Alimera Sciences: Iluvien Sales Seem to Have Caught Traction; It Is Time to Buy! (ALIM, Buy, $1.35)

Key Points

- In 1Q, 2017 unit sales of Iluvien increased 34% in the US and foreign unit sales increased 32%.Management believes that these rates of growth could continue for the balance of 2017.

- Management also believes that it can reach breakeven or turn cash flow positive later in 2017. My model shows the Company achieving this in 4Q, 2017.

- Here are the key points of the financial models I have put together which reflects this encouraging guidance.

- Iluvien seems to have found a meaningful role in the treatment of diabetic macular edema and sales are gaining traction on a global basis. Alimera is transforming from an emerging company with a high cash burn to a rapidly growing, profitable commercial enterprise-a somewhat rare breed in emerging biopharma.

- Investors are concerned that the Company may have to do one more large equity financing to bolster the balance sheet and to potentially retire part or all of a term loan of some $35+ million. The Company will likely seek to re-finance the loan with a different lender on better terms as it emerges into a cash flow positive position. It may then gradually retire the debt over time out of internal cash flow.

- Assuming the refinancing of the loan takes place, there may not be the need for another equity financing or if there is a financing, it would likely be done at higher prices with the objective of making investments that would accelerate growth. I don’t think that this is factored into thinking of many investors who fear a large, dilutive equity offering at distressed prices will lead to another leg down for the stock.

- The Company currently reports that there are 66 million shares outstanding. However, this does not include possible shares that could arise from conversion of preferred stock, warrants and options that could bring the total to 102 million. This is likely to be close to the fully diluted share count in 2018 and 2019 although I would not rule out a modest equity offering that could increase the share count by perhaps 10 to 15 million shares. Based on 102 million shares outstanding and a current price of $1.35, the market capitalization is a modest $138 million.

- Because of its very difficult to emulate Iluvien’s sustained release formulation, I think that it would be extremely expensive and difficult to develop a generic to it. Hence, I believe that Iluvien could enjoy a decades long commercial life without generic competition. The chief competitive concern would be competition from new drugs, but I don’t see any such threat in the next few years.

Is Now The Time to Buy Alimera?

Alimera has been the subject of several disappointments over the last seven years. This forced it into a weak financial position so that it has had to raise capital from a strained financial situation. This has depressed the price and resulted in the issuance of many shares. The stock is not widely followed by analysts and investors and most of those who do have a “show me” stance.

I initiated coverage of Alimera on May 31, 2013, but have never recommended the stock because of concerns that the worldwide launch would be slow and the distressed financial condition. At that time, I believed and still do that Iluvien had the potential to reach sales of several hundreds of millions. I have been looking for an entry point. About one year ago, I had thought that the Company could reach cash flow breakeven in 2H, 2016 but sales fell short of my expectations and I never pulled the trigger.

After four years of coverage, I am now moving to a Buy on the stock. I think that if the Company emerges into positive cash flow in late 2017 or 2018 that this will create considerable investor excitement. Also, I think that the market may be concerned that there is likely to be an equity offering in 2017 or 2018 at distressed prices that will dump a lot more shares into the market. I think that the Company has a good chance of avoiding this and if the market comes to believe this, it will remove an overhang on the stock.

I am projecting sales of $44 million in 2017 and $57 million in 2018. As we enter 2018 and beyond, I think that the market view could undergo a dramatic change. Alimera is now seen as a struggling, unprofitable company that is financially distressed. I think this view could change to the view that it is a profitable fast growing company will an asset in Iluvien that has prospects for a very long commercial life with little if any potential for generic competition. If this becomes the consensus view in 2018, I could see the Company selling a market capitalization of five to ten times 2018 projected revenues of $57 million or $285 to $570 million. Dividing this by 102 million fully diluted shares would result in a price target of $2.80 to $5.60 in 2018.

As with all companies, there are lots of things to worry about. Perhaps my greatest concern is that Iluvien sales are more difficult to model than is the case for most drugs. The first sale of Iluvien is not followed by a second sale in the same eye for as long three years so there is no recurring purchase pattern on which to rely. Each dollar of sales is from one entirely new patient and not a repeat sale to an exisiting patient. This causes uncertainty in projecting sales so that I am concerned that my sales forecast could be too aggressive. If so, it could force the Company into a large financing at depressed price levels and negate my investment thesis for 2018.

