Antares: Detailed Sales and Earnings Projections for 2015 and 2016 (ATRS, Buy, $2.77, subscription required)

Investment Thesis

I continue with my long standing recommendation on Antares. Last year was a disappointing year for the stock, but the basic reasons for my positive view of the Company remain largely intact. I discussed this is detail in my report of November 23, 2004 called Antares: 2015 Could Be the Breakout Year for the Stock (ATRS, $2.24, Buy) As the title implies, I thought then and now that Antares is poised for a strong stock performance in 2015. I would urge investors who are not familiar with the Company and/or my perspective of Antares to review that report. The purpose of this report is to explain the reasoning behind my financial model for 2015 and 2016, which is shown in detail at the end of this report.

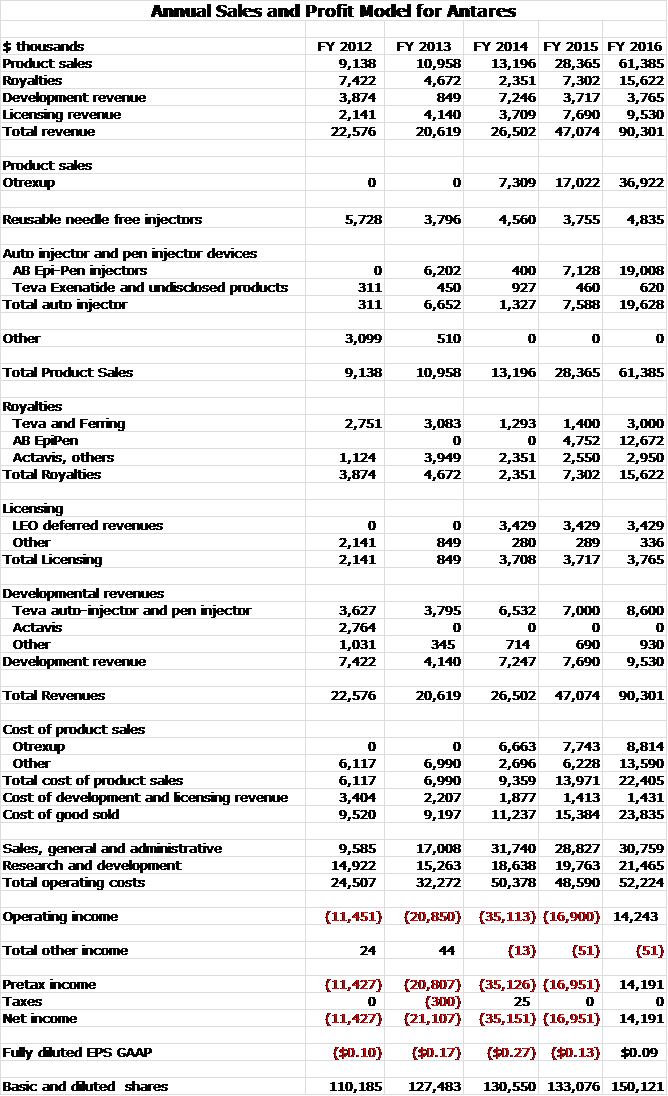

I believe that Antares is now emerging as a Company with a strong and rapidly growing revenues base. Specifically, my model shows that 2015 revenues will increase by 85% over 2014 to $49 million and that 2016 revenues will increase by 89% over 2015 to $93 million. I expect the Company to turn profitable in the fourth quarter of 2015. This type of revenue performance and emergence as a profitable company should attract a much broader base of potential investors than those who invest in emerging biopharm companies; I think this augurs well for stock performance. In focusing on 2015 and 2016, I am ignoring for the time being the promising pipeline of products that will also affect stock price performance and help drive results beyond 2016; these are discussed in my November 23 report.

