Senesco Offers a New Approach to Cancer Treatment and Dr. Phillip Frost Is Now With the Company (SNTI, $5.31) (Subscribers Only)

Investment Overview

Progress in the treatments of most cancers is a gradual and incremental process in which very few therapies can come provide effective therapy by themselves. Cancer cells have evolved numerous biological mechanisms that allow them to resist or overcome the effect of most drugs when used as a single agent. This has led to the near universal practice of combining drugs with different modes of action, most commonly chemotherapies, monoclonal antibodies and targeted therapies. Used in combination, they can produce synergistic results.

My interest in Senesco (SNTI) initially was based on their lead drug SNS01-T, which has a very unique and differentiated mechanism of action. This gives rise to the promise that it could offer a unique approach to treating cancer that could result in its being added to existing therapies. It is this differentiated mechanism of action that makes SNS01-T so conceptually interesting to me. The recent announcement of the potential merger with Fabrus and with this the involvement of the famed biotechnology investor Dr. Phillip Frost has added to my interest. I will go into this shortly.

SNS01-T stems from Senesco's unique understanding of the gene called eukaryotic translation initiation factor or eIF5A which plays an integral role in regulating the life and death (apoptosis) of cells. Cells are programmed to have a finite lifespan and once this has been reached, nature has evolved mechanisms to cause cells to die and be eliminated from the body, a process known as apoptosis. Most forms of cancers are the result of cells that have developed mutations that allow them to evade apoptosis. Senesco's objective is to alter cancer cells so that they are once again subject to the programmed death cycle.

SNS01-T holds the promise that because of its highly proprietary and unique biological approach, it can be added to existing therapies to improve overall outcomes. The initial therapeutic target of SNS01-T is B cell cancers, principally multiple myeloma (MM) and non-Hodgkin's lymphomas such as diffuse large B-cell lymphoma (DLBCL) and mantle cell lymphoma (MCL). Animal studies have suggested that it is highly synergistic with Revlimid and Velcade, the two current mainstay drugs for treating multiple myeloma. This suggests a promising pathway to clinical development

The Company is now in a phase Ib/IIa trial that is primarily evaluating SNS01-T in multiple myeloma (MM) and to a lesser extent in diffuse large B cell lymphoma (DLBCL) and mantle cell lymphoma (MCL). The primary purpose of the trial is to establish that the drug is safe. The trial started with a low dosage of SNS01-T in cohort 1 and then progressed to higher doses in cohorts 2 and 3. These doses have each demonstrated that the drug is safe. In addition, out of nine evaluable patients the drug has stabilized the cancer for a period of time in five MM patients and one DLBCL patient.

The phase Ib/IIa trial is entering a critical phase as the fourth cohort of six patients (possibly more) is now being recruited. The dosing in cohort 4 on an mg/kg dosing basis is nearly double that of cohort 3 and thirty times greater than cohort 1. Preclinical data in both MM and DLBCL demonstrated pronounced tumor shrinkage at this dose level.

I think that in order for the Company to move to the next step of a phase IIb trial that potentially could be the basis of a regulatory filing, SNS01-T will have to show at least one objective response in cohort 4 in which the tumor shrinks for a meaningful period of time. Stable disease will not be enough to warrant moving forward. In the event that this is not achieved, the options would be to add more patients, increase the dose, increase the number of cycles or some combination of the three. Results from cohort 4 could be known by 3Q or 4Q, 2014. This is obviously a critical event for Senesco.

Senesco's stock has asymmetric upside potential if results in cohort 4 are promising and allow the Company to move into a phase IIb trial that could be potentially the basis for approval. This trial could start in 1H, 2015 and potentially complete in late 2016 in a positive scenario. This could lead to an NDA filing in 2017 and approval in 2018 if everything goes right.

