Cadence: Potential Near Term Catalyst for the Stock (CADX, $5.34)

Investment Thesis

I continue with my buy recommendation on Cadence Pharmaceuticals (CADX). I believe that there is a high probability for an important near term catalyst that could give the stock a nice boost. This would be a legal settlement with Exela Pharmaceuticals, which is challenging Ofirmev's patents. If it is similar to a settlement reached with the other generic challenger Perrigo (PRGO), it could extend the period of exclusivity until 2019 or longer. The case is scheduled for trial in May, 2013 and it is likely that we will hear of the settlement before then. If I am wrong and Exela chooses to go to trial, I think that there is an excellent chance that Cadence ultimately wins the lawsuit. However, Exela's choosing to go to trial could cause modest price weakness.

Cadence introduced its first and only product, the hospital analgesic Ofirmev (intravenous acetaminophen), in January 2011 when the stock was trading at about $7.00. The price climbed steadily and reached about $9.00 in mid-2011. Then sentiment began to shift sharply negative. The sales ramp for Ofirmev was slower than expected leading to downward revisions in sales projections and in June, 2011, Ofirmev's patents were challenged by two generic drug companies: Exela Pharmaceuticals and Perrigo.

Bearish sentiment took control and the stock drifted steadily and sharply lower to a 2011 yearend close of $4.00 and for most of 2012 traded in a range of $2.50 to $4.75. It has been moderately stronger in 2013 trading up to $5.30 per share. The bears argued that sales expectations were too high and more importantly they predicted that generic competition could begin as early as 2014 in the worst case but almost certainly in 2015 or 2016 and that this would cause a rapid meltdown in Ofirmev sales. The 90% drop in sales suffered by Plavix in the first year it faced generic competition was sometimes cited as a precedent for what might happen to Ofirmev.

Over the last few quarters, it has become apparent that the launch of Ofirmev is now on an impressive upward trajectory. The bears have given up on the disappointing launch argument and are now solely focused on the risk that there will be generic competition in the near term. On November 28, 2012 Cadence announced that it had reached a settlement with Perrigo, one of two generic challengers to Ofirmev's patents. Perrigo essentially agreed to not market a generic version of Ofirmev until December 6, 2020. Later in this article I describe why I think that the second generic challenger, Exela Pharma, may enter into a similar settlement. If so, Ofirmev might not face generics until 2019 or 2020. Remember that bears are looking for generic competition in 2014, 2015 or 2016 and even the bulls are expecting it in 2018.

The trial with Exela on the patent litigation is scheduled to start in May of 2013. If Cadence and Exela are going to settle, I would expect an announcement before then. If the settlement is in line with my thinking, I think the stock could jump to $7 to $8 in 1H, 2013 and then steadily climb toward my 2015 price target of $14. I want to caution readers that while these numbers appear to be precise, they are just my best guesses and I would urge you to take them with a grain of salt. Still, I think that they capture my thinking about the possible level and trend of the stock price for the next three years.

Price Target Thinking

If I look at spectacularly successful specialty pharmaceutical companies like Forest Laboratories and Cephalon, their success was based on being able to initially develop a product(s) around which they could build a sales and commercial infrastructure. I would argue that the most important asset of Cadence is its sales force and strong presence in the US hospital market. This can be used to extend the product line through licensing agreements or outright acquisitions of products or companies. Potential sellers and licensees will be attracted to the demonstrated ability of Cadence management and sales force to commercialize new products in the hospital market.