The one certainty that I found in my years as an analyst on Wall Street and in the last three years that I have been writing this blog is that in my analysis of a company is that a lot of things do not work out as I originally expected. There are just so many unconstrained variables in a company analysis that precision in forecasting is impossible. My basic goal is to try to recognize the major driving forces and remain resolute if my basic investment thesis remains largely intact; I recognize that I am probably going to be wrong or disappointed on some issues. The most disappointing development for me in my analysis of Antares has been the performance of Otrexup in 2014. I thought that sales would come in at $10-$12 million in 2014 and they wound up at $7.3 million which was disappointing. Of concern, recent trends in monthly prescriptions were roughly flat for the October 2014 to January 2015 period.

Addressing the Otrexup uncertainty is a major objective of this report. I continue to believe that Otrexup is an outstanding product that fills an unmet medical need in the treatment of rheumatoid arthritis as a bridge between oral methotrexate that is the drug of choice for initial treatment and the biological drugs that are used as the disease progresses. I still feel very strongly that this is the case. Why then the disappointing sales? There are three probable reasons:(1) reimbursement hurdles have slowed the uptake, (2) the impact from the launch of Medac’s comparable drug Rasuvo in October of 2014, and (3) sales force execution issues. This has led me to use what I think are conservative sales estimate on Otrexup. I am now estimating 2015 sales of $17 million and 2016 sales of $37 million as compared to $22 million and $37 million that I estimated in my November 23, 2014 report. I believe the Street is at $20 million of sales for Otrexup in 2015 (I am at $17 million) and total sales of $49 million (I am also at $49 million). My long term view that the peak sales potential for Otrexup is $100 million remains unchanged.

The other key driver of near term revenues is the launch by Teva of an AB rated version of EpiPen which uses Antares’ auto injection technology. Antares receives revenues from selling the auto-injector to Teva and also from royalties on sales. My conviction that Teva will launch an AB rated version of EpiPen has gone from being pretty certain one year ago to 99% probability. EpiPen is a $1.2 billion product in the US. I estimate that Teva will price their product at a 40% discount and will capture 40% of the market to achieve sales of $250 million in its first year of market which should start in by July of 2015. I estimate that Antares will receive on annualized basis about $19 million of revenues from sales of injectors and $13 million of royalties if Teva’s revenues reach $250 million.

Otrexup and the AB rated version of EpiPen are the two big drivers for sales in 2015 and 2016 and I focus very heavily on their prospects. Beyond 2016, there is a very strong pipeline that promises continued strong growth. However, as I previously stated this report is focused on 2015 and 2016.

Price Target Thinking

Let’s assume for the time being that you accept my sales and earnings projections. How might the stock be valued in 2016? Using a P/E based on EPS is not really meaningful as the company would just be emerging into profitability. Valuing the company on the basis of sales may provide more insight into a possible valuation.

Let’s look at the example of Avanir (AVNR). This Company launched its only product, Nuedexta for pseudobulbar affect, in 2010. The sales growth (mostly due to Nuedexta) has been as follows: $10 million in 2011, $41 million in 2012, $75 million in 2013 and a projected $111 million in 2014. The stock currently sells at $13.88 and there are 160 million shares outstanding giving it a market capitalization of $2.2 billion. The ratio of market capitalization to 2014 projected sales is 20. Avanir is expected to lose about $50 million in 2014 and become profitable in 2015.

Based on my model, Antares may develop sales on a comparable trajectory. Projected sales are $26 million in 2014, $47 million in 2015 and $93 million in 2016. I am projecting full year profitability in 2016. While there are substantial fundamental differences between Avanir and Antares, the sales trajectories are pretty similar as is the manner in which they are projected to become profitable. They are also both thought of as specialty pharma companies.

I think that we can look at the possibility of Antares being valued similarly to Avanir. If Antares were to sell at 20 times 2016 sales its market capitalization would be $1.86 billion and based on say 150 million shares outstanding (allows for some share issuance as current share count is 136 million), the price per share would be $12.40. If it were to sell at ten times sales the price per share would be $6.20. I think that this price target range of $6.00 to $12.00 probably captures the range of possibilities, but doesn’t pinpoint the most probable outcome. My best judgment is that it will be in excess of ten times sales or $6.00 per share with a reasonable chance of something greater.

