this report. That said, patiromer appears to be a safe and effective drug.

I would also caution that my judgment on product attributes is based on published clinical data that has not yet undergone the harsh scrutiny of FDA review. Moreover, widespread commercial use can sometimes lead to new insights into a drug. Both of these have the potential to change some of my views down the road. At this point in time, I think that ZS-9 could control 2/3 of the market in perhaps a three to five year time frame. This is a purely subjective on my part; I don’t know how to go about quantifying this. Even so, this is not a zero sums game and in a market opportunity of this size, I think that patiromer has hundreds of millions of dollars of peak sales potential (perhaps $1 billion plus) in the US and perhaps as much abroad.

Patiromer has first mover advantage as it could get to market six to nine months before ZS-9. Given that it is very safe and very effective product in hyperkalemia, an area of high unmet medical need; it could establish a strong foothold before ZS-9 is available. Relypsa sales reps will be the only voice in the market for one half year or more and they can subtly counter-detail issues about ZS-9. If physicians try a product and are satisfied, it is very difficult to replace that product with another. So, the first mover advantage is a major positive for patiromer.

Will the Initial Product Launch of Patiromer Be Disappointing?

Let’s turn now to the launch of Relypsa's patiromer. All close observers of biotechnology are aware that many or most recent new product launches have been disappointing in their initial phase. Managed care has created a thick playbook of techniques to control the uptake and spend on new products. These include formulary approval, positions in the formulary (tiering from generics to branded products) co-pays and just generally making it difficult for a physician to prescribe a drug and for the patient to get reimbursed.

I am uncertain and concerned about a slow launch of Relypsa not related to its product attributes but just due to managed care roadblocks. I can see that there are clear medical reasons that may result in my fears being unjustified. The only approved drug for hyperkalemia is Kayexalate which is a drug of questionable efficacy and serious side effects. Also, if I am right managed care should recognize patiromer first and then ZS-9 as much needed drugs in a life threatening disease. They should easily be persuaded to replace Kayexalate use. Both managements seem to feel that at a price of about $7000 per year (the price point for comparable drugs such as phosphate binders) that pricing will not be a big hurdle.

Another issue to consider is how aware physicians are of patiromer and ZS-9 at the time of launch. To put this in some perspective, at the time of launch the new drugs for hepatitis C-most recently Gilead’s Sovaldi- have seen sales explode after the launch. This is because the key prescribing physicians were totally familiar with the product characteristics of these drugs and had already decided how to use them in their practice.

This high physician awareness is less the case with patiromer. Across all trials including phase 3, over 80% of patients were enrolled outside of the US. Also, at this point in time there are no ongoing trials in which physicians are using patiromer to treat patients. Across all trials, almost 80% to 85% of ZS-9 patients were enrolled in the US. Also, there are two one year long safety studies that currently are treating patients with ZS-9. Despite what I believe are outstanding product characteristics, it may take Relypsa some time to educate and convince physicians of the value of patiromer.

Obviously, the degree of success with the patiromer launch is uncertain and this is an issue not only for Relypsa, but also for ZS Pharma as investors would question the potential of the hyperkalemia treatment market. In the longer term, I am convinced that both will be successful products. As I have pointed out, the addressable market in the US is several billions of dollars and if my prediction of the split between ZS-9 and patiromer proves correct, both products could reach over $1 billion of sales in the US. The point is that we may have to navigate the rapids of a slow launch in order to get to the quiet waters of widespread acceptance.

Are We In A Biotechnology Bubble?

Another issue to consider is that we are in a period of extreme enthusiasm for biotechnology stocks and they have been market leaders for the last several years. Some have said that we are in a biotechnology bubble. I am not smart enough to determine this and it is the case that the same people have been saying we are in a bubble for the last two years. However, I do recognize the risk of recommending stocks in a group that is hot. If something happens to shift sentiment more in favor of other segments of the market we could see weakness in the group due to reallocation of investments away from biotechnology. All ships drop if the tide goes out.

The current market valuation of Relypsa is $1.4 billion and ZS Pharma is $1.1 billion. Clearly, these are not undiscovered stocks. I am not sure that anyone can say exactly what the valuation should be of a company that is yet to have any sales; I know I can’t. Nevertheless, the valuations are richer than I would like.

I Am Not Recommending ZS Pharma Aggressively Because of a Valuation Judgment

I dislike making price judgments on extremely promising biotechnology stocks like ZS Pharma. I think this has caused a lot of investors to miss great price runs in some great companies which never seem to be cheaply priced at any time. I think that both Relypsa and ZS Pharma could be great long term stocks. Despite my trepidation at making price judgments, I am not going to buy either stock in my own account at this time.

Why then did I spend all of this time on researching the hyperkalemia market and the potential for these two companies? It is because I am an investor and great companies make great investments. It is an aberration for me to make a price call and not recommend these stocks. I am making the bet that I can find a better price point to enter which is always risky, but that is just the way I feel.

There are probably investors who agree with my fundamental outlook but not my price judgment. They may be looking to buy one or both stocks. If they want my opinion on which to buy, it would be ZS Pharma. I feel that ZS Pharma should sell at a premium to Relypsa. If I were a prescribing physician, I would choose ZS-9 over patiromer. I feel very strongly that I will eventually buy ZS Pharma and perhaps Relypsa.

Price Target for ZS Pharma

I am not making any official price target projection at this time, but let me give you a way of judging the potential for ZS Pharma and Relypsa. As a rule of thumb, biotechnology companies with commercial products in the hundreds of millions of dollars can sell at five to ten times revenues. I started out this report by saying that the US market opportunity is in the billions of dollars in the US and there are no viable products on the market. I then went on to speculate that both ZS-9 and patiromer have huge potential in the US, perhaps in the several hundreds of millions or billion plus range for Relypsa and twice that level for ZS Pharma. Foreign sales could be as much. So let’s say that ZS-9 reaches $1 billion of US sales in five years. This could lead to a market capitalization of $5 to $10 billion which compares to the current $1.1 billion and foreign sales through a licensee could add significantly more to that valuation level.

With such huge upside, am I being overly cautious in not coming out with a Buy? That could be the case. I laid out my arguments previously as to why I am not going with a Buy, but if someone disagrees with my position and wants to buy the stock now, I wouldn’t vigorously protest.

Brief Overview of Hyperkalemia Market

Again I would refer you to my detailed report on the hyperkalemia market called Effective Treatment of Hyperkalemia Promises to be a Multi-billion Opportunity for a detailed explanation of the potential I see for ZS-9 and patiromer. I am not going to repeat those arguments in this report, but I do have a few brief comments to make.

Unmet Medical Need in Large Potential Market

When I first started doing research on ZS-9 and patiromer and their role in hyperkalemia, I did not understand how large the addressable market may be. A major cause of hyperkalemia is impaired kidney function which can result as an end stage complication from such highly prevalent diseases as hypertension, heart failure and diabetes. There is also a surprising cause of hyperkalemia. Drugs like angiotensin converting enzyme inhibitors (ACEs), angiotensin II receptor blockers (ARBs) and aldosterone antagonists (AAs) are used ubiquitously in treating hypertension and heart failure. They are extremely effective therapies but their mode of action also can cause hyperkalemia as a side effect so that when this occurs their dosages have to be reduced to less effective levels or sometimes the drug must be halted entirely.

I also did not realize how dangerous hyperkalemia can be. Potassium plays a critical role in the contraction of the heart so that raised levels can lead to cardiac arrhythmias and in the most severe cases sudden death. Normal potassium levels in the blood range between 3.5 and 5.0 mEq/L; as levels increase above 5.0, the risk of death increases sharply. At >6.0 mEq/L, the risk of death at one day after reaching that levels is 3.7% which is the same risk as one day after having a heart attack.

