Antares’ Pipeline is Bursting with New Products; Vibex MTX is the Star (ATRS)

Investment Opinion

I am reiterating my Buy recommendation on Antares which was initiated on December 6, 2011 at a price of $2.77. My price target for 2015 is $11 per share.

Reaction to Recent Price Weakness

Antares (ATRS) has fallen 27% from its closing price of $5.30 on July 16, to a recent closing price of $3.88 on September 7. Price behavior like this can presage problems and gives cause for investors to ask if there are issues with the current business and/or the new product outlook. I don't think so. I regard this price behavior as "normal" volatility that goes hand in hand with biotechnology investing. I think that many investors and hedge funds try to trade biotechnology stocks aggressively attempting to capture short term moves. This can often exacerbate price changes on the upside and downside and this probably played a role in the sharp move up to $5.30 and then the sharp retraction.

I am not a fan of short term trading. Wayne Gretsky was once asked why he was arguably the best hockey player ever. He answered that others skate to where the puck is and I skate to where the puck will be. This kind of summarizes my approach to Antares. In the case of Antares, there is not just one puck but a barrage of pucks which is a metaphor for new product introductions. Those who have followed my work on Antares will understand that I have focused on what I think the company will look like in 2016 and beyond, by which time I expect that the company will have put an impressive number of pucks in the net.

Price Target Thinking

Antares at the current price of $3.88 carries a market capitalization of $407 million. To put this in perspective, let's hypothesize some more mature company that is valued on earnings and is selling at about 14 times projected earnings which is roughly the P/E ratio for the S&P 500 based on 2012 EPS projections. This $407 million market capitalization might correspond to a company that was earning about $30 million on $300 million of sales. Antares is on track to report sales of $22 million (not earnings) in 2012. As is the case in biotechnology investing, investors have bid the price up because of enthusiasm for new products that should dramatically accelerate growth in the future.

Antares has an exceptional new product potential and it is this on which investors are focused with particular attention to Vibex MTX, an injectable methotrexate product for rheumatoid arthritis. I think that Vibex MTX has the potential to transform Antares. The company continues to guide that it will file an NDA in 1Q, 2013 and I expect marketing to begin in mid-2014. (Later in this report, I review the clinical development progress of this product.). While Vibex MTX is the crown jewel of the product pipeline, there are six new injectable and two new products based on gel that could come to market by 2016; there are likely to be additional products.

The stock price will certainly ebb and flow over the next few years and it is clearly ebbing right now. Using my Wayne Gretsky investment approach, I look through the current weakness focusing on my price target for Antares in 2015 of $11. This is based on applying a 25x price earnings ratio to my projection for fully taxed 2016 EPS of $0.44. The EPS by 2016 are heavily driven by Vibex MTX in my model and it is the key to the stock at this point.

I am assuming that Antares decides to make the transition from a company licensing products on its own to becoming a fully integrated marketing operation with Vibex MTX being the first proprietary product. This will entail significant costs for hiring sales reps and launch expenses in the 2014 period and beyond, but will allow Antares to potentially capture all of the profits from products it develops instead of perhaps 20% to 25% when it licenses a product.

Students of the biotechnology industry understand that the licensing strategy that Antares has had to follow because of financial and infrastructure constraints can produce good investment outcomes. However, the great success stories almost always are with companies who make the transition to fully integrated marketing companies. This strategy is usually rewarded with a premium price to earnings ratio. This along with EPS growth prospects for a doubling in EPS in 2016 over 2015 and strong product pipeline prospects should lead to a healthy P/E ratio in 2015. Based on my experience and personal judgment, I am estimating that in 2015 the market will apply a P/E of 25x to 2016 EPS.

The EPS estimate of $0.44 that I am using for 2016 needs some explanation. I do not expect that Antares will exhaust its net operating loss carry-forwards until 2017. Under generally accepted accounting principles or GAAP, it may pay no taxes until 2017. It has been my experience that the market normalizes GAAP by making an adjustment that assumes full taxes are paid. My model shows GAAP EPS of $0.64 in 2016 and pro forma fully taxed EPS of $0.44. I apply the 25x P/E ratio to the $0.44 to arrive at my $11 price target for 2015.