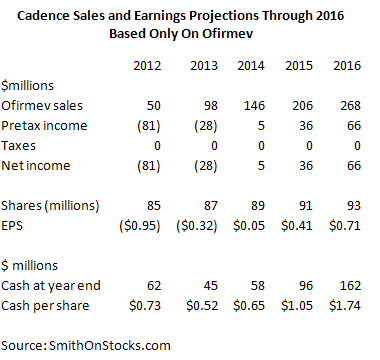

I am going to start my price target discussion with an analysis of how Cadence may grow sales of Ofirmev between now and 2016 as shown in the following table. This assumes for the sake of illustration purposes only, that the company will just market Ofirmev. In reality, I would expect that Cadence will gain marketing rights to several additional products that will contribute meaningfully to sales in 2016 and also will be the basis for a promising pipeline. As a starting point, my sales and earnings model under the assumption that Ofirmev is the only marketed product in 2016 is shown below:

In 2016, Ofirmev could contribute $0.71 to EPS. However, this is based on the assumption that operating loss carry forwards result in Cadence paying no taxes. On a fully taxed basis, I think that EPS would be about $0.46. Importantly, I would expect that new products in 2016 could contribute as much as 30% or more of corporate revenues. I would also expect that Cadence would also create a broad pipeline of new products by then. The strong buildup of cash that I project gives the Company the financial strength to acquire new products. You may ask how I can make such a leap of faith. I can only answer that I have seen it occur time after time with the specialty pharmaceutical business model and I harken back to the early days of Forest Laboratories (FRX) and Cephalon when the same question was asked about them.

It is important to understand the enormous earnings leverage that an established sales force brings. Let's assume that Cadence brings in products with $100 million of sales and gross margins of 70% in 2016; this would lead to $70 million of gross profits. Because the sales force is already established the only incremental costs would be promotional support of perhaps $20 million. This scenario would allow the company to bring $50 million to the pretax line and assuming a tax rate of 35% would contribute $0.35 per share to the bottom line. Added to the earnings power of Ofirmev, this would result in EPS of $0.80 in 2016 on a fully taxed basis.

To arrive at a positive investment thesis for Cadence, you have to believe that management has the skill to acquire new products to supplement Ofirmev. You have to believe that a patent settlement with or winning the patent dispute with Exela will provide marketing exclusivity through 2019 or beyond.

You also have to believe that the company can create something like $100 million of sales through product acquisitions by 2016. With all of these assumptions, we would be looking at $0.80 per share of EPS in 2016. I think that in 2015, the company could sell at 15 to 20 times EPS projected for 2016, resulting in a price range of $12 to $16 in 2015; I use the mid-point of this range or $14 as my price target. You may find this investment thesis intellectually unsatisfying and I can appreciate your skepticism, but I have seen this specialty pharmaceutical sales model play out time and time again. The key is to have that first big product, which in this case is Ofirmev.

Fourth Quarter, 2012 Sales Metrics Confirm Strength of Ofirmev Launch

Cadence gave metrics on its quarterly conference call that provide useful information to gage the strength of the Ofirmev launch. Let's take a look first at the sequential changes in key metrics from 3Q, 2012 to 4Q, 2012. Here are the highlights.

These metrics illustrate the strength of the launch and management's confidence that it will continue. The company reconfirmed 2013 sales guidance of $94 to $100 million; up from $50 million in 2012.The company provided some additional useful information. Ofirmev has established a strong presence in key hospitals. It is now being used in more than 80% of the top 2,000 hospitals in the United States as ranked by the quantity of IV analgesic products purchased. Cadence estimates that it has treated 2.5 million to 3 million patients since the January 2011 launch with Ofirmev with an average of 2.0 to 2.5 vials being used per patient. The ultimate potential is believed to be in the 4.0 to 6.0 range.

Using These Metrics to Predict Future Sales

In a survey conducted in December, 2012, anesthesiologists and surgeons indicated that they expect to treat up to 55% and 60% of their patients respectively with Ofirmev within the next three years. Ofirmev is currently being used in about 10% of surgical patients. The company has concentrated on the surgical pain market in the hospital so far. It estimates that the non-operative pain market is about half the size of the surgical market.

If we were to assume that within three years Ofirmev: (1) captures 50% of the surgical pain market up from 10% currently, (2) that 5.0 vials are used on average per patient versus 2.5 now, (3) that the company captures 25.0% of the non-operative pain market and (4) raises prices at 6% per annum; annual sales in three years (2016) would be about $285 million. Sales in 2012 were $50.1 million and guidance for 2013 is $94 to $100 million. This suggests substantial sales growth in the next few years. My estimate based on a different methodology for 2016 is $268 million.