Senesco has been operating with a strained balance sheet for some time. Given the cash constraints that it has faced, it has done a credible job of moving SNS01-T forward through pre-clinical trials and into phase Ib/IIa. It still has a substantial challenge ahead as it tries to get the drug into and through a phase IIb trial. My cash flow projections suggest that the Company will need to add $26 to $28 million of cash to complete a phase IIb trial and then be in a position to partner SNS01-T. A recent financing could enable the Company to access enough capital to accomplish this.

Senesco recently announced an innovative equity offering in which it is issuing 180,000 units at a price of $30 per unit. This immediately brought in $5.3 million through the issuance of 1.8 million shares at an effective price of $2.92. In addition, there are three tranches of series A, B and C warrants that, if exercised, could bring an additional $20 million of cash. This new financing under the assumption that all warrants are exercised could bring in $25 million at an effective price of $3.21.This would likely allow for the Company to complete the phase II trial and partner SNS01-T assuming that the phase IIb trial is successful.

Senesco has added 1.8 million new shares to its previous share base with this recent offering bringing the number of currently outstanding shares from 3.2 million to 5.0 million. In addition, there are 0.8 million warrants outstanding from other financings so that the potential fully diluted share count currently is 5.8 million shares. If all of the series A, B and C warrants are exercised, there will be 11.2 million shares outstanding. Based on the current share price of $6.00 the market capitalization would be $67 million based on 11.2 million fully diluted shares.

Success in the phase II trial that then leads to an attractive partnering deal would likely have a dramatic effect on the stock price. If it is the case that the phase IIb trial is successful, the data is robust and a partnering relationship results, I think that we could see a market capitalization of $150 million or more; this is obviously data dependent. At the lower end of this range, this would represent more than a doubling of the share price by the end of 2016.

Fabrus Merger Adds a New Dimension to the Senesco Story

As I was completing this article on Senesco, an important new element was added to the investment equation. On December 30, 2013, Senesco announced that it had executed a non-binding letter of intent to merge with Fabrus, a privately-held, biotechnology company. Fabrus will be merged into a wholly-owned subsidiary of Senesco and Senesco will be the surviving corporation. Stockholders of Fabrus and current Senesco shareholders will each own about 50% of the "new" Senesco. The companies expect to sign a definitive agreement in early 2014, subject to final review and approval by their boards. Current Senesco stockholders will not be required to vote on this transaction.

The founder and President of Fabrus is Dr. Vaughn Smider, a faculty member at The Scripps Research Institute in La Jolla, CA. He is a co-inventor of its technology. Fabrus was started by Pfizer (PFE) as a part of a biotechnology incubator program in 2007. It was spun out in 2010 as a separate company with Pfizer maintaining an equity stake. Fabrus owns all of the rights to its intellectual property and drug candidates.

In 2010, Opko Health (OPK) and the Frost Gamma Investments Trust invested alongside to acquire 13% of the outstanding shares of Fabrus. Dr. Phillip Frost is the CEO and Chairman of both Opko Health and Frost Gamma Investments Trust. He is also the current Chairman of Teva Pharmaceuticals (TEVA). Dr. Frost became a billionaire based on a fabulously successful career as a biotechnology entrepreneur that began with the founding of Key Pharmaceuticals which was sold to Schering-Plough in 1986. He is the current Chairman of Fabrus and is instrumental in its management and development.

The uniqueness of Fabrus' technology is that it brings the speed and flexibility of small molecule screening to fully human antibody therapeutics. Importantly, this technology base is unique and not dependent on existing antibody engineering intellectual property. The discovery format is analogous to a combinatorial chemistry library and enables direct cell based screening of targets that are difficult to address with conventional antibody technologies. These include G-protein coupled receptors and ion channels. This technology approach allows for the rapid development of data at very early discovery stages, and can screen multiple targets or pathways in parallel.

Fabrus is at a pre-clinical stage of development. It has two collaborations in place with a large pharma and a large biotech company to discover antibodies for drug targets that are resistant to traditional antibody discovery methods, and has an internal pipeline that includes next generation antibodies targeting renal cell carcinoma and inflammation. An additional appeal of the merger is that Fabrus antibodies could complement Senesco's eIF5A gene regulatory platform by directing its nanoparticle-based therapeutics to cells of interest.

