Repligen: Fundamentals Are Exceptional But The Stock Carries A Premium Valuation (RGEN, $39.97, For Paid Subscribers)

Investment Thesis

When I wrote my first report on Repligen on December 4, 2012, I concluded that Repligen had one of the best business models that I have seen in the Life Sciences universe and that management was doing an excellent job of execution. This has cetrainly been reflected in the stock price which has risen from $6.13 at the time of my first report to the current price of $39.97 which is compounded growth of 130% per annum). This was in part due to strong growth as product revenues increased from $42 million in 2012 to $66 million (current trailing twelve month) revenues which is compounded growth of 22% per annum).

Clearly, the market has become mesmerized with the Company and has awarded it an extremely high valuation. It has a market capitalization of $1.3 billion. Based on 2015 projections, the P/E ratio is 123 times, the market capitalization to sales ratio is 17 and market capitalization to EBITDA ratio is 69 times. These are lofty valuation measures.

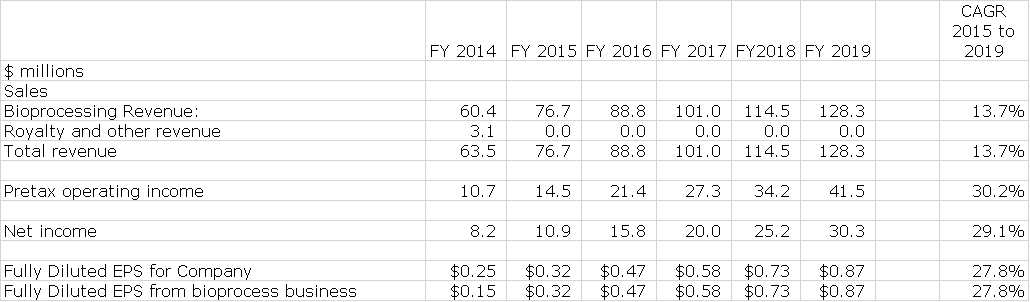

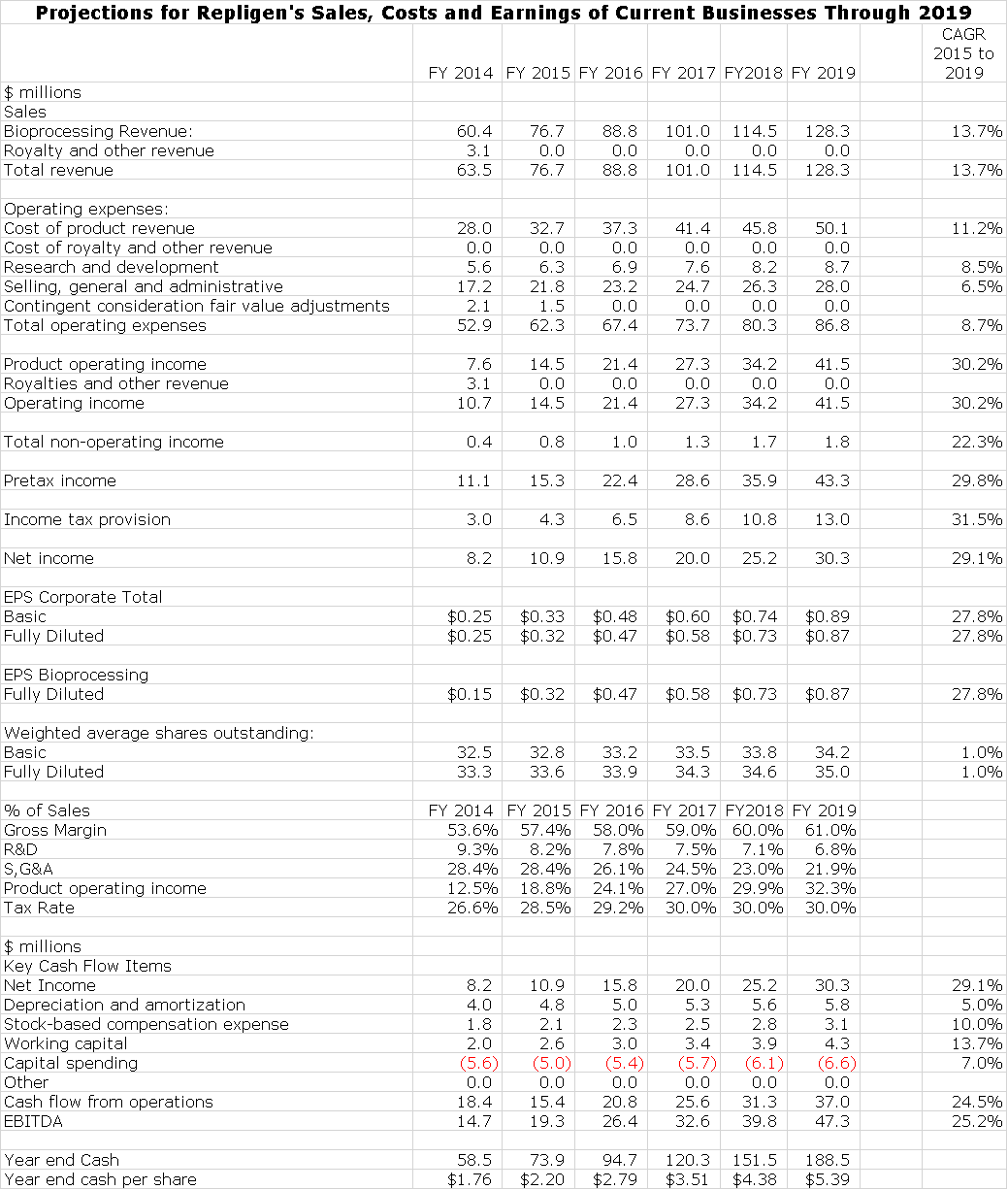

I am estimating that sales of the existing business will increase from $77 million in 2015 to $128 million in 2019 which is a compounded annual growth rate of 14%; This is in line with management guidance for 10% to 15% long term sales growth of existing business. Management has not given precise guidance on EPS growth, but I estimate that EPS will increase from $0.32 in 2015 to $0.87 in 2019 for compound growth rate of 28%. This is shown below:

In my judgment, the market is expecting that EPS growth actuallly will be much better. I think that the market is factoring in the probabilty of accretive acquisitions. The relatively small sales base of the Company and its exceptionally strong position in the bioprocessing business suggests that acquisitions can make a major impact. For example, the acquisition of ATF in June 2014 increased the rate of sales growth in 2014 from 14% to 27% and the effect in 2015 could be to increase the rate of sales growth from 22% to 27% according to my projections. While I feel that there is a strong probability for future meaningful acquisitions that will add meaningfully to future sales and earnings growth, this is very difficult for an analyst to model.

Another consideration in thinking about valuation is that Repligen licensed a drug to BioMarin that is being developed for the Orphan disease Friedreich’s ataxia for which there is no effective drug currently. BioMarin is one of the industry leaders in Orphan drug development so that its invovlement provides some validation of the potential for success. This drug is pre-clinical development and I have no data from which to make a judgment as to whether it will be successfully developed. However, if it is ultimately shown to produce meaningful clinical benefit, this could be a billion dollar drug and I would guess that Repligen might receive a royalty on the order of 5% to 10% which would lead to $35 to $70 million of net income for Repligen (assumed tax rate of 30%); this would likely be in the post 2020 period. If this net income were capitalized at 20 times, it would resultin a contribution to market capitalization of $700 million to $1.4 billion at that time. This amounts to about $20 to $40 per share. Of course, it could also be zero if BioMarin doesn’t go ahead.

I an uncomfortable recommending purchase at this price level. However, this is a great company and you could not pry this stock out of my portfolio with a crow bar.