Patents Covering Ofirmev

The intellectual property protection (patents) for Ofirmev is not based on composition of matter claims which are the most rigorous of patents. Acetaminophen is a generic drug that has been on the market for more than 60 years as an oral product. Attempts to produce an intravenous formulation repeatedly failed because acetaminophen readily breaks down when exposed to oxygen or water. The key inventions underlying and allowing for the commercialization of Ofirmev were developing a stable formulation and manufacturing process.

Ofirmev is protected by two key patents. The 6,028,222 patent covers the formulation of Ofirmev; with a pediatric extension, it will expire on February 15, 2018. The second is the 6,992,218 patent covering manufacturing of Ofirmev, which expires on December 6, 2021 with the pediatric extension. Bulls have generally believed that the '222 patent was defensible, but believed the '218 was weaker and might be broken. Bears on the stock believe that neither will block generics.

Cadence has consistently maintained that Ofirmev's patents are so broad that it would be very difficult for a generic company to work around. They believe that the formulation patent covers all excipients needed to produce the Ofirmev formulation and in order to bring a generic form of intravenous acetaminophen to market without infringing their patents, a generic company would have to develop an entirely new formulation and manufacturing process. The manufacturing process used by Cadence, to my knowledge, is the only one that has resulted in a stable intravenous formulation of acetaminophen. It seems unlikely that a generic firm has suddenly discovered an entirely new formulation and manufacturing process that doesn't infringe when others have failed for decades. Had anyone else identified a suitable process for stabilizing IV acetaminophen, they would have used that technology to create an intravenous acetaminophen long ago.

Two generic firms have challenged the Ofirmev patents. The filing of an ANDA does not necessarily denote that the patents are weak. Generic firms challenge most patents, even those covering the composition of matter patents on newly discovered drugs. The first generic company to successfully challenge a patent is awarded 180 days of exclusivity before another generic can enter the market. This creates a very strong economic incentive to be the first to challenge a patent. In the case of Ofirmev, two generic companies challenged the patents, Paddock and Exela Pharmaceuticals. Paddock was subsequently acquired by Perrigo.

Highly Favorable Patent Settlement with Perrigo

In what I regard as extremely positive news, Cadence announced on November 28, 2012 that it had entered into a settlement in which Perrigo agreed not to market a generic until late 2020. According to the agreement, Perrigo in return has the right of first refusal to negotiate an agreement to market an authorized generic version of Ofirmev in the U.S, if Cadence decides to do so. It also has the non-exclusive right to market a generic in the U.S. under Cadence's NDA, after December 6, 2020 or at such a time as the patents covering Ofirmev are ruled invalid. If this agreement is exercised, Perrigo will purchase product exclusively from Cadence and will pay Cadence for product costs plus an administrative fee, as well as a royalty payment based on the net profits achieved by Perrigo.

Litigation remains ongoing with Exela. It is uncertain as to which of these two companies was first to file as the FDA has not yet designated who was the first filer. If it is Perrigo, it will enjoy the 180 days of exclusivity awarded the first filer and Exela would not be able to launch until after Perrigo. While the status of first filer in uncertain, the timing of notifications of a paragraph IV filing to Cadence by the FDA suggests that Exela was first to file. If so, it could still proceed to trial and, if successful go on to launch its generic in perhaps 2014 or 2015.

It seems to me that the decision of Perrigo to settle with Cadence has significant ramifications. It is a large publicly traded company with huge resources and the infrastructure needed to genericize Ofirmev. Remember that it was Paddock and not Perrigo that filed the paragraph IV challenge. Thus Perrigo's decision is one of a company that is not influenced by the need to justify a previous decision and perhaps can be more objective. It is also a company with great expertise in the field of patent challenges. I can only conclude that Perrigo judged the patents for Ofirmev as being strong and defendable and that there was a good chance of losing if they went to trial. This can't help Exela's confidence in their position.