Price Action Subsequent to Announcement of Fabrus

The announcement of the Fabrus merger caused a significant increase in the price of Senesco. On December 13, 2013, Senesco reached its lowest closing price of the month at $3.95. On December 30, 2013 following the release of the news on the Fabrus merger, it closed at $6.25. This was a 58% price increase.

At this point in time it is hard to model the effect of the Fabrus merger on Senesco. We know little about the product pipeline of Fabrus and the additional capital needs that this will impose on Senesco. This price movement reflects the faith of investors in Dr. Frost's role in the "new" Senesco. He has great credibility based on his business accomplishments and his involvement validates for many investors the promise of Senesco's technology.

Dr. Frost also brings the potential for Senesco to more easily access larger amounts of capital than has been possible in the past. He controls substantial investment potential based on his role in Opko and his own personal wealth. In addition, his reputation may cause many other investors to want to invest alongside him.

On a nearer term note, if the price appreciation in the stock is maintained it makes it much more likely that the warrants issued in the recent financing will be exercised and would give Senesco the full $25 million potentially available from that offering.

Investment Opinion

The involvement of Dr. Phillip Frost in Senesco could cause investors to look at the Company in a totally different light. It has been a small, micro-cap company with extremely limited financial resources and largely has been ignored. I think that many investors now may choose to invest in the Company simply because they want to invest alongside Dr. Frost. I think there will also be less concern that Senesco will run out of money as Dr. Frost could provide much easier access to capital given his personal resources and his business connections. Simply put, Senesco has gained enormous credibility assuming that the merger with Fabrus goes through. This is now a stock to watch.

I am not recommending the stock at this point in time although this is always subject to change. Results so far in the phase Ib/IIa trial have not yet demonstrated a strong biological effect for SNS01-T although stable disease in six of none evaluable patients is encouraging and the safety profile is also encouraging. There is a tremendous amount riding on the outcome of cohort 4 for which we may see results in 2H, 2014. If results are encouraging (one or more objective responses) and the Company proceeds to a phase IIb trial that could potentially be a registrational trial, the stock could react very positively. However, more equivocal results might cause the Company to treat additional patients with an altered dosing form and/or dosing schedule. Such an outcome would have a negative impact on the stock and probably would require the Company to raise capital at a depressed price.

At this point, we know very little about Fabrus other than that it seems to have a very interesting technology platform with a good intellectual property position. It seems to be in a very early stage of product development so that it is difficult to evaluate its products; they are several years away from meaningful clinical data. The cash burn of Fabrus will add to the burn rate of the "new" Senesco and as I have previously outlined, the Company just barely has enough cash to get SNS01-T through phase IIb.

I will need to know a great deal more about the business strategy of the "new" Senesco before I can evaluate its long term potential. While I respect Dr. Frost, I am not willing to follow him unquestionably. I am also concerned that the recent sharp run-up in the stock could result in some profit taking and stock weakness as investors get past the "Dr. Frost" euphoria and take a more sober look at the Company. There is also the possibility of sustained selling pressure on the stock if the warrants from the recent financing are exercised as seems probable. For the time being, I am on the sidelines with this stock, but intend to cover it closely in the future.

Technology Overview

Senesco's technology platform is based on its understanding of certain genes, primarily the eukaryotic translation initiation factor gene or eIF5A.The gene expresses eIF5A, a protein that is about 154 amino acids in length, which plays an integral role in regulating the life and death (apoptosis) of cells. Based on this understanding Senesco has developed patented technologies that could produce innovative new treatments for cancer and inflammatory diseases. As small cash strapped company, it is currently focused on a drug for the treatment of B-cell cancers such as multiple myeloma and non-Hodgkin's lymphoma.

