Northwest Biotherapeutics: A Critique of Adam Feuerstein of TheStreet’s Recent Analysis (NWBO, $3.50)

Purpose of this Report

I have undertaken a point by point examination of a negative blog on Northwest Biotherapeutics (NWBO) by Adam Feuerstein of The Street.Com. I ordinarily don't respond to comments that other bloggers make on companies. However, in this case Mr. Feuerstein accused the company of purposely deceiving investors on the results of its clinical trials and I could not stand by and let his comments go unchallenged. I have taken verbatim quotes from his blog, as I didn't want to be perceived as twisting his words or meanings, and responded to them.

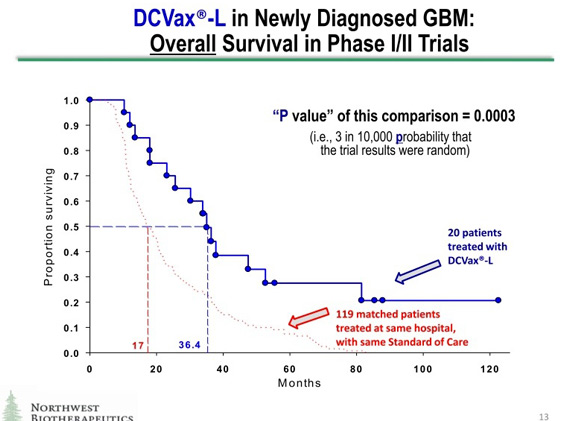

Explanatory Note: Some of Mr. Feuerstein's comments deal with the interpretation of data shown in the following graph that is part of NWBO's investor presentation.

1. Adam Feuerstein : Powers claims the company's cancer immunotherapy DCVax [sic, DCVax-L] demonstrated a large and statistically significant survival benefit in a couple of phase I brain tumor (glioblastoma multiforme, or GBM) studies. The blue line represents survival of the 20 GBM patients treated with DCVax; median overall survival is 36.4 months. These data were collected from single-arm studies, meaning all the patients received DCVax. There was no placebo or other control treatments to compare against the DCVax survival results.

SmithOnStocks : Mr. Feurstein implies elsewhere in his blog that Northwest was attempting to portray this as a randomized trial comparing DCVax-L to a control group of patients and that this was deceitful. This was clearly not the case, as can be seen from the explicit labeling on the slide. In the first place, phase I/II trials are by definition, single arm, non-randomized studies and the graph clearly states that this data is from a phase I/II trial; this is clinical trials 101. In addition, the slide specifically states that the red line is "matched patients" treated at the same hospital with the same standard of care. The term matched patients also has a standard meaning. It means that these are patients who were not in the clinical trial but who have similar characteristics as the patients who were in the trial (comparable concomitant treatment, age, gender, physical condition, etc.); this is also clinical trials 101.

The graph specifies that there were 20 patients in the DCVax-L arm and 119 in the matched patient group who were treated at the same hospital and with the same treatment. There would be no reason to note this if this was a randomized trial and all of the patients were within the same trial. Moreover, no phase II or phase III randomized trial would have 20 patients in the drug arm and 119 in the control arm; again clinical trials 101. This makes it immediately apparent that the two lines are not data from a single randomized trial.

I see no intent to deceive and no basis for confusion about this data. I think that all clinicians, regulators and experienced biotechnology investors would view this for what it plainly says it is: namely, a comparison of the DCVax-L phase I /II results to results that were seen at same hospital with patients treated with standard of care that were not in the DCVax-L phase I/II trial. They would immediately recognize what the company is doing and none would think that the two graphs represent data from the same trial.

2. Adam Feuerstein: The red dotted line in the chart above represents overall survival data from 119 "matched patients." Northwest Bio claims these "matched patients" had a median overall survival of 17.0 months, implying a 19.4-month survival benefit favoring DCVax.

SmithOnStocks : The 20 patients who received DCVax-L plus standard of care had a median overall survival of 36.4 months while the data for the 119 matched patients show a median overall survival of 17.0 months. Based on these data sets, there is indeed a 19.4 month difference in median overall survival favoring DCVax-L.

Note that the survival benefit favoring DCVax-L may be even greater than 19.4 months (it could actually be represented as 22.2 months) if the DCVax-L data are compared to the "official" figure on median survival that was achieved in the pivotal clinical trial which formed the basis for regulatory approval of what is now the standard of care for GBM.