Treatment Settings and Currently Available Therapies

There are two important treatment settings for ZS-9 and patiromer: the emergency room and the outpatient setting in the doctor’s office. Because of the lack of effective therapy, physicians in the outpatient setting when they see alarmingly high levels of potassium- somewhere >6.0 mEq/L- immediately send their patients to the emergency room. Treatment in the ER involves some short acting therapies to maintain the patient for a few hours but the only effective therapy is dialysis. About half of the diagnosed cases of hyperkalemia are first treated in the emergency room. Currently, there is no effective therapy when these patients are sent home even though chronic therapy is needed. There is a great sense of urgency in the emergency room setting to lower the potassium level as quickly as possible; onset of action is critical in this setting.

Currently, there are only three possible treatments for hyperkalemia on a chronic outpatient basis; these are a low potassium diet, a loop diuretic and a 50 year old drug called Kayexalate. Diet is extremely difficult because most fruits, vegetables and meats that humans consume are high in potassium. Loop diuretics increase the production of urine and this increases potassium excretion in a person with normal kidneys. However, in patients with impaired kidney function the excretion of urine is interfered with so that this can cause highly undesirable fluid retention.

Kayexalate has never been studied in a controlled clinical trial and there are mixed opinions on its effectiveness. It is a cumbersome drug to take as it is given as an oral dosage form two to four times a day or as an enema. It must usually be taken with a laxative that often causes severe diarrhea to the extent that patients often refuse to take the drug. These are the current treatment choices and I think it might be an overstatement to call them sub-optimal.

How Big is the Market?

There are estimated to be about 500,000 emergency room visits per year for hyperkalemia. Later in this report I give my reasoning that shows that if ZS-9 and patiromer replace all Kayexalate usage in the US that it would result in $400 million of sales. Remember that Kayexalate is a difficult drug to take so that it is not used widely in the outpatient setting.

I am estimating that patients will be sent home from the emergency room with a prescription for ZS-9 or patiromer. These drugs will be used as chronic therapy for the rest of the patients’ lives and I am estimating that these drugs will be priced at $7,000 per year. The size of the addressable market stemming from patients who are first diagnosed in the emergency room may be $3.5 billion. To the extent that some of these may be repeat visits, this estimate would be high but in any event this is a huge patient audience.

The outpatient market may be much larger. Relypsa has estimated that there are 15.4 million patients with chronic kidney disease due primarily to hypertension and diabetes and 4.9 million have advanced to stage 3 and 4 disease (the two most advanced stages) of which 2.5 million have hyperkalemia. There are 2.3 million heart failure patients and of these 0.5 million have hyperkalemia. This suggests that the potential addressable market is about 3.0 million patients. However, not all of these patients will be treated immediately as doctors may first try diet or watchful waiting.

Many chronic kidney disease and heart failure patients are being treated by the renin angiotensin aldosterone inhibitor (RAASi) drugs and because of the hyperkalemia caused by these drugs; they may be currently dosed at sub-optimal levels or may have been taken off the drugs. This is the patient group that could immediately benefit from ZS-9 and patiromer. I don’t have a precise estimate on what the size of this outpatient market opportunity can be as there is currently no therapy that can be looked at to gauge the size of the market. However, intuitively it would seem to be huge.

Comparison of ZS-9 and Patiromer

I think that ZS-9 is a better drug than patiromer and will ultimately gain perhaps two thirds of the market while patiromer will obtain one-third. Put another way, ZS-9 sales could be twice those of patiromer. This judgment is based on a comparison of the two products which I detail in this section.

Product Descriptions

Patiromer

Patiromer uses a well-established mechanism of action; it is an ion exchange polymer. The active ingredient is a cross-linked polymeric bead that uses calcium as a counter ion which is exchanged for other ions as it transits through the gastrointestinal tract. Patiromer is insoluble and passes through the GI tract also the beads are too large for systemic absorption.

The extent of ion exchange is a function of the concentration of counter ions. In the case of potassium the highest concentrations occur in the lower intestine and this is where patiromer exchanges much of its calcium ions for potassium and is then excreted in the feces.

Currently, the only FDA approved product for lowering potassium is Kayexalate which is also an ion exchange polymer. One primary difference in the two products is that patiromer uses calcium as the exchange ion and Kayexalate uses sodium. Importantly, patiromer has been shown to bind about twice the amount of potassium as Kayexalate (patiromer 8.5 mEq/g; Kayexalate 4.6 mEq/g). This affords very meaningful efficacy and safety advantages.

ZS-9

ZS-9 is a three dimensional crystalline structure comprised of zirconium, silicon and oxygen atoms covalently bound to one another and arranged to form ion-binding pores that exchange hydrogen and sodium for potassium. The oxygen atoms are arranged in a way that preferentially traps potassium and disfavors the binding of smaller and larger ions such as magnesium and calcium. ZS Pharma describes it as a highly selective ion trap for potassium while minimizing disturbance of the balance of other electrolytes.

Organic polymers like Kayexalate and patiromer are non-selective and bind potassium most effectively in areas of high potassium concentration like the colon while ZS-9 can bind potassium throughout the GI tract. The onset of significant activity for patiromer is dependent on transit time to the lower intestine whereas ZS-9 can bind potassium in the upper intestine where potassium concentrations are lower and thus has a faster onset of action.

ZS-9 is a non-absorbed, odorless, tasteless substance that has been formulated as a powder and tablet. It is insoluble in the gastrointestinal tract and passes through without degradation. Unlike polymers, it does not swell in the presence of water, enabling it to be effectively eliminated from the body without the need for a laxative to avoid constipation as may be the case with organic polymers. Constipation is a major issue with Kayexalate but much less so with patiromer at doses used in clinical trials.

SmithOnStocks Comment: Patiromer and ZS-9 have different mechanisms of action. ZS-9 has the advantage of having more selectivity for potassium and quicker onset of action. In some settings, this may be a major differentiation. However, in clinical trials patiromer has been shown to be a safe and effective drug that is a major advance over Kayexalate.

Regulatory Status

Patiromer

The FDA has assigned a PDUFA action date of October 21, 2015 for patiromer. Relypsa says in its 2014 10-K that The FDA has indicated it will not convene an advisory committee for advice regarding the NDA. The Company plans to submit a Marketing Authorization Application, or MAA, with the European Medicines Agency (EMA) for patiromer in late 2015 or early 2016. I would anticipate a US launch in late 4Q, 2015 or early 1Q, 2016 and a European launch in 2017.

ZS-9

ZS Pharma probably will file an NDA for ZS-9 in 2Q 2015. Upon filing, the FDA generally aims to reach a decision on approving a new drug within ten months. I would expect approval in early to mid- 1H, 2016 and a commercial launch in 2Q or 3Q, 2016. ZS Pharma says in its 2014 10-K that The FDA has indicated it will not convene an advisory committee for advice regarding the NDA. The MAA will likely be filed in 2H 2015 and approval in Europe and launch could occur in late 2017 or early 2018.

SmithOnStocks Comment: Relypsa with patiromer has important first mover advantage; it could begin marketing six to nine months before ZS Pharma in the US. I do not anticipate any problems in approval for either product.

Advantage: Patiromer has the important first mover advantage.

Clinical Trial Designs

Patiromer

The clinical development program for patiromer consisted of eight clinical trials: three phase 1 trials, four phase 2 trials and one two-part phase 3 trial (RLY5016-301). This phase 3 trial was conducted under a SPA in which each part (Part A and Part B) served as one of two pivotal trials required for the NDA. Part A was a 4-week, single arm, single-blind treatment phase with patiromer only.

Part B followed and was an 8-week study with the first 4 weeks as the primary endpoint. It was a parallel group, single-blind, placebo-controlled randomized withdrawal trial. Subjects with a baseline serum potassium level ≥5.5 mEq/L at the time of enrollment in Part A and whose serum potassium level was controlled at week 4 of Part A were entered into Part B. Patients’ potassium levels were then evaluated at the end of the first 4 weeks of Part B.