Introduction

This report is not intended as a comprehensive overview of Alimera and its only product Iluvien. I initiated coverage of the company in a report issued on May 31, 2013. I have since written five update reports, the latest of which was written on August 8, 2016. I am assuming that the reader has a good understanding of the issues that Alimera has and will face. If this is not the case and if you have an interest in the stock, I would suggest that you review the reports I just cited.

Important Investment Issues

As a starting point, I have thought for some time that Iluvien has a unique profile that should make it a key product for treating diabetic macular edema. Unfortunately, the pathway to commercialization has been long and hard. The company announced that it had met the end points of two phase 3 trials called the FAME study on June 29, 2010 and submitted an NDA. It received a Complete Response Letter (CRL) on November 11, 2011 and responded only to receive another CRL on October 18, 2013. This looked like the end of the road for Iluvien, but the FDA then completely changed course and approved the product on September 26, 2014. The approval was based on the same data included in the original NDA filing in June 2010. This indecision by the FDA devastated the stock price of Alimera forcing the Company to finance under distress during the three year period of indecision by the agency. This put Alimera in a financing hole that it has yet to work its way out of.

Iluvien is a sustained release formulation of the steroid fluocinolone that is injected in the eye and releases fluocinolone over the course of as much as three years. There is no question about the efficacy of Iluvien and there is ever growing evidence that it is the most effective treatment for severe cases of DME, particularly those in which anti-VEGF drugs have failed. The issue is side effects. Steroids have been used for decades in treating DME, employing short acting formulations that were not specifically developed for this indication. Their usage resulted in raised intraocular pressure and/ or enhancing cataract growth in some patients. The understandable concern of the FDA was that because Iluvien lasts for three years, the patient would be exposed for that time to these potentially sight threatening side effects that might not be reversible.

Ultimately, the FDA came to the belief that most of those patients who are at risk of side effects can be identified prospectively and, of course, would not be treated with Iluvien. These patients could be identified beforehand by first giving them a short acting steroid and if no side effects occurred, they could progress to Iluvien. Based on this and because of the efficacy of Iluvien in treating patients who did not respond to other therapies, the risk to benefit ratio was deemed acceptable and the product was approved.

All commercial launches in the US are slow due to reimbursement hurdles set by managed care, but the Iluvien launch was made even more difficult because of product specific issues. From a physician standpoint, there were two major issues. The first was that regardless of what the FDA might say, there remained a concern among many physicians about injecting steroids into the eye even with a short acting formulation, let alone a drug that lasted for three years.

The second issue was reimbursement. Iluvien costs about $8,800 to treat one eye. The physician or the hospital have the option to buy the drug outright and then seek reimbursement. In this event, the physician is reimbursed for about 4.8% to 5.8% of the cost of the drug. However, if reimbursement is denied, they are stuck with the cost. The issuance of a J-code in early 2016 largely removed this risk but this was a major issue in 2015. The drug is also available from specialty pharmacies if the physician or hospital does not want to take this reimbursement risk.

The first European approval was in Germany in July 2012. This approval and all subsequent European approvals, was based on a more restricted label. The European launches faced the same physician resistance as in the US. In addition, European launches are even slower than in the US. First, broad country approval are gained through a decentralized procedure and then reimbursement must be negotiated on a country by country basis in the European Union. This reimbursement can drag on for a year or more.

Alimera licensed worldwide rights for Iluvien from pSivida. Through all of the struggles to commercialize the product, they have retained these rights although they use distributors to sell the product in some foreign countries. Looking back, it is amazing that the perpetually cash strapped company has been able to retain rights and avoid partnering or licensing of Iluvien; it controls the asset. Unfortunately, this has not been without a cost to shareholders as several distressed financings have resulted in many more shares outstanding than might have been the case.

The major thrust of this report is that it looks like the rubber is finally meeting the road for Iluvien. In 2016 sales of Iluvien reached $34.3 million and I am projecting $44.7 million for 2017 and $57.9 million for 2018. Importantly, the life cycle should extend far beyond this. It should be extremely difficult to create a generic version of Iluvien. The steroid used-fluocinolone- is available as a generic, but showing that a generic device can deliver the drug with the same pharmacokinetics is extremely challenging and the FDA would likely require a clinical study. However, such a study would take years and there would be significant ethical concerns that the generic might not have the same release characteristics as Iluvien. I think that it is unlikely that under current FDA procedures that a generic ever will emerge to Iluvien. I think that the primary competitive risk is not a generic, but a superior drug.