Otrexup

Otrexup Sales Performance in 2014 Was Disappointing

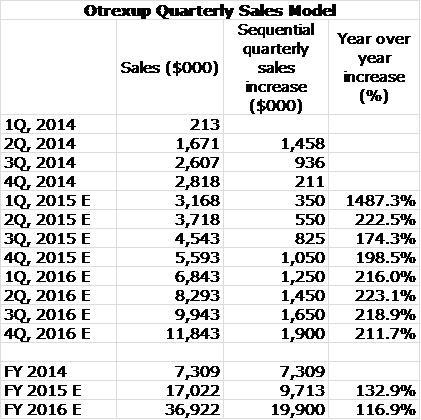

Otrexup was introduced in the first quarter of 2014 and sales by quarter were as follows: 1Q, $0.2 million; 2Q, $1.7 million; 3Q, $2.6 million and 4Q, $2.8 million. The full year sales of $7.3 million were below estimates of Street analysts, my estimates and almost certainly those of the Company. At the beginning of 2014, Wall Street analysts were estimating Otrexup sales of $11 to $17 million for 2014. I thought the lower end of that range was achievable and was looking for $12 million of sales.

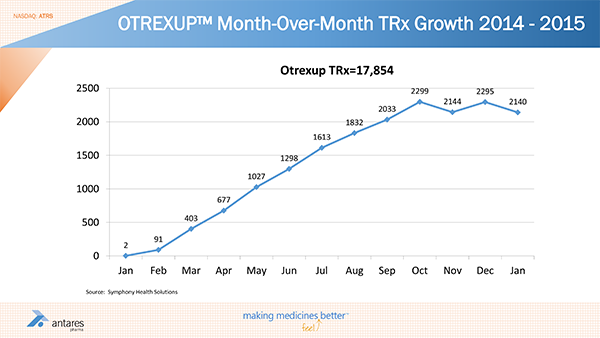

Let’s review 2014 performance by taking a look at the prescription trend for 2014 and January of 2015 as is shown below:

There was a nice, steady increase in prescriptions through October, 2014 although they were below expectations. This was followed by a decline in November and only a small uptick in December and a small downtick in January. This led to a modest sequential increase in reported sales from $2.6 million in 3Q, 2014 to $2.8 million in 4Q. It is important to understand that the accounting employed by Antares only recognizes sales when a prescription is filled. It is not based on sales to wholesalers and hence is a good gauge of actual demand for the product.

What Effect is Rasuvo Havng?

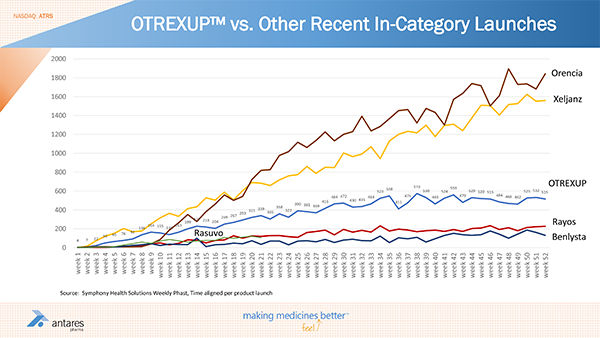

Rasuvo is an injectable methotrexate product comparable to Otrexup that was launched by Medac Pharma in October of 2014. The next chart shows how the launch of Rasuvo and other somewhat comparable product launches have gone; this was taken from a slide at the recent Cowen Conference in March 2015. The chart tracks prescriptions written each week for these products from the period when they were launched. These are drugs intended for use in inflammatory conditions like rheumatoid arthritis and include Orencia, Xeljanz, Rayos, Benlysta, Otrexup and Rasuvo.

This chart offers some key takeaways:

- It shows cumulative prescriptions written for Rasuvo twenty one weeks after launch were about 1,200. Otrexup at twenty one weeks after its launch had 3,498 cumulative prescriptions. This indicates that the launch for Otrexup relative to Rasuvo generated about three times as many cumulative prescriptions twenty one weeks into the launch.