Patiromer successfully met the primary endpoint in both Part A and Part B. In phase 3, a large proportion of subjects had heart failure, diabetes, hypertension or existing cardiovascular disease, 60% were elderly and 45% had baseline serum potassium greater than or equal to 5.5mEq/L. Patiromer was effective in each of the major population groups in which it was tested and which comprise the vast majority of hyperkalemics.

ZS-9

ZS Pharma said in its 2014 10-K that the development program incorporates input from the FDA (including a pre-NDA meeting in early 2015) and the EMA. It will seek an indication for the treatment of acute and chronic hyperkalemia, regardless of the underlying disease state.

The FDA approved the IND for ZS-9 in December 2010. The Company has completed two phase 3 trials, ZS003 and ZS004, and the ZS002 phase 2 trial. These were all randomized, placebo controlled, dose ranging trials that treated patients up to 30 days. These trials enrolled 1,101 patients with hyperkalemia due to all major causes, including patients with chronic kidney disease, heart failure, type 2 diabetes and those on renin-angiotensin aldosterone system inhibitor (RAASi) therapy. Each of these three studies achieved its primary efficacy endpoint.

ZS003 was a two part double-blind, randomized, placebo-controlled, dose ranging pivotal trial. It enrolled 753 patients with hyperkalemia (indicated by potassium levels between 5.0 and 6.5 mEq/L). ZS004 was a double blind, randomized, placebo controlled, dose ranging phase 3 trial in 258 patients that had serum potassium levels of ≥5.0 mEq/L and also treated patients with potassium levels > 7.0 mEq/L.

The Company is also conducting an 11 month extension to the ZS004 study called ZS004e and a 12 month safety study, ZS005. These will provide data on safety and efficacy for 12 months of exposure. As of March 1, 1,474 patients have been enrolled in the ZS-9 programs with some patients in these trials having safely received once-daily ZS-9 for over 11 months as of March 2015. Filing the NDA is not contingent on this data, but the FDA will require access to it during the review process.

SmithOnStocks Comment: I do not anticipate any regulatory issues related to clinical trials for either product. I think both products will be approved in the US at their PDUFA dates.

Dosing

ZS-9

ZS-9 was developed to be given as an oral dose of 5, 10 or 15 grams once per day (QD). In cases in which there is urgency to quickly lower potassium, it can be given as a loading dose of 10 grams three times a day until normokalemia is reached. An impressive 99% of patients achieve normokalemia by 48 hours with this dose level. After this initial loading dose, patients are then given 5 grams per day and titrated, if needed, in 5 gram increments up to 15 grams per day. Greater than 95% of patients in the 12 months ZS005 study are on 5 grams or 10 grams of ZS9 (the remainder are on 5 grams every other day or 15 grams once a day).

ZS-9 is packaged as a sachet, dissolved in water and swallowed. About 80% of patients can be maintained in the normal range with a QD 5 gram dosage and 90% can be maintained with 10 grams QD; there are no excipients in ZS-9. The average daily dose for the phase 3 studies was about 6 grams per day. ZS9 can be suspended in 40 ml to 180 ml based on patient preference; all doses are easily suspended in 40 ml of water. The Company says that there are no issues such as suspension or palatability that dictates the amount of water to be ingested. It says that ZS-9 can actually be taken without water.

Patiromer

Based on the clinical trial data, the anticipated starting dose of patiromer will be 8.4 grams/day (as determined by the amount of ion exchange polymer) for patients with baseline serum potassium levels of 5.1 to 5.5 mEq/L and 16.8 grams/day for patients with baseline serum potassium levels >5.5 mEq/L. The average across these two doses is about 11 grams per day of ion exchange polymer. However, most patients titrate to higher doses than the starting dose, up to 50.4 grams per day if necessary.

Patiromer is a powder that is mixed with water to form a suspension that is then taken orally. In a sachet containing 4.2 grams of the ion exchange polymer, there are also 2.0 grams of sorbitol, 0.8 grams of calcium and some amount of xanthan gum so there is more than 7 grams of drug product in the patiromer sachet. In the case of ZS-9, 5 grams of ZS-9 is just that, 5 grams.

The average amount of the ion exchange polymer contained in patiromer in the clinical trials was about 12.8 grams for patients in the 5.0 to 5.5 mEq/L range and 21.4 grams for >5.5 mEq/L. With the 21.4 grams per day dose, there are 4.0 grams of calcium, 10.0 grams of sorbitol and an unknown amount of xanthan gum as excipients. This brings the total amount of drug ingested to about 21 grams per day for potassium levels <5.5 mEq/L and 35 grams per day for >5.5 mEq/L. In the clinical trials, the drug was supplied as a sachet containing 4.2 grams. With this dosage, on average, patients with potassium levels > 5.5 mEq/ L would consume about 5 packets each day. Two packets can be mixed with 50 ml of water and then swallowed. Five packets require about 100 ml. Relypsa has stated that the sachets used in commercialization will contain more than 4.2 grams but has not been specific.

During the phase 3 trial, patiromer was dosed twice per day (BID). The Company told investors in 2014 that it was planning a trial to determine if the drug could be given once a day (QD). However, Relypsa recently announced that based on feedback from the FDA it believes that a QD study may not be required in order to include QD dosing in the prescribing instructions section of the label. Relypsa will be trying to clarify the FDA’s thinking on QD dosing. It noted in its 2014 10-K that it will probably do a QD study even if the FDA confirms that it is not required for the product label. The Company also notes that the FDA could change its position and require further studies to support inclusion of QD dosing in the product label.

Two phase 1 trials, in healthy volunteers, RLY5016-101 and RLY5016-102, demonstrated that administration of patiromer resulted in a significant, dose-dependent, increase in fecal potassium excretion at doses up to 60 grams/day. Single and multiple doses (up to three times a day) administration of patiromer were well-tolerated. I have not seen data on how much patiromer can reasonably be administered in a single dose with acceptable side effects.

SmithOnStocks Comment: For chronic use drugs, there is a major advantage in having once a day dosing versus twice a day. It may sound like a modest difference, but QD results in much higher compliance and resulting better efficacy. ZS-9 is clearly a QD dose at the 5, 10 and 15 gram dosage especially when patients are taking 3-10x less drug once a day.

I am unsure of what the language may be in the patiromer package label if the FDA does allow QD to be mentioned in the prescribing instructions. Because all of the phase 3 data is based on BID dosing, it is hard for me to see the FDA broadly encouraging QD without clinical data. As Relypsa noted in its 10-K, it will in any event conduct a QD study.

By simple deduction, it seems that there must be some issue with side effects or some other determinant that caused Relypsa to go with BID in phase 3. If so, it may be the case that lower doses of patiromer could be dosed at QD while higher doses would be at BID. It is a meaningful advantage for ZS-9 to have clear QD prescribing for all strengths.

If we take the average chronic dose of patiromir to be 17 grams per day of the ion exchange resin, the number of 4.2 gram sachets needed would be roughly four and this would require 100 ml of water. This would require something like two sachets of patiromer mixed with water and taken orally followed by another two sachets. The total amount of drug product for patiromer would be 28 grams (1 ounce). For ZS-9, it would be 6 grams of drug product and 40 to 180 ml of water depending on patient preference. For comparison, the standard Snickers candy bar is 52.7 grams.

The lesser amount of drug product ingested each day is an advantage for ZS-9, but not as important as the QD advantage. Overall, the sachet formulations seem to be well tolerated and easy to use for both products.

Advantage: ZS-9 has several dosing advantages over ZS-9. It is a clear once a day product, is easier to titrate and can be given with a high loading dose.

