Trius Therapeutics’ Tedizolid has Blockbuster Potential for MRSA Infections (TSRX, $5.05)

Introduction

Trius Therapeutics is in late stage clinical development of its new antibiotic, tedizolid, for treatment of MRSA infections that have increased to epidemic levels in both the hospital and community settings. There are a number of companies competing in this market and a host of new products in development, but I see tedizolid as the most promising of the new products. I am projecting an introduction in the US in 2H, 2014 and see the potential for worldwide sales of $1+ billion in 2020. I estimate that this could lead to a market valuation of three times revenues at that time and a potential stock price of $60+.

I am recommending purchase of Trius (TSRX) at these levels. Ordinarily, I put my investment perspective at the front of a report, but in this report, I have started with sections that provide needed perspective to follow my thinking about Trius as an investment opportunity. These deal with the MRSA market, tedizolid’s clinical attributes, how it compares to current leading products and competitive new products from Forest Laboratories, Durata (privately held) and The Medicines Company.

Investment Perspective on the MRSA Antibiotic Market

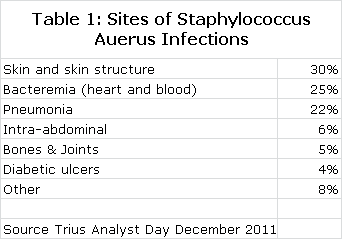

Staphylococcus aureus is arguably one of the greatest bacterial threats to mankind. It is a rapidly growing and particularly virulent bacterium that is often involved in infections involving the skin and skin structure tissues, lungs, blood stream (bacteremia) and other organ systems as shown in the following table. The death rates for pneumonia and bacteremia are alarming at about 20% and 25% respectively.

Each copy of Staphylococcus aureus can reproduce itself every half hour so that one bacterium can produce over 1 trillion copies in just 20 hours. This rapid reproduction rate results in frequent genetic mutations that through natural selection give rise to strains of Staphylococcus aureus resistant to antibiotics that were previously effective.

Resistant strains of Staphylococcus aureus are referred to as methicillin resistant Staphylococcus aureus or MRSA as opposed to methicillin susceptible (MSSA) strains. Methicillin in the late 1960s was the preferred antibiotic but due to the emergence of resistance, it is no longer effective or in in use. The term MRSA is now broadly applied to Staphylococcus aureus strains that are resistant not only to methicillin, but to many antibiotics of the important penicillin and cephalosporin classes.

A healthy human immune system can generally deal with bacterial infections, but for MRSA or MSSA infections even people with healthy immune systems are still vulnerable to these extremely aggressive pathogens. When Staphylococcus aureus gains access to the interior of the body through open wounds, cuts, burns or intravenous catheters, its rapid replication can overwhelm the immune system and antibiotic support becomes critical. Without effective antibiotic therapy, the outcome can be devastating. Both MRSA and MSSA cause very dangerous infections, but the antibiotic options for MSSA are broader making it somewhat less of a problem.

The most widely used drug for treating MRSA is vancomycin, which was first introduced in 1958 and has been the “go to” drug for MRSA ever since. Because of increased vancomycin usage, strains of Staphylococcus aureus are becoming less susceptible. In 2005, 3% of MRSA strains displayed intermediate resistance to vancomycin and this number increased to 11% by 2009. The decreasing susceptibility of MRSA to vancomycin has led the Infectious Disease Society of America to issue new guidelines that require higher dosages of vancomycin. Unfortunately, one of vancomycin’s significant drawbacks is kidney toxicity or nephrotoxicity and the higher dosing regimen in the IDSA’s guidelines is associated with a three-fold increase in nephrotoxicity. These drawbacks are creating a need for new antibiotics that are safer and more effective against MRSA.

There are currently six drugs approved for MRSA: generic vancomycin, Pfizer’s Zyvox, Cubist’s Cubicin, Forest Laboratories’ Teflaro, Pfizer’s Tygacil and Theravance’s Vibativ. The pharmaceutical industry has responded aggressively to the medical need for new drugs effective against MRSA as there are at least 9 new drugs in phase 2 or 3 development. This report focuses on Trius’ new antibiotic tedizolid. In my opinion, it is the most promising new agent in late stage development.

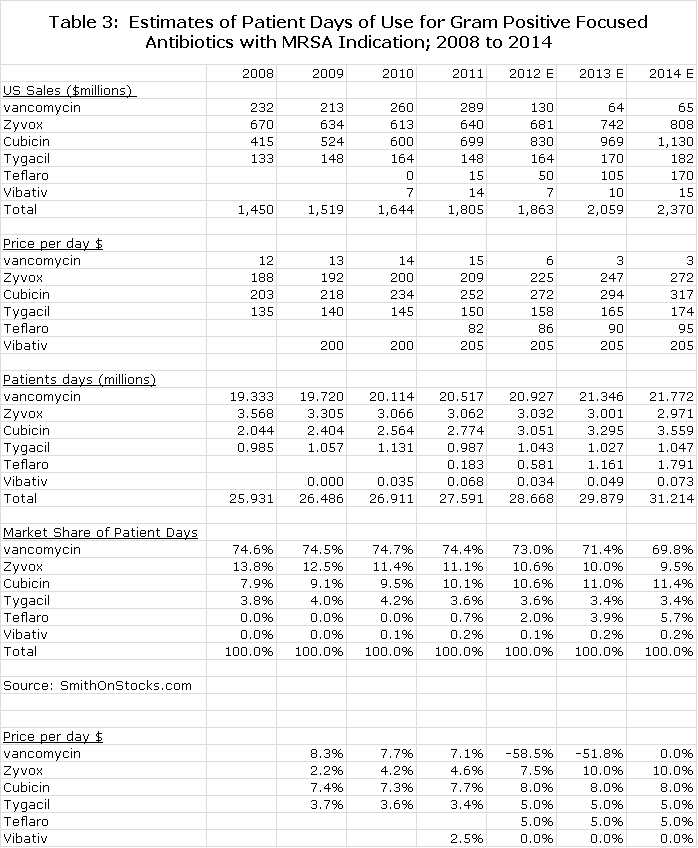

US sales of the six approved drugs reached $1.8 billion in 2011 led by Cubicin with $699 million, Zyvox $640 million and vancomycin $289 million (see Table 1). The sales figures are not representative of unit usage because Cubicin is priced at about $250 per patient day, Zyvox at $200 for oral and $225 for IV and vancomycin at $15, respectively. I estimate that there were 28 million patient days of therapy in 2011 with vancomycin accounting for 74%, Zyvox 11% and Cubicin 11% (see Table 2).

If vancomycin were priced at $225 per patient day of therapy or midway between Cubicin and Zyvox, it would be a $4.6 billion product. Looked at in this way, the market addressed by tedizolid is a $5.8 billion opportunity. Assuming pricing of $235 per patient day for tedizolid, each 1% of market share that it gains in the US is roughly $65 million of sales and worldwide could be about double that or $130 million.

The Potential Role of Tedizolid in MRSA

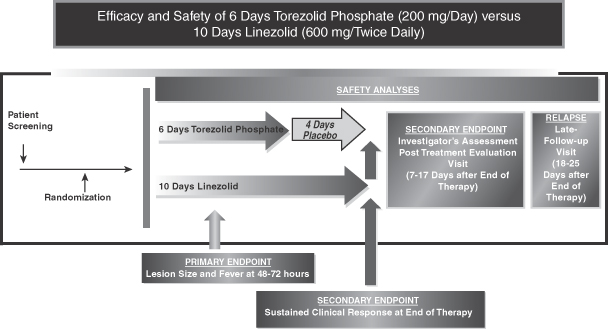

Trius has completed one successful trial of tedizolid in acute bacterial skin and skin structure infections or ABSSSI and should report topline data from a second Phase 3 ABSSSI trial in early 2013. If this second trial is successful, an NDA could be filed in 3Q, 2013, setting the stage for potential approval for ABSSSI and a commercial launch in the US late in 2014. A trial in pneumonia should start in 2013 and approval might be gained in 2016. A bacteremia trial and approval could occur somewhat later.

All of the antibiotics approved for MRSA and most of those in development have a high cure rate in ABSSSI. This is so much the case that it is difficult to show that a new antibiotic is statistically better than older ones in clinical trials. This was the case with the recently approved Teflaro and Vibativ and was the case in the Phase 3 trial that compared tedizolid to Zyvox. As a result, the primary endpoint of clinical trials is non-inferiority, but this does not mean that the drugs are all the same. There are key differentiating points such as potency, drug schedule (oral or IV administration and number of doses per day), length of therapy, bactericidal or bacteriostatic mode of action, spectrum of bacterial coverage, pharmacokinetics and effectiveness against organisms resistant to other antibiotics that are all important considerations in selecting a drug.