Monoclonal Antibodies Drive Repligen’s Business

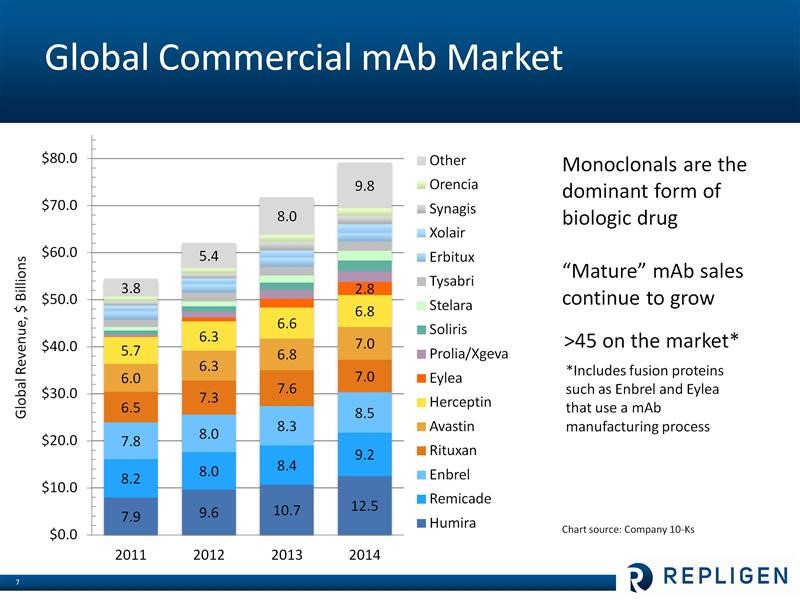

I have described Repligen’s business model in some detail in my initiation report and I am not going to go into expand on this in this note. However, let me give a perfunctory overview for those who may be unfamilar with the Company. The macro-driver of Repligen’s business is research and commercialization of monoclonal antibodies, which is a major driver of the world pharmaceutical industry. The worldwide pharmaceutical market is estimated to be about $740 billion and is growing at about 4% per year. Of this, in 2014, 47 monoclonal antibody-based drugs accounted for about $79 million in sales. Monoclonals continue to be one of the fastest growing segments of the pharmaceutical market at about 8% per year. The largest selling biopharmaceutical in the world is the monoclonal antibody Humira which had $12.5 billion of sales in 2014, a year in which six of the top ten selling drugs in the world were monoclonals. Sales of leading monoclonal antibody drugs are shown below:

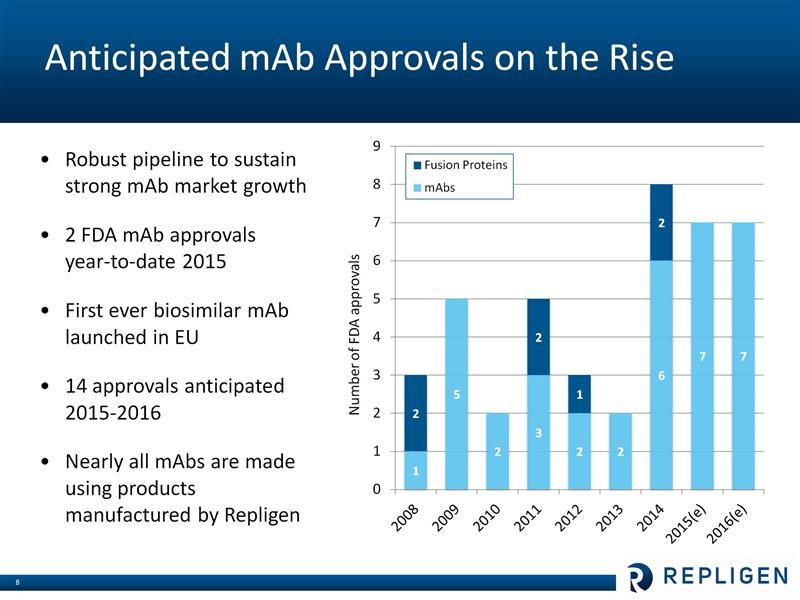

It is estimated that 40% of the bioharma industry’s current R&D pipeline is based on monoclonal antibodies. Eight monoclonal antibodies were approved in 2014 and there are >350 invarious stages of phase 1, 2 and 3 development. Probably the two hottest new types of monoclonal antibody drugs are the checkpoint inhibitors for treating cancer led by Merck’s Keytruda and Bristol-Myers Squibb’s Opdivo. Some analysts are projecting over $15 billion in sales by 2020. The PCSK-9 inhbitors for lowering LDL cholesterol, which are about to be introduced by Amgen and Regeneron, are also projected to produce blockbuster revenues. Repligen sells products that are needed in the production of almost all of these products. The following table shows the uptick in new product development in monoclonal antibodies which could acccelerate in the future, all to the benefit of Repligen.

Repligen’s Role in Manufactruing Monoclonal Antibody Drugs

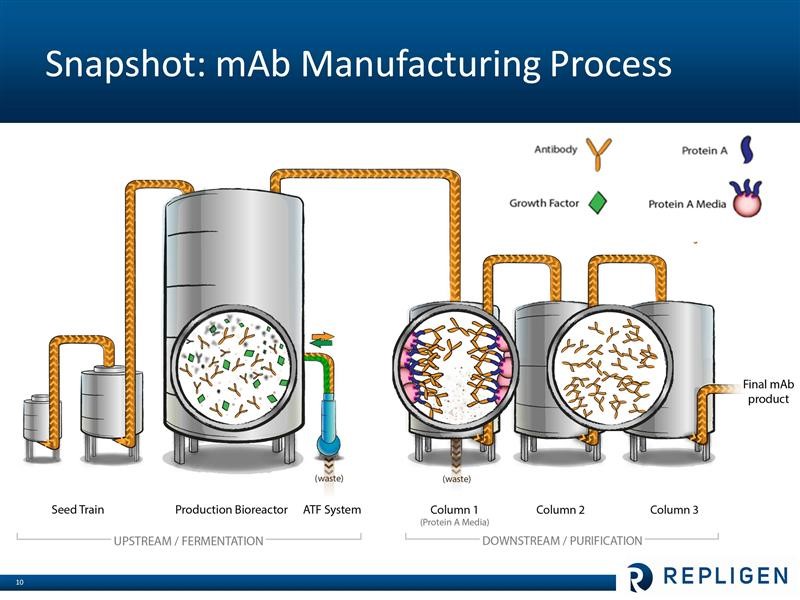

Repligen does not research or commercialize any monoclonal drugs. It is involved in helping drug developers manufacture their products. I have only a layman’s understanding of the bioprocessing of monoclonal antiodies, but let me offer a simplistic overview. Broadly, bioprocessing can be divided in two areas. The upstream step is where the cells are cultured that produce the monoclonal antibody product of interest. This is essentially a fermentation proces which takes place in large bioreactors. The downstream step is where the monoclonals are separated from the cells and contaminants that are producted during fermentation. Central to the purification process is letting the liquid containing the monoclonal antibody drug pass through columns filled with Protein A chromatography media (beads that are coated with protein A ligands). The Protein A binds very tightly (with high affinity) to the monoclonal antibody (and only the monoclonal), while the waste flows out of the column. The monoclonal antibodies are later separated from the Protein A media. At this point the antibody product is more than 95% pure. Two additional columns with other (less expensive than Protein A) chromatography media are typically used for “polishing” – or to reach virtually 100% purity. These steps are shown in the following diagram.