- At the latest week in the survey, Otrexup (52 weeks after its launch) generated 515 prescriptions and Rasuvo (21 weeks after its the launch) had about 100 prescriptions. Hence the current prescription split is 83%/17%

I am not prepared to extrapolate these trends into the future as it just too early, but they seem to indicate that the first mover advantage of Otrexup may translate into a higher market share. While Rasuvo appears to be getting only 17% of the market currently based on prescriptions, I would not be surprised to see it rise to the 30% to 40% range. Rasuvo is probably being sampled much more aggressively than Otrexup.

Medac has come in at a wholesales acquisition price (WAC) that is $100 lower than the $525 for Otrexup. I am a little surprised that Medac is that aggressive on price, but it is a privately held company and doesn’t have to be accountable for shareholder expectations. Of course, WAC is not the same as the actual price paid as there is always a good deal of discounting from WAC. I suspect that Antares has chosen to be price competitive on some accounts and this could have affected sales. I think that this initial price aggressiveness of Medac will ease once they gain a solid foothold in the market. In an oligopoly of two products, there is nothing to be gained from price aggressiveness if the intent of each company is to maximize revenues and profits.

My opinion remains that this is a large potential market in which peak sales of the combined products could be $200 million. It is large enough to support very meaningful sales for both products. However, the launch of Rasuvo certainly seems to have been a factor in the leveling of prescriptions written for Otrexup in the four month period October 2014 to January 2015 as Rasuvo was launched on October 6, 2014. However, this is not the only reason.

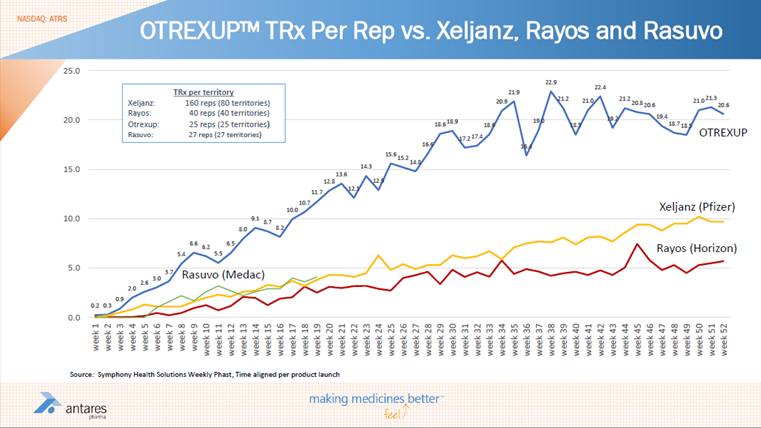

The above chart suggests that Otrexup is leveling off at a point in time post launch at which Pfizer’s Xeljanz was accelerating. However, this may be because Pfizer added many more reps than Antares did with Otrexup. A fairer way to look at this is to look at sales per rep. Viewed in this way, the launch trends for Otrexup appears to be better than Xeljanz or Rayos. Interestingly, Rasuvo seems to be tracking exactly with Xeljanz. Also at twenty one weeks, prescriptions per rep for Otrexup is about 10.7 versus about 4.0 for Rasuvo. Again, this could be distorted by sampling of Rasuvo.

Sales Force Changes at the End of 2014 Probably Had a Negative Effect

Antares launched Otrexup with a contract sales force organized by Quintiles. In the beginning of November, 2014 Antares gave Quintiles notice that it intended to integrate the sales force into Antares. This created uncertainty among the sales representatives, because some were unsure if they would be asked to join Antares. This caused a distraction and probably a drop-off in productivity.

By March of 2015, this process was completed and Antares also expanded the number of sales territories (each covered by a rep) from 25 to 32. Some underperforming sales reps were replaced by people who had previous rheumatoid arthritis product selling experience or were proven top performers from other pharma companies. The Company believes that it will take several months for the new reps to get up to speed. Approximately 13 (roughly 40%) of the 32 territories are covered by new Otrexup reps. This suggests that reps covering 6 territories were let go; this was about a quarter of the original sales force.