Tedizolid is on track to be the second drug from the oxazolidinone class of antibiotics to be approved; Zyvox was the first. Tedizolid ranks superior or preferable to Zyvox on each of the differentiating factors just described and its greatest commercial opportunity is grabbing share from Zyvox. It has additional advantages that could allow it to take some usage from vancomycin and to a much lesser extent Cubicin. In addition to taking share from the current market leaders, I think that tedizolid will also benefit from strong market growth as I expect the patient days of therapy for MRSA antibiotics to grow at about a 3.7% annual rate through 2020.

I think that tedizolid has a very significant commercial and medical opportunity, but as is always the case there are investment concerns. With the introduction of each new antibiotic, the argument always arises that it should be used sparingly and only after other antibiotics have been tried and fail. The premise is that exposure of a new antibiotic to bacteria will inevitably lead to the emergence of resistance and exposure in the early years should be kept to a minimum so that it can be a drug of last resort. If this argument were to be widely accepted by the medical community, tedizolid would only be used after vancomycin, Zyvox and Cubicin have been judged to be ineffective either through clinical use or laboratory tests.

A second concern is that the Zyvox patent expires in May 2015 in the U.S. and Cubist has reached a settlement that allows Teva to introduce a generic to Cubicin in 2018. Investors have seen that when major products in other therapeutic categories went generic, it switched usage from other branded products to the newly generic agents. Cost conscious hospital formularies and health care plans jump on the opportunity to reduce costs by incenting generic prescribing.

I think that these issues, while legitimate, will not prevent tedizolid from becoming a very successful drug. MRSA is different from many diseases in that it can become life threatening within days of a patient presenting at an emergency room or developing an infection in a hospital. This is not like treating a slowly progressing chronic disease such as hypertension. Physicians don’t have the time to try the least expensive generic first and then switch to a branded product. They need to prescribe the drug which their experience suggests will have the best immediate chance of curing their patient. The concern about overuse of a new antibiotic and its cost are not at the top of the physician’s prescribing check list.

There are historical situations that can be examined to test the hypotheses of “holding a new antibiotic in reserve” argument and utilizing a generic may not be significant limiting factors in the uptake of tedizolid once it gains approval. In 1999, the new flouroquinolone antibiotic Levaquin entered a market dominated by the leading product Cipro which would go generic in 2003. Levaquin took off rapidly, continued to grow after Cipro went generic and by 2006 had reached $1.6 billion in sales.

The experiences with Zyvox and Cubicin support my point: both were accepted into widespread clinical use even though vancomycin was generic. This is not to say that physicians should use new drugs promiscuously and ignore the “hold in reserve” argument or any price consideration in their prescribing decision. Indeed, vancomycin still accounts for 74% of patient days in the MRSA antibiotic market. It is just that these issues aren’t so dominant that they preclude the potential for tedizolid’s success. When the chips are down and the physician is faced with a life threatening Staphylococcus aureus infection, he will choose the antibiotic that he thinks has the best chance of immediately curing the patient.

A third issue to consider is that tedizolid will initially be approved only for use in skin and soft tissue infections (ABSSSI) which accounts for about 30% of infections caused by Staphylococcus aureus. The approval in “skin” could come in 2014. It is not likely to be approved for pneumonia until 2016 and bacteremia will be somewhat later. Skin and soft tissue infections, while quite serious, are easier to treat and the competitive advantages of tedizolid are less compelling.

It is in pneumonia, bacteremia and other infections requiring long-term treatment in which tedizolid may offer the most significant therapeutic advantages. While it will take two or more years after tedizolid’s initial approval to gain these additional indications, physicians can use a drug off-label and I think there will be considerable off-label prescribing of tedizolid. In 2004 and 2005 during the early days of the Cubicin launch, it was only approved for skin and soft tissue infections. Cubist at the time reported that about 50% of its use was off-label. Importantly, Cubicin is not effective in lung infections so that most of this off label usage was in bacteremia and endocarditis. The off-label usage has now dropped to about 25% with the approval of Cubicin in bacteremia.

Zyvox achieves about 40% of current sales in off-label indications, primarily in bacteremia and infections requiring long-term therapy. This is importantly due to its being available in an oral dosage form; vancomycin and Cubicin can only be given IV. Zyvox failed to reach its primary endpoint in a bacteremia trial, but it is estimated that 15% of its use still occurs in bacteremia.

Sophisticated physicians will weigh the advantages shown by tedizolid against Zyvox indicated by in vitro, animal and clinical studies and they will make their prescribing decisions almost as much on these factors as the label. I expect meaningful off-label prescribing in pneumonia and bacteremia before tedizolid is formally approved for these indications. This will usually be in infections not responding to vancomycin, Cubicin or Zyvox or infections requiring long-term therapy in which oral dosing provides a significant benefit. Because of its potential superiority to Zyvox and because Cubicin is ineffective in lung infections, I see considerable potential in pneumonia.

Tedizolid versus Zyvox versus Vancomycin

Zyvox was the first of the oxazolidinone class of antibiotics and tedizolid is on track to be the second. The greatest economic opportunity for tedizolid is replacing some of the usage of Zyvox. Zyvox is considered to be somewhat more potent than vancomycin and has the important advantage of being administered twice-a-day as either an intravenous infusion or oral, while vancomycin must be infused twice a day.

About half of Zyvox’s usage is in the oral dosage form and half is in IV. The oral dosage form can allow a patient to be released more quickly from the hospital reducing costs for the hospital. The oral dosage form is also much more practical for treating infections that can require long term therapy of 10 to 60 days such as infections of the heart valves, bones, joints and blood. Tedizolid also offers both an oral and IV formulation; importantly, the bioavailability of both dosage forms is comparable allowing for an easy transition from the IV.

Vancomycin can cause kidney toxicity and about 15% to 20% of potential patients have pre-existing kidney impairments. This can preclude vancomycin use or require extensive monitoring of vancomycin treatment in these patients which is not required for Zyvox. Because of decreasing susceptibility of Staphylococcus aureus to vancomycin, current dosing guidelines are calling for ever higher doses of vancomycin. However, when vancomycin is dosed according to the current guidelines, there is a significant risk of kidney toxicity and this creates the need for Zyvox or Cubicin to be prescribed instead.

More than almost any other drug category, the characteristics of a new antibiotic can be importantly determined by its efficacy against bacteria cultured in the laboratory (in vitro) and infections induced in animal models (in vivo). If an antibiotic can kill bacteria in a petri dish or in animals, it will also kill bugs in humans, if it can be effectively delivered to the site of the infection. Based on pre-clinical and animal studies and then substantiated by human phase 2 and 3 studies, tedizolid appears to be a superior drug to Zyvox on several counts. However, both are very effective agents and as I have previously discussed, the first phase 3 study showed that tedizolid was non-inferior to Zyvox in ABSSSI, not superior.

Based on the weight of evidence tedizolid is superior to Zyvox on several broad measures. In laboratory tests, tedizolid has been shown to be 4-16 times more potent than Zyvox against both MRSA and MSSA bacteria. Tedizolid is given once-a-day versus twice-a-day for Zyvox and requires only six days of therapy (in ABSSSI infections) rather than ten for Zyvox. Physicians feel these features are extremely important because it increases compliance. Missing a dose or doses can result in a drop in blood levels of an antibiotic to sub-therapeutic levels and allow the infection to resurge. The more doses required per day and the longer the duration of therapy, the greater is the risk for non-compliance especially if the patient feels better and stops medication on their own.

Tedizolid is also bactericidal which means that it kills bacteria. (Technically, tedizolid is bacteriostatic in vitro and bactericidal in vivo.) One of the most important reasons for Cubicin’s success is that it is bactericidal, while Zyvox and vancomycin are bacteriostatic and only slow or halt the growth of bacteria. They must rely on the immune system to eradicate the bacteria. Physicians generally believe that bactericidal agents are more effective than bacteriostatic agents in eradicating disease and prefer bactericidal drugs for serious infections and those requiring a long duration of therapy.

Tedizolid and Zyvox both showed good safety and tolerability in the first six days of therapy in the first phase 3 trial conducted by Trius and which compared the two drugs. However, tedizolid did show statistically fewer reports of nausea, vomiting, diarrhea and dyspepsia. The most serious side effect of Zyvox is that it can cause myelosuppression (damage to bone marrow) and result in a dangerous decrease in blood platelets. This starts to occur at around six days of therapy and can grow more severe as duration of therapy increases. Animal studies suggest that tedizolid may not have the same risk.

