Recently Added Board Member Brings Great Expertise to the Potential Launch of APF530 (APPA, $0.64)

Investment Thesis and Price Target

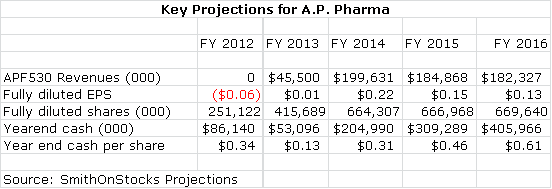

I initiated coverage of A.P. Pharma (APPA.OB) with a buy at $0.42 per share on April 25, 2012. I am reiterating a buy at the current level of $0.64 per share. For more details on the fundamental outlook for A.P. Pharma please refer to my initiation report called Unusual Potential For A Small Company and an important follow-up piece on July 22, 2012 called Side Effect Issue With Competitive Drug Is A Huge Positive. These reports document the assumptions that lead to key sales, fully diluted EPS cash per share as summarized in the following table:

My price target for late 2013 is arrived at by applying a P/E ratio of 20 to projected 2014 EPS of $0.22 and results in a price target of $4.40. My model showing cash building on the balance sheet is highly unlikely to occur. I think that management would likely use the cash to make product or company acquisitions that would likely result in additional EPS contributions in the years 2014 through 2016. There is also the possibility for an outright sale of the company.

Company Overview

A.P. Pharma (APPA.OB) is a specialty pharmaceutical company developing APF530, which is a subcutaneous formulation of granisetron being developed for the prevention of chemotherapy induced nausea and vomiting (CINV) in patients receiving moderately or highly emetogenic chemotherapy. A.P. Pharma plans to resubmit the APF530 new drug application by the end of this month. The Company's stock has risen significantly this year in anticipation of APF530 resubmission and potential approval. The Company has $67MM of cash, which should fund the Company well into commercialization and to the point of positive cash flow, if my assumptions are correct.

In late July, A.P. Pharma completed a private placement, which sold 102 million shares of common stock at $0.525 per share. The offering grossed $53.6MM and the net proceeds were $50.7MM. This significant cash infusion gave A.P. Pharma the necessary capital to begin the APF530 commercialization process. At about the same time, the Company appointed Robert Rosen to its Board of Directors. I believe that this is a significant even given Mr. Rosen's impressive track record and expertise in commercializing oncology products.

Robert Rosen's Background

Currently, Mr. Rosen is a managing partner of Scotia Nordic LLC. Before that (2005-2011), he was the global head of oncology at Bayer Healthcare where he led the development of the oncology business unit for the Americas, Europe, Japan, and Asia Pacific regions. At Bayer, he spearheaded the launch of Nexavar for the treatment of renal cell carcinoma and hepatocellular carcinoma; in 2011, Nexavar achieved annual sales of ~$1B.

From 2002 to 2005, Mr. Rosen was VP of the Sanofi-Synthèlabo (SNY) oncology business unit where he launched Eloxatin for colon cancer. In 2005, the third year of Eloxatin marketing, the drug achieved US sales of ~$1.1B. Clearly, Mr. Rosen has a proven and successful track record of managing commercial teams and successfully launching drugs at world-renowned pharma companies. This gives me confidence that he will be able to prepare APF530 for commercialization and successfully launch the product.

Mr. Rosen's Initial Actions

Under Mr. Rosen's direction, A.P. Pharma plans to hire core sales and marketing leadership consisting of 10 people by the end of 2012. Upon my projection for APF530 approval in the first half of 2013, 40 additional field sales representatives will be hired. This sales force should be sufficient to reach approximately 50% of the market. I am confident that a seasoned executive like Mr. Rosen will be able to successfully launch APF530.

Tagged as A.P. Pharma Inc., A.P. Pharma. APF530, Heron Therapeutics + Categorized as Company Reports