Key Products of Repligen

Repligen was a biotechnology development company that happened to manufacture Protein A until 2011 when it acquired the Swedish company Novozymes. At the time, the two companies each had a little under one-half of the protein A market so that the combination gave Repligen over 95% of the worldwide market. Protein A is used in the downstream/ purification process as was just described. At that time the Company made a radical change in its business model as it decided to sell or license its biotechnology assets and to focus on bioprocessing. The dominant position of the Company in the production of Protein A provided a strong foundation to build on.

The Novozymes acquisition also brought growth factors used in the upstream/ fermentation process which brought another building block. The fastest growing product line is OPUS disposable chromatography columns that are used in the downstream/ purification step. The underlying technology for OPUS was obtained through the acquisition of BioFlash in 2010, but Repligen did much of the engineering development. Then in June 2014, Repligen bought the ATF cell filtration and separation business which is used in the upstream/ fermentation process.

Once a drug company incorporates products manufactured by Repligen in its manufacturing process for Phase 2 or Phase 3 clinical trial materials, it is next to impossible to switch to another product. In living cell manufacturing, even the slightest change in the manufacturing process can lead to a change in the end product. If a manufacturer were to change to another supplier of Protein A or another product, regulatory agencies might require studies, possibly even new human clinical trials, to demonstrate that the product characteristics have not changed. Thus a change would involve high risk for the manufacturer against which potential for modest cost savings would be difficult to justify. Hence, drug products that use products made by Repligen in their manufacturing process effectively incorporate it for the commercial life of the product-talk about stickiness of revenues.

Sales and Earnings Projections for Repligen

Protein A is about 50% of current sales. It historically has grown at 8% to 9% per year, but in 2015 the rate could be 15%-20%. The OPUS disposable chromatography column business doubled sales in 2014 and management is projecting more than 50% growth in 2015, but this is probably low. Growth factors may also grow at a higher rate than the historical 10% to 15% during 2015. I don’t have a good handle on the ATF business, but I am projecting that it can could grow at 15% per year (I think this will be low.)

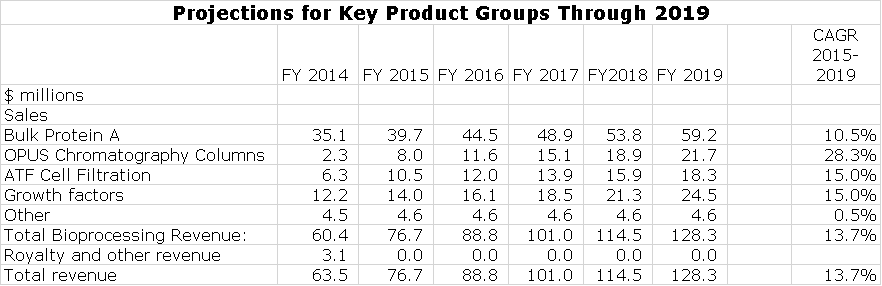

Management reports sales of all products under the category called bioprocessing revenues. They give limited guidance on the product categories that make up bioprocessing. I have put together some estimates on sales of key product groups in order to build my sales model. The reader should understand that while they appear to have great precision, in actuality the estimates just give an indication of magnitude and trend. This is shown in the following table.