The technology is also applicable in plants; environmental factors such as drought, temperature and disease can accelerate cell death, a process termed senescence. This leads to rotten fruit, smaller plants and wilted flowers, amongst other undesirable traits. The processes and genes involved in cell death are virtually identical in plants and humans. Senesco has out-licensed its technology for agricultural applications that enhance the quality, productivity and stress resistance of agronomic crops and biofuel feedstock crops through the control of senescence in plants. The development of this technology is now being performed by licensors.

The agricultural part of the business is extremely hard to assess as the licensing companies operate under tight secrecy which makes it extremely difficult for Senesco, let alone outside investors, to determine whether there is economic potential in the form of royalties for Senesco. This report focuses only on therapeutic applications of Senesco's technology.

Mechanism of Action

The protein eIF5A plays an integral role in regulating cell death in conjunction with a number of intercellular molecules. I am not going to try to give a detailed explanation of this complex biological process as I am not a molecular biologist; I will just try to give my layman's interpretation.

Cells are programmed to have a finite lifespan and once this has been reached, nature has evolved mechanisms to cause cells to die and be eliminated, a process known as apoptosis. The eIF5A protein is integral to the pathway that causes the breakdown of cellular components such as structural proteins and regulatory enzymes. This leads to the elimination of unwanted old, redundant or defective cells by causing these cells to die and be eliminated in a controlled way.

Cancers are the result of cells that have developed mutations that allow them to evade apoptosis. Senesco's objective is to alter cancer cells so that they are once again subject to the programmed death cycle. eIF5A is a protein that is about 154 amino acids in length. At position 50 on this protein, the amino acid lysine occurs (this is a critical point to understand). After eIF5A (the lysine containing protein) is expressed, it is quickly converted by enzymes in the cell so that the amino acid hypusine is substituted for lysine at position 50.

These two structurally very similar proteins have opposite properties. When eIF5A, the lysine containing protein, is released in the cell, it promotes apoptosis. However, the cell upon sensing elevated levels creates enzymes that result in a substitution of the amino acid hypusine at position 50 on the protein. This hypusinated protein has the opposite effect of allowing the cell to live and differentiate. Senesco has developed a drug that through affecting the lysine and hypusine containing proteins can regulate the apoptotic process and cause cancer cells to die.

SNS01-T: Senesco's Lead Drug

Senesco's lead drug is based on the regulation of the eIF5A gene and its expressed proteins. The lysine containing form of the protein is naturally expressed and leads to apoptosis if it accumulates in the cell. Normally, after the production of the eIF5A protein, it is rapidly changed into the hypusinated form that promotes cell life and differentiation. The therapeutic goal is to alter the occurrence of these two proteins in a way that promotes death in a cancer cell.

Senesco has developed two separate techniques to achieve this therapeutic goal. The Company found that if the amino acid arginine is substituted at position 50 for lysine, the resulting protein has the same effect of promoting apoptosis; critically however, it cannot be converted into pro-survival hypusine containing protein. Since it cannot be hypusinated it serves as a stable mimic of the pro-apoptotic actions of unmodified native eIF5A.

Senesco then developed a DNA plasmid that contains a gene that expresses the arginine containing protein. When delivered to cytoplasm of B-cells, this results in the expression of the arginine form of eIF5A. This plasmid also contains a promoter region that is necessary for this gene to express the arginine containing protein. This promoter is activated by molecules that are specific to B cells. Hence, the focus for development of SNS01-T is for cancers of B-cells such as multiple myeloma and non-Hodgkin's lymphomas.

SNS01-T also uses a separate and distinct biological mechanism of action. This mechanism utilizes a short interfering RNA or siRNA that blocks the messenger RNA of the eIF5A gene from being translated by ribosomes into the protein eIF5A which reduces the amount of the eIF5A protein produced. Because there is less eIF5A to convert, the amount of the hypusine containing protein is therefore also reduced. This reduction in the hypusine form reduces the amount of the pro-survival form of eIF5A available to help cancer cells to survive.