The de facto "official" figures come from the survival results in the 573-patient phase III randomized, controlled trial which was the basis for regulatory approval of what is standard of care today. This Stupp protocol consists of surgery, followed by 6 weeks of radiation plus daily concomitant chemotherapy with temozolamide, followed by monthly cycles of temozolamide. The phase III pivotal trial which formed the basis for approval of temozolamide and

established this regimen as the standard of care was led by Dr. Stupp, and was published in the New England Journal of Medicine in 2005. N Engl J Med 352: 987-96, 2005. The result of this pivotal trial was that patients who were treated with the Stupp protocol had median survival of 14.6 months. This represented improvement of 10 weeks beyond the median survival with what was standard of care at the time in 2005.

The "official" figure then is for median survival of only 14.6 months. By comparing its phase I/II trial results (36.4 months median progression free survival) with the matched control patients represented in the red line in the chart (17.0 months of median survival), the Company used a materially tougher comparison for DCVax-L than the "official" estimate of 14.6 months (The 2.5 month difference between a median of 14.6 months and a median of 17 months is equivalent to the whole survival benefit seen with temozolamide in the Stupp trial). So, using the 17.0 month matched-patients median as the comparison for DCVax, instead of the de facto "official" median of 14.months, amounts to treating the survival extension from temozolamide as double what it was in the Stupp trial.)

3. Adam Feuerstein : Northwest Bio actually runs a statistical analysis and finds the DCVax survival benefit is highly statistically significant with a p value of 0.0003. Northwest Bio has the chutzpah to claim the benefit conjured up in this ginned-up survival analysis is statistically significant.

SmithOnStocks : The Company determined a "p value" for the comparison between the two sets of patients: those treated in its phase I/II trials and the 119 matched patients. The slide explicitly stated that the p value presented was the p value "of this comparison."

The purpose was to give an indication of the significance of the differences in clinical outcomes (length of survival) of patients who received DCVax-L compared with matched patients who received existing standard of care and did not receive DCVax-L. Although p value is usually associated with results of a randomized controlled trial, there is nothing about the p value that necessarily limits it to being used only in this way. It is simply a statistical tool to enable comparisons. As long as the comparisons are clearly described, as they certainly are in NWBO's slide, there is nothing deceitful about using this statistical tool to give an indication of the magnitude of differences in therapeutic benefit between patients given DCVax-L plus standard of care as compared to patients given just standard of care. In fact, it can be illuminating as it is in this case, as the p value is a strong 0.0003.

The accepted view about the p value is that p=0.05 is the point at which the difference in the data sets is significant. This is also the level of p value that regulators generally set for a product approval. It means that there is one chance in twenty (a 5% chance) that the outcome occurred by chance. In the case of a p value of 0.0003 it means that there are 3 chances in 10,000 that the outcome occurred by chance.

4. Adam Feurstein : This DCVax overall survival analysis is sloppy, wrong and wildly misleading. The 119 "matched patients" were not enrolled in the DCVax studies. Northwest Bio doesn't tell us how they were chosen for this faux control group. What was the baseline health of these patients? We don't know. How was their GBM treated? We don't know. When were they treated? We don't know. Were other GBM patients excluded from inclusion in this faux control group? If so, why? We don't know.

SmithOnStocks : The term "matched patients" has a fairly standard meaning. It means matching the characteristics of the 119 patients to those of the 20 patients in the DCVax-L trial based on such key elements as: comparable concomitant therapy, age, gender and physical condition (Karnofsky score). In addition, the Company specified right on the slide two critical factors: (1) the matched patients received treatment at the same hospital and (2) received the same standard of care treatment as the patients in the DCVax-L phase I/II trial. The Company has also stated in its presentations that the matching factors included all available prognostic factors.

This is not of the same precision as a randomized trial, but it is a reasonable way to present a comparison that provides context for data from phase I/II trials. For example, ImmunoCellular (IMUC) also displays its single-arm Phase I trial data in comparison to patients who received only standard of care.

5. Adam Feuerstein : Linda Powers remains CEO and dominant shareholder through two intertwined entities she controls -- Toucan Capital and Cognate BioServices. (The latter is Northwest Bio's manufacturing partner, which puts more money in her pocket.)