Animal studies and Phase 1 trials also suggest that tedizolid has much better penetration in lung tissues than Zyvox which promises greater efficacy in pneumonia. Cubicin, incidentally, is destroyed by proteins found in lung surfactants and cannot be used in pneumonia. Zyvox failed in a clinical study in bacteremia, potentially because it is bacteriostatic. Nevertheless, about 15% of the usage of Zyvox is in bacteremia because it still produces some benefit. Animal studies show that tedizolid should be effective in bacteremia.

Prescribing an antibiotic for a suspected MRSA infection is as much of an art as a science. These infections can take many different forms in different organ systems so that no two situations are the same. To give an example, let’s take a look at how doctors might choose to prescribe tedizolid over Zyvox and Cubicin in bacteremia. In the case of life-threatening bacteremia (blood) infections, in a clinical trial Zyvox was associated with higher mortality and failed to gain approval for this indication. Cubicin is approved for this indication, but it is destroyed by surfactants in the lung so that when Cubicin is prescribed for bacteremia, it will not control bacteria in the lungs; this could provide a reservoir for the bacteria to hide in and resurge. Tedizolid is bactericidal and should be more effective than Zyvox in bacteremia and it is also well absorbed in the lung fluids and tissues. It is a logical choice when treating bacteremia to choose tedizolid over Zyvox and perhaps Cubicin. By the way, it is estimated that 15% of the use of Zyvox is in bacteremia even though it was associated with the higher mortality rate.

Another example is the treatment of infections like osteomyelitis that require treatment of up to 60 days. Vancomycin and Cubicin can only be given IV so that it is difficult to use them in this setting. Due to convenience, Zyvox with its oral dosage form is often preferred for osteomyelitis, but upon long-term use it can cause myelosuppression resulting in decreased blood platelets, as well as peripheral and optic neuropathy. This is another potential setting where tedizolid might be preferred. These are only two examples, but they illustrate how complex the prescribing of MRSA antibiotics can be and how tedizolid in important niches of the market may provide highly differentiable properties.

Development of New Antibiotics for MRSA is Intense

If there is caution by investors about the commercial potential for new antibiotics effective against MRSA, it is not shared by the pharmaceutical industry. There are a large number of companies that are developing MRSA antibiotics and I am aware of 9 drugs in phase 2 or 3 development. This competitive onslaught will also be part of the investment discussion around Trius and tedizolid.

I find three products to be of the most interest. The privately held company Durata (just filed an S-1) is developing dalbavancin and The Medicines Company is developing oritavancin. Both belong to the glycopeptide class of antibiotics of which vancomycin is the charter member. They are on the same development timeline as tedizolid and both will be revealing topline data from phase 3 trials in 2013 and depending on the outcomes could be filing NDAs in 2013 at about the same time as tedizolid. The third product is Forest Laboratories’ Teflaro (ceftaroline), a fifth generation cephalosporin antibiotic with good activity against MRSA that was introduced in 2010; Forest is guiding for sales on $65 million for the year ending March 2013.

Both dalbavancin and oritavancin have previously submitted NDAs that were not approved by the FDA. Based on my research, I am inclined to think that these rejections were due to trial design. My working view is that both are effective agents, but this can only be determined when phase 3 data is released in early 2013. A major differentiating point for both of these drugs is their administration. Dalbavancin requires an initial IV infusion followed by a second infusion seven days later. Oritavancin requires only one infusion.

The developers of dalbavancin and oritavancin argue that these drugs will be highly cost effective. A patient showing up at the emergency room can be given an injection and sent home without the need for costly hospitalization. Tedizolid would require an initial IV infusion or oral dosage followed by five days of once-a-day oral therapy in this setting. The assured compliance of dalbavancin and oritavancin might offer some advantages in this setting.

The dosing advantage of dalbavancin and oritavancin would be most meaningful for the least severe skin and soft tissue infections caused by MRSA. This is not an insignificant market as recent reports indicate that about 60% of the patients showing up at emergency departments with skin and soft tissue infections have MRSA and about 25% of these patients are admitted to the hospital. There are significant cost advantages and health benefits in keeping patients out of the hospital. The hospital is no place to be sick because of the risk of acquiring a new infection.

Patients presenting at an emergency room with the most severe skin and soft tissue infections, pneumonia and bacteremia would almost certainly be admitted to the hospital for medical management of their conditions and observation. Patients with less severe skin and soft tissue infections might receive dalbavancin or oritavancin. I have seen no estimates on how much of vancomycin, Zyvox and Cubicin use is currently in this patient population that can potentially be treated in the emergency room and sent home. My guess is that it is significant and growing rapidly. This market segment is also being treated with generic agents that have activity against community-acquired MRSA, such as clindamycin and trimethroprim combined with sulfamethoxazole. These drugs are unapproved for MRSA.

Patients who show up at the emergency room and who are then admitted are usually treated by an emergency room physician who would likely prescribe vancomycin if MRSA is suspected or a cephalosporin like Keflex if MSSA is believed to be the causative agent. The emergency room physician treats empirically without knowing what the cause of the infection might be. Accurate identification requires that a culture be taken and sent to the laboratory which reports back in 24 to 48 hours on what the bacteria is. If the results come back as MRSA, the infectious disease physician or other physician assuming care of the patient would choose to continue vancomycin if already prescribed or if not, shift to vancomycin, Zyvox or Cubicin depending on their judgment and the epidemiology in the hospital. It is unlikely that a patient who is going to be admitted to the hospital would be started on dalbavancin or oritavancin.

Both of these drugs have certain reimbursement issues. Zyvox and Cubicin are priced at about $2,000 per course of therapy. If dalbavancin were priced equivalently each infusion would cost $1,000 and oritavancin would be priced at $2,000 for its only infusion. The cost per course of therapy is the same, but there might be sticker shock at the price of these drugs versus $225 per day for Zyvox and about $250 for a Cubicin infusion.

The hospital might also have another subtle reimbursement issue that could give it pause on these two drugs. In the case of a patient who is admitted to the hospital for say one day, the cost of treating with oritavancin is $2,000 per the previous example and $1,000 for dalbavancin versus $225 for Zyvox and $250 for Cubicin. In the case of Zyvox and Cubicin the remaining cost of therapy would be the responsibility of the patient’s health insurance plan. The cost of drug therapy is probably only 10% to 20% of the total cost of a stay in a hospital for a MRSA infection, but a savings of $600 to $1,600 for the hospital by shifting reimbursement to another payor is not insignificant.

I see other issues that have to be addressed by these two drugs. I think that they have the potential to carve out meaningful market niches, but I don’t see the dosing advantage as being profound. There will be questions on pharmacokinetics with these long acting drugs and how they might be administered in more severe infections in which the doctor might want to increase the dose. Also in long-term infections requiring 10 to 60 days of therapy there might be a difficulty or confusion in scheduling doses.

Teflaro is a different therapeutic consideration. It is quite effective in infections in patients who have or are suspected of having a mixed infection caused by both gram positive and gram negative infections such as occur in severe skin and soft tissue infections, pneumonia and bacteremia and particularly in intra-abdominal infections. Currently in these types of infections with MRSA involvement suspected, the patient is treated with vancomycin, Cubicin (except in pneumonia) and Zyvox in combination with a drug that protects against gram negative bacteria; aztreonam is often used.

Using one drug instead of two is an advantage. However, Teflaro loses this advantage if Pseudomonas aeruginosa is involved and it is frequently involved or suspected of being involved when therapy is started; Teflaro is not active against Pseudomonas aeruginosa. Physicians also avoid using broad spectrum antibiotics if possible due to the side effects inherent in wiping out large elements of bacteria in the bowel. I see Teflaro as having a meaningful niche in mixed infections with MRSA involvement, but this niche is somewhat different from vancomycin, Cubicin, Zyvox and tedizolid. Teflaro also is hampered by the requirement for twice a day IV infusions for 5 to 14 days.

