Cryoport: A Model Projecting How Commercially Approved Products Supported by Cryoport Will Drive Growth Through 2024 (CYRX, Buy, $15.12)

Investment Perspective

The main revenue driver for Cryoport from 2015 to 2019 came from providing cryogenic shipping services to companies conducting clinical trials preparatory to seeking regulatory approval. However, this began to change in 1Q, 2018 as regulatory approvals were gained for two commercial products, the CAR-T drugs Kymriah and Yescarta. These were supported by Cryoport in their clinical trials and obviously this support continued as they went commercial. The dynamics between supporting clinical trials and supporting products approved for commercial use are striking. In the case of a commercial product the potential revenue potential is much, much greater. Also, the revenues recur over the commercial life of the product. Clinical trials sometimes (often) fail, in which case the revenue stream evaporates and, in any case, clinical trials are conducted only over a relatively short period of time. Hence, evolving the revenue base from one based on supporting clinical trials to one based on supporting commercial products very meaningfully improves the Cryoport’s growth prospects.

Kymriah and Yescarta are CAR-T products. They are genetically modified autologous T cells that target the CD-19 antigen that is present on many B-cell hematological cancers. The initial approvals for Kymriah were for pediatric relapsed/ refractory acute lymphocytic leukemia (r/r ALL) and relapsed/ refractory diffuse large B cell lymphoma (r/r DLBCL). Additional indications are in phase 2/3 development that could substantially expand the patient population addressed. The initial approval for Yescarta was for r/r DLBCL.

There are likely to be two new CAR-T drugs introduced in 2H, 2020 from Bristol-Myers Squibb. These are liso cel and bb2121. liso cel is targeted at CD19 and is a direct competitor to Kymriah and Yescarta. bb 2121 is a totally different product as it targets B-call maturation antigen (BCMA), a protein present on the surface of multiple myeloma cells. I believe that the potential for approval in this time frame is quite high and have included sales estimates for them in my model, but obviously it is not a certainty. I project that these four products will lead to explosive growth in commercial sales over the 2019 to 2024 period.

Key Points:

- The companies marketing Kymriah, Yescarta, liso cell and bb 2121 have given guidance that peak sales for each product will reach or exceed $1 billion.

- Currently Cryoport receives revenues of about 1.32% of sales recorded for Kymriah and Yescarta. These revenues stem from multiple service offerings that are not broken out for investors. If this ratio holds (it has been steadily improving) for each of these four products, it would mean that each $1 billion of commercial sales would lead to $13+ million of revenues for Cryoport.

- Cryoport is currently supporting 54 phase 3 trials. This does not necessarily mean that these are based on 54 products as one drug could be involved in more than one trial. Even so this represents 54 different market opportunities. I hasten to point out that some of these trials will fail.

- Cryoport is supporting 425 phase 1/2 trials. The failure rate for these trials is much, much higher than for phase 3.

- The FDA has predicted that by 2025 it will be approving 10 to 20 cell and gene therapy products per year. With its dominant position in temperature-controlled shipping, I would expect Cryoport to support an overwhelming majority of these products.

- The CAR-T products are the first major commercial products to be supported by Cryoport, but they are almost certainly just the tip of the iceberg. The regenerative medicine area using living cells as therapeutic products promises to be the next major product development focus in the world pharmaceutical industry. We are just at the initial phase in what is likely to be a several decades period of intensive drug development that will require cryogenic shipping services.

Purpose of This Report

The primary purpose of this report is to formulate a model for projecting Cryoport sales through 2024 that are directly related to sales of commercial products supported by Cryoport. My estimates are based only on the potential for Kymriah, Yescarta, liso cel and bb 2121. I make no sales estimates for any other products that might be approved in this time frame, even though I believe it is probable that there will be (several or many) contributions. I also make no projections for Zynteglo, bluebird bio’s new drug that was just approved in Europe and is supported by Cryoport. I just don’t have a feel for the market potential, but I think it is quite small.