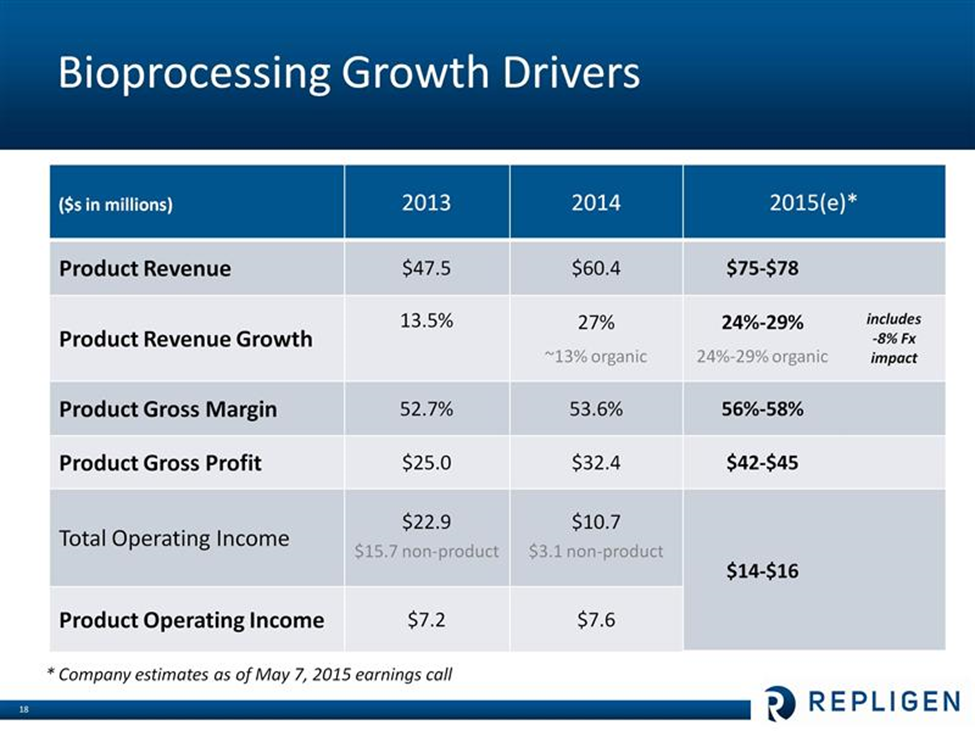

Management has provided guidance for 2015 sales and costs as follows, In 2015, they are looking at 24% to 29% sales growth which includes an expected negative currency impact of 8%. They expect $14 to $16 million in bioprocessing operating income in 2014 up from $7 million in 2014. This is shown in the following chart.

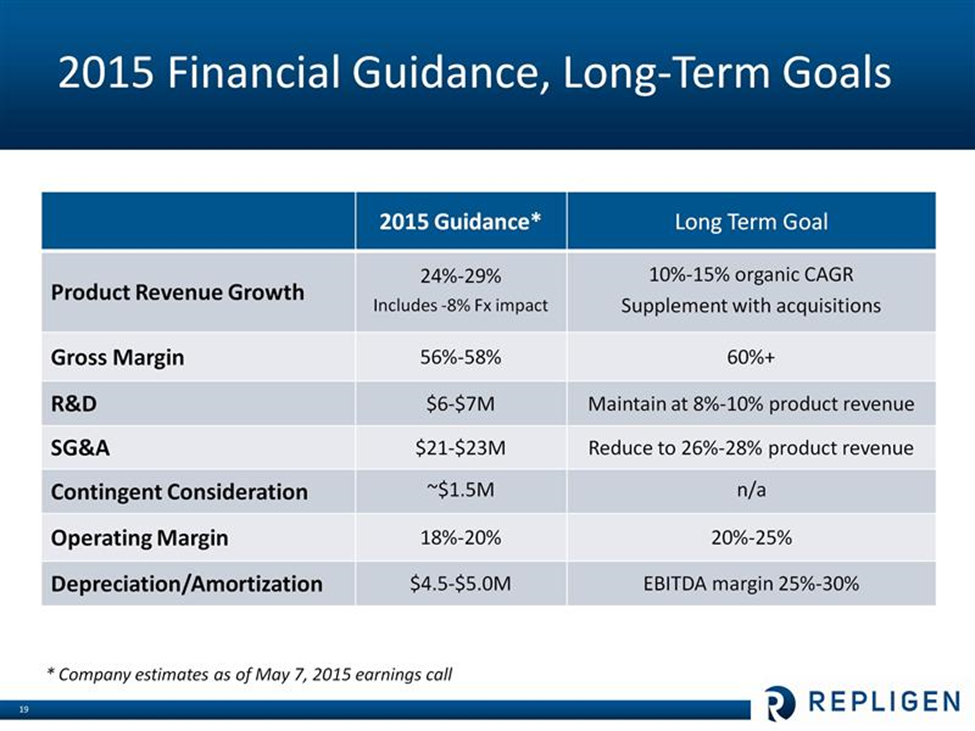

Further detail is provided in the next chart.