There seems to be a growing opinion among physicians that the potential side effects of Iluvien can be managed by prospectively identifying patients at risk-not all of course but enough to make it an acceptable risk when weighed against the potential benefit. The efficacy seems to be significantly greater than that of the anti-VEGF drugs in treating DME and it is estimated that only one-third to two-thirds of patients respond well to these drugs, Very importantly, Iluvien offers major cost advantages to payors and patients as will be discussed later.

The Company has guided that it believes that it can become cash flow positive at some point this year. Thereafter, sales growth could be impressive and Iluvien sports an extremely impressive gross margin of 91% or so. It could begin to generate positive cash flow in 2018 and possibly 2017. For a commercial stage company, this is often the critical catalyst for a sharp, upward price movement.

Iluvien Sales Growth over Last Two Years Has Been Impressive

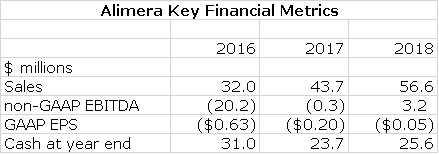

Over the two year period covering 1Q, 2015 to 1Q, 2017 growth has been impressive even as the Company had to work through difficult launches in the US and internationally. US sales growth achieved a compounded annual growth rate (CAGR) of 35% for that period and the international sales CAGR was 21%. Gross profits averaged over 90% of sales (an extremely impressive number) and had a CAGR of 32% over these two years. For the 12 months ending March 31, 2017, worldwide sales were $35.2 million and worldwide gross profits were $32.6 million. This is shown below:

CLICK TO ENLARGE IMAGES

1Q, 2017 Results in the US At First Glance Looked Disappointing When Compared to Two Year Trends; This Needs to be Explained

US sales in 1Q, 2017 were $4.4 million which was up only 8% from 1Q, 2016. On a sequential basis, US sales declined sharply from $8.2 million in 4Q, 2016. The US sales number was not reflective of the actual sales trend of the product. Management stated that end user demand for Iluvien increased 34%. Why the discrepancy?

In recent years there has been a pattern developing for Alimera and the biopharma industry as a whole that the first quarter of the calendar year shows a meaningful sequential drop from the fourth quarter. This is not specific to Iluvien. A significant part of this is due to managed care issues such as switching of plans, adjusting of coverage and deductibles and other issues. Also, there is generally a meaningful drop in patient visits in the colder weather months of January and February.

In the case of Iluvien, the first quarter sales were affected by these issues, but there were product specific issues. Iluvien distribution is handled by two companies and there appears to have been some inventory adjustments. Sales in the US were up 8% to $4.4 million but end user demand increased by 34% so that if sales growth were in line with unit growth, sales would have been $5.5 million. Also, there was an unusual bulk shipment of $1 million in 4Q, 2016 that may have overstated 4Q results. Adjusting for this, 4Q sales might have been $7.3 million.

International user unit demand growth increased 32% and revenues increased a lesser 29% to $2.2 million owing to a modest, negative foreign currency effect.

Outlook for Remainder of 2017

Alimera has provided guidance that both the U.S. and international end-user demand seen in 1Q, 2017 are consistent with their expectations for the full year 2017. If so, I would expect revenue growth for the next three quarters to track end user demand, which could be 34% in the US and 32% internationally and I am assuming this in my income statement modeling. The Company has extremely high and consistent gross margins of 91% so that growth of gross profits should track with sales.

Management says that they have right sized their cost structure for the current environment and with this believe that they can achieve positive quarterly non GAAP EBITDA later this year: this is defined as operating income less the non-cash expense items of stock based compensation and depreciation and amortization. It is essentially operating income calculated on a cash basis. To achieve this at the sales I am projecting, there will need to be tight control over costs so that I am estimating that R&D and S,G &A decline. I have used this management guidance to construct an income statements for 2017 and then made some key assumptions about 2018:

- US sales increase 27% in 2018 and international sales increase 35%.

- Gross profit margin is 92%.

- Operating expenses are kept under tight control.