Detailed Investment Thesis

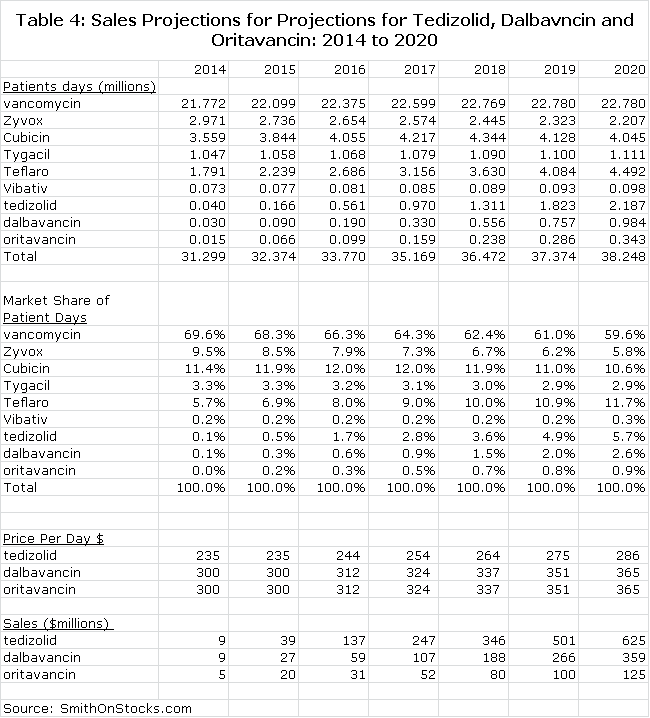

I project that tedizolid will be approved and launched commercially in the US and Europe in 2H, 2014. I have projected a launch that produces US sales of $39 million, $137 million and $625 million in 2015, 2016 and 2020 respectively and international sales could be comparable (See Table 3). I think that the valuation based on 2020 worldwide sales of $1.2 billion could be 3x revenues (or more) reflecting the long patent life (through 2029) and good growth potential through 2029; this would result in a market capitalization of $3+ billion and a stock price of $60+ around the 2020 timeframe.

I know that this argument arouses skepticism in investors who want to know what is going to happen to the stock in the next year or month or nanosecond and would point out the inherent inaccuracies in long term forecasting. I understand this, but my purpose in doing such a long term projection is to show the value in the franchise that a potential pharmaceutical partner or acquiror or long term investor might see in the franchise.

The stock does face headwinds and uncertainties over the next three years. The outcome of the second phase 3 trial that will be reported in early 2013 will be a critical binary event and while the success of this trial is made highly probable by the safety and efficacy shown in the first phase 3 trial, there is never a guarantee of success. Trials can sometimes fail for execution reasons even though the drug may be effective. Failure would cause a sharp decline in the stock price.

Even if the results of the trial are successful, the company still faces the challenge of gaining approval. In response to the majority of newly submitted NDAs, the FDA issues Complete Response Letters which are often due to sections of the NDA other than the clinical data such as chemistry, manufacturing and control. A CRL usually delays approval by a year or two. It has also been the case that most new product launches prove disappointing and investors will be wary that the initial launch will be slow. It could be 2016 before the outcome of all of these issues are known and put behind the company, a time frame that is forever in the current short term focused market.

The trial uncertainty and the potential for a CRL at the probable PDUFA date in mid-2014, is likely to restrain investors’ near term enthusiasm toward the stock. However, there are other aspects to the investment equation that are more compelling. Tedizolid has the potential to be one of the most important antibiotics for treating the MRSA epidemic over the next decade. While impatient investors focusing on day to day events may not find this particularly compelling, potential pharmaceutical partners or potential pharmaceutical acquirors could.

I think that there is a high probability of a partnering deal for Europe alone or perhaps the US, Canada and Europe later this year or in early 2013 that would bring in a significant upfront payment. Bayer has already licensed tedizolid for all other countries of the world for an upfront payment of $25 million. Another large upfront fee later this year from a licensee could cause a significant move in the stock.

However, the most upside potential for Trius in the short term comes from the possibility of an outright acquisition of Trius by big pharma which has the cash flow and inclination to do so. The prospect of acquiring a product that appears to be a meaningful improvement on Zyvox, which is in late stage development and has a strong patent position, is a compelling investment opportunity for big pharma. I think that there is a strong possibility that this will occur. Turning the product over to big pharma would produce an excellent return for shareholders and avoid the time and risk involved in commercializing tedizolid. I think that a takeover bid on the order of $12 to $15 is possible (market capitalization of $450 to $570 million).

I am recommending the stock on the basis of these arguments. The current market capitalization of $200 million is not much more than sometimes accorded to venture capital investments with far less probability of success. I think that patient investors can buy the stock and over the next five to ten years it could be a very rewarding investment. This is made more interesting by the potential for a partnering deal that could cause a meaningful bounce in the stock or an outright acquisition that could double or triple the stock overnight. I think that the most reasonable risk in the risk reward equation is that the stock will be boring over the next year or two or three, particularly if the company receives a CRL. I recognize that there is very significant downside risk to the $1 to $2 level if the second Phase 3 trial fails, but I think the probability is small.

The Current Market for Antibiotics with MRSA Indications

The market in which tedizolid will compete does not have sharp boundaries. To determine the size of the market in which it will compete, I have initially looked at sales of antibiotics which have an indication for MRSA. However, there are two groupings within this. Vancomycin, Cubicin, Zyvox, Vibativ, tedizolid, dalbavancin and oritavancin primarily cover primarily gram positive bacteria. Teflaro and Tygacil are broader spectrum covering certain gram positive and gram negative bacteria.

In infections in which it is suspected that there might be both gram positive and gram negative bacteria, Teflaro and Tygacil could be used alone while the gram positive antibiotics would need to be combined with a second antibiotic that provides gram negative coverage. Tygacil was introduced in 2005 and had a very successful launch, but it did not appear to slow the growth of Cubicin and Zyvox. Although it is early days, the launch of Teflaro in 2010 has not had any apparent effect on the growth trend for Cubicin and Zyvox. Worldwide sales of all products approved for MRSA are shown in Table 2:

Calculating US Patient Days of Therapy for Antibiotics with a MRSA Indication

I think that tedizolid will compete primarily with vancomycin, Cubicin, Zyvox and Vibativ and to a lesser extent with Tygacil and Teflaro. Prices charged per patient day of therapy range from $8 per day for vancomycin (prior to generization) to $250 per day for Cubicin

In table 2, I divided US sales by my estimates for the average price per day of therapy. This allowed me to calculate patient days of therapy for each antibiotic for the 2008 to 2011 period and also market share based on patient days of therapy. I then projected patient days for each antibiotic and its price per patient day through 2014. The results of all of these calculations are shown in Table 2:

Projecting Tedizolid Sales

The MRSA market will change in 2014 with the probable entry of tedizolid, dalbavancin and oritavancin in the second half of the year. I am projecting that the market will grow at 4.5% per year from 2014 through 2020. I continue to see vancomycin as the cornerstone of therapy. The uncertainty is whether resistance increases rapidly or gradually; I am projecting gradual.

I think that tedizolid will be able to convert a significant amount of volume away from Zyvox as I have previously discussed as gaining some share from vancomycin and a modest share from Cubicin in cases where an oral dose is preferable to IV. The opportunity for dalbavancin and oritavancin is more constrained as I doubt that they will have a major differentiation from vancomycin and will not be as potent as Cubicin. Their long acting dosage form is the major marketing hook.

I am assuming that the Phase 3 trials of dalbavancin and oritavancin will support approval of these products. However, unlike tedizolid, there is no recent phase 3 data available and there is potential for a surprise on the data.

I am assuming that tedizolid will be priced at a modest premium to Zyvox and estimate an initial price per patient day of $235 per day in 2014. I am assuming that dalbavancin will be priced at a slight discount to Cubicin on a price per patient day basis or $300. Because one infusion cover covers seven days of therapy, this would amount to $2,100 for the first infusion. I am assuming the same price for oritavancin.

Table 3 summarizes all of my projections. I have made projections for patient days of therapy for the six older products and the three newer ones through 2020. I have not assumed any launches of other new products in this time frame, but I would be surprised if there aren’t any. I have included a calculation for market share based on patient days of therapy to provide some perspective. Finally, I multiply patient days of therapy by assumed price per patient day to make sales projections for tedizolid, dalbavancin and oritavancin. All of this is show in Table 3.

Financial Issues

Trius ended the first quarter with $96 million of cash. Based on the recent burn rate of $10 million per quarter, this would take the company into the first quarter of 2014. I would expect that the company will consummate a partnering deal for Europe late this year or early next year. The company has partnered tedizolid with Bayer for development of tedizolid in countries other than the US, Canada and the European Union for a $25 million upfront payment.

The company is weighing options on partnering in the US, Canada and Europe or partnering in Europe and perhaps Canada while commercializing the product on its own in the US or some combination. I think that a partnering deal for Europe alone could result in an upfront fee of $50 million or more.

I do not see the company financing until the approval of tedizolid in 2H, 2014. This will depend on how the company might want to go about commercializing tedizolid in the US.