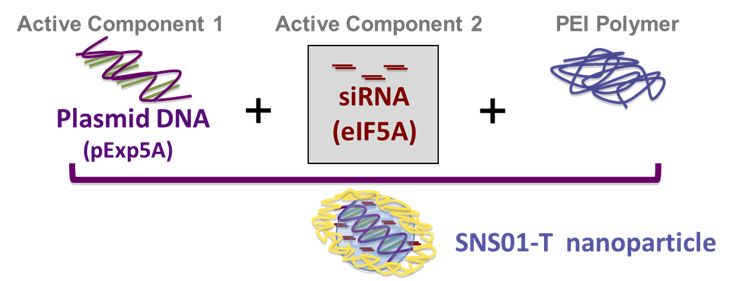

The third component of SNS01-T is the drug delivery mechanism for transporting the plasmid and the siRNA to the cell. If injected on their own, they would rapidly be degraded and eliminated from the blood. SNS01-T uses polyethylenimine to deliver these active molecules to the cytoplasm of the cell. It a polycationic carrier that assembles the active molecules into nanoparticles that protect the DNA plasmid/siRNA combination from degradation in the blood stream until it can reach the tumor cells and release its active ingredients.

The following schematic shows the components that are combined to form the SNS01-T nanoparticle.

Pre-Clinical Studies of SNS01-T

Investors have to be skeptical in interpreting animal models of cancer. As limiting as these models are, it still is necessary to test drugs in xenographic models before progressing to human trials. Flawed though it may be, it is the gold standard. Senesco has used not just one cancer model but rather three different cell lines from each of three different cancers for nine different models. The drug has worked in every case

In vitro cell studies and in vivo xenograft studies demonstrated that SNS01-T induced tumor suppression in multiple B-cell cancer types. Human multiple myeloma cell lines were used to establish subcutaneous tumors in severe combined immunodeficiency (SCID) mice. In two different cell lines, a precursor to SNS01-T resulted in 80% reduction in tumor mass when the siRNA component was administered alone and 70% for when the plasmid was administered alone. When the two were combined the reduction was 94%

It was also demonstrated that there may be a synergistic effect when SNS01-T is administered with Revlimid (lenalidomide) or Velcade (bortezomib); these are two of the mainstay drugs used in treating multiple myeloma. The studies suggested that these drugs were up to forty times more effective in inhibiting cell growth when used in combination with SNS01-T.

Overview of Phase 1b/2a Trial

Based on the pre-clinical data, Senesco designed a phase 1b/2a study. This study was initially intended to enroll refractory multiple myeloma (MM) patients who had progressed after several prior courses of therapy. However, slower than expected enrollment led to the inclusion of patients with refractory diffuse large B cell lymphoma (DLBCL) and mantle cell lymphoma (MCL).

The primary objective of phase 1b/2a was to evaluate safety, but it also was designed to look for evidence of tumor response. In MM, this was monitored through using biomarkers such as M-protein and in DLBCL tumor shrinkage was used. The design of the trial calls for a division into four cohorts in which there are twice-weekly intravenous infusions of patients for 6 weeks followed by a 4 week observation period. In cohort 1 the dose was 0.0125 mg/kg; in cohort 2, 0.05 mg/kg; in cohort 3, 0.20 mg/kg; and in cohort 4, 0.375 mg/kg. Cohort 4 dose was the fully effective dose in the mouse model of cancer.

In order to progress from one cohort to the next, three patients had to complete this protocol with an acceptable safety profile. Because some patients progressed and were moved to a different therapy or dropped out for some reason, it was generally required that more than three patients were enrolled in each cohort. The initial expectation was that 15 patients would be enrolled in the study and it would take one year to complete so that it would complete in late 2012. However, due to slow enrollment and a higher than expected dropout rate, the study is just now entering enrollment in cohort 4.

Cohort 1 Results

The first patient in cohort 1 was dosed at the Mayo Clinic on November 3, 2011 and results of this cohort were reported on August 15, 2012. There were six patients enrolled but three were withdrawn from the trial due to disease progression before completing treatment.

