Antares: One of My Top Stock Picks for 2015 and 2016 (ATRS, Buy, $2.40, For Paid Subscribers)

Introduction to Report

One of my assets is also one of my biggest drawbacks. When I am writing on a Company I start out thinking that I have a good understanding of the Company, but inevitably as I dig deeper, I find out that the more information I gather the more questions that arise in my mind. Reports that I initially think can be a few pages sometimes escalate to encyclopedic proportions. Some subscribers have said to me that they have “day jobs” and can’t spend several hours reading and digesting a report. They have asked that I sometimes just give my bare-boned reasons for an opinion on a stock and if it catches their interest they will dig deeper. It is painful for me, but I am going to try to do so with this note on Antares.

The Antares Investment Thesis

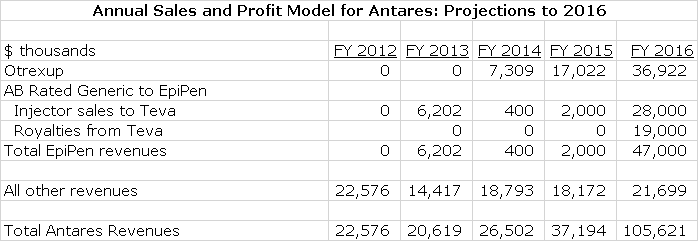

In a nutshell, the fundamental driver of my recommendation is that I believe that the rubber is finally meeting the road for the launch of Otrexup; I am looking for impressive sales growth in 2015 and 2016. Secondly, I believe that the probable launch by Antares’s partner Teva of an AB generic to EpiPen will result in a quick explosion of injector sales and royalties for Antares. Here are my projections for 2014, 2015 and 2016 for these products and Antares as a whole.

As can be seen in the above table as I am projecting that 2016 revenues will be about four times the level of 2014. For those who would like a little more understanding on how I got to those numbers, I recommend that you read my report of April 23, 2015 called Antares: Detailed Sales and Earnings Projections for 2015 and 2016,

Investment Thinking

In my experience, the dramatic growth in sales that I am projecting is almost invariably accompanied by equally dramatic growth in stock price. Another key factor correlating with stock price performance is upside surprises from consensus expectations. As investors began to see in late 2014 that Otrexup’s launch was slower than expected; fear began to build that it would be a flop. If my sales projections come to pass, I believe it will be a significant upside surprise. Gaining an AB rating on an injectable product is always difficult and it is especially so for EpiPen. The Antares/ Teva device has to have the exact look and feel of the injectable branded drug EpiPen because it is used in life threatening situations. If the FDA feels that there is any difference in the device that might create a problem for a patient, it would not grant an AB rating which allows the pharmacist to interchange the two products. This is a difficult engineering challenge and has caused many investors to believe that the Antares/Teva product might not get the AB rating. The product might still be approved, but without an AB rating sales would be minuscule. This has created uncertainty and approval would be a great relief. I think that if an AB rating is gained, it will be a trigger that could cause a very sharp increase in the stock price; I expect this approval in 2H, 2015.

Another key issue in my thinking is that I believe that Antares has been the subject of significant naked short selling as described in my recent report “Illegal Naked Short Selling Appears to Lie at the Heart of an Extensive Stock Manipulation Scheme.” When the Otrexup launch stumbled in late 2014 and as uncertainty arose over Quick Shot Testosterone (the next major new product opportunity) we saw one of the finest example of the illegal naked shorting tactic of walking the stock down resulting in a near 50% decrease in the price. If I am correct, hedge funds who have been shorting Antares may get squeezed.

Price Target Thinking

I am basing much of my price thinking by comparing Antares to valuations of other specialty pharmaceutical companies. Because Antares is in an early stage of corporate development and is spending heavily on R&D and marketing infrastructure, valuing the company on the basis of applying a P/E ratio to 2016 estimated EPS of $0.15 is not a reasonable way of valuing the company. I think that looking at the ratio of market value to sales may be a better approach. This is not a rigid valuation approach for an emerging biopharma company (there are none that I am aware of) but it is a way of thinking about the price target. Let me start by looking at what I think might be the most positive and most negative outcomes based on the market value to sales ratio.