Disclosure: The author of this article did not own shares of Trius Therapeutics at the time this note was written. In reading this note, you acknowledge that you have not used it as the sole basis of your decision making and that all investment decisions are based on your own analysis. An investment in Trius Therapeutics carries substantial risk and investors could potentially lose much of their investment. The reader acknowledges that he/she has carefully read the Investment Approach, Terms/Conditions and Disclosures sections in the About Us section of the website. The reader acknowledges that he/she will not hold SmithOnStocks accountable for any investment loss that may be incurred if a decision is made to invest in Trius Therapeutics.

Appendix

During the preparation of this report, I did a considerable amount of research to support the conclusions reached in this report. For those investors who like detail, I have included this work in the appendix of this report. It is not as carefully written or organized as the previous sections.

The Battle between Bacteria and Antibiotics

Bacteria first appeared on Earth over a billion years ago. These single cell organisms are remarkably adaptable to their environment and continue to thrive as the most successful and abundant life form on the planet. There are thousands of different bacteria species and many live in incalculable numbers around, on and in the human body which is often a rich food source and habitat. Most are harmless and some like the bacteria that line the intestines and help digest food are necessary for life. Under some conditions, however, bacteria can become pathogenic (disease causing) when they invade tissues and organs throughout the body and cause infections of the skin, lung, blood, bone, heart and urinary tract.

An antibiotic is a compound that kills or slows the growth of certain, strains of bacteria. The term was coined to describe a substance produced by one microorganism to kill or impede the growth of another rival microorganism. Most current classes of antibiotics are modifications of naturally occurring compounds produced by microorganisms. Classic examples are proteins produced by fungi to protect themselves against attacking bacteria which were the basis for the development of very important beta-lactam antibiotics: penicillins, cephalosporins, and the carbapenems. The aminoglycosides and glycopeptides, two other important classes are also based on natural substances. Some newer classes like the quinolones and oxazolidinones have been produced solely by chemical synthesis.

The long term survival of bacteria has been dependent on their ability to adapt to their environment. Bacterial genes are constantly changing so that bacteria can evolve and better adapt to their environment. When bacterial strains encounter an antibiotic the more susceptible are killed, but invariably some survive. As these surviving strains are repeatedly exposed to the antibiotic, natural selection leads to the creation of increasingly drug-resistant strains.

The human immune system has evolved to protect against bacterial infections. It is a remarkably effective arrangement of many cell types; some produce proteins that can kill bacteria while others engulf and digest bacteria. Antibiotics work in concert with the immune system by either slowing the growth of the bacteria or making it easier for the immune system to eradicate them or by killing the bacteria outright. Bacterial infections are caused by pathogens present in the environment that enter the body and overwhelm the body’s immune system. These bacteria establish themselves in various tissues and organs throughout the body causing infections of the skin, lung, blood, bone, heart and urinary tract.

Bacteria are differentiated into two broad categories based on the structure of their membrane envelope. Gram positive bacteria possess a single membrane and a thick cell wall and turn dark-blue or violet when subjected to a laboratory staining method known as Gram’s stain. Gram negative bacteria possess two membranes with a thin cell wall and lose the stain or are decolorized when subjected to Gram’s staining. The most clinically relevant gram-positive bacteria include staphylococci, streptococci and enterococci. Common infections that are caused by gram-positive bacteria and can result in hospitalization include infections of the skin, lung, blood and bone.

Antibiotics work by inhibiting a function essential to a bacterium’s growth or survival; they bind to one or more specific targets on the cell wall or the interior of the cell. There are several factors that are critical to the effectiveness of an antibiotic:

- Potency is generally expressed as the minimum inhibitory concentration, or MIC. This is the lowest concentration of an antibiotic in a laboratory setting that will stop visible growth of bacteria taken from an infection and cultured for 24 to 48 hours in laboratory conditions. The measure commonly used is the MIC90, which is the concentration of the drug measured in µg/ml that will inhibit 90% of the bacteria isolated from these infections. The lower the MIC90, the more potent the antibiotic against those isolates.

- Dosing Schedule and Duration Antibiotics whether dosed orally or intravenously can be administered once, twice or more times per day and the duration of therapy is the number of days required to administer a full course of therapy. Once a day therapy and shorter duration are very important properties as they can lead to better patient compliance that result in improved efficacy and less potential for the emergence of resistant bacteria. Vancomycin is given intravenously twice a day for at least 10 days. Cubicin is given once a day intravenously for 7-14 days for skin infections. Zyvox can be given twice a day either as an oral dose or intravenously for at least 10 days. Tedizolid can be given once a day orally or intravenously over six days of therapy.

- Bactericidal or bacteriostatic Antibiotics can kill the bacteria outright (bactericidal) or stop the growth (bacteriostatic) and allow the immune system to eradicate the bacteria. Physicians generally prefer bactericidal agents. Cubicin is bactericidal while vancomycin and Zyvox are bacteriostatic. Tedizolid is bactericidal in vivo and bacteriostatic in vitro

- Spectrum of Coverage The spectrum of activity of an antibiotic is described by its activity against gram positive and gram negative bacteria. Those like Forest Laboratories’ Teflaro cover important segments of gram negative and gram positive and are referred to as broad spectrum. Vancomycin, Cubicin, Zyvox and tedizolid are primarily active against gram positive bacteria and are referred to as gram positive antibiotics.

- Pharmacokinetics The effectiveness of an antibiotic is determined by its ability to kill or halt the growth of bacteria when they come in contact, but it is equally important that the antibiotic can get to the site of the infection. This is determined by the absorption, distribution, metabolism and excretion of the drug by the body, as reflected by measuring drug concentration over time. Less patient-to-patient variability in the concentration of the antibiotic in blood generally means that drug exposure, and subsequently, the drug’s efficacy and safety is more predictable across a broad patient population. The pharmacokinetics of Vancomycin, Cubicin, Zyvox and tedizolid are complex and it is difficult to generalize about the relative merits. Pharmacokinetics may favor one drug over another based on the type of bacterial infection and where it occurs.

- Resistance The use of antibiotics can promote the development of bacterial strains with decreased susceptibility to the antibiotic. The frequency at which mutations occur is an indicator of the likelihood that resistance will develop; this can be experimentally determined. The clinical and commercial success of Cubicin and Zyvox has stemmed in part from their effectiveness in treating vancomycin-resistant strains.

- Safety and Tolerability The safety of an antibiotic is characterized by the type and number of adverse events such as nausea, vomiting, headache, dizziness or other expressions of discomfort. It is also assessed by its impact on organs like the blood, kidney or liver, changes in cardiovascular or other physiological signals and effects on other vital organ and tissue functions typically expressed by abnormal clinical laboratory tests or parameters.

New antibiotics must offer improvements in most of these measures to be successful in the market. This can be done though the development of new antibiotic classes or improvements within a class. Vancomycin, oritavancin and dalbavancin are all members of the glycopeptides, the first group of antibiotics with efficacy against MRSA. Cubicin is the first and only member of the lipopeptide class. Zyvox was the first of the oxazolidinones and tedizolid promises to be the second. There will be an unending need to develop new antibiotics as older ones encounter bacterial resistance and lose effectiveness.

Gram Positive Infections

Tedizolid is being developed to treat infections caused by gram positive bacteria similar to vancomycin, Zyvox and Cubicin. Gram positive bacteria include: (1) the cocci (spheres) Staphylococcus and Streptococcus and (2) the bacilli (rods) Listeria, Corynebacterium, Bacillus and Clostridium species. The Staphylococcus genus includes at least 40 species, most of which are harmless and reside normally on the skin and mucous membranes of humans and other organisms. The Streptococcus genus contains over 30 species. The most prevalent and dangerous gram positive bacteria is Staphylococcus aureus.

The human body is a natural habitat for Staphylococcus aureus. In about one out of four healthy people, it can be found on the skin or nasal passages which normally form a protective barrier to prevent them from gaining access to the interior tissues of the body. However, breaks in the skin or mucosal barriers resulting from a cut, sore, burn or catheter can give Staphylococcus aureus access to the nutrient rich internal tissues. Staph in this environment reproduces prodigiously so that one bacterium can expand into 1 trillion in 20 hours. They release enzymes and toxins that can greatly damage body tissues. The most common sites of infection for Staphylococcus aureus are skin and soft tissue, lungs, blood, heart valves, bones and joints.

Antimicrobial resistance can be transferred from one bacterial strain to another through the transfer of genetic material. Staphylococcus aureus is promiscuous and acquisitive, constantly searching for ways to increase its virulence and resistance by genetic exchange with other bacteria, even other species of bacteria. Staphylococcal aureus is a continually evolving organism.