Onset of Action

ZS-9

ZS-9’s high selectivity for potassium enables ZS-9 to absorb potassium immediately upon ingestion and throughout the GI tract, even in locations where potassium is not the most abundant ion. This holds the promise of:

- a rapid onset of action, as soon as one hour after a 10 gram dose, by acting early in the upper part of the GI tract where potassium is not the most abundant ion;

- high efficacy at modest dose amounts;

- and being well tolerated with GI adverse event rates similar to placebo and no material effect on other important electrolytes that are critical for normal human function

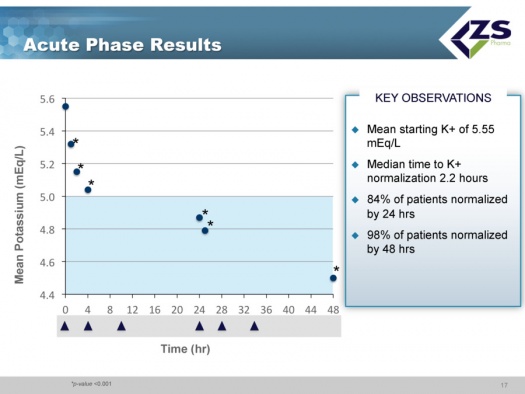

In the acute portion of the phase 3 trial, ZS004, the median time to normalization of potassium levels was 2.2 hours. After receiving ZS-9 three times a day, 84% of patients became normokalemic at 24 hours and 99% were normokalemic after 48 hours. In the phase 3 ZS003 trial, 10 grams was the highest dose tested. The mean serum potassium reduction for the entire population was -0.73 mEq/L and 99% of patients had normal potassium values within 48 hours.

Two very important findings of the induction phase of ZS004 were that decreases in serum potassium levels occurred almost immediately and were greater for patients with higher readings:

- in patients with severe hyperkalemia (potassium > 6.0 mEq/L), ZS-9 produced mean changes of -0.5 mEq/L at one hour and -0.7 mEq/L at two hours suggesting potential for use in emergency and acute settings.

- patients with baseline serum potassium <5.5 mEq/L had a change of -0.8 mEq/L at 48 hours,

- those with baseline serum potassium in the range of 5.5 to 6.0 mEq/L had changes of -1.2 mEq/L at 48 hours,

- those with baselines >6 mEq/L had changes of -1.5 mEq/L at 48 hours.

Patiromer

The RLY5016-103 phase 1 trial was an uncontrolled, open-label, single arm trial that enrolled 25 patients. It was designed to evaluate the time-to-onset for the potassium-lowering action of patiromer. The trial design included a three-day run-in period to control the dietary intake of potassium followed by a 48-hour treatment period and a 7-day post-treatment safety follow-up period. The change from baseline in serum potassium levels was assessed at multiple time points during the 48-hour treatment period. Patients enrolled in this trial had an average baseline level of potassium of 5.93 mEq/L, which is at the upper end of the 5.5 to 6.0 range that defines moderate to severe hyperkalemia. Reductions in potassium levels were seen at the first blood draw that was taken four hours after the first dose.

There was a statistically significant reduction at seven hours according to the Company, but this has not been quantified. It can be estimated by examining (eye balling) a graph that Relypsa has included in its corporate presentation. Based on this:

- at 4 hours, the mean level appears to have been reduced from 5.93 mEq/L at baseline by perhaps 0.1 mEq/L to 5.8 mEq/L

- at 7 hours, the reduction from bassline was about 0.2 mEq/L to 5.7.

- at 24 hours the mean level appears to have been reduced from baseline to less than 5.5 mEq/L.

- at 48 hours, the change appears to have been -0.80 bringing serum potassium to 5.12 mEq/L.

The data suggests that patiromer is not as effective for acute lowering of potassium. I note that in the label for Kayexalate, which uses an ion exchange polymer, like patiromer, it states that Kayexalate is not suitable for acute use. However, patiromer absorbs about twice as much potassium as Kayexalate and is no doubt more effective in the acute setting.

SmithOnStocks Comment: ZS-9 does have a meaningful advantage in onset of action. The results from the ZS004 study showed that patients with severe hyperkalemia (potassium> 6.0 mEq/L), ZS-9 produced mean changes of -0.5 mEq/L at one hour and -0.7 mEq/L at two hours suggesting potential for use in emergency and acute settings is pretty compelling. Patiromer lowered potassium levels from a baseline of 5.93 mEq/L to about 5.8 in four hours.

Detractors of patiromer have probably over-emphasized the advantage of speed of onset for ZS-9 as patiromer appears to result in clinically meaningful drops in potassium at 24 and 48 hours. However, in those situations that require a quick drop in potassium, ZS-9 has a clear advantage. The onset of action may also prove to be a key differentiation outside of the emergency room as ZS-9. If the doctor is confronted with a patient for whom there is no history of changes in potassium and is unsure if there is an uptrend that may be dangerous, rapid onset of action is an advantage.

The differences in onset of action may be the reason that Relypsa is emphasizing that the key commercial opportunity is in physicians’ offices where speed of onset is probably not crucial. ZS Pharma emphasizes the emergency room setting where speed of onset is very important as being a key opportunity as well as the physician’s office.

ZS Pharma believes that a key part of the ZS-9 prescribing characteristics is the product simplicity. They say there is no reason to spend two weeks or so normalizing a patient and having to titrate multiple times when their data shows that ZS-9 can safely and rapidly lower potassium with 10 grams given three times per day and then can be used once daily for maintenance. They state they can give one or two days of ZS-9 treatment at high dose levels and then move patients to 5 grams (This is the dosing design used in the ongoing ZS005 12 month safety trial). This will normalize 98% and maintain 80-90% of patients without having to do multiple titrations and physician visits.

Advantage: ZS-9 has a clear advantage in onset of action and ease of titration.

Duration of Effect

ZS-9

Both phase 3 trials were successful in reaching their endpoints of bringing patients to normokalemia. The extension portion of ZS004 demonstrated that over 28 days (total of 30 days) the reductions achieved in the acute phase could be maintained in 80%, 90%, and 94% of patients using 5g, 10g, or 15g of ZS-9 QD, respectively. ZS003 was also successful in reaching its endpoint of bringing 99% of patients to normokalemia in 48 hours.

The long term studies ZS004e and ZS005 are intended to establish that normokalemia can be maintained over a one year period. These trials are not necessary for filing or approval.

Patiromer

Data from the phase 3 trial showed that 76% of patients had their serum potassium in the normal range at week 4. Additionally, the 52-week Phase 2b trial also showed that 86% of subjects had normal potassium levels at 52 weeks.

SmithOnStocks Comment: Patiromer has clearly shown that it can keep the vast majority patients normokalemic for up to one year. ZS Pharma has not shown this as yet because the ZS004e and ZS005 trials have not completed. I am expecting ZS-9 to be as effective as patiromer in this time frame.

What Happens to Potassium Levels When the Drugs are Withdrawn?

ZS-9

At the end of the 28 day maintenance period for ZS003 when ZS-9 was no longer administered, average potassium levels rebounded to near baseline levels, similar to the levels in those patients that received placebo during the maintenance portion. This indicates that ZS-9 should be taken chronically.

Patiromer

Data from Part B of the phase 3 trial showed that when patiromer was withdrawn, significantly more placebo subjects than patiromer subjects saw hyperkalemia return. This establishes the need for long term chronic treatment in patients where the underlying cause of hyperkalemia remains unchanged.

SmithOnStocks Comment: Patients should remain on patiromer and ZS-9 for as long as the underlying cause of hyperkalemia remains. For almost all patients, this means lifelong usage.

Side Effects

ZS-9

The most common adverse events associated with ZS-9 have been mild-to-moderate GI symptoms, including nausea, vomiting, constipation and diarrhea with rates of occurrence similar to placebo. For example, in the induction phase of ZS003, the highest dose tested was 10 grams of ZS-9 given three times per day (30g per day). The GI event rate was 3.5% which compared to a placebo rate of 5.0%. In the maintenance phase that followed induction, ZS-9 was given as 5 or 10 grams once a day; the incidence of GI side effects was 5.5% across all doses for ZS-9 versus 3.7% for placebo.