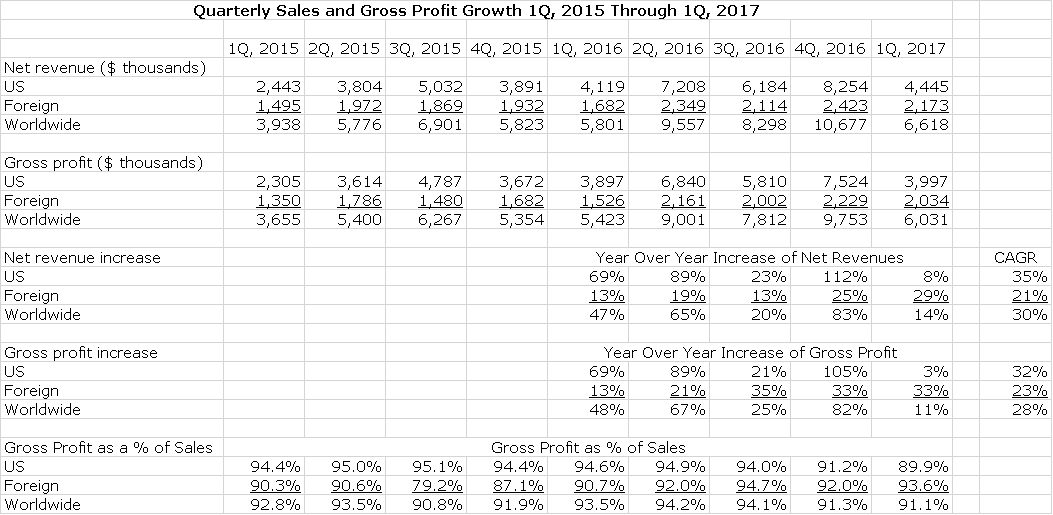

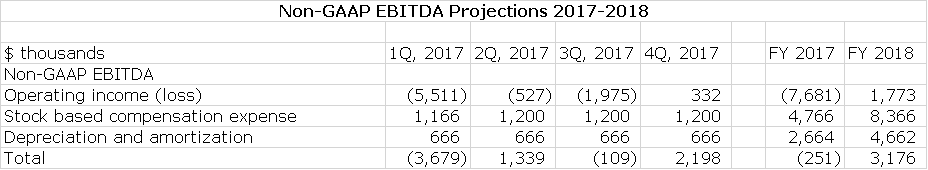

My detailed income statement for 2017 and 2018 is shown in the following table. I am projecting that on sales of $43.7 million in 2017 and $56.6 million in 2018 that GAAP EPS will results in loss of $0.20 in 2017 and $0.05 in 2018. Please refer to the following table for details.