A Detailed Sales Model is Needed to Analyze Antares

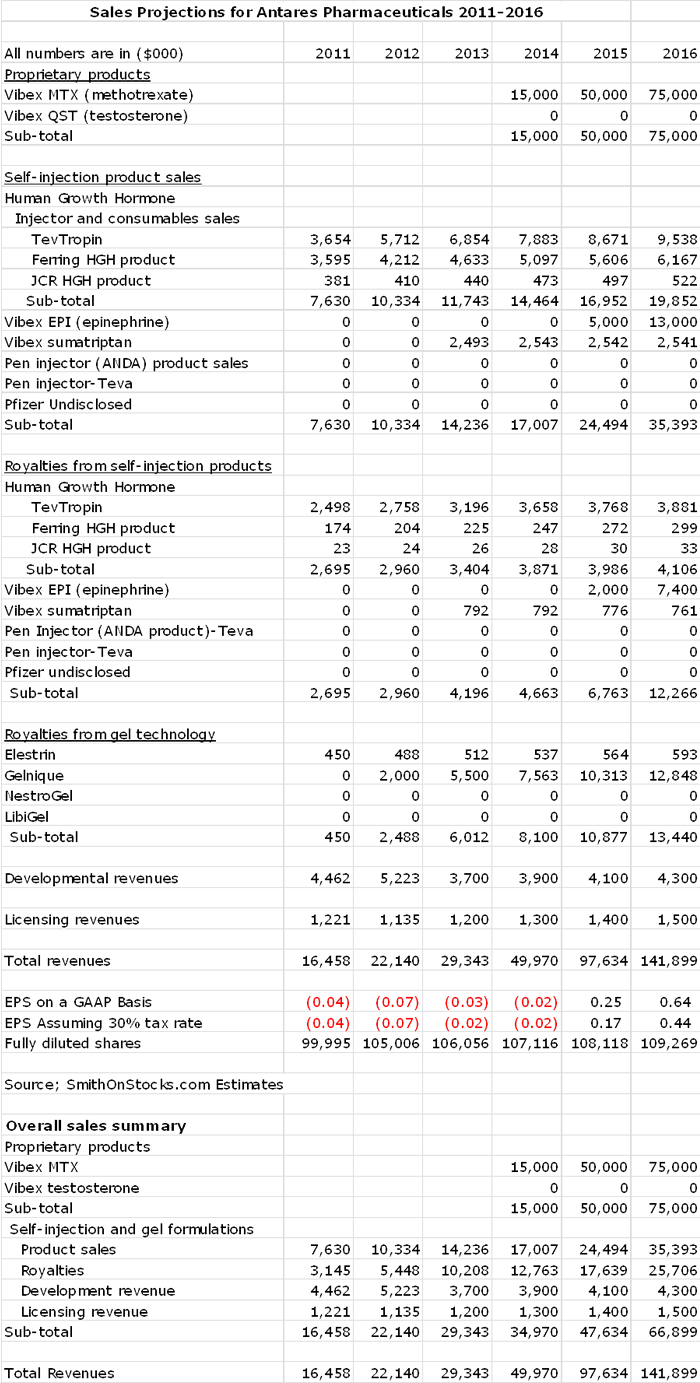

I have struggled to find a way to present my thinking on the potential for Antares as there are so many products that are involved in the investment outlook. In the case of Antares, a picture or in this case a detailed sales and earnings model is worth a thousand words.

Source: SmithOnStocks.com estimates

Let's now take a look at what has been going on with Antares and the prospects for 2012 and 2013 according to my sales model. In 2011, sales increased by 28% and management guidance for 2012 is for a 20% to 30% gain in sales; my estimate calls for 25% growth. In 2013, led by a full year of royalties from Gelnique and an anticipated launch of a new injectable generic believed to be sumatriptan (for migraine headaches), I am estimating a 43% increase in sales. This indicates that near term sales growth should continue to impress. However, it is the new product outlook led by Vibex MTX and complemented by the possible introductions of at eight or more other new products that is the essence of the story.

It is highly likely that there will be a number of new injection products in addition to those disclosed by the company. Because it uses the 505-b-2 pathway for drug development (explained later in this report), it has short development timelines. It can choose from a vast array of generic drugs for which its injection technology may afford superior efficacy, safety and/or administration. The technology may also have great promise for improving the delivery of biologicals which require administration through injection. Investors may not be aware of a new product until one or two years before it is ready for regulatory filing. It may be the case that the impressive new product pipeline we are now looking at may be even more impressive.

There are some important things to point out about my sales and earnings model. The first is how important Vibex MTX is to the long term outlook. In my model, it accounts for over 50% of sales in 2016. You will also notice that the only other new product that I have shown as making a meaningful contribution is Vibex EPI (epinephrine) that I project to account for 14% of sales in 2016.

You are probably scratching your heads as to why I have made no sales projections for six new products in the sales model. The first reason is that with the exception of Vibex QST (testosterone) and the contraceptive Nestrogel, Antares has not identified the active pharmaceutical ingredient in these products. It is hard to make projections for unknown products aimed at unknown markets. Intuitively, I think that they can make important contributions, but I have decided to wait until we have more information before putting them in my sales model. This injects conservatism and allows for upside surprise in my model.

In projecting EPS for 2014, 2015 and 2016, I am assuming that Antares establishes a 30 person sales force to launch Vibex MTX in mid-2014. I estimate that in 2014 the cost of sales representatives will be $4 million and that the launch expenses for Vibex MTX will be $5 million; the same expenses in 2015 are estimated at $5 million and $10 million respectively.