In the ZS004 maintenance phase of 28 days, the incidence of GI side effects in the study with the maximum dose of 15 grams per day was 8.9% versus 14.1% for placebo. All events were considered mild or moderate in severity and the most common adverse events were diarrhea (1.2%), as well as constipation, dizziness and nausea (all 0.8%).

ZS-9 and Edema

Because the mechanism of action of ZS-9 results in the exchange of sodium and hydrogen for potassium, there is a biological concern that the increase in body levels of sodium could cause edema. There were reports of edema in the maintenance phase of the ZS004 study. There were 14 cases of edema that mostly involved foot and ankle swelling: two on placebo (2.4%), one on 5 grams of ZS-9 (2.2%), three on 10 grams (5.9%), and eight cases on 15 grams (14.3%). Seven cases of edema resolved or did not require treatment during study (one case on 5 grams, all three cases on 10 grams, and three cases on 15 grams). Of the 14 patients with edema, 13 completed the study.

Each of the subjects who had edema events were receiving multiple types of medications for which edema is a common adverse effect. The majority of the subjects also had chronic kidney disease and most had a medical history of edema. In the 2014 10-K, ZS Pharma said that it believed that none of the cases were related to ZS-9, and most were mild or moderate in severity. The Company also reported that after nine months of treatment in the open label ZS004e and ZS005 trial that the rate of edema is comparable between ZS-9 and placebo. They also did not see an increased incidence of edema at any dose.

Kayexalate Side Effects Highlighted

Because patiromer is an ion exchange polymer like Kayexalate, it is important to understand the side effects of Kayexalate. The types of side effects could be similar for the two products, but importantly the severity seems to be much less with patiromer.

Kayexalate (sodium polystyrene sulfonate) has an ion exchange polymer that exchanges sodium for potassium, calcium, and magnesium. The calcium loaded form that is marketed abroad, but not in the US, is called Resonium (calcium polystyrene sulfonate) and exchanges calcium for potassium, sodium, and magnesium.

In the case of Kayexalate, the sodium release raises the concern for fluid retention. In the case of Resonium, the calcium release raises the concern of vascular calcification. ZS-9 uses sodium as an exchange ion while patiromer uses a sorbitol-calcium complex. Both Kayexalate and Resonium can swell and cause constipation that requires co-administration of a laxative that can cause hypomagnesemia.

The product label for both Kayexalate and Resonium include warnings of severe GI side effects which can be fatal and include GI necrosis, bleeding and perforation which is most common when the polymers are used in combination with sorbitol. The Kayexalate label states that caution should be exercised when Kayexalate is administered to patients who cannot tolerate increases in sodium loads, while the label for Resonium states that some patients, who cannot be screened out beforehand, show a sudden rise in serum calcium to high levels after therapy with calcium resin.

Patiromer

Across the clinical trials, the most commonly reported adverse event was constipation (7%), which was mostly mild (5%) to moderate (2%) with no severe events and a very low discontinuation rate. Over the 52-week period, less than 10% of subjects were withdrawn due to adverse events including worsening chronic renal failure (2.6%), gastrointestinal events (1.6%) and hypokalemia (1.6%). The most common adverse events over the 52 weeks were hypomagnesemia (9%), worsening hypertension (8%), worsening chronic kidney disease (9%), diarrhea (6%), constipation (6%), death (5%), and hypoglycemia (3%). Serious adverse events were reported in 15% of patients, and all such events were assessed by the trial investigators as not related to patiromer. This is a patient population at high risk of such adverse events.

SmithOnStocks Comment:

Both drugs seem to be well tolerated. The explanation by ZS Pharma of the edema issue indicates that it is not the cause of edema. However, because there did seem to be a dose related increase in the incidence of edema in ZS004, the FDA may include this information in the label. This would be a slight negative for ZS Pharma; it is something for Relypsa to counter detail. On the flip side the potential for calcium loading, sorbitol risks, and hypomagnesemia will be pointed out by ZS sales reps.

All of these risks emphasize the need for adequate biochemical control when using either product. Serum calcium levels should be estimated at weekly intervals to detect the early development of hypercalcemia. It is important to note that sevelamer, the billion dollar phosphate binder, is used instead of cheap CaCO3 because of fear of calcium exposure and vascular calcification.

Hypokalemia

Patiromer

The objective of both patiromer and ZS-9 is to lower potassium which raises the risk that it is lowered too much and causes hypokalemia which has its own set of problems. In the phase 3, hypokalemia was defined as a serum potassium level less than 3.5 mEq/L. This occurred in 4.7% of all subjects, with no subject developing serum potassium less than 3.0 mEq/L that is considered serious

ZS-9

There were five cases of hypokalemia (also defined as a serum potassium level less than 3.5 mEq/L) in ZS004e on the 10gram dose (9.8% of patients) and six cases on 15 grams (10.7%), all of which occurred in the extended phase. This compared to no cases on both placebo and 5 grams so there is a dose dependent effect. All cases of hypokalemia were transient, mild (3.0 to 3.4 mEq/L), and resolved after the dose of ZS-9 was reduced from daily to every other day (per protocol) for the remainder of the study.

SmithOnStocks Comment: Monitoring for hypokalemia will be required for both drugs. I don’t see this as a problem that will restrain usage nor do I see one drug as having an advantage over the other on this issue.

Effect on Bicarbonate Levels

ZS-9

Metabolic acidosis increases with chronic kidney disease progression and is associated with higher mortality. Bicarbonate is used as a treatment for metabolic acidosis and it is used to bring bicarbonate levels to within the normal range, especially in chronic kidney disease patients. ZS-9 has been shown to increase serum bicarbonate levels in a dose dependent way and this could improve clinical outcomes in patients in addition to the cardiac benefits of serum potassium normalization.

Some nephrologists believe that effective control of bicarbonate levels is as important as the use of RAASi drugs in slowing progression to chronic kidney disease. If so, this represents an important new element for judging the efficacy of ZS-9.

Patiromer

Results of patiromer in phase 3 trials do not indicate any effect on bicarbonate.

Effect on Aldosterone Levels

ZS-9

Aldosterone is a hormone that is involved in blood pressure regulation, reabsorption of sodium ions and excretion of potassium ions. Potassium stimulates aldosterone with the result that hyperkalemic patients often have elevated levels of aldosterone. This can lead to heart and kidney problems. In its phase 3 trial, ZS-9 demonstrated that patients on the drug showed decreased levels of aldosterone. Lowering of aldosterone levels is the mechanism of action of RAASi drugs. Again, the ability of ZS-9 to lower aldosterone is an added benefit over and above lowering potassium levels.

Patiromer

I have not seen comparable data for patiromer. Results in phase 3 trials do not speak of any effect on aldosterone.

Effect on Other Ions

ZS-9

In ZS003, no statistically significant changes were observed in serum sodium or magnesium levels over 28 days. There was a small decrease in the average serum calcium levels in the ZS-9 group that was statistically different to the mean change from baseline in the placebo group at the highest doses tested for ZS-9 but calcium levels always remained in the normal range. ZS Pharma says that these changes were deemed not to be clinically significant because all patients remained in the normal range.

Patiromer

The Company stated in the 2014 10-K that a small mean reduction in serum magnesium level was seen within the first two weeks of treatment, which remained stable thereafter, and without symptoms being observed. Mild to moderate hypomagnesemia was reported in less than 10% of patients. There were no reports of severe hypomagnesemia, with no subject experiencing a serum magnesium serum level of less than 1.0 mg/dL. In the 2014 10-K, Relypsa states that there were no clinically significant effects of patiromer on serum sodium, calcium or phosphorus levels. Hypomagnesia incidence was less than 1.8% and was not highlighted as a significant issue.