SmithOnStocks : There seems to be a clear implication that insider dealings have benefitted Ms. Powers at the expense of shareholders. I have gone over her financial dealings with the company in considerable detail in my July 19, 2012 report and also in my January 14, 2013 report. The bottom line is quite the opposite of this implication of benefit to Ms. Powers. Without the capital Toucan invested and without Cognate having continued to manufacture for NWBO for several years without being paid, which no unrelated party would have done, NWBO would no longer exist today. NWBO was not able to finance through the capital markets until very recently because of the weak financial position of the company and the skepticism of the investment community about immunotherapy.

Ms. Powers, certain non-traditional investors and Cognate were the only sources of capital available. I might add that all of the investments of Ms. Powers and her affiliated funds were made at or above the prices of other investors, and nearly all were at higher than today's price. In regard to Cognate

BioServices, this is a company owned by Ms. Powers and her funds. It continued to manufacture product for NWBO's clinical trials even though NWBO was unable to pay them; as a result, NWBO accrued significant liabilities to Cognate. The bottom line is that without the investments of Ms. Powers and the support of Cognate, NWBO would almost certainly have failed. She now owns or controls about 40% of the outstanding stock. If you are looking for CEOs with skin in the game, she has to be at the top of the list.

6. Adam Feuerstein : Smart investors shun Northwest Bio because Powers spends a majority of her time promoting the stock instead of directing credible drug development.

SmithOnStocks : I am clearly not a smart investor by Mr. Feuerstein's standards whatever they may be. However, I think that when readers compare my responses to Mr. Feuerstein's arguments, they will conclude that I have done considerable due diligence.

I think that this allegation is absolutely wrong. In fact, Ms. Powers has focused so much on substantive operations, and done so little promotion up till now, that in my past reports I have compared her to an empty chair in the public debate among competitors in this space. NWBO is a small company with limited human resources. Ms. Powers has been stretched like a rubber band as she has worked on establishing critical collaborations with Fraunhofer in Germany and King's College in the UK to establish manufacturing in Europe and move the phase III clinical trial forward in Europe and the US. She has also spent an enormous amount of time on the recently completed restructuring of the balance sheet, fundraising and up listing from the pink sheets to NASDAQ.

In contrast to Mr. Feuerstein's allegation that she has spent all her time promoting the stock, Ms. Powers has actually been quite inactive on public promotion. Her presentation at the BIO CEO conference last week was the first presentation at a significant investor conference in a couple of years. My experience is that many CEOs of emerging biotechnology present three to six times per year. Far from promoting the stock, I think that her pre-occupation with operational programs has meant that investors have not had the opportunity to meet her and understand her strategy. She plans to become more visible and as she does, I think that many investors, as is the case with me, will be impressed.

7. Adam Feuerstein : Northwest Bio simply wants you to suspend critical thinking and believe the 20 handpicked GBM patients selected for treatment with DCVax by an investigator at a single hospital lived more than twice as long as 119 other hand-selected patients who weren't enrolled in the same study.

SmithOnStocks : Mr. Feuerstein seems to imply that the patients in NWBO's Phase I/II trial were "handpicked" in the sense of biased selection and that the patients did not live more than twice as long as the matched patients. Mr. Feuerstein cites no basis of any kind for either of these serious accusations. Mr. Feuerstein overlooks the fact that these data have been reviewed and accepted by both the FDA and the UK's MHRA (the UK equivalent of FDA), as well as multiple major partners of NWBO, the German government, and investigators and IRBs at 41 clinical trial sites.

Mr. Feuerstein also overlooks the fact that, regardless of whether NWBO's phase I/II trial patients lived more than twice as long as a group of matched patients, they lived even more than twice as long compared with the "official" survival data from the 573-patient Stupp trial, as explained above.

There is no substitute for a randomized trial, but this doesn't mean that there is not a lot of valuable information that can be garnered from the phase I/II data presented by Northwest.

8. Adam Feuerstein : Northwest Bio has even shape-shifted the ongoing phase III study of DCVax in GBM patients to make it look more robust than reality. The study is designed to enroll 300 GBM patients who have already undergone surgery, radiation and Temodar therapy. They're then randomized to receive DCVax or a placebo, with progression-free survival as the primary endpoint. What the company wishes investors would forget is that this DCVax GBM study began life as a smaller phase II study in 2006-2007, which was never conducted or completed. Instead, the study underwent numerous changes and was stopped and re-started. Last May, Northwest Bio decided to upgrade the study and call it a phase III clinical trial.