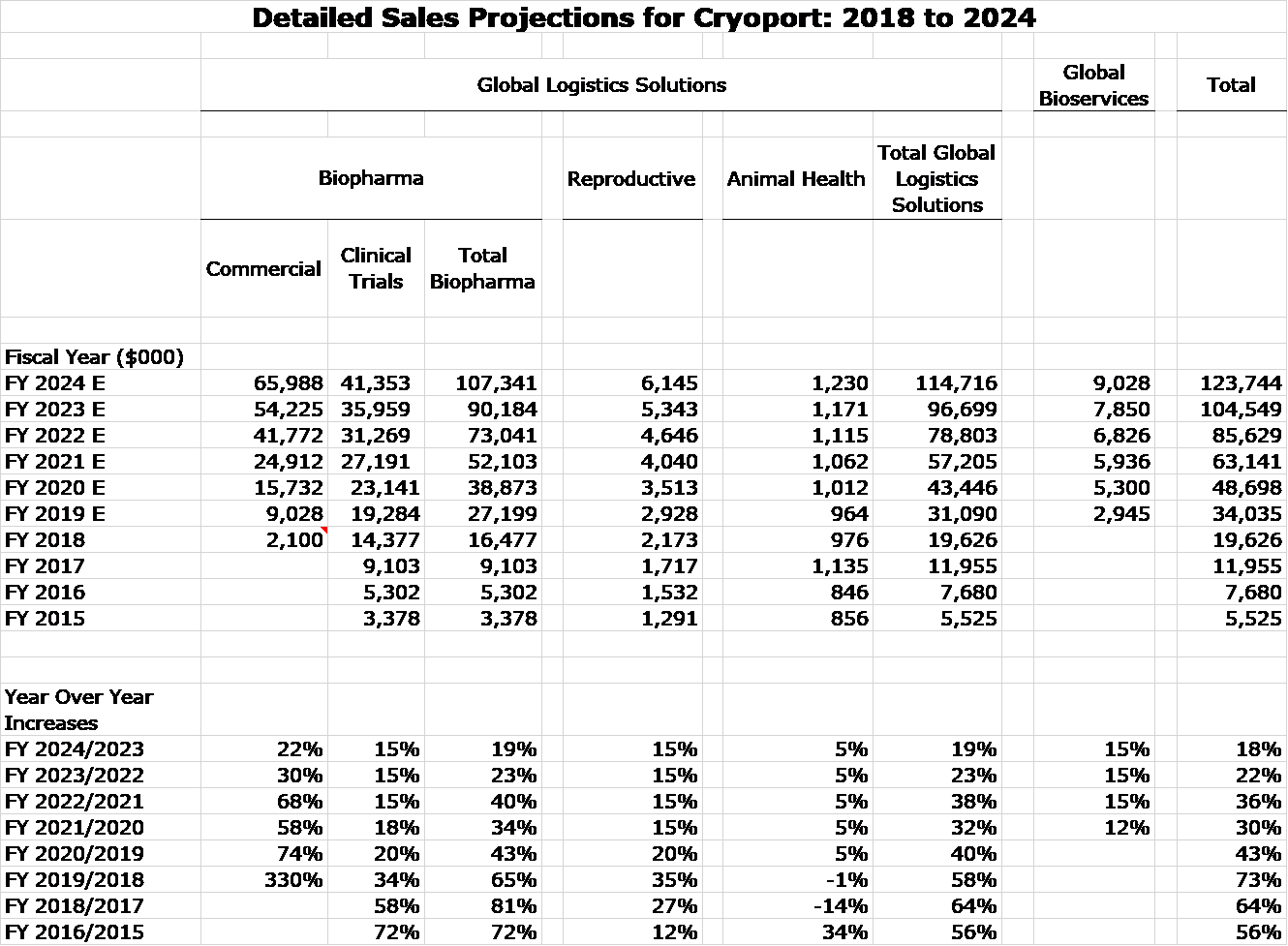

There are many assumptions underlying my sales model shown in the next table, so much so that I take these numbers with a grain of salt and so should you. That said, I think that they capture trend and magnitude and portray a period of explosive growth for Cryoport through 2024. I am projecting that 2024 revenues could more than three times sales reached in 2019 and I may very well be conservative. I assume:

- No commercial revenues through 2024 other than from Kymriah, Yescarta, liso cell and bb 2121. At this point I am making no sales estimate for Zynteglo although I expect a small contribution. I would be flabbergasted if other products do not contribute to sales.

- No acquisitions. Cryoport has $94 million of cash and is becoming cash flow positive. It has the firepower to undertake several acquisitions.