Patiromer exchanges calcium for other ions which means that calcium is left behind in the body. The average dose of calcium that is contained in the 21.4 grams of patiromer used to treat patients with serum potassium of 5.5 to 6.0 mEq/L is about four grams. This exceeds the average recommended daily calcium dose of 1.2 grams. Some critics have suggested this is a health risk but Relypsa responds that about three grams of this calcium is bound to the polymer resin and excreted in the feces so that only one gram is left behind.

SmithOnStocks Comment: The effect on the balance of other cations does not seem to be a significant issue for either product. However, the potential for calcium loading and the mild to moderate incidence of hypomagnesia for patiromer is something to be aware of and to monitor.

Manufacturing

ZS-9

ZS-9 is made via a two-step, proprietary manufacturing process using readily available starting materials. It is formulated as a room temperature, stable, dry, odorless, tasteless powder that is filled into packets or bottles or pressed into a dissolvable tablet and is suspendable in small amounts of water (40-120 mL). Another formulation of ZS-9 in development is an enema for pediatric and hospital use.

ZS-9 is manufactured in-house in two facilities. The Company is in the process of increasing manufacturing capacity to support anticipated commercial scale quantities. It says that scaling up only involves increasing the number of production units and they are very confident in their ability to do this.

The Company scaled up to a 2,000 liter commercial scale reactor during the second quarter of 2014 and received delivery of a second 2,000 liter commercial scale reactor in the fourth quarter of 2014. ZS Pharma believes that its in-house manufacturing capabilities will better ensure their ability to meet market demand and will allow them to achieve an attractive cost of goods if ZS-9 is approved. ZS Pharma has stated that it believes that when it is at commercial scale that it can achieve a gross margin of greater than 90% on ZS-9.

The initial dosage presentation will be a powder in a sachet that will be mixed with water. However, ZS Pharma has the ability to present the product in multiple forms; they have pills in development and there are other presentations that can be used because the product is so stable. The Company will do all manufacturing in house and they state that they now are at commercial scale levels of manufacturing.

Patiromer

Relypsa is using two well respected manufacturers with polymer production experience: Lanxess and DSM Fine Polymers. They just signed a contract with Patheon to manufacture the finished product.

Relypsa hasn’t commented to me on its potential gross margin at scale. However, a source with some knowledge of manufacturing polymeric resins suggests that patiromer’s gross margin could be on the order of 60% to 70%.

SmithOnStocks Comment:

Relypsa is using outside vendors to produce the active pharmaceutical ingredient and ZS Pharma is doing manufacturing in-house. There have been other ion exchange resins like cholestyramine that have been produced in large quantities so that I do not think that production will be an issue for patiromer. There is a concern with ZS Pharma just from the standpoint that it has no previous manufacturing experience.

Both of these drugs are going to be manufactured in large quantities. Patiromer will require about 35 grams of drug ingredient (includes 21.4 grams of ion exchange polymer) per day to treat patients with potassium levels of 5.5 to 6.0 mEq/L. The average dose used to treat patients with <5.5 mEq/L is 21 grams (includes 12.8 grams of ion exchange binder) grams per day.

Averaging these two doses suggests that the average for all patients treated may be 17 grams of ion exchange polymer per day and 11 grams of excipient. On an annual basis per patients, this is 6,200 grams (13.64 pounds) of ion exchange binder, 1,160 grams (2.6 pounds) of calcium, 2,900 grams (6.4 pounds) of sorbitol and some additional amounts of xanthan gum. Treating 1 million patients would require 13.6 million pounds of ion exchange binder, 2.6 million pounds of calcium, 6.4 million pounds of sorbitol and additional amounts of xanthan gum.

The average daily dose for ZS-9 in clinical trials was about 6 grams. By, the same thought process; 1 million patients would require about 4.8 million pounds of ZS-9 per year.

Distribution

Patiromer

Patiromer must be refrigerated once API is made and also in the distribution channel and has twelve months of stability in cold chain distribution; Relypsa will store patiromer in a refrigerated warehouse. Once it leaves the cold chain, it has three months of stability at room temperature. Partly because of this, Relypsa is using specialty pharmacy distribution.

One advantage of specialty pharmacy distribution is that they will know who their patients are and to aggressively assist them in the reimbursement process. An uncertainty is that most of the products distributed so far using the specialty pharmacy channel have been high priced drugs which target small patient populations. The price point and amount of product needed are unusual in this setting.

ZS-9

ZS-9 has four years stability at room temperature. It will be distributed through normal distribution channels and sold through pharmacies. This will simplify distribution, physician sampling and storage for both physicians and patients.

SmithOnStocks Comment: The three months shelf life stability could in some instances be an issue for patiromer. For example, if a hospital is looking to add patiromer to its formulary, there is the question of whether they would need to refrigerate the inventory. This adds a level of complexity that works in favor of ZS-9. With the specialty pharmaceutical distribution, this is not an issue with use outside the hospital. I do not see this as an overly significant problem at this time for patiromer.

Commercialization

ZS-9

ZS Pharma plans on addressing the US market with a 150 person sales force that will target hospitals, cardiologist’s offices and nephrologist’s offices. The sales force will focus on a subset of the approximately 5,000 practicing nephrologists and approximately 15,000 practicing non-interventional cardiologists currently treating the target patient populations. In addition, it will make ZS-9 available in the hospital setting for the rapid treatment of acute hyperkalemia.

Patiromer

Relypsa is planning on a 100 to 120 person sales force that will have to cover about 8, 200 targets; these are 7,500 nephrologists and non-interventional cardiologists and 700 institutions. This is based on data research that determined who were the high volume RAASi prescribers and Kayexalate users.

SmithOnStocks Comment:

Both companies are taking the fully integrated approach in the US. This is a much more lucrative model for shareholders than licensing the product.

Both will seek licensees for foreign sales. I would expect very lucrative deals for each product; both may wait for MAA approval in order to maximize the value of each deal. This points to the potential for a deal in late 2016, or possibly a little thereafter, for each Company.

ZS-9 Clinical Development Program

Overview

Throughout the development program ZS Pharma states that they have had clear guidance from the FDA as well as the EMA so they knew exactly what they have to do to get approval of this product. They plan to submit the NDA in the first half of 2015 and on the heels of that they then plan to submit the MAA. They expect a standard nine month review in the US and approval in 1H, 2016 which points to a 2H, 2016 launch.

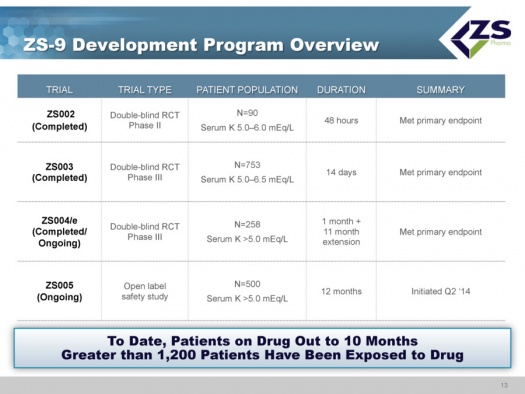

The clinical development program has completed three randomized, placebo controlled studies: ZS002, ZS003 and ZS004; the latter is continuing an extended phase. Also ongoing is ZS005, which is a study focused on long term safety. As of early 2015, over 1,200 patients have been exposed to the drug with some patients having been on the drug for as long as ten months.

All studies of ZS-9 have met their primary endpoints.

- ZS002 was a phase 2 double blind randomized controlled trial in 90 patients with serum potassium levels ranging from 5.0 to 6.0 mEq/L. The trial was for a period of 48 hours.

- ZS003 was a double blind randomized controlled phase 3 study in 753 patients with potassium levels of 5.0 to 6.5 mEq/L that ran for 14 days.

- ZS004/e was a double blind phase 3 trial in 754 patients that had serum potassium levels of ≥5.0 mEq/L. The duration to evaluate the primary endpoint of lowering potassium was 1 month; this was then followed by an 11 month extension. The initial component of the trial was completed and the extension period is ongoing.