All three evaluable patients had MM. Two patients showed stable disease at weeks three and six; the latter is the end of the dosing period. One of these patients was stable until week 14 which was eight weeks after the end of dosing. The diagnosis of stable disease was based on no greater than a 25% change in M protein. This level of response was encouraging as based on extrapolation of results from animal studies; there was little expectation for an efficacy signal. The safety findings were also quite encouraging and allowed the trial to proceed to cohort 2.

Multiple myeloma is an incurable cancer of plasma cells, a type of white blood cell derived from B-lymphocytes that produces antibodies. In cancer, abnormal plasma cells accumulate in the bone marrow leading to bone lesions and interfering with the production of normal blood cells. They produce an abnormal monoclonal antibody protein called M-protein that is released into the blood.

A high level of M-protein in the blood is an important characteristic of multiple myeloma. Progressively increasing M-protein levels is a marker of worsening disease and a reduction in M-protein is an indicator of a tumor response. Normally plasma cells account for approximately 5% of the cells in the bone marrow. In multiple myeloma, plasma cell content of the bone marrow typically exceeds 10%. Reductions in the percent of plasma cells in the bone marrow are representative of the partial elimination of tumor cells and provide another estimate of apoptosis of myeloma cells.

Cohort 2 Results

The first patient in cohort 2 was dosed on September 13, 2012. Two new cancer sites were added in addition to the Mayo Clinic. These were the University of Arkansas for Medical Sciences in Little Rock, and the Mary Babb Randolph Cancer Center at University of West Virginia. The hope was that with more clinical sites enrolling that results in cohort 2 could be disclosed by the end of 2012. However, the three patients needed to evaluate safety and allow the trial to move on to cohort 3 didn't complete their evaluation until April 22, 2013.

In cohort 2, two MM patients and one DLBCL patient completed the study out of a total of four enrolled; one MM patient progressed. All four patients were refractory to, or had relapsed after a significant number of previous treatments, including bone marrow transplantation in 3 of the 4 patients. This is a striking indication of how advanced their cancers were.

One of the 3 myeloma multiple myeloma patients at this dose level showed stabilization of their serum monoclonal M protein levels at weeks 3 and 6, while two MM patients progressed during treatment. The single DLBCL patient treated at this dose level had progressive disease at week 6. As in cohort 1, there were no drug-related serious adverse events or dose-limiting toxicities in the three patients who completed dosing, nor in the other patient who withdrew after receiving just five of the scheduled twelve infusions. On May 6, 2013 the Data Review Committee gave the go-ahead to proceed to cohort 3.

Cohort 3 Results

The 0.2 mg/kg dosing for cohort 3 was sixteen times greater than in cohort 1 and four times greater than cohort 2 on an mg/kg basis. There were high hopes for better efficacy results in cohort 3 because of the higher dose. Also, in animal studies conducted at comparable doses (based on mg/kg), therapeutic benefits were seen.

Harlan Waksal, M.D., Chairman of Senesco stated that. "In cohort 3 patients will now be receiving dose levels of SNS01-T that are in the same range where we started to observe efficacy in preclinical cancer models". A clinical investigator on the trial said that now that patients would be receiving higher doses, Senesco has the opportunity to ascertain whether SNS01-T can show significant efficacy in patients."

In June 2013 the Company began to recruit patients into cohort 3 and in the middle of November, 2013 the cohort was completed. On December 9, 2013 Senesco reported results of cohort 3 in its Phase 1b/2a clinical study of SNS01-T at the American Society of Hematology Meeting (ASH). There were two MM and two DLBCL patients enrolled of whom all four completed the dosing schedule and three were evaluable for safety. The fourth patient had a dose reduction to 0.05 mg/kg due to an exacerbation of pre-existing thrombocytopenia.

Two multiple myeloma patients and one diffuse large B-cell lymphoma patient exhibited stable disease at week 3 and one multiple myeloma patient and one diffuse large B-cell lymphoma patient were stable at week 6, the end of the dosing period. Senesco said that it observed that there were longer treatment durations and fewer dropouts as compared to cohorts 1 and 2. I think that there was the hope for an objective response as opposed to stable disease and this was not achieved. However the effects in cohort 3 were generally more robust than had been observed at the lower doses.