For the most positive case, let’s look at the example of Avanir. This Company launched its only product, Nuedexta for pseudobulbar affect, in 2010. The sales growth due to Nuedexta was as follows: $10 million in 2011, $41 million in 2012, $75 million in 2013 and an estimated $111 million in 2014. (I am projecting for Antares 2015 sales of $38 million and 2016 of $106 million. Avanir was acquired by Otsuka in December 2014 for $3.5 billion which was 32 times expected 2014 sales. There are many differences between Avanir and Antares of which the most striking are that Nuedexta has a much better patent position than the products of Antares, but Antares has a much broader pipeline. At the other extreme in valuation is Acorda. Of 2014 revenues of $401 million, the product Ampyra accounted for $331 million of sales. Ampyra is a maturing product and faces a major patent challenge. The Company has an interesting and broad pipeline. Currently, it sells at about 3.1 times projected 2015 revenues.

Using the Avanir market capitalization to sales ratio of 32 times and applying it to projected 2016 revenues of $106 million for Antares in 2016 would result in a market capitalization of $3.4 billion. Taking into account the 26 million shares issued in the May, 2015 stock offering, Antares has about 158 million shares outstanding. This $3.4 billion market capitalization would result in a stock price in 2016 of $31. At the other extreme, applying the 3.1 market capitalization to sales ratio given to Acorda would result in a market capitalization of $329 million and a 2016 price per share of $2.08. If we look at these two estimates of $31 and $2 as being at the extremes of a bell shaped curve (perhaps two standard deviations), the mean be a market capitalization 16.5 times sales and a stock price of 16.50.

I know this doesn’t exactly provide a clear insight on a possible price target. However, my educated guess is that the market will value Antares at 6 to 9 times sales which leads to a price target range of $4.00 to $6.00 in 2016. If I am wrong, I think I will be low.

There is still another aspect to Antares that I have not touched on and that is the product pipeline. Otrexup is the first proprietary product of Antares that is marketed by its own sales force. The next proprietary product is Quick Shot Testosterone which is an injectable testosterone product that I think could be introduced in 2017. I see Otrexup as a $75+ million product and think that QST could be $150+ million. The next proprietary product is referred to as Quick Shot M. The active pharmaceutical ingredient in this product has not been disclosed so it is a little hard to estimate sales, but we might guess that it has potential in the Otrexup range. Antares is also working on an AB rated version of the diabetes drug Byetta (exenatide); I think this product might come to market in 2018 and has about one-third the potential of the AB rated generic to EpiPen. Finally, the Company has mentioned that it is working another AB rated product with Teva, an over the counter gel (ingredient undisclosed) with Pfizer and a life cycle extension for an undisclosed drug.

This is a pretty powerful product pipeline that is given almost no value at the current time. If I am right on the sales ramp for Otrexup and the launch of the AB rated generic to EpiPen, I think that investors will begin to focus on and become excited about the pipeline. If so, my price target estimate of $5.00 to $6.00 in 2016 could be too low.

Risks

The obvious risks are that I am wrong on the sales ramp of Otrexup and that the AB rated generic to EpiPen is not approved for some reason. There is another risk to the Antares business model that is a little more subtle and should be understood by investors. Essentially, Antares takes proven generic drugs and using its engineering skills in injectable technology to create a product with better pharmaceutical properties that enhances the efficacy and safety of the drug. It gains approval for its drugs using the 505 (b) 2 regulatory pathway which only requires that its product is bioequivalent to the generic drug. It does not have to do clinical trials demonstrating efficacy and safety. Under current law, a new drug developed by via the 505 (b) 2 regulatory pathway has three years of market exclusivity as opposed to 17 years of patent protection for a drug with a composition of matter patent.

So what happens after three years? The launch of a generic to an oral product usually leads to a quick meltdown of sales if a generic company can establish an AB rating which means that the branded product and generic are interchangeable at the pharmacist’s discretion. Injectable products are much less susceptible to AB ratings in general because manufacturing of injectables is more complicated and expensive to duplicate. In the case of Antares, the differentiation of its product from generics is based on the injector itself. In the case of the AB rated generic to EpiPen every single aspect of the two injectors had to be identical. If this is required for companies trying to get an AB rating to Otrexup, Quick Shot Testosterone and other proprietary products to follow, Antares has patents on its injector designs that are likely to prevent an AB rating. Other companies can come up with injectable methotrexate or testosterone products but they have to promote them as separate branded products rather than generic equivalents. This is a tough issue to figure out with any degree of confidence, but my guess is that it will be difficult to develop generic equivalents to Antares products.