Reimbursement Has Probably Been the Biggest Hurdle

The biggest barrier to this point probably has been the reimbursement process; Antares has now put a lot of things into place in order to streamline the reimbursement process for both the physicians and the patients based on its Total Care program. The aim is to make physicians more confident that they will get reimbursed in a timely manner.

Antares states that just since the beginning of 2015 they have signed contracts with multiple managed care organizations covering millions of commercial lives. The goal in addition to gaining coverage is to also remove prior authorizations and step edits wherever possible; these can eat up a lot of a physician’s time and are a deterrent to prescribing.

Management said that in some plans Antares will be in a preferred or exclusive position to their competitor Medac Pharma and vice versa. Antares stresses that it will be fiscally responsible on discounting to plans; it has shareholders to answer to. Medac is less constrained as a private company. The new contracts take effect at various times from January 1 through April of 2015.

The Company recently held its first national sales meeting since the sales reps became full time Antares employees. Sales management reviewed improved messaging and outlined new sales tools such as the Otrexup Total Care program designed to make it easier for patients and physicians to get access to Otrexup. They also reviewed the status of contracts with managed care organizations. The sales representatives spent two days in training.

Impressive Growth in Prescribing Physicians

The number of unique prescribers of Otrexup increased to approximately 1,400 physicians at the end of the fourth quarter of 2014 as compared to approximately 1,000 at the end of the third quarter. This is encouraging as a 40% sequential increase in prescribing physicians would seem to suggest stronger sales down the road. This means that about half of the targeted 2,800 targeted, high prescribing physicians have now prescribed Otrexup. Altogether, they wrote15,700 prescriptions in 2014. Antares believes that penetration of the targeted physician universe will continue to increase.

Projecting Otrexup Sales for 2015

The disruption caused by the Rasuvo launch almost certainly had a negative impact on Otrexup. As I have said repeatedly, I think that this is a large market opportunity that can support both products and some might argue that having two companies promoting an injectable methotrexate product could expand the market to the benefit of both products (this has been the case with many other products in the past). There will likely be a point of time at which market shares for both products will stabilize and both will grow with the market. I just can’t judge when the negative effect of the Rasuvo launch will have run its course and this is a major uncertainty in projecting 2015 sales.

Reimbursement barriers should be reduced in 2015 and beyond and this is a major positive. The new company owned sales force effectively was put in place in January and February. There will be an initial learning curve for new reps and even for the older reps to understand and market the new sales tools. Management is confident that this will have a significant effect on prescriptions in 2015, but the inflection point could come in mid-2015. Finally, market penetration among targeted physicians has been impressive and still has a long way to go.

If someone can come up with a model that interweaves all of these variables into a coherent sales forecast they are certainly much better than me and probably even Antares. I am just making an educated guess at this time and I am trying to keep my projections conservative in the near term. I am looking for modest sequential quarterly sales growth in the first half of 2015. Here is my thought process:

- The sales force will be in flux and the impact of Rasuvo is an uncertainty in 1H, 2015.

- The reimbursement picture should be improving throughout the year and could be a big positive.

- The expanded sales force should have a very meaningful effect in the second half of 2015.

- Another important but hard to quantify variable is physician prescribing behavior. Physicians will usually start one or two patients on Otrexup and watch their response over a period of perhaps a half year. If the patients respond positively as I believe they will, the physicians will begin to become more aggressive in prescribing to more patients.