A Company in Transition

The company's business strategy has been based on using its drug delivery technology to develop products for other companies in return for milestone and development payments; royalties; and manufacturing reimbursement. It sold its drug delivery business based on topical gel formulations, but some legacy products remain.

To date the company has developed and seen commercialized one product from its injection technology. This is human growth hormone that is marketed by three firms, Teva (TEVA), Ferring and JCR in three different geographic areas of the world. Two legacy products from its topical gel delivery business have been commercialized, Gelnique for female urinary incontinence and Elestrin for post-menopausal hot flashes.

Antares' current management led by CEO Paul Wotton inherited a struggling business in 2008 and has done a highly credible job turning around and growing its drug delivery business. They have built infrastructure and drug development capability while keeping cash burn to impressively low levels. Over the last 10 quarters the average operating cash burn per quarter was only $1.4 million. Despite this modest cash burn the company has been able to build its strong pipeline of new drugs for partners. Now it is turning to the development of proprietary products that it completely controls with the goal of becoming a fully integrated pharmaceutical company.

It is extremely difficult to develop a great business based on developing products and licensing them to another company to market. Let me show why. The development of an Auto-injector device to deliver Teva's Tev-Tropin human growth hormone product was a transforming event for Antares as it was then cash strapped and struggling. This was the key factor in turning the company around. However, a very large share of the profits form Tev-Tropin accrues to Teva.

I estimate that net sales of TevTropin will reach $56 million in 2012 and that Antares will receive a royalty that is 5% of sales or $2.8 million. Antares also supplies the Auto-injector and components on a cost plus basis. I estimate Teva pays Antares $5.2 million which is 50% over costs or a markup of $1.7 million. Overall, Antares receives $5.5 million before figuring in operating costs. If Antares had been able to market the product on its own (which at the time of the 2009 launch was not a possibility), I estimate that it would receive about $48 million before operating costs. There is, of course, an offset as operating costs in the form of selling, marketing and research expenses increase significantly with a "go it alone" strategy. Even so the proprietary strategy is the way that great companies are built.

The CEO of the company Wooton stated on a recent conference call that the future of the company is going to be developing proprietary products for its own account. In particular, the development of Vibex MTX is the driving force behind this strategy. This is the next transforming event for the company that could change it from a very good company to a great company.

Another product that could be a game changer is the Vibex injector for testosterone. This was recently identified by Antares as being the second product that it may develop for its own account. Antares has estimated that one-third of the usage in a $6 billion US market is from injectable testosterone products. This indicates that the injectable testosterone market for Vibex testosterone could be $2 billion. If this product is differentiable from currently marketed injectable testosterone products, it may have the potential comparable to Vibex MTX.

The Status of Vibex MTX Clinical Development

The Vibex methotrexate auto-injection system is being developed under the 505-b-2 pathway. This allows Antares to use information previously supplied to the FDA through earlier drug filings related to methotrexate. Antares doesn't have to perform the pre-clinical and clinical studies that are required for an NDA on a new drug. Antares only needs to show that the Vibex methotrexate injection system can deliver drug as effectively as methotrexate given through subcutaneous or intramuscular injection using a conventional syringe and needle; this can be shown with pharmacokinetic studies.

In August of 2011, the results were reported of a pharmacokinetic study demonstrating equivalency of Vibex MTX to commercially marketed injectable methotrexate products. This established pharmacokinetic equivalence at several dosage strengths of methotrexate. The clinical study met the primary endpoints providing equivalent performance and comparable safety in the patients who participated in the study.

The next and final step in the development process is to determine if Vibex MTX can be delivered safely and effectively at home by lay caregivers or the patients themselves. Many rheumatoid arthritis patients have finger and hand deformities that make it difficult to grip objects. In June of 2012, Antares reported results from a simulated human use study of 50 patients representing three potential user groups; rheumatoid arthritis patients, lay caregivers and health care professionals. All of the participants in the rheumatoid arthritis group had severe to very severe hand impairment. A simulated injection was given on days one and seven, which reflects once a week dosing. The results of this study showed that the Vibex MTX device is safe and effective for intended users with a greater than 96% simulated injection success rate.

The last phase of development is an actual human use study in just over 100 rheumatoid arthritis patients. The study is being done in a clinical setting to record the ability of patients to safely and effectively use the Vibex MTX auto-injector. It is an open label study in which patients give themselves one injection and are observed doing so. Audited results should be available by October of 2012.

Antares said at the last conference call in early August that it remains on track to file an NDA submission in 1Q, 2013. Approval could be gained in late 2013 and marketing might begin in early to mid-2014.

The company will also need to decide whether it will commercialize the product on its own or through a partnership. Barring a partnering deal on terms impossible to turn down, I think that the company will market the product on its own to approximately 3000 rheumatologists in the United States using 30 to 35 reps.

Tagged as Antares Pharma Inc. + Categorized as Company Reports