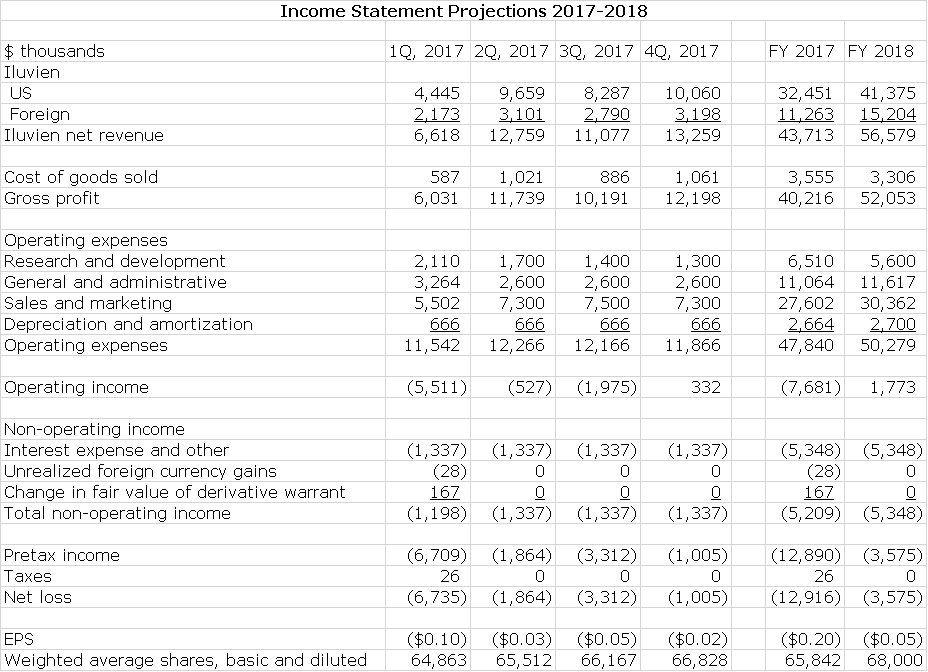

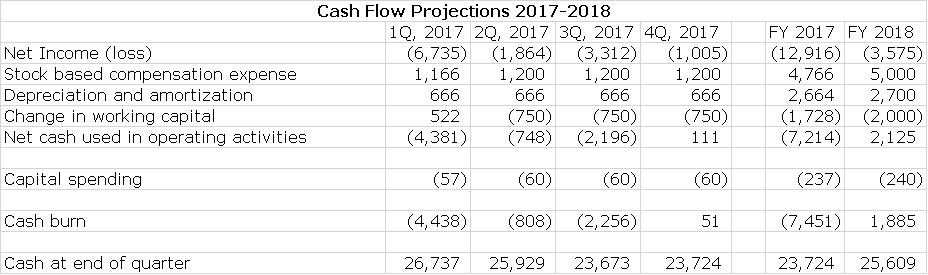

My projections as shown below suggest that Alimera could be at close to or operating cash flow break even (Alimera refers to this as non-GAAP EBITDA) in the next three quarters of 2017 and fiscal 2017 as a whole. In 2018, there should be continuing improvement. This is shown in the following table.

International Geographic Expansion Is Growing Dramatically

International sales of Iluvien are extremely hard to model on a micro basis, but macro indicators look very promising. Iluvien is currently sold direct in Germany and the UK and through distributors in other countries. Having been only available in Germany, the United Kingdom, Portugal and the United Arab Emirates in 2016, Alimera expects Iluvien also will be available in Austria, Italy, Ireland, Spain, and Kuwait. Saudi Arabia, Qatar and Bahrain this year. This will more than double the geographical footprint outside the USA by the end of 2017.

- In February 2017, Iluvien received a reimbursed price in Italy for pseudophakic patients and expect their Italian distributor to begin commercial sales in 2Q, 2017. Italy is 4th largest country in the EU and has a diabetic population of over 3.5 million people.

- In March, 2017, Alimera announced agreement with Brill Pharmaceuticals for distribution in Spain on a name patient basis and will pursue a reimburse price in that country. Spain is the fifth largest country in the EU

- Knight Pharmaceuticals, the distributor partner in Canada, submitted Iluvien for regulatory approval in February, 2017 with a decision expected in late 2018

- In 1Q, 2017, Alimera; s Middle Eastern partner MEAgate, submitted for regulatory approval in the United Arab Emirates and Kuwait. Saudi Arabia, Kuwait, Qatar, Bahrain and the UAE, in that order, have the highest percentage diabetes prevalence in the world, both diagnosed and undiagnosed. As MEAgate awaits regulatory approval, they are pursuing named patient sales and Alimera expects some sales in the second half of the year.

- initial sales in Austria were made in 1Q, 2017 leveraging the German infrastructure

- They expect to begin selling in Ireland in 2Q, 2017, leveraging resources in the U.K.

Iluvien’s Growing Role in Treating Diabetic Macular Edema (DME)

What is Diabetic Macular Edema?

Diabetic macular edema (DME) is the most common complication of diabetic retinopathy and the most prevalent cause of blindness in working age adults under 55. It is a swelling of the retina resulting from fluid leakage in the capillaries of the macula. DME results from chronically elevated blood sugar levels caused by diabetes which leads to structural changes and leakage in the walls of retinal blood vessels.

Treatment of DME

Prior to 2012, the only approved treatment for DME was laser photocoagulation. Laser coagulation is effective in about 50% to 60% of cases. The anti-VEGF drugs, Lucentis and Eylea, were approved in the US in August of 2012 and July 2014 respectively. They have now become the standard of care with laser coagulation being used later, often in conjunction with the anti-VEGFs.

In patients who do not respond to anti-VEGF products or lasers, steroids are often added. Immediate release steroids have been used off-label in this way for many years. The sustained release steroid Ozurdex (dexamethasone) and Iluvien (fluocinolone) were approved for certain DME patients in June of 2014 and September of 2014.