- The recent Lonza collaboration seems to be a major positive for Cryoport as Lonza is the leading contract manufacturer for worldwide biopharma. I think this could be a big positive to clinical trials sales growth, but I don’t know how to model it.

Background on CAR-T Administration, Reimbursement and Other Issues Important to Commercialization

Training Medical Centers to Administer CAR-T Cells

Administration of the CAR-T products is very complex and is quite comparable to stem cell transplants. T cells must first be obtained from the patient and genetically engineered to make them specifically attack antigens on the cell surface of the cancer being treated; they are then reinfused into the patient.

Early trials established that before infusing CAR-T cells, it is necessary to use a chemotherapy pre-conditioning regimen to destroy much of the natural T-cell population. This allows the CAR-T cells to expand much more rapidly after they are infused. Both the pre-conditioning program and CAR-T infusion are associated with life threatening side effects which means that the patients must be hospitalized and carefully monitored and treated by a multi-disciplinary team of doctors, nurses, pharmacists, et al who follow a complex protocol. The all-in cost of administering CAR-T cells can be $1 million with the cells themselves costing about $325,000.

All new product launches are a challenging, but the CAR-T launches of Yescarta and Kymriah were especially difficult because of the need for medical personnel training and reimbursement complexities. In the early stages of the Kymriah and Yescarta launches, only a select few hospitals had the ability to administer CAR-T cells. These were mostly hospitals that had participated in the clinical trials. Subsequently, the number of centers certified to administer CAR-T cells has expanded significantly and this will continue.

Reimbursement Issues

CMS is the agency that works with Medicare and Medicaid in establishing appropriate reimbursement for new products and procedures. Managed care usually follows the precedents set by CMS. You can imagine how difficult it is for CMS and managed care to determine how and for whom it will reimburse these new, paradigm changing products that can give rise to $1 million of costs per each patient treated. In the initial stage of the launch, the decision on whether to reimburse for treatment is exceedingly difficult. There is encouraging evidence that for some patients who have failed available treatments that these drugs can meaningfully extend life, but available data doesn’t allow a precise determination of who these patients are. This presents a terrible dilemma for payors. They don’t want to deny patients what might be their only chance at extending their lives, but if they allowed treatment to everyone who potentially might benefit, it could bust budgets. Every 1000 patients treated is about $1 billion of costs.

The drug reimbursement process for CMS evolves over time. Initially, the CAR-T products were reimbursed under temporary C-codes which were not specific to CAR-T products leaving considerable ambiguity for providors on what type of patient would be reimbursed. In August of 2018, J-codes were issued which provided specific, nationwide coverage for Kymriah and Yescarta. The next step which will make the reimbursement easier will be the issuance of a DRG(s) which reimburses for the entirety of costs associated with CAR-T administration. Such DRGs have not yet been issued. Lack of clarity on reimbursement is a major factor for providors because if CMS or managed care refuse to reimburse for a patient treated with CAR-T cells they can be out $1 million.

Despite Strong Headwinds, Progress is Being Made

Training medical centers to administer CAR-T cells and fighting through reimbursement issues have been strong headwinds for Novartis and Gilead. Against this backdrop, since their introduction in 1Q, 2018 the sales of these products have been encouraging. Yescarta on a trailing 12 months basis has reached $430 million and Kymriah has registered $210 million. Production issues have slowed the Kymriah launch. I would submit that the procedures to administer cells has been meaningfully improved, the number of medical centers able to administer the cells has been expanded and procedures have been put in place to make reimbursement easier. This is a process that will take some years to evolve. Still, I think that the headwinds have been substantially reduced and this should be a positive for future growth of CAR-T products

Expanding Indications to Other Cancers Bodes Well for CAR-T Drugs

Another issue to consider in trying to project future growth for CAR-T products is that cancer drugs are in most cases initially tested in the most severe cancers for which there are no effective therapies. They may be used in combination or alone and in the case of CAR-T drugs are used alone. The first indications for Kymriah was to treat pediatric r/r acute lymphocytic leukemia (r/r ALL) and r/r diffuse large B-cell lymphoma (r/r DLBCL) in patients who had relapsed from and/or were refractory to other approved therapies. Yescarta is approved only in r/r DLBCL. These were patients whose life expectancies were usually measured in months.