As I previously mentioned, consensus thinking of bulls on Cadence has been that only the'222 formulation patent expiring in 2018 would offer meaningful protection and generally dismissed the "218 patent expiring in 2021 as being weak. Bears of course thought that neither patent was valid. However, after the Markman hearing in the summer of 2012 that was preparatory to the patent trial scheduled for May 2013, some observers came away feeling that the "218 patent was much stronger than generally believed. The action of Perrigo to settle in a time frame of 2020 supports this thinking. Court cases are always difficult to predict, but having to overturn two strong patents increases the problems for Exela.

Perrigo's actions can be explained by the hypothesis that they judged the patents to be strong and that fighting the legal battle was a poor use of funds, even though it easily has the resources to wage a legal battle. In any event, settling is not such a bad deal for Perrigo. They can forgo the legal expenses, risk of losing the trial and can ultimately rely on Cadence to supply product rather than going through the costly process of building their own manufacturing capacity. It also allows Cadence more time to build the usage of Ofirmev in the marketplace. I estimate that in 2015, Ofirmev could have sales of about $235 million, but the level could increase to $500 million by 2020 substantially increasing the size of the Ofirmev generization opportunity.

What Will Exela Do?

Even if it was first to file, this puts great pressure on Exela to also settle. Exela is a small, privately owned company with just a handful of employees and no commercial manufacturing capacity; I have not seen any financial information on the company but I would think that it has limited financial resources. With Perrigo/ Paddock exiting the stage, Exela is left to carry on the patent battle by itself whereas there would likely have been cost sharing with Perrigo had it not folded its cards. Preparation for the trial could take perhaps $2 to $5 million of legal expenses which might be a pretty significant amount of money for a private company like Exela. Moreover, even if Exela were to win the trial, Cadence would appeal the decision and this would result in still further legal expenses.

The key remaining question is how this will affect Exela in its decision to settle or go to trial. As background, most paragraph IV challenges are resolved through settlements. Given its presumably limited resources, settlement might have been Exela's strategy all along. And the decision of Perrigo to settle has to persuade them that there is a good chance that they could lose and incur sizable legal expenses in going to trial. Some investors have raised the question that Exela might choose to partner or license whatever rights it obtains from this paragraph IV challenge to another company in return for that company helping with the costs of the trial and of course the considerable expense of building manufacturing. However, there might not be a long lineup of potential licensees in the wake of Perrigo's actions and the margins realized by Exela on such a deal could be paper thin.

My best judgment is that Exela will elect to settle and obviously the announcement must be made before the trial scheduled for May 2013 and probably before their lawyers start the costly process of depositions and trial preparations. The next question is if they settle what kind of terms would there be? I think that Cadence and Exela each have something of considerable value to offer the other. If Exela agrees to a settlement that prevents marketing until 2020, it would be huge win for Cadence. Remember that the bears have been saying there will be generics in 2014, 2015 or 2016 and the bulls have been expecting generic competition in 2018. Clarity on the patent situation and two more years of patent life longer than even the bulls were expecting would be a huge win for Cadence; this substantially increases the net present value of future Ofirmev cash flows.

The question is what might there be in this for Exela? First of all, like Cadence, it takes away the uncertainty of the outcome of a trial and associated expenses. Remember also that if Cadence were to lose, it would certainly appeal the decision resulting in still more legal expense. Cadence will not discuss what it might be willing to do for concern that they might be tipping their hand in any negotiations. I have seen in other settlements that the brand name manufacturer has been willing to help a generic company set up production to become a source of product supply for the branded product. This manufacturing would be in place at the time the brand name drug goes generic and along the way, the generic company would be making manufacturing profits. Exela might respond favorably to such an offer from Cadence. I don't propose this as the probable outcome, but it is representative of a settlement that is in the interest of both Cadence and Exela. The recent termination of the supply agreement with Baxter encourages my thinking along this line. Cadence will need a backup supplier.

Tagged as Cadence Pharmaceuticals + Categorized as Company Reports