Studies were presented at the September 2010 advisory committee meeting considering the use of ceftaroline for treating ABSSSI in patients who arrived at the emergency room with a skin infection. The study reported that 40% had abscesses, 40% had cellulitis and 14% had wounds. Nearly 80% of bacterial pathogens were staphylococcus aureus and about 30% of these were MRSA indicating that 25% of the patients showing up at the emergency room had MRSA. The second most reported bacterial species was Streptococcus pyogenes, at about 12%.

Upon gaining access, a Staph infection may initially be a red, swollen, and painful area on the skin with accompanying pus. The infection can be minor and local as in the case of a pimple and can often be treated by excising and draining the infection site. The immune system can be relied upon to eradicate the remaining bacteria. However, Staphylococcus aureus can spread rapidly so that within 48 to 72 hours a small local infection can cause life-threatening infections in the bones, joints, surgical wounds, bloodstream, heart valves and lungs. In the case of the serious infections, gram negative bacteria may opportunistically invade the infected organs or vice versus. Mixed gram negative gram positive infections are a major factor in pneumonias and bacteremia.

Examples of Skin and Soft Tissue Infections

Skin and soft tissue infections are overwhelmingly the result of Staphylococcus aureus. Trius estimates that the breakdown for ABSSSI by type of infection is 40% cellulitis, 30% abscesses and 30% infected wounds. It further estimates that 95% of all ABSSSI is caused by gram positive bacteria primarily Staphylococcus aureus (both MRSA and MSSA). Streptococcus strains are the second most important causative agent and may account for 10% to 15% of ABSSSI infections while other bacterial strains are not that important.

An abscess is characterized by a collection of pus underneath a portion of the skin. That area of skin affected is red, tender, warm, and swollen and may be accompanied by a fever. Abscesses can sometimes form if minor superficial skin infections are not treated appropriately and in a timely fashion. They can usually be treated effectively if caught early by draining the abscess and through the use of topical and systemic anti-bacterials. Abscesses can develop into much more severe infections if left untreated as shown by the following photo.

Source: Trius Investor and Analyst Day, December 1, 2011

In the case of cellulitis, the bacteria penetrate through the skin and form deep areas of infection. Abscesses can form within the cellulitis and bacteria may also spread into the bloodstream. However, most cases of cellulitis resolve with appropriate antibiotic therapy. An example of cellulitis in a hand is shown below.

Source: Trius Investor and Analyst Day, December 1, 2011

Severe infections can also occur in open wounds resulting from diabetes or injuries.

Source: Trius Investor and Analyst Day, December 1, 2011

MRSA (Methicillin-resistant Staphylococcus aureus)

The term MRSA refers to any stain of Staphylococcus aureus that is resistant to the beta lactam antibiotics, i.e., the penicillins (methicillin, ampicillin, amoxicillin, oxacillin, etc.) the cephalosporins and the carbapenems. At one time in the early 1960s, methicillin was the drug of choice in treating Staphylococcus aureus infection, but widespread resistance emerged and methicillin is no longer in use. The term methicillin-resistant Staphylococcus aureus or MRSA is now used to broadly designate bacteria that have become resistant to other beta lactam antibiotics. The defining characteristic of MRSA is its ability to thrive in the presence of the beta-lactam antibiotics like the penicillins and cephalosporins whose mechanism of action is to block synthesis of bacterial cell walls.

As was previously noted as many as 60% of infections seem at the emergency room are caused by MRSA. Many people think of MRSA as being more virulent than MSSA that is sensitive to penicillins and cephalosporins, but this is not necessarily the case. It is just that there are less antibiotic options for MSSA.

The MRSA Epidemic

There are MRSA epidemics taking place in two settings. The most dangerous is in hospitals in which more severe MRSA infections and the vast majority of MRSA related fatalities occur. MRSA strains also circulate in communities across the U.S. and can be more virulent than hospital strains.

Hospitals are filled with patients having weakened immune systems, surgical wounds, intravenous drips or catheters that provide ready access to the interior of the body. Patients are also housed in close proximity. Staphylococcus aureus bacteria encounter a wide range of antibiotics in the hospital and through genetic change and natural selection emerge as resistant strains that thrive in the hospital setting. They are spread widely throughout the hospital by contact between patients and staff.

The hospital and particularly the intensive care unit or ICU is not a good place to be sick because of the high risk of nosocomial (hospital acquired) infections, many of which are due to Staphylococcus aureus. A study in the Journal of the American Medical Association surveyed the infection status of over 13,000 patients in 1,200 ICUs in 75 countries. About 51% of ICU patients had infections; the patients with infections were more than twice as likely to die as patients without infections. It was found that the risk for acquiring an infection increases the longer a patient stays in the ICU. Of patients in the ICU for a day or less, only 32% had infections, while those patients who stayed for more than a week 70% had infections.

About 60% of reported MRSA infections in the US occur in the community setting and about 75% of infections are localized to the skin and soft tissue. Recall that about one in four healthy people carry Staphylococcus aureus (MRSA and MSSA) staph on their skin and can spread the bacteria through contact. There are a significant number of people in the community who are at high risk because of weakened immune systems due to HIV, lupus, cancer and organ transplants. There are also groups in which the bacteria can find easy access to the interior of the body such as diabetics with open wounds and intravenous drug users.

Outbreaks can occur in settings where there are otherwise healthy people living in close proximity in which there is a lot of skin contact and often a lack of good hygiene. Examples are military facilities, homeless shelters, college dormitories, nursing homes and prisons. Infections can also occur in athletes who participate in contact sports in which MRSA can be spread through cuts and abrasions and in gyms where there is the potential for transmission through sharing towels or touching exercise equipment.

Cases of MRSA are increasing in livestock, especially in intensively reared production animals such as pigs, cattle and poultry. These can be transmitted to humans processing the meat product and perhaps to those who consume it. Some studies have suggested that as much as 50% of the meat and poultry sold in the US is contaminated with MRSA.

Incidence of MRSA

There are no definitive estimates for the incidence of MRSA and its mortality effects. At the previously cited September 2010 advisory committee on ceftaroline the infectious disease expert, Dr. Corey of Duke University, said that we are in the middle of an epidemic caused by MRSA-induced skin infections. As a result, over 500,000 Americans each year are hospitalized with these infections. He cited a survey of 422 patients with skin infections seen in emergency rooms around the United States of whom 60 % were infected with MRSA.

According to the Centers for Disease Control, about 1% of the US population is colonized with MRSA. Carriers of MRSA have the ability to spread it, even if they're not sick themselves. Healthy individuals may carry MRSA asymptomatically for periods ranging from a few weeks to many years. The number of MRSA deaths according to the CDC is 20,000 to 40,000 per year or roughly 2% to 4% of those infected. An article in JAMA placed the incidence of MRSA infections at 31.8 cases per 100,000 persons.

According to MRSA.org, in 2009, there were 1.3 million incidences of MRSA infections. An in-hospital patient is seven times more likely to die of MRSA than a community based patient. The average hospital stay for a MRSA infected patient is extended by an average of six days as compared to a MSSA patient resulting in an additional $10,000 in medical bills.

A number of companies involved in marketing or development of drugs for MRSA have made estimates on the market size. Durata, the sponsor of the new intravenous drug dalbavancin, in their recent S-1 filing estimated that there are approximately 35 million days of treatment annually for MRSA utilizing intravenous antibiotics, with approximately 75% of these treatments occurring in the hospital setting and the remaining 25% occurring in the out-patient setting. The branded products Zyvox and Cubicin cost about $200 to $250 per day so that the potential size of the intravenous market at these price levels is $7.0 billion for all days of therapy with the hospital market being $5.3 billion and the out-patient market being $1.7 billion.

This market is significantly larger when expanded to include methicillin-sensitive Staphylococcus aureus (MSSA) and oral step-down therapies prescribed to patients in connection with their discharge from the hospital. This includes Zyvox and other oral antibiotics. Durata expects the number of treatment days in the out-patient setting to grow at a faster rate than in the hospital in-patient setting as a result of increased use of current agents in the out-patient setting as well as the potential use, if approved, of product candidates with more convenient dosing schedules.

In a conference call, Theravance estimated that there are approximately 34.4 million treatment days each year with antibiotics active against MRSA. It cited data from Arlington Medical Resources' Hospital Antibiotic Guide for the July to December 2008 period which concluded that about 35% of the hospital treatment days were for skin and skin structure and 20% were related to lower respiratory tract infections with hospital acquired and community acquired being equally important as causative. These are treatment days for agents that are active against resistant gram-positive infections.

Current Treatments for MRSA

It is often difficult to accurately determine the most appropriate antibiotic for a particular infection. Bacteria cause infections in different organ systems and they can attack in combinations making it difficult to determine what bacteria are involved. Also, antibiotics just don’t act against one bacterial strain, but can often have wide ranging activity against gram negative and gram positive organisms.