The next steps in life cycle development are to determine if these drugs provide medical benefit in less advanced cases of ALL and DLBCL and other hematological cancers which have much larger patient populations. The mode of action of Kymriah and Yescarta is to target the CD-19 antigen in the case of ALL and DLBCL. Importantly, this antigen is also found on other B-cell malignancies such as transformed indolent non-Hodgkin’s lymphoma and mantle cell lymphoma. There is reason to believe that Yescarta and Kymriah will also provide medical benefits in these new indications.

The current pipeline of Gilead’s Yescarta features a phase 2 trial in high risk 1st line DLBCL and a phase 3 trial in 2nd line DLBCL. Patient populations in these indications are several fold higher than in the currently approved r/r DLBCL population. Gilead is also running phase 2 trials in transformed indolent NHL, mantle cell lymphoma and adult and pediatric ALL. There is good reason to believe that Yescarta will be medically important in some or all of these indications. I am awaiting the data on the effectiveness and cost-effectiveness of Yescarta and at this it is premature to make projections on how this will affect sales, but it could be very substantial.

New Clinical Trial Data on Survival Could Bolster Usage

Both Yescarta and Kymriah were approved on the basis that they could produce objective responses (cause tumor shrinkage) in r/r ALL and r/r DLBCL and this was in relatively small trials. The only data on survival and duration of response was anecdotal. This sparsity of data was a restraint on usage and hindered reimbursement. For example, Yescarta could only state in its promotion that it produced complete responses (no remaining sign of the tumor) in 51% of patients (52 out of 101). While this is a powerful indicator that patients given Yescarta will live longer it is not definitive.

Follow-up to this trial has been encouraging. Gilead reported at ASCO in 2019 that 54% of patients treated in the r/r DLBCL clinical trial were alive at two years. Historical data indicates that only about 50% of such patients survive for eight months or so when treated with other therapies. This is encouraging that Yescarta does have a medically important improvement in survival and this is highly beneficial for expanding the use of Yescarta in this indication.

Projecting Future Sales of Kymriah and Yescarta

It is always difficult making projections for new product launches, but it is especially so for hospital products. There just aren’t good, readily available metrics like prescription trends. My own approach is to look at the trend in sales and then consider factors that will positively or negatively affect future growth of Kymriah and Yescarta. As listed below, each factor seems to be becoming more positive:

- The number of medical centers qualified to administer CAR-T cells is meaningfully increasing.

- Reimbursement procedures have been made clearer although they still have a way to go. Providers now have much greater confidence about receiving reimbursement.

- Both Kymriah and Yescarta have initially been used in the most severe forms of DLBCL and in the case of Kymriah, pediatric ALL in which patients have relapsed or are refractory to other treatments. If these products are shown to be effective in less severe forms, the addressable population could expand significantly.

- Clinical trials showing efficacy in other cancers such as mantle cell lymphoma and transformed indolent non-Hodgkin’s lymphoma could also meaningfully expand the addressable population.

It is very difficult to quantify the impact of these variables on sales growth of Kymriah and Yescarta. The growth rate will certainly slow as the sales base expands, but these positively trending factors very strongly suggest that there will be continued rapid growth. Both Novartis and Gilead have publicly stated that they expect peak sales of Kymriah and Yescarta to exceed $1 billion. For the trailing 12 months, Kymriah revenues were $210 million and for Yescarta were $430 million. Hence, these companies are expecting strong growth from current levels.

Bristol-Myers Squibb and Celgene seem to have great confidence in liso-cel and bb 2121. In its acquisition of Celgene, BMY offered as part of the price, a contingent value right tied to liso cel and bb 2121. Initially they were going to pay $57 per Celgene share in cash and one share of BMY per each share of CELG. Toward the end of negotiations, they changed this to $50 per CELG share, one share of BMY for each share of CELG and a CVR for each share of CELG. The CVR will pay $9 if three of products in Celgene’s pipeline are approved- they are ozanimod to treat multiple sclerosis, liso-cel and bb2121 to treat multiple myeloma. There is also a time limit for FDA approval which in the case of liso cel is the end of 2020 and for bb 2121 is March of 2021. This underlines the importance of liso cel and bb 2121 in the deal.