The data monitoring committee saw no dose limiting toxicities and approved the progression to cohort 4. The most frequent adverse events were manageable infusion reactions, which decreased with repeated treatments and in the one patient with a platelet count decrease, the platelet count increased over time concomitant with the reduced dosage. This may have been drug related.

Cohort 4

The dosing in cohort 4 at 0.375 mg/kg will be 88% higher on an mg/kg dosing basis than in cohort 3 and thirty times greater than cohort 1. Preclinical data in both MM and DLBCL demonstrated pronounced tumor shrinkage at this dose level. Of the nine patients who have completed dosing of SNS01-T there have been five MM patients and one DLBCL patient who have had stable disease at the end of the six week dosing period. In terms of MM, there were two patients with stable disease in cohort 1, one in cohort 2 and two in cohort 3. There was one DLBCL patient with stable disease in cohort 3.

In my opinion in order for clinical studies to progress to a phase 2b trial, SNS01-T will have to show an objective response in at least one and hopefully more patients. Stable disease will not be enough to warrant moving forward. In the event that this is not achieved, the options would be to add more patients, increase the dose, and increase the number of cycles or some combination of the three.

Cohort 4 will require six patients to complete dosing and demonstrate acceptable safety versus three in cohorts 1, 2 and 3. With the addition of Seattle Cancer Care Alliance (includes Fred Hutchinson) they now have five sites enrolling in the US. They are looking to add two sites in South Africa to speed enrollment. Potentially, results could be available in 3Q or 4Q, 2014.

Potential Phase II Trial

Assuming that the Company does decide to move into phase II, I think that they will likely conduct the trial in multiple myeloma although Senesco has not ruled out diffuse large B cell lymphoma. This trial would likely combine SNS01-T with either Celgene's (CEGE) Revlimid or Pomalyst in a refractory setting. This is based on the synergy seen in animal studies.

The design of the trial is obviously not determined at this point. Management believes that it would have a control group. They note that Amgen's new protease inhibitor Kyprolis was approved in a similar disease setting on the basis of a phase II study that enrolled just 100 patients. The study could start in 1H, 2015 and potentially complete in late 2016 in a positive scenario. This could lead to an NDA filing in 2017 and approval in 2018 if everything goes right.

There is a lot of drug development going on in B cell malignancies with new proteasome inhibitors; also Revlimid and Pomalyst are still young drugs that are evolving into every nook and cranny of MM. Johnson & Johnson's (JNJ) Imbruvica (ibrutinib) is the hottest drug on the planet in terms of B cell malignancies but does not seem to work well in MM.

Manufacturing Process is Conducted at the Pharmacy

The three separate components of SNS01-T are the DNA plasmid, the siRNA and the nanoparticle. The plasmid is produced by VGXI, Inc.; the siRNA by Avecia Biotechnology and the nanoparticle by Polyplus. These ingredients are shipped to the pharmacy of the investigative site where they are mixed to produce SNS01-T. There is a process that must be followed that includes the order in which the three components are added and the temperature at which it is done.

A specific batch is made up for each administration of the drug. Every 10th sample is evaluated by the University of Waterloo for efficacy evaluation and to external vendors to determine the quality and stability of the plasmid and siRNA. Improvements to this process are in the works.

Partnering

Senesco would like to enter into collaboration with a biotechnology or pharmaceutical company to support the further development of SNS01-T after completion of phase IIb.

Financing Issues

Senesco has been operating with a strained balance sheet for some time. Given the cash constraints that it has faced, it has done a credible job of moving SNS01-T forward through development, pre-clinical trials and into phase Ib/IIa. It still has a substantial challenge ahead as it tries to get the drug into and through a phase II trial. A recent innovative financing could enable the Company to access enough capital to accomplish this.

A Possible Burn Rate Scenario

The current burn rate of the Company should be about $1.0 to $1.25 million per quarter. Assuming that it begins phase II in 1Q, 2015, it will have burned through $5.0 million to $6.3 million of cash to get to the point in time at which the phase 2 trial starts. In addition, it will need to spend $2.0 million or so in preparing for the phase II trial. This increases the total cash needs to $7 to $8 million in that time frame.

The cost of phase II will be dependent on the design of the study but could be in the range of $8 million to $12 million, let's say $10 million. Again assuming a $1.0 to $1.125 million burn for to fund the Company aside from phase II cash need, the company could burn through $17 million to $18 from the period beginning in 1Q, 2015 million to reach topline results in late 2016.

If these calculations are correct, the total burn rate from the end of the September 2013 calendar quarter until the completion of the phase II trial in late 2016 could be $23 to $26 million. Assuming that they want to have a cushion of $2 million on their balance sheet at that time, the total cash need of the Company would be $26 to $28 million. It ended the September quarter with about $1.6 million of cash so most of this has to be raised from outside investors.

Recent Financing

Senesco recently announced an unusual equity offering in which it is issuing 180,000 units at a price of $30 per unit. This immediately will bring in $5.40 million of cash on a gross basis and net proceeds of $5.25 million. Each unit consists of ten shares of stock or 1.8 million shares in total so that the effective issuance price of these new shares is $2.92.

There are also three tranches of warrants associated with the units: Series A, B and C. The Series A warrants are exercisable immediately at an exercise price of $3.00 per share and expire in 6 months. There are 1.8 million Series A warrants so that if they are exercised they could bring in $5.4 million. There are also 1.8 million Series B warrants that are exercisable immediately and expire in six months at a price of $4.00 so that it exercised they could bring in $7.2 million. There are 1.8 million Series C warrants that are exercisable immediately and expire in three years at a price of $4.00 per share so that if exercised, they would also bring in $7.2 million of cash.

Potential Impact on Share Count

So Senesco has added 1.8 million new shares to its previous share base bringing the number of currently outstanding shares from 3.2 million to 5.0 million. In addition, there are 0.8 million warrants outstanding from other financings so that the potential fully diluted share count currently is 5.8 million shares.

If all of the series A, B and C warrants are exercised, there will be 11.2 million shares outstanding so that based on the current share price of $4.10 the market capitalization would be $46 million. This new financing under the assumption that all warrants are exercised could bring in $25 million at an effective price of $3.21.

How the Financing Might Affect Cash Balances

The Company with the $1.6 million that it had on hand at the end of the September quarter and the immediate infusion of $5.2 million has $6.8 million of cash. This compares to my projected burn of $7 to $8 million needed to get to the start of the potential phase II trial in 1Q, 2015. It seems likely that if the stock stays around $4.10 or even lower at say $3.50, that the Series A warrants will be exercised and bring in an additional $5.4 million. This provides enough cash to get the Company to about 2Q or 3Q, 2015.

The stock will probably have to trade to perhaps $4.50 to induce the Series B and C warrants holders to convert. If this is achieved, it would probably fund the Company to close to the release of topline data on the phase II trial. Hopefully, the phase II data will be sufficiently good to bring in a partner and significant milestone payments. The recent announcement on the merger has moved the stock to $6.00 greatly increasing the potential for the warrants to be exercised.

The Financing Was a Good Deal for Shareholders

While this deal could result in a near tripling of the share count from 3.9 to 11.2 million, it is positive for existing shareholders if it works out that all of the warrants are ultimately exercised. It would allow the Company to complete phase II for SNS01-T, assuming the clinical data supports such a trial.

Assuming 11.2 million shares outstanding at the time the phase II trial completes and that the current price of $6.00 prevails then, the market capitalization would be $67 million. If it is the case that the phase II trial is successful, the data is robust and a partnering relationship results, I think that we could see a market capitalization of anywhere from $150 million to as much as $400 million; this is obviously data dependent. At the lower end of this range, this would represent a tripling of the share price by the end of 2016.

Tagged as Senesco, SNTI + Categorized as Company Reports