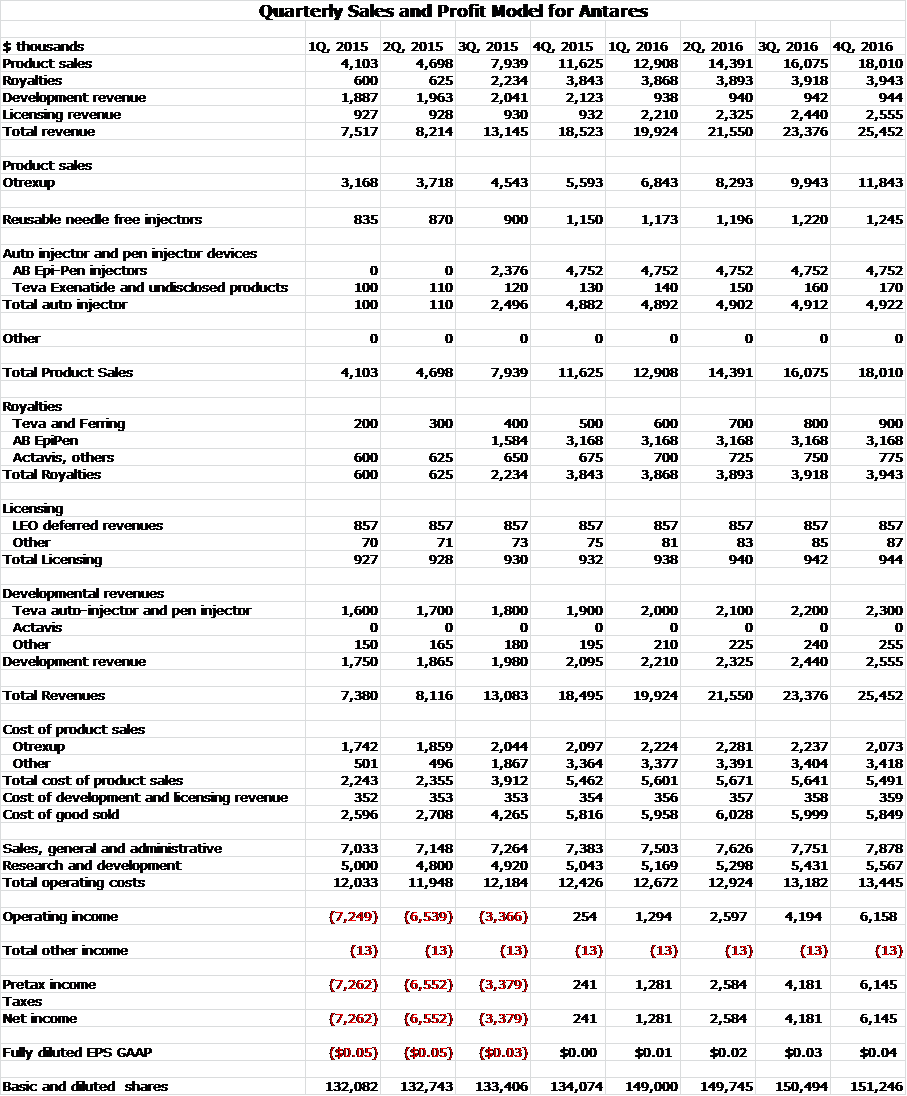

My sales projections are made on the basis of sequential increase in quarterly sales based on a subjective judgment of how the variables I just discussed will work out. This table lays out my projections, click on the image if you want to enlarge it:

AB Rated Generic to EpiPen

The Opportunity for an AB Rated Generic EpiPen is Substantial

EpiPen sales in the US are running at about a $1.2 billion sales rate. Teva and Antares have partnered to produce the first AB rated generic which allows pharmacists to substitute the product for EpiPen. Antares and Teva are not aware of any products that are seeking an AB rating.

An AB rating is based on the FDA judgment that the products are completely interchangeable so that the look and feel of the products is identical. This is extremely important in the case of EpiPen which is used in a potentially life threatening situation. Using the 510 K regulatory process, other epinephrine products have been approved. However, these must be marketed to physicians and require that physicians write a specific prescription for them. The Teva product can be given when an EpiPen prescription is presented and this makes all the difference.

In late 2013 and throughout much of 2014, Antares management was quiet on this product. Also, the company shipped over $6 million of injectors to Teva in 2013 and none so far in 2014. This caused some concern on my part that Teva was encountering difficulties gaining the AB rating. This appears to have all turned around in the last couple of months and management has become pretty confident of an AB rating and launch on July 2015. Both Teva and Epi Pen’s marketer Mylan are including the effect of an AB rated EpiPen in their 2015 sales and earnings guidance. Antares is prepared to manufacture substantial device quantities and it began shipping the devices to TEVA in early. I believe that Teva is on track for a June 2015 FDA approval and an AB rating on their generic.