Projections for Two New CAR-T Products

liso cel is directly competitive with Kymriah and Yescarta as all three are based on targeting the CD 19 cancer antigen. Celgene, which is now owned by Bristol-Myers Squibb, has maintained that liso cel will be safer and more effective than Kymriah and Yescarta, but this remains to be established. If liso cel is not much differentiated, historical experience suggests that it will still broaden the usage over and above that now seen with Kymriah and Yescarta. This is how I have tried to model it in my projections, i.e. as a third and undifferentiated product.

bb 2121 addresses a whole new indication in relapsed refractory multiple myeloma which Kymriah, Yescarta and liso cell don’t address. I think that the patient population initially addressed by bb 2121 will be as large or larger than the addressable market for the other three CAR-T products. Very advanced multiple myeloma patients tend to live longer than r/r ALL and r/r DLBCL patients. I also think that there may be more patients eligible for the first indication of bb 2121 than for the current indications of Kymriah and Yescarta. With these thoughts in minds here is how I arrived at my bb 2121 sales estimates.

- I started by looking at actual combined sales of Kymriah and Yescarta in 2018 (first year of marketing) and my projections for 2019 and 2020. These are $340 million in 2018, $753 million in 2020 and $1,429 million in 2020.

- I took this trend as being directional for how bb2121 might perform in 2021 (first year of marketing), 2022 and 2023.

- My sense is that bb2121 could have greater sales potential than Kymriah and Yescarta over these three years. However, I arbitrarily applied a haircut of 25%. This resulted in bb221 sales estimates of $255 million in 2021, $565 million in 2022 and $1,072 million in 2023.

Celgene has publicly guided that both products will exceed $1 billion in revenues which is consistent with my projections for liso cel and bb2121.

Other New Products That May Be Supported

The CAR-T products are the first major products to be supported by Cryoport, but they are almost certainly just the tip of the iceberg. The regenerative medicine area using living cells as therapeutic products is the next major product development in the world pharmaceutical industry and living cells require careful control at cryogenic temperatures during shipping and also in storage awaiting use. A warming in temperature could potentially cause the cells to divide and alter or destroy their therapeutic characteristics. We are just at the initial phase in what is likely to be a several decades period of drug development and cryogenics shipping service are mission critical and should grow apace.

On June 3, 2019, bluebird bio received marketing approval for Zynteglo from the European Commission (EC) granted bluebird bio conditional marketing approval. This is a gene therapy, which is indicated for patients 12 years or older with transfusion-dependent beta-thalassemia who did not have a β0/β0 genotype and for patients where hematopoietic stem cell (HSC) transplantation wasn’t appropriate, and for whom a human leukocyte antigen (HLA)-matched related HSC donor isn’t available. This is the first Cryoport supported product that has been approved that is not a CAR-T product. I just don’t have a feel for how large this product might be. Hence, I am not making any sales projections.

Even at this early stage, the promise for Cryoport is a bit breathtaking, Cryoport is supporting 54 phase 3 trials. This does not necessarily mean that these are based on 54 products. One drug could be involved in more than one trial. Even so this represents 54 different market opportunities. Again, I should point out that some of these trials fail. Cryoport is also supporting 425 phase 1/2 trials. The failure rate in phase 1/2 is much higher than phase 3, but some will ultimately progress to commercialization. As with Zynteglo, I am making no projections for any new products. My intuition is that the commercial opportunity could dwarf what we are seeing with the CAR-T products.

Sales Projections for Commercial Products Supported by Cryoport for 2019 Through 2024