VEGF Drugs in Diabetic Macular Edema

The VEGF drugs were dramatically more effective than steroids when introduced for the treatment of age-related macular degeneration. This disease affects the retina but through a somewhat different biological mechanism. Relative to immediate release steroids, the side effect profile in terms of intraocular pressure increase, cataract formation and inflammatory responses were much less. This was in part because the anti-VEGF drugs are solutions whereas the steroids are suspensions. The anti-VEGFs had amazing efficacy against age-related macular degeneration visual loss and they were expected to have the same effect in diabetic macular edema but the treatment effects were not as good. Some data suggests that somewhere between 1/3 and 2/3 of DME patients don’t respond well to anti-VEGF drugs

The side effects have also proved to be more troublesome than was initially thought. They are associated with elevated intraocular pressure and cataracts although not to the same extent as the first generation steroids. The approximate requirement one shot into the back of the eye every four to six weeks can cause complications. Patients can move during injection or doctors can miss their target and cause damage to the back of the lens capsule. The damage caused by numerous injections can complicate future cataract surgery and infections are also an issue.

Immediate Release Steroids Have Been Around for a While

Retinal specialists have known for decades that steroids have a significant effect in treating, diabetic macular edema. However, the first generation of steroids were developed for other indications and used off-label for DME and were not formulated properly. This resulted in significant side effects, especially intraocular pressure, inflammation and increased cataract formation. Also, improper handling could lead to infections and inflammation. Nevertheless, physicians used steroids extensively before the anti-VEGFs drugs were introduced.

Iluvien and Ozurdex Are Newer, Second Generation Sustained Release Steroids

Iluvien is a tiny non-bioerodible polyimide tube filled with 190 mcg of fluocinolone acetonide suspended in a polyvinyl alcohol matrix. It is injected with a 25 gauge needle into the back of the eye and the fluocinolone is released through a proprietary membrane over the course of 36 months. Ozurdex is an extended release biodegradable ocular implant containing a different steroid-dexamethasone. The implant erodes over 37 days so that its treatment effect is three months or less.

Iluvien’s Unique Characteristics

Iluvien is a second generation steroid that incorporates what is good about steroids (their strong treatment effect) and reduces the incidence of side effects. Vis a vis the anti-VEGFs they have a comparable treatment effect with the major advantages being that they can be used when the anti-VEGFs fail they reduce the treatment burden for patients, physicians and care givers. Of course, this reduction of treatment burden is enormously greater for Iluvien than Ozurdex.

The principal concern with Iluvien is that the phase 3 trial and other data suggests that about one-third of patients given steroids are more inclined to develop dangerous intra-ocular pressure and cataracts. Patients developing these side effects usually need to use eye drops to control the pressure and about 5% of patient’s required surgery to lower intraocular pressure. The package label in the US states that these patients should be identified before being given Iluvien. This can be done with a steroid challenge using either an immediate release steroid or Ozurdex.

Fluocinolone, the steroid used in Iluvien has certain advantages over other steroids. It is highly lipophilic which means that it can be effective at super low concentrations which is not the case with dexamethasone; it can be given at a 200 times lower dose than dexamethasone, Because it is lipophilic it is readily absorbed into the retina. In humans, Iluvien can deliver steady state drug levels out to three years while Ozurdex has more of a bolus type of pharmacokinetic profile.

Why One KOL Uses Iluvien

Dr. Chris Riemann, a retinal surgeon at the Cincinnati Eye Institute, spoke about his increasing usage of Iluvien during the 1Q, 2017 conference call. He is extremely positive on the drug and you may want to read his remarks in total at this link.

https://seekingalpha.com/article/4071488-alimera-sciences-alim-ceo-dan-myers-q1-2017-results-earnings-call-transcript?part=single

He believes that Iluvien is a next-generation steroid technology that is a game changer. It is not like the crude steroids of the past. The sustained release formulation provides continued micro- dosing for up to 3 years and avoids most of the side effect issues.

He emphasizes that patients are very happy that they get only one shot every three years or and don’t have to get a shot every month or two over a course of years as is required by the anti-VEGFs. The intraocular pressure risk, which is what physicians are most worried about, is quite manageable when used in accordance with the label. The physician needs to know prior to injection which patients are most susceptible to steroid side effects. The infection and inflammation risk is much less because of the sharply reduced number of injections; one injection every two or three years for Iluvien versus 8 to 12 per year with the anti-VEGFs.

Some Iluvien patients may still be at risk of increased ocular pressure and this requires periodic checkups. There is a potential problem if physicians have an unreliable patient who doesn’t show up for their checkups.

Ozurdex Compared to Iluvien

Ozurdex is a sustained release drug that uses dexamethasone. It is differentiated from Iluvien because it works in a much shorter time frame which in some instances is appropriate. It can also be used to do a steroid challenge prior to using Iluvien.