SmithOnStocks : In the US and Europe, in order for a trial to be called a phase III trial, a company must go through a rigorous discussion with and review by regulators in which there is interaction on trial design, the statistical analysis plan and other aspects of the trial. The regulators must be satisfied that there is a sufficient basis for the trial and that all aspects of the trial are satisfactory before the regulators will allow a trial to proceed as a Phase III trial.

Regulators must also be satisfied that the manufacturing is at a level of rigor that it can be relied on to reliably reproduce the product in the clinical trials and also if it is successful in the trial and commercialized. This is particularly challenging with a living cell product.

Northwest has passed muster on all these fronts and has obtained regulatory approval of its current trial as a Phase III trial from regulators in two different countries: the US and the UK. Contrary to Mr. Feuerstein's assertion, a company cannot just choose to "call" its trial whatever it wants. In order to be in a Phase III trial, a company must obtain regulatory approval.

9. Adam Feuerstein : The Company can call the study whatever it wants, but the fact remains the only prior data on DCVax in GBM comes from 20 patients, all enrolled at a single center. There is no survival benefit, no credible data to believe DCVax is having any benefit for patients.

SmithOnStocks : The Company is calling the trial now in progress a phase III trial because it has been approved as such by the FDA and the UK's MHRA.

Mr. Feuerstein cites no basis of any kind for his claim that "there is no survival benefit" from DCVax-L and "no credible data to believe that DCVax is having any benefit." Mr. Feuerstein's unsupported claim stands in stark contrast to actions by regulators in both the US and UK, the Fraunhofer Institute, Kings College, Sarah Cannon Research Institute, the German government and the investigators and IRBs at 41 medical centers across the US serving as sites in NWBO's Phase III trial, and multiple other parties. Their approval or involvement with NWBO's programs can only be interpreted as their viewing the data on the survival benefit as being credible.

NWBO has clearly stated in all of its regulatory filings and in its investor slide presentations that its prior data comes from a phase I/II trial of 20 patients from a single center. It has never called this anything else. The data from the phase I/II trial provides, I believe, credible evidence of a delay in disease progression and survival benefit.

10. Adam Feuerstein : The last cancer-focused company to jump from a tiny phase I study right into a large phase III was Celsion (CLSN_) and that didn't turn out well. Wall Street largely shunned Celsion until the very end because no one believed its data, which sounds a lot like Northwest Bio.

SmithOnStocks : Although it is relatively rare for a company to go directly from small Phase I/II trials to a large Phase III trial as NWBO has done, there are several factors which seem to make it a reasonable business judgment by NWBO. First, it is likewise relatively rare for an experimental cancer treatment to show such a large difference in clinical outcome (such a large extension of survival) as DCVax-L showed in NWBO's Phase I/II trials. In metastatic disease, improvement of 4.0 months in median overall survival is considered quite good. DCVax-L showed a 17.0 month or more improvement

Second, the fact that the time to tumor recurrence and overall survival time were both extended in patients treated with DCVax-L provides some added comfort about the clinical effects seen. Third, other parties have done some work that provides some corroboration. Dr. Keith Black, who is now associated with IMUC, conducted a clinical trial at Cedars Sinai with essentially a copy of DCVax-L, and obtained largely the same clinical results as shown in NWBO's phase I /II trials. Those results were published.

In addition to these factors, NWBO has carefully designed its Phase III trial to take special account of the fact that the Company has gone directly from a small Phase I/II trial directly into the large Phase III trial. This was explained in detail in the same slide deck from which Mr. Feuerstein selected the slide above, and Ms. Powers specifically discussed these special points about the Phase III trial design in her presentation of the slides at the Bio CEO conference in early February.

The key to success in a phase III trial is powering the trial appropriately. The most critical assumption is the difference in the expected outcome in the treated group from the control group. This assumption forms the basis for the size and powering of the trial. NWBO has been conservative on this critical point in their phase III trial design: they have designed the trial so that to satisfy the primary endpoint, the results only have to be 1/3 as good as the results in NWBO's Phase I/II trials i.e., a 6-month extension of progression free survival, rather than an 17-month or more extension as was seen in the Phase I/II trials as compared with standard of care.