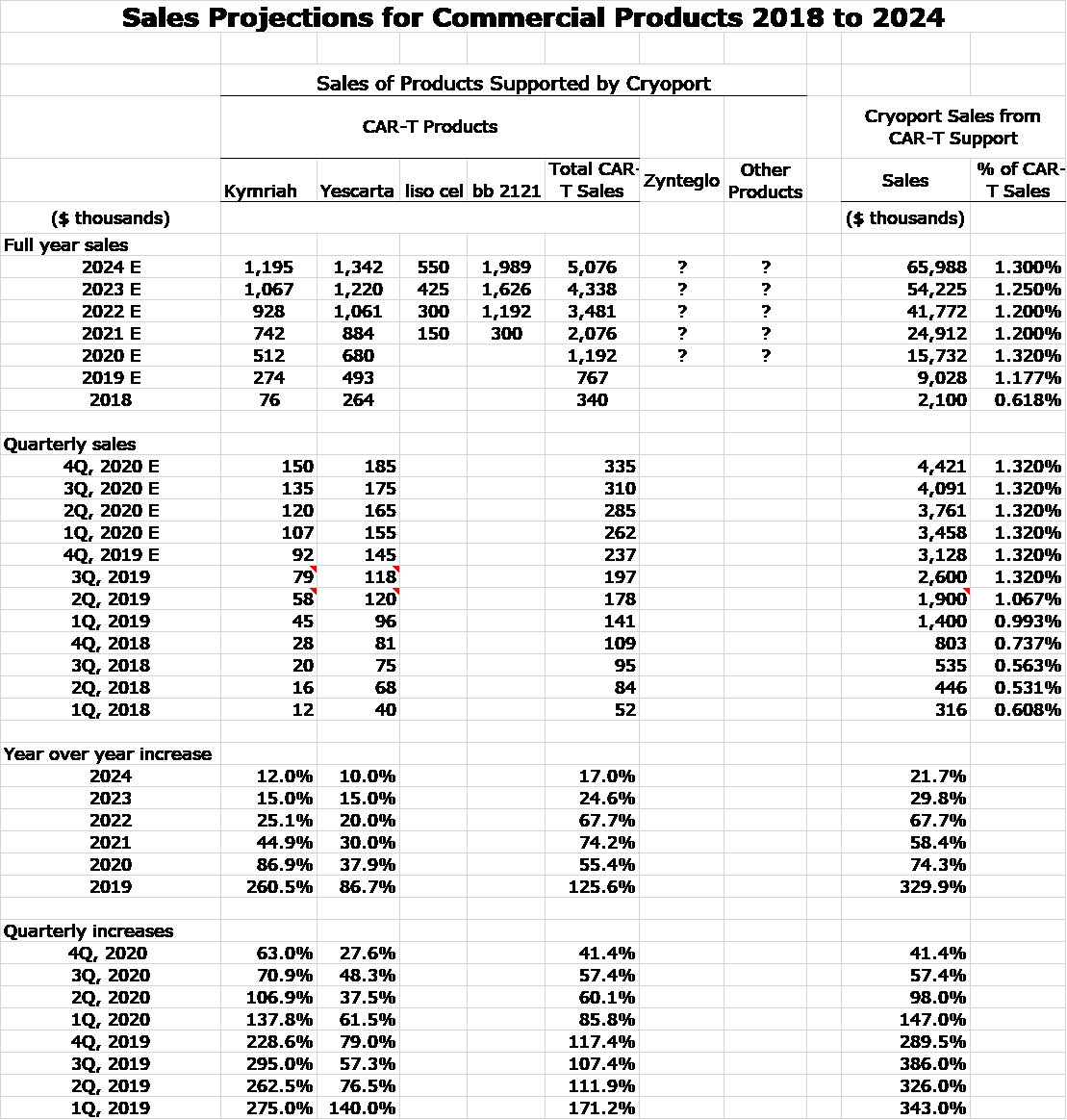

So here goes my attempt to model commercial sales based on Kymriah, Yescarta, liso cel and bb 2121. You can see in the following table that I have included sales of Kymriah and Yescarta on a quarterly basis since their introduction in 1Q, 2018. Based on looking at the trend line and incorporating my thoughts that suggest an improving environment in terms of more centers using them, better reimbursement and the potential for added indications, I have projected quarterly sales through 4Q, 2020 and full year sales for 2021, 2022, 2023 and 2024.

I am projecting that liso cel will follow a track roughly characteristic of a third product to enter a market. However, I am looking at bb 2121 in the 2021 to 2024 time frame to follow a sales track comparable modeled on combined sales of Kymriah and Yescarta in the 2018 to 2020 timeframe. In line with guidance given by Celgene I am expecting both products to be approved in 2H, 2020 and to be introduced in 1Q, 2021. I make no attempt to model sales for Zynteglo or any other potential new products.

I would be the first to point out the imprecision on which these estimates are based, but my intention is to give investors a sense of the trend and magnitude of sales.

Tagged as CAR_T products supported by Cryoport, Cryoport + Categorized as Company Reports, LinkedIn