The current medical practice is to first give patients photocoagulation or anti-VEGF drugs. If they fail they are then given Ozurdex and physicians then carefully watch to see if the steroid is effective and if it increases intra-ocular pressure. This usually takes a month or two which is the length of time that Ozurdex lasts. It wears off after 10 weeks even though the label says it should be given every six months. After 10 weeks, the physician can switch to Iluvien. There is a taper from the Ozurdex dose until the steady state Iluvien dose is reached.

Ozurdex can be used to identify which patients are less susceptible to steroid side effects and thus could be used as a screen for Iluvien use. Some physicians like the idea of being able to turn off the steroid side effect just by discontinuing Ozurdex if intraocular pressure is high after one shot. Moreover, if the patient is unreliable about coming in for a checkup, the concern about untreated increased ocular pressure is reduced. Ozurdex will be used in less compliant patients and Iluvien will be used for more compliant patients. Some physicians are very concerned about putting something in the eye and not having the patient show up for a year or more.

Issues with the Anti-VEGFs

VEGF treatment places a troublesome treatment burden on providors, patients and care givers. Patients often have to come from far away. Because they are vision impaired, they usually must be driven by a family member and this takes up a half day for both. If the family member has a job, this is especially burdensome. In some cases, this is not sustainable for many patients and their families.

Currently, there is a strong financial incentive for physicians to use an anti-VEGF. The price per injection is $1,200 to $1,800 per dose and physicians get to keep part on this as an administration and handling fee. However, CMS has identified this as a problem and this reimbursement system may eventually go away. Medicare’s CMS is publishing HEDIS scores which measure the cost-effectiveness of treatment so physicians know their practices are being watched. There are penalties for HEDIS scores that are low and bonuses for high scores. The cost of a injecting an anti-VEGF every four to six weeks for a year is $17,000 to $30,000 per year and $54,000 to $90,000 over three years. Iluvien cost $7,500 for up to three years of treatment. Used in the right type of patient, it is much more cost effective than the anti-VEGFs.

Another issue with the anti-VEGFs is that the clinic is clogged because of the frequent injections so that it is like an assembly line of injections. The time for consultations with existing patients is reduced and there may not be room for new consultations.

Financing Issues

Cash Position Could Be Stable Through Remainder of 2017 and Increase Slightly in 2018

Alimera ended 1Q, 2017 with $26.7 million of cash. Based on my income statement estimates, I project that the Company will end 2017 with $23.7 million of cash and 2018 with $25.6 million.

Term Loan Overhangs the Company

Alimera entered into an agreement with Hercules Capital in April 2014 for a loan of up to $35 million that can only be described as predatory. Since then, the loan has been renegotiated four times because of failure to meet covenants and Hercules each time has been given a cash fee for renegotiating, payment for legal expenses and warrants. The latest renegotiation that occurred on October 2016 allows Alimera to borrow an additional $10 million. The first $5 million is subject to Alimera achieving three month trailing revenues of $12 million before June 30, 2017 and the second $5 million is subject to Alimera achieving $15 million in trailing three month revenues before December 31, 2017. As of March 31, 2017 the outstanding balance on the term loan was $33.4 million.

Interest on the balance of the term loan accrues at a floating per annum rate that is based on a complex formula plus the prime rate. Currently, the interest rate is 11.5%. In addition, there is also a payment in kind interest rate of 1% on the outstanding loan balance which is added to principal owed. Currently, Alimera is only paying interest with no principal repayment on the loan. The loan is due and payable in 24 equal monthly payments of principal and interest beginning on December 1, 2018 and ending in full on November 1, 2020. Of course, there are prepayment penalties. So, in those two years Alimera could repay somewhere between $35 and $45 million at a monthly rate of roughly $1.5 to $2.0 million.

Potential Share Count

As of March 31, 2017, the Company reported EPS on the basis of 68.9 million shares. This did not include 35.4 million shares of potentially dilutive shares. Not all of these shares may ultimately be issued but if they were, the share count would increase to 104.3 million shares.

| Potential Share Count | |

| Shares Outstanding | 66,341,281 |

| Series A convertible preferred | 9,022,550 |

| Series B convertible preferred | 8,416,251 |

| Series A convertible preferred warrants | 4,511,379 |

| Common stock warrants | 1,795,663 |

| Stock options | 11,696,269 |

| Total potential shares | 101,783,393 |

Tagged as ALIM, Alimera, Iluvien in diabetic macular edema + Categorized as Company Reports, LinkedIn