Antares will be shipping devices before the approval. Teva has to have a fully packaged product at launch and so Antares will be recognizing those device sales before the launch just as they did in 2013 when they shipped $6 million of product. From a royalty standpoint, it’s obviously a function of when Teva starts selling its product. Antares will receive a high single-digit royalty on the value of those products when they are shipped into the trade.

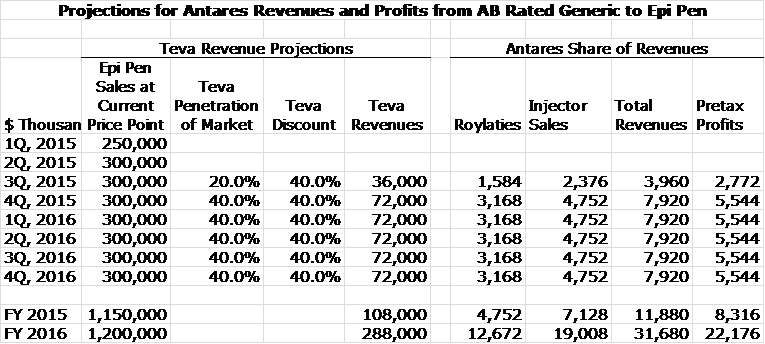

Sales Model for AB Rated Generic to EpiPen

Teva reached a patent settlement with Pfizer (PFE) that will allow the launch of this product on June 15, 2015. Pfizer owns the product, but Mylan (MYL) markets it. An AB rating from the FDA allows pharmacists to substitute Teva’s generic for EpiPen. With an AB rating, the Teva generic could quickly capture a significant share of the market. Without the AB rating, Teva would be forced to market it as a new product and would have to devote considerable resources to establish sales; the commercial potential would be much less.

I estimate that in 2014 EpiPen will have US sales of nearly $1.0 billion and by mid-2015 could reach a sales run rate of $1.2 billon. Mylan is raising prices at 20% per year and continues to aggressively market the product. Mylan has said that if the Teva product obtains an AB rating that it believes that the generic can capture 40% of the market. This is based on the anticipation that Teva will be the only entrant in the market for some time and will not aggressively cut price. With these assumptions, I think that Teva could achieve an annualized sales run rate of $288 million by year end 2015 based on gaining a 40% share of the unit market. Because of the difficulty in obtaining an AB rating versus EpiPen, it may be the case that Mylan and Teva could be the only entrants in this market for some time.

Antares has given guidance that through sales of the auto-injector to Teva and royalties that it will achieve sales equivalent to roughly 10% to 12% of Teva’s sales or roughly $32 million if Teva’s sales reach $288 million. Antares has not given guidance, but I estimate that 60% of these revenues or roughly $19 million will be due to product sales and 40% or $13 million will come from royalties. Assuming a gross margin of 50% on product sales, this would result in a gross profit of $11 million. The combination of $11 million of gross profits and $14 million of royalties would produce $22 million of annualized pretax profits for Antares. Because of prior losses, current earnings are untaxed so that $25 million amounts to $0.17 per share.

All of my assumptions results in the following sales and profit projections:

Source: SmithOnStocks Projections

Sales and Earnings Model for Antares

Antares sales have a lot of moving parts. The 10-K identifies four main areas of revenues: product sales, royalties, development revenues and licensing revenue.

Product sales currently come four sources:

- Sales of Otrexup;

- Sales of the reusable needle free injector to Ferring used with Tev-Tropin in the US,

- Auto-injector sales for (1) the AB rated EpiPen injector, (2) development of other products such as an AB rated generic to exenatide development with Teva and (3) development of an undisclosed product with Teva.

Royalty revenues come from

- Sales of Tev-Tropin in the US and abroad by Ferring,

- Sales of an AB rated EpiPen,

- Older gel based products such as Gelnique of Actavis.

Developmental revenues arise from amortization of milestone payment from LEO for Otrexup. Developmental revenues also arise from work with Teva on auto-injectors and pen injectors.