Disease causing organisms can be quite different depending on whether they occur in the hospital or in the community and vary from hospital to hospital and community to community. Also, physicians have to treat infections before results from cultures, which take 24 to 48 hours to complete, identify the bacteria they are dealing with. Physicians also may choose to treat patients prophylactically to prevent an infection.

The MRSA market that this report focuses on is deep seated, difficult to treat ABSSSI infections that are resistant to most beta-lactam antibiotics. It also includes dangerous infections of the lungs, heart valves, bone, joints and blood, but ABSSSI is the most common type of MRSA infection.

There are three primary antibiotics that are used in this market and they are Pfizer’s Zyvox, Cubists’ Cubicin and the gold standard vancomycin. There are other drugs approved for MRSA such as Pfizer’s Tygacil and Theravance’s Vibativ and generics without MRSA indications also play a role. Forest Laboratories recently launched Teflaro, which has strong activity against MRSA and also gram negative bacteria. It is an effective agent that will probably be used in infections involving both gram positive MRSA and gram negative bacteria.

The mainstay of treating MRSA is the old drug vancomycin. This product has been the go to drug for many years, but resistance is now beginning to occur albeit still at a low level. This has created the need for drugs to use when vancomycin is not effective or cannot be given due to side effect issues. Three new drugs have been introduced that fill this role. They are primarily Pfizer’s Zyvox (linezolid), Cubist’s Cubicin (daptomycin) and to a much lesser extent Pfizer’s Tygacil (tygecycline).

Vancomycin

Vancomycin is a glycopeptide antibiotic used in the prophylaxis and treatment of infections caused by gram-positive bacteria. Since its introduction in 1958, it has been the go to drug for treating MRSA. However, increasing usage has led to the emergence of resistant bacteria at an alarming rate. In 2005, 3% of Staphylococcus strains were intermediately-resistant to vancomycin, but by 2011 this had risen to 11%. The emergence of vancomycin-resistant organisms has led to a substantial increase in the usage of Zyvox and Cubicin, which are active against vancomycin-resistant strains.

Vancomycin was first isolated in 1953 from a soil sample collected from the interior jungles of Borneo by a missionary. Clinical trials showed that it was very effective against penicillin-resistant Staphylococcus aureus (cephalosporins had not been introduced at this time). It was apparent that staphylococci did not develop significant resistance despite repeated exposure to vancomycin. The rapid development of penicillin resistance by staphylococci led to vancomycin being fast-tracked for approval by the FDA in 1958.

Vancomycin for many years was the only drug that could be relied on when other antibiotics failed. However, it has several drawbacks. It has poor oral bioavailability and it must be given intravenously, twice daily. Early trials also showed that it was toxic to the ears and to the kidneys.

Zyvox

The next drug to be introduced for treating MRSA was Pfizer’s Zyvox, which was approved in 2000. It is the first antibiotic of the oxazolidinone class of drugs. The oxazolidinones have a different mechanism of action than vancomycin; they are protein synthesis inhibitors that stop the growth of bacteria by disrupting translation of messenger RNA into proteins in the ribosome and stopping or slowing their growth. Zyvox then depends on the human immune system to eradicate the bacterium; it is bacteriostatic.

Zyvox is effective against gram positive bacteria including Staphylococcus aureus strains (MRSA) that are resistant to vancomycin. The main indications of Zyvox are infections of the skin and soft tissues and pneumonia (particularly hospital-acquired pneumonia). It was approved in 2000 and is the only drug of this class that is approved for commercial use. Bacterial resistance to Zyvox has remained very low so far. Tedizolid based on laboratory measures is 4-16 times more potent than Zyvox for both MSSA and MRSA strains

Zyvox has very good bioavailability, unlike vancomycin, that allows it to be given orally as well as intravenously. Vancomycin must be given intravenously twice a day and blood levels must be monitored. This makes it difficult to administer vancomycin outside of the hospital. Zyvox in contrast can be started in the hospital as an intravenous dosage and the patient can be sent home with pills for the duration of therapy. This has important cost and health benefits. It is generally given twice a day for a duration of 10-14 days. It can be used in adults and children and in people with liver or kidney dysfunctions. Vancomycin can be toxic to the kidney at higher doses, precluding its use.

In short term use of ten days or less, the side effects are headache, diarrhea, and nausea which are manageable and not too concerning. However, in long term use required for deep seated infections such as in the bone or heart valves, it has more troublesome side effects. When used for more than two weeks, it can cause bone marrow suppression resulting in low platelet counts. If it is used for even longer periods, it can cause peripheral neuropathy (which can be irreversible), optic nerve damage, and lactic acidosis (a buildup of lactic acid in the body).

Studies have shown that it is more effective than beta lactams and vancomycin in treating ABSSSI, whether caused by MRSA or non-MRSA bacteria. In the treatment of pneumonia without MRSA involvement there appears to be no significant difference between linezolid, vancomycin or appropriate beta-lactam antibiotics. It is generally reserved for cases in which MRSA is confirmed or suspected. Linezolid or vancomycin is recommended as first-line treatment for hospital-acquired (nosocomial) MRSA pneumonia. It may be slightly superior to vancomycin because of its better penetration into bronchial fluids.

One of Zyvox’s drawbacks is that physicians generally prefer to treat deep infections such as bone and joint, osteomyelitis or infective endocarditis with bactericidal antibiotics and Zyvox is bacteriostatic. These and other long term infections also pose a problem because of the toxicities associated with long term use. It is also not appropriate for treating catheter related infections in which gram negative bacteria are involved.

Zyvox is a weak monoamine oxidase inhibitor, and should not be used concomitantly with food and drugs having the same effect. These include tyramine-rich foods such as pork, aged cheeses, and alcoholic beverages, smoked and pickled foods. It also includes drugs such as the serotonin reuptake inhibitors, Prozac and Zoloft that are widely used in treating depression. There have been nervous system reactions and reports of serotonin syndrome when the drugs are used in combination with Zyvox.

Linezolid does not inhibit or induce the cytochrome P450 (CYP) system, which is responsible for the metabolism of many commonly used drugs, and therefore does not have any CYP-related interactions. This means that it is does not cause significant drug interactions.

Cubicin

Cubicin (daptomycin) is a lipopeptide antibiotic developed from a naturally occurring compound found in the soil. It has strong activity against Gram positive organisms and has a distinct mechanism of action that may make it effective against bacteria that are resistant to the penicillins, cephalosporins, vancomycin and Zyvox. There is some cross resistance between vancomycin resistant strains and daptomycin.

Daptomycin binds to bacterial cell membranes causing rapid depolarization that inhibits protein, DNA and RNA synthesis resulting in bacterial cell death. It is only active against the Gram-positive bacteria Staphylococcus aureus (including MRSA), streptococci, corynebacterium and enterococci (including vancomycin resistant strains). Based on in vitro data, it is effective against 99.9% of strains of Staphylococcus aureus strains including MRSA.

Daptomycin was disoverered by Eli Lilly in the late 1980s but development was halted because at high doses, it was associated with severe side effects on muscle. Its development rights were acquired by Cubist in 1997 which gained FDA approval for ABSSSI in 2003. Cubicin then expanded the label to include MRSA and MSSA caused bacteremia and right sided endocarditis in May 2006. EU approval was gained in 2007. Because daptomycin binds avidly to pulmonary surfactant, it cannot be used in the treatment of pneumonia.

In December 2010, the FDA approved a two minute IV bolus formulation of Cubicin. The original formulation was administered via a 30 minute IV infusion similar to vancomycin. This saves labor and has improved acceptance in the outpatient setting and bolstered cost effectiveness versus vancomycin in the in-patient setting.

Cubicin is dosed once a day over 7 to 14 days as compared to twice a day for 10 to 14 days for vancomycin. It can be given in a 30 minute infusion or two minute infusion versus 30 minutes for vancomycin. Unlike vancomycin, it requires no monitoring. Vancomycin must usually be restricted to use in the hospital, but Cubicin can be easily infused in out-patient settings. This allows patients to be discharged quicker from the hospital or to be treated in the emergency room without requiring admission. This has important health and cost benefits.

Cubicin is bactericidal and kills bacteria unlike Zyvox which is bacteriostatic. It has demonstrated efficacy in infections that require long term treatment durations without a significant increase in adverse events as can sometimes occur with Zyvox.

The oral dosing of Zyvox can be an advantage although the IV infusions required for Cubicin may result in better patient compliance. Unlike Cubicin, Zyvox can be used in pneumonia. Both are effective and useful drugs in the outpatient setting.