Thoughts on the Timing of the Launch of the AB Rated Generic to EpiPen

Let me touch briefly on the why I am projecting approval of the AB rated generic to EpiPen in 2H, 2015. Mylan is the marketer of the branded EpiPen product and Teva is the sponsor of the AB rated generic. Both companies in issuing investor guidance for 2015 have assumed that approval will be gained in 2H, 2015. I am relying on these statements to support my assumption of a second half approval. Also, in a presentation at a conference on June 4, the Antares Chief Financial Officer hinted at approval by August,

I am estimating that the launch will be at the beginning of 2016. This would appear to be later than what Mylan, Teva and Antares are indicating. I have no factual basis for this other than my experience that the FDA often (usually) moves slower than companies and investors anticipate. Hopefully, approval will come sooner.

How is Otrexup Doing?

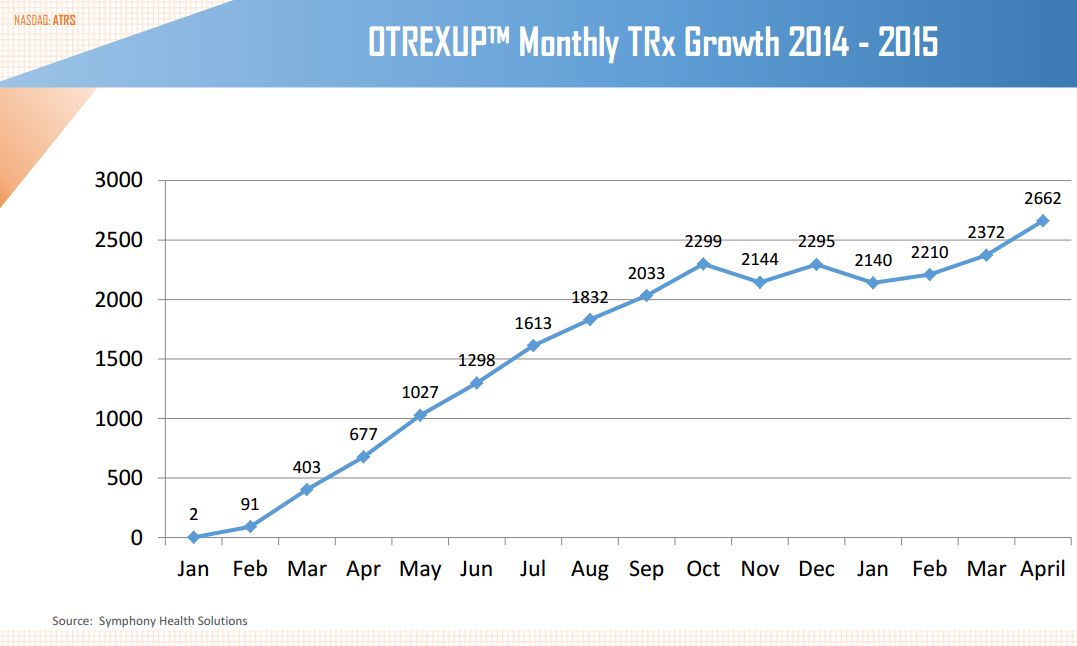

I would refer you again to my April 23 report for a detailed discussion of what I believe were the reasons for the disappointing launch (from an investor standpoint) of Otrexup and why I believe that it will get back on track in 2015 and 2016. Investors will be closely watching prescription trends for Otrexup. Antares generally obtains and releases prescription results with a lag. In a brokerage conference in early June, they released prescription trends through April of 2015. Otrexup may be breaking out of the flattening of prescription trends began in October 2015. However, it is too early to have strong confidence that it is back on track.

Product Pipeline

I am not going to go through a detailed discussion of the product pipeline beyond what I did in the price target thinking section. The following table shows the proprietary product alliance products and complex generics developed by Antares or are under development. Only Otrexup, Elastin and Gelnique are currently marketed and the epinephrine pen (AB rated equivalent to EpiPen) is close to marketing and Elestin and Gelnique are minor products. The other products listed below are all drugs in clinical development that should come to market by 2018. This list is likely to grow substantially over the next few years.