NWBO has also built at least two further important protections into their Phase III trial design. First, NWBO has powered the trial for the secondary endpoint of overall survival in addition to the primary endpoint of progression free survival. Second, NWBO has built in an interim analysis for size of the trial in addition to two interim analyses for efficacy. This allows NWBO to increase the trial size if needed in order to have sufficient powering.

In many drug development programs, phase I and phase IIa trials may not provide a clear insight into the differences in treatment effect between drug and control. Companies usually are looking for signals of activity in phase I and focus most heavily on safety and dosing. They then proceed to phase II trials to try to determine in a much larger population the difference in effect between drug and control in order to design and power the phase IIb or phase III trials. While this is the usual approach, there is no regulatory or clinical requirement to do a phase II. If a sponsor has reasonable confidence in their estimate of the difference in therapeutic effect and is confident on safety, there is nothing wrong with proceeding directly from small Phase I/II trials to a large phase III. I do acknowledge that this is not the usual course of action, but in NWBO's situation it may be a reasonable business judgment, especially with the conservative assumptions and additional protections they have built into their Phase III trial design.

11. Adam Feuerstein: I'm skeptical about ImmunoCellular but with an open mind waiting for data at year's end from the first adequately designed study of ICT-107. Northwest Biotherapeutics is much more difficult to take seriously given the company's checkered past and present.

SmithOnStocks : Of all the comments that Mr. Feuerstein has made, I find this to be the most puzzling as to why he is open-minded about IMUC and close-minded about NWBO. Let me go through some important points to consider.

1. Both ImmunoCellular and Northwest Biotherapeutics are basing their studies on small phase I/II data sets. There were 16 patients in the ICT-107 study and 20 in the trials of DCVax-L. The results (as reported by the companies in their investor presentations) were remarkably similar as progression free survival was 16.9 months for ICT-107 and 26.4 months for DCVax-L. Median overall survival was 38.4 months for ICT-107 and 36.4 months for DCVax-L.

2. Both IMUC and NWBO are comparing the results of their phase I or I/II trials to the clinical results in matched patients treated with standard of care. The companies use different methods of portraying the comparison but both are doing so. Mr. Feuerstein was fiercely critical of the chart in which NWBO compared its Phase I/II data with matched controls.

3. NWBO is now in a Phase III trial while IMUC is in a Phase II trial. In his presentation at the BIO CEO conference in early February, the CEO of ImmunoCellular described the ongoing 124 patient ICT-107 trial as a phase II trial and stated that he believed the company would have to do a confirmatory phase III trial before seeking regulatory approval. Mr. Feuerstein did not indicate whether he believes this is a phase II or phase III trial, but other bloggers have mistakenly stated that it is a phase III trial.

4. NWBO's current 312 patient phase III trial is nearly three times the size of IMUC's current 124 patient phase II trial. There is a widespread misconception about the patient size of the IMUC's current trial. Because ICT-107 only works in a certain immune type (HLA A1 and A2 positive) it is not applicable to the entire glioblastoma population. In the phase I/II trial of ICT-107, the company screened 278 patients, but only 124 patients were randomized and enrolled in the trial. Over 50% of patients screened were excluded, primarily because of the immune typing issue. Some investors have not understood that this is a 124 patient trial, not 278 patients.

5. NWBO's phase III trial has a better chance of reaching statistical significance because it is so much larger. The size of IMUC's trial (number of patients) is relatively small in relation to the anticipated difference in treatment outcome (6 months of additional survival), and may be underpowered.

6. NWBO's trial has been approved as a Phase III trial by two different regulators: the US FDA and UK MHRA. IMUC's trial has only been approved as a phase II trial by one regulator (the FDA).

7. NWBO has extensive collaborations with large marquee partners in both the US and Europe, which provides significant third party validation. There is no such validation for IMUC's technology.

8. NWBO has completed phase I/II trials in two other cancers besides brain cancer (prostate and ovarian) cancers, and both of these trials had encouraging or striking results. IMUC has not conducted any other clinical trials with any other product besides the one 16-patient Phase I trial in brain cancer with ICT 107.