The key drawbacks of Cubicin are that it is not indicated in pulmonary infections and can cause elevated CPK enzyme levels and cases of rhabdomyolosis or muscle toxicity. CPK elevation is higher in endocarditis/ bacteremia than vancomycin (25.0% versus 12.5%). There have been reports of myopathy and rhabdomyolosis occurring in patients simultaneously taking statins but whether this is due entirely to the statin or whether daptomycin potentiates this effect is unknown. Due to the limited data available, the label recommends that statins be temporarily discontinued while the patient is receiving daptomycin therapy.

It has a number of moderate side effects such as constipation, diarrhea, rash, vomiting, rash, hypotension and others that occur with a frequency of less than 6%. The incidence of infusion site reactions is about 6%. Abnormal liver function tests occur in about 3% of patients.

As of December 31, 2011, Cubicin has been used in the treatment of an estimated 1.4 million patients in the U.S. Cubicin is marketed to more than 2,000 U.S. institutions (hospitals and outpatient acute care settings) that account for approximately 80% of the total market opportunity for I.V. antibiotics to treat serious Gram-positive infections in the U.S. As of December 31, 2011, Cubist estimates that Cubicin had approximately 13% share of this market on a rolling 12-month basis.

In April 2011, Cubist entered into a settlement with Teva to resolve patent infringement litigation with respect to Cubicin. Under the terms of this agreement, Teva will not enter the market until 2018. In February 2012, Cubist received a Paragraph IV Certification Notice Letter from Hospira notifying Cubist that it had submitted an ANDA to the FDA seeking approval to market a generic version of Cubicin.

Outside of the U.S., where outpatient infusion is a less established practice, the use of Cubicin is primarily in the hospital setting. Cubicin is commercially available in approximately 52 countries.

Teflaro (ceftaroline)

Forest Laboratories received FDA approval for ceftaroline in October of 2010. It is a fifth generation, injectable cephalosporin antibiotic that is bactericidal. It has a broad spectrum of activity against gram negative and gram positive bacteria. It was approved for the treatment of community acquired bacterial pneumonia and acute bacterial skin and skin structure infections (ABSSSI) including MRSA strains. It was also approved for the treatment of pneumonia other than those resulting from MRSA.

Clinical studies presented at its advisory committee meeting showed that it works well in patients with cellulitis, large abscesses, and in infected wounds. Some of the compelling features of ceftaroline arise from its broad spectrum of activity. There are conditions in which MRSA and other gram positive organisms may be combined with gram negative bacteria. In the community setting this could occur in trauma victims. In the hospital, it would be used primarily for patients suspected of having MRSA, but who also may have gram-negative infections.

Ceftaroline in vitro shows that it inhibits a significant number of bacterial isolates at lower concentrations than vancomycin or Zyvox. Ceftaroline is also active against some very rare bacterial phenotypes, such as the fully vancomycin resistant strains of Staphylococcus aureus and MRSA not susceptible to daptomycin. It is a very good agent for MRSA.

The commercial launch of Teflaro in March 2011 did not have a significant impact on Cubicin. It is initially being used as a second line agent in patients with bacteremia and other indications. Over time it will replace older cephalosporins to gain front line usage in ABSSSI due to MSSA as well as MRSA, replacing older cephalosporins.

Dalbavancin

Dalbavancin is a second generation, semi-synthetic lipoglycopeptide; the same class as vancomycin, telavancin and oritavancin. It has broad activity against gram-positive bacteria including Staphylococcus aureus including MRSA.

Its most differentiating factor is that it can be given as an initial intravenous infusion followed by another seven days later. Its pharmacokinetic profile and its relatively long half-life compared to many currently available treatments result in continuous bactericidal activity over a prolonged period of time following treatment. This offers the potential for more rapid and effective cure for patients with ABSSSI, greater patient compliance, improved safety outcomes and a lower overall cost of care.

Durata acquired dalbavancin through the acquisition of Vicuron Pharmaceuticals in December 2009; Pfizer had earlier acquired Vicuron in September 2005; this was after an NDA filing for dalbavancin in December 2004. Between 2005 and 2007, the FDA issued three complete response letters to the NDA filing. The first two related to manufacturing issues and the third was based on the design of the Phase 3 trials that could only be answered with a new Phase 3 program. In September 2008, Pfizer withdrew the NDA and marketing applications in other countries. Instead of conducting a new Phase 3 program, Pfizer elected to sell Vicuron and dalbavancin to Durata. In June 2010 and in anticipation of the publication of new FDA draft guidance Durata resumed development of dalbavancin.

Dalbavancin is involved in two global Phase 3 clinical trials for the treatment of patients with acute bacterial skin and skin structure infections, or ABSSSI. These are being conducted under SPAs with the FDA. These trials are also designed to meet the requirements of the EMA and allow for potential approval in Europe. Topline data could be available by the beginning of 2013 and if positive, the company would submit an NDA in 1H, 2013 and an MAA in 2H, 2013. Durata intends to market the product in the US and Western Europe on its own.

Dalbavancin under the control of Pfizer and Vicuron completed three other Phase 3 trials in which more than 1,000 patients were treated. It achieved the primary endpoint of these trials which was non-inferiority to Zyvox, cefazolin or vancomycin at test of cure 28 days after therapy. However the FDA stated that a new trial with an earlier endpoint would be required for approval. Durata states that the incidence and duration of side effects was comparable to comparator drugs and dalbavancin was not associated with any negative drug-drug interactions.

Dalbavancin is designed to provide seven days of treatment with the initial dose and is bactericidal with a second dose given seven days later. It is well suited for emergency room and outpatient settings. The short, infrequent dosing could be less disruptive to a patient than currently available treatments that require daily dosing. It would also allow doctors to send patients home directly from the emergency room or out-patient setting, rather than admitting them to the hospital.

The infusion of antibiotics can be a time consuming process that takes up resources in the out-patient and emergency room settings. Subsequent multi-day dosing requirements can extend hospital stays or require the patients to return for subsequent infusions. This raises compliance issues. Failure to continue treatment can cause readmission. Dalbavancin can eliminate the admission of patients to the hospital and reduce overall cost of treating ABSSSI to the healthcare system, improve patient compliance and decrease the spread and cost of MRSA. In comparing dalbavancin to vancomycin, there is more to be considered than just the price of the drug. The administration costs of administering the drug over multi-days can be high. It requires the insertion of peripherally inserted central catheter and possibly an overnight stay.

Durata believes that dalbavancin could also provide significant therapeutic and economic benefits when administered in the hospital in-patient setting. It may make the hospital stay shorter as the first dose could be given in the hospital and the second in an emergency room or out-patient setting. The hospital could discharge the patient after only a short stay and then schedule a follow-up appointment for the second infusion. This second appointment would serve the dual purpose of allowing a doctor to reexamine the patient and to administer the second dose of dalbavancin, all while limiting the duration of the patient’s hospital stay

Durata owns worldwide commercial rights to dalbavancin that are royalty free with the exception of Japan. Dalbavancin has no composition of matter patent and is covered by three methods of use and formulation patents in the US which expire in 2023. In Europe, if dalbavancin is approved by the EMA, it will qualify for eight years of data exclusivity and an additional two years of marketing exclusivity in the European Union.

Oritavancin

Oritavancin is another semi-synthetic lipoglycopeptide like vancomycin, Vibativ and dalbavancin that is being developed by The Medicines Company for skin and soft tissue infections including those caused by MRSA. It is a molecule that is synthetically modified from a naturally occurring compound discovered by Eli Lilly. It was developed to treat antibiotic-resistant gram-positive pathogens, including MRSA and pathogens resistant to vancomycin.

Eli Lilly first licensed this compound to InterMune which then transferred rights to Targanta in 2005. The Medicines Company acquired Targanta in February 2009 and has exclusive rights to develop oritavancin worldwide.

Targanta conducted two phase 3 trials in which oritavancin was administered once-daily for three to seven days. Both trials compared oritavancin to a control arm of vancomycin followed by the oral antibiotic, cephalexin. In the trials, Targanta stated that oritavancin met the primary endpoint and combined results showed that oritavancin was effective in an average of 5.3 days compared to an average of 10.9 days for the vancomycin followed by cephalexin control arm.

In September 2008, Targanta completed a Phase 2 clinical study of oritavancin in 300 patients in which one arm of the study was given a single 1,200 mg dose of oritavancin; a second was given 800 mg on day one and 400 mg on day 5: and a third was given 200 mg for three to seven days. The results showed comparable efficacy and safety across all three treatment arms. In addition, a QTc study on the 1,200 mg dose showed no effect on QT interval.