Quick Shot Testosterone is the most important new product. If you are interested, there is a detailed discussion of this product in my August 19, 2014 report Antares Pharmaceuticals: An Update on Key Issues (ATRS, Buy, $2.14).

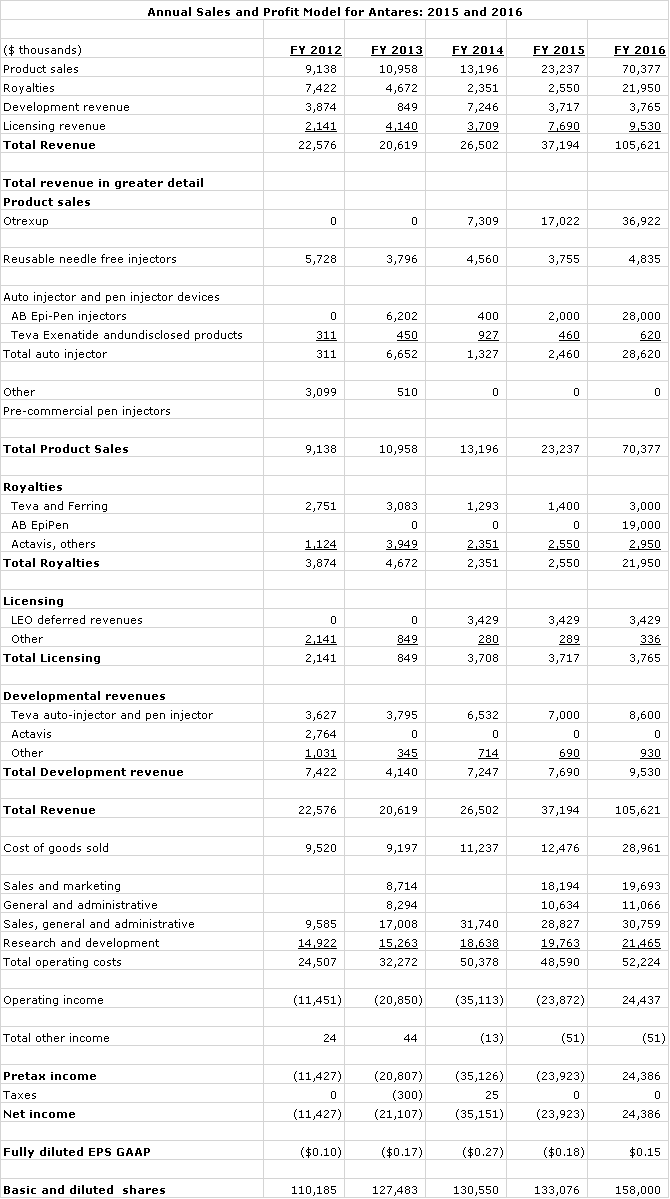

Sales and Profit Projections for 2015 and 2016

This is my detailed sales, cost and profit projections for 2015 and 2016 in comparison to 2014. It shows the strong sales projections and also projects that the Company will reach profitability in 2016 and show EPS of $0.15 cents per share.

Tagged as AB Rated Generic to EpiPen, Antares Pharma Inc., ATRS, otrexup, Quick Shot Testosterone + Categorized as Company Reports

13 Comments

Trackbacks & Pingbacks

-

Quick Take on Antares Following 2Q, 2015 Conference Call (ATRS, Buy, $2.10) | Expert Financial Analysis and Reporting | Smith on Stocks

[…] than justified decline in the stock. I continue to be a buyer. In my report of June 21, 2015 Antares: One of My Top Stock Picks for 2015 and 2016 (ATRS, Buy, $2.40, For Paid Subscribers), I explained my thinking that results in a price target range of $4.00 to $6.00 in […]

Comment

You must be logged in, or you must subscribe to post a comment.

Hi Larry,

Thanks for the article. In past articles where you’ve mentioned Teva’s generic epi application you’ve indicated that you believe Teva will receive AB approval. From the comments in this article it appears you’re still bullish on Teva’s Epi gaining AB approval later this year. Am I interpreting your epi comments correctly?

Yes

Thanks Larry. Looking at the price action on Antares since last week, makes me wonder if the short hedge funds are once again going after the stock. It’s dropped on low volume.