9. NWBO has received more regulatory approvals for more and larger trials than IMUC. NWBO received an extraordinary scope of approval from FDA for its first-in-man, combined phase I and II trial of its DCVax-Direct product for direct injection of dendritic cell precursors into any type of solid tumor that is inoperable. This trial starts with 36 patients, and includes dose escalation and confirmation, and efficacy endpoints, not just safety. NWBO also received FDA approval some time ago for a 612-patient randomized, controlled phase III trial in prostate cancer. IMUC has received only small phase I trial approvals beyond its current phase II trial with ICT 107. IMUC received FDA approval of a small phase I trial in recurrent GBM brain cancer (the same type of brain cancer as is already addressed in its current trial), and a 20-patient phase I trial in ovarian cancer.

10. NWBO's product lines have broader applicability to diverse cancers than IMUC's products. NWBO's DCVax-L is applicable to all solid tumor cancers that can be surgically resected. NWBO's DCVax-Direct is applicable to all solid tumor cancers that are inoperable - and FDA has approved it that broadly for trials. IMUC's products hopefully will eventually be shown to apply to several cancers, but as of now, IMUC's ICT-107 is only applicable to brain cancer and ICT-140 is only applicable to ovarian cancer. IMUC's ICT-121 targeting a single biomarker believed to be on cancer stem cells may eventually be applicable to many cancers but that is unclear as of now.

11. NWBO is positioned to be able to apply for product approval in both the US and Europe, while IMUC is only positioned in the US. NWBO is not only conducting its phase III trial in Europe, it has also established a manufacturing capability in Germany and the UK, a process that took more than two years, while IMUC is manufacturing only in the US.

In view of the above factors, I find it difficult to understand why Mr. Feuerstein is open-minded about IMUC as a company and close-minded about NWBO. I would also expect that Mr. Feuerstein would be more positive on DCVax-L than ICT-107, but for unexplained reasons he is more positive on ICT-107. I draw the opposite conclusion and find DCVax-L to be the product more likely to be successful in the current clinical trials.

While I favor the chances for success of DCVax-L over ICT-107 based on everything I know, investors should not think that I am slamming ICT-107. The most important thing to remember is that both ICT-107 and DCVax-L have shown unusual, powerful median overall survival and median progression free survival benefits in glioblastoma, an extremely aggressive cancer in which the average patient dies in about 14 months. There is a large unmet medical need for new and better treatments for brain cancer, and as I have previously written, both drugs have the potential to be successful in their clinical trials and subsequent commercialization. If their clinical trials are successful, both drugs have blockbuster potential. It is not a zero sums game between the two products.

Closing Comments

I have no issue with Mr. Feuerstein taking the position that the phase III trial of DCVax-L is a risky undertaking and could fail. I agree. Glioblastoma is a tough disease and dendritic cell cancer vaccine technology is in its infancy and there is much to learn about how to use it. However, clinical trial risk is not unique to DCVax-L as risk of failure is inherent in all clinical trials. I have seen phase III trials conducted by big pharma and big bio fail after years of clinical trials and the expenditures of hundreds of millions and in some cases a billion dollars. The recent failure of bapineuzumab for Alzheimer's' disease comes to mind.

The reason that I have gone to great lengths in this note to critique Mr. Feuerstein's comments is that they were made with no discernible effort at fairness and balance. I think that authors who are advising investors have an obligation to present both the negatives and positives of an investment case. It offends my sense of fairness when an article like his only presents negative statements in the worst possible light and without any apparent basis. I felt obligated to give investors a balanced perspective on the issues that Mr. Feuerstein raised.

I am not trying to convince investors that the phase III trial of DCVax-L will be successful. My argument is that there is reasonable chance for success and investors seem to be just beginning to realize this. If the trial fails, the disappointment is likely to cause the stock to fall precipitously. There is a chance that investors could lose most of their investment. I am willing to accept this risk because I perceive the upside in the chance of success to be so great that the risk of losing all of my money is acceptable in the risk/ reward evaluation.

If in the case of extreme success in which phase I results are replicated in the phase III trial, based on comparisons with comparable company situations, I could see a market capitalization of as much $1 billion or more. In the event that the results are much less robust but still positive, the market capitalization might still reach $500 million. The current market capitalization is about $90 million. The upside for the stock price in these two scenarios could be on the order of $15 to $35. This must be weighed against the risk of losing $3.50 (all of your current investment) if the trials are so disappointing that clinical development of DCVax-L is discontinued and all pipeline projects are discontinued. This is obviously the extreme worst case.

Tagged as Northwest Biotherapeutics Inc. + Categorized as Company Reports