- ZS005 is an open label study in 500 patients with serum potassium ≥5.0 mEq/L. The study was started in 2Q, 2014 and is ongoing with a planned duration of 12 months.

ZS003 Study

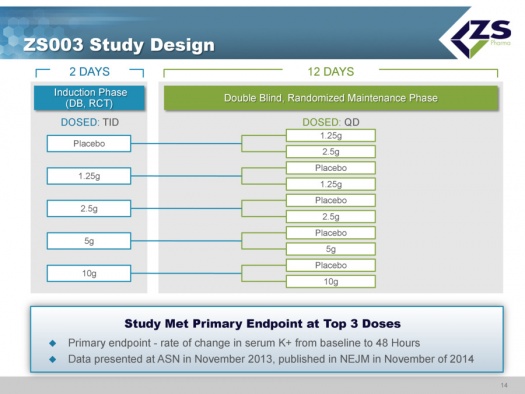

ZS003 was the first phase 3 study. The design used an induction phase in which patients were dosed twice a day for two days; the five doses were placebo, 1.25 grams, 2.5 grams, 5 grams, and 10 grams.

If patients became normokalemic they were then entered into a twelve day maintenance study. Patients in the placebo group also were dosed once or twice per day. Patients in the four different drug dosages were randomized to either stay on the dosage they received in the induction phase or receive a placebo for the next 12 days.

The primary endpoint was the rate of change in serum potassium from baseline to 48 hours. The 2.5, 5.0 and 10.0 gram dosages all met the primary endpoint. Data was presented at ASN in November 2013 and published in NEJM in November 2014.

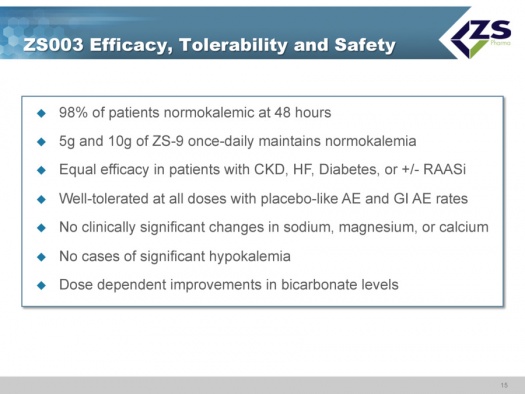

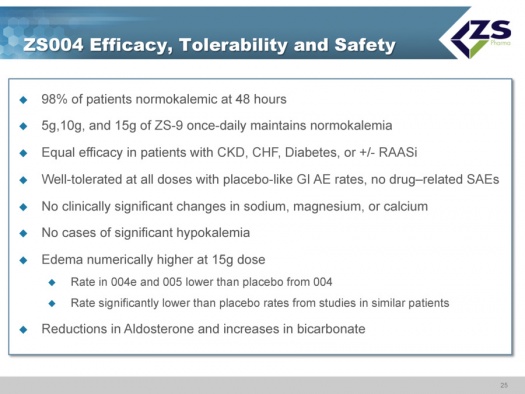

The 5 grams and 10 grams of ZS-9 dosed daily maintained normal potassium levels. There was equal efficacy in patients regardless of etiology with chronic kidney failure, diabetes and with or without RAASi. ZS-9 was well tolerated at all doses with placebo like adverse event rates, There were no clinically significant changes in sodium, magnesium or calcium, There were no cases of significant hypokalemia which is defined as mEq/L <3.0; there were two measurements below 3.5. There were dose dependent improvements in bicarbonate levels. Ninety eight percent of patients were normokalemic at 48 hours. This is summarized below:

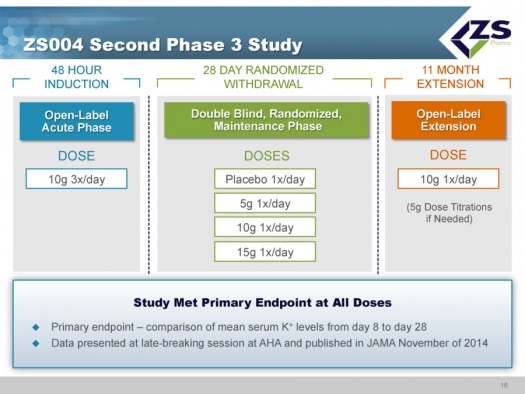

ZS004 Study

ZS004 was the second phase 3 study. It had a 48 hour induction phase in which all patients were given 10 grams three times per day. The design of the study allowed the enrollment of patients with a broad range of serum potassium levels. They actually had patients entering the study with serum potassium levels of 7.0. Once patients were brought to normokalemic range they entered into a 28 day treatment period. In this 28 day maintenance phase of the trial, patients were randomized to placebo, 5 grams, 10 grams and 15 grams each; each of these doses was given once a day for 28 days. These doses could be titrated in 5 gram intervals. The study design is shown below:

In the acute component of the trial, the study was looking at how quickly and to what level serum potassium levels could be reduced. The mean starting serum potassium level was 5.55 mEq/L of potassium. The median time to normalization (half of patients) was 2.2 hours and 84% of patients were normalized in 24 hours and 98% in 48 hours. Patients ended up on average around 4.5 mEq/L. This was virtually identical to what they saw in their first phase 3 study.

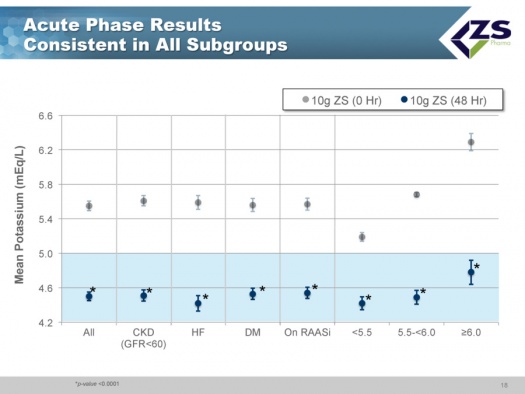

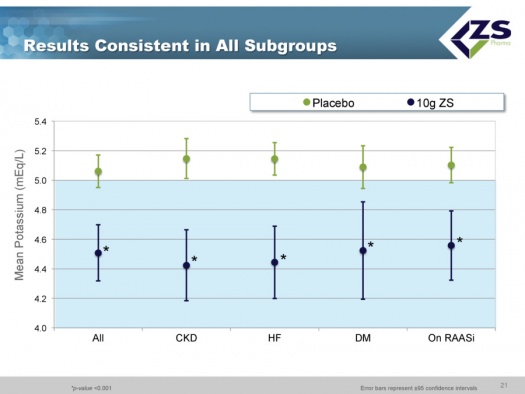

There was consistent efficacy across all sub-groups as can be seen in the next chart. It did not matter whether patients were suffering from chronic kidney disease, heart failure or diabetes. The only sub-group in which differential efficacy was seen was in patients who entered the study with serum potassium levels above 6.0 mEq/L. These are the patients most at risk and they experienced a steeper decline of 1.5 mEq/L over 48 hours; at one hour they had 0.5 mEq/L drop and at 2 hours they had a 0.7 mEq/L drop; this is an important finding as it is those patients who need quick onset of action the most.

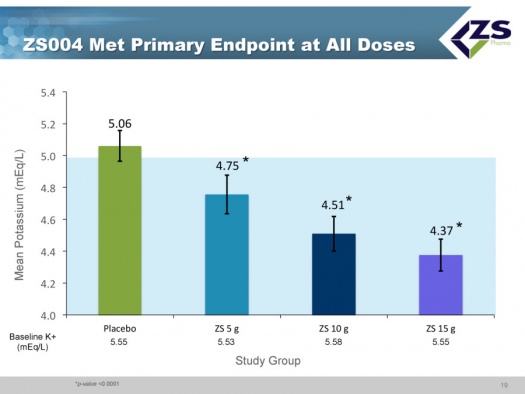

The study met its primary endpoints at all doses which compared mean serum potassium levels from day 8 to day 28. The results were presented at a late breaking session of the American Heart Association in November 2014 and published on the same day in a JAMA article.