An amendment to my June 24th comment, short interest has increased each of the past two reporting periods for ATRS. Consequently, it sure looks like the stock price (again) is being pounded down by the shorts. Trading volume has been low and there’s been no news one way or the other. Deerfield has slightly lightened their ATRS position (less than 5%), but they still own over 19M shares. Thoughts on what’s happening?

larry, in their presentation last week at the JMP conference, they showed the monthly Otrexup sales slide updated since the slide in this latest write up of yours. I see May scripts slipped slightly (2584 v Apr – 2662) – though one data point does not a trend make. JMP used to put out the weekly script number, but I haven’t seen it for a while. If you don’t subscribe to one of the big script reporting data providers, where can you get this number….the company? Would the June number be available at the end of next week?

I am not well skilled in decifering Form 4 Fed Filings. CEO Hobbs appears to have been awarded 245,670 vested shares on 5/28/15 – so not an open market purchase or an options exercise (and held) acccording to an Edgar posting today…bringing his total vested shareholdings to 445,254, plus another option grant (same date) for an additional 293,670 shares with an exercise price of $2.18. The money didn’t come out of his own pocket (like ours), but I guess on balance it is good to see management own significant stock as their interests are aligned with the rest of us.

oops, the Edgar filing was an amended one from June 1 (I wondered why the delay from the 5/28 date of the awards). The earlier filing incorrectly showed stock option award of 498,310 shares, corrected to the 293,670 options in today’s filing. No change in the vested amount (direct ownership of 445,254.

2015-07-27

Teva buys Allergan’s generic drug unit for $40.5B

The Mylan Merger is canceled.

I think this is good news for Antares and EpiPen.

What is your opinion Larry?

I thought that there was no chance that if Teva acquired Mylan that Teva would somehow sabotage the AB rated generic to EpiPen. Launching the AB version would have been a condition of regulators to allow the deal to go through. However, Teva might have acted with less urgency. So I think this is probably a modest positive.

Met with a company yesterday, GlycoMimetics (GLYC). They have a compound in Ph3 addressing an unmet need in sickle cell anemia which they have handed over to PFE in exchange for cash and royalties. Their technology, which is beyond my pay grade, deals with “Selectin”, which has to do with passage of white blood cells in the bloodstream. Other early programs #2 in AML and #3 distrupting tumor stroma are, to a degree, versions of the same chemistry. What was interesting, and why I am posting this on the ATRS thread, is that they talked about a potential for sub-cutaneous injection, and the name of PFE came up more than once. I am wondering if this could be the undefined program mentioned in ATRS’ run down of future pipeline. The sickle cell compound, Rivipansel, is currently enrolling Ph3. It received the “Best of ASH” designation at that conference in Dec, 2013, and received a US Orphan Drug designation. People who suffer from this disease have episodic flairups which cause great pain, and are often hospitalized for 5-6 days, during which time they are administered a lot of pain medicine. The Ph2 results showed very significant statistical improvement vs placebo in both median time to resolution of vaso-occlusive crisis and median time to discharge from hospital (84 hours!), the primary and secondary endpoints of the study design. PFE stepped in at this point and is now running and funding the Ph3 study. The subcutaneous opportunity would be potentially not unlike the concept of Epipen – the abilitiy to self inject before an episode cascades. The company did say they/PFE (?) was working with Halozyme. From what I can gather, HALO is not in the SubC injector business itself, but rather aids in formulating a compound for maximum effectiveness as a SubC delivery. The GLYC CFO did not know ATRS, so I am ovbiously speculating. Even if the connection I am proposing is false, it does reveal the interest in SubC has many potential applications and opportunities. What always concerns me is finding a great racecourse, but picking the wrong horse.

MYL 2Q conf call this week gave 2015 guidance in which they assume a generic Epipen introduction in the 2H (they have said before, but re-iterated.) 7/22 WS reported that Otrexup TRx was 2,876 in June, which is a data point that would look good on the chart above. Deerfield Management (shows in news as “Benef Owner Flynn James E”) has continue to sell pieces of their position, but they remain largest shareholder by far with latest reported position of 17.3mm shares after disposing of 5.2mm in most recent Form 4. PR yesterday on initial enrollment in Testosterone safety study. ATRS will release 2Q and hold conf call next Monday am.

Otrexup July total scripts – 3,096 – another good month