In 2014 sales of Otrexup accounted for $7.7 million of sales which was 28% of revenues. According to my estimates, in 2015 and 2016 sales of Otrexup and EpiPen related injector sales and royalties will account for $28.9 million and $68.6 million or 61% and 76% of total revenues. My quarterly sales projections are shown below along with my detailed sales and earnings projections.

I think that investors will focus first on sales growth. With the introduction of the AB rated generic to EpiPen, I am looking for year over year quarterly sales to more than double starting in 3Q, 2015 and continuing through 3Q, 2016. My projections show Antares reaching profitability in 4Q, 2015.

Source: SmithOnStocks Estimates

My annual sales and profit model is shown below:

Tagged as Antares Pharma Inc., ATRS, EpiPen, Medac Pharma, otrexup, Rasuvo + Categorized as Company Reports

8 Comments

Trackbacks & Pingbacks

-

Comments on Antares, Agenus, Cytokinetics, Discovery Laboratories and ZS Pharma | Expert Financial Analysis and Reporting | Smith on Stocks

[…] just wrote an update on Antares in which I made projections for Otrexup sales and sales of an AB rated generic to EpiPen, which is […]

-

Antares: One of My Top Stock Picks for 2015 and 2016 (ATRS, Buy, $2.40, For Paid Subscribers) | Expert Financial Analysis and Reporting | Smith on Stocks

[…] As can be seen in the above table as I am projecting that 2016 revenues will be about four times the level of 2014. For those who would like a little more understanding on how I got to those numbers, I recommend that you read my report of April 23, 2015 called Antares: Detailed Sales and Earnings Projections for 2015 and 2016, […]

Comment

You must be logged in, or you must subscribe to post a comment.

Dear Larry,

thank you for your update on Antares Pharma.

Unfortunately you forgot the recent news, that Teva is trying to buyout Mylan.

I do not think, that they will launch an generic EpiPen if they have the right to marketing the

branded product.

Yesterday i contacted Jack Howarth from Antares with the following question:

“Do you see any impact regarding the projected launch and the potential for the Gx EpiPen?

And if there is a change in the Teva strategy because of the bouyout – do Antares has the

Right of First Refusal on Gx EpiPen?”

Her his answer:

“Stefan – the epinephrine pen ANDA submitted by Teva remains under active review at the FDA. With respect to the remainder of your question, I would be happy to walk through the possibilities when and if Mylan accepts Teva’s offer and when and if there is a change to Teva’s strategy.”

Anyway i see a little insecure situation and guess we will here more details in May at the Q1 Conference Call.

Best Regards

Stefan

Please with your commentary list a price target for a stock

is Stefan,

If Teva would try and withdraw their generic epi application the FTC would never approve the merger and Teva is well aware of this. Also, once epi approval is granted consumer groups would ensure that there are no delays with launching the product. Even if this merger would be attempted, it would be well into 2016 before it would have any chance to close due to the layers of anti-trust issues that would have to be overcome. Simply, there is no risk of Teva delaying or attempting to remove their generic epi application. If a Teva / Mylan merger would ever occur, divestitures of certain products would be required butt only at that time. No product divestitures will occur until it’s a certainty that a deal such as this could close. Bottom line is as Larry said, if Teva would buy Mylan it would be a neutral event for Antares.

Larry,

Curious – do you think Antares will need to raise cash in 2016? I ask because the 10K from 2014 indicated that no cash raise would be needed this year due to anticipated milestones and other payments (etc) in the forseable future. included would be the Epi approval milestone, Antares share of the related settlement payment, the Suma approval or launch milestone, and the Pfizer gel milestone (if or when the latter ever occurs). There is also reasonable speculation that the QST partner will be named this year and an upfront payment may (or should) be associated with that event. If even most of those events transipire, and profitability is achieved by Q4, why would Antares need to raise cash?

Hi Larry,

today Antares announces Termination of LEO Pharma Marketing Agreement.

What does this mean for your Otrexup sales numbers?

The 8-K says that LEO was 5% of total prescriptions. Given the confidence interval around my estimates, I will probably not change the sales estiimates.