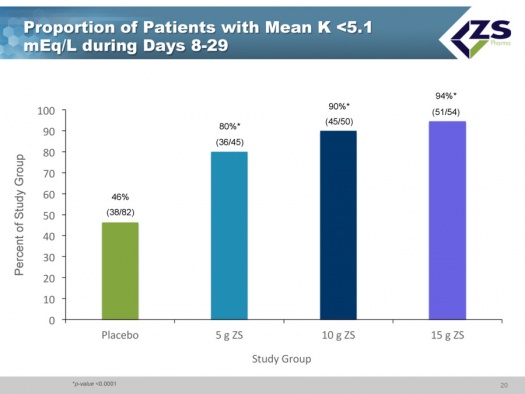

Less than half of the placebo patients who had been brought into normokalemia during the induction phase were able to maintain it over the 8 to 29 day period. In sharp contrast, 80% of the patients on 5 grams of ZS-9; 90% on 10 grams and 94% on 15 grams were able to keep mean potassium levels below 5.1 mEq/L.

As in the induction phase, in the maintenance phase there was also consistency across all sub-groups.

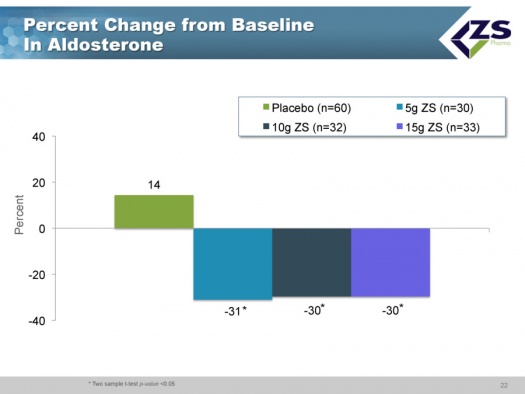

The three most interesting aspects of this study were the rapid onset of action, the effect seen on aldosterone and the effect seen on bicarbonate. In placebo patients, the aldosterone levels actually went up whereas they declined about 30% in each of the three drug groups. About 70% of patients were on RAASi drugs and would be expected to have well controlled aldosterone levels. Nevertheless, they were able to lower aldosterone in this group.

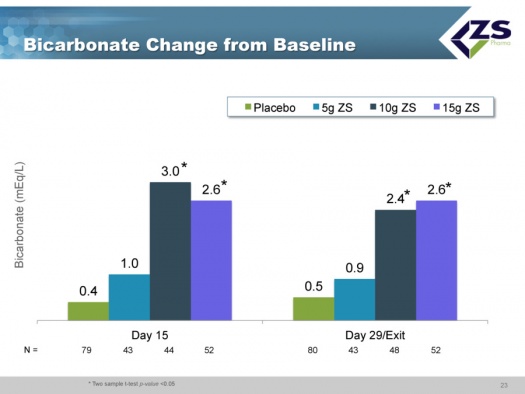

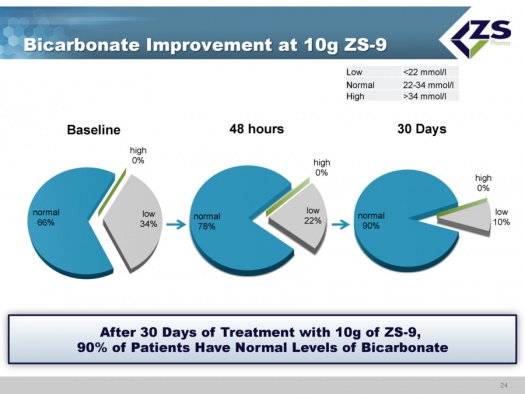

There were absolute increases in bicarbonate levels throughout the study. At baseline, about two thirds of patients had normal bicarbonate levels, about one-third were low and no patients had high levels. After just 48 hours, 78% of the patients were normal and after 30 days, 90% were normal. The reason that this is so important is that increased bicarbonate levels have been shown to improve patient outcomes and it is something that physicians really can’t deal with right now.

Here are the key conclusions to be drawn from ZS004.

- There was a high response rate as 98% of patients became normokalemic during the 48 hour run-in phase.

- All three doses used in the 28 day maintenance phase met the primary endpoint and there was equal efficacy regardless of the underlying etiology.

- Gastrointestinal adverse events were numerically lower than placebo, and there were no clinically significant changes in sodium, magnesium or calcium and no cases of significant hypokalemia.

- The one concerning finding was a numerical increase in edema at the top dose. This was addressed at length at the analysts’ day on November 19, 2015. At that time, the rate of edema in the 004e as well as 005 trial was lower than the placebo rate in 004. The rate of edema in their studies is lower than the placebo rate in other published studies in similar populations for similar durations. The data does not support an issue with edema.

- The really exciting findings in this study were the rapid onset of action and the ability to reduce aldosterone levels and at the same time increase bicarbonate levels.

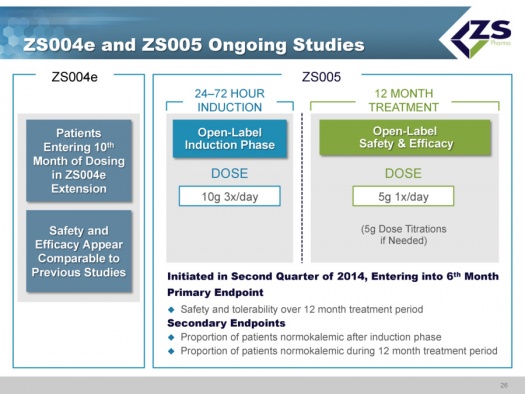

ZS004e and ZS005 Ongoing Studies

In terms of the studies that are still ongoing, ZS004e is an extension of the ZS004 study; some patients are out to 10 months on the drug and safety and efficacy are comparable to other, shorter studies.

The ZS 005 study was started in June of 2014. This study will mimic how physicians will use the drug if approved. Patients take the drug for 24 to 72 hours at the high dosage level of 10 grams three times per day until their serum potassium levels are normalized. Once they are normalized, they will be started on 5 grams per day and titrated in 5 gram increments as needed. The study is well underway and it is estimated that it will enroll about 500 patients.

The primary endpoint is safety and tolerability over 12 months. The secondary endpoint is the patients who are normokalemic after the induction phase and the proportion of patients who are normokalemic during the 12 month treatment period.

Tagged as kyperkalemia, patiromer, Relypsa, RLYP, ZS Pharma, ZS-9, ZSPH + Categorized as Company Reports

Thank you for a comprehensive report that seems to cover the many aspects of investing in these companies….I really appreciate your in-depth analysis of this and the companies you choose to share with me…..I am sooooooooo glad I subscribe to your service and hope for your continued well-being and enjoyment which makes reading these reports so meaningful….cheers

Thanks for an excellent article. One question. How about buying a couple thousand shares of each company. This way you dont run the risk on missing out on the winner and, if one fails, you will most probably make it up and some on the other. Forgetting of course, for discussion purposes, the fact that as you have pointed out, they may both be overvalued for now.

I am concerned that on a near term basis because of their valuations, they are vulnerable to a correction in the overall market in general or biotechnology in particular. Looking out two to three years, I think that you can make money from these levels. Maybe, I am being too cute. As I pointed out in my report, making price judgments like this can sometimes keep you away from a big move. However, there is not a lot of news over the next half year. ZSPH will file an NDA on ZS-9 in 2Q, 2015 and patiromer should be approved in October 2015. I am going to sit on my hands. Remember that I think that ZS-9 will double the sales of patiromer. It is just a better drug although patiromer is a very good drug.

As always, you are very thorough…Thanks for the report and analysis. I am very pleased with your subscription service,