New product launches are very important for sales growth and management points to three new product launches in 2015. In 1Q they launched their OPUS 60 chromatography column which they say has taken offf quite nicely. They launched a new Protein A resin in June and in 2H, 2015 will be launching a disposable ATF system.

They have also focused on their commercial infrastructue and have started to expand it agggressively over the last 12 months; this has been the primary focus of the new CEO. They had about 7 sales, marketing and marketing management, and customer support people about one year ago; they are now up to 22 people and the goal is to build a world class commercial operation. Management says that bigger infrastructure this will have a significant impact in the latter half of 2015 and in 2016.

Management says that growth will be a balance of internal growth and strategic acquisitions. In virtually every quarter, they are in discussions with 2 or 3 potential acquirees. They are looking at companies with leading edge technology. These products can be folded into Repligen’s infrastructure and become highly accretive to sales and earnings. In terms of acquisitions, they want innovative non-commmodity product lines that they can integrate into their manufactuing and commerical operations in which they have similar call points. They are interested also in analytical companies that have products that go across the upsteam and downstream space, which is a little bit different. Repligen is a cash flow generating machine that allows for acquisitions to be paid for all or in part with cash.

The goal of the commercial operation is to become a platform company across all the sites of a client biotechnology company. This means that every time an existing or potential account develops a monoclonal antibody, they will likely turn to Relpigen’s products first and only if that product doesn’t fit will they look elsewhere. The goal is to participate in phase 1, 2 and 3 development and become an integral, irreplaceble part of the manufactruing process.

Repligen can be looked at as an ETF for monoclonal antibodies. They are not dependent on the success of any one product, but rather the collective success of this class of products. One or more of their products are used in almost all of the 47 or so monoclonal antibodies that are on the market and they could be used in almost all of the 350 monoclonals in development.

Most of the top monoclonal antibodies are beginning to face competition from biosimilars. This started off in Asia in Indian, Korea and China and now what they are seeing over the last two or three years is that the large biopharma companies are jumping in. An example Samsung Bioepis, Biogen’s partnership with Samsung. There are 15 to 20 companies developing biosimilars for Humira or Remicade. That is good news for the bioprocessing industry as it involves a lot of process development. If biosimlars lower the price of drugs they are mimicking and in doing so increase unit usage, this could be a postive for Repligen.

Sales, Cost and Earnings Projections for Repligen’s Existing Business Through 2019

Yogi Berra once famously said that projections are very hard, especially about the future. From long experience I have learned that companies with all of the detailed information which they have about their business are frequently wrong in their projections. It is to be expected that outside analysts working with just a fraction of that information will be wrong even more frequently. However, it is important to make the best possible models that we can, recognze the limitations and adjust as things inevitably develop in a manner that we don’t expect. I think that investors should look at models as giving an insight into magnitude and trend rather than something that has great mathematical rigor.

In the sales, costs and earnings model that I have put together, I have made my best judgment on how the existing business will grow. I have previously pointed out that acquisitions will play a major role in the growth of Repligen. This is next to impossible to model in and yet it is a critical factor. Finally, I make no estimates for potential impact from BioMarin’s development of a drug for Friedreich’s ataxia or other biotechnology assets. Here are the projections for Repligen’s existing business through 2019.

Tagged as ATF Cell filtration systems, OPUS Chromatography columns, Repligen, RGEN + Categorized as Company Reports

Larry,

Are you comfortable recommending RGEN at today’s price of $26?

I am certainly thinking about it, but the whole biotechnology sector is going through a period of uncertainty and price weakness. I